When trading or investing in the Philippine stock market, analyzing historical brokers’ transactions for market sentiment analysis can provide you with valuable insights. Here are three reasons why it is important:

- Understand Market Trends: By examining historical brokers’ transactions, you can gain a deeper understanding of market trends in the Philippine stock market. This analysis allows you to identify patterns and tendencies in trading activity, which can help you make informed decisions. For example, if you observe a consistent increase in buying activity from major brokerage firms, it may indicate a positive sentiment in the market, signaling potential opportunities for investment.

- Gauge Investor Sentiment: Brokers’ transactions provide a glimpse into the sentiment of investors participating in the Philippine stock market. Analyzing historical data can help you assess whether investors are optimistic or pessimistic about certain stocks or sectors. For instance, if you notice a surge in selling activity among brokers for a particular stock, it might indicate a negative sentiment or lack of confidence in that company’s performance. Such insights can be useful in aligning your investment strategy accordingly.

- Identify Institutional Activity: Examining historical brokers’ transactions enables you to track the activities of institutional investors, such as mutual funds, pension funds, and large brokerage firms. Institutional investors often possess extensive resources and conduct thorough research before making trading decisions. Therefore, monitoring their transactions can provide you with valuable information about their market positioning. If you notice consistent buying or selling patterns from institutional investors, it can indicate a strong conviction in their investment choices, influencing your own trading or investing decisions in the Philippine stock market.

By leveraging historical brokers’ transactions for market sentiment analysis in the Philippine stock market, you can gain a competitive edge, make well-informed decisions, and increase your chances of achieving successful outcomes in trading and investing.

From these principles I founded by proprietary Market Sentiment Index. I’ll share with you my overall market sentiment analysis for the 30 bluechip stocks that comprise the Philippine Stock Exchange Index (PSEi). My data coverage is from May 22 to 31 of 2023.

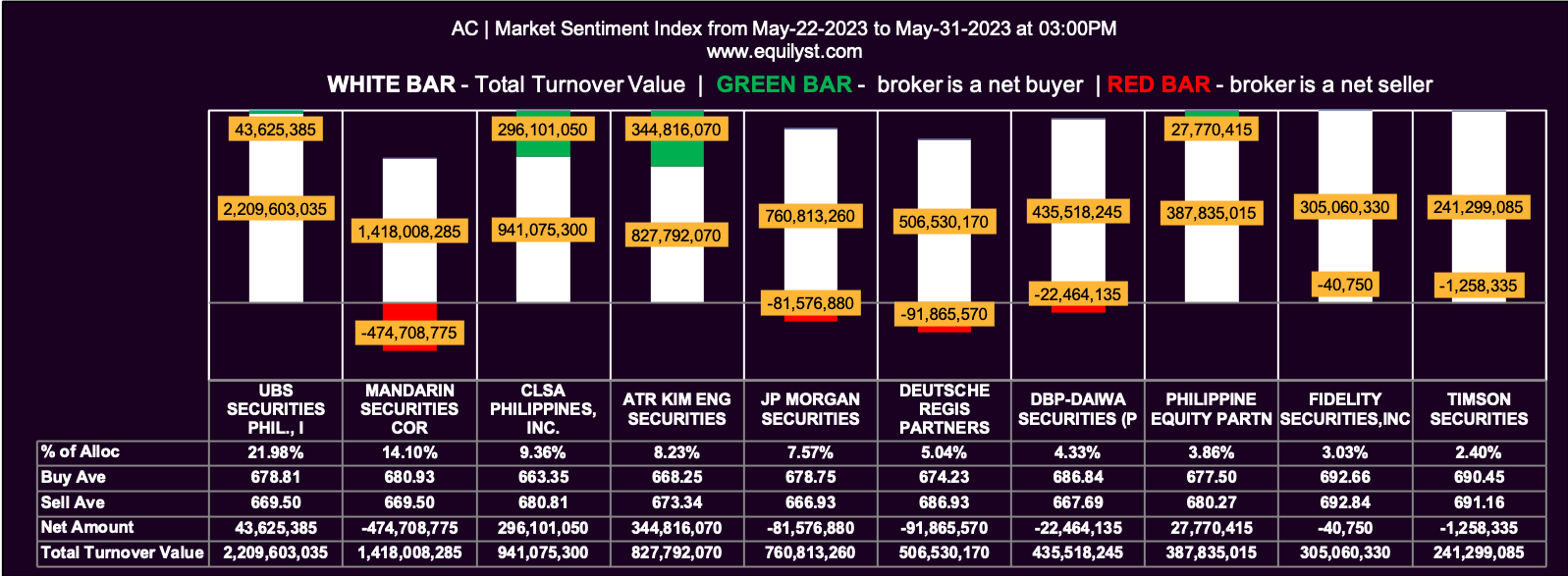

Ayala Corporation (AC)

Market Sentiment Index: BEARISH

34 of the 83 participating brokers, or 40.96% of all participants, registered a positive Net Amount

18 of the 83 participating brokers, or 21.69% of all participants, registered a higher Buying Average than Selling Average

83 Participating Brokers’ Buying Average: ₱676.86274

83 Participating Brokers’ Selling Average: ₱688.36450

7 out of 83 participants, or 8.43% of all participants, registered a 100% BUYING activity

17 out of 83 participants, or 20.48% of all participants, registered a 100% SELLING activity

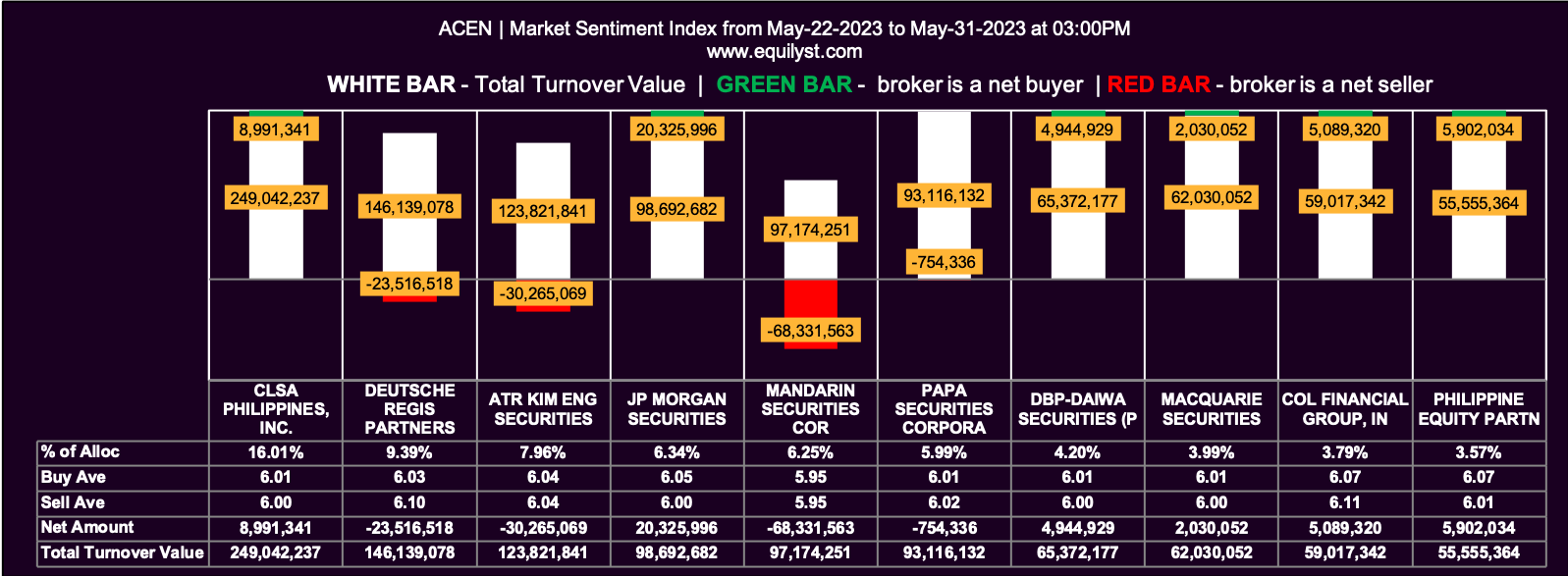

ACEN Corporation (ACEN)

Market Sentiment Index: BEARISH

50 of the 81 participating brokers, or 61.73% of all participants, registered a positive Net Amount

35 of the 81 participating brokers, or 43.21% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱6.06446

81 Participating Brokers’ Selling Average: ₱6.10826

14 out of 81 participants, or 17.28% of all participants, registered a 100% BUYING activity

9 out of 81 participants, or 11.11% of all participants, registered a 100% SELLING activity

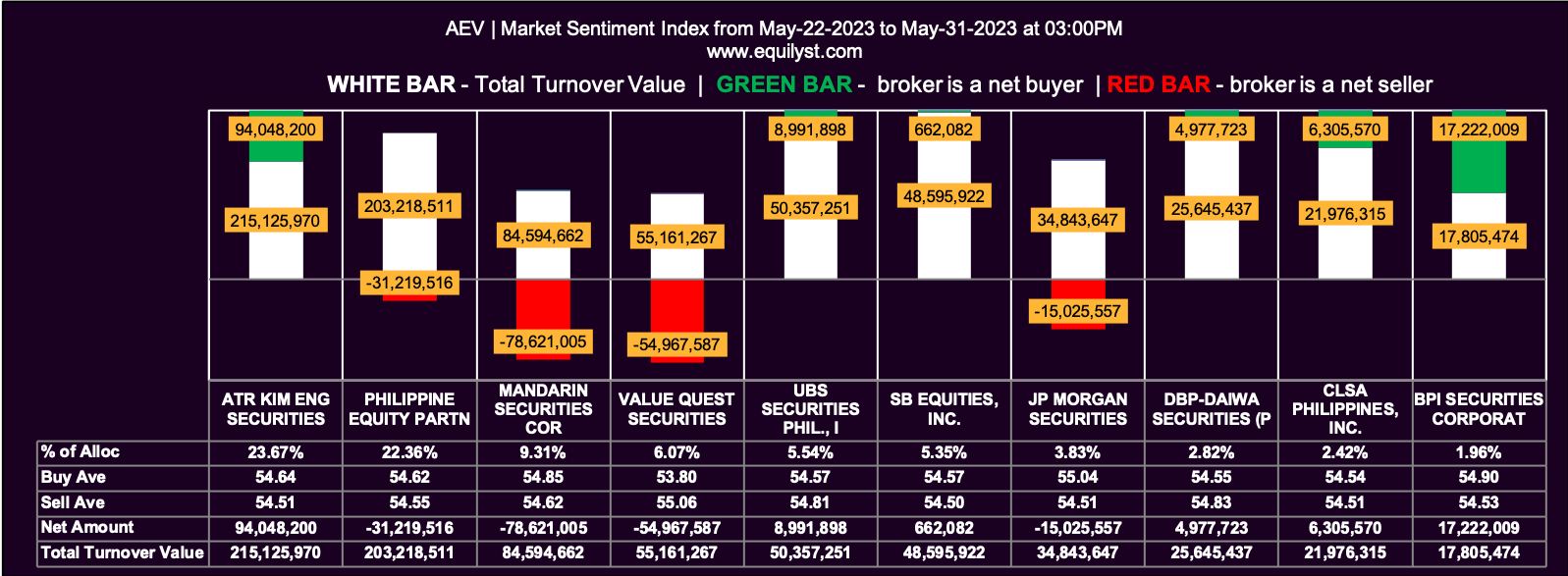

Aboitiz Equity Ventures (AEV)

Market Sentiment Index: BEARISH

28 of the 48 participating brokers, or 58.33% of all participants, registered a positive Net Amount

21 of the 48 participating brokers, or 43.75% of all participants, registered a higher Buying Average than Selling Average

48 Participating Brokers’ Buying Average: ₱54.52274

48 Participating Brokers’ Selling Average: ₱54.72487

8 out of 48 participants, or 16.67% of all participants, registered a 100% BUYING activity

6 out of 48 participants, or 12.50% of all participants, registered a 100% SELLING activity

