Did you already read the first part of this report?

No? You should read it first here, so you’ll understand what I’m talking about in this second part of my free report.

I’ll talk about the 10 remaining companies that form part of the PSE DivY Index.

- Metropolitan Bank & Trust Company (MBT)

- Manila Electric Company (MER)

- Metro Pacific Investments Corporation (MPI)

- Nickel Asia Corporation (NIKL)

- Robinsons Land Corporation (RLC)

- Robinsons Retail Holdings (RRHI)

- Semirara Mining and Power Corporation (SCC)

- Security Bank Corporation (SECB)

- PLDT (TEL)

- Universal Robina Corporation (URC)

The coverage of my data is from July 1 to 31 of 2022.

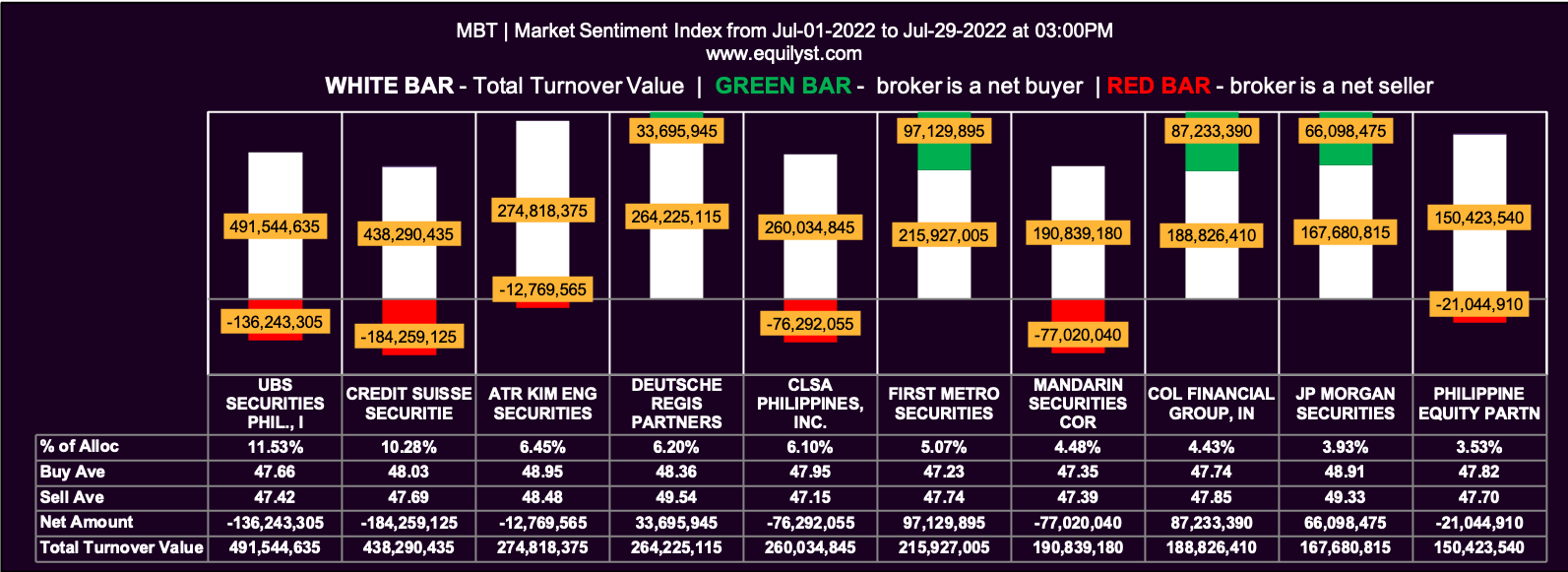

Metropolitan Bank & Trust Company (MBT)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

68 of the 92 participating brokers, or 73.91% of all participants, registered a positive Net Amount

33 of the 92 participating brokers, or 35.87% of all participants, registered a higher Buying Average than Selling Average

92 Participating Brokers’ Buying Average: ₱47.29036

92 Participating Brokers’ Selling Average: ₱47.82268

13 out of 92 participants, or 14.13% of all participants, registered a 100% BUYING activity

2 out of 92 participants, or 2.17% of all participants, registered a 100% SELLING activity

