Do you monitor the circulars published by the Philippine Stock Exchange on pse.com.ph?

I do.

If you do, too, you must have already read the circular entitled “LAUNCH OF THE PSE DIVIDEND YIELD AND PSE MIDCAP INDEX” published last March 28, 2022.

What does that circular say?

I’m not going to parrot what you can read for yourself. Read it here.

In this report, I will share the market sentiment for the first 10 stocks of the Dividend Yield Index for July 2022.

I’m also not going to re-explain my Market Sentiment Index because I’ve explained it more than 1,000 times in the nearly 2,000 reports I’ve published on this website.

If this is your first time to know about my proprietary Market Sentiment Index and its use, please go to the RESOURCES menu of this website, click the ANALYSIS tab, and read 3 to 5 articles.

With reading comprehension, you’ll understand why I find checking the Market Sentiment Index of a stock useful in my trade and investment decisions.

The Dividend Yield Index of the Philippine Stock Exchange (PSE DivY) comprises 20 member stocks.

Liquidity, free float, financials, and 3-year average dividend yield were the criteria for selecting the PSE DivY.

Here are the top 20 companies that form part of the PSE DivY Index.

- Aboitiz Equity Ventures (AEV)

- Aboitiz Power Corporation (AP)

- AREIT

- Bank of the Philippine Islands (BPI)

- DMCI Holdings (DMC)

- D&L Industries (DNL)

- Globe Telecom (GLO)

- GMA Network (GMA7)

- International Container Terminal Services (ICT)

- LT Group (LTG)

- Metropolitan Bank & Trust Company (MBT)

- Manila Electric Company (MER)

- Metro Pacific Investments Corporation (MPI)

- Nickel Asia Corporation (NIKL)

- Robinsons Land Corporation (RLC)

- Robinsons Retail Holdings (RRHI)

- Semirara Mining and Power Corporation (SCC)

- Security Bank Corporation (SECB)

- PLDT (TEL)

- Universal Robina Corporation (URC)

Some of these companies also appear in the Philippine Stock Exchange Index (PSEi) and the Philippine Stock Exchange Mid-Cap Index (PSE MidCap).

This report will only talk about the top 10 PSE DivY stocks. I’ll discuss the bottom 10 in the second part of this report.

The coverage of my data is from July 1 to 31 of 2022.

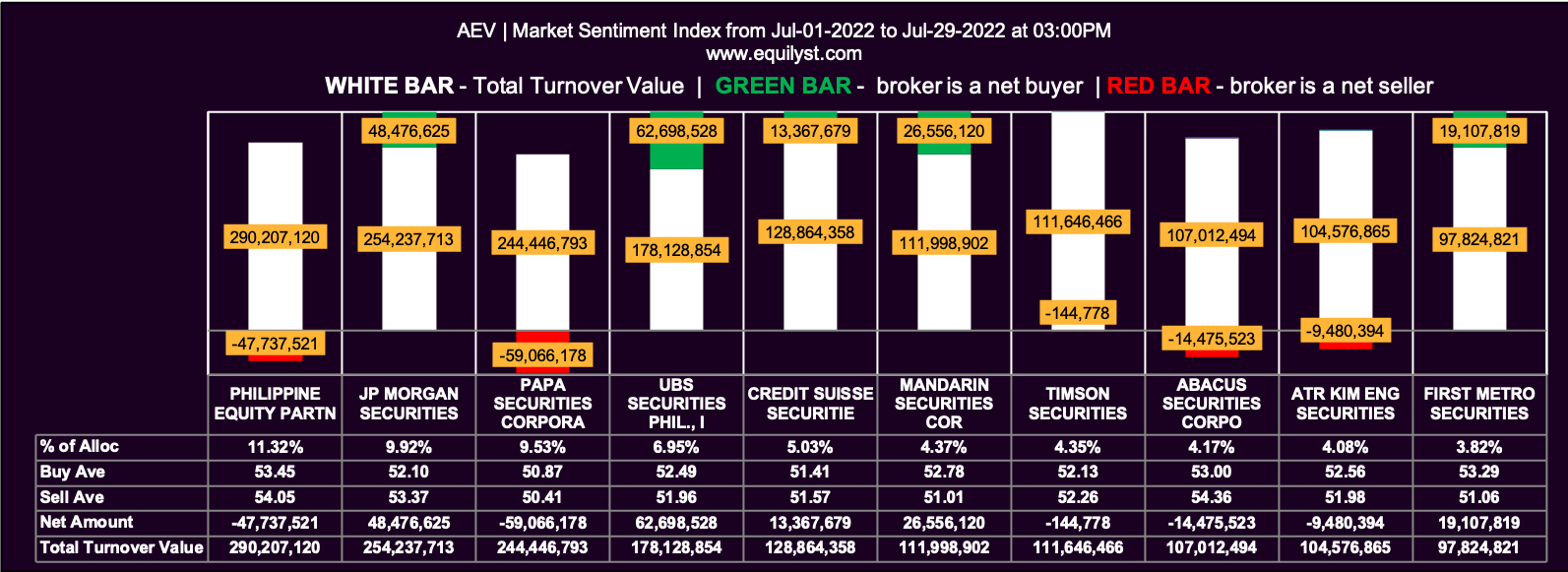

Aboitiz Equity Ventures (AEV)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