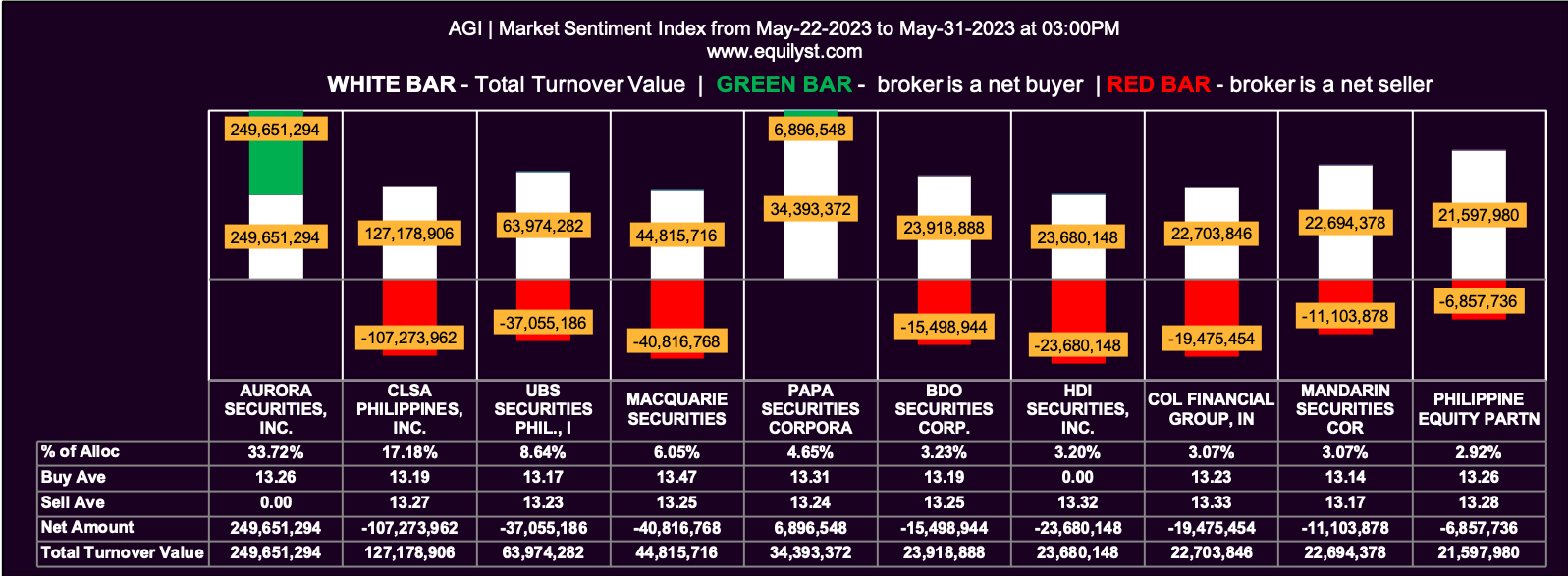

Alliance Global Group (AGI)

Market Sentiment Index: BEARISH

20 of the 53 participating brokers, or 37.74% of all participants, registered a positive Net Amount

20 of the 53 participating brokers, or 37.74% of all participants, registered a higher Buying Average than Selling Average

53 Participating Brokers’ Buying Average: ₱13.22710

53 Participating Brokers’ Selling Average: ₱13.23887

7 out of 53 participants, or 13.21% of all participants, registered a 100% BUYING activity

12 out of 53 participants, or 22.64% of all participants, registered a 100% SELLING activity

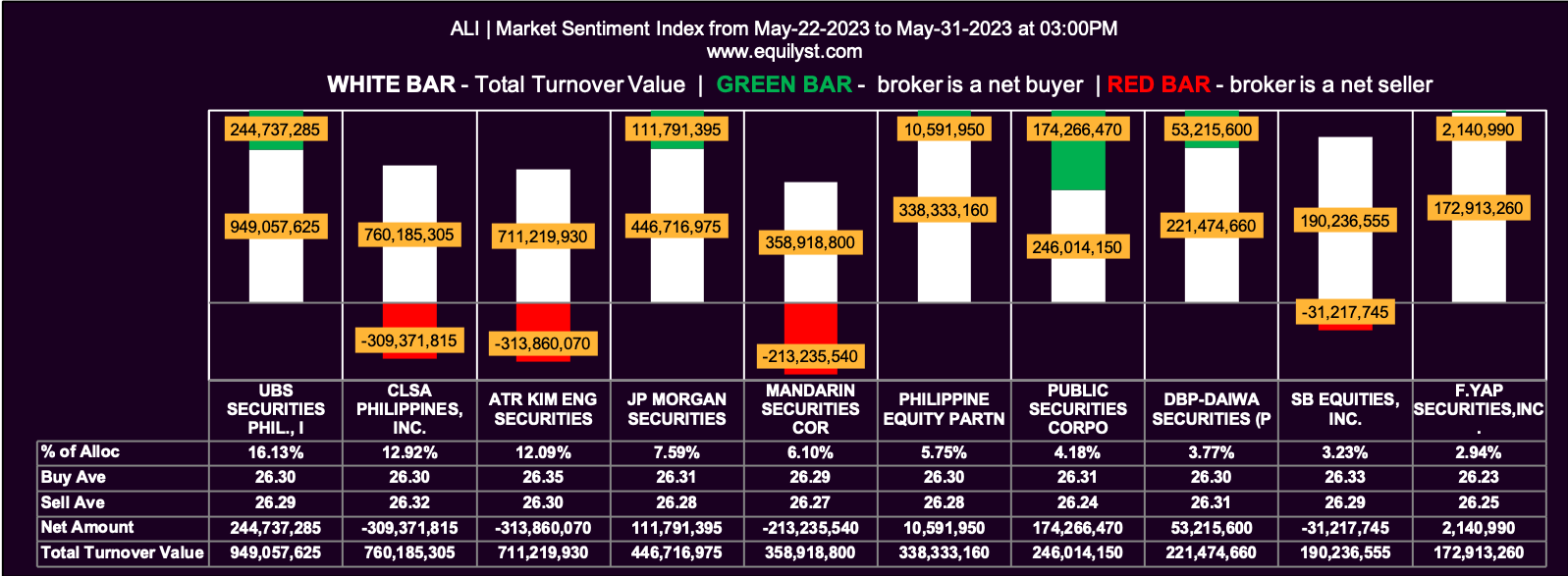

Ayala Land (ALI)

Market Sentiment Index: BULLISH

71 of the 92 participating brokers, or 77.17% of all participants, registered a positive Net Amount

49 of the 92 participating brokers, or 53.26% of all participants, registered a higher Buying Average than Selling Average

92 Participating Brokers’ Buying Average: ₱26.26871

92 Participating Brokers’ Selling Average: ₱26.33199

26 out of 92 participants, or 28.26% of all participants, registered a 100% BUYING activity

5 out of 92 participants, or 5.43% of all participants, registered a 100% SELLING activity

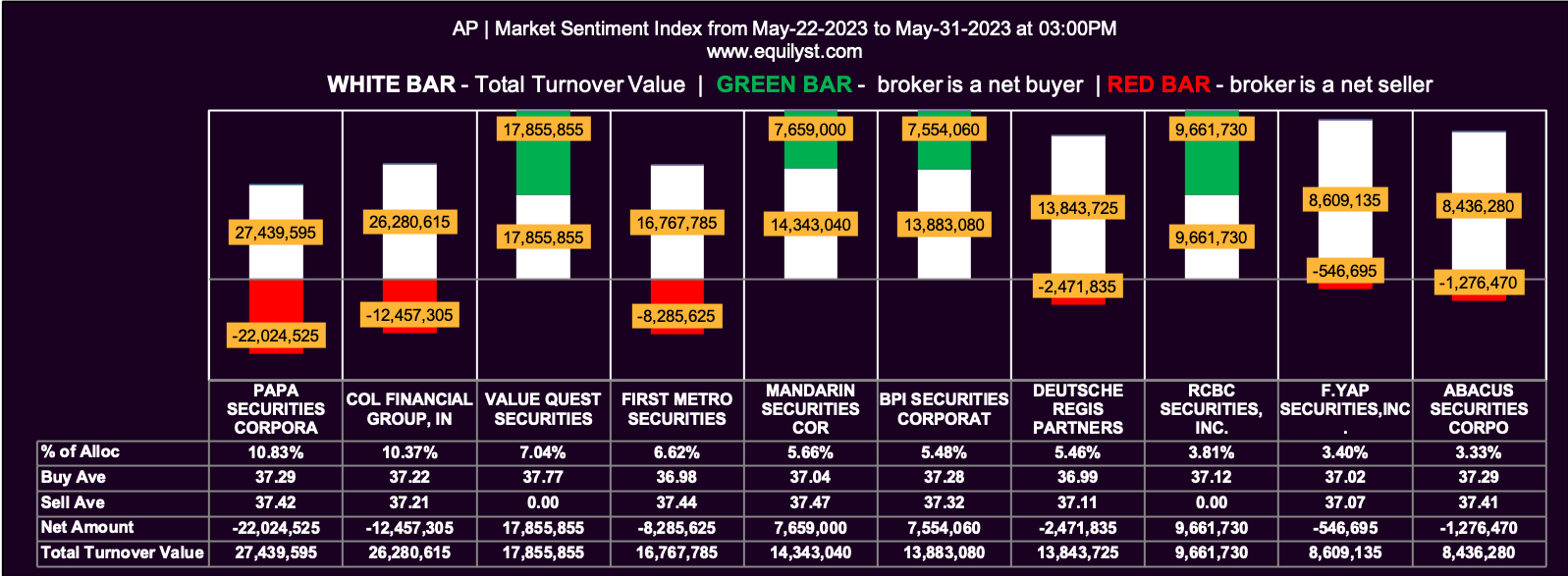

Aboitiz Power Corporation (AP)

Market Sentiment Index: BEARISH

30 of the 56 participating brokers, or 53.57% of all participants, registered a positive Net Amount

23 of the 56 participating brokers, or 41.07% of all participants, registered a higher Buying Average than Selling Average

56 Participating Brokers’ Buying Average: ₱37.14674

56 Participating Brokers’ Selling Average: ₱37.38536

14 out of 56 participants, or 25.00% of all participants, registered a 100% BUYING activity

10 out of 56 participants, or 17.86% of all participants, registered a 100% SELLING activity

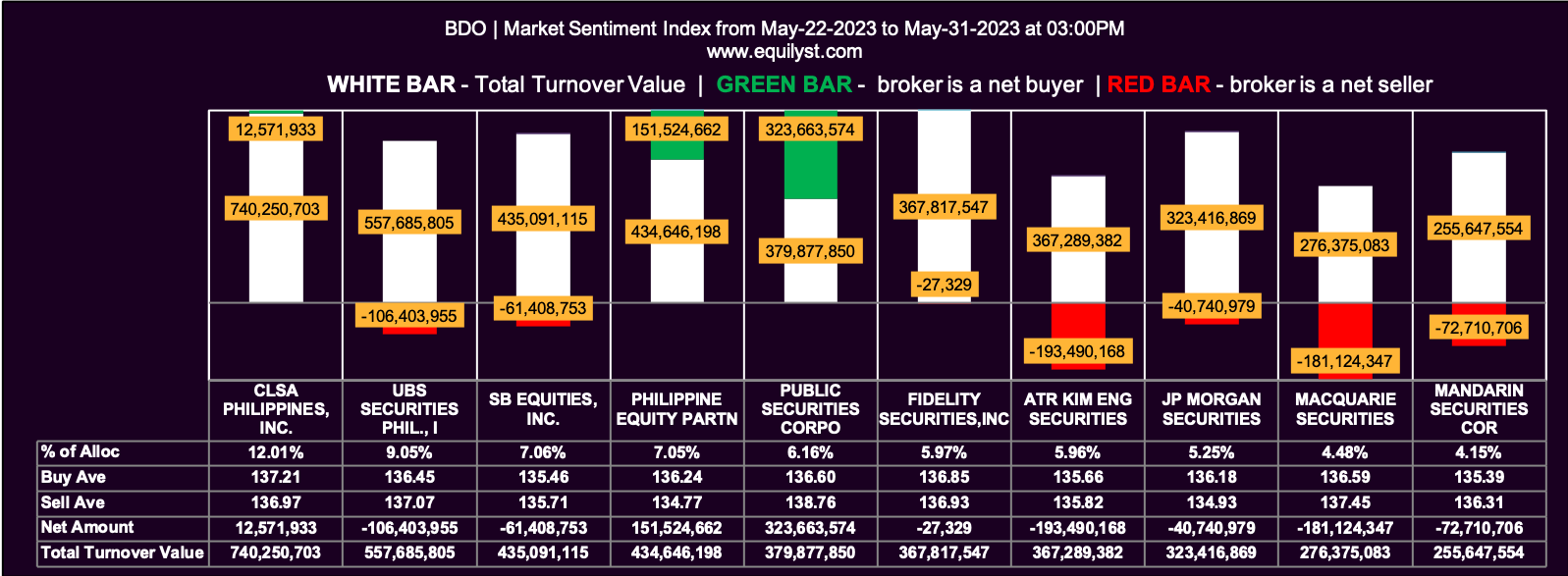

BDO Unibank (BDO)

Market Sentiment Index: BEARISH

51 of the 76 participating brokers, or 67.11% of all participants, registered a positive Net Amount

34 of the 76 participating brokers, or 44.74% of all participants, registered a higher Buying Average than Selling Average

76 Participating Brokers’ Buying Average: ₱135.58172

76 Participating Brokers’ Selling Average: ₱136.26391

16 out of 76 participants, or 21.05% of all participants, registered a 100% BUYING activity

6 out of 76 participants, or 7.89% of all participants, registered a 100% SELLING activity

