Jollibee Foods Corporation (JFC) Technical Analysis

Jollibee Foods Corporation (JFC) closed at P235.00 per share on June 13, 2023, slid by 0.25% today, but advanced by 2.17% year-to-date.

Is it time to enter a new position or buy more JFC shares now?

I’ll do a technical analysis on JFC to give you a data-driven basis for your decision.

I will not decide for you because only you know your present financial circumstance and the risk tolerance you can handle.

My way of doing technical analysis is based on my proprietary Evergreen Strategy. So, don’t expect me to do traditional technical analysis.

I’ll start now.

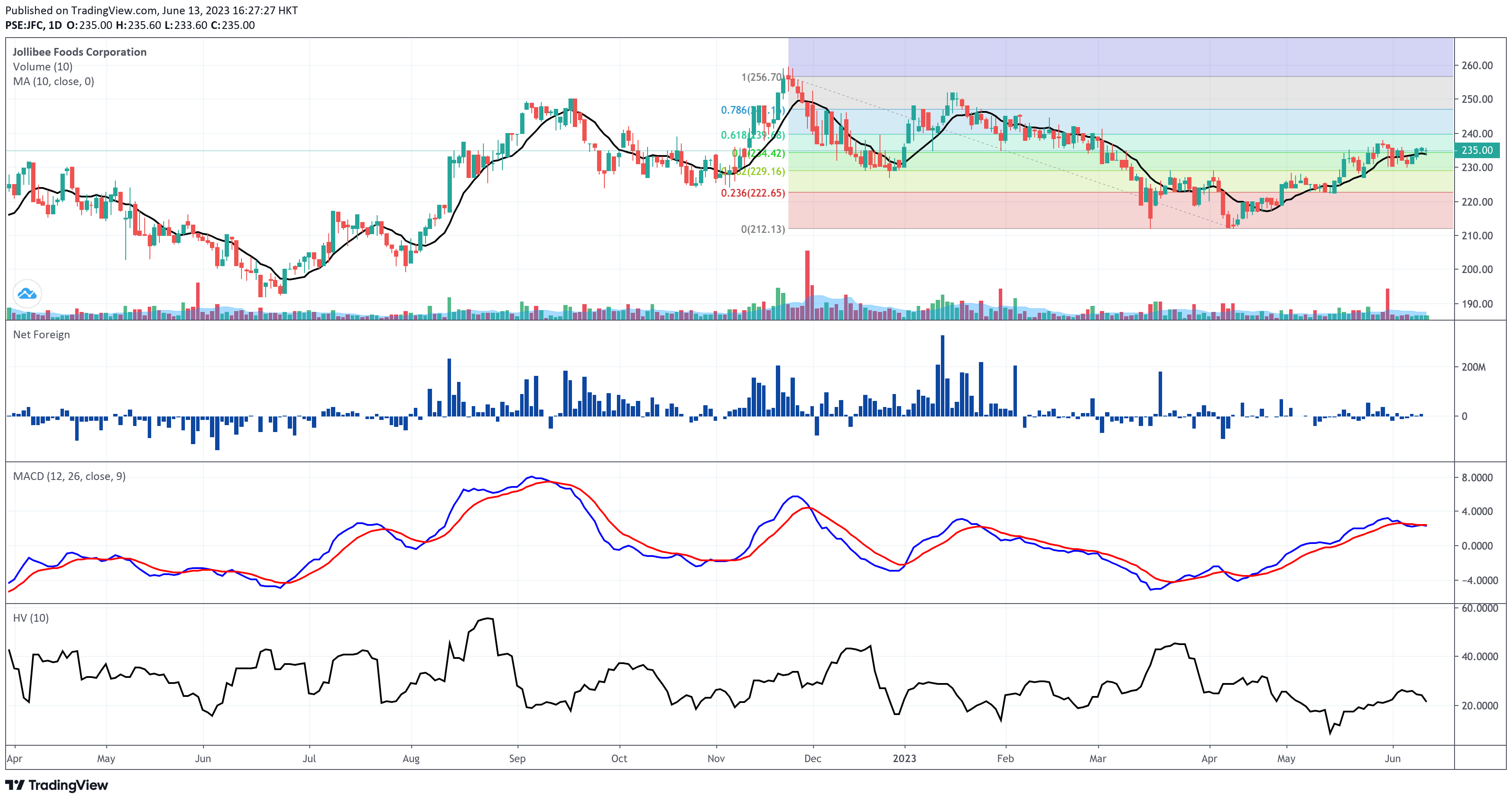

JFC trades above its 10-day simple moving average. That’s one bullish point.

