Jollibee’s Financial Rollercoaster: Surge in Sales but EPS Declines

Jollibee Foods Corporation (JFC) released its operational financial outcomes for the second quarter and first half concluding on June 30, 2023, as per its Unaudited Consolidated Financial Statements.

Ernesto Tanmantiong, JFC’s CEO, remarked on the second quarter’s performance, expressing satisfaction with the outcomes – a continuous surge in sales and operating profit.

In comparison to the corresponding quarter last year, the Philippine business observed a 14.5% growth in system-wide sales, while the international sector experienced a 20.9% growth.

The China business recorded the most substantial annual increase in international sales due to the recovery in consumption post-pandemic disruption in 2022.

The second quarter witnessed a total system-wide sales rise of 16.9%, comprising a 9% increase in same store sales, 6.2% from novel outlets, and 1.7% from currency fluctuation.

Throughout the initial half, JFC inaugurated 270 new stores, with 230 of these positioned in international markets.

JFC achieved an operating profit of Php4.0 billion during the quarter, an augmentation of 31.0% in comparison to Q2 2022.

This accomplishment demonstrated the potency of JFC’s sales expansion and judicious management of expenditures.

The operating profit margin remained sturdy during the quarter, displaying enhancement in both year-on-year (70 bps) and quarter-on-quarter (10 bps) parameters.

These financial results during the second quarter and first half bolstered confidence in JFC’s full-year guidance for 2023.

System wide sales (SWS), a comprehensive sales metric covering both company-owned and franchised establishments, exhibited growth of 16.9% in Q2 and 23.3% in the initial half of 2023 versus corresponding periods in the prior year.

Revenue growth aligned with system-wide sales progression.

During the quarter, the Philippine business observed a 14.5% rise in system-wide sales, while the international sector experienced a 20.9% increase.

The China division emerged as a growth leader with a remarkable 76.9% expansion.

SWS for North America and EMEA Philippine brands expanded by 15.1% and 16.1%, respectively.

JFC’s coffee and tea business also displayed an 11.0% upswing.

Jollibee, comprising over 1,600 global outlets and contributing to 49.0% of JFC’s SWS, achieved a robust growth of 16.0%.

Global same store sales (SSS) for the quarter saw a 9.0% rise propelled by a 6.5% hike in transaction volume and a 2.4% increase in average check.

Performance across diverse regions and brands exhibited variability.

The Philippines registered an 11.3% expansion driven by an upswing in transaction volume (7.1%) and augmented average check (3.9%).

International SSS% ascended by 5.0%, primarily driven by China (35.3%), EMEA Philippine brands (5.1%), and North America (2.6%).

However, SSS% for JFC’s coffee and tea business experienced a decline of 1.8%.

CBTL encountered a -0.4% decline mainly due to a high-base effect, especially for Singapore and Malaysia where coffee sales in Q2 2022 rebounded post reopening of international borders.

Highlands Coffee witnessed a decline of 7.5% in SSS% owing to weak demand.

JFC’s commendable topline performance translated to an unprecedented operating income of Php4.0 billion for the quarter, significantly driven by the Philippine business.

This signified a 31.0% YoY surge and a margin enhancement of 70 bps, progressing from 5.9% of revenues in Q2 2022 to 6.6% in Q2 2023.

The quarterly and initial half results reflected the influence of inflationary pressures, with inventory costs rising by 40 bps.

However, this was counterbalanced by improved store and manufacturing expenses as well as general administrative costs, which contracted by 40 bps and 70 bps, respectively.

Richard Shin, JFC’s CFO, commented on the performance, emphasizing robust double-digit growth in sales and operating income, underscoring JFC’s strength and adaptability.

The organization’s focus remains steadfast on margin improvement through robust revenue generation and operational efficiencies, alongside the pursuit of strategic priorities aimed at accelerating international business growth and enhancing profitability.