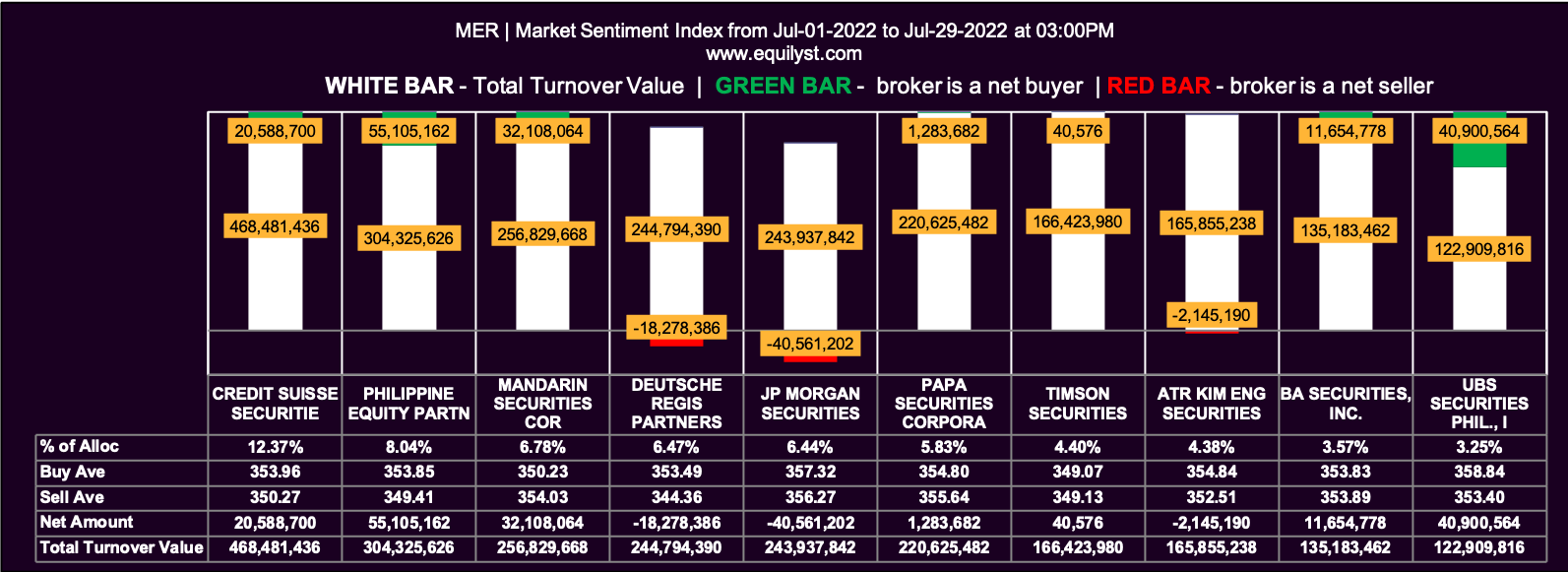

Manila Electric Company (MER)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

60 of the 99 participating brokers, or 60.61% of all participants, registered a positive Net Amount

37 of the 99 participating brokers, or 37.37% of all participants, registered a higher Buying Average than Selling Average

99 Participating Brokers’ Buying Average: ₱346.04589

99 Participating Brokers’ Selling Average: ₱354.14207

23 out of 99 participants, or 23.23% of all participants, registered a 100% BUYING activity

11 out of 99 participants, or 11.11% of all participants, registered a 100% SELLING activity

