Latest News About Megawide Construction Corporation (PSE:MWIDE)

Megawide Construction Corporation is venturing into real estate development and is aiming to expand beyond its core construction and infrastructure projects.

Shareholders of the company have approved the acquisition of 100% ownership of PH1 World Developers Inc. from Citicore Holdings Investment Inc., which was approved during the annual stockholders’ meeting on July 12.

The acquisition involves a total cost of P5.2 billion.

According to Edgar Saavedra, Chairman and CEO of Megawide, this move represents a natural progression from their construction and engineering origins toward more profitable opportunities.

The company has always pursued growth by diversifying into higher value-added ventures since its establishment as a construction firm more than two decades ago.

Saavedra highlighted that construction serves as a stepping stone to explore value-generating platforms like airport and landport operations and property development along with their associated revenue streams and contributions.

Megawide’s successful Public Private Partnership (PPP) undertakings, such as the Mactan-Cebu International Airport and Parañaque Integrated Terminal Exchange, have opened up additional revenue streams that enhance the overall value of the company.

The acquisition is expected to invigorate Megawide’s growth and improve the quality of its order book by reducing risks from external clients and optimizing project management for increased efficiency and employee productivity.

Moreover, Megawide envisions more stable revenues by leveraging PH1’s long-term project visibility and availability.

The pipeline of vertical and horizontal developments under PH1, including My Enso Lofts in Timog, Quezon City, and Modan Lofts in Pasig and Taytay, Rizal, is predicted to provide a reliable income stream for the company.