Net income attributable to equity holders of the Parent Company for Q2 2023 and earnings per share (EPS) underwent a decline of 16.6% and 14.1%, respectively, reaching Php2.3 billion and Php1.984.

The net income for Q2 2022 integrated a one-off gain from land transaction and property sale.

Excluding the impact of this one-off gain in Q2 2022, net income attributable to equity holders of the Parent Company and EPS observed growth rates of 34.6% and 46.5%, correspondingly.

As of June 2023, JFC’s store network burgeoned by 5.1% in contrast to the preceding year.

The JFC Group operated 6,617 outlets across the globe, comprising 3,287 in the Philippines and 3,330 internationally.

This international distribution featured 511 in China, 389 in North America, 340 in EMEA, 673 under Highlands Coffee mainly in Vietnam, 1,117 with CBTL, and 300 with Milksha.

Noteworthy brands by outlet count encompass Jollibee with 1,609, CBTL with 1,117, Chowking with 613, Highlands Coffee with 673, and Mang Inasal with 569.

On June 16, 2023, the JFC Board of Directors approved the following measures:

- Declaration of a regular cash dividend of Php8.20525 per share for Series A preferred shares, amounting to Php24.6 million.

- This dividend will be dispensed to JFC stockholders recorded as of July 4, 2023 (ex-dividend date being June 29, 2023), with payment scheduled for July 14, 2023.

- Declaration of a regular cash dividend of Php10.60125 per share for Series B preferred shares, totaling Php95.4 million.

- This dividend will be extended to JFC stockholders recorded as of July 4, 2023 (ex-dividend date being June 29, 2023), with payment scheduled for July 14, 2023.

