As of September 27, 2023, COL Financial Investment Guide shows a BUY rating for seven (7) stocks in the Commercial and Industrial sector.

READ: How to Access the COL Financial Investment Guide

What you will not find in the COL Financial Investment Guide is the present Market Sentiment Index rating for those seven stocks with a buy rating.

In this article, I’ll share with you the Market Sentiment Index rating for each of those stocks. Take note that the Market Sentiment Index indicator is my proprietary indicator. You won’t find it on COL Financial’s platform or any online stockbrokerage firm.

Understanding Market Sentiment

The Market Sentiment Index indicator discussed in this report is my proprietary creation, and I am the sole authority on its methodology for determining bearish and bullish ratings, as well as the specific criteria it considers.

The market sentiment helps me estimate if the prevailing direction of the share price is likely to continue or reverse.

For example, if the stock is in a downtrend and the prevailing market sentiment is bearish, it means the downtrend is likely to continue.

If the stock is in a downtrend, but the market sentiment turns bullish, it’s a sign that investors might see a bullish reversal.

Again, and again, notice the adverbs I’m using – “likely” and “might”. We’re still talking about probabilities and not certainties.

Still, it’s better to be data-driven and be proven wrong by the market than make decisions based on gut feeling alone. The former gives you the opportunity to optimize something while the latter doesn’t.

This brief explanation of what and how my Market Sentiment Index works cannot paint the entire picture. You can only appreciate it fully if you understand the principles behind it. If your portfolio’s size is more than P1 million, you may consider enrolling yourself to my online one-on-one masterclass. For four straight hours, I’ll teach you my entire stock investment strategy so you’ll know how I preserve my capital, protect gains, and prevent unbearable losses.

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

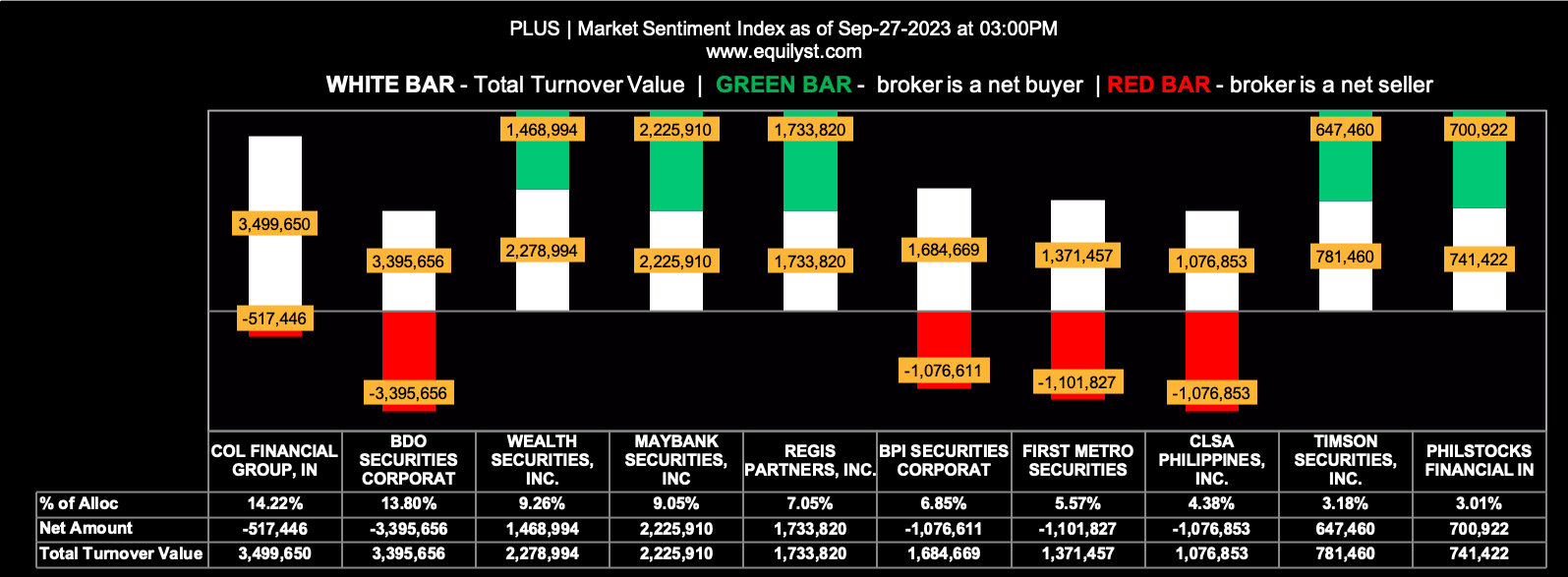

DigiPlus Interactive Corp. (PLUS)

