Importance of Knowing Investors’ Market Sentiment in Decision-Making

How do you gauge the market sentiment?

By running a survey or observing discussions on stock market-related Facebook Groups?

But how do you verify the integrity or objectivity of their comments? That’s the problem!

Occasionally, I run surveys on Facebook Groups, but not to check the market sentiment but to ask them which stock they’d like me to write about in my next article. That way, I maintain the objectivity of my stock selection process as far as when deciding which stock to feature in my articles.

I check the overall market sentiment rating of a stock to help me decide whether I should hold my position since my trailing stop is still intact or pre-empt it.

The market sentiment also helps me estimate if the prevailing direction of the share price is likely to continue or reverse.

For example, if the stock is in a downtrend and the prevailing market sentiment is bearish, it means the downtrend is likely to continue.

If the stock is in a downtrend, but the market sentiment turns bullish, it’s a sign that investors might see a bullish reversal.

Again, and again, notice the adverbs I’m using – “likely” and “might”. We’re still talking about probabilities and not certainties.

Still, it’s better to be data-driven and be proven wrong by the market than make decisions based on gut feeling alone. The former gives you the opportunity to optimize something while the latter doesn’t.

I have an extensive explanation about why I created my proprietary Market Sentiment Index indicator in some articles on my website. Use the SEARCH box on this website and type “Market Sentiment” to read my other articles where I talked about this subject.

MTD Market Sentiment for the Top 5 Banking Stocks

I’ll share with you my findings when checked the overall Market Sentiment Index score of the five banking stocks with the biggest market capitalization using data from August 1, 2023 to August 29, 2023.

