How and Why Do I Do Market Sentiment Analysis

Introducing my proprietary tool, the Market Sentiment Index, designed to gauge the consolidated sentiment of all brokers involved in trading a particular stock during a specified timeframe. Unlike what is available on standard stock broker platforms, this unique indicator is an exclusive creation of Equilyst Analytics.

The Market Sentiment Index plays a vital role in generating a comprehensive understanding of market sentiment, enabling us to determine whether the overall sentiment leans towards bullish or bearish. To accomplish this, it addresses the following key questions:

- How many participating brokers have recorded a positive Net Amount?

- How many participating brokers have registered a higher buying average compared to the selling average?

- What are the average buying and selling amounts across all participating brokers?

- How many participating brokers have engaged in 100% buying and selling activity?

As part of my data-driven sentiment analysis, the Market Sentiment Index acts as a neutralizer alongside other indicators within my Evergreen Strategy, which is a proprietary algorithm used for trading and investing in the Philippine stock market.

Consider a scenario where all the other indicators of my Evergreen Strategy indicate a bullish market outlook. However, if the Market Sentiment Index for a particular stock indicates a bearish sentiment, it serves as a data-driven reminder to exercise caution.

To proceed with caution, I closely monitor my trailing stop and refrain from purchasing during dips unless a confirmed buy signal is generated by my Evergreen Strategy. Additionally, I adopt a proactive approach by trimming losses or selling all shares if the Market Sentiment Index and Dominant Range Index of a stock have consecutively exhibited bearish trends for 2 to 3 days, even if my trailing stop is still intact. I refer to this proactive action as pre-empting my trailing stop, prioritizing risk management in response to prevailing market conditions.

In this complimentary report, it is my pleasure to present the Market Sentiment Index for the following stocks, accompanied by their corresponding date and time stamps as depicted on their charts. I invite you to delve into this insightful information and leverage it to enhance your understanding of the market dynamics surrounding these stocks.

