I developed my Market Sentiment Index to know the consolidated sentiment of all brokers who traded the stock within a given period.

This is my proprietary tool. You will not find this in any stock broker’s platform.

My Market Sentiment Index indicator answers the following questions to generate a bullish or bearish overall sentiment:

1. How many participating brokers registered a positive Net Amount?

2. How many participating brokers registered a higher buying than selling average?

3. What is the buying and selling averages of all participating brokers?

4. How many of the participating brokers registered a 100% buying and selling activity?

My Market Sentiment Index indicator acts as one of the neutralizers of my data-driven sentiment.

Why did I say neutralizer?

Let’s say the other indicators of my Evergreen Strategy (my proprietary algorithm when trading and investing in the Philippine stock market) are all bullish.

If the Market Sentiment Index of the stock I’m checking is bearish, it’s a data-driven reminder for me to err on the side of caution.

How do I err on the side of caution?

It’s by closely monitoring my trailing stop.

It’s by not buying the dips when there’s no confirmed buy signal issued by my Evergreen Strategy.

It’s by trimming my losses or selling all shares at once when the Market Sentiment Index and Dominant Range Index of my stock have been bearish for 2 to 3 consecutive days even if my trailing stop is still intact (I call that pre-empting my trailing stop).

So, in this free report, I’d like to share with you the Market Sentiment Index for SCC, DMC, MPI, SPNEC, and MER as of March 28, 2023.

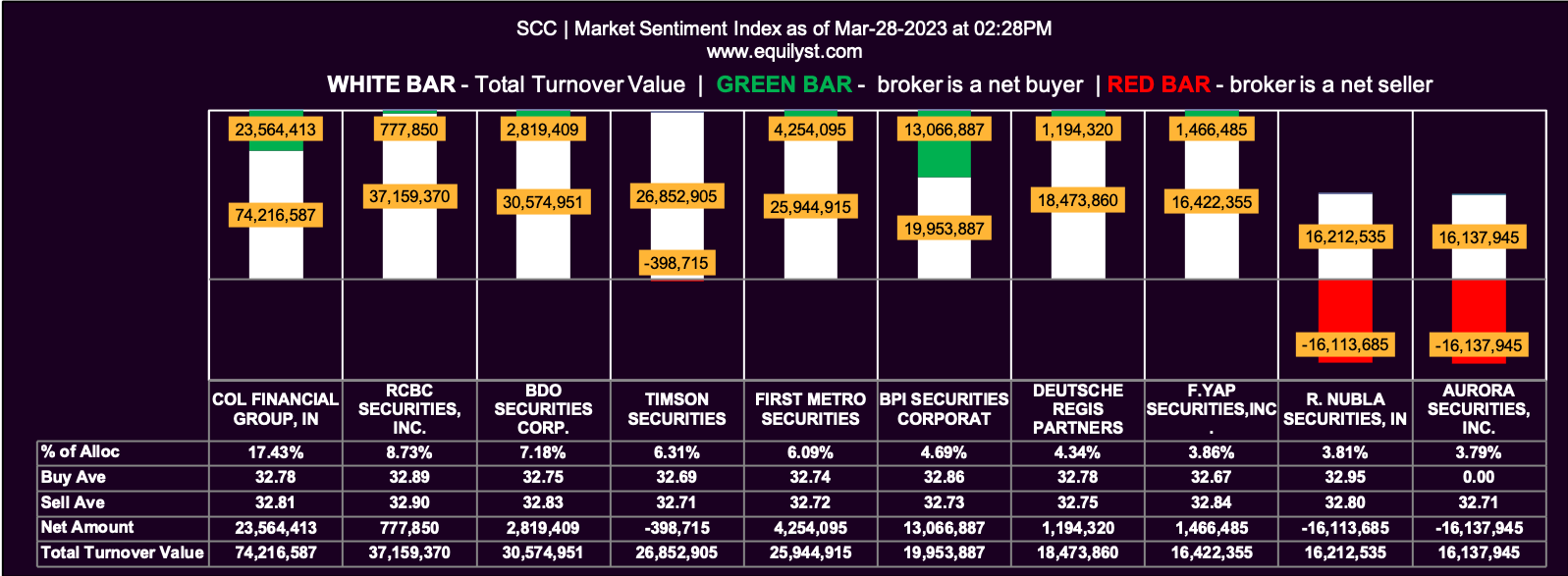

Semirara Mining and Power Corporation

Market Sentiment Index: BULLISH

39 of the 70 participating brokers, or 55.71% of all participants, registered a positive Net Amount

35 of the 70 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

70 Participating Brokers’ Buying Average: ₱32.71072

70 Participating Brokers’ Selling Average: ₱32.75992

20 out of 70 participants, or 28.57% of all participants, registered a 100% BUYING activity

