Metrobank’s Robust Performance: 34.1% Net Income Boost in H1

Metropolitan Bank & Trust Co. (MBT) saw a 34.1% surge in its net income for the first half of 2023, reaching P20.9 billion.

This increase was propelled by the bank’s expansion of assets, improved margins, and robust growth in fee income, all while maintaining stable asset quality.

The outcome was a 12.9% return on equity, notably higher than the 10.0% figure registered in the corresponding period of the previous year.

During the second quarter exclusively, the bank exhibited a notable 37.1% growth in earnings, recording P10.4 billion, as compared to the same timeframe a year ago.

According to Metrobank President Fabian S. Dee, the bank’s fundamental business sectors experienced continuous expansion and drew advantages from a solid balance sheet.

He conveyed that with the ongoing expansion of the economy, the bank anticipates more opportunities within the market that will both sustain the upward momentum and reinforce the bank’s commitment to enhancing customer service.

Net interest income of the bank observed a substantial increase of 27.0%, ascending to P50.6 billion.

This rise was influenced by a 50-basis point elevation in the net interest margin, resulting in a figure of 3.9%.

The gross loans portfolio displayed an 8.6% YoY ascent, propelled by a 7.2% surge in commercial loans and a remarkable 14.1% expansion in consumer loans.

Moreover, the consumer segment saw a surge in net credit card receivables by 28.8% and auto loans grew by 17.5%, thereby upholding the growth trajectory.

Simultaneously, total deposits witnessed a growth of 9.3%, reaching P2.3 trillion from the previous year.

Remarkably, low-cost Current and Savings Accounts (CASA) accounted for 62.2% of this total.

Trading and foreign exchange gains totaled P3.1 billion, while fee income experienced a growth of 10.2%, recording P8.1 billion.

The ratio of cost to income showed ongoing improvement, declining from 53.8% to 51.8% in comparison to the previous year.

This favorable trend was driven by a solid 19.1% growth in revenues, surpassing the 14.5% increase in operating expenses, which amounted to P33.7 billion.

The rise in operating expenses was largely attributed to heightened transaction-related taxes and technology costs.

As a result, the pre-provision operating profit observed a notable rise of 24.4%, reaching P31.8 billion.

Metrobank’s non-performing loans (NPLs) ratio saw a further reduction from 1.9% to 1.8% within the same period, reflecting the bank’s cautious lending practices.

The NPL coverage ratio reached an elevated figure of 184.4%, thus providing a significant cushion against portfolio risks.

Metrobank’s overall consolidated assets maintained their position at P2.9 trillion, reaffirming the bank’s status as the country’s second largest private universal bank. Meanwhile, the total equity reached a figure of P329.8 billion.

The bank’s capital ratios remain notably robust within the industry, with the capital adequacy ratio at 17.9% and the Common Equity Tier 1 (CET1) ratio at 17.1%, both exceeding the BSP’s regulatory requirements.

Additionally, Metrobank’s Liquidity Coverage Ratio (LCR) demonstrated a substantial value of 243.4%.

Technical Analysis: A Glimpse of Hope for Metrobank To Recover Above P56?

First off, Metrobank has an active cash dividend declaration of P0.80 per share, with an Ex-Dividend Date of September 7, 2023. Expect its share price to decline by more or less the same amount on its Ex-Dividend Date.