Market Sentiment Index: BULLISH

19 of the 32 participating brokers, or 59.38% of all participants, registered a positive Net Amount

20 of the 32 participating brokers, or 62.50% of all participants, registered a higher Buying Average than Selling Average

32 Participating Brokers’ Buying Average: ₱6.76119

32 Participating Brokers’ Selling Average: ₱6.76094

10 out of 32 participants, or 31.25% of all participants, registered a 100% BUYING activity

5 out of 32 participants, or 15.63% of all participants, registered a 100% SELLING activity

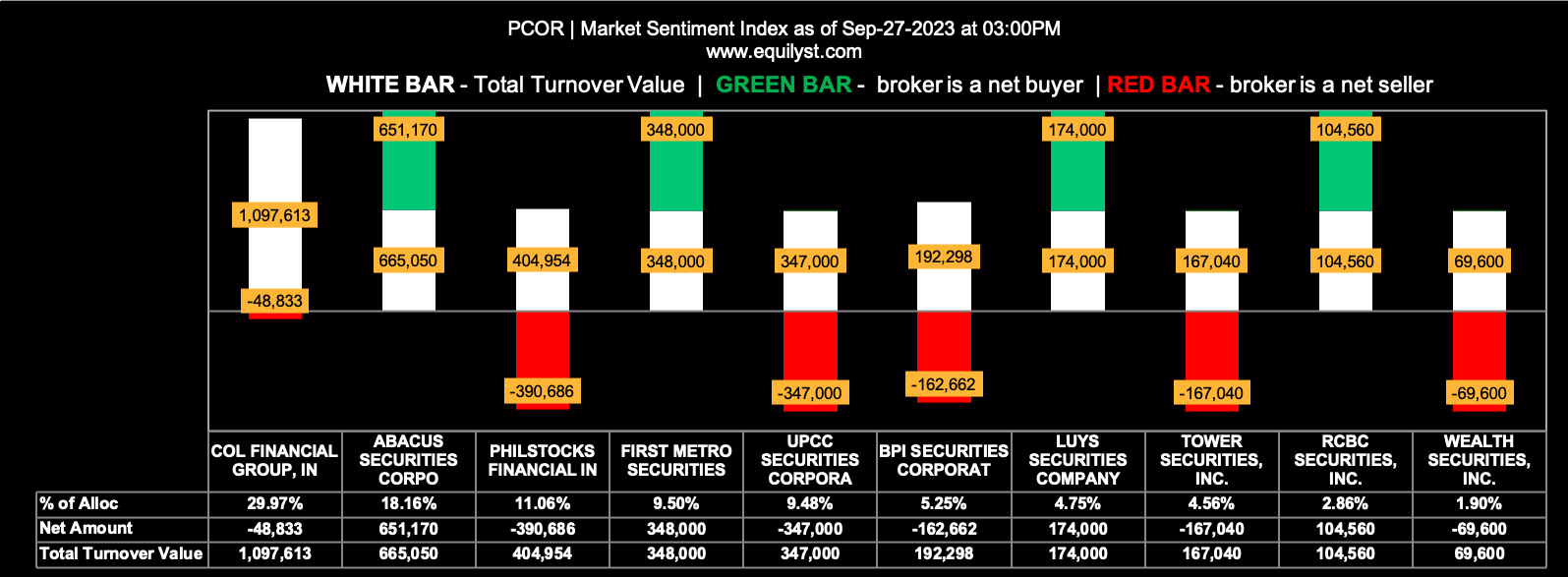

Petron Corporation (PCOR)

Market Sentiment Index: BEARISH

4 of the 17 participating brokers, or 23.53% of all participants, registered a positive Net Amount

4 of the 17 participating brokers, or 23.53% of all participants, registered a higher Buying Average than Selling Average

17 Participating Brokers’ Buying Average: ₱3.45350

17 Participating Brokers’ Selling Average: ₱3.46255

3 out of 17 participants, or 17.65% of all participants, registered a 100% BUYING activity

10 out of 17 participants, or 58.82% of all participants, registered a 100% SELLING activity

