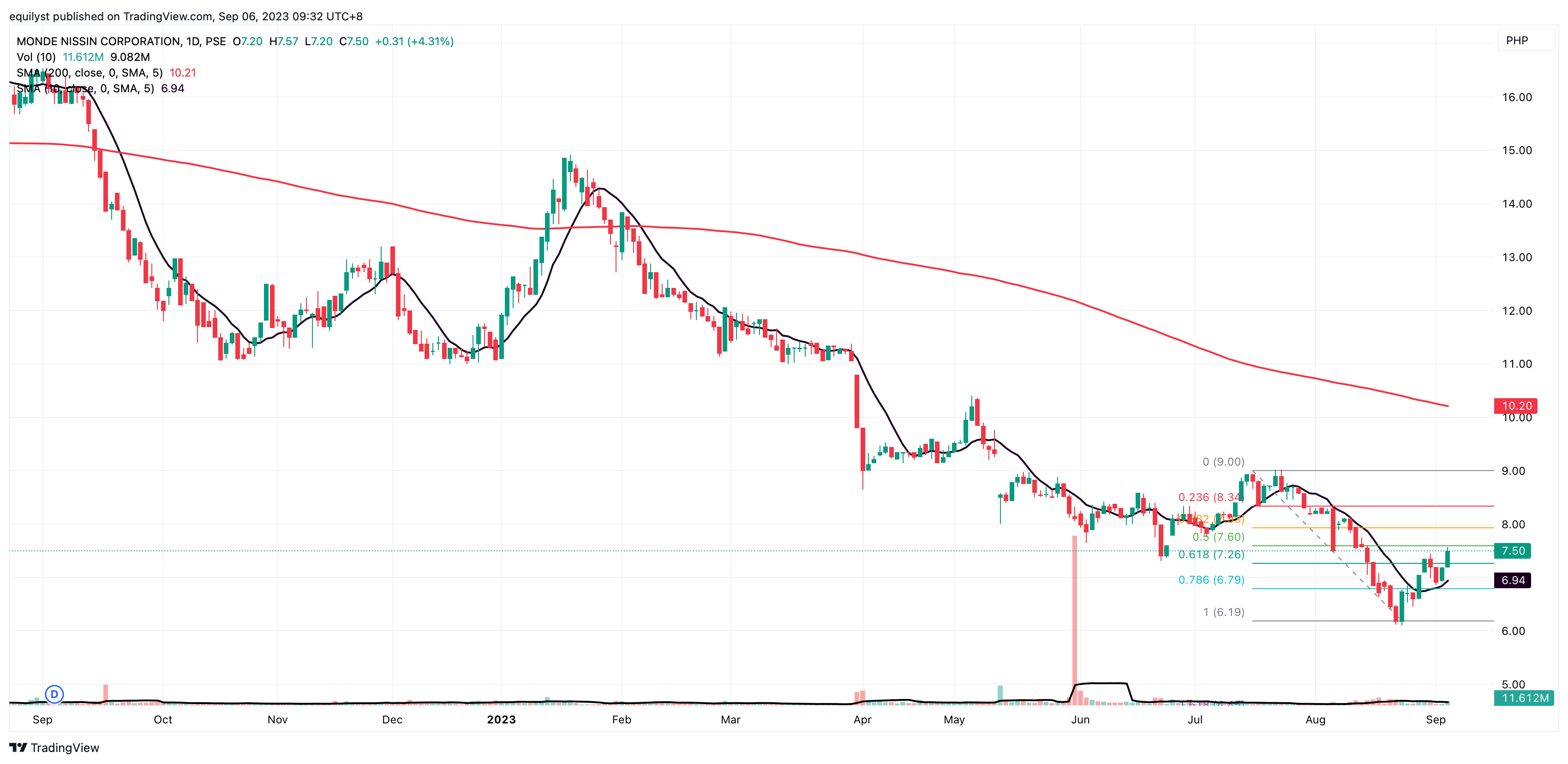

Last July 18, 2023, I published that I saw no confirmed buy signal for Monde Nissin as its share price was likely to continue to go down during that time.