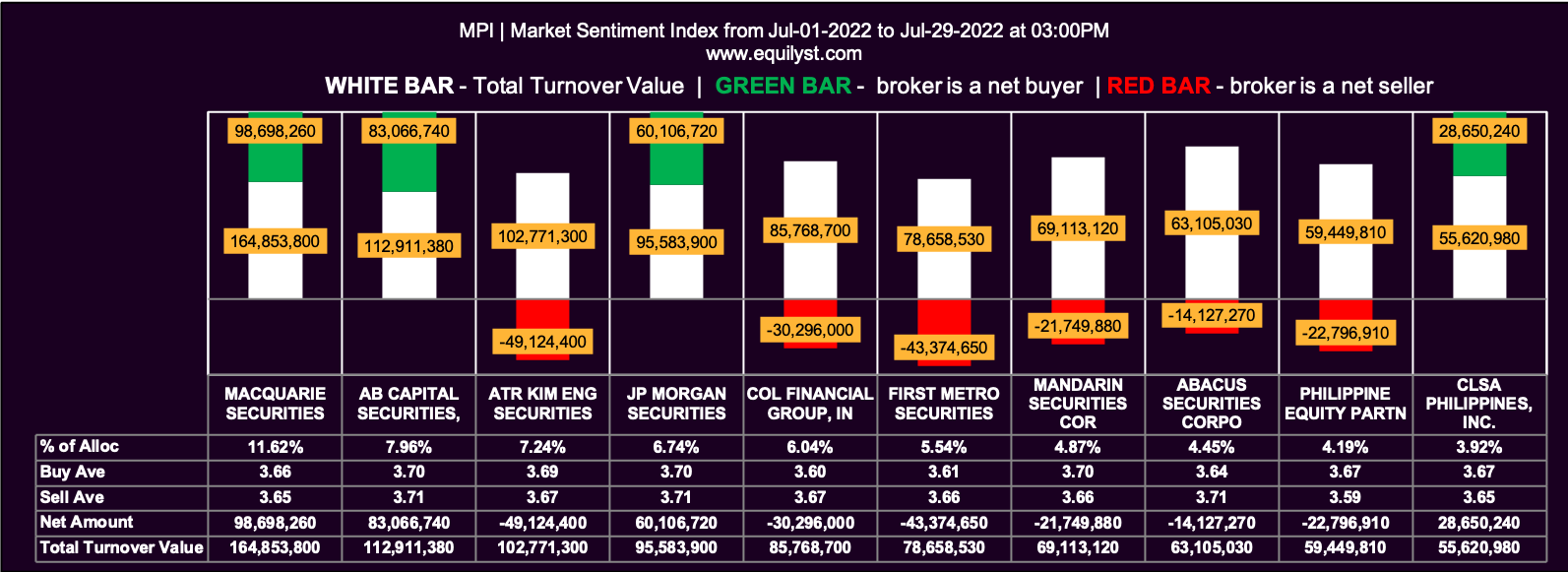

Metro Pacific Investments Corporation (MPI)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

33 of the 85 participating brokers, or 38.82% of all participants, registered a positive Net Amount

26 of the 85 participating brokers, or 30.59% of all participants, registered a higher Buying Average than Selling Average

85 Participating Brokers’ Buying Average: ₱3.61828

85 Participating Brokers’ Selling Average: ₱3.67450

12 out of 85 participants, or 14.12% of all participants, registered a 100% BUYING activity

20 out of 85 participants, or 23.53% of all participants, registered a 100% SELLING activity

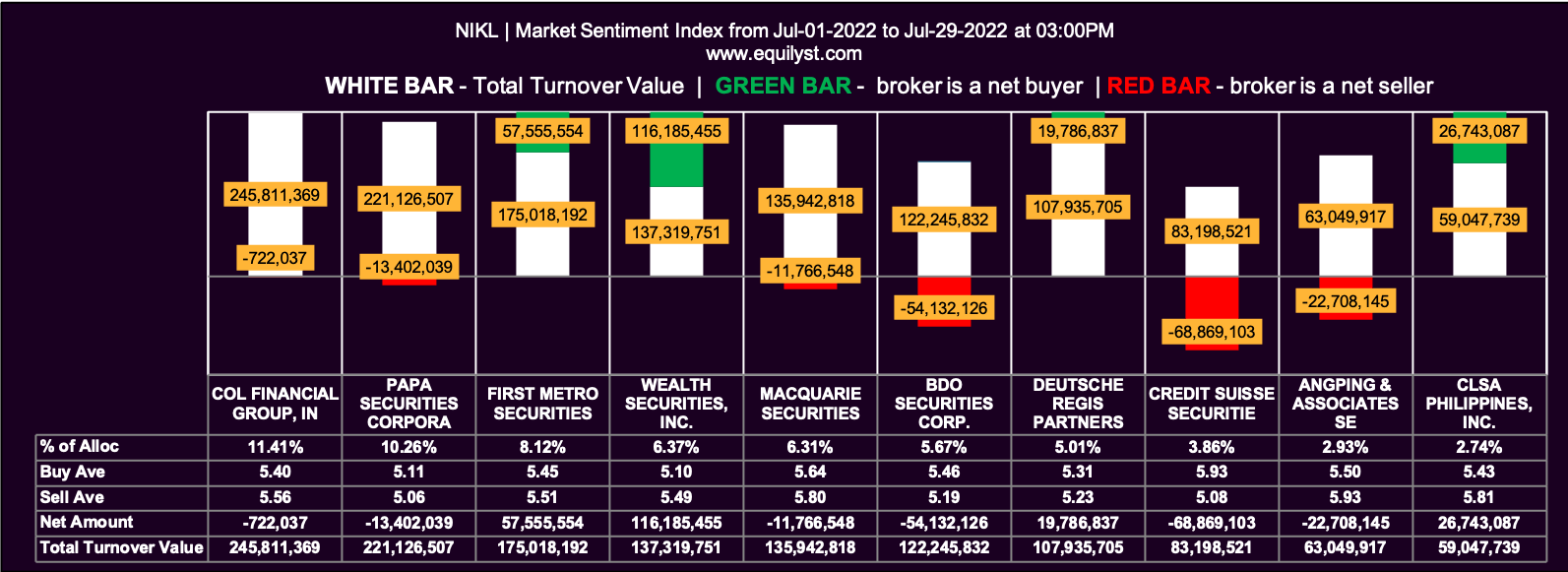

Nickel Asia Corporation (NIKL)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