19 out of 70 participants, or 27.14% of all participants, registered a 100% SELLING activity

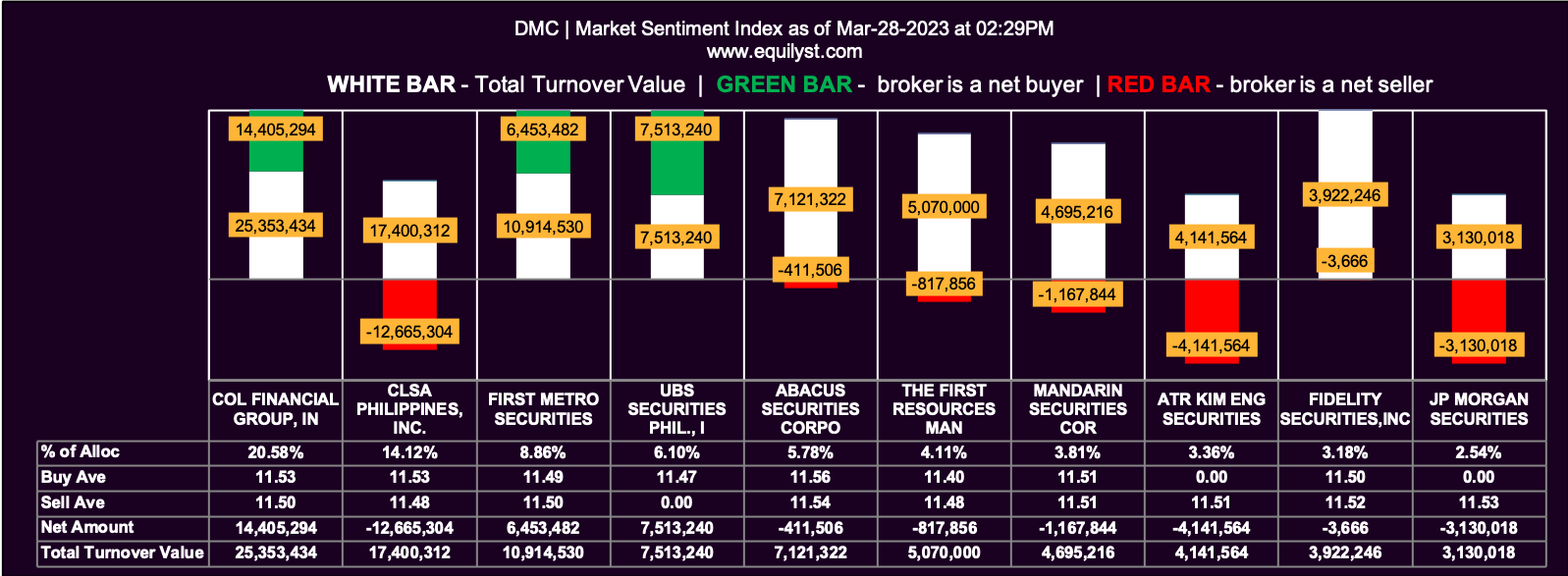

DMCI Holdings

Market Sentiment Index: BEARISH

19 of the 47 participating brokers, or 40.43% of all participants, registered a positive Net Amount

19 of the 47 participating brokers, or 40.43% of all participants, registered a higher Buying Average than Selling Average

47 Participating Brokers’ Buying Average: ₱11.49544

47 Participating Brokers’ Selling Average: ₱11.50858

11 out of 47 participants, or 23.40% of all participants, registered a 100% BUYING activity

16 out of 47 participants, or 34.04% of all participants, registered a 100% SELLING activity