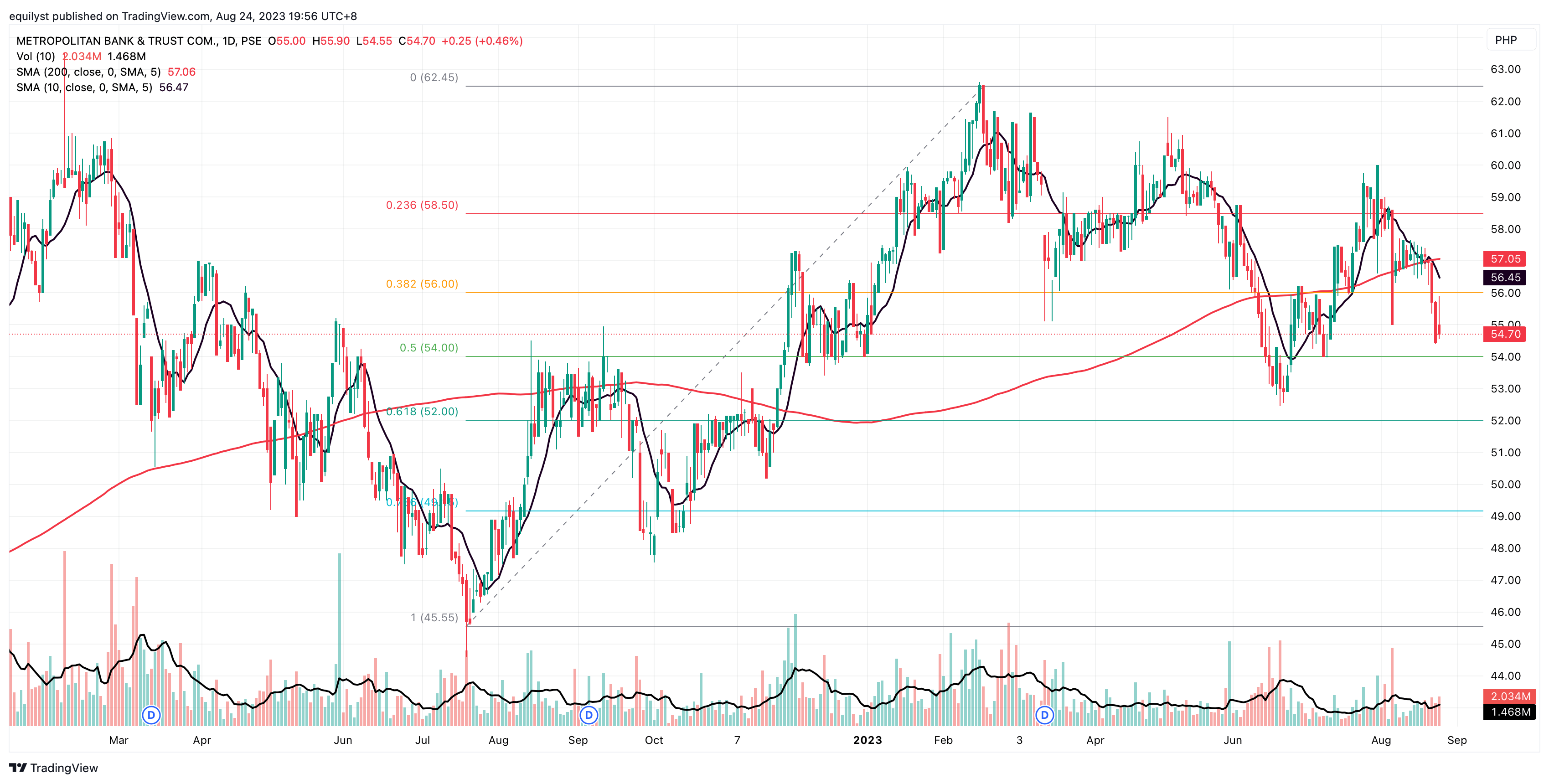

Metrobank’s share price picked up by 3.15% in the first six months of 2023 from P54.00 on December 29, 2022 to P55.70 on June 30, 2023. However, it has a disappointing negative MTD price change as it declined 8.83% from P60.00 on July 31 to P54.70 on August 23. Metrobank remains in the negative territory for its WTD change of 3.95% from P56.95 on August 18 to its present price of P54.70 as of closing on August 24.

The bearishness of Metrobank got worse on August 17 when its shorter-term 10SMA registered a death cross on its longer-term 200SMA. To date, its 10SMA is still below its 200SMA. Adding more pain to the injury is seeing the last price of P54.70 trading below both moving averages.

The bearishness of Metrobank got worse on August 17 when its shorter-term 10SMA registered a death cross on its longer-term 200SMA. To date, its 10SMA is still below its 200SMA. Adding more pain to the injury is seeing the last price of P54.70 trading below both moving averages.

Metrobank is now much closer to its support at P54.00 (aligned with 50% retracement of its Fibonacci) than the resistance at P56.00 (aligned with the 38.2% retracement of the Fibonacci).

Don’t look for a volatility issue on Metrobank since this is a bluechip stock. All its daily volume for the past five trading days are all higher than 100% of its 10-day volume average. Unfortunately, all five volume bars are for the bears.

Metrobank is on a net foreign buying state YTD. Thanks to the P14.8 billion net foreign buying registered on July 31, 2023. Without that, Metrobank would have been in a net foreign selling stance. Did something special happen on that day? Did it happen just because of window dressing for July or something else? Let me give you that as your assignment so you can do your due diligence.

If Metrobank breaks below P54, the next support will be P52, confluent with the Fibonacci’s golden ratio.

