Meralco: 47% Increase in Core Net Income for H1 2023

On July 31, 2023, Manila Electric Company (MER) issued its financial report for the first half of 2023. The report indicated a noteworthy upswing in Consolidated Core Net Income (CCNI), which reached P19.2 billion. This marked a substantial 47% surge from the previous year’s P13.1 billion during the same period. This growth was predominantly fueled by a remarkable 186% rise in the contribution of the Power Generation business.

Consolidated Reported Net Income also witnessed a 36% climb, ascending to P17.9 billion from the previous P13.1 billion. Core Earnings per Share (EPS) elevated to P17.039, reflecting a 47% increase compared to the previous year, while Reported EPS showed a 36% boost, reaching P15.840.

The company observed a 13% increase in Consolidated revenues, reaching P224.8 billion from last year’s P199.6 billion. This surge was primarily attributed to several factors: the influence of higher fuel prices on pass-through charges of distribution utilities and energy fees of non-renewable power generation plants, depreciation of the Peso against the US dollar, increased spot prices and energy purchases from the Wholesale Electricity Spot Market (WESM), and a combined effect of a 3% growth in distributed volumes and a slightly higher average distribution rate following the completion of the ATU refund in November the previous year.

Notably, Meralco’s average retail rate surged by 14%, reaching P10.68 per kWh from P9.33 per kWh. This spike was driven by a 25% escalation in the generation charge, which constitutes about 68% of the overall retail rate. Despite this, a lower transmission charge (7% of the retail rate), which declined by 10%, partially offset the increase. Moreover, subsidies and taxes (10% of the retail rate) experienced a 15% growth.

Conversely, the average distribution charge of P1.08 per kWh, accounting for 9% of the retail rate, witnessed an 11% decline. This occurred due to the implementation of distribution rate true-up (DRTU) adjustments, which averaged P0.42 per kWh during the first half of the year. Meralco completed the total DRTU refund of P48.3 billion ordered by the Energy Regulatory Commission (ERC) in May 2023.

Purchased power cost (PPC) surged by 13% to P167.5 billion, reflecting higher prices and energy purchases from WESM, augmented fuel expenses, and depreciation of the peso against the US dollar.

The average WESM price saw an increase to P7.13 per kWh from an average of P6.86 per kWh. This was attributed to the ongoing restriction of the Malampaya gas facilities and a significant rise in power demand. On May 9, the Luzon grid recorded a peak demand of 12,431 MW, surpassing the previous year’s demand by 318 MW.

During the same period, Malampaya gas prices climbed to an average of $9.78 per GJ from $9.25 per GJ a year ago. The imposition of Malampaya gas supply restrictions since March 2021, combined with a 15-day maintenance shutdown in February 2023, prompted the Sta. Rita and San Lorenzo natural gas plants to employ more costly liquid fuel to maintain a stable power supply to Meralco.

In terms of capital expenditures, Meralco allocated P14.1 billion in the first semester. The sum was allocated to Networks projects, tower business, and power generation. Operating expenses rose by 7% to P18.2 billion, primarily due to increased manpower costs, bills management-related expenses, cybersecurity costs, sales-related expenses, and material and manpower expenses for construction projects.

Consolidated interest-bearing debt, including the total debt of all subsidiaries, amounted to P101.5 billion. Out of this total, P33.8 billion were set to mature within a year.

On July 31, 2023, the Meralco Board of Directors approved the declaration of interim cash dividends amounting to P8.520 per share. This dividend is payable on September 14, 2023, to all shareholders of record as of August 30, 2023. It represents 50% of Meralco’s Core EPS.

The first half of 2023 witnessed higher demand from Residential and Commercial segments, driving energy sales volumes to an all-time high. Consolidated DU energy sales volumes during this period rose by 3% to 24,792 GWh, with Meralco and Clark Electric Distribution Corporation (Clark Electric) experiencing increases of 3% and 7%, respectively.

