Month-to-Date Market Sentiment Rating for the Stocks with the Most Viewed Disclosures

This is based on the Most Viewed Disclosures section of PSE Edge as 7 AM GMT+8 on September 8, 2023.

The market sentiment also helps me estimate if the prevailing direction of the share price is likely to continue or reverse.

For example, if the stock is in a downtrend and the prevailing market sentiment is bearish, it means the downtrend is likely to continue.

If the stock is in a downtrend, but the market sentiment turns bullish, it’s a sign that investors might see a bullish reversal.

These are only few of the many scenarios where the overall market sentiment rating can be helpful in making a data-driven investment decision.

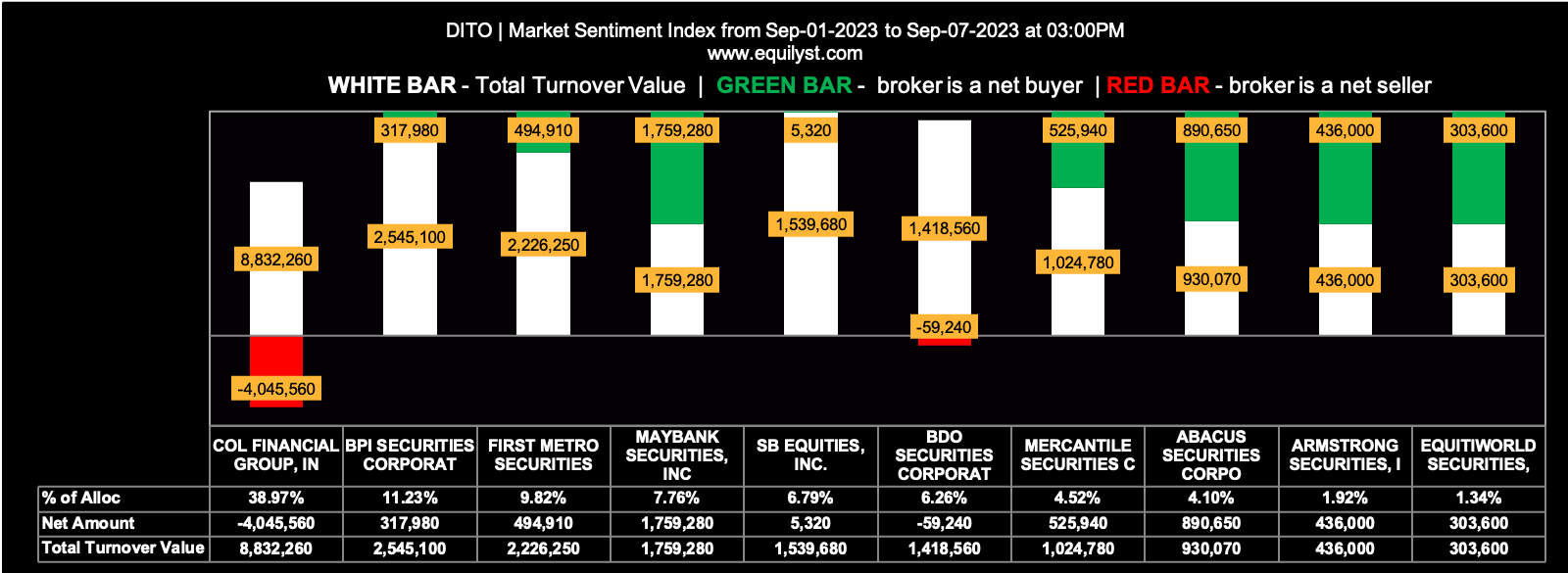

DITO

Market Sentiment Index: BEARISH

15 of the 33 participating brokers, or 45.45% of all participants, registered a positive Net Amount

14 of the 33 participating brokers, or 42.42% of all participants, registered a higher Buying Average than Selling Average

33 Participating Brokers’ Buying Average: ₱2.19305

33 Participating Brokers’ Selling Average: ₱2.19744

9 out of 33 participants, or 27.27% of all participants, registered a 100% BUYING activity

12 out of 33 participants, or 36.36% of all participants, registered a 100% SELLING activity

