Monde Nissin Invests P1.2B in Davao Plant Expansion

Monde Nissin Corp. (PSE:MONDE) has allocated a substantial amount of P1.2 billion to improve its manufacturing facility situated in Davao. This investment aims to address the increasing demand in Mindanao.

To meet the rising needs, the expansion project involves establishing a new facility dedicated to baking and producing biscuits. This facility will manufacture well-known brands such as Butter Coconut and Monde Mamon.

For more than a decade, Monde Nissin’s existing manufacturing plant in Davao City has been supplying Lucky Me! noodle products to the region.

According to Jesse Teo, Chief Financial Officer at Monde Nissin, this expansion is in accordance with the company’s mission to enhance food security, accessibility, and sustainability in Filipino communities.

By February 2024, which coincides with the company’s 45th anniversary, it is expected that the expanded plant will positively impact Monde Nissin’s financial performance.

The expansion project is set to generate over 500 job opportunities to support the plant’s highly automated and advanced operations.

Additionally, the company aims to procure production materials such as eggs and flour from local suppliers. This strategic move aims to improve cost management, logistics, and inventory cycles while enhancing the visibility of their products on store shelves in the Visayas and Mindanao regions.

Teo emphasized that this expansion not only strengthens the company’s manufacturing capacity but also enhances its network of partner distributors and retailers. This will enable more efficient distribution of Monde Nissin’s beloved products in the region.

Romeo Marañon, the head of Monde Nissin’s bakery and biscuits unit, pointed out that the fortified supply chain will contribute to enhancing community resilience in Mindanao, an area prone to natural disasters. This expansion will enable Monde Nissin to provide additional food products and act promptly in delivering assistance to communities in need.

With the expansion of the Davao plant, Monde Nissin aims to expand its regional and national distribution network, leveraging its leading position in the food and beverage industry.

The company reported a significant 15.4 percent increase in sales for the Asia-Pacific Branded Food and Beverage segment in the first quarter compared to the previous year. This growth was observed across all categories of products.

Monde Nissin’s distribution channels encompass a wide range of outlets, including wholesalers, smaller retailers, local convenience stores, supermarkets, groceries, and sari-sari stores. This extensive network ensures broader accessibility to their diverse portfolio of products.