Monthly sales volumes exceeded the 4,000-GWh level since April, reaching a peak of 4,643 GWh in June. Demand in the Meralco franchise area also reached a peak of 8,438 MW on May 9, reflecting a 4% increase compared to the peak demand in the first half of 2022.

The Commercial segment led the sales volume with 9,162 GWh, indicating a substantial 10% growth from the previous year. This performance was attributed to the recovery of various business sectors and a surge in public confidence. The Residential segment recovered from a slight decline in the first quarter and ended the first half with 8,629 GWh in sales volume, 1% higher than the previous year. The Industrial segment, however, experienced a 2% decline due to economic challenges.

At the end of the first semester, Meralco’s consolidated customer count reached 7.716 million, marking a 3% increase from the previous year. This growth was attributed to the continued addition of new customers.

Meralco achieved notable sustainability milestones, including impressive ESG ratings, significant tree planting initiatives, and international recognition for transformative efforts.

The company upheld its exceptional environmental, social, and governance (ESG) performance, maintaining its top ratings in global indices. Meralco garnered a 3.2 ESG score from FTSE Russell ESG Ratings, surpassing both Philippine and energy sector averages. MSCI, Inc. also recognized Meralco’s achievements and accorded it with a BBB rating, signifying commendable performance in renewable energy opportunities and water management. Moreover, the company obtained climate scores aligned with the Paris Agreement’s goals.

In terms of sustainability efforts, Meralco successfully planted over two million trees across the Philippines, contributing to its goal of cultivating five million trees by 2026. The company’s sustainability initiatives were also acknowledged internationally, receiving awards for stakeholder management and corporate social responsibility programs.

Meralco’s financial performance in the first half of 2023, coupled with its commitment to sustainability and growth, sets the stage for a promising year ahead. The company’s leadership anticipates continued growth in sales and earnings, driven by its diversified ventures and dedication to meeting the nation’s energy needs while embracing renewable solutions.

Technical Analysis: Meralco (MER)