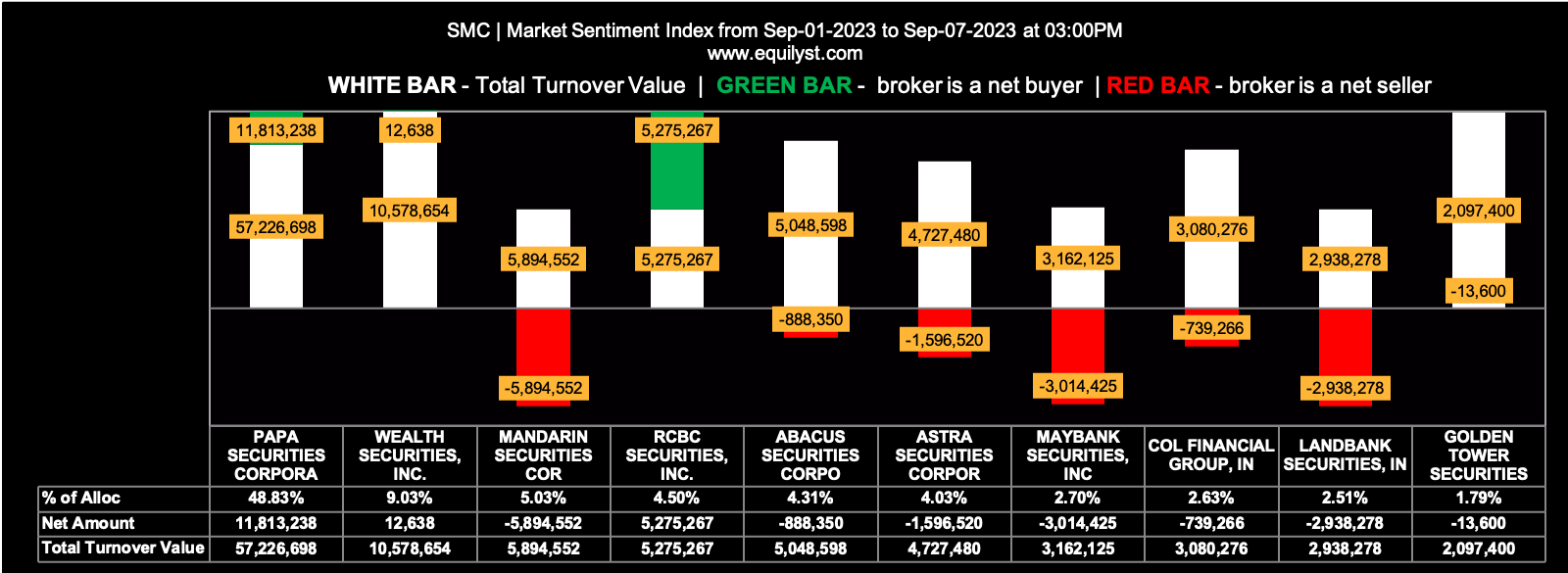

SMC

Market Sentiment Index: BEARISH

15 of the 47 participating brokers, or 31.91% of all participants, registered a positive Net Amount

16 of the 47 participating brokers, or 34.04% of all participants, registered a higher Buying Average than Selling Average

47 Participating Brokers’ Buying Average: ₱104.93029

47 Participating Brokers’ Selling Average: ₱105.04159

9 out of 47 participants, or 19.15% of all participants, registered a 100% BUYING activity

20 out of 47 participants, or 42.55% of all participants, registered a 100% SELLING activity