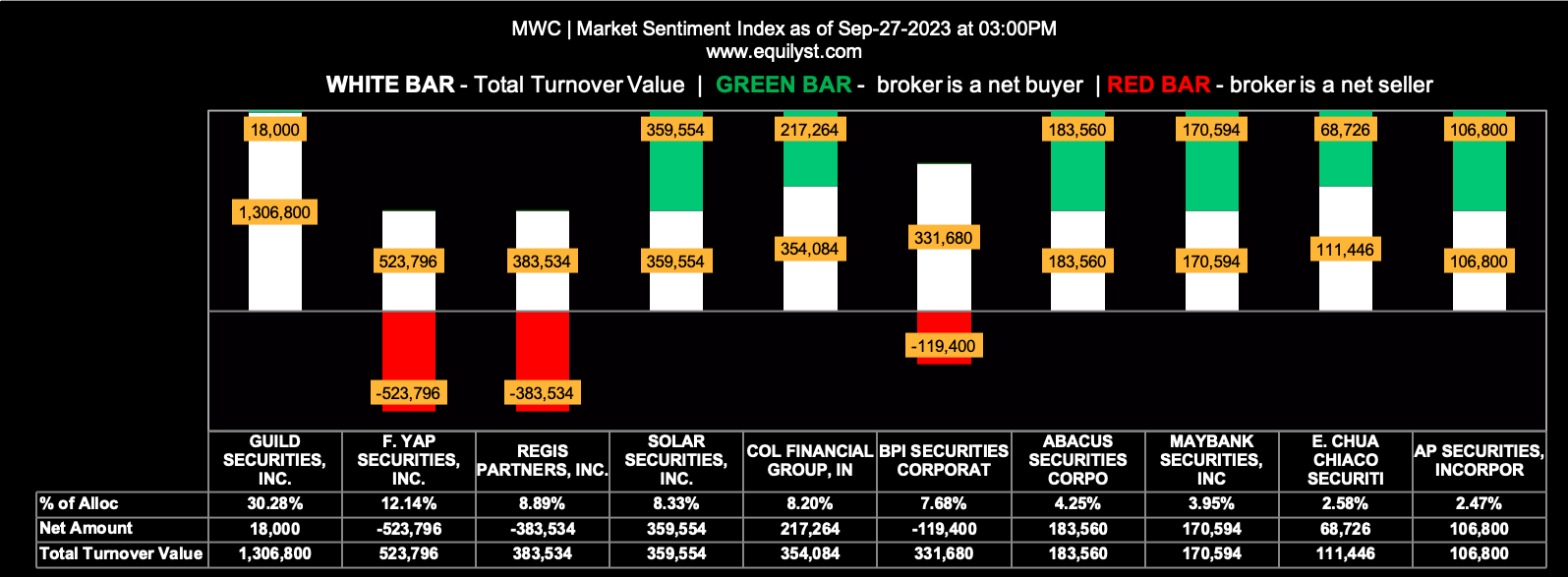

Manila Water Company (MWC)

Market Sentiment Index: BEARISH

12 of the 20 participating brokers, or 60.00% of all participants, registered a positive Net Amount

10 of the 20 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

20 Participating Brokers’ Buying Average: ₱17.92938

20 Participating Brokers’ Selling Average: ₱17.87551

6 out of 20 participants, or 30.00% of all participants, registered a 100% BUYING activity

7 out of 20 participants, or 35.00% of all participants, registered a 100% SELLING activity