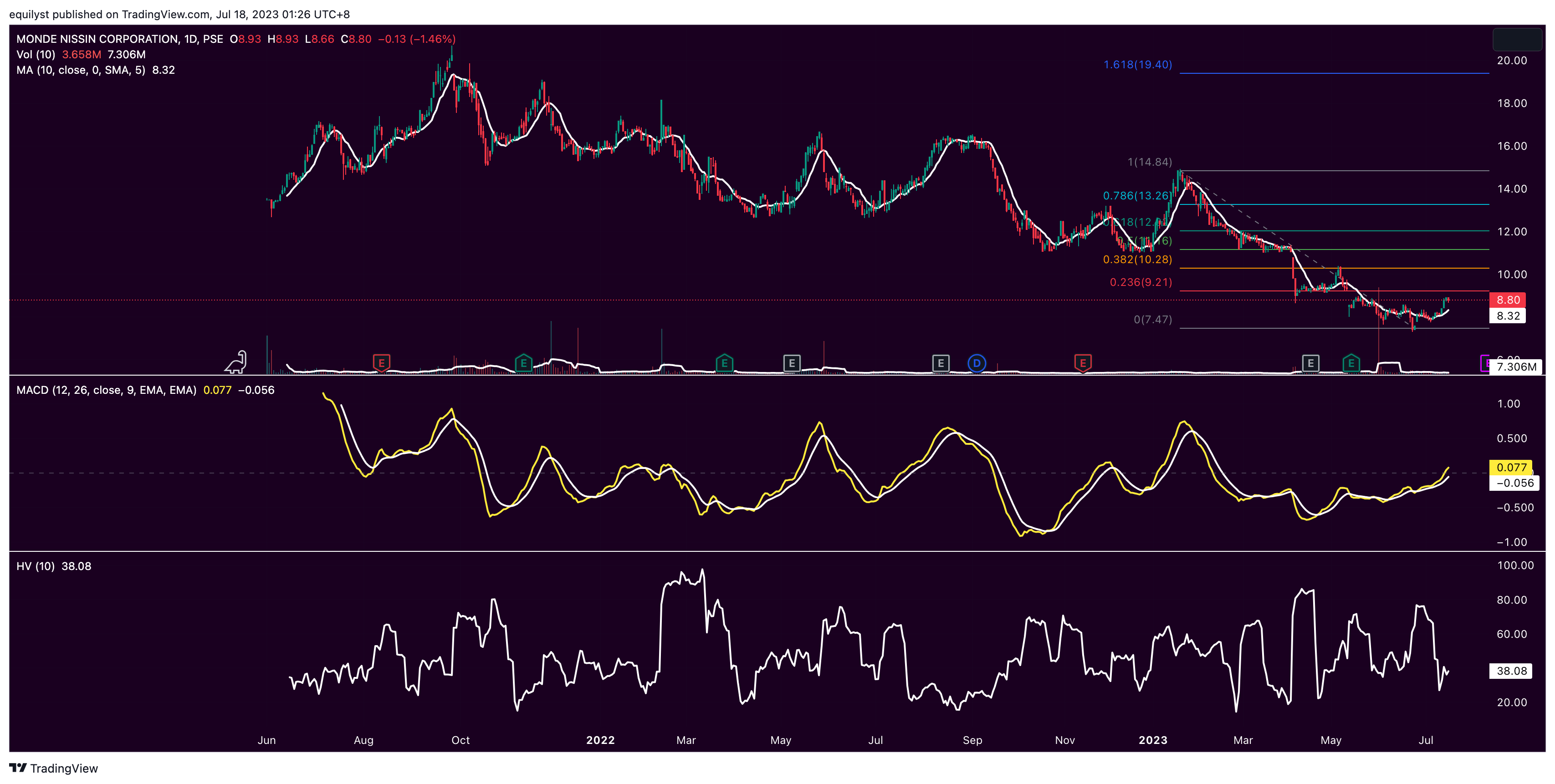

Technical Analysis: Monden Nissin

On July 17, 2023, MONDE closed at P8.80 per share, down by 1.46%. On the other hand, MONDE is up by 9.86% month-to-date but down by 20.58% year-to-date.

Support is near P7.45 while resistance is at P9.20, aligned with the 23.6% Fibonacci retracement.

I see no pressing issue with MONDE’s daily volume since the majority of its daily volume this July is higher than 50% of its 10-day volume average for each day.

It also trades above its 10-day simple moving average (SMA), signifying bullishness in the short term.

MONDE’s moving average convergence divergence (MACD) still trades above its signal line. I also see no sign of a formation of a bearish convergence with the signal line.

MONDE’s risk level remains low according to its 10-day historical volatility score. That means no significant price gaps or huge engulfing candlesticks were registered in the past 10 trading days.

The foreign investors are net sellers on MONDE year-to-date. Out of the 6 past months, only two months ended on a net foreign buying state.