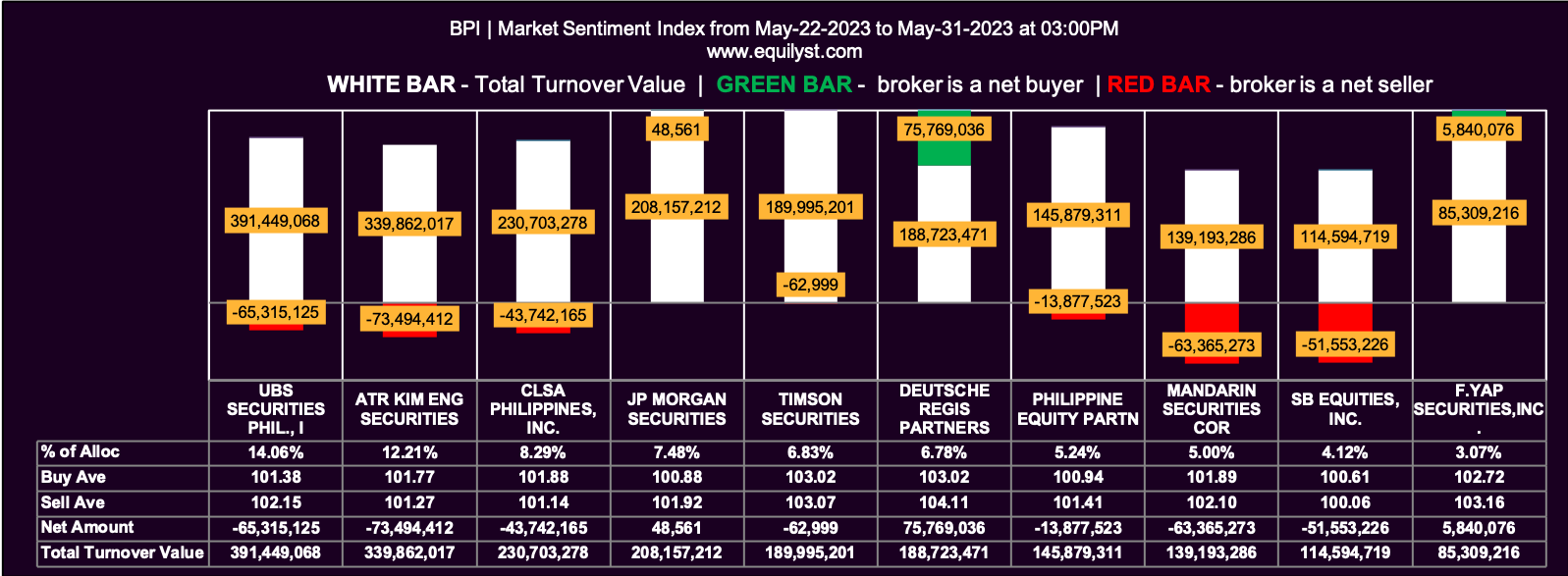

Bank of the Philippine Islands (BPI)

Market Sentiment Index: BULLISH

60 of the 82 participating brokers, or 73.17% of all participants, registered a positive Net Amount

43 of the 82 participating brokers, or 52.44% of all participants, registered a higher Buying Average than Selling Average

82 Participating Brokers’ Buying Average: ₱101.72783

82 Participating Brokers’ Selling Average: ₱102.76818

34 out of 82 participants, or 41.46% of all participants, registered a 100% BUYING activity

4 out of 82 participants, or 4.88% of all participants, registered a 100% SELLING activity

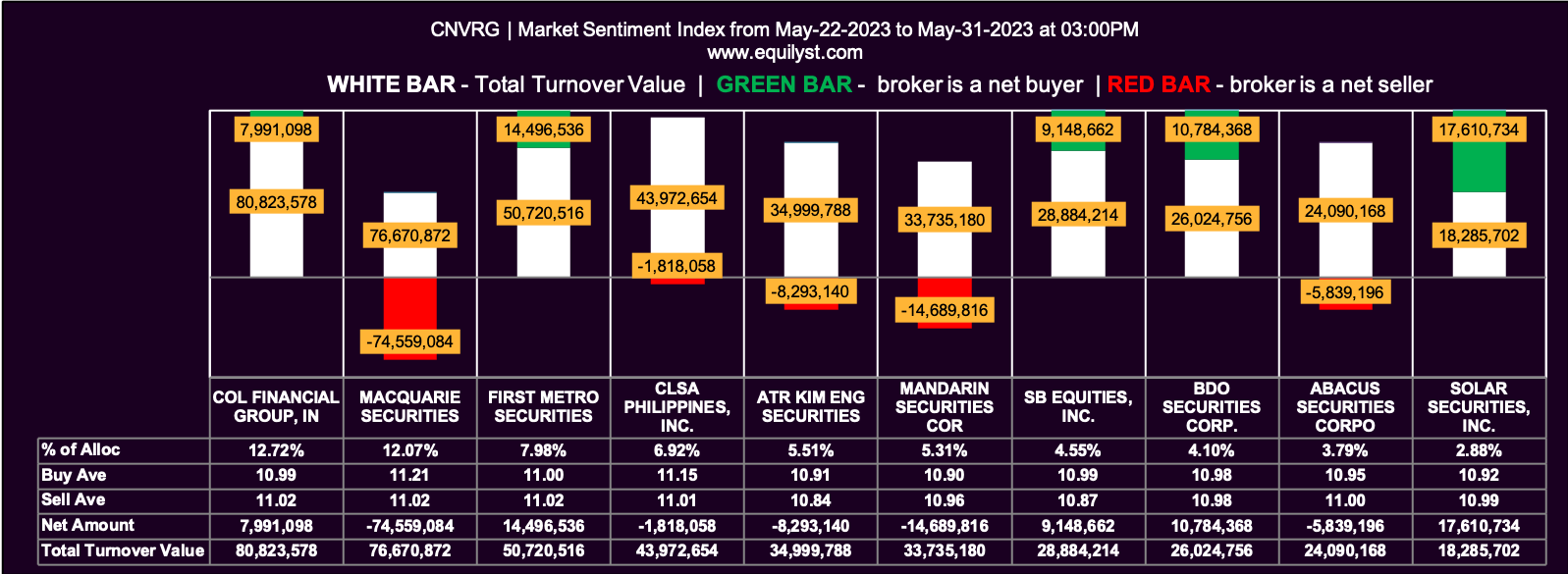

Converge ICT Solutions (CNVRG)

Market Sentiment Index: BULLISH

57 of the 83 participating brokers, or 68.67% of all participants, registered a positive Net Amount

52 of the 83 participating brokers, or 62.65% of all participants, registered a higher Buying Average than Selling Average

83 Participating Brokers’ Buying Average: ₱10.99929

83 Participating Brokers’ Selling Average: ₱10.99042

23 out of 83 participants, or 27.71% of all participants, registered a 100% BUYING activity

5 out of 83 participants, or 6.02% of all participants, registered a 100% SELLING activity

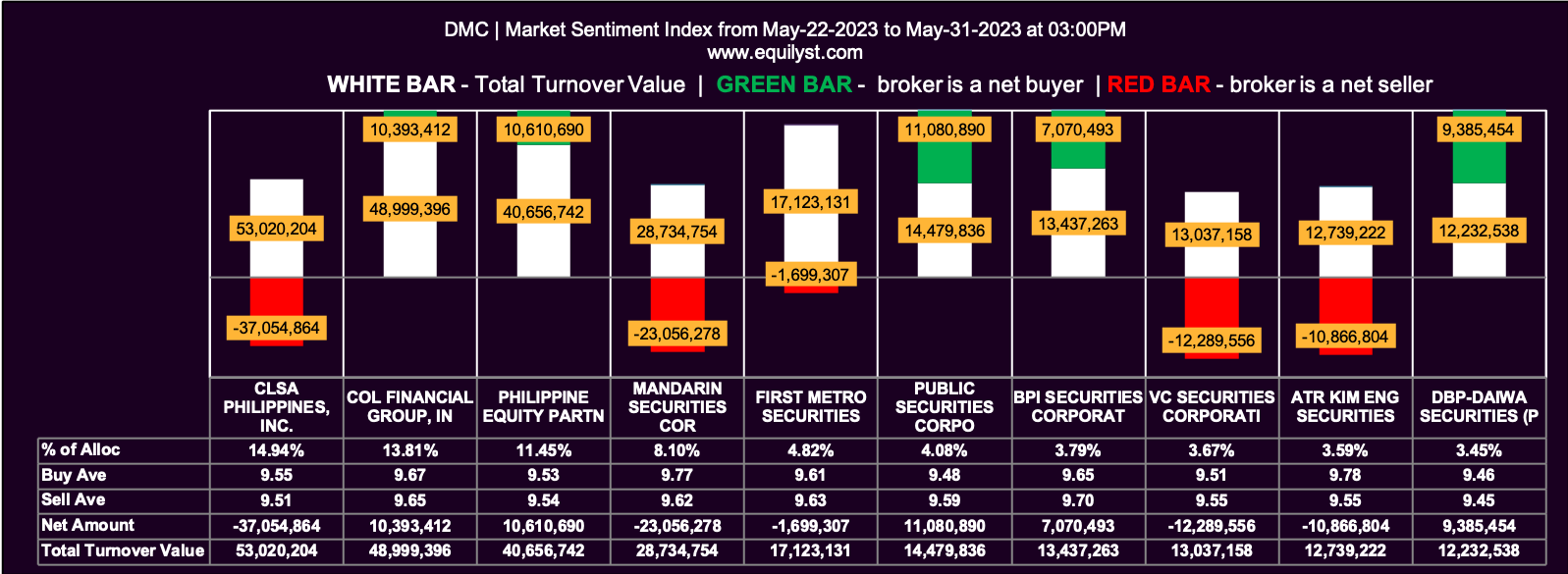

DMCI Holdings (DMC)

Market Sentiment Index: BEARISH

45 of the 66 participating brokers, or 68.18% of all participants, registered a positive Net Amount

32 of the 66 participating brokers, or 48.48% of all participants, registered a higher Buying Average than Selling Average

66 Participating Brokers’ Buying Average: ₱9.63733

66 Participating Brokers’ Selling Average: ₱9.68574

21 out of 66 participants, or 31.82% of all participants, registered a 100% BUYING activity

10 out of 66 participants, or 15.15% of all participants, registered a 100% SELLING activity

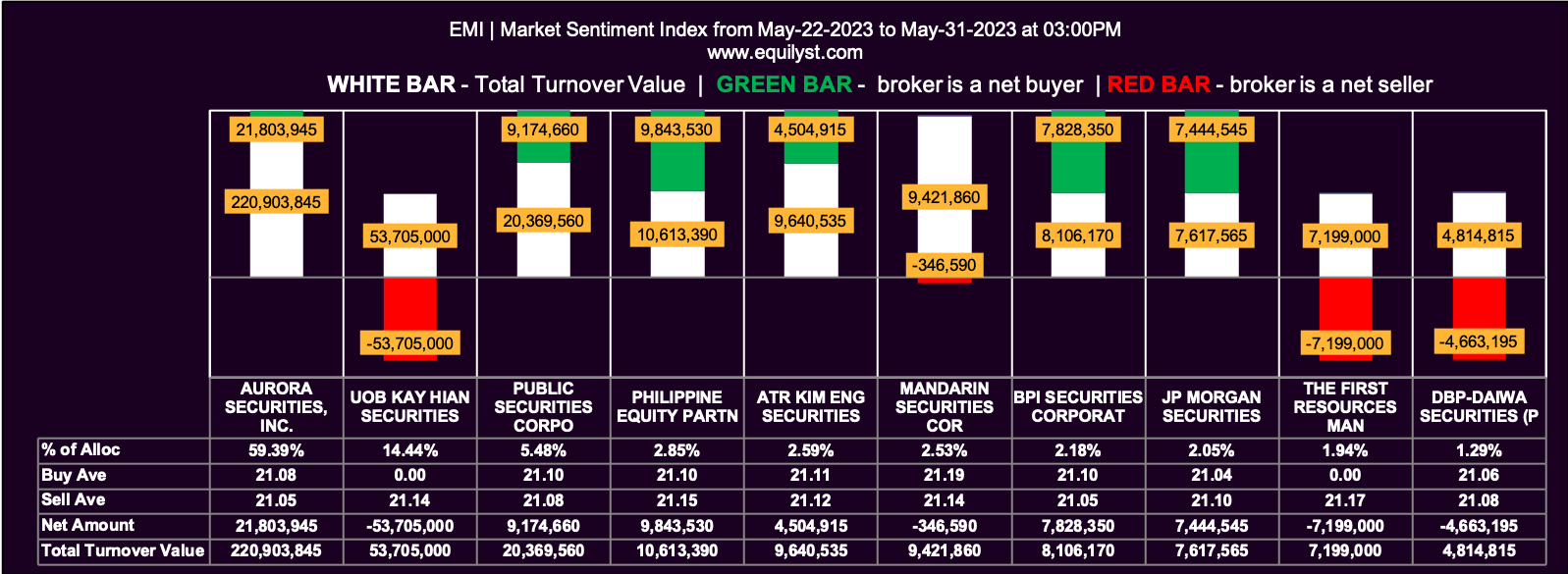

Emperador (EMI)

Market Sentiment Index: BULLISH

19 of the 35 participating brokers, or 54.29% of all participants, registered a positive Net Amount

19 of the 35 participating brokers, or 54.29% of all participants, registered a higher Buying Average than Selling Average

35 Participating Brokers’ Buying Average: ₱21.09448

35 Participating Brokers’ Selling Average: ₱21.08959

8 out of 35 participants, or 22.86% of all participants, registered a 100% BUYING activity

8 out of 35 participants, or 22.86% of all participants, registered a 100% SELLING activity