59 of the 95 participating brokers, or 62.11% of all participants, registered a positive Net Amount

51 of the 95 participating brokers, or 53.68% of all participants, registered a higher Buying Average than Selling Average

95 Participating Brokers’ Buying Average: ₱5.46455

95 Participating Brokers’ Selling Average: ₱5.44638

16 out of 95 participants, or 16.84% of all participants, registered a 100% BUYING activity

4 out of 95 participants, or 4.21% of all participants, registered a 100% SELLING activity

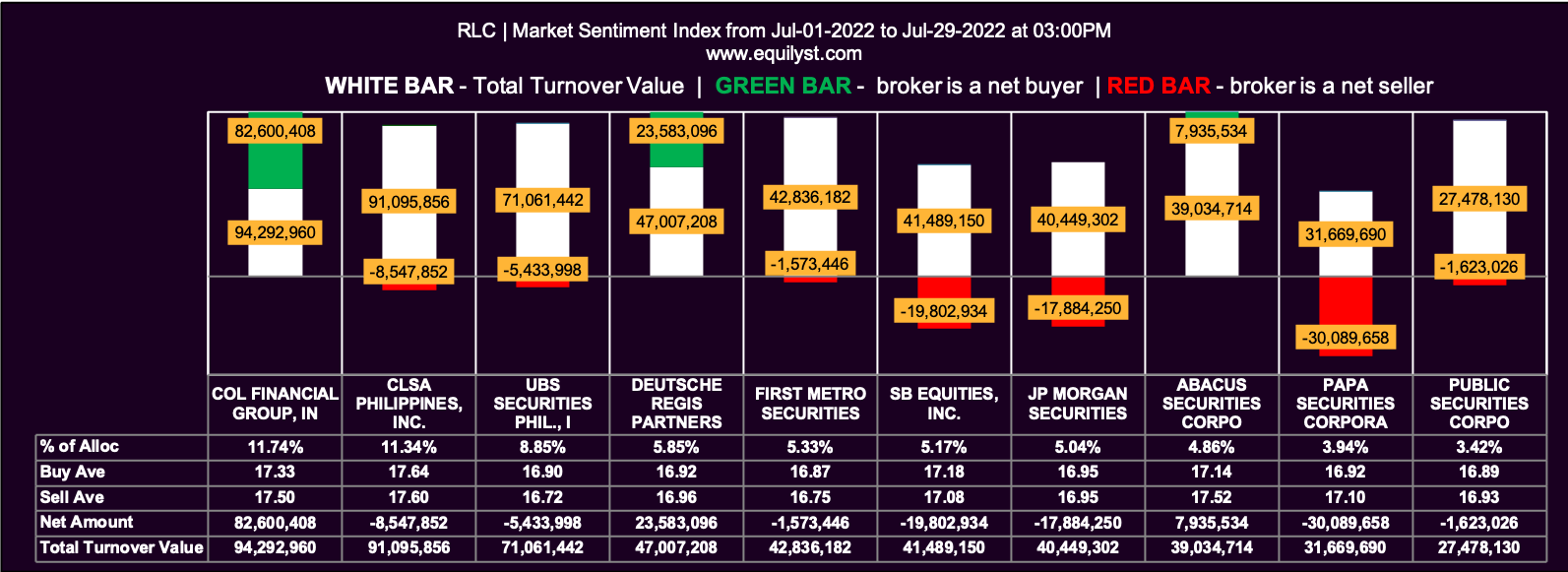

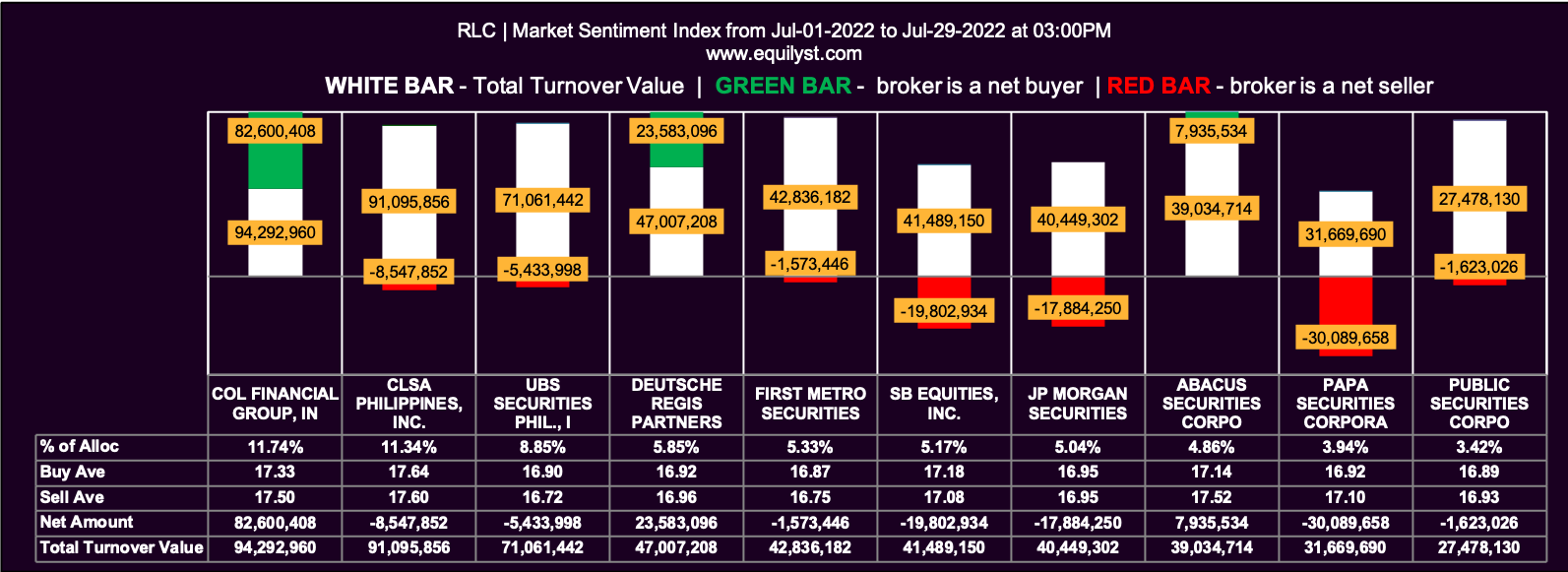

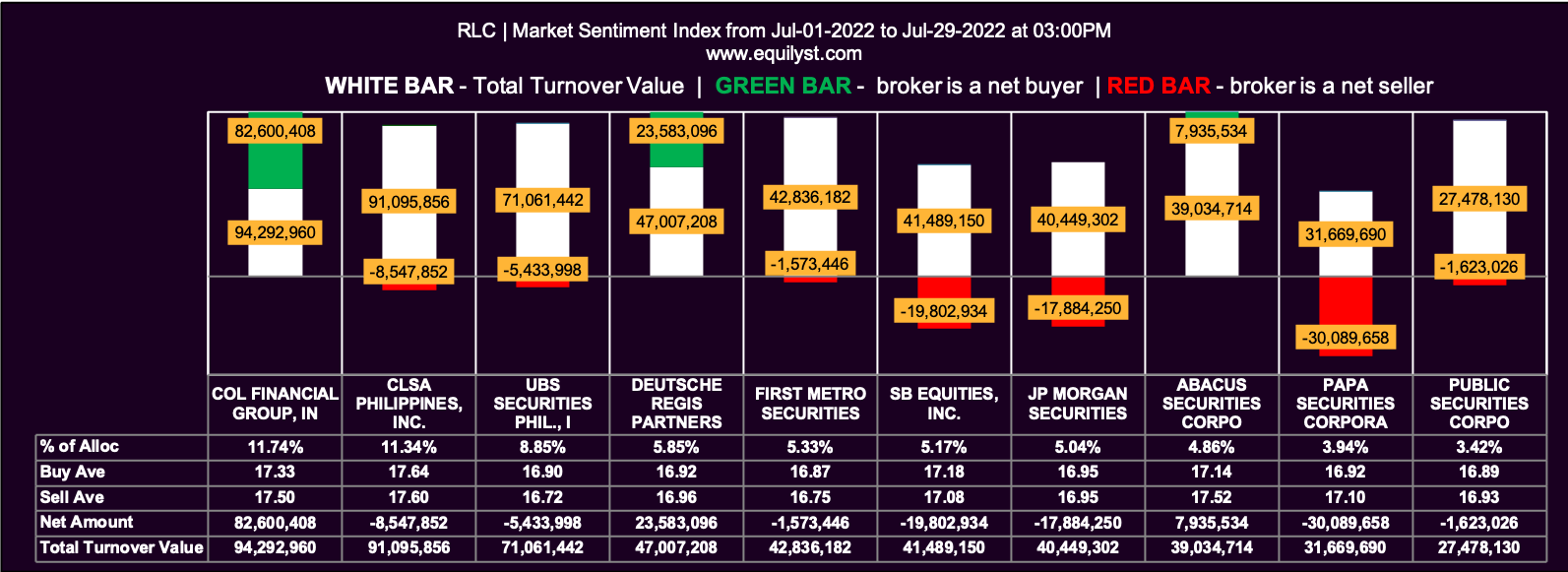

Robinsons Land Corporation (RLC)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