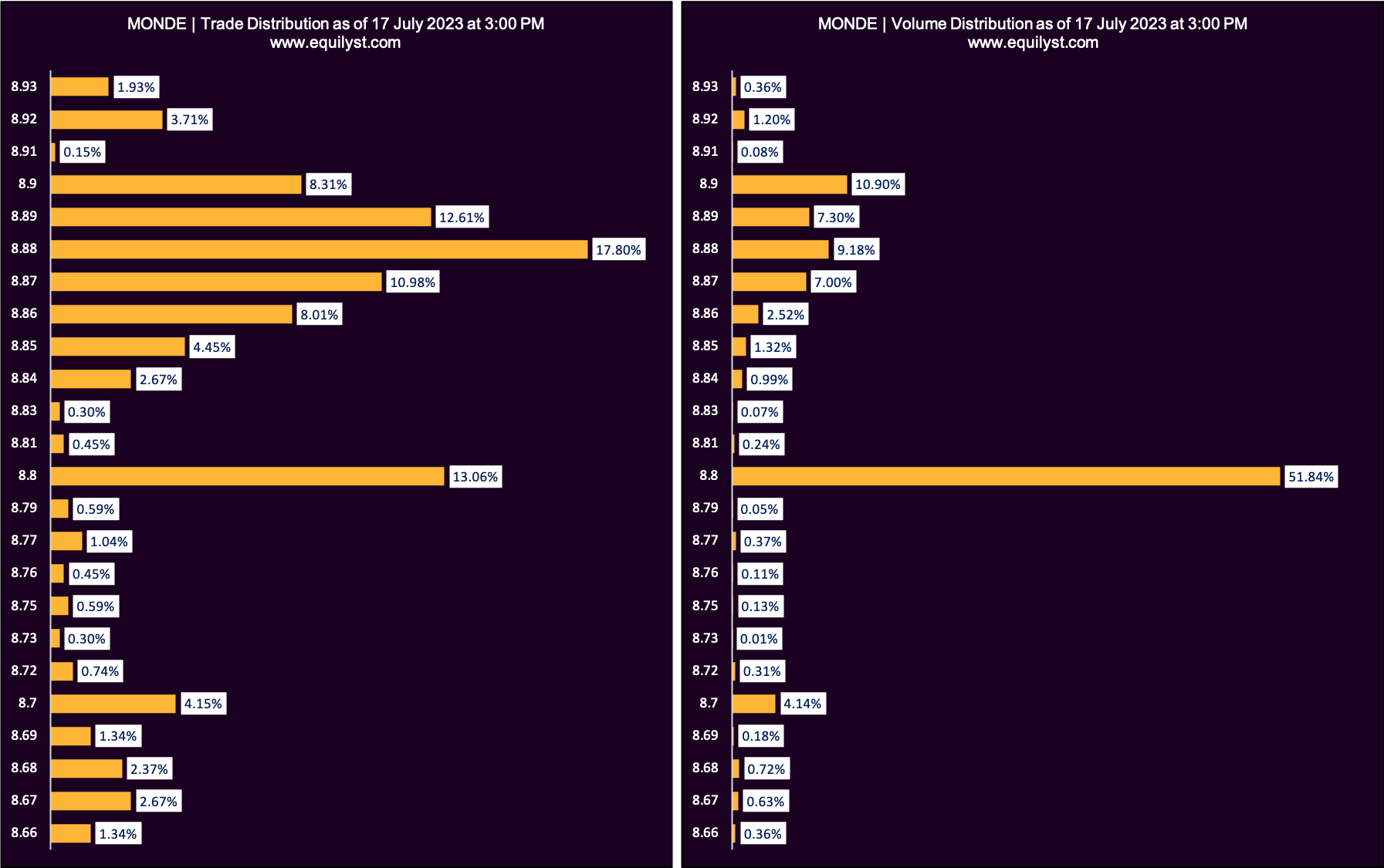

Trade-Volume Distribution Analysis

While it’s good to see that the Dominant Range Index is bullish, MONDE’s last price is lower than its volume-weighted average price (VWAP). I prefer to see the last price higher than the VWAP for a more bullish conviction.