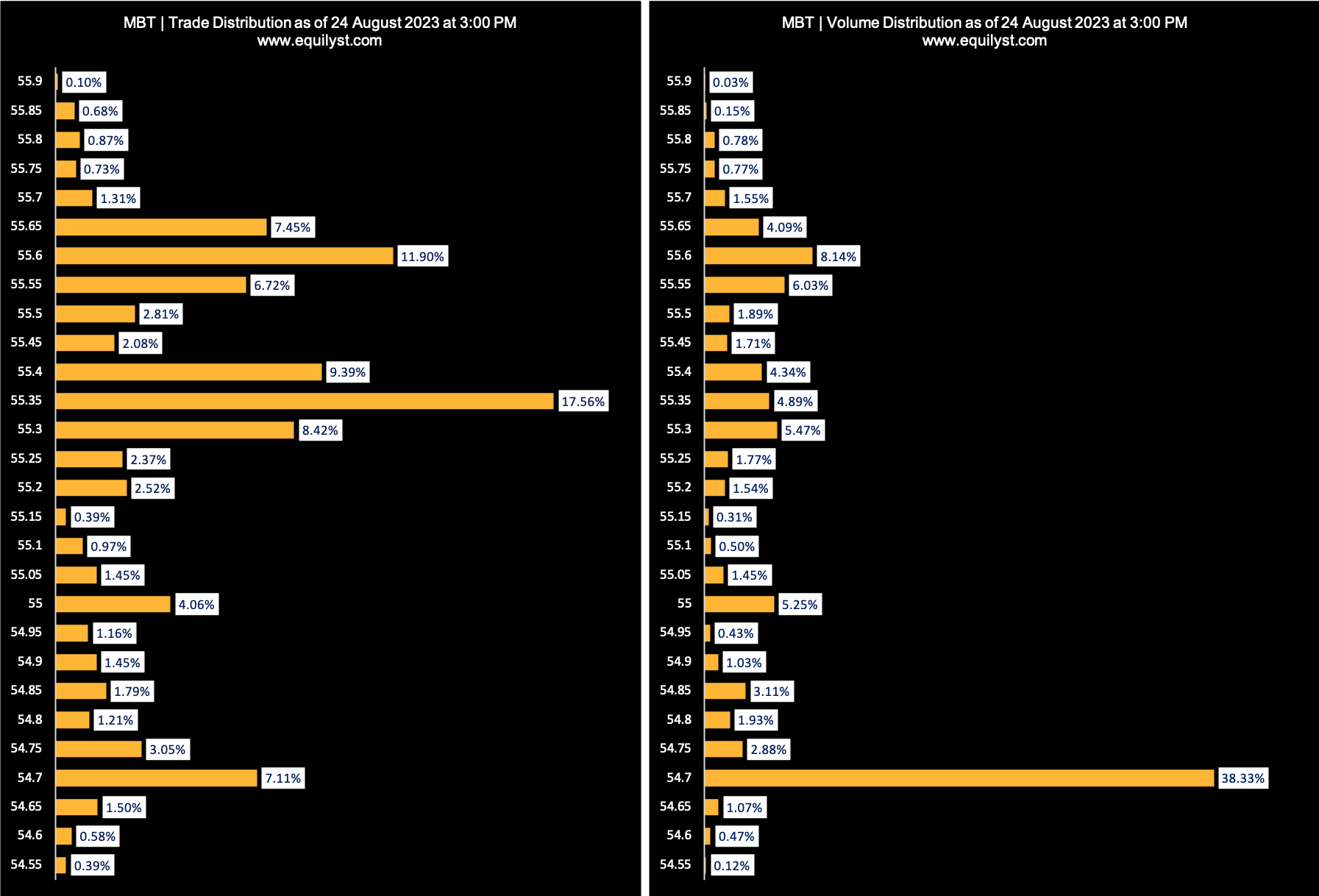

As of closing on August 24, 2023, Metrobank’s volume-weighted average price of P55.07 surpasses its closing price, which is a bearish signal.

The cross-trade of UBS Securities at P54.70 for almost 150,000 shares, around 2:47 pm, brought the dominant range closer to to the intraday low than the intraday high. If UBS Securities didn’t do that, the dominant range would have between P55.30 and P55.65. Unfortunately, my Dominant Range Index rating for Metrobank today is bearish because I programmed this indicator to judge the situation based on what actually happened and not on “what ifs”.

The cross-trade of UBS Securities at P54.70 for almost 150,000 shares, around 2:47 pm, brought the dominant range closer to to the intraday low than the intraday high. If UBS Securities didn’t do that, the dominant range would have between P55.30 and P55.65. Unfortunately, my Dominant Range Index rating for Metrobank today is bearish because I programmed this indicator to judge the situation based on what actually happened and not on “what ifs”.