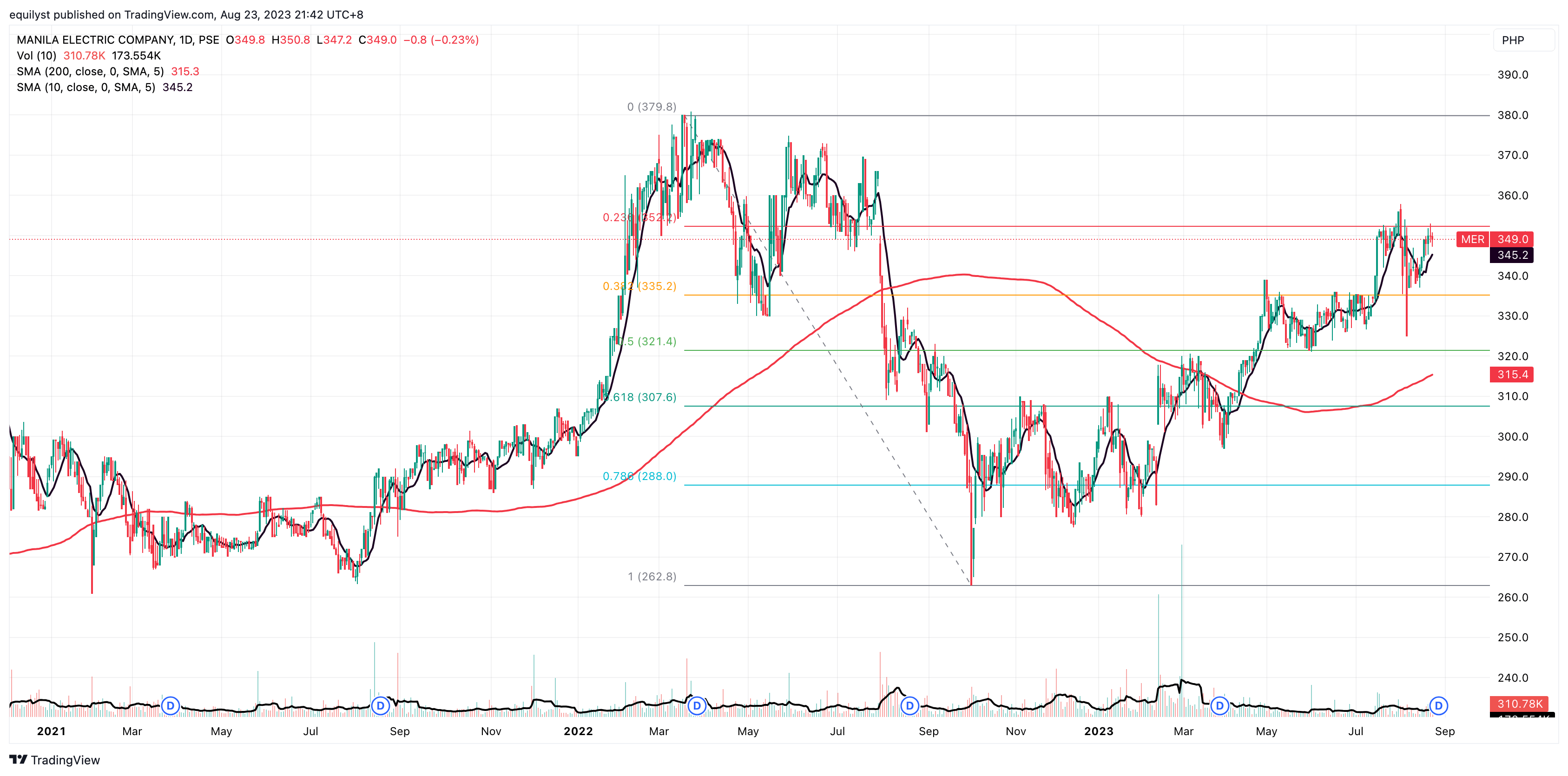

The stock price of Manila Electric Company (MER) surged by 21.12% in the first six months of 2023, rising from P298.80 on December 20, 2022, to P335.00 on June 30, 2023. However, this positive performance hasn’t carried over to its month-to-date (MTD) and week-to-date (WTD) price changes.

Manila Electric Company (MER) has declined by 1.97% for August MTD, dropping from P356 on July 31 to P349 on August 23. Additionally, it is down by 0.29% WTD, decreasing from P350 on August 18 to P349 on August 23.

This electric company is bullish in both the short-term (10SMA) and long-term (200SMA) periods, as its last price hovers around these two moving averages. Furthermore, the alignment of the 10SMA above the 200SMA confirms Meralco’s bullish stance in relation to its price and moving averages.

This electric company is bullish in both the short-term (10SMA) and long-term (200SMA) periods, as its last price hovers around these two moving averages. Furthermore, the alignment of the 10SMA above the 200SMA confirms Meralco’s bullish stance in relation to its price and moving averages.

Meralco’s support stands at P335.20, corresponding with its 38.2% Fibonacci retracement level. On the other hand, resistance is set at P352.20, aligning with the 23.6% Fibonacci retracement.

It’s notable that the resistance at P352 is quite robust, as the stock has been attempting to breach and maintain a level above P352 for over five weeks without success.

For Meralco to break this resistance and sustain the breakout, its green candlestick must be accompanied by a volume exceeding 100% of its 10-day volume average for three to five consecutive days or more.

Meanwhile, foreign investors have maintained a net buying stance on Meralco Year-to-Date (YTD), although their net foreign buying amount each month has been relatively modest. For instance, they only recorded a net foreign buying amount of P8 million in June, P21 million in July, and P22 million MTD. The foreign investors could have performed better in this regard.