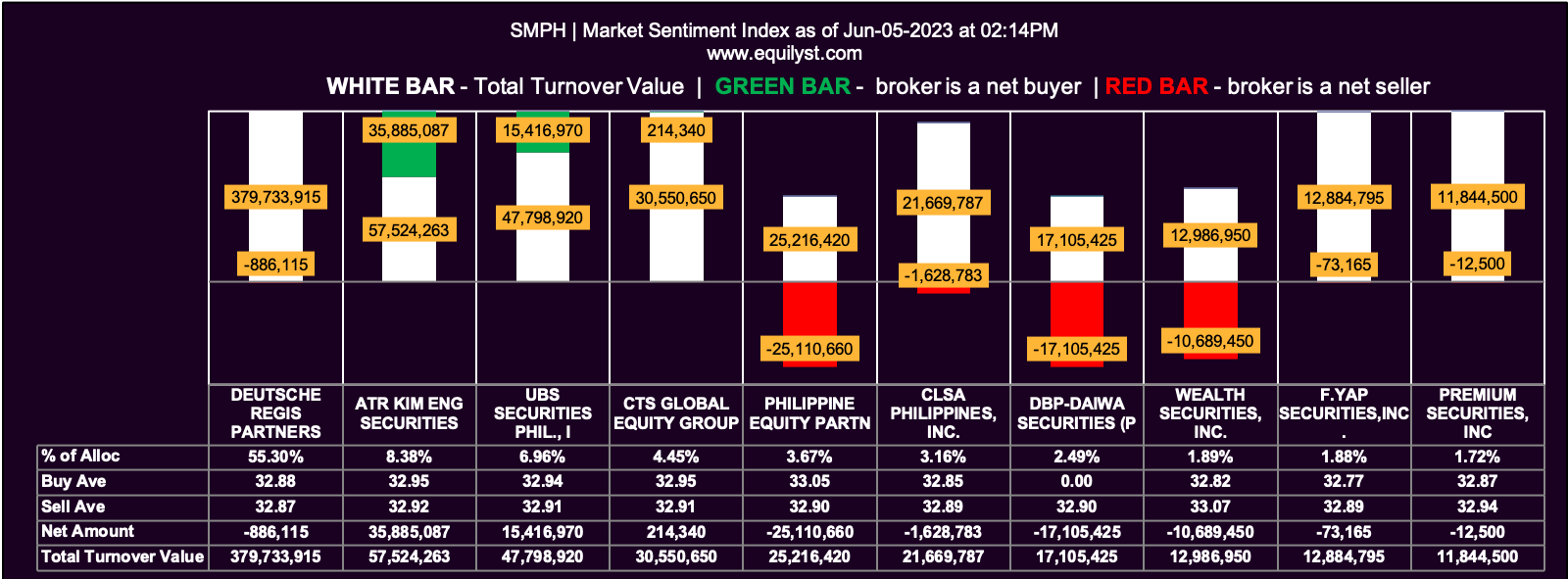

SM Prime Holdings (SMPH)

Market Sentiment Index: BULLISH

16 of the 30 participating brokers, or 53.33% of all participants, registered a positive Net Amount

15 of the 30 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

30 Participating Brokers’ Buying Average: ₱32.89108

30 Participating Brokers’ Selling Average: ₱32.94027

7 out of 30 participants, or 23.33% of all participants, registered a 100% BUYING activity

3 out of 30 participants, or 10.00% of all participants, registered a 100% SELLING activity

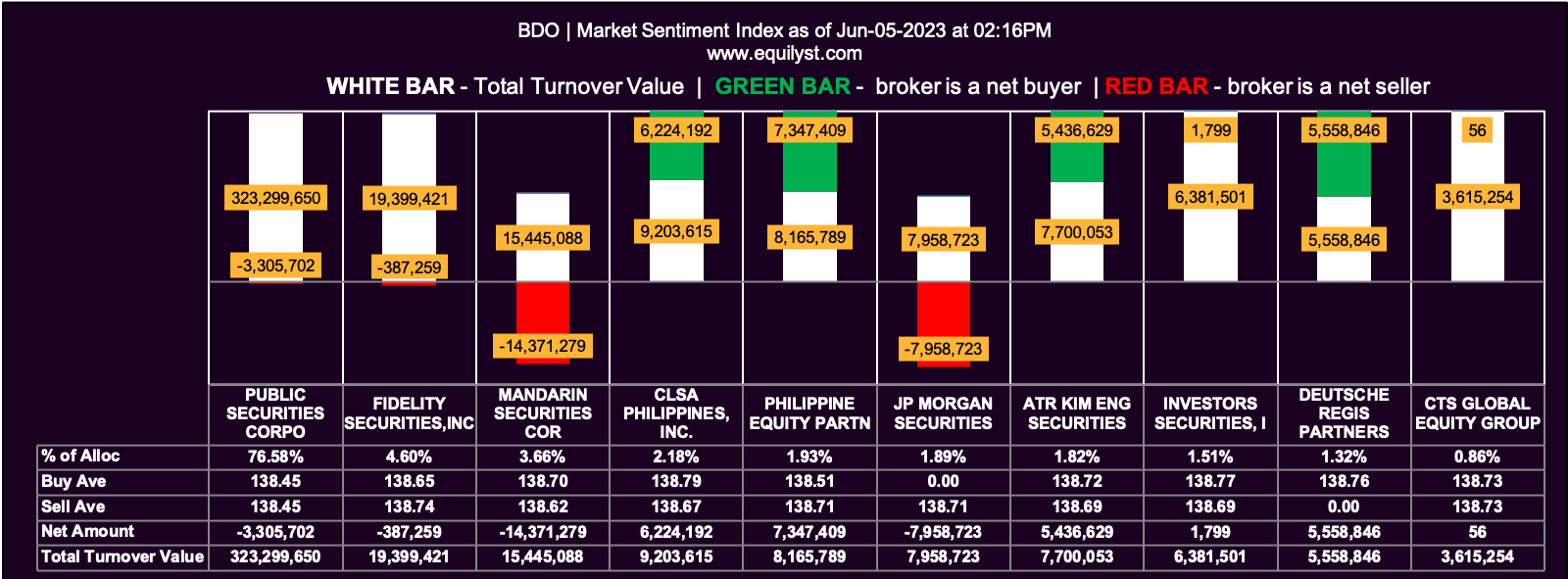

BDO Unibank (BDO)