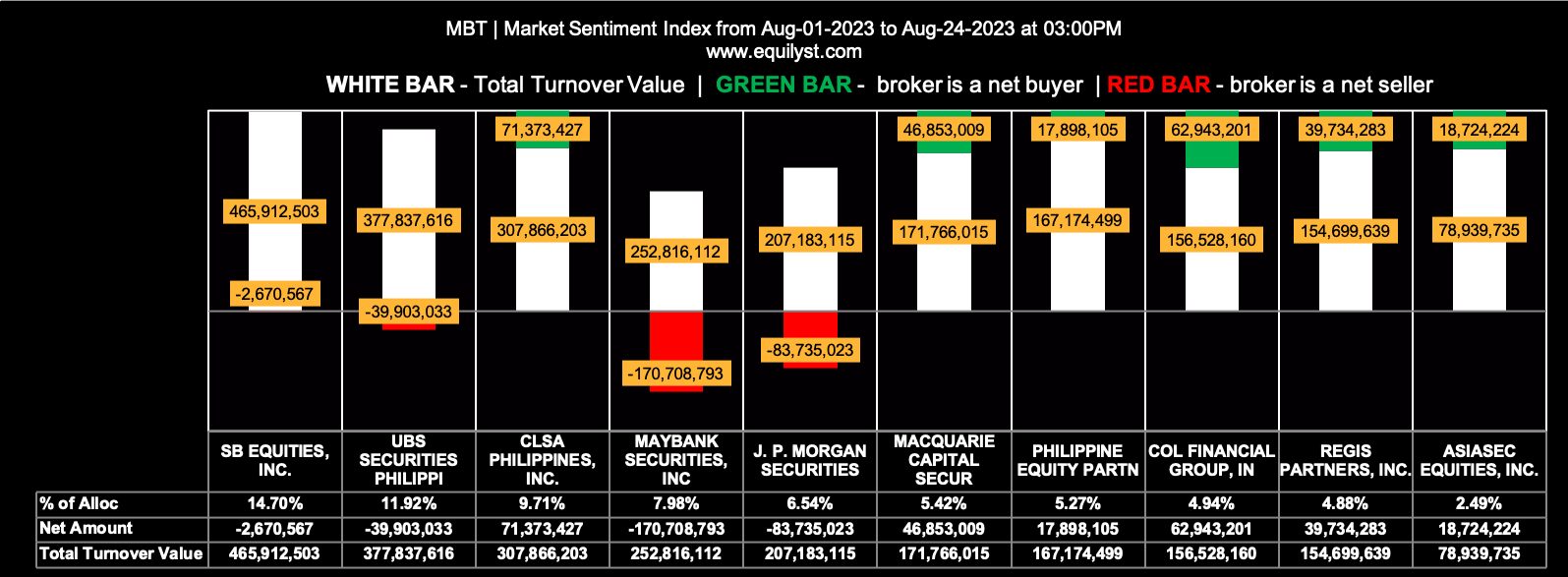

As though Metrobank has a scarcity for bearish signals, its Market Sentiment Index for MTD (August 1 to 24) is bearish. Refer to the stats below so you’ll know why.

54 of the 87 participating brokers, or 62.07% of all participants, registered a positive Net Amount

26 of the 87 participating brokers, or 29.89% of all participants, registered a higher Buying Average than Selling Average

87 Participating Brokers’ Buying Average: ₱56.09387

87 Participating Brokers’ Selling Average: ₱57.04681

13 out of 87 participants, or 14.94% of all participants, registered a 100% BUYING activity

9 out of 87 participants, or 10.34% of all participants, registered a 100% SELLING activity

Overall Sentiment and Price Forecast From August 25 to 31

Overall Sentiment and Price Forecast From August 25 to 31

Based on all the data I’ve shared with you, it’s clear Metrobank has a bearish month.

I see no signs of selling exhaustions on Metrobank yet. All of the five most recent volume bars are higher than 100% of Metrobank’s 10-day volume average. It means the impatient holders still have so much shares to regurgitate.

Don’t tell me you’re going to “waste” your buying power by hurriedly buying Metrobank when all data points to a continuing bearish trajectory for this stock. Anyway, your money, your life.

Historically, Fridays are sell-off days. If the bearish volume won’t lay low, we might see Metrobank below P54.00 on or before the end of August 2023.

What do I recommend if you are planning to enter on a new position on Metrobank? Stay in a wait-and-see mode.

What if you already have it in your portfolio? If that’s the case, you should check if your trailing stop is still intact. If it’s still intact, then, continue to monitor its price and volume profile so you can decide if there’s a data-driven reason to pre-empt your trailing stop already.

If your trailing stop is no longer intact and you haven’t done anything yet, I’d ask you, “Why did you even bother calculating a trailing stop if you’re going to ignore it anyway? You should have just tossed a coin. Much simpler. Faster.”

If you want a tailored-fit recommendation relative to the size of your portfolio and risk tolerance, please complete this form to avail yourself of my crypto and stock market consulting service.

Fill out this form if you want to hire me to write for your website in the blockchain, crypto, Web3, or stock market space.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025