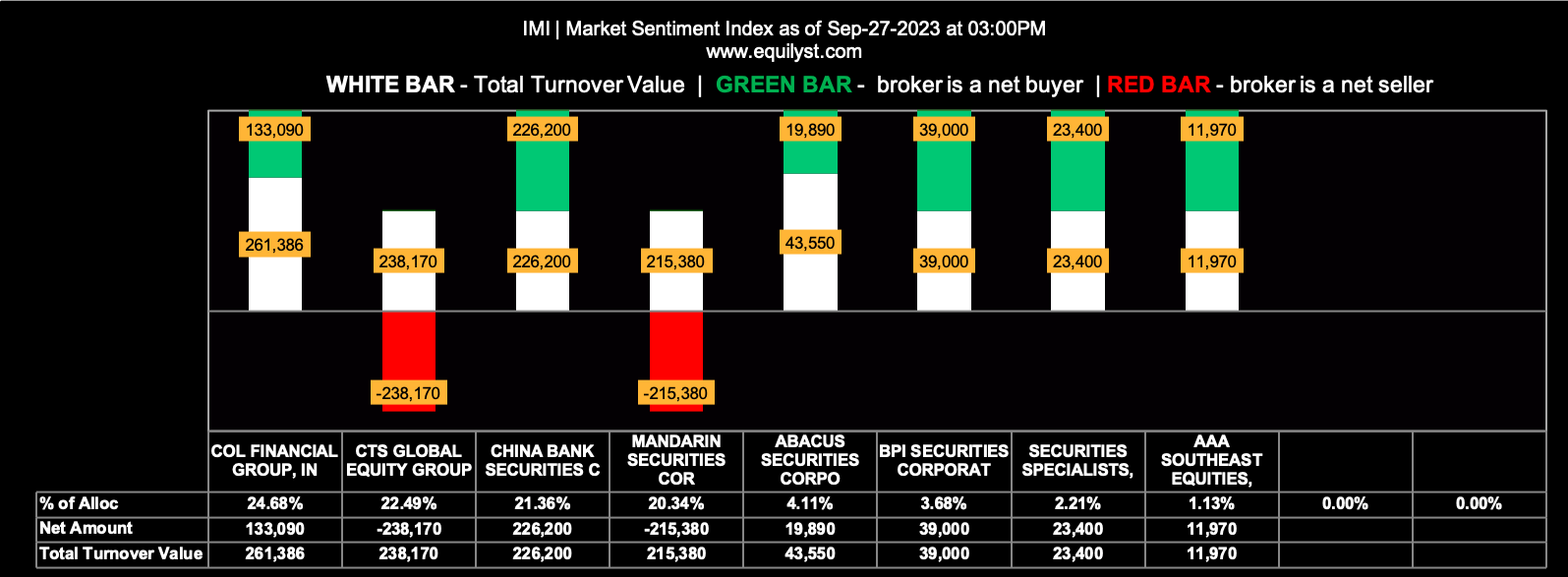

Integrated Micro-Electronics (IMI)

Market Sentiment Index: BULLISH

6 of the 8 participating brokers, or 75.00% of all participants, registered a positive Net Amount

5 of the 8 participating brokers, or 62.50% of all participants, registered a higher Buying Average than Selling Average

8 Participating Brokers’ Buying Average: ₱3.93067

8 Participating Brokers’ Selling Average: ₱3.93088

4 out of 8 participants, or 50.00% of all participants, registered a 100% BUYING activity

2 out of 8 participants, or 25.00% of all participants, registered a 100% SELLING activity