25 of the 73 participating brokers, or 34.25% of all participants, registered a positive Net Amount

24 of the 73 participating brokers, or 32.88% of all participants, registered a higher Buying Average than Selling Average

73 Participating Brokers’ Buying Average: ₱51.49544

73 Participating Brokers’ Selling Average: ₱52.46011

5 out of 73 participants, or 6.85% of all participants, registered a 100% BUYING activity

10 out of 73 participants, or 13.70% of all participants, registered a 100% SELLING activity

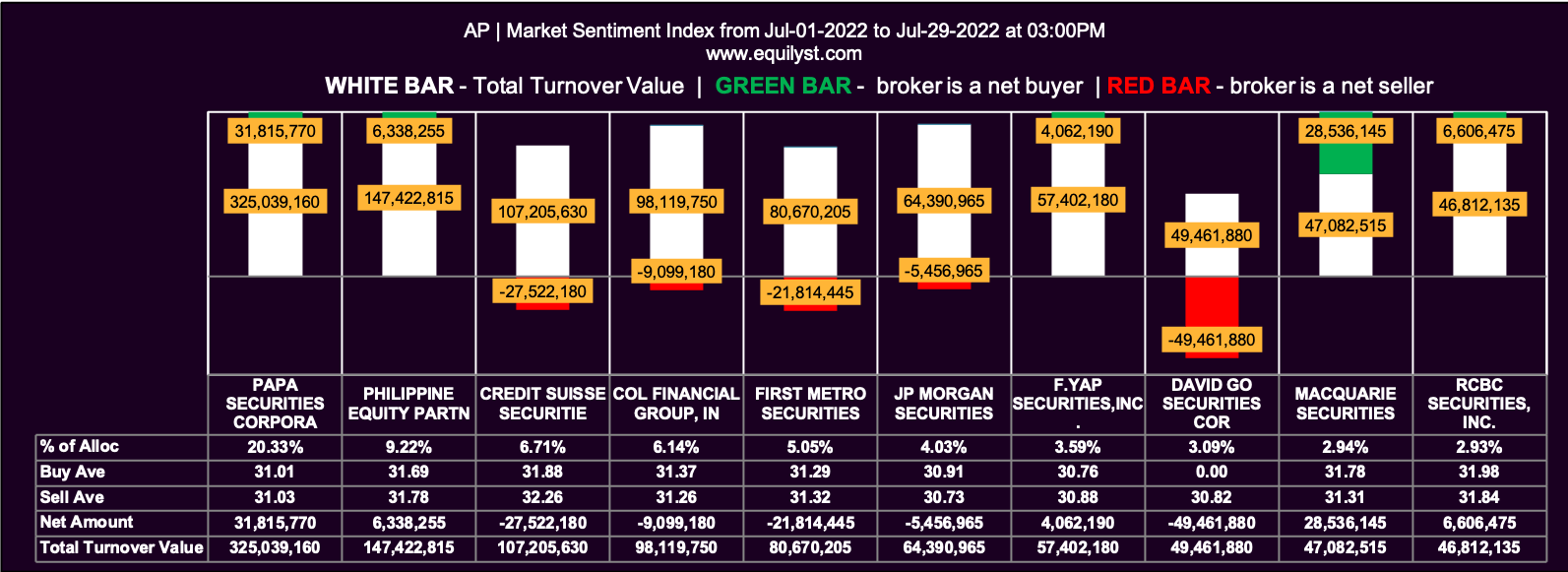

Aboitiz Power Corporation (AP)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

37 of the 89 participating brokers, or 41.57% of all participants, registered a positive Net Amount

43 of the 89 participating brokers, or 48.31% of all participants, registered a higher Buying Average than Selling Average

89 Participating Brokers’ Buying Average: ₱31.39862

89 Participating Brokers’ Selling Average: ₱31.36163

11 out of 89 participants, or 12.36% of all participants, registered a 100% BUYING activity

20 out of 89 participants, or 22.47% of all participants, registered a 100% SELLING activity