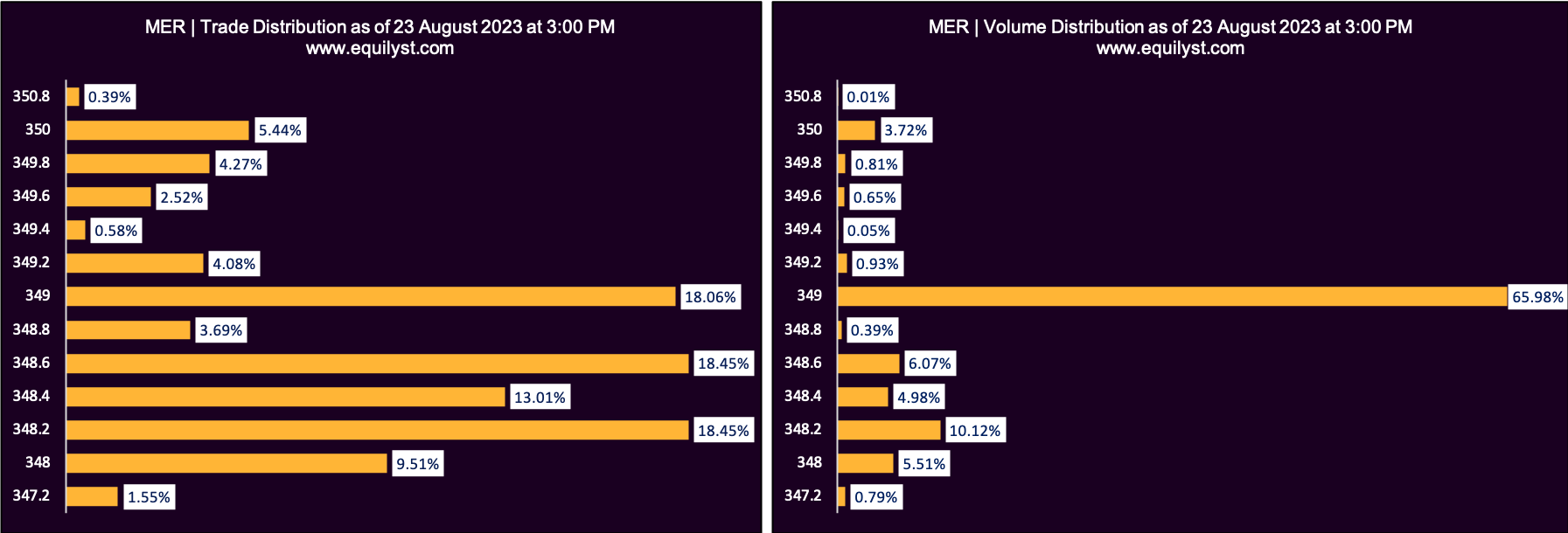

Conversely, Meralco’s last price of P349.00, which is higher than its volume-weighted average price (VWAP) of P348.84 as of the closing date on August 23, 2023, signals a bullish trend. Nevertheless, this signal is overshadowed by the prevailing bearish range. The price points with the highest volume and most trades (P348 to P349) are closer to the intraday low than the intraday high.

Conversely, Meralco’s last price of P349.00, which is higher than its volume-weighted average price (VWAP) of P348.84 as of the closing date on August 23, 2023, signals a bullish trend. Nevertheless, this signal is overshadowed by the prevailing bearish range. The price points with the highest volume and most trades (P348 to P349) are closer to the intraday low than the intraday high.