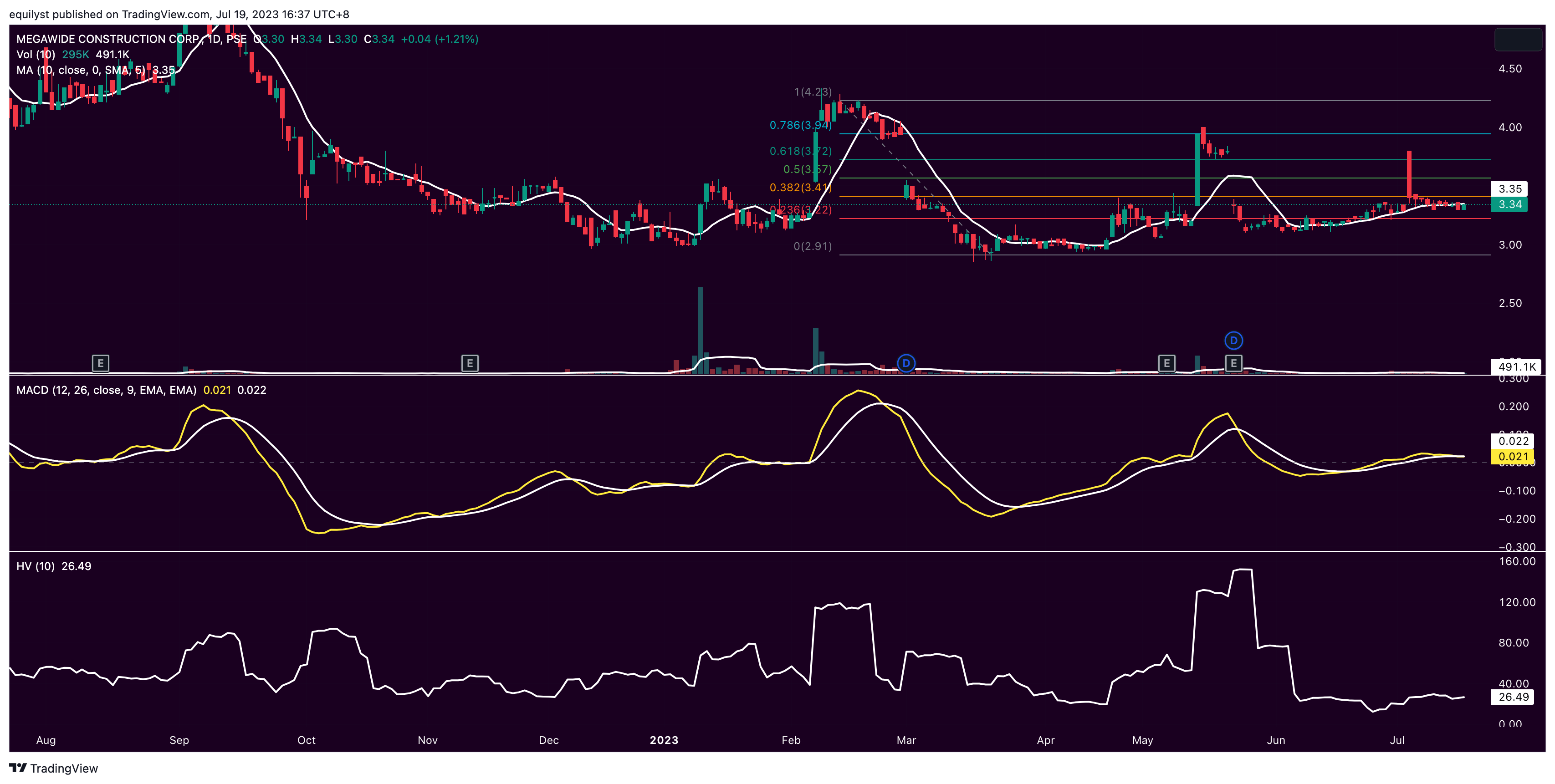

Megawide Construction Corporation (PSE:MWIDE) Technical Analysis

PSE:MWIDE trades at P3.34 per share as of the time of writing this report on July 19, 2023, up by 1.21%. It also progressed by 2.14% month-to-date and by 7.40% year-to-date.

Support and resistance levels are spotted at P3.22 and P3.41, respectively.

MWIDE struggles to break above its resistance level due to thin volume, particularly toward the end of the second week of July.

MWIDE trades below its 10-day simple moving average (10SMA) and moving average convergence divergence (MACD).

Zooming out on MWIDE’s chart, we see that it’s been traversing the downtrend channel since the second quarter of 2019. I hope those holding their position on MWIDE pre-2019 have an intact trailing stop relative to their risk tolerance percentage. Otherwise, you can’t convince me that your paper loss still gives you peace.