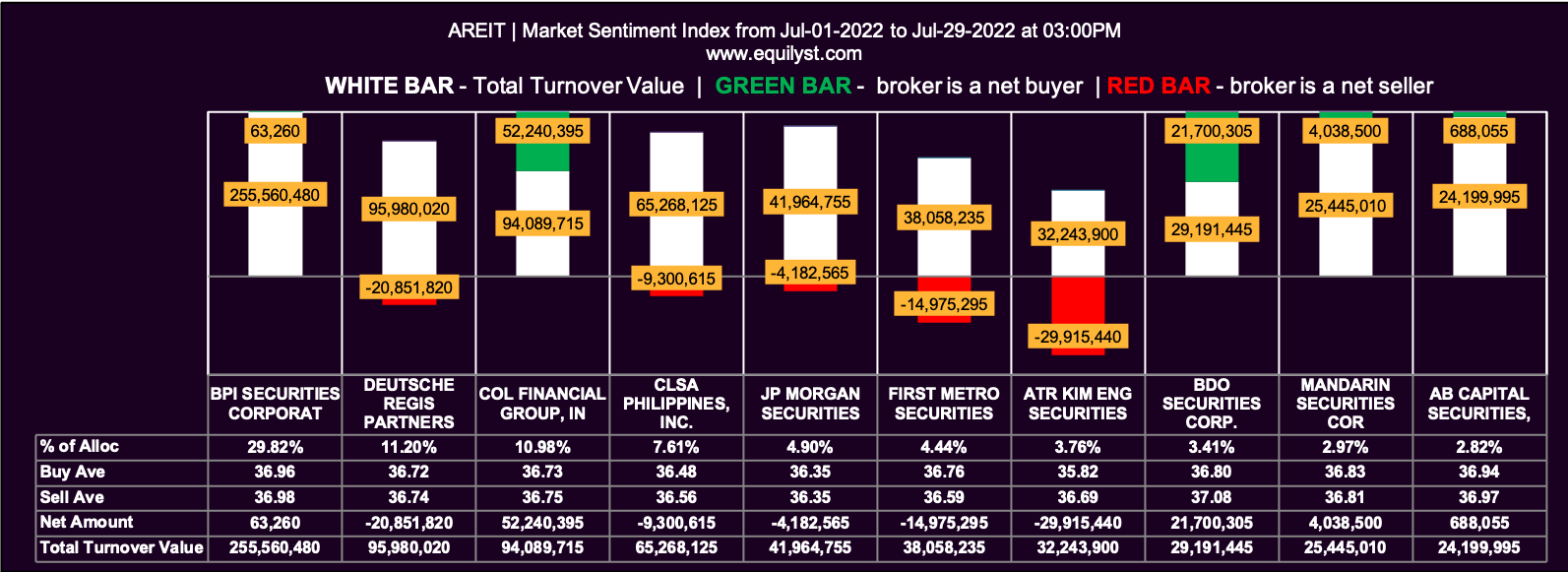

AREIT

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

48 of the 71 participating brokers, or 67.61% of all participants, registered a positive Net Amount

43 of the 71 participating brokers, or 60.56% of all participants, registered a higher Buying Average than Selling Average

71 Participating Brokers’ Buying Average: ₱36.68948

71 Participating Brokers’ Selling Average: ₱36.77881

27 out of 71 participants, or 38.03% of all participants, registered a 100% BUYING activity

6 out of 71 participants, or 8.45% of all participants, registered a 100% SELLING activity