The immediate support is at P234.40, aligned with the 50% retracement of the Fibonacci.

The resistance is near P239.70, aligned with the golden ratio or 61.8% retracement of the Fibonacci.

At this point, you might be thinking, “Wow! If my basis point for calculating my reward-to-risk ratio is the proximity of the last price to the support and resistance, I’ll get a very attractive ratio!”

Please don’t jump to irrational conclusions like that. You need to check other angles.

Speaking of other angles, let me check the volume.

Today’s volume exceeds 50% of JFC’s 10-day volume average. That’s another plus point.

Let’s check more angles!

Surprisingly, foreign investors are net buyers of JFC year-to-date. As a matter-of-factly, they’ve been consistent net buyers each month since August last year. That’s another plus point!

Meanwhile, JFC’s moving average convergence divergence (MACD) registered a death cross on the signal line last June 5, 2023. It would have been a nice picture had it sustained its position above the signal line. JFC gets its first bearish point in this technical analysis.

Would you like to know if JFC moves erratically without looking at its daily chart? Yes, there’s a way! Look at its 10-day historical volatility score. It’s at 21.55%. This means JFC is a low risk stock as far as its erraticity score is concerned.

Is it relatively safe to buy JFC now?

Mind you, not because the stock doesn’t fluctuate so erratically, it doesn’t mean you should buy that stock without batting an eyelash.

Please wait for me to finish my analysis.

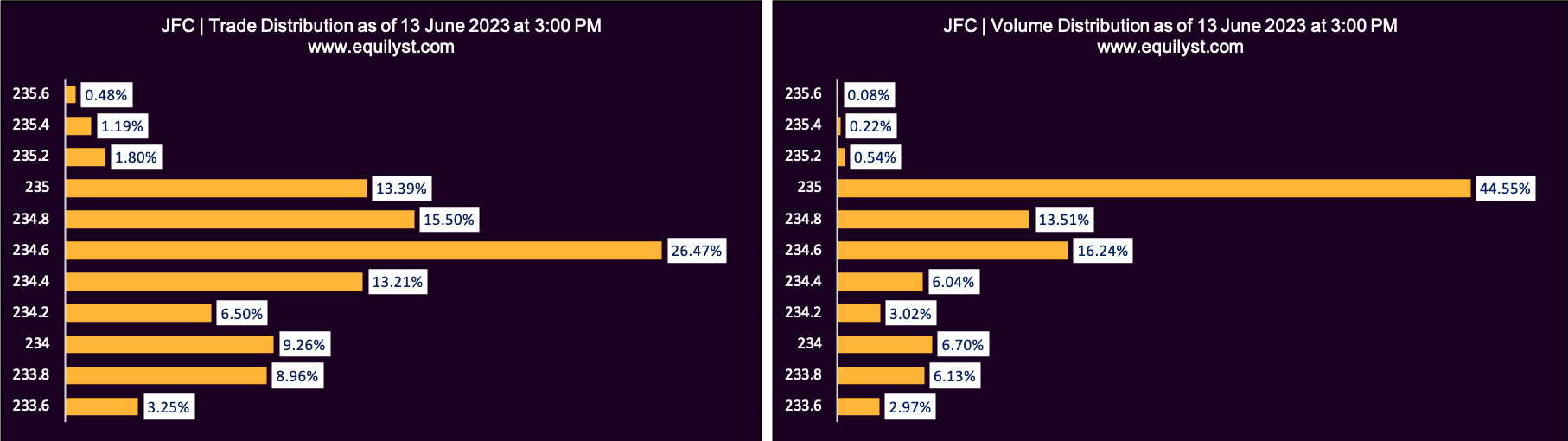

Trade-Volume Distribution Analysis

Dominant Range Index: BULLISH

Last Price: 235

VWAP: 234.67

Dominant Range: 234.6 – 235

JFC got a bullish trade-volume distribution rating because the prices (at least 50% of the total trades and volume) that got the biggest volume and highest number of trades are printed on the chart’s upper half.

Add the fact that the closing price of P235.00 is higher than the volume-weighted average price of P234.67 as of today’s closing.