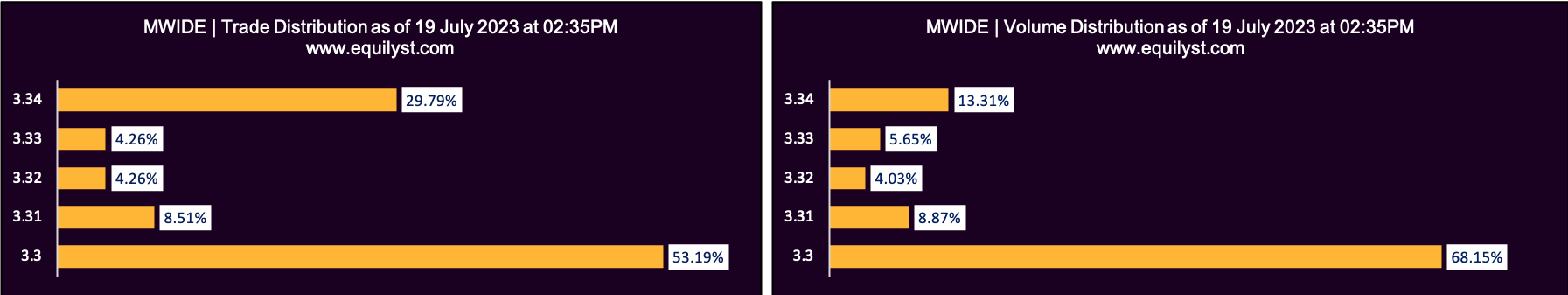

Trade-Volume Distribution Analysis

Dominant Range Index: BEARISH

Last Price: 3.34

VWAP: 3.31

Dominant Range: 3.3 – 3.3

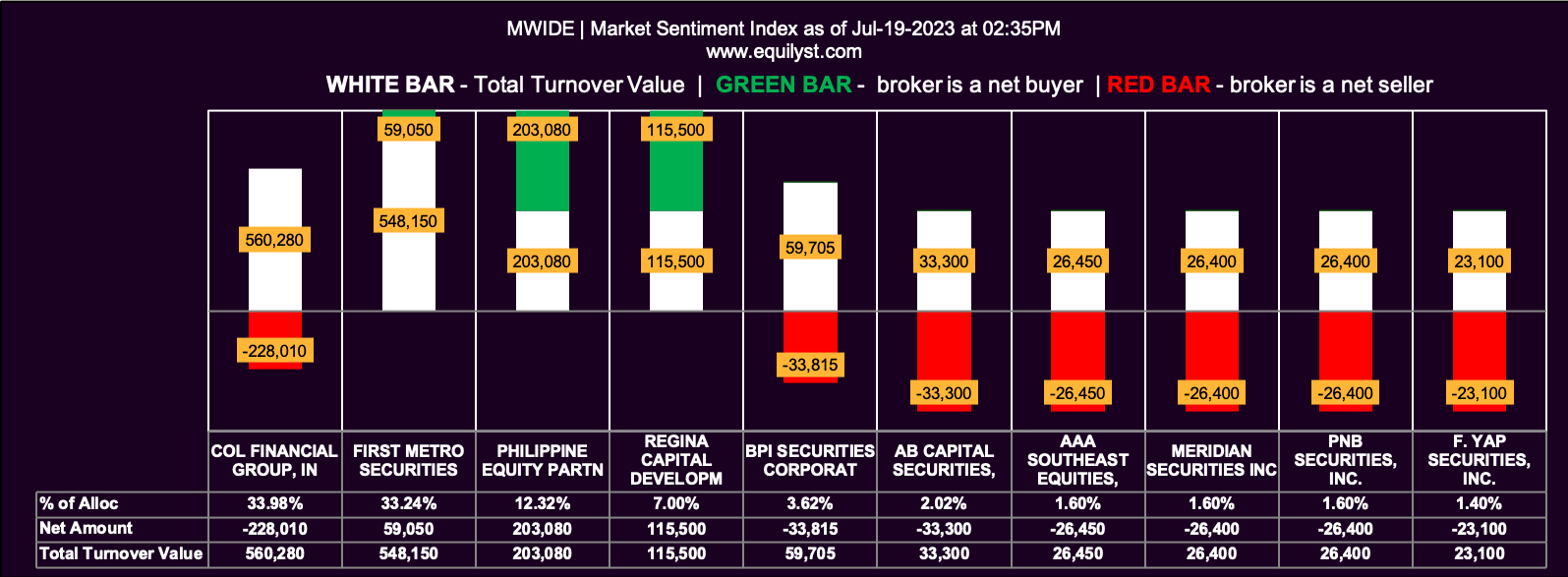

Market Sentiment Analysis

Market Sentiment Index: BEARISH

6 of the 13 participating brokers, or 46.15% of all participants, registered a positive Net Amount

4 of the 13 participating brokers, or 30.77% of all participants, registered a higher Buying Average than Selling Average

13 Participating Brokers’ Buying Average: ₱3.29528

13 Participating Brokers’ Selling Average: ₱3.31417

4 out of 13 participants, or 30.77% of all participants, registered a 100% BUYING activity

5 out of 13 participants, or 38.46% of all participants, registered a 100% SELLING activity

While the last price is higher than its volume-weighted average price (VWAP), the price with the biggest volume and highest number of trades is the intraday low also. It means there’s a very low conviction to buy at a higher price.

Also, most of the elements that form my Market Sentiment Index are bearish, resulting in a bearish overall Market Sentiment Index rating.

This alignment of ratings between the Dominant Range Index and Market Sentiment Index signifies the possibility for MWIDE to continue moving sideways with a bearish bias.

Bringing It Together

If your strategy is to trade the range between P2.90 and P4.20 with a 10% risk tolerance, and you entered a new position near P2.90, you should have already raked in your profits when the price hit P3.50 to P3.60, which is aligned to the 50% Fibonacci retracement.

If your risk tolerance percentage was 20%, you should have already locked in your profits when the price dove near P3.20, aligned with the 23.6% Fibonacci retracement.

If you entered near P2.90 and are still holding your position up to this point, I’m not sure if you’re reviewing your position properly or you just keep adding Hail Marys. If you’re in this situation, you should sell on strength. Compute where your trailing stop should have been positioned by using my trailing stop calculator.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025