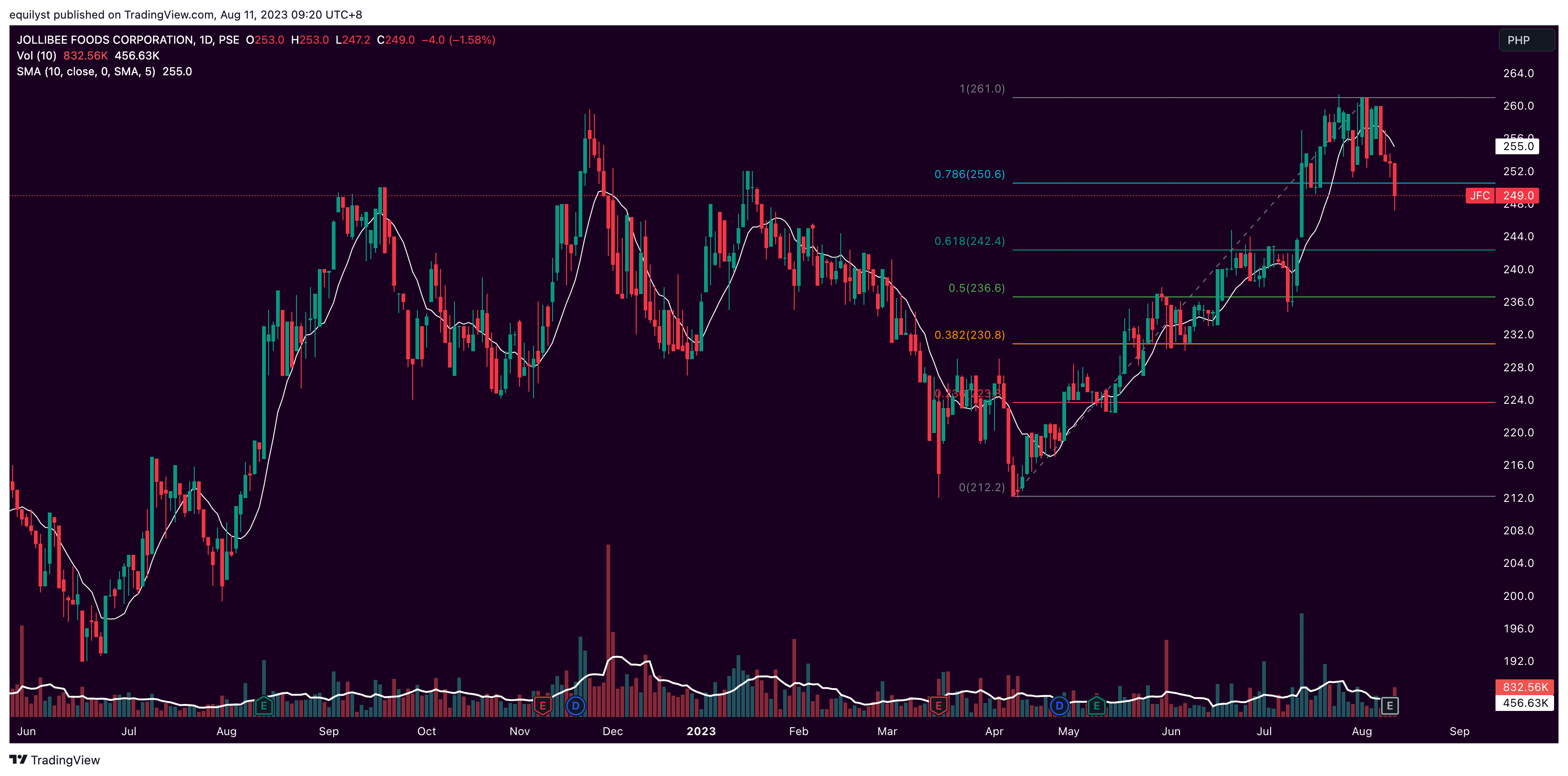

Jollibee (JFC): Price and Market Sentiment Analysis

Jollibee closed on August 10, 2023, at P249.00 per share, down by 1.58% from August 9’s closing price of P253.00. This price drop is significant, as it occurred with a bearish volume greater than 100% of its 10-day volume average.

On a larger scale, Jollibee is down by 4.23% week-to-date (from August 4th’s closing price to August 10th’s) and has also declined by 2.35% month-to-date (from July 31st’s closing price to August 10th’s).

Jollibee broke below its previous support level at P250 on August 10, 2023. P250 is in line with the 78.6% Fibonacci retracement. P250 now serves as its immediate resistance.