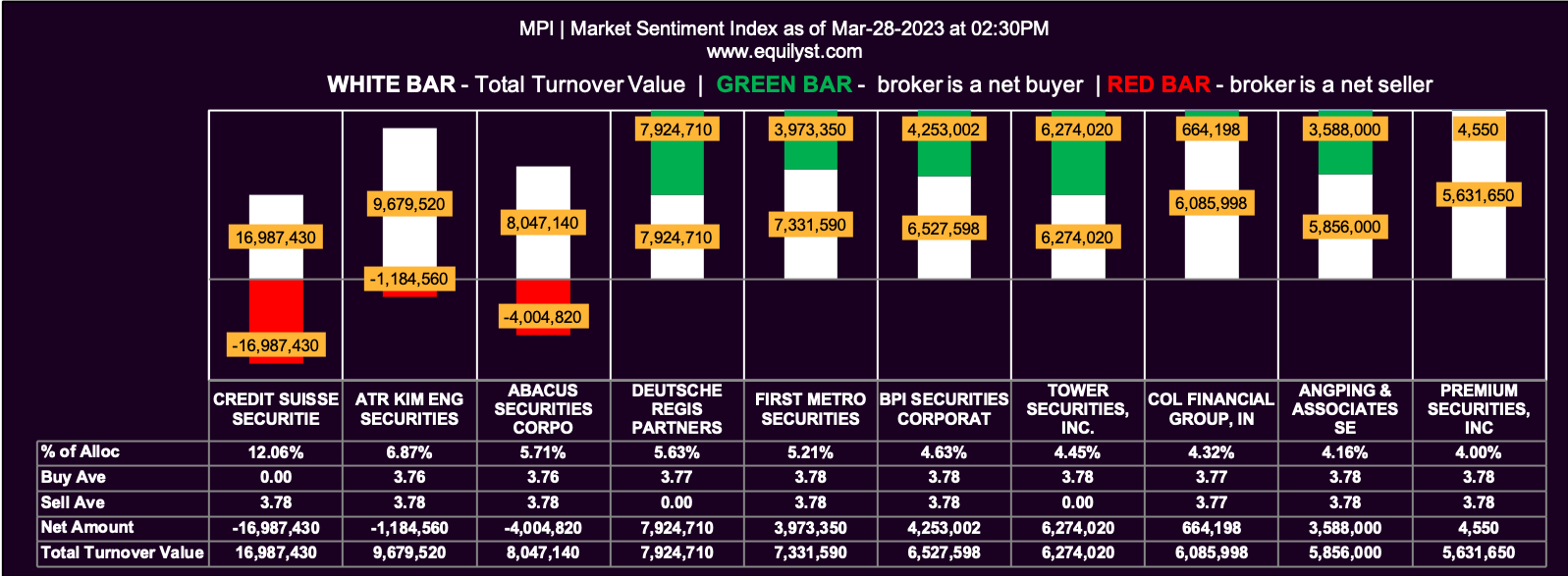

Metro Pacific Investments Corporation

Market Sentiment Index: BEARISH

25 of the 47 participating brokers, or 53.19% of all participants, registered a positive Net Amount

23 of the 47 participating brokers, or 48.94% of all participants, registered a higher Buying Average than Selling Average

47 Participating Brokers’ Buying Average: ₱3.77061

47 Participating Brokers’ Selling Average: ₱3.77495

15 out of 47 participants, or 31.91% of all participants, registered a 100% BUYING activity

12 out of 47 participants, or 25.53% of all participants, registered a 100% SELLING activity

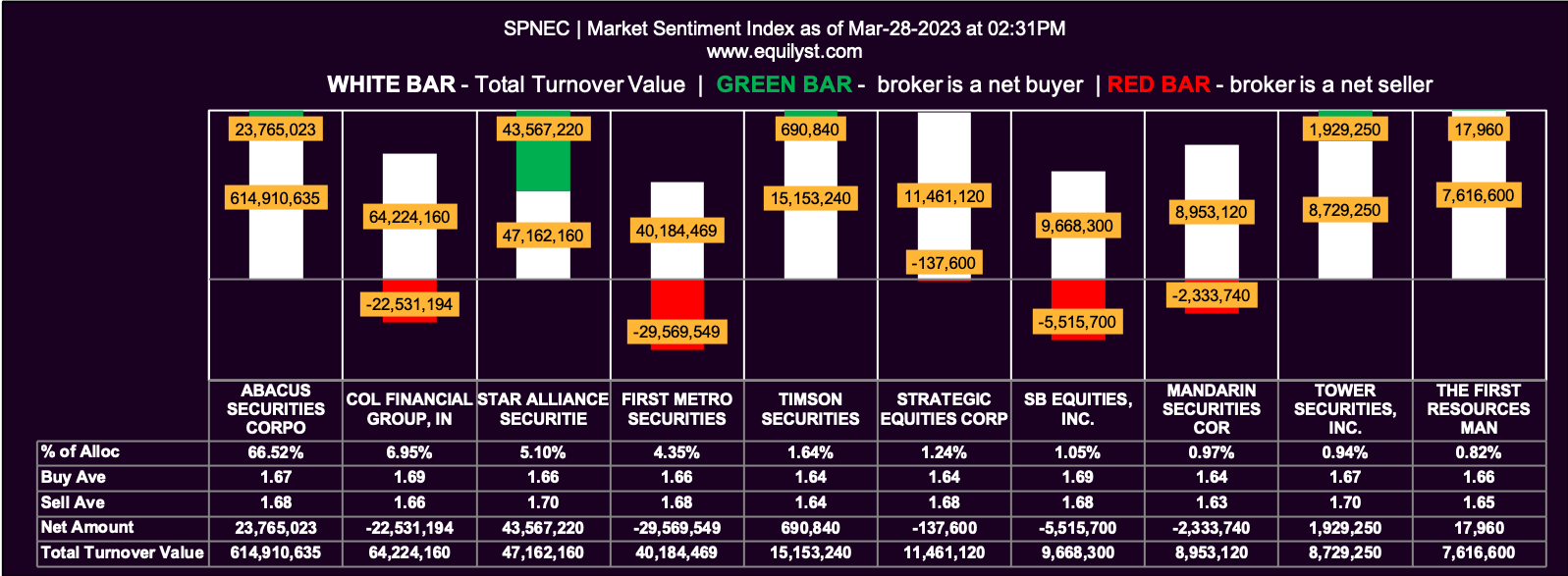

SP New Energy Corporation

Market Sentiment Index: BEARISH

17 of the 51 participating brokers, or 33.33% of all participants, registered a positive Net Amount