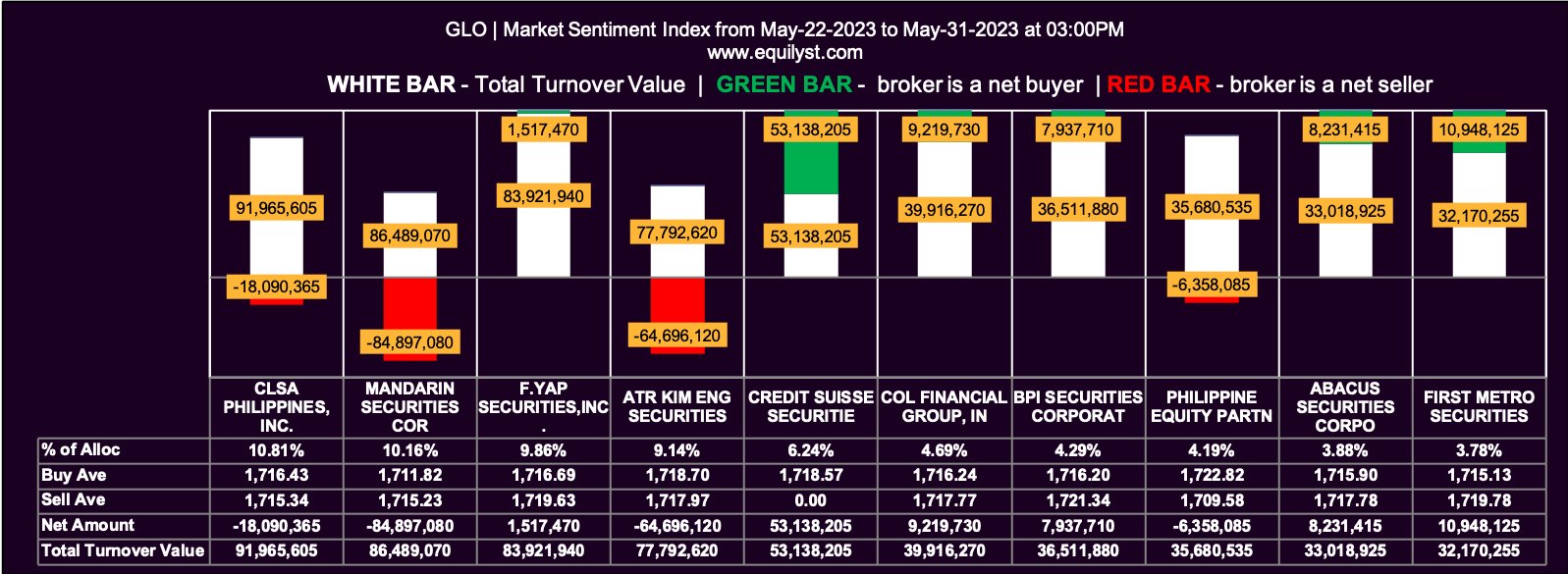

Globe Telecom (GLO)

Market Sentiment Index: BEARISH

40 of the 66 participating brokers, or 60.61% of all participants, registered a positive Net Amount

28 of the 66 participating brokers, or 42.42% of all participants, registered a higher Buying Average than Selling Average

66 Participating Brokers’ Buying Average: ₱1714.86940

66 Participating Brokers’ Selling Average: ₱1719.75926

17 out of 66 participants, or 25.76% of all participants, registered a 100% BUYING activity

10 out of 66 participants, or 15.15% of all participants, registered a 100% SELLING activity

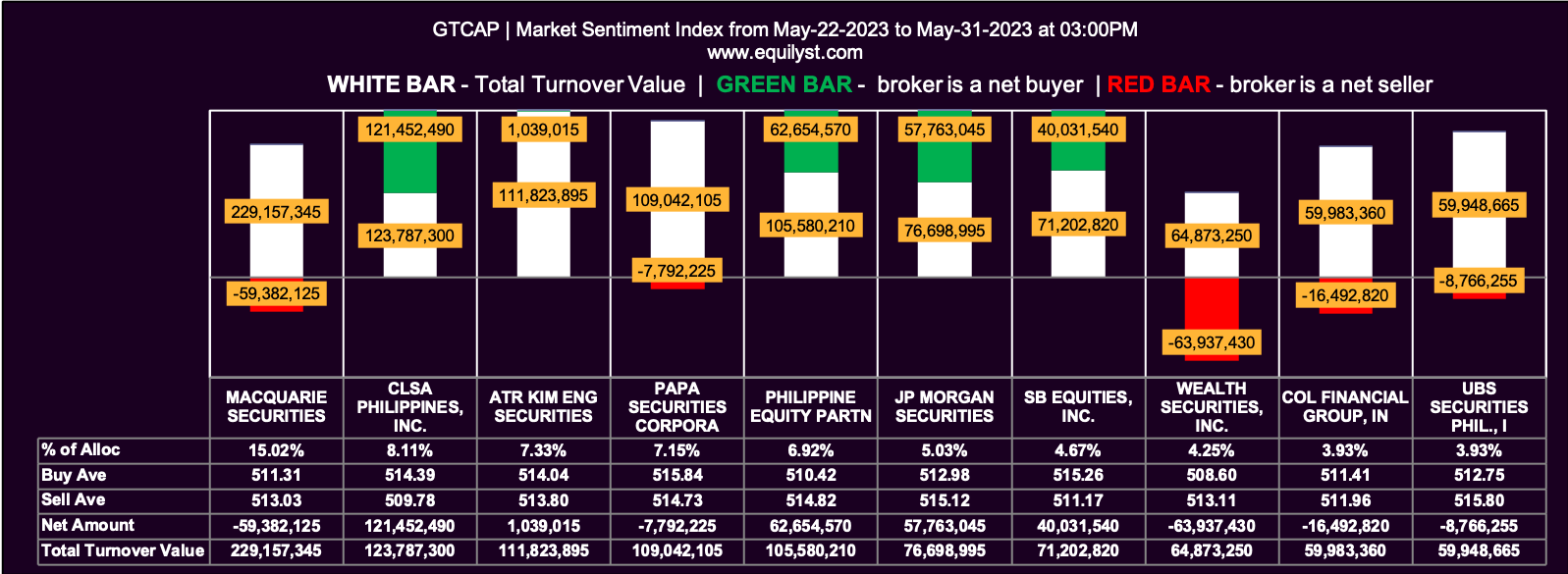

GT Capital Holdings (GTCAP)

Market Sentiment Index: BEARISH

15 of the 68 participating brokers, or 22.06% of all participants, registered a positive Net Amount

17 of the 68 participating brokers, or 25.00% of all participants, registered a higher Buying Average than Selling Average

68 Participating Brokers’ Buying Average: ₱512.24811

68 Participating Brokers’ Selling Average: ₱514.08316

3 out of 68 participants, or 4.41% of all participants, registered a 100% BUYING activity

24 out of 68 participants, or 35.29% of all participants, registered a 100% SELLING activity

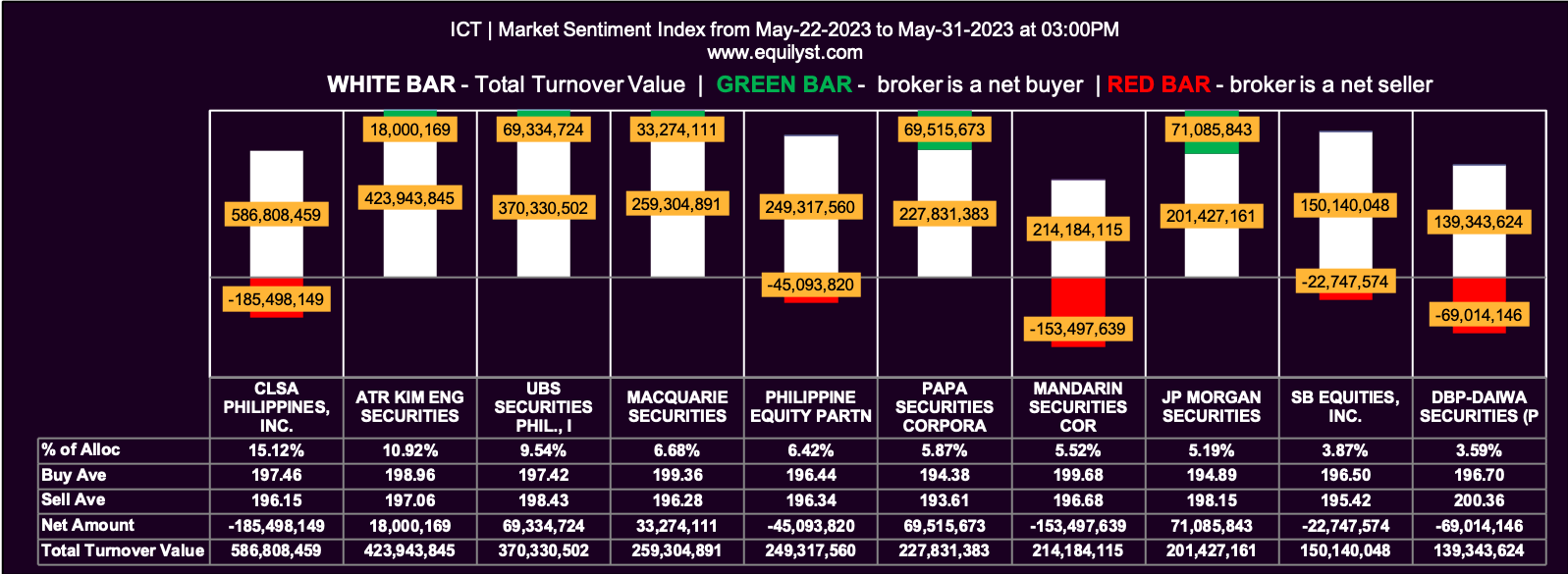

Int’l Container Terminal Services (ICT)

Market Sentiment Index: BEARISH

55 of the 79 participating brokers, or 69.62% of all participants, registered a positive Net Amount

35 of the 79 participating brokers, or 44.30% of all participants, registered a higher Buying Average than Selling Average

79 Participating Brokers’ Buying Average: ₱196.01151

79 Participating Brokers’ Selling Average: ₱198.41483

21 out of 79 participants, or 26.58% of all participants, registered a 100% BUYING activity

1 out of 79 participants, or 1.27% of all participants, registered a 100% SELLING activity

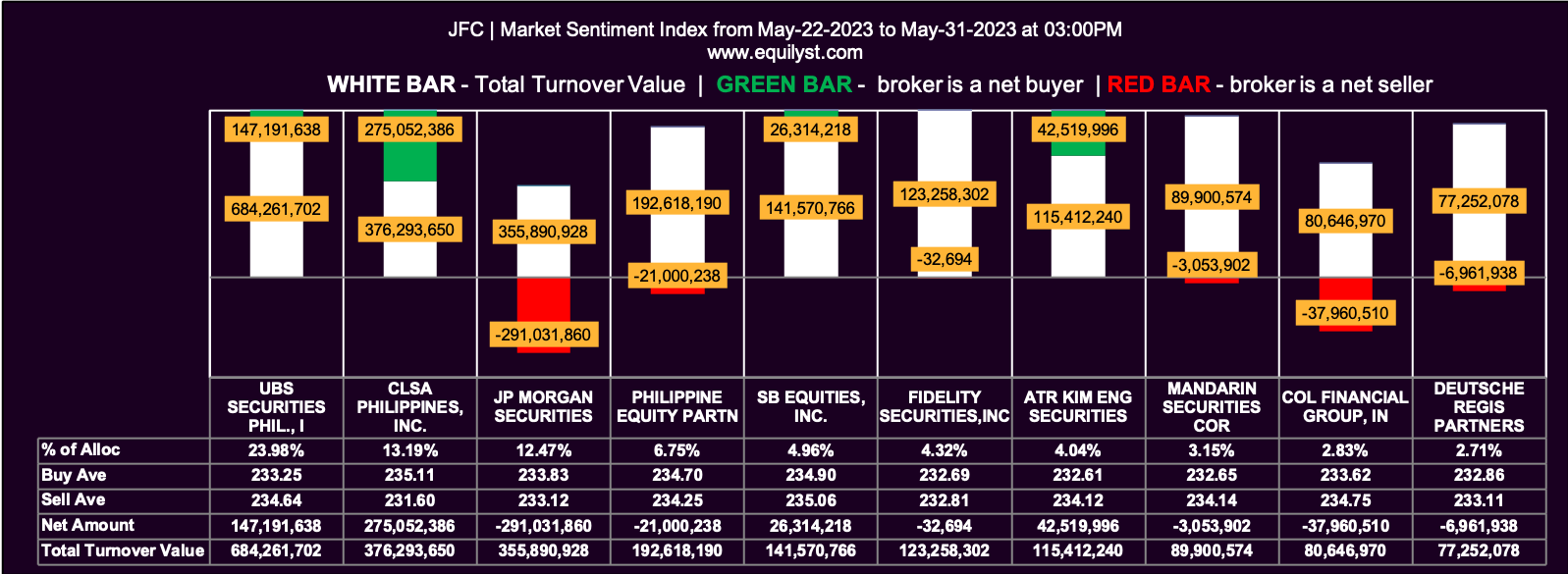

Jollibee Foods Corporation (JFC)

Market Sentiment Index: BEARISH

17 of the 66 participating brokers, or 25.76% of all participants, registered a positive Net Amount

10 of the 66 participating brokers, or 15.15% of all participants, registered a higher Buying Average than Selling Average