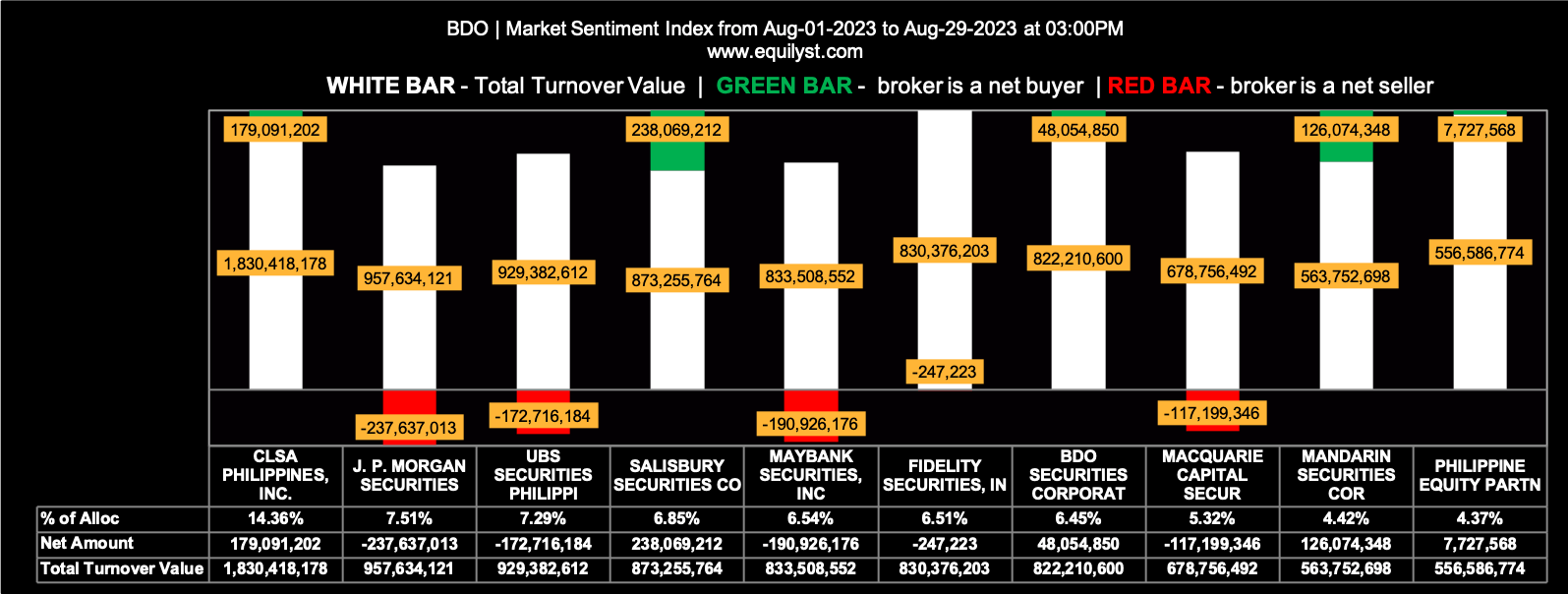

Rank: 1

Stock Code: BDO

Company: BDO Unibank, Inc.

Market Cap: P751,692,951,489

Market Sentiment Index: BEARISH

48 of the 87 participating brokers, or 55.17% of all participants, registered a positive Net Amount

33 of the 87 participating brokers, or 37.93% of all participants, registered a higher Buying Average than Selling Average

87 Participating Brokers’ Buying Average: ₱141.21234

87 Participating Brokers’ Selling Average: ₱142.10580

10 out of 87 participants, or 11.49% of all participants, registered a 100% BUYING activity

8 out of 87 participants, or 9.20% of all participants, registered a 100% SELLING activity