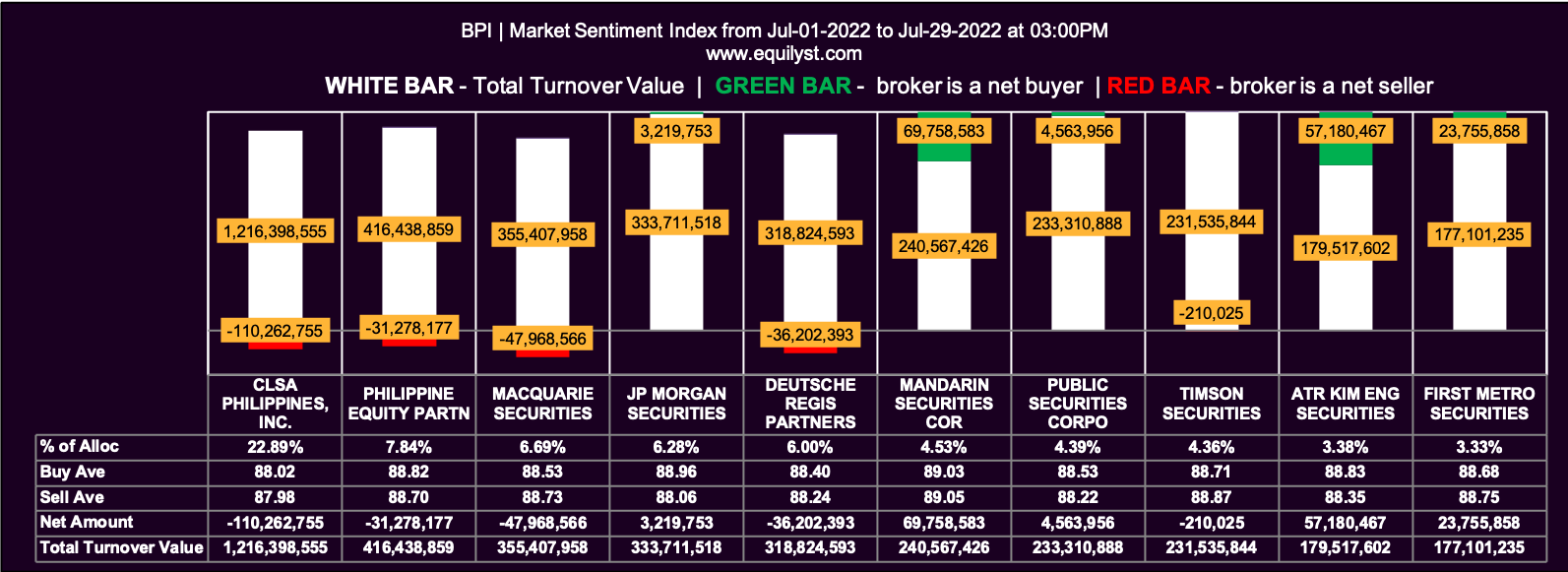

Bank of the Philippine Islands (BPI)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

34 of the 85 participating brokers, or 40.00% of all participants, registered a positive Net Amount

29 of the 85 participating brokers, or 34.12% of all participants, registered a higher Buying Average than Selling Average

85 Participating Brokers’ Buying Average: ₱87.79236

85 Participating Brokers’ Selling Average: ₱89.04484

8 out of 85 participants, or 9.41% of all participants, registered a 100% BUYING activity

11 out of 85 participants, or 12.94% of all participants, registered a 100% SELLING activity

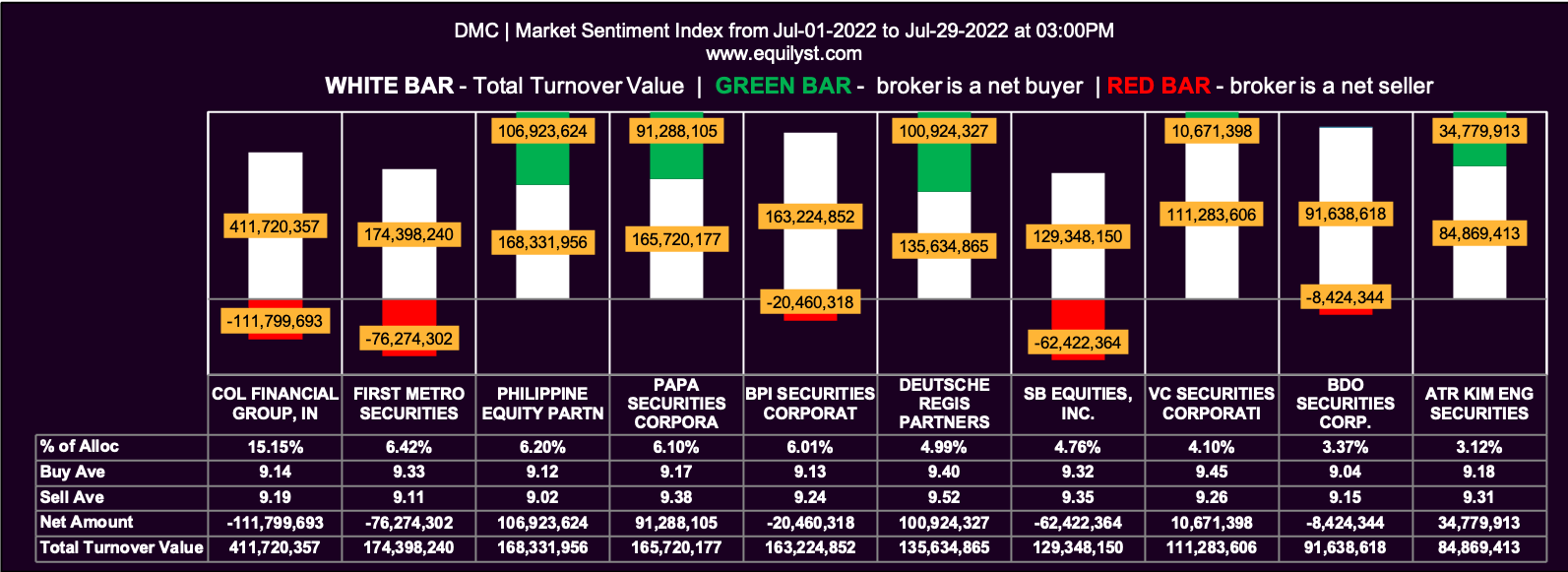

DMCI Holdings (DMC)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

30 of the 100 participating brokers, or 30.00% of all participants, registered a positive Net Amount