66 Participating Brokers’ Buying Average: ₱233.40848

66 Participating Brokers’ Selling Average: ₱234.18075

2 out of 66 participants, or 3.03% of all participants, registered a 100% BUYING activity

22 out of 66 participants, or 33.33% of all participants, registered a 100% SELLING activity

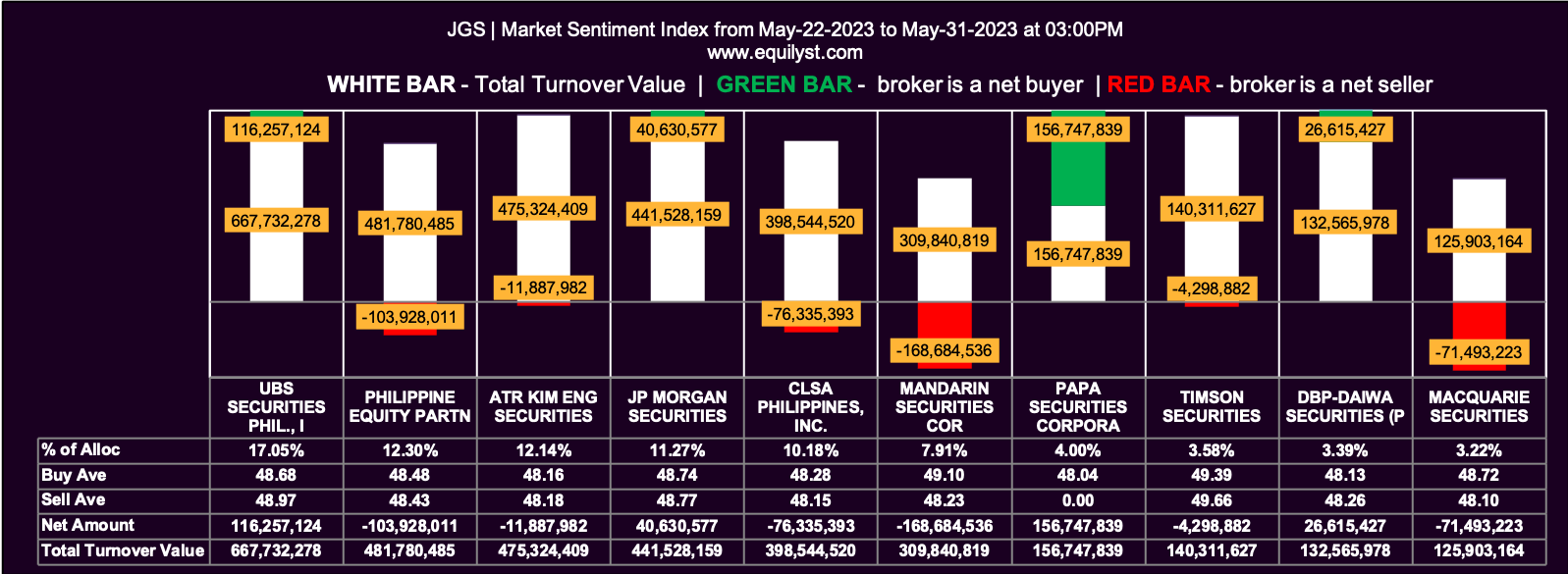

JG Summit Holdings (JGS)

Market Sentiment Index: BEARISH

42 of the 70 participating brokers, or 60.00% of all participants, registered a positive Net Amount

29 of the 70 participating brokers, or 41.43% of all participants, registered a higher Buying Average than Selling Average

70 Participating Brokers’ Buying Average: ₱48.78962

70 Participating Brokers’ Selling Average: ₱49.64187

16 out of 70 participants, or 22.86% of all participants, registered a 100% BUYING activity

5 out of 70 participants, or 7.14% of all participants, registered a 100% SELLING activity

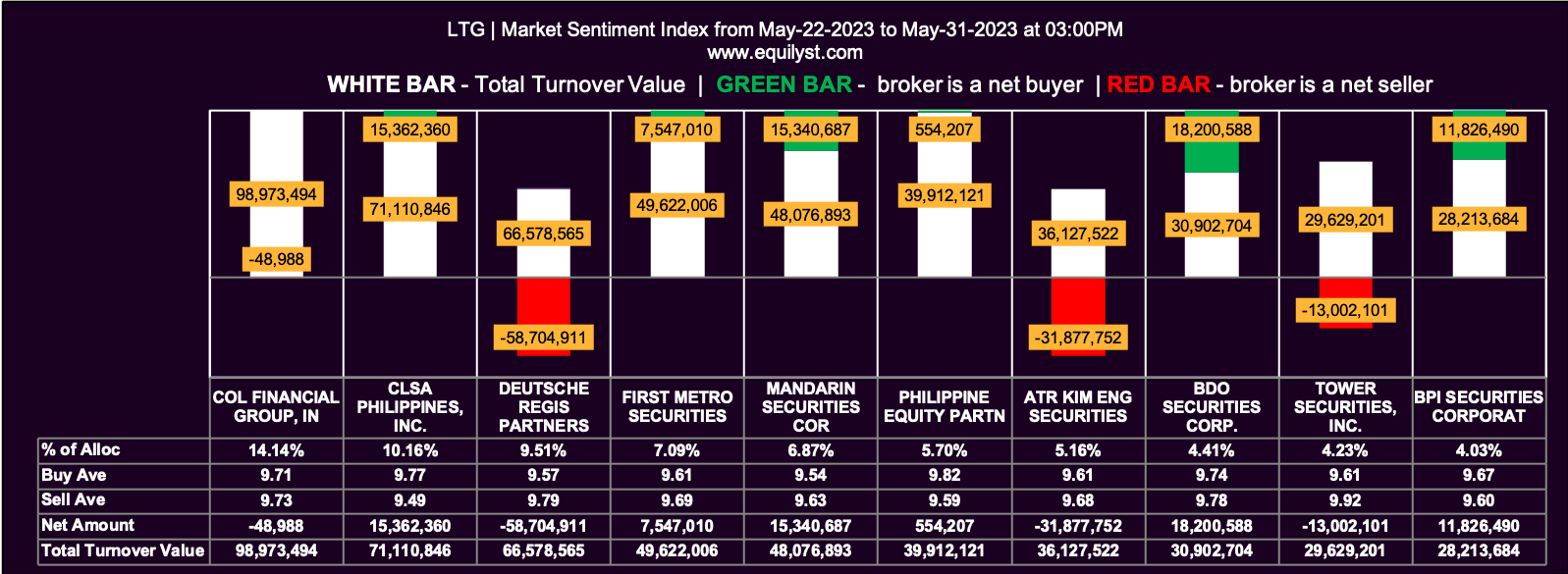

LT Group (LTG)

Market Sentiment Index: BULLISH

64 of the 81 participating brokers, or 79.01% of all participants, registered a positive Net Amount

66 of the 81 participating brokers, or 81.48% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱9.67805

81 Participating Brokers’ Selling Average: ₱9.64919

41 out of 81 participants, or 50.62% of all participants, registered a 100% BUYING activity

0 out of 81 participants, or 0.00% of all participants, registered a 100% SELLING activity

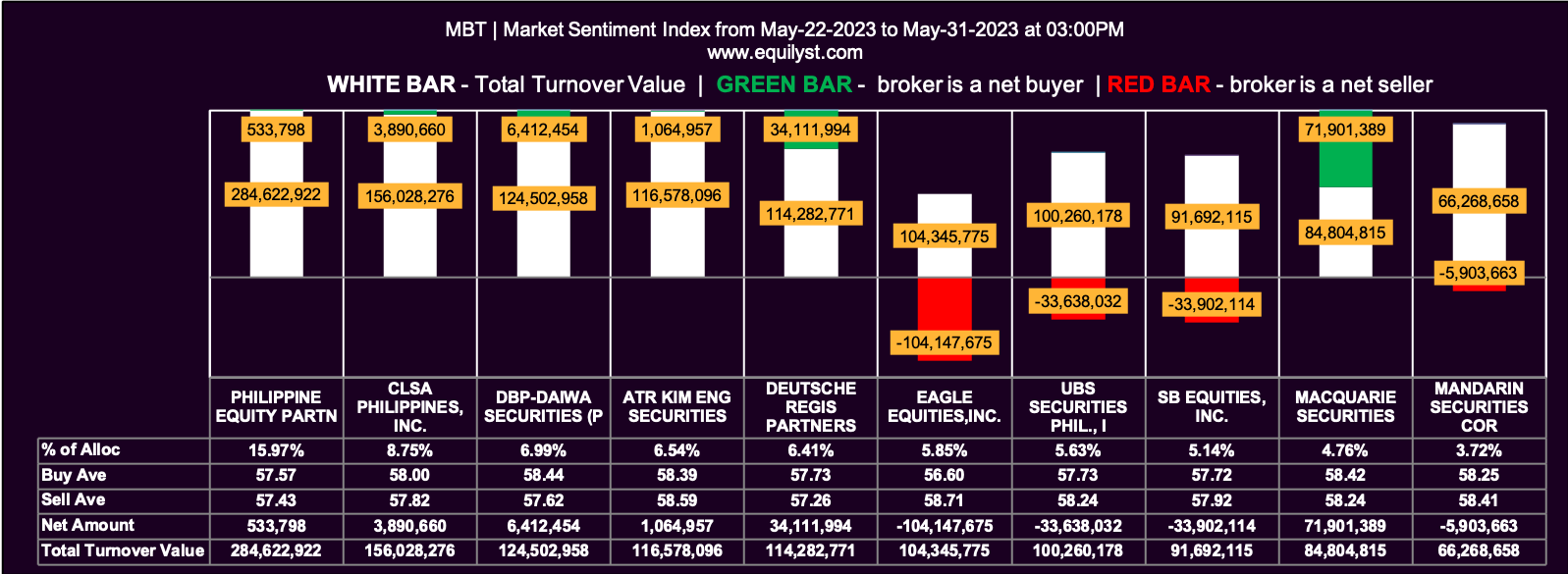

Metropolitan Bank and Trust Company (MBT)

Market Sentiment Index: BEARISH

47 of the 74 participating brokers, or 63.51% of all participants, registered a positive Net Amount

36 of the 74 participating brokers, or 48.65% of all participants, registered a higher Buying Average than Selling Average

74 Participating Brokers’ Buying Average: ₱57.71410

74 Participating Brokers’ Selling Average: ₱58.17931

19 out of 74 participants, or 25.68% of all participants, registered a 100% BUYING activity

4 out of 74 participants, or 5.41% of all participants, registered a 100% SELLING activity

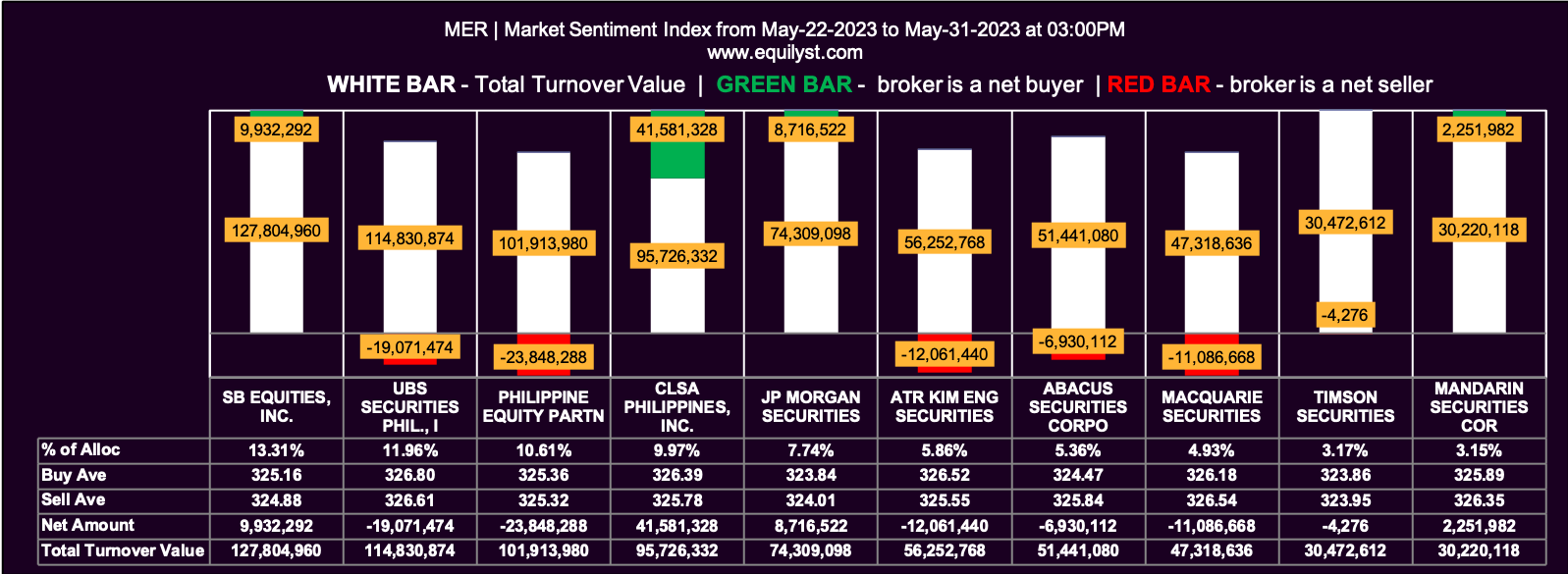

Manila Electric Company (MER)

