Voluntary Delisting in Sight as Holderfin Buys Holcim Shares

Holcim Philippines, Inc. (PSE:HLCM) plans to delist from the Philippine Stock Exchange following the purchase of Sumitomo Osaka Cement Co.’s shares by Holderfin B.V., a significant stakeholder in the cement manufacturer. On Thursday, the company disclosed the details of the transactions.

According to the statement, Holderfin notified Holcim that if the company fails to issue additional shares to the public to meet the required level, Holderfin is prepared to make a tender offer for all common shares held by the public. The aim is to subsequently conduct a voluntary delisting of the company’s common shares from the Main Board of the PSE.

Holcim is currently evaluating the possibility of a voluntary delisting from the PSE. In a separate disclosure, Holcim cited market conditions and expressed their inability to raise their public float within a reasonable period. Similar situations have caused companies like Ovialand to postpone their market debut earlier this month.

To facilitate the delisting process, Holcim will initiate voluntary tender offer proceedings.

In a regular block sale on Thursday, Holderfin purchased 594,952,725 common shares previously owned by Sumitomo. These shares accounted for 9.22% of the cement maker’s outstanding capital stock. As a result of this acquisition, Holderfin’s equity in the company increased from 18.11% to 27.33%.

Holcim clarified that since Holderfin is a major stakeholder and the shares previously owned by Sumitomo were considered public shares, the company’s public float will decrease to 5.05% of its outstanding common shares. As of March 31, Holcim’s public ownership stood at 14.27% of its capital stock.

Due to these developments, trading of Holcim Philippines’ shares has been suspended by the local bourse.

Technical Analysis: Holcim Philippines (HLCM)