If you haven’t read that analysis, you can read it here: MONDE Analysis: Is There a Buy Signal After Monday?

Now, you got a real-life example why I wrote this: 4 Reasons to Stop Using Buy Below and Target Selling Price

So, the share price went down, indeed.

MONDE’s share price dropped 25.99% more from P8.35 on July 18 to P6.10 on August 24.

Analysis on MONDE as of September 5, 2023

This stock is on the verge of breaking above its resistance at P7.26, aligned with the 61.80% Fibonacci retracement.

If it breaks above P7.26, the next target will be P7.93, aligned with the 38.20% Fibonacci retracement.

If the bears pull the price down, I’m looking at P6.79 as the lower support level, aligned with the 78.60% Fibonacci retracement.

MONDE already got its track back above its 10-day simple moving average. However, it still has lots of work to do to regain its positive above its 200-day moving average at P10.20 as of September 5.

If you’re a MONDE investor with an intact trailing stop, you don’t have to pressure this stock into breaking its longer-term moving average. It’s in a good track as long as it’s breaking one resistance after another in a slowly-but-surely fashion.

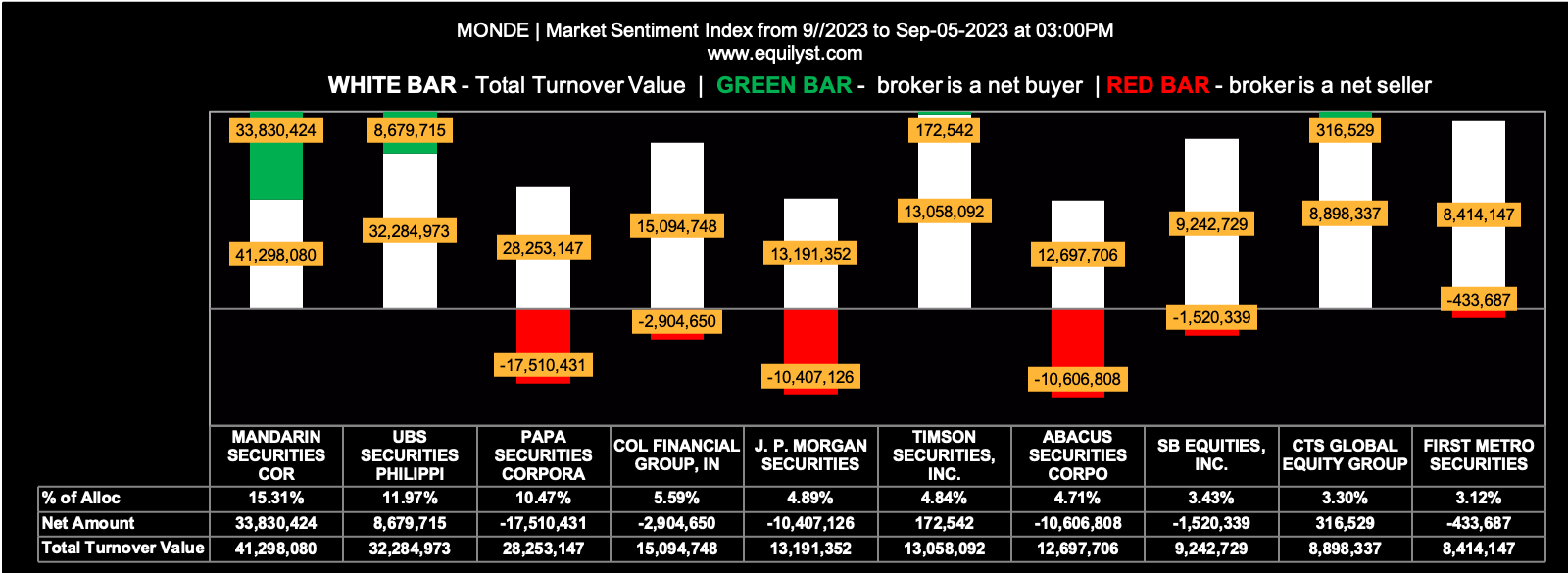

In case you’re wondering if the foreign investors are behind the recovery of the share price of MONDE, no, it isn’t their work. Foreign investors still keep their Net Foreign Selling status on MONDE year-to-date. I give the credit to the local investors.