27 of the 56 participating brokers, or 48.21% of all participants, registered a positive Net Amount

17 of the 56 participating brokers, or 30.36% of all participants, registered a higher Buying Average than Selling Average

56 Participating Brokers’ Buying Average: ₱16.97882

56 Participating Brokers’ Selling Average: ₱17.25291

7 out of 56 participants, or 12.50% of all participants, registered a 100% BUYING activity

6 out of 56 participants, or 10.71% of all participants, registered a 100% SELLING activity

Robinsons Retail Holdings (RRHI)

Market Sentiment Index: BEARISH

Market Sentiment Index: BEARISH

18 of the 65 participating brokers, or 27.69% of all participants, registered a positive Net Amount

17 of the 65 participating brokers, or 26.15% of all participants, registered a higher Buying Average than Selling Average

65 Participating Brokers’ Buying Average: ₱53.69607

65 Participating Brokers’ Selling Average: ₱54.04984

4 out of 65 participants, or 6.15% of all participants, registered a 100% BUYING activity

29 out of 65 participants, or 44.62% of all participants, registered a 100% SELLING activity

Semirara Mining and Power Corporation (SCC)

Market Sentiment Index: BEARISH

Market Sentiment Index: BEARISH

26 of the 103 participating brokers, or 25.24% of all participants, registered a positive Net Amount

30 of the 103 participating brokers, or 29.13% of all participants, registered a higher Buying Average than Selling Average

103 Participating Brokers’ Buying Average: ₱38.41378

103 Participating Brokers’ Selling Average: ₱38.80675

0 out of 103 participants, or 0.00% of all participants, registered a 100% BUYING activity

21 out of 103 participants, or 20.39% of all participants, registered a 100% SELLING activity