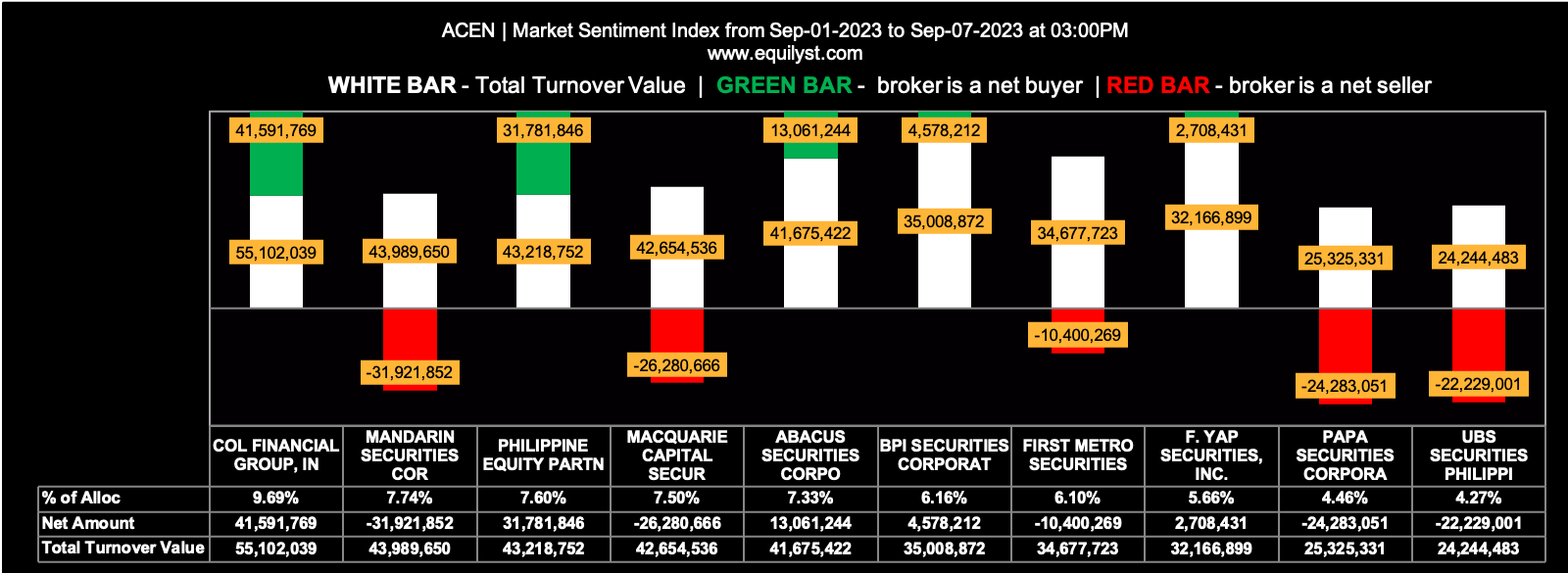

ACEN

Market Sentiment Index: BULLISH

60 of the 81 participating brokers, or 74.07% of all participants, registered a positive Net Amount

52 of the 81 participating brokers, or 64.20% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱5.02862

81 Participating Brokers’ Selling Average: ₱5.04156

31 out of 81 participants, or 38.27% of all participants, registered a 100% BUYING activity

4 out of 81 participants, or 4.94% of all participants, registered a 100% SELLING activity

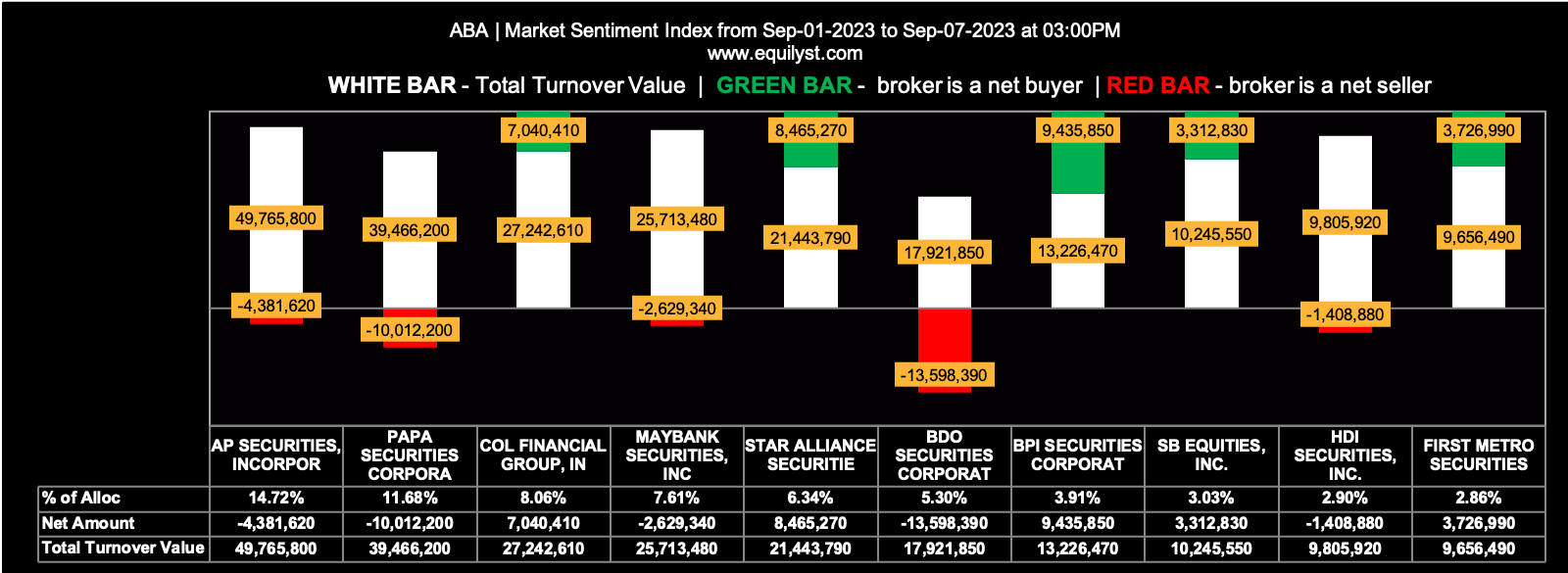

ABA

Market Sentiment Index: BULLISH

37 of the 66 participating brokers, or 56.06% of all participants, registered a positive Net Amount