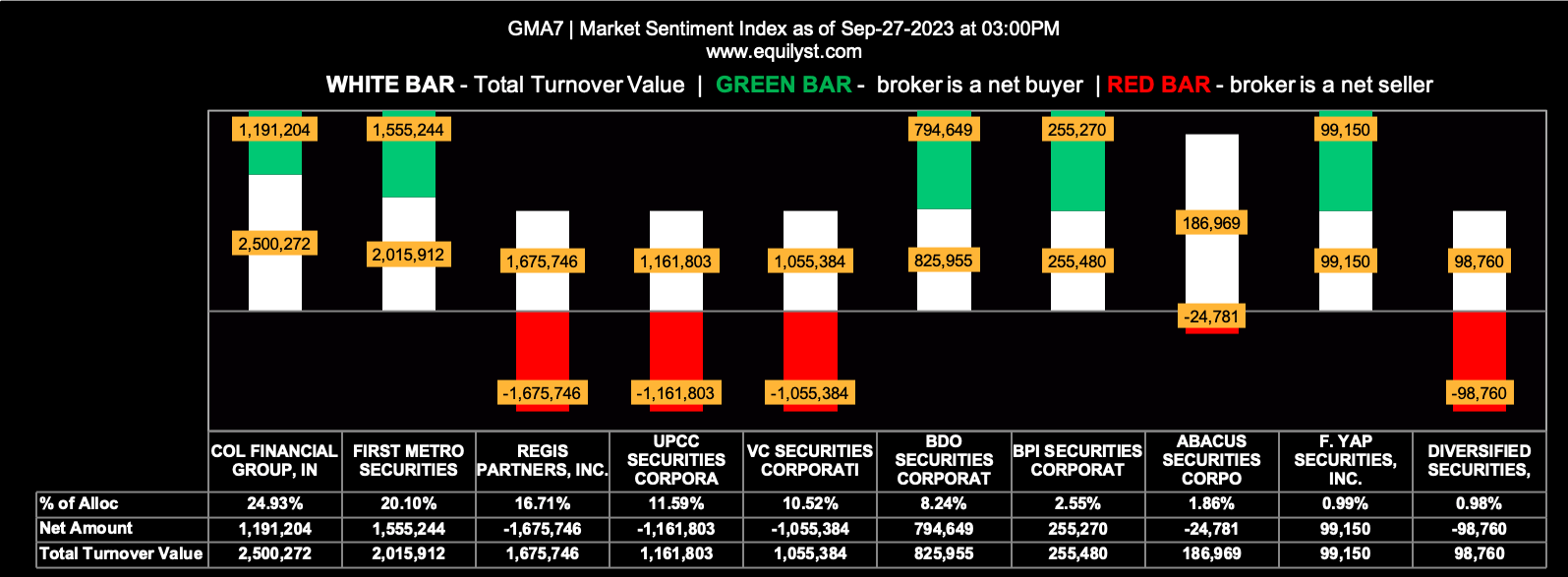

GMA Network (GMA7)

Market Sentiment Index: BEARISH

12 of the 18 participating brokers, or 66.67% of all participants, registered a positive Net Amount

8 of the 18 participating brokers, or 44.44% of all participants, registered a higher Buying Average than Selling Average

18 Participating Brokers’ Buying Average: ₱8.17599

18 Participating Brokers’ Selling Average: ₱8.40422

7 out of 18 participants, or 38.89% of all participants, registered a 100% BUYING activity

4 out of 18 participants, or 22.22% of all participants, registered a 100% SELLING activity

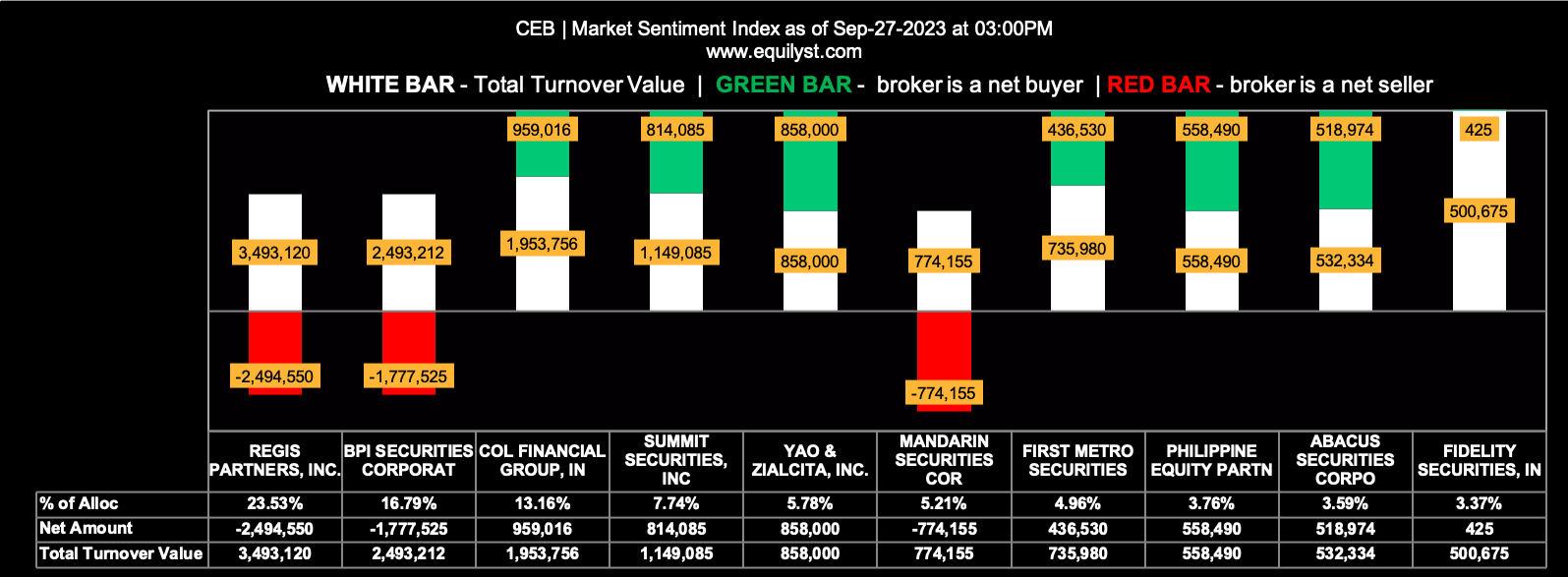

Cebu Air (CEB)