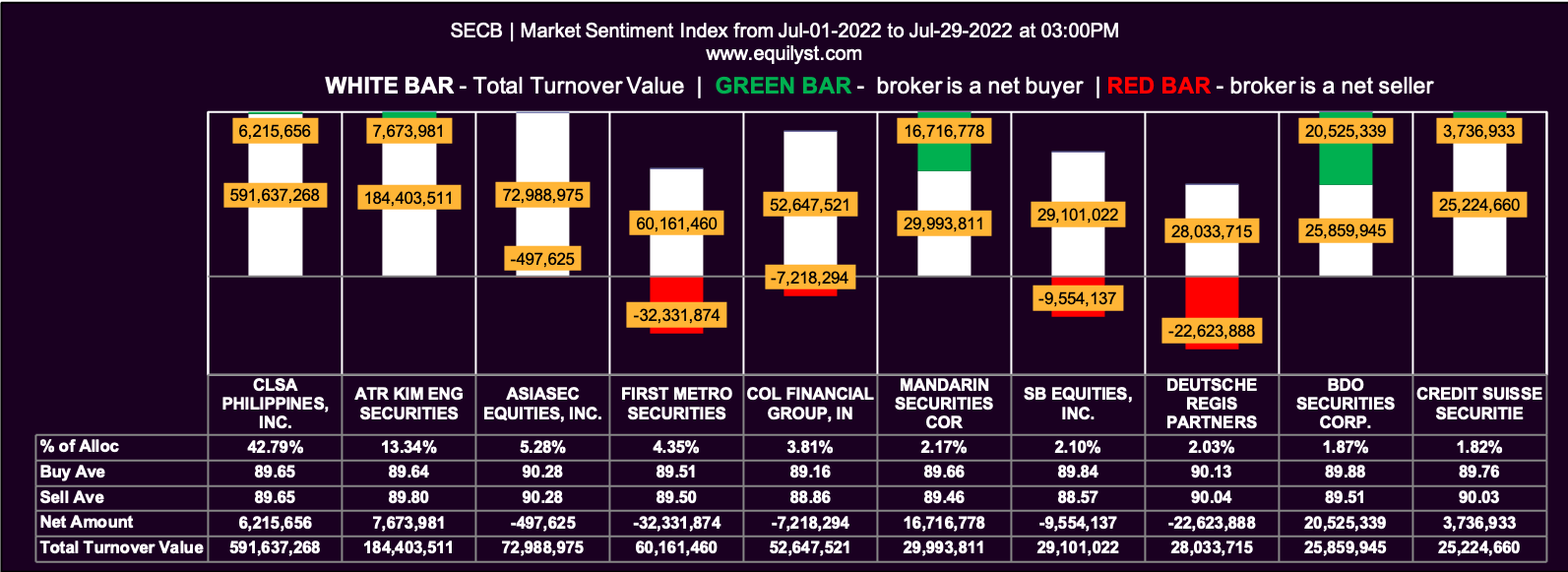

Security Bank Corporation (SECB)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

41 of the 79 participating brokers, or 51.90% of all participants, registered a positive Net Amount

37 of the 79 participating brokers, or 46.84% of all participants, registered a higher Buying Average than Selling Average

79 Participating Brokers’ Buying Average: ₱89.24491

79 Participating Brokers’ Selling Average: ₱89.95835

14 out of 79 participants, or 17.72% of all participants, registered a 100% BUYING activity

9 out of 79 participants, or 11.39% of all participants, registered a 100% SELLING activity

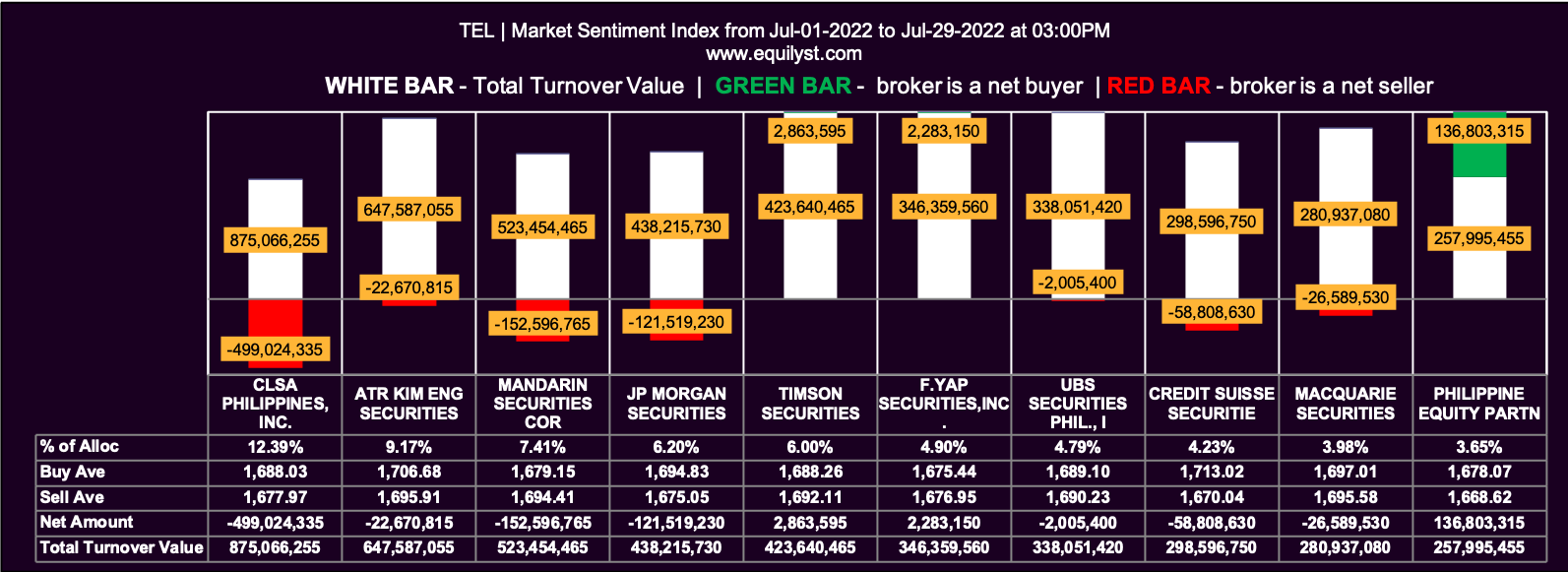

PLDT (TEL)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

60 of the 89 participating brokers, or 67.42% of all participants, registered a positive Net Amount

37 of the 89 participating brokers, or 41.57% of all participants, registered a higher Buying Average than Selling Average

89 Participating Brokers’ Buying Average: ₱1676.03858

89 Participating Brokers’ Selling Average: ₱1697.43869

19 out of 89 participants, or 21.35% of all participants, registered a 100% BUYING activity