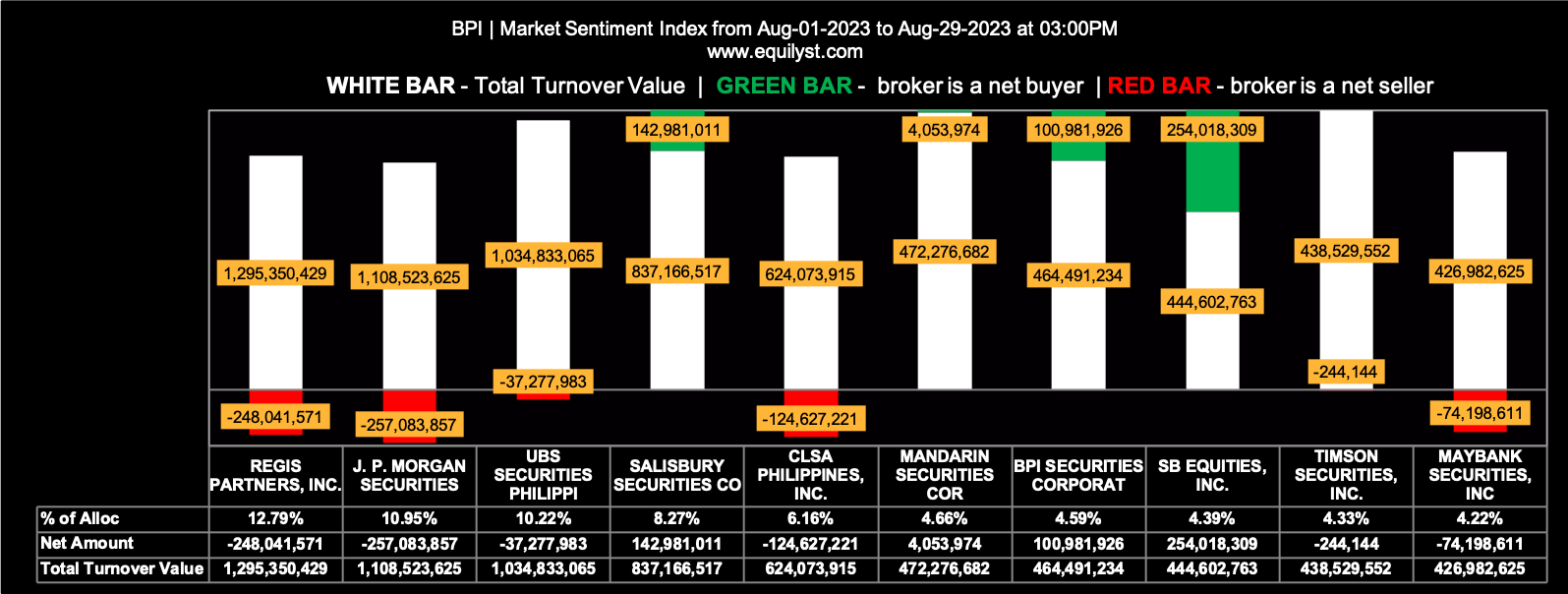

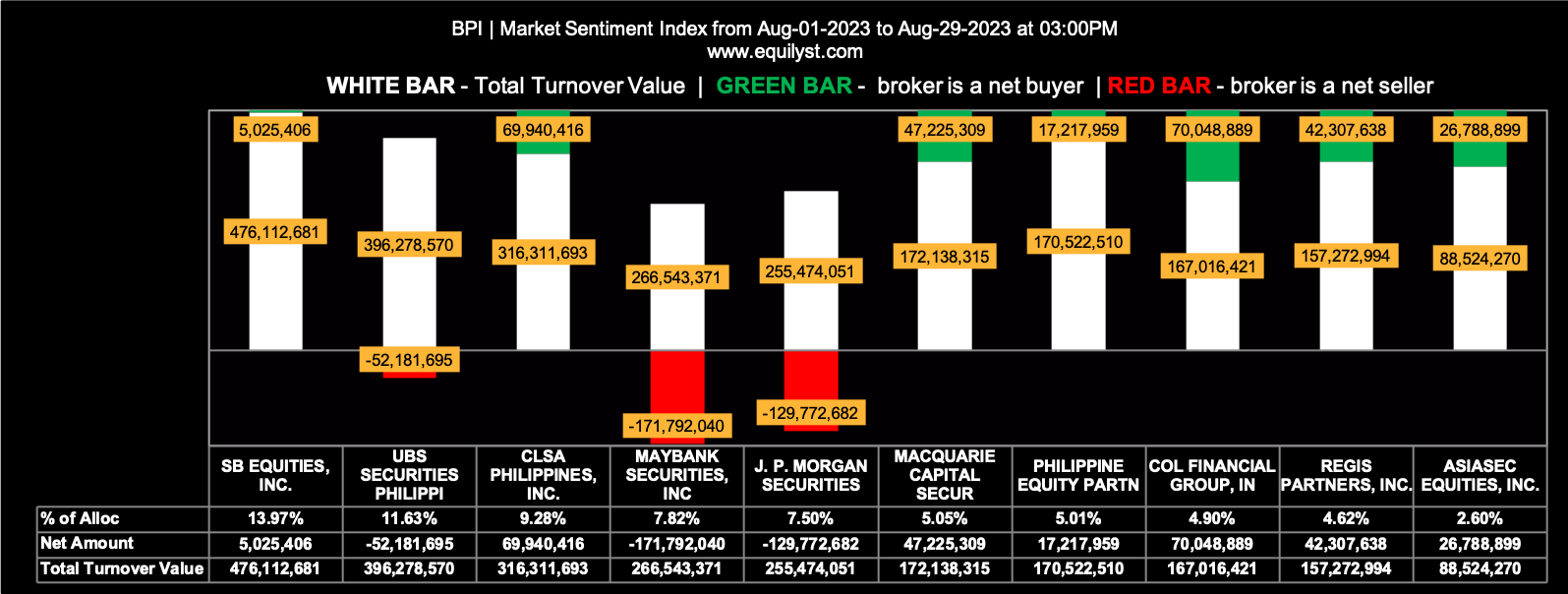

Rank: 2

Stock Code: BPI

Company: Bank of the Philippine Islands

Market Cap: P534,081,307,428

Market Sentiment Index: BEARISH

56 of the 87 participating brokers, or 64.37% of all participants, registered a positive Net Amount

29 of the 87 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

87 Participating Brokers’ Buying Average: ₱110.65310

87 Participating Brokers’ Selling Average: ₱113.09954

12 out of 87 participants, or 13.79% of all participants, registered a 100% BUYING activity

7 out of 87 participants, or 8.05% of all participants, registered a 100% SELLING activity

Rank: 3

Stock Code: MBT

Company: Metropolitan Bank & Trust Comp

Market Cap: P248,032,467,858

Market Sentiment Index: BEARISH

62 of the 88 participating brokers, or 70.45% of all participants, registered a positive Net Amount