Market Sentiment Index: BULLISH

18 of the 30 participating brokers, or 60.00% of all participants, registered a positive Net Amount

17 of the 30 participating brokers, or 56.67% of all participants, registered a higher Buying Average than Selling Average

30 Participating Brokers’ Buying Average: ₱138.71847

30 Participating Brokers’ Selling Average: ₱138.74690

8 out of 30 participants, or 26.67% of all participants, registered a 100% BUYING activity

7 out of 30 participants, or 23.33% of all participants, registered a 100% SELLING activity

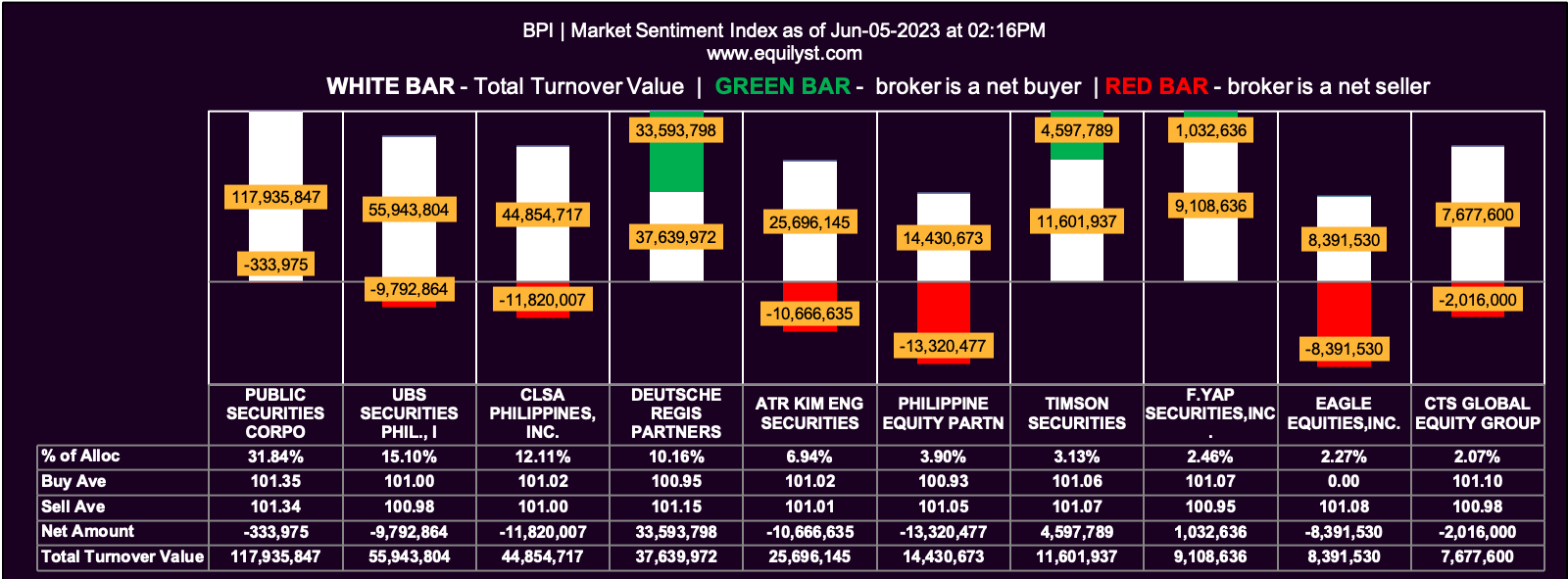

Bank of the Philippine Islands (BPI)

Market Sentiment Index: BULLISH

21 of the 33 participating brokers, or 63.64% of all participants, registered a positive Net Amount