4 out of 89 participants, or 4.49% of all participants, registered a 100% SELLING activity

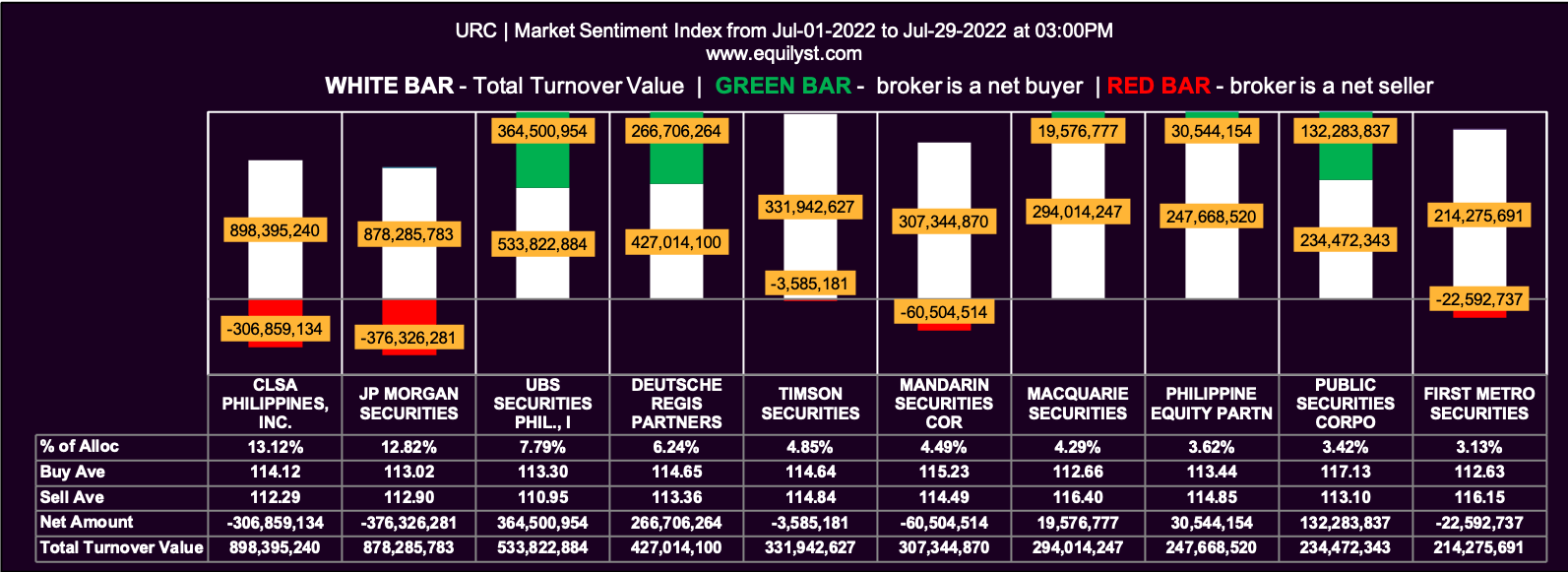

Universal Robina Corporation (URC)

Market Sentiment Index: BEARISH

Market Sentiment Index: BEARISH

26 of the 82 participating brokers, or 31.71% of all participants, registered a positive Net Amount

24 of the 82 participating brokers, or 29.27% of all participants, registered a higher Buying Average than Selling Average

82 Participating Brokers’ Buying Average: ₱113.37360

82 Participating Brokers’ Selling Average: ₱115.08079

3 out of 82 participants, or 3.66% of all participants, registered a 100% BUYING activity

17 out of 82 participants, or 20.73% of all participants, registered a 100% SELLING activity

Final Reminder

Subscribe to my free newsletter, so you’ll receive an email notification when I publish the second part of this report or whenever I publish a new article on my website.

Again, to appreciate the purpose of my Market Sentiment Index, you must read 3 to 5 articles on the RESOURCES menu of this website.

Contact me if you need my help through my stock market consultancy service.

When you subscribe to my service, you’ll be able to attend the online workshop where I’ll teach you my entire Evergreen Strategy.

You’ll also get access to the Private Clients Forum where you can ask follow-up questions 24 hours a day and 365 days a year.

Would you like access to my Stock Screener’s daily results? You’ll get access to that, too.

There’s more. I will not mention everything in this article because all inclusions are already written here.

The only gap between losing in the stock market and having more winning than losing trades is your decision to subscribe to my service, one of the longest-running and most trusted stock market consultancy services in the Philippines.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025