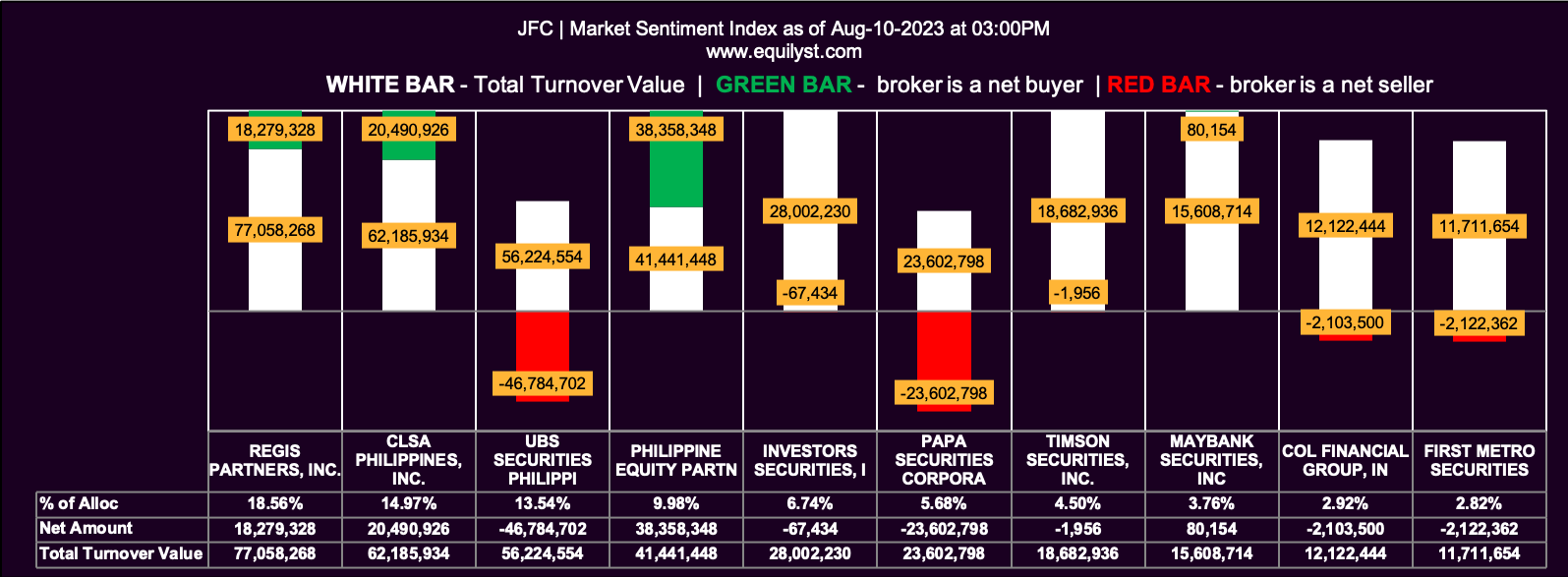

On August 10, 2023, 63.41% of the 41 brokers who traded Jollibee registered a positive net amount.

Individually, 56.10% of the 41 brokers recorded a higher buying average than selling average.

Cumulatively, the 41 brokers had a higher selling average (P249.66813) than a buying average (P249.58028).

Meanwhile, 31.71% of the 41 brokers had a 100% buying activity, while 12.20% of them recorded a 100% selling activity.

Considering all these statistics, Jollibee attained a bullish Market Sentiment Index rating for August 10, 2023.

For my clients, you can ask me for my broader market sentiment analysis for JFC.

Jollibee (JFC): Price Forecast

If Jollibee’s bearish price action persists, it’s likely to approach the immediate support level at P242, which aligns with the 61.8% Fibonacci retracement.

Monitor the daily volume. If the price keeps showing a negative day change but the volume remains below 50% of the stock’s 10-day volume average, it could indicate that the level of selling exhaustion has been reached.

Recognition of signs indicating selling exhaustion could potentially indicate a forthcoming bullish reversal.

Conversely, should Jollibee’s price decline persist and be accompanied by a volume exceeding 50% of its 10-day volume average, the likelihood of it reaching P242.00 becomes high.

Keep in mind the correlation between price and volume.

Wrapping It Up

Once you identify a bullish price reversal and are considering entering a new position in Jollibee, I highly recommend that you calculate your initial trailing stop and reward-to-risk ratio beforehand.

In terms of my methodology, the value of your initial trailing stop forms part of the equation for the reward-to-risk ratio.

Even in the case of a bullish reversal, refrain from purchasing unless you’re content with your reward-to-risk ratio.

There isn’t a strict rule on what constitutes an acceptable or unacceptable reward-to-risk ratio; this decision rests with you.

Ideally, I aim for a 3:1 ratio, though I sometimes accept a 2:1 ratio.

On the other hand, if you already hold a position in Jollibee, you needn’t compute the reward-to-risk ratio anew. You can augment your position immediately provided the buy signals you’re seeking have materialized.

In my methodology, all six signals must be bullish for me to consider a stock to possess a buy signal.

Whether we adhere to the same methodology and psychology or not, what truly matters is being driven by data and following a systematic approach.

When you’re data-driven and process-oriented, you’ll know how to proceed regardless of whether the market aligns with or diverges from your analysis and forecasts.

Would You Like to Hire Me as Your Stock Investment Consultant?

Read my five to ten stock analyses on this website first for you to get a good feel of my analytical skills and investment psychology. Hire me as your equity investment consultant if you like how I analyze. I’ve been an equity investment consultant since 2012. Message me here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025