31 of the 100 participating brokers, or 31.00% of all participants, registered a higher Buying Average than Selling Average

100 Participating Brokers’ Buying Average: ₱9.11539

100 Participating Brokers’ Selling Average: ₱9.25409

9 out of 100 participants, or 9.00% of all participants, registered a 100% BUYING activity

13 out of 100 participants, or 13.00% of all participants, registered a 100% SELLING activity

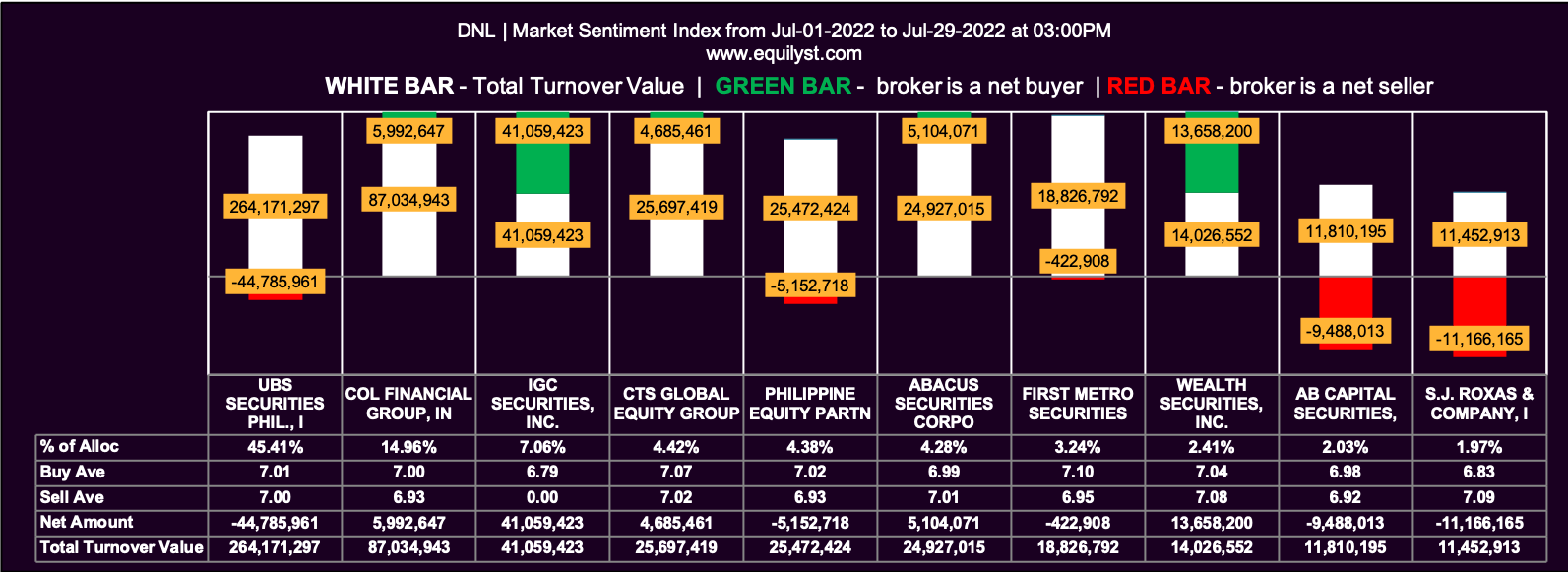

D&L Industries (DNL)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

36 of the 67 participating brokers, or 53.73% of all participants, registered a positive Net Amount

32 of the 67 participating brokers, or 47.76% of all participants, registered a higher Buying Average than Selling Average

67 Participating Brokers’ Buying Average: ₱7.00879

67 Participating Brokers’ Selling Average: ₱7.00711

16 out of 67 participants, or 23.88% of all participants, registered a 100% BUYING activity

17 out of 67 participants, or 25.37% of all participants, registered a 100% SELLING activity