20 of the 33 participating brokers, or 60.61% of all participants, registered a higher Buying Average than Selling Average

33 Participating Brokers’ Buying Average: ₱101.04559

33 Participating Brokers’ Selling Average: ₱101.01437

10 out of 33 participants, or 30.30% of all participants, registered a 100% BUYING activity

6 out of 33 participants, or 18.18% of all participants, registered a 100% SELLING activity

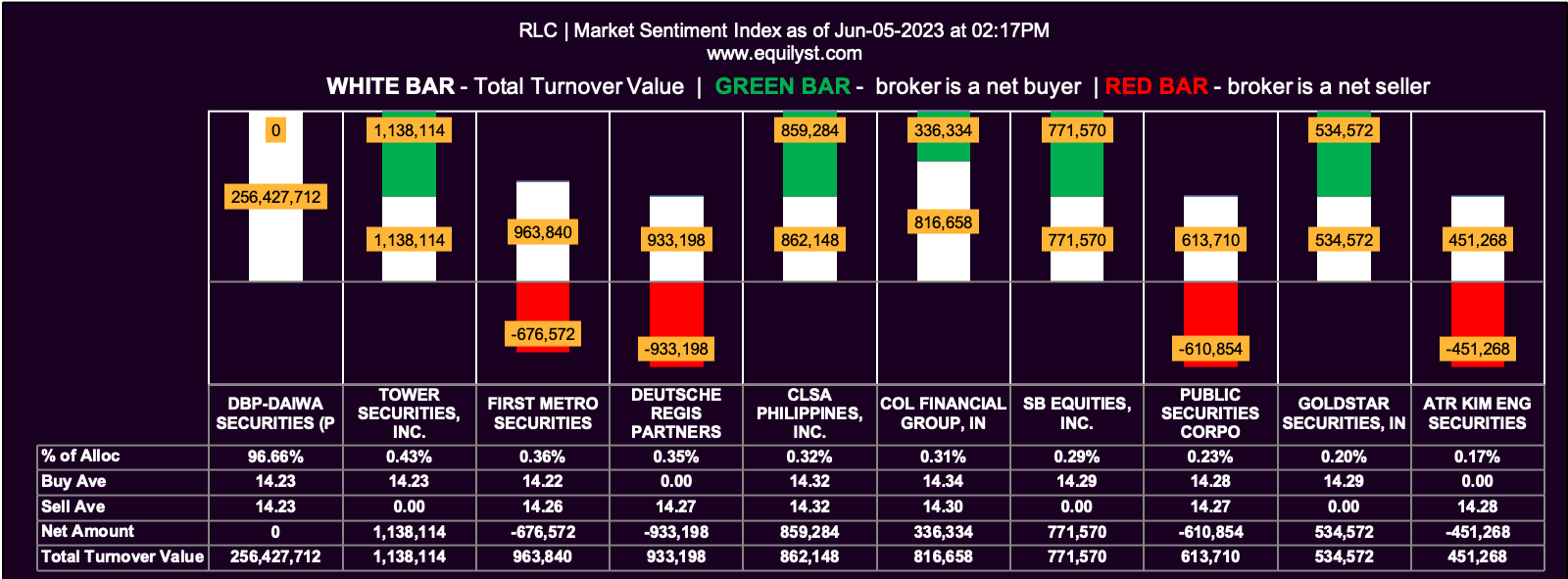

Robinsons Land Corporation (RLC)

Market Sentiment Index: BEARISH

7 of the 22 participating brokers, or 31.82% of all participants, registered a positive Net Amount

10 of the 22 participating brokers, or 45.45% of all participants, registered a higher Buying Average than Selling Average

22 Participating Brokers’ Buying Average: ₱14.26521

22 Participating Brokers’ Selling Average: ₱14.29154

5 out of 22 participants, or 22.73% of all participants, registered a 100% BUYING activity

9 out of 22 participants, or 40.91% of all participants, registered a 100% SELLING activity