20 of the 51 participating brokers, or 39.22% of all participants, registered a higher Buying Average than Selling Average

51 Participating Brokers’ Buying Average: ₱1.66358

51 Participating Brokers’ Selling Average: ₱1.66933

5 out of 51 participants, or 9.80% of all participants, registered a 100% BUYING activity

11 out of 51 participants, or 21.57% of all participants, registered a 100% SELLING activity

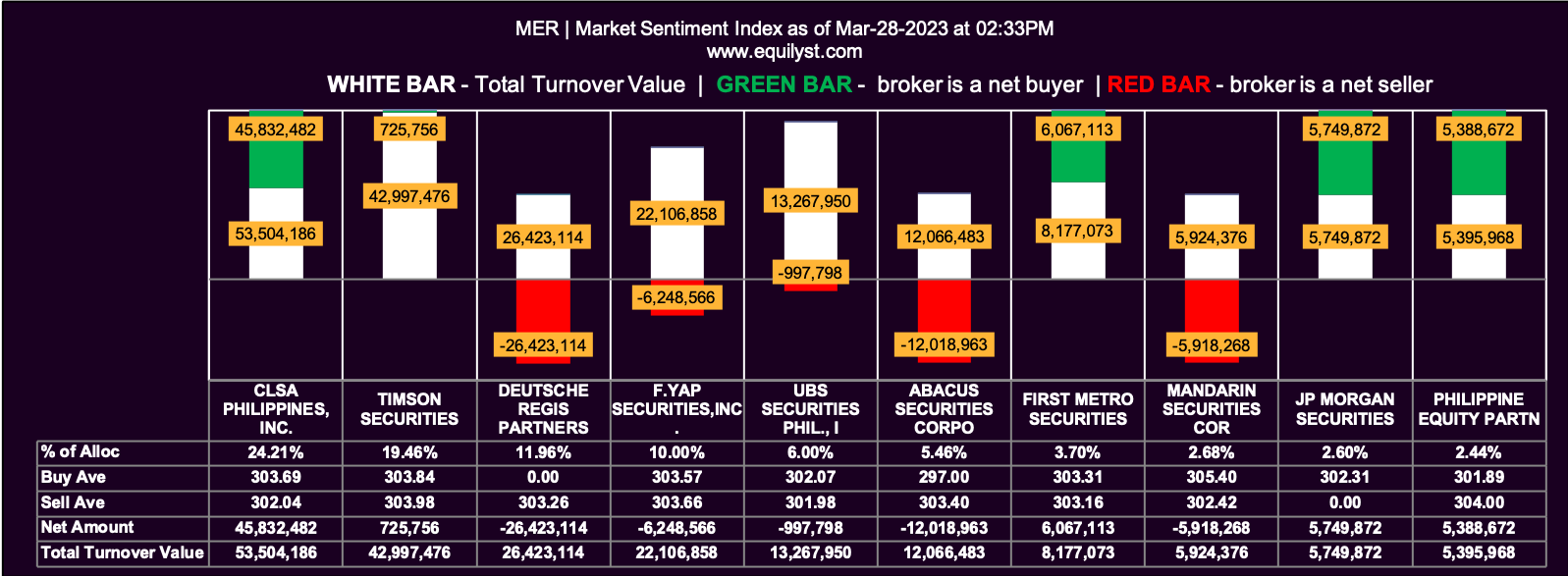

Manila Electric Company

Market Sentiment Index: BEARISH

12 of the 40 participating brokers, or 30.00% of all participants, registered a positive Net Amount

12 of the 40 participating brokers, or 30.00% of all participants, registered a higher Buying Average than Selling Average

40 Participating Brokers’ Buying Average: ₱302.00092

40 Participating Brokers’ Selling Average: ₱303.67860

7 out of 40 participants, or 17.50% of all participants, registered a 100% BUYING activity

17 out of 40 participants, or 42.50% of all participants, registered a 100% SELLING activity

Hire Me as Your Private Consultant

Here’s what you’ll get if you hire me as your private consultant when trading and investing in the Philippine stock market:

- one-on-one online training with me on how you can preserve your capital, protect your gains, and prevent unbearable losses when trading and investing in the Philippine stock market

- 10 credits for you to email me your stock analysis requests

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025