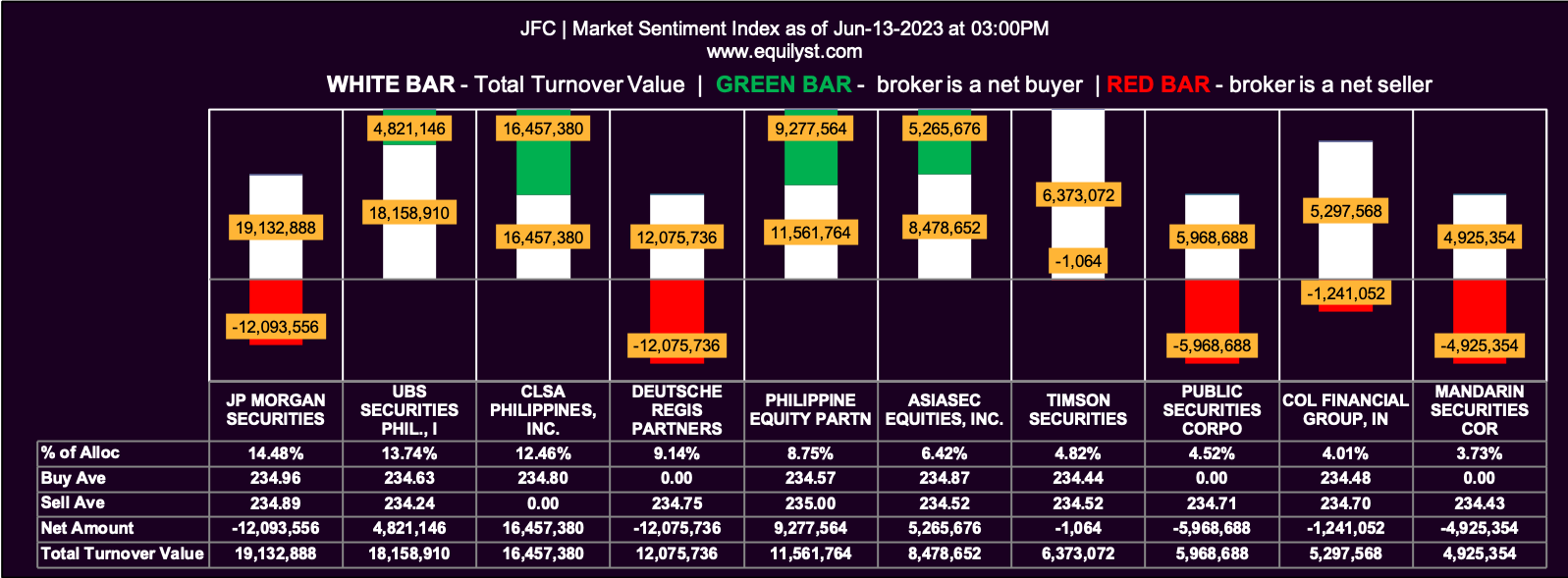

Market Sentiment Analysis – EOD

Market Sentiment Index: BEARISH

12 of the 30 participating brokers, or 40.00% of all participants, registered a positive Net Amount

10 of the 30 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

30 Participating Brokers’ Buying Average: ₱234.53750

30 Participating Brokers’ Selling Average: ₱234.59831

5 out of 30 participants, or 16.67% of all participants, registered a 100% BUYING activity

8 out of 30 participants, or 26.67% of all participants, registered a 100% SELLING activity