Dominant Range Index: BULLISH

Last Price: 8.80

VWAP: 8.83

Dominant Range: 8.80 – 8.88

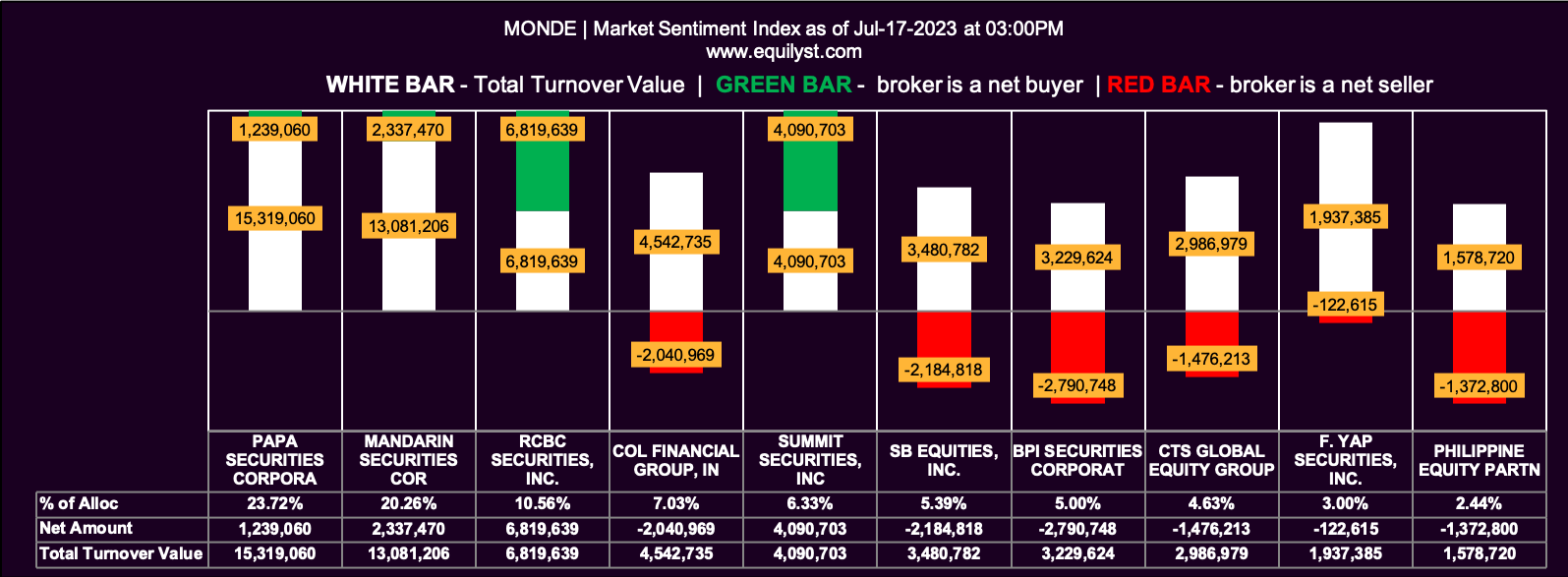

Market Sentiment Analysis

Today’s bearish Market Sentiment Index supports my impression of the last price that’s lower than MONDE’s VWAP.

Market Sentiment Index: BEARISH

9 of the 36 participating brokers, or 25.00% of all participants, registered a positive Net Amount

9 of the 36 participating brokers, or 25.00% of all participants, registered a higher Buying Average than Selling Average

36 Participating Brokers’ Buying Average: ₱8.80374

36 Participating Brokers’ Selling Average: ₱8.83413

6 out of 36 participants, or 16.67% of all participants, registered a 100% BUYING activity

14 out of 36 participants, or 38.89% of all participants, registered a 100% SELLING activity

Bringing It Altogether

MONDE did not secure a buy signal as of Monday closing based on my proprietary methodology in detecting a buy signal.

Three out of six indicators that form my Evergreen Strategy are bearish.

If you already have MONDE in your portfolio, the first question is, “Is your trailing stop still intact?”

You’re in trouble if you’re going to answer my question with, “What’s a trailing stop?”

Assuming you’re aware of the importance of a trailing stop and you’re one of my clients, I suggest that you keep an eye on the status of the Dominant Range Index and Market Sentiment Index of this stock.

If those two indices become bearish for 2 to 3 consecutive trading days, you have the option to pre-empt your trailing stop or recalculate your trailing stop with a lower risk tolerance percentage.

I believe you need to attend a one-on-one online training with me to understand my methodology.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025