37 of the 66 participating brokers, or 56.06% of all participants, registered a higher Buying Average than Selling Average

66 Participating Brokers’ Buying Average: ₱1.27991

66 Participating Brokers’ Selling Average: ₱1.27972

10 out of 66 participants, or 15.15% of all participants, registered a 100% BUYING activity

4 out of 66 participants, or 6.06% of all participants, registered a 100% SELLING activity

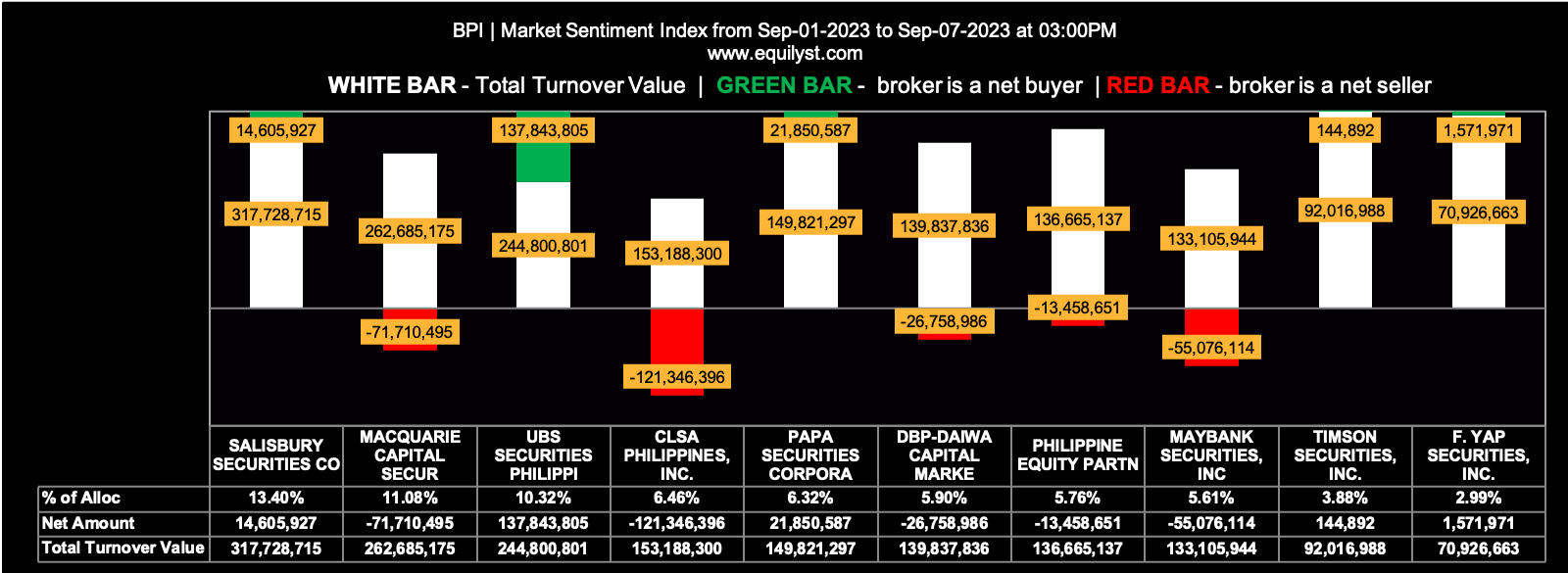

BPI

Market Sentiment Index: BULLISH

45 of the 63 participating brokers, or 71.43% of all participants, registered a positive Net Amount

34 of the 63 participating brokers, or 53.97% of all participants, registered a higher Buying Average than Selling Average

63 Participating Brokers’ Buying Average: ₱105.32902

63 Participating Brokers’ Selling Average: ₱105.61021

17 out of 63 participants, or 26.98% of all participants, registered a 100% BUYING activity

3 out of 63 participants, or 4.76% of all participants, registered a 100% SELLING activity

Which of These Stocks Do You Monitor?

If any of these stocks are already in your portfolio and you’re planning to top up, will you proceed in topping up even if it has a bearish month-to-date market sentiment?

Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025