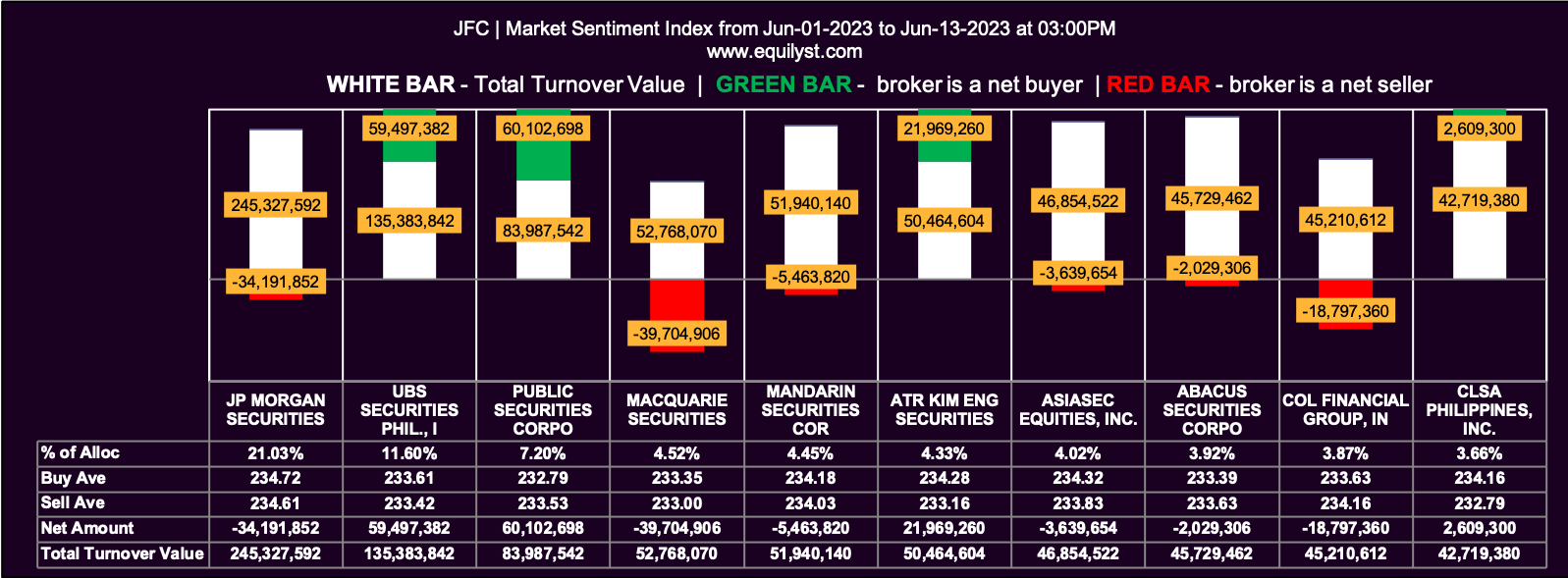

Market Sentiment Analysis – MTD

Market Sentiment Index: BEARISH

18 of the 61 participating brokers, or 29.51% of all participants, registered a positive Net Amount

24 of the 61 participating brokers, or 39.34% of all participants, registered a higher Buying Average than Selling Average

61 Participating Brokers’ Buying Average: ₱233.21609

61 Participating Brokers’ Selling Average: ₱233.58648

9 out of 61 participants, or 14.75% of all participants, registered a 100% BUYING activity

12 out of 61 participants, or 19.67% of all participants, registered a 100% SELLING activity

I got the month-to-date market sentiment rating for JFC after seeing that the end-of-day rating is bearish to give you a wider view of the market sentiment.

Unfortunately for those hoping to see a bullish score, even the month-to-date market sentiment rating is bearish for JFC.

JP Morgan is a serious seller of JFC shares today and month-to-date.

So, if you’re the type of trader or investor who piggybacks or monitors a broker’s activity, keep an eye on JP Morgan’s activities on JFC.

Verdict: Does JFC Have a Buy Signal?

Two of the six indicators of my Evergreen Strategy are bearish, and four are bullish.

The discipline says that all six indicators must be bullish to have a confirmed buy signal.

In short, JFC has no confirmed buy signal as of today’s closing.

What to Do If You Already Have JFC in Your Portfolio?

Hold your position if your unrealized loss exceeds your risk tolerance percentage.

Don’t average down yet. JFC might retest the support at P234.40 to P229.00. Aren’t you comfortable being in a wait-and-see mode?

Why hurry if there’s a data-driven method of checking the next probable direction of the stock?

Why would you like to hurry? Is it because you believe that you’re buying more for less if you do so?

Aren’t you buying more for a lot less if the price plummets further?

If the market proves my analysis wrong, at least you won’t see yourself snapping your fingers and saying, “Shucks! I should not have hurried in buying more!”

Remember, hold your position if, and only if, your trailing stop is intact.

You are free to use my trailing stop calculator.

What to Do If You Don’t Have JFC Yet?

You may add JFC to your watchlist if you still have an available slot.

Then, you may use one of our Stock Analysis Request credits (if you subscribed to my stock market consultancy service) to ask for my latest analysis of JFC by the end of the next trading day.

I will tell you if I see significant changes or if it’s still the same.

Eavesdrop with JFC’s top 10 market participants (brokers) by knowing the Market Sentiment Index rating.

For now, the end-of-day and month-to-date Market Sentiment Index ratings remind us to err on caution.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025