25 of the 88 participating brokers, or 28.41% of all participants, registered a higher Buying Average than Selling Average

88 Participating Brokers’ Buying Average: ₱55.87203

88 Participating Brokers’ Selling Average: ₱56.83625

11 out of 88 participants, or 12.50% of all participants, registered a 100% BUYING activity

7 out of 88 participants, or 7.95% of all participants, registered a 100% SELLING activity

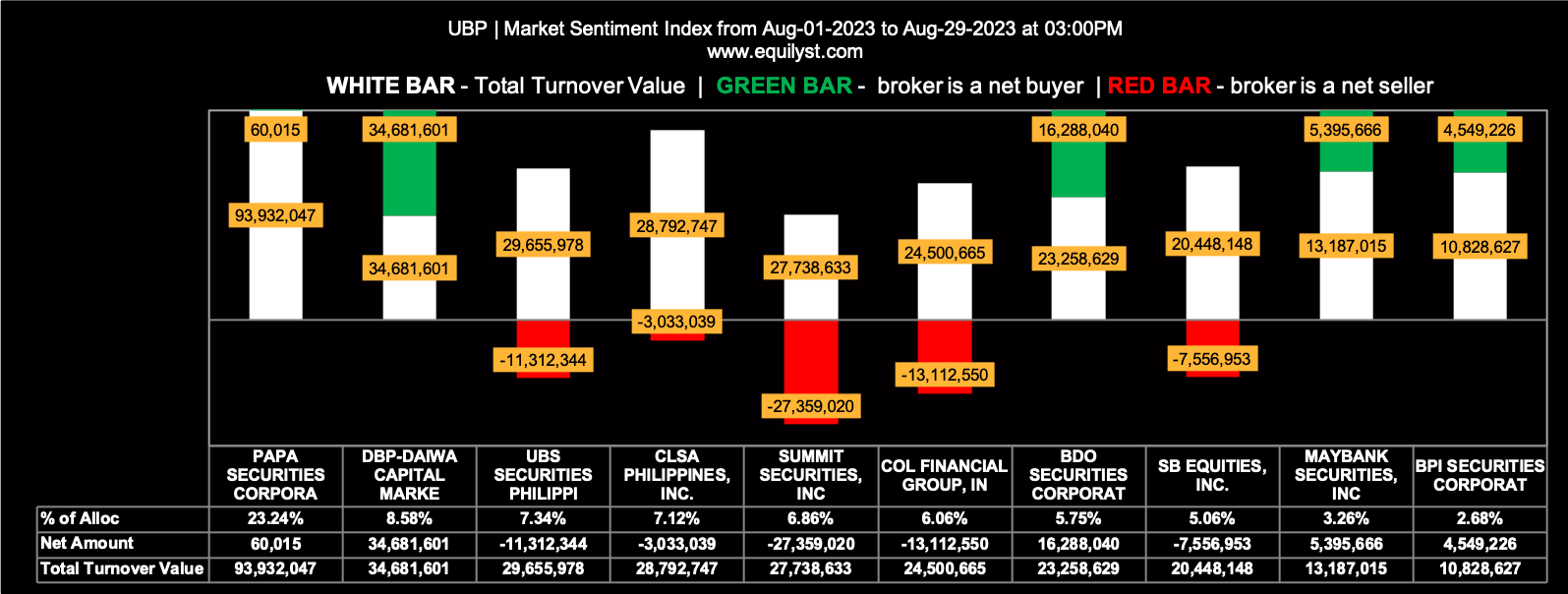

Rank: 4

Stock Code: UBP

Company: Union Bank of the Philippines

Market Cap: P161,349,328,745

Market Sentiment Index: BEARISH

35 of the 61 participating brokers, or 57.38% of all participants, registered a positive Net Amount

30 of the 61 participating brokers, or 49.18% of all participants, registered a higher Buying Average than Selling Average

61 Participating Brokers’ Buying Average: ₱71.93087

61 Participating Brokers’ Selling Average: ₱72.42741

18 out of 61 participants, or 29.51% of all participants, registered a 100% BUYING activity