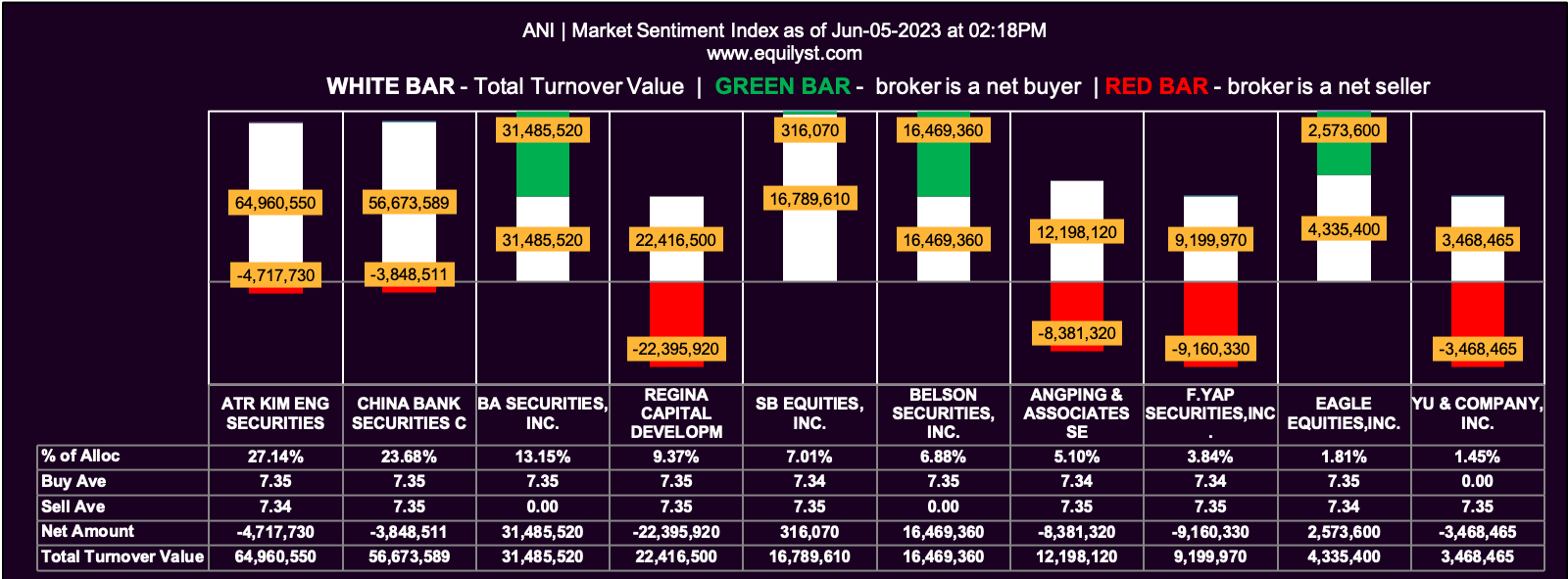

AgriNurture (ANI)

Market Sentiment Index: BULLISH

11 of the 18 participating brokers, or 61.11% of all participants, registered a positive Net Amount

13 of the 18 participating brokers, or 72.22% of all participants, registered a higher Buying Average than Selling Average

18 Participating Brokers’ Buying Average: ₱7.34812

18 Participating Brokers’ Selling Average: ₱7.34646

8 out of 18 participants, or 44.44% of all participants, registered a 100% BUYING activity

1 out of 18 participants, or 5.56% of all participants, registered a 100% SELLING activity

Need Help?

If you are in need of further assistance and a more profound comprehension of my Market Sentiment Index, alongside the comprehensive principles encapsulated within my Evergreen Strategy When Trading and Investing in the Philippine Stock Market, I invite you to explore my stock market consultancy service. Through a personalized 1-on-1 online workshop, I will provide invaluable insights into capital preservation, gain protection, and effective loss prevention techniques. Choose from our range of three comprehensive packages, tailored to suit your specific needs. To discover more about these packages and to schedule a session, please do not hesitate to contact me. Click here to view the available packages.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025