Market Sentiment Index: BULLISH

18 of the 24 participating brokers, or 75.00% of all participants, registered a positive Net Amount

13 of the 24 participating brokers, or 54.17% of all participants, registered a higher Buying Average than Selling Average

24 Participating Brokers’ Buying Average: ₱33.24054

24 Participating Brokers’ Selling Average: ₱33.35719

10 out of 24 participants, or 41.67% of all participants, registered a 100% BUYING activity

3 out of 24 participants, or 12.50% of all participants, registered a 100% SELLING activity

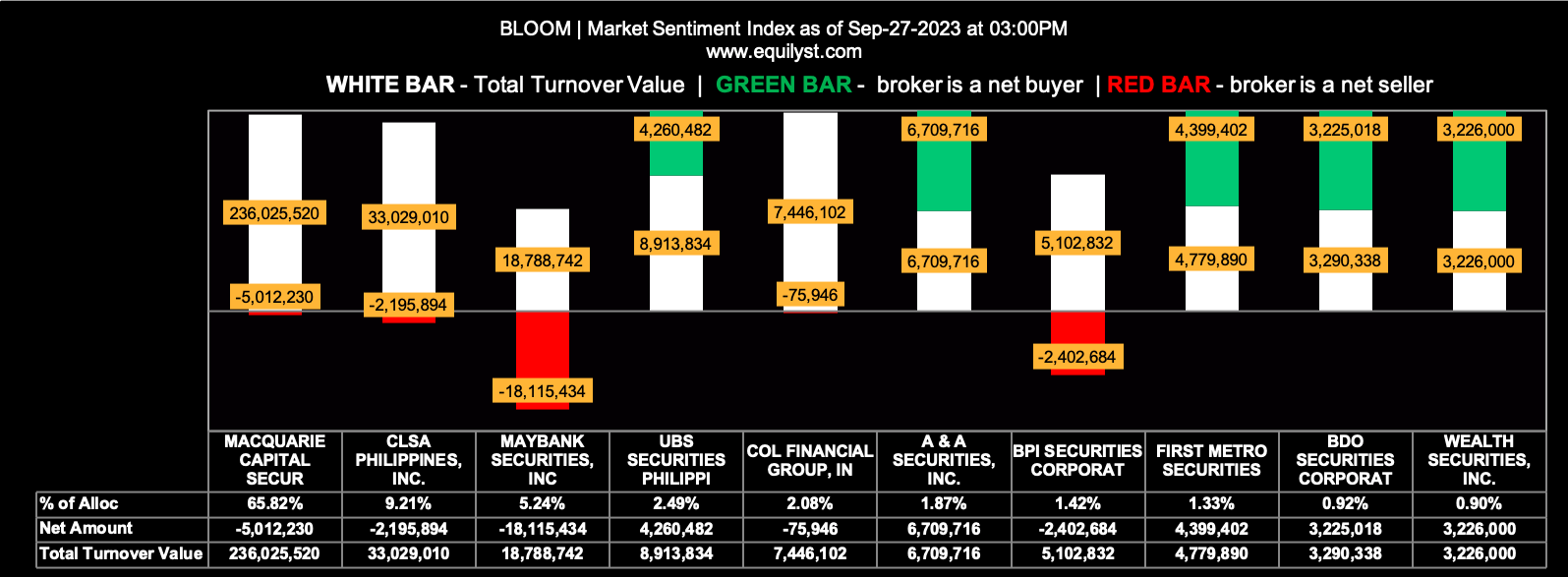

Bloomberry Resorts Corporation (BLOOM)

Market Sentiment Index: BEARISH

26 of the 43 participating brokers, or 60.47% of all participants, registered a positive Net Amount

20 of the 43 participating brokers, or 46.51% of all participants, registered a higher Buying Average than Selling Average

43 Participating Brokers’ Buying Average: ₱10.73208

43 Participating Brokers’ Selling Average: ₱10.80570

14 out of 43 participants, or 32.56% of all participants, registered a 100% BUYING activity

7 out of 43 participants, or 16.28% of all participants, registered a 100% SELLING activity

At Equilyst Analytics, you can:

- hire me as your private stock investment consultant

- hire me as your crypto and stock investment content writer

- subscribe to my members-only stock analyses

- subscribe to my members-only stock screener so you’ll know which stocks I’m monitoring daily

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025