Market Sentiment Index: BEARISH

22 of the 60 participating brokers, or 36.67% of all participants, registered a positive Net Amount

25 of the 60 participating brokers, or 41.67% of all participants, registered a higher Buying Average than Selling Average

60 Participating Brokers’ Buying Average: ₱324.96591

60 Participating Brokers’ Selling Average: ₱325.70480

8 out of 60 participants, or 13.33% of all participants, registered a 100% BUYING activity

12 out of 60 participants, or 20.00% of all participants, registered a 100% SELLING activity

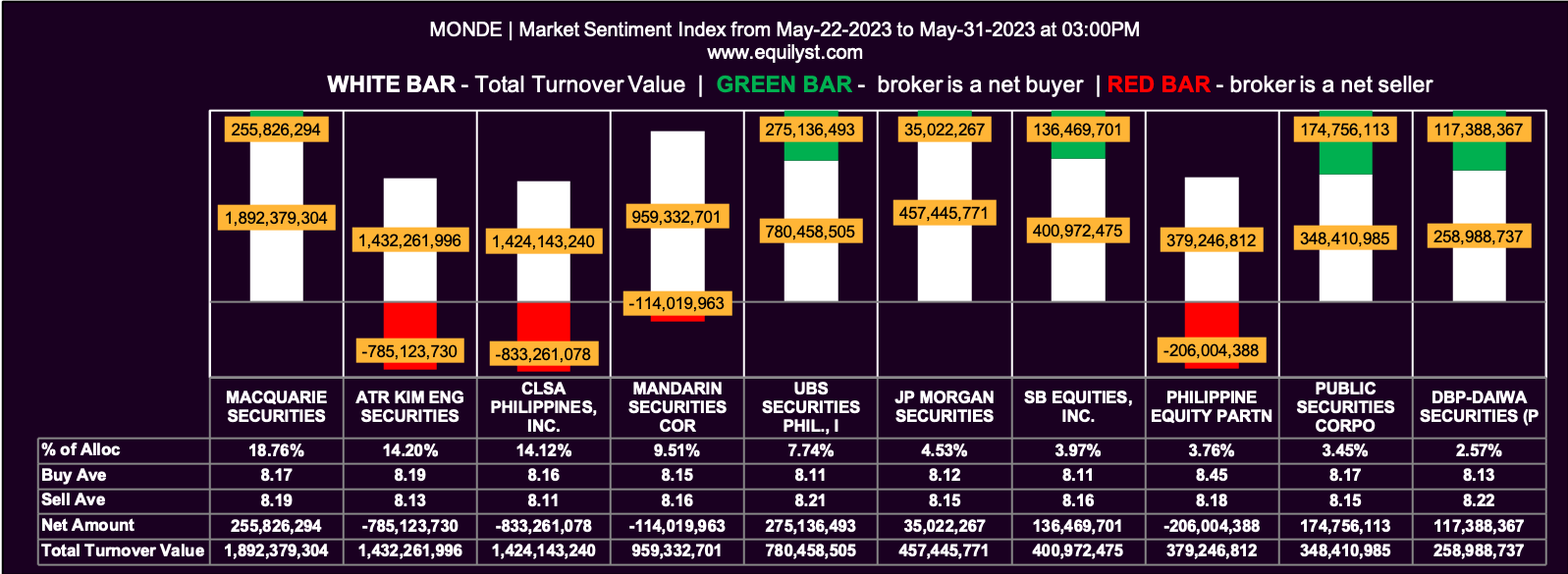

Monde Nissin Corporation (MONDE)

Market Sentiment Index: BEARISH

71 of the 87 participating brokers, or 81.61% of all participants, registered a positive Net Amount

38 of the 87 participating brokers, or 43.68% of all participants, registered a higher Buying Average than Selling Average

87 Participating Brokers’ Buying Average: ₱8.23802

87 Participating Brokers’ Selling Average: ₱8.38256

30 out of 87 participants, or 34.48% of all participants, registered a 100% BUYING activity

4 out of 87 participants, or 4.60% of all participants, registered a 100% SELLING activity

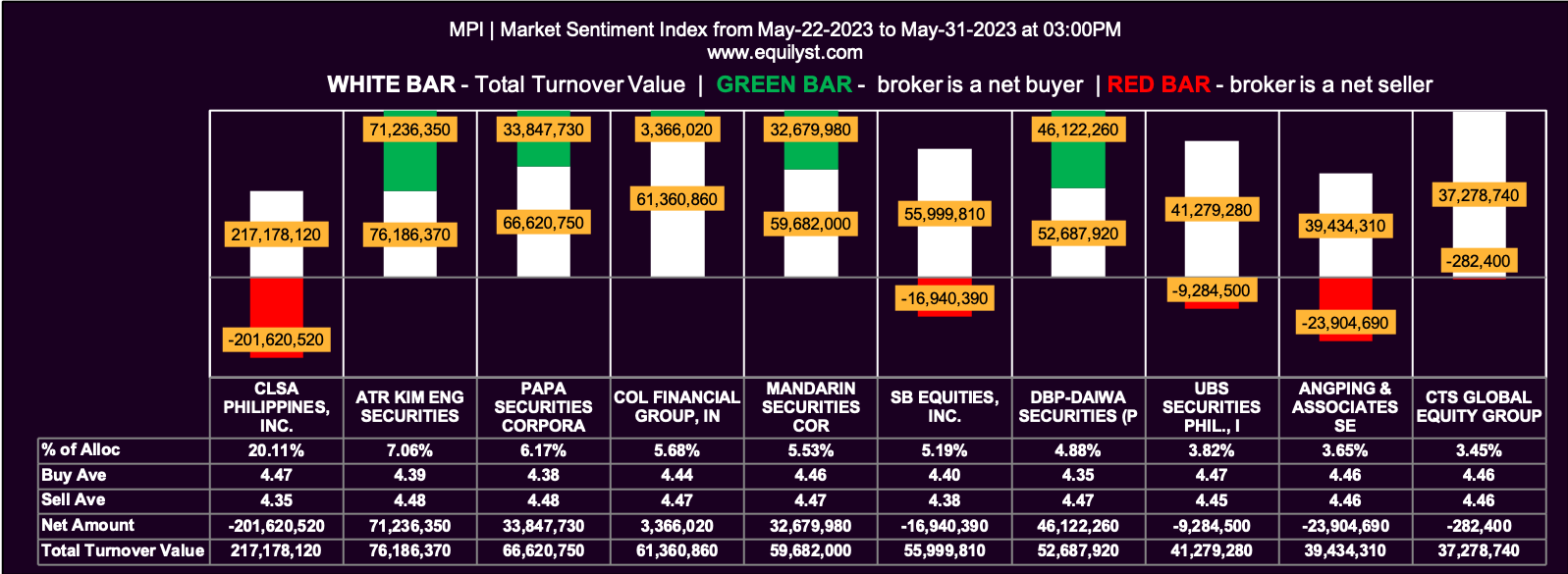

Metro Pacific Investments Corporation (MPI)

Market Sentiment Index: BEARISH

31 of the 65 participating brokers, or 47.69% of all participants, registered a positive Net Amount

24 of the 65 participating brokers, or 36.92% of all participants, registered a higher Buying Average than Selling Average

65 Participating Brokers’ Buying Average: ₱4.43220

65 Participating Brokers’ Selling Average: ₱4.46462

12 out of 65 participants, or 18.46% of all participants, registered a 100% BUYING activity

16 out of 65 participants, or 24.62% of all participants, registered a 100% SELLING activity

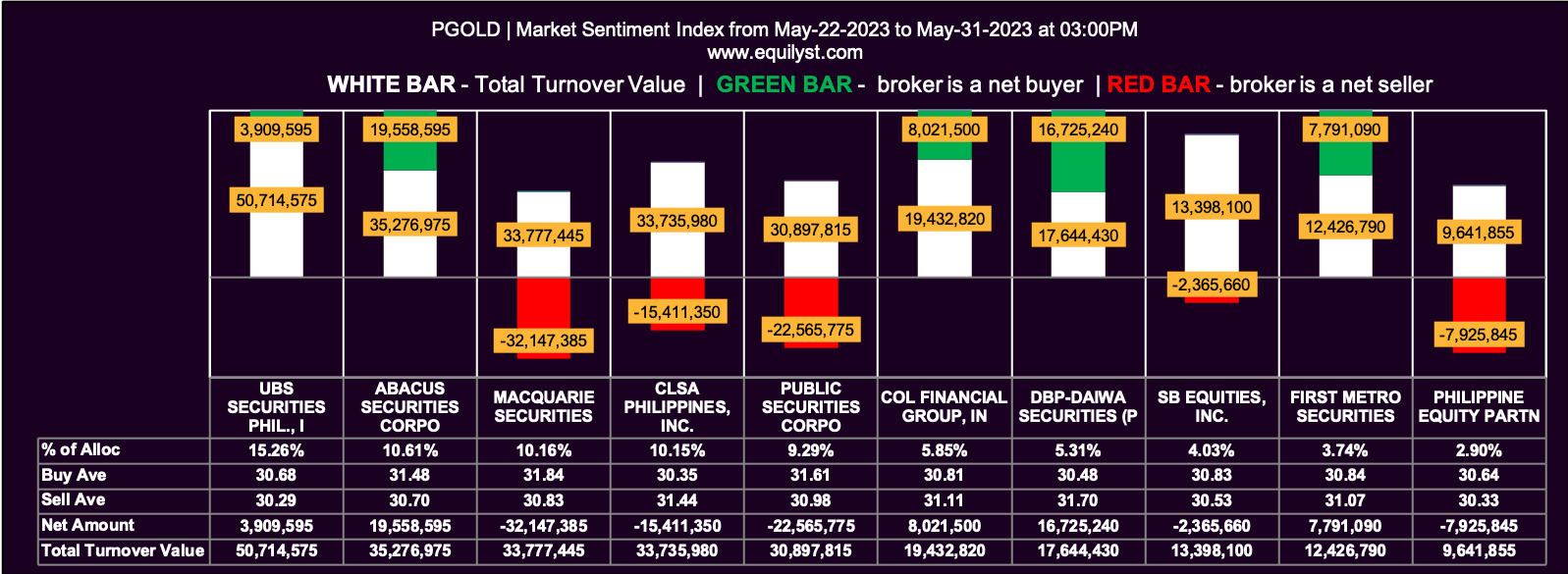

Puregold Price Club (PGOLD)

Market Sentiment Index: BULLISH

39 of the 54 participating brokers, or 72.22% of all participants, registered a positive Net Amount

37 of the 54 participating brokers, or 68.52% of all participants, registered a higher Buying Average than Selling Average

54 Participating Brokers’ Buying Average: ₱30.82092

54 Participating Brokers’ Selling Average: ₱30.92447

27 out of 54 participants, or 50.00% of all participants, registered a 100% BUYING activity

3 out of 54 participants, or 5.56% of all participants, registered a 100% SELLING activity

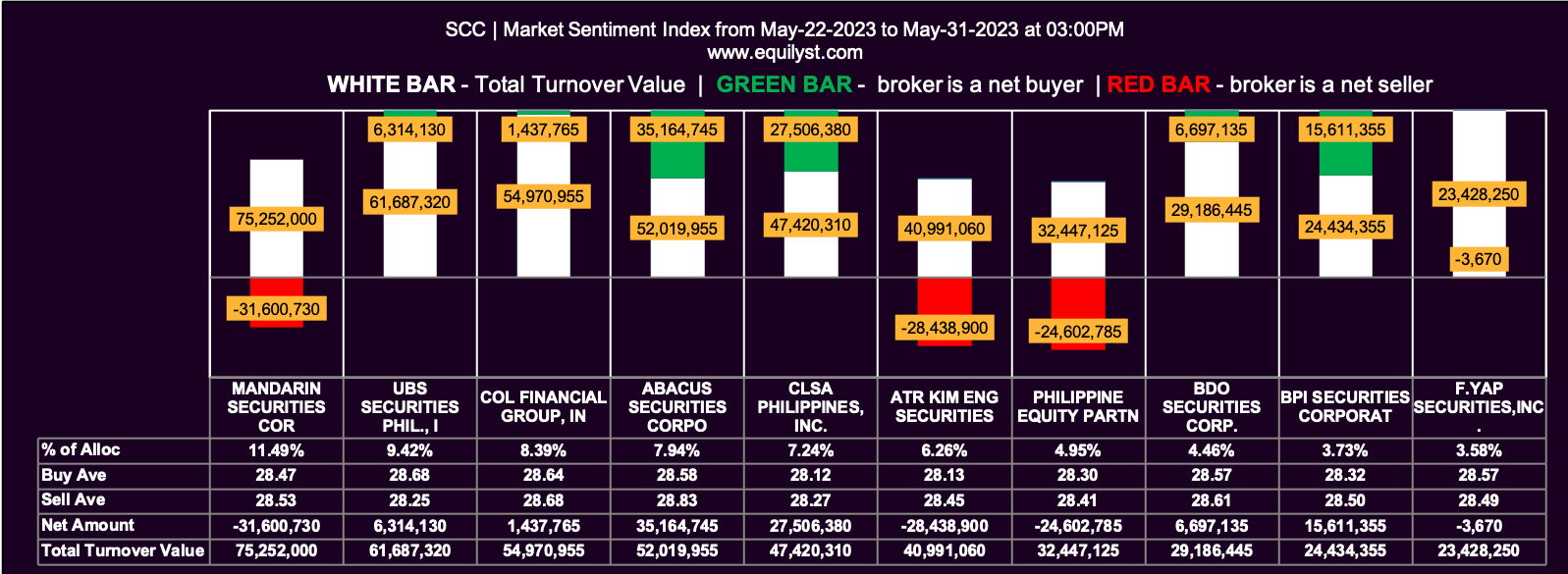

Semirara Mining and Power Corporation (SCC)