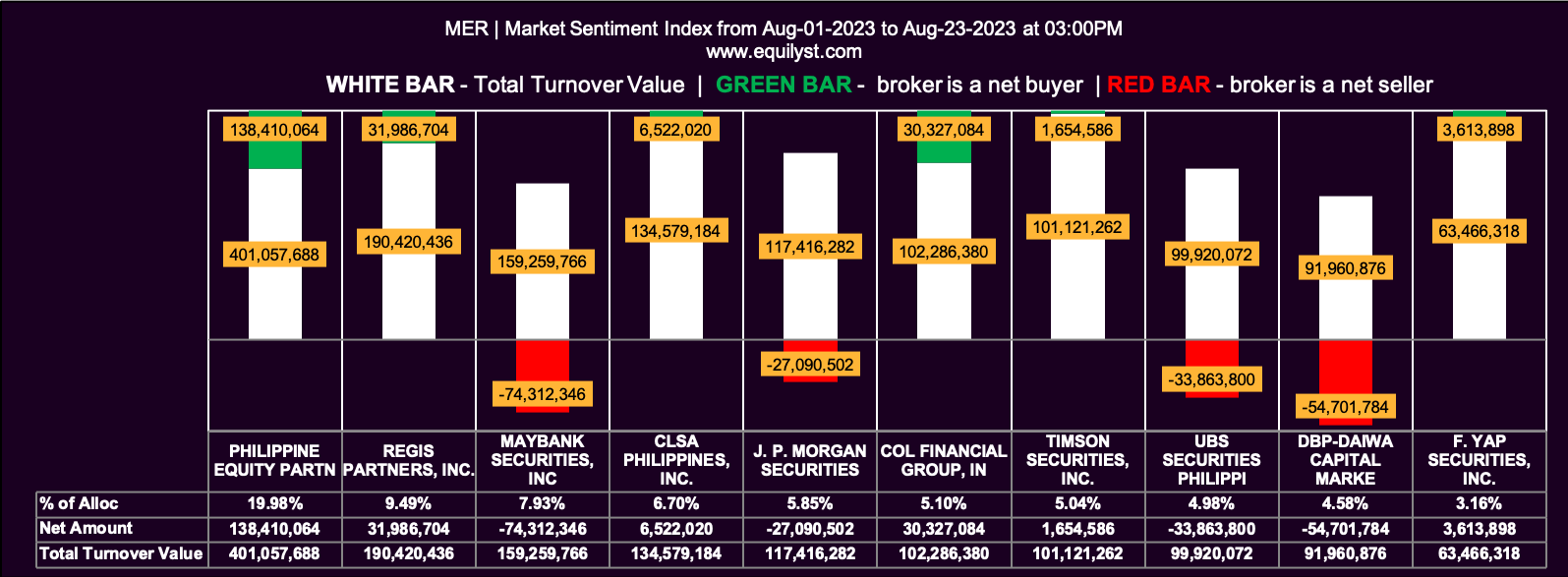

Compounding the situation is the bearish Market Sentiment Index for August MTD (August 1 to 23). Here are the statistics:

Compounding the situation is the bearish Market Sentiment Index for August MTD (August 1 to 23). Here are the statistics:

- 33 of the 82 participating brokers, or 40.24% of all participants, registered a positive Net Amount

- 25 of the 82 participating brokers, or 30.49% of all participants, registered a higher Buying Average than Selling Average

- 82 Participating Brokers’ Buying Average: ₱341.45389

- 82 Participating Brokers’ Selling Average: ₱344.58208

- 5 out of 82 participants, or 6.10% of all participants, registered a 100% BUYING activity

- 18 out of 82 participants, or 21.95% of all participants, registered a 100% SELLING activity

Manila Electric Company (MER): Overall Sentiment and August 24 to 25 Price Forecast

My overall sentiment for Meralco is neutral, with a bearish bias. There’s a sense of bearishness because those who are aware of this stock’s unsuccessful attempts to break the resistance at P352 may be more inclined to lock in profits at or near that level rather than to buy higher due to its history.

However, it doesn’t hurt to adopt a wait-and-see approach as Meralco progresses toward P352. We will cross the bridge when we get there.

If you want a tailored-fit recommendation relative to the size of your portfolio and risk tolerance, please complete this form to avail yourself of my crypto and stock market consulting service.

Fill out this form if you want to hire me to write for your website in the blockchain, crypto, Web3, or stock market space.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025