8 out of 61 participants, or 13.11% of all participants, registered a 100% SELLING activity

Rank: 5

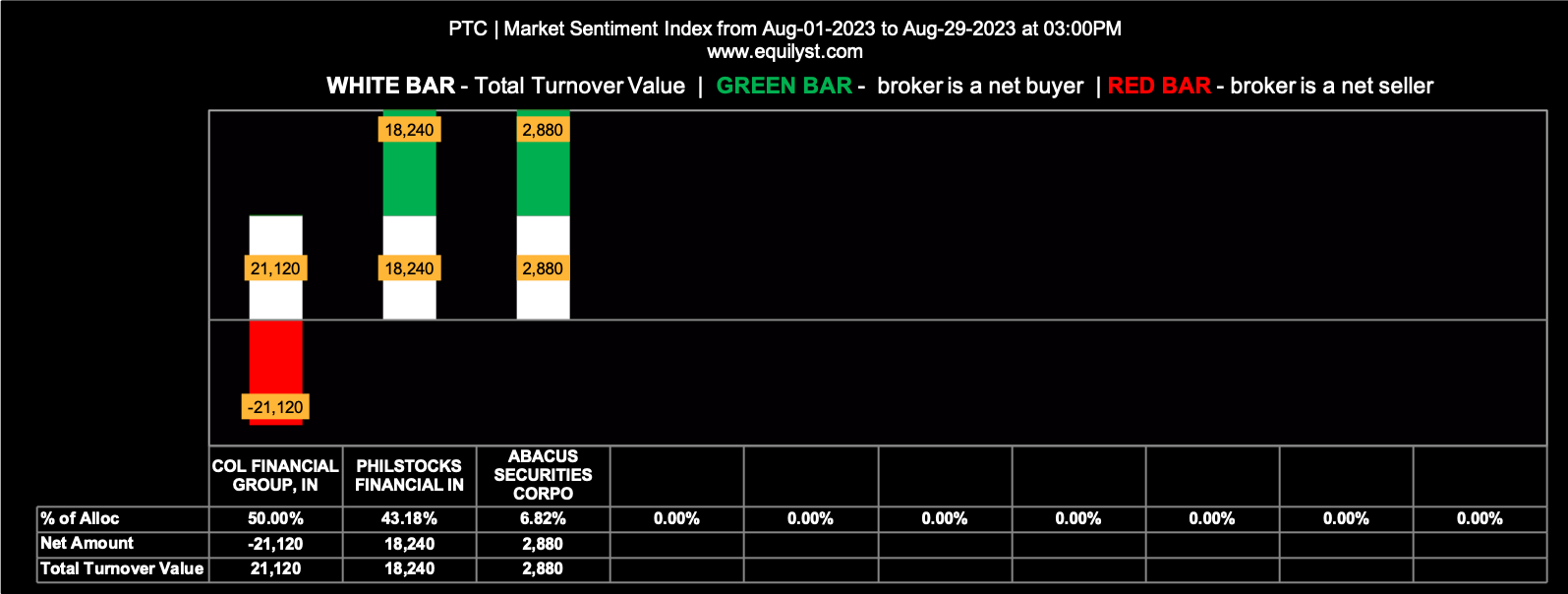

Stock Code: PTC

Company: Philippine Trust Company

Market Cap: P96,000,000,000

Market Sentiment Index: BULLISH

2 of the 3 participating brokers, or 66.67% of all participants, registered a positive Net Amount

2 of the 3 participating brokers, or 66.67% of all participants, registered a higher Buying Average than Selling Average

3 Participating Brokers’ Buying Average: ₱96.00000

3 Participating Brokers’ Selling Average: ₱96.00000

2 out of 3 participants, or 66.67% of all participants, registered a 100% BUYING activity

1 out of 3 participants, or 33.33% of all participants, registered a 100% SELLING activity

Personal Note: I won’t take the “bullish” rating for PTC because of volatility issues. As you can see, there are exemptions to the rule, and this is one of those exemptions.

Did You Find This Helpful?

If you find this article helpful, I’d like you to share in the comments below how it has specifically assisted you in making intelligent investment decisions

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025