Month-to-Date Market Sentiment for MONDE

From September 1 to 5, 65 brokers traded MONDE. Of those 65 brokers, only 35.38% of them registered a positive Net Amount, while 29.23% recorded a higher Buying than Selling Average.

On the other hand, 21.54% of those brokers registered a 100% selling activity, while 15.38% logged a 100% buying activity. The selling stance dominated the buying stance. That explains why the cumulative selling average of those brokers at P7.33 is higher than their cumulative buying average at P7.18.

The overall market sentiment for MONDE from September 1 to 5 is BEARISH.

I know you’re wondering why the market sentiment is bearish if the share price of MONDE recovered by 21.36% already from P6.18 on August 22 to P7.50 on September 5.

The overall market sentiment rating is not based on what I believe, feel, or believe. It is based on the statistics I presented above.

Monde Nissin’s Meat Alternative Business Restructure

Monde Nissin Corp, a major player in the snack food industry, has successfully completed the restructuring of its meat alternative division and holds a cautious but positive outlook for the growth potential of this segment in the upcoming quarters.

Monde Nissin CEO Henry Soesanto shared that the restructuring of their meat alternative business, as previously disclosed, is now substantially finalized, and they are on track to realize the savings previously outlined. Despite the ongoing challenges in this category, an improvement in EBITDA was observed during the second quarter. Their optimism is guarded, but they anticipate this positive trend to persist in the quarters ahead.

During the first half of the year, the company generated consolidated revenue amounting to $39.2 billion, marking a seven percent increase.

However, core gross profit witnessed a decline of 2.2% during this period, totaling $12 billion. In the second quarter, core gross profit also experienced a dip of 2.6%.

The core net income attributable to shareholders followed suit, exhibiting a 14.1% decrease in the first half, reaching $3.5 billion. This decline primarily stems from reduced gross profit in the meat alternative sector, escalated marketing expenses in the Asia Pacific Branded Food and Beverage (APAC BFB) division, and foreign exchange losses.

In terms of the business segments, revenue from the meat alternative unit contracted by 6.6 percent in the first half and further shrank by 8.8% in the second quarter, primarily due to the persistent challenges in this category.

Comparatively, APAC BFB net sales for the first half registered a 10% uptick, reaching $32.1 billion. The domestic sector experienced a 9.3% year-on-year growth in the first half, amounting to $30 billion, driven by moderate expansion in the second quarter at 3.7%.

The growth in biscuits and other product categories was counterbalanced by weakened demand for noodles.

Meanwhile, international revenue surged by 20.8% in the first half, reaching $2.1 billion, propelled by robust growth in the biscuits segment.

Soesanto stated that the second quarter witnessed a slowdown in topline growth across all categories within the APAC BFB business, with the most noticeable deceleration occurring in the noodles category. This mirrors their observations over the past several months, reflecting an overarching macro trend of subdued consumption in numerous food and beverage categories. Nonetheless, despite this deceleration, they recorded a substantial improvement in their gross margin compared to the previous quarter and year-over-year. They anticipate this trend will persist as the year progresses. Looking ahead, they foresee a more favorable year-on-year growth in the third quarter, aided by the lower base from the previous year.

Putting It Altogether

So, how do I process all of these then?

Suppose I have MONDE in my portfolio.

This bearish month-to-date market sentiment is a data-driven reminder that I should not put all my eggs (buying power) in one basket (MONDE).

Err on the side of caution when investing on MONDE. That means topping up when there’s a confirmed buy signal and parking my buying power in my account if there’s no confirmed buy signal. In the stock market, doing nothing with your buying power is a good thing to do sometimes.

What if I don’t have MONDE yet in my portfolio?

Then, I might add it in my watchlist if I still have an available slot. I’ll continue monitoring it.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025