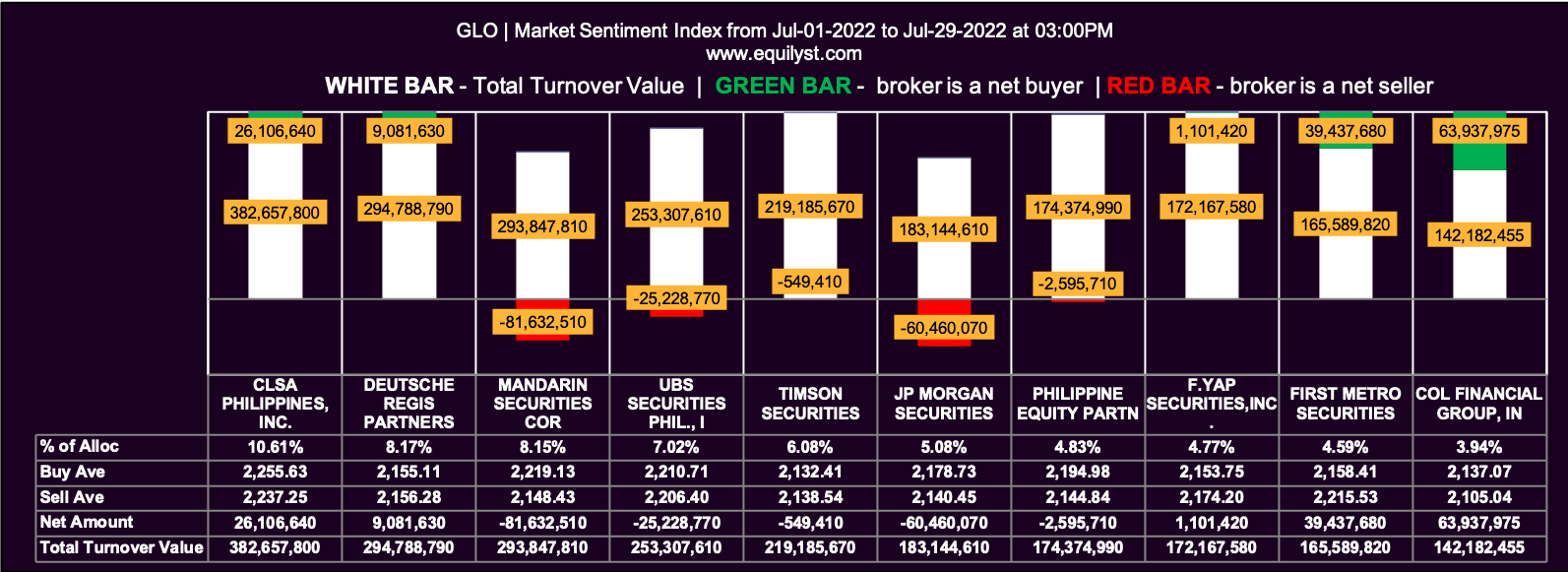

Globe Telecom (GLO)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

56 of the 87 participating brokers, or 64.37% of all participants, registered a positive Net Amount

31 of the 87 participating brokers, or 35.63% of all participants, registered a higher Buying Average than Selling Average

87 Participating Brokers’ Buying Average: ₱2146.95414

87 Participating Brokers’ Selling Average: ₱2192.65685

19 out of 87 participants, or 21.84% of all participants, registered a 100% BUYING activity

6 out of 87 participants, or 6.90% of all participants, registered a 100% SELLING activity