Market Sentiment Index: BEARISH

38 of the 71 participating brokers, or 53.52% of all participants, registered a positive Net Amount

34 of the 71 participating brokers, or 47.89% of all participants, registered a higher Buying Average than Selling Average

71 Participating Brokers’ Buying Average: ₱28.52748

71 Participating Brokers’ Selling Average: ₱28.62586

20 out of 71 participants, or 28.17% of all participants, registered a 100% BUYING activity

13 out of 71 participants, or 18.31% of all participants, registered a 100% SELLING activity

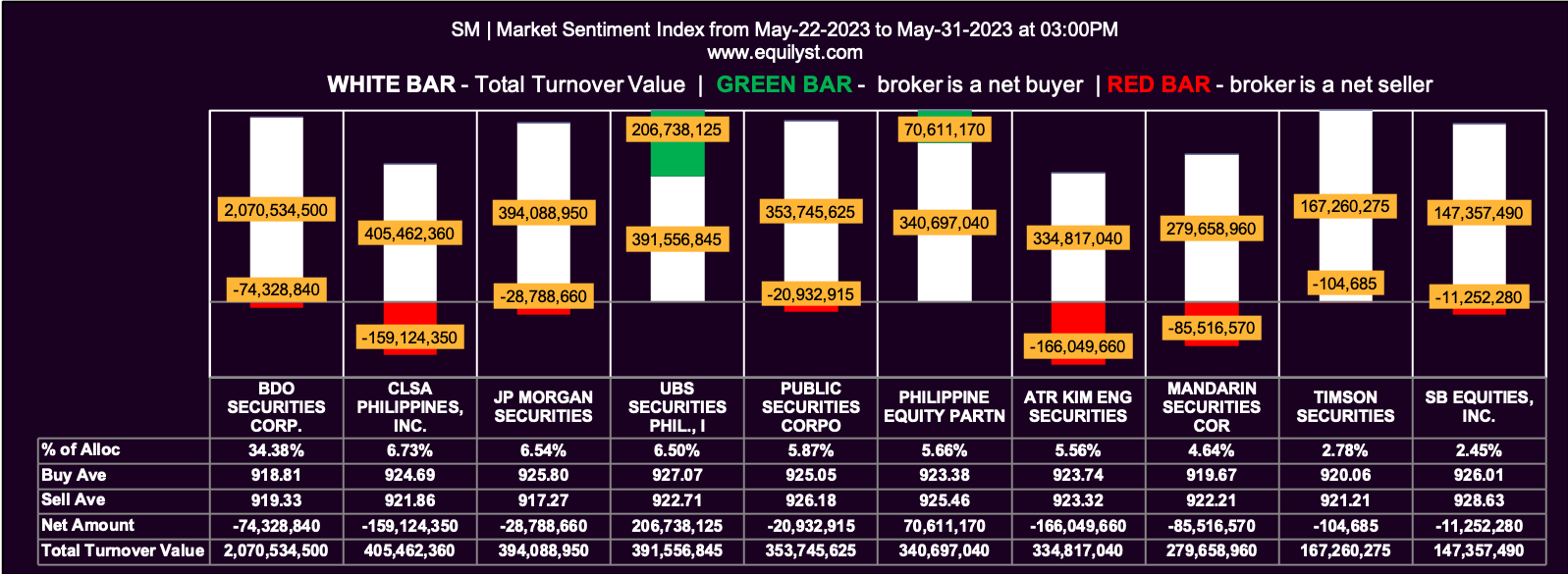

SM Investments Corporation (SM)

Market Sentiment Index: BEARISH

23 of the 56 participating brokers, or 41.07% of all participants, registered a positive Net Amount

17 of the 56 participating brokers, or 30.36% of all participants, registered a higher Buying Average than Selling Average

56 Participating Brokers’ Buying Average: ₱919.40533

56 Participating Brokers’ Selling Average: ₱922.85205

5 out of 56 participants, or 8.93% of all participants, registered a 100% BUYING activity

6 out of 56 participants, or 10.71% of all participants, registered a 100% SELLING activity

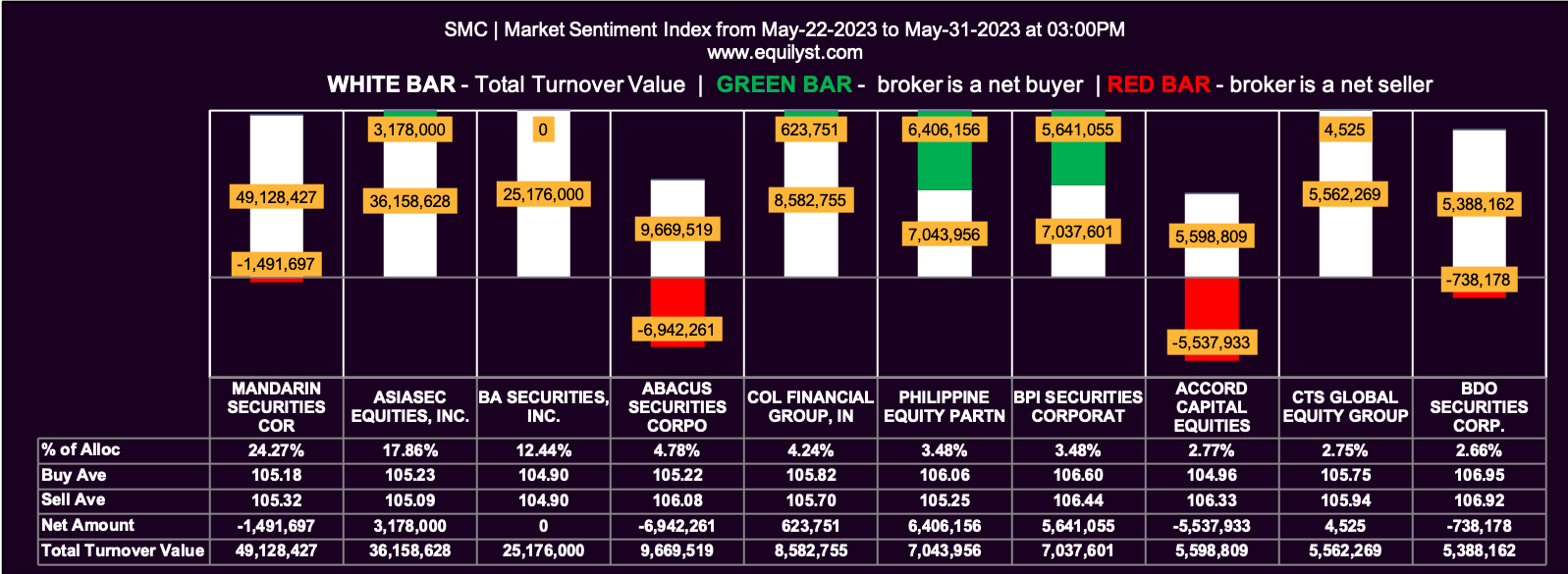

San Miguel Corporation (SMC)

Market Sentiment Index: BEARISH

23 of the 53 participating brokers, or 43.40% of all participants, registered a positive Net Amount

19 of the 53 participating brokers, or 35.85% of all participants, registered a higher Buying Average than Selling Average

53 Participating Brokers’ Buying Average: ₱105.64311

53 Participating Brokers’ Selling Average: ₱105.70433

5 out of 53 participants, or 9.43% of all participants, registered a 100% BUYING activity

11 out of 53 participants, or 20.75% of all participants, registered a 100% SELLING activity

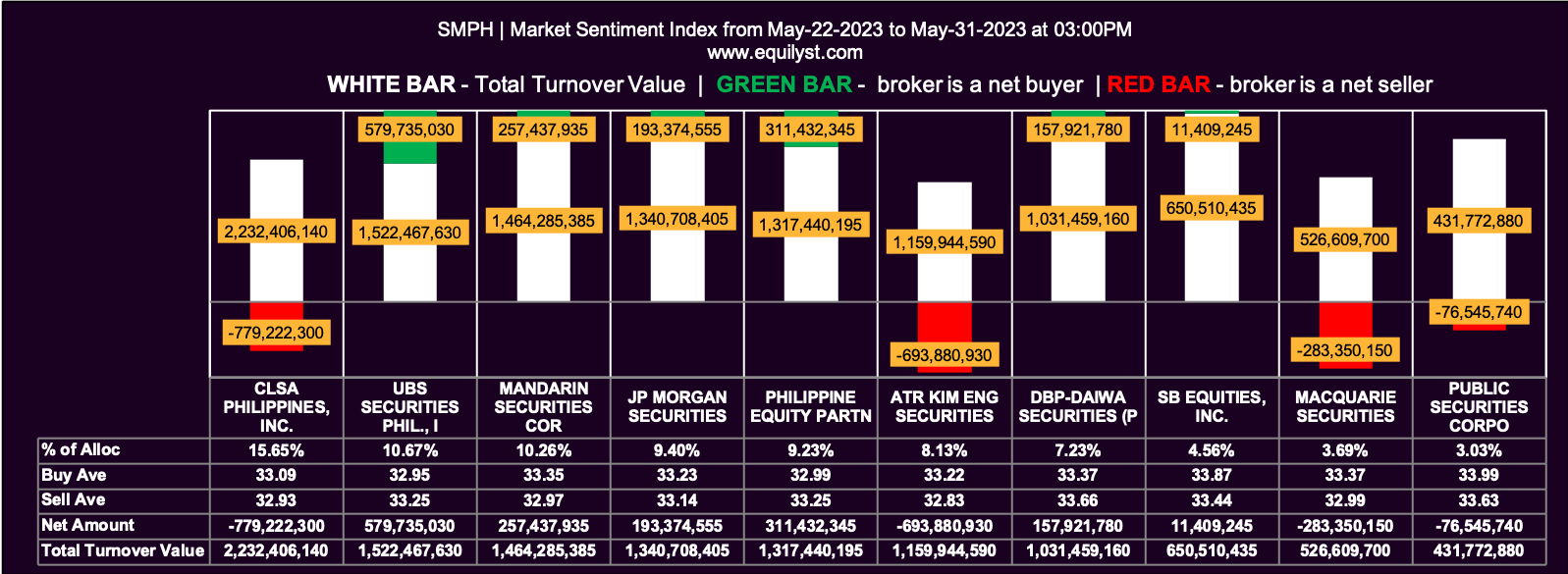

SM Prime Holdings (SMPH)

Market Sentiment Index: BEARISH

35 of the 69 participating brokers, or 50.72% of all participants, registered a positive Net Amount

23 of the 69 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

69 Participating Brokers’ Buying Average: ₱33.42032

69 Participating Brokers’ Selling Average: ₱33.93071

11 out of 69 participants, or 15.94% of all participants, registered a 100% BUYING activity

6 out of 69 participants, or 8.70% of all participants, registered a 100% SELLING activity

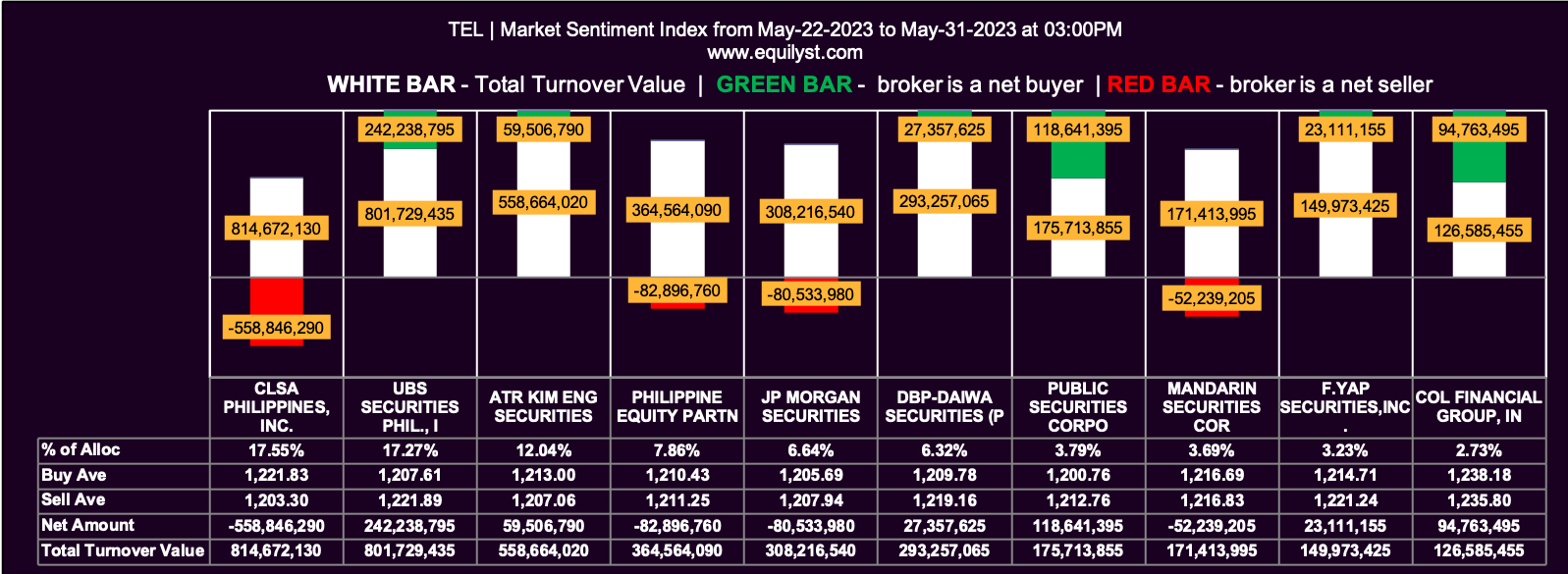

PLDT (TEL)