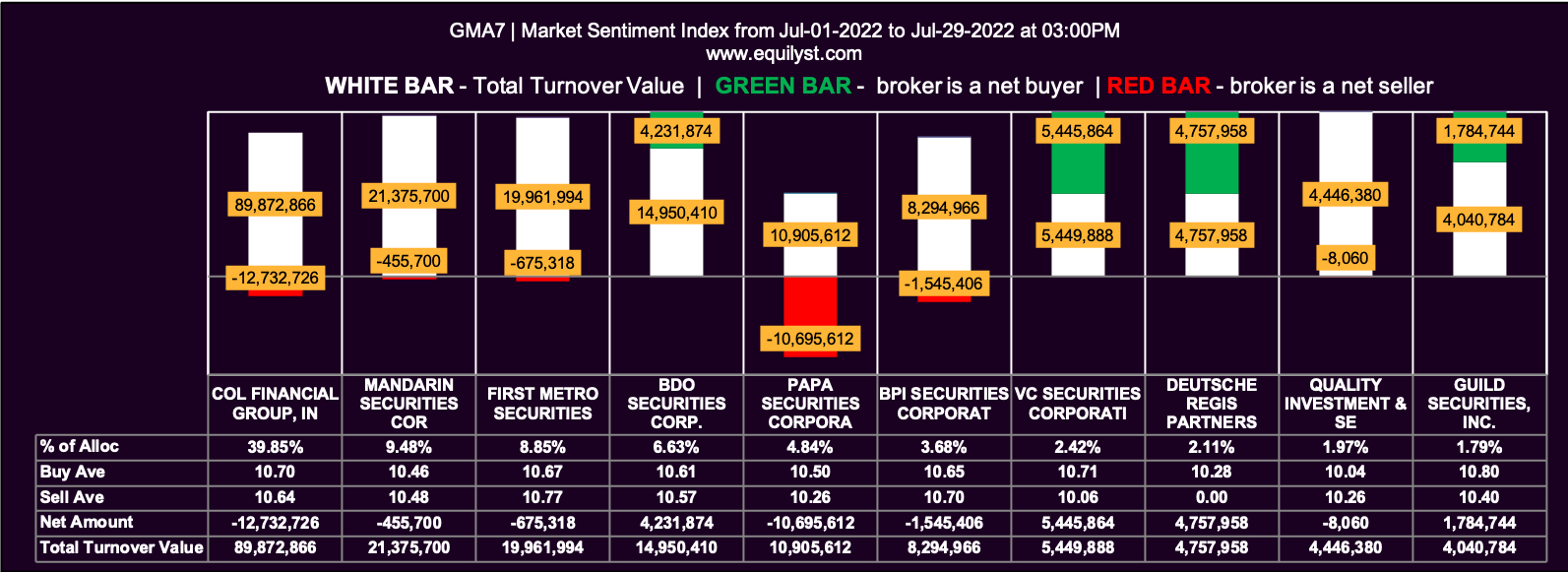

GMA Network (GMA7)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

39 of the 58 participating brokers, or 67.24% of all participants, registered a positive Net Amount

31 of the 58 participating brokers, or 53.45% of all participants, registered a higher Buying Average than Selling Average

58 Participating Brokers’ Buying Average: ₱10.56364

58 Participating Brokers’ Selling Average: ₱10.62810

19 out of 58 participants, or 32.76% of all participants, registered a 100% BUYING activity

4 out of 58 participants, or 6.90% of all participants, registered a 100% SELLING activity

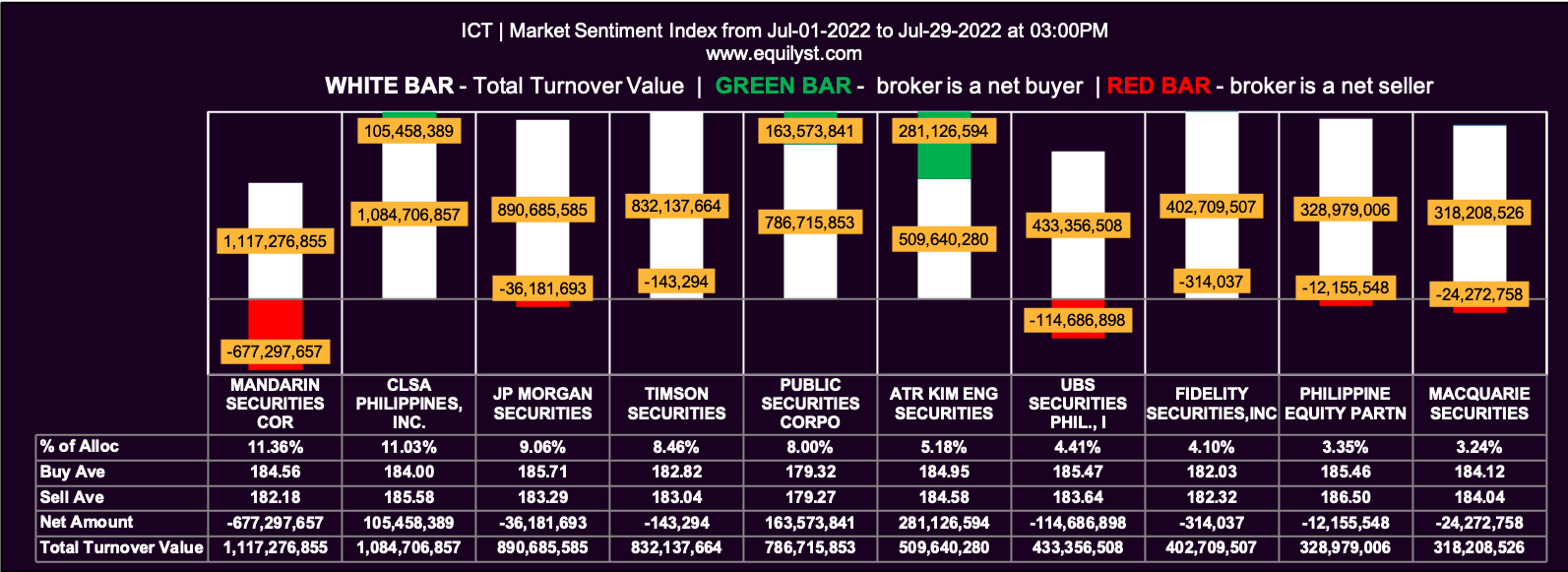

International Container Terminal Services (ICT)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

49 of the 86 participating brokers, or 56.98% of all participants, registered a positive Net Amount

26 of the 86 participating brokers, or 30.23% of all participants, registered a higher Buying Average than Selling Average

86 Participating Brokers’ Buying Average: ₱182.99712

86 Participating Brokers’ Selling Average: ₱185.64128

10 out of 86 participants, or 11.63% of all participants, registered a 100% BUYING activity

2 out of 86 participants, or 2.33% of all participants, registered a 100% SELLING activity

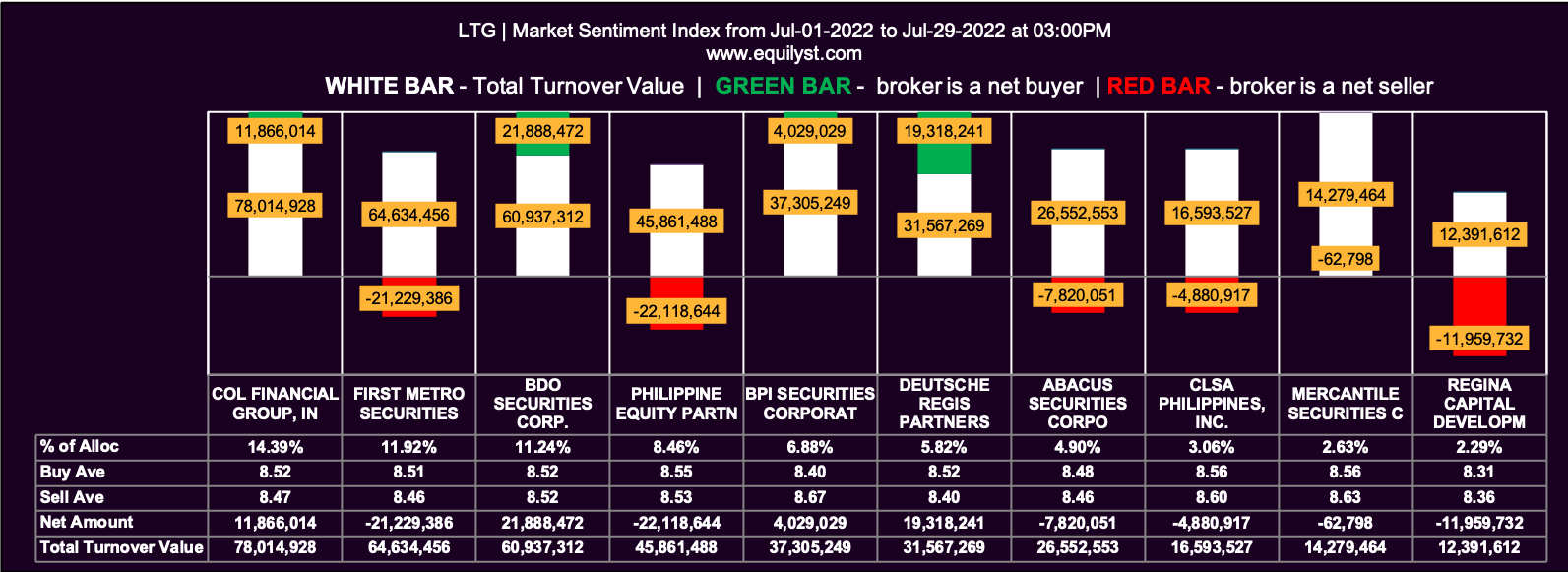

LT Group (LTG)

Market Sentiment Index: BULLISH

Market Sentiment Index: BULLISH

31 of the 68 participating brokers, or 45.59% of all participants, registered a positive Net Amount

30 of the 68 participating brokers, or 44.12% of all participants, registered a higher Buying Average than Selling Average

68 Participating Brokers’ Buying Average: ₱8.48940

68 Participating Brokers’ Selling Average: ₱8.51498

9 out of 68 participants, or 13.24% of all participants, registered a 100% BUYING activity

6 out of 68 participants, or 8.82% of all participants, registered a 100% SELLING activity

Final Reminder

Subscribe to my free newsletter, so you’ll receive an email notification when I publish the second part of this report or whenever I publish a new article on my website.

Again, to appreciate the purpose of my Market Sentiment Index, you must read 3 to 5 articles on the RESOURCES menu of this website.

Contact me if you need my help through my stock market consultancy service.

When you subscribe to my service, you’ll be able to attend the online workshop where I’ll teach you my entire Evergreen Strategy.

You’ll also get access to the Private Clients Forum where you can ask follow-up questions 24 hours a day and 365 days a year.

Would you like access to my Stock Screener’s daily results? You’ll get access to that, too.

There’s more. I will not mention everything in this article because all inclusions are already written here.

The only gap between losing in the stock market and having more winning than losing trades is your decision to subscribe to my service, one of the longest-running and most trusted stock market consultancy services in the Philippines.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025