Market Sentiment Index: BULLISH

66 of the 81 participating brokers, or 81.48% of all participants, registered a positive Net Amount

46 of the 81 participating brokers, or 56.79% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱1217.87755

81 Participating Brokers’ Selling Average: ₱1235.58131

38 out of 81 participants, or 46.91% of all participants, registered a 100% BUYING activity

2 out of 81 participants, or 2.47% of all participants, registered a 100% SELLING activity

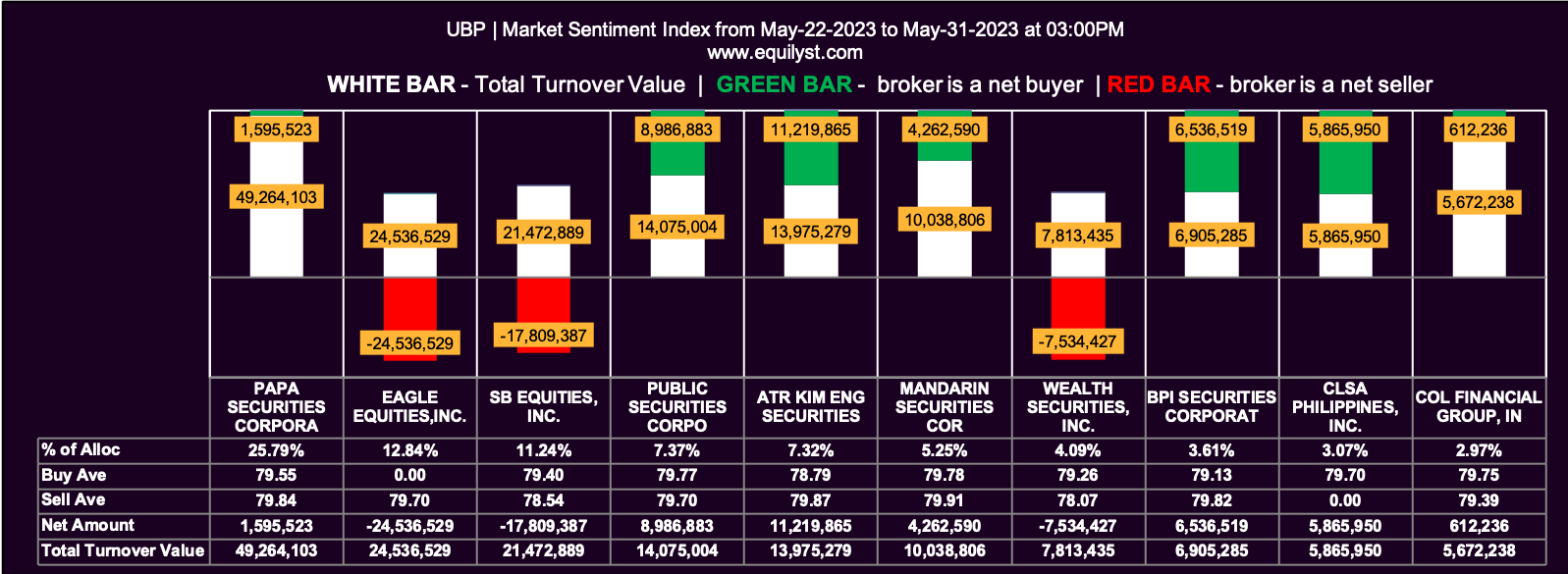

Union Bank of the Philippines (UBP)

Market Sentiment Index: BULLISH

32 of the 44 participating brokers, or 72.73% of all participants, registered a positive Net Amount

25 of the 44 participating brokers, or 56.82% of all participants, registered a higher Buying Average than Selling Average

44 Participating Brokers’ Buying Average: ₱79.15145

44 Participating Brokers’ Selling Average: ₱79.39488

19 out of 44 participants, or 43.18% of all participants, registered a 100% BUYING activity

7 out of 44 participants, or 15.91% of all participants, registered a 100% SELLING activity

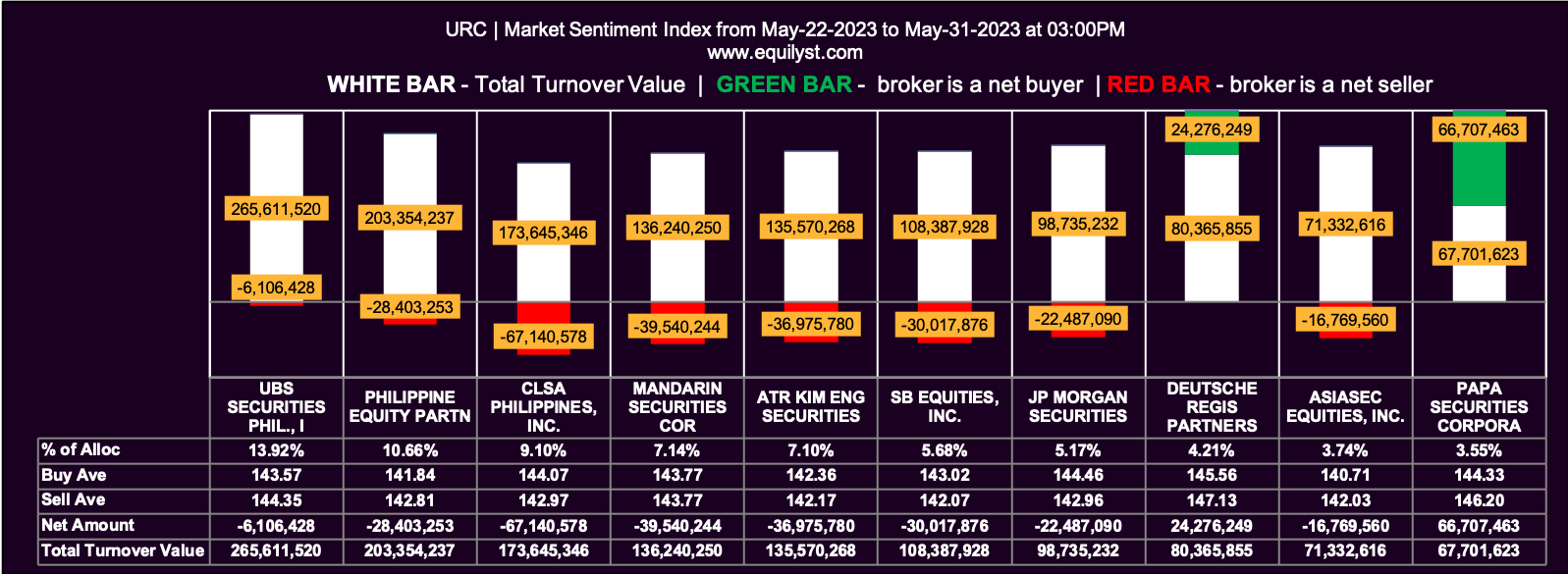

Universal Robina Corporation (URC)

Market Sentiment Index: BEARISH

34 of the 62 participating brokers, or 54.84% of all participants, registered a positive Net Amount

27 of the 62 participating brokers, or 43.55% of all participants, registered a higher Buying Average than Selling Average

62 Participating Brokers’ Buying Average: ₱144.09351

62 Participating Brokers’ Selling Average: ₱144.98367

16 out of 62 participants, or 25.81% of all participants, registered a 100% BUYING activity

6 out of 62 participants, or 9.68% of all participants, registered a 100% SELLING activity

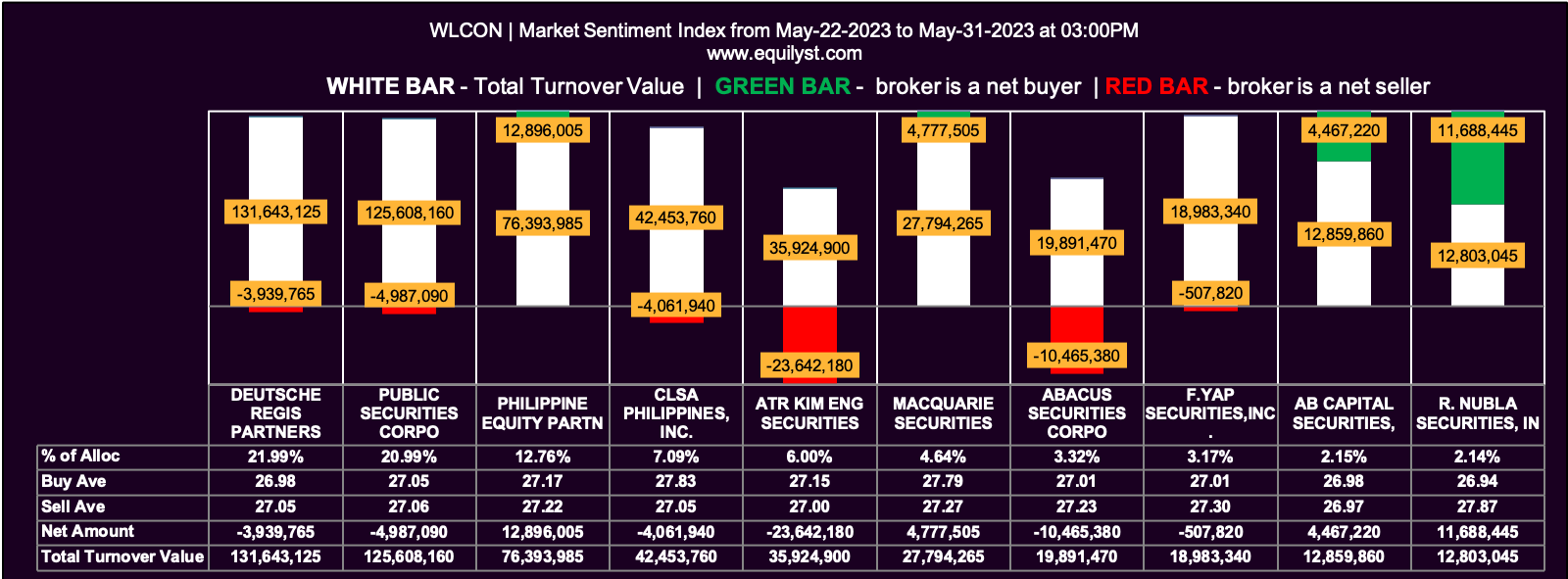

Wilcon Depot (WLCON)

Market Sentiment Index: BEARISH

27 of the 48 participating brokers, or 56.25% of all participants, registered a positive Net Amount

19 of the 48 participating brokers, or 39.58% of all participants, registered a higher Buying Average than Selling Average

48 Participating Brokers’ Buying Average: ₱27.19350

48 Participating Brokers’ Selling Average: ₱27.43434

9 out of 48 participants, or 18.75% of all participants, registered a 100% BUYING activity

8 out of 48 participants, or 16.67% of all participants, registered a 100% SELLING activity

Unlock Your Trading Potential with Equilyst Analytics’ Proven Strategies and Support

A common challenge that many beginner traders and investors face is the lack of a reliable and structured approach to learning the ins and outs of the stock market. It can be overwhelming to navigate through the vast amount of information and resources available, leading to confusion and a sense of being lost in the complex world of trading.

In such situations, it is crucial to find a trusted source of guidance and support. This is where Equilyst Analytics’ stock market consultancy service comes into play. With our expertise and experience, you can gain access to valuable insights and knowledge that can help you advance your trading skills.

Equilyst Analytics offers three packages, all aimed at empowering beginner traders like you. We understand the unique challenges you face and provide a structured approach to learning, making the journey less overwhelming.

By subscribing to the services of Equilyst Analytics, you can benefit from our proven strategies and methodologies. Our emphasis on technical analysis, risk management, and identifying profitable opportunities can provide you with a solid foundation to navigate the stock market with confidence.

Remember, advancing your trading skills is a gradual process that requires continuous learning and guidance. Equilyst Analytics can be your trusted partner in this journey, helping you overcome obstacles and build the necessary skills to make informed trading decisions.

So, if you’re a beginner trader looking to take your skills to the next level, consider exploring what Equilyst Analytics has to offer. Together, let’s navigate the complexities of the stock market and embark on a path towards growth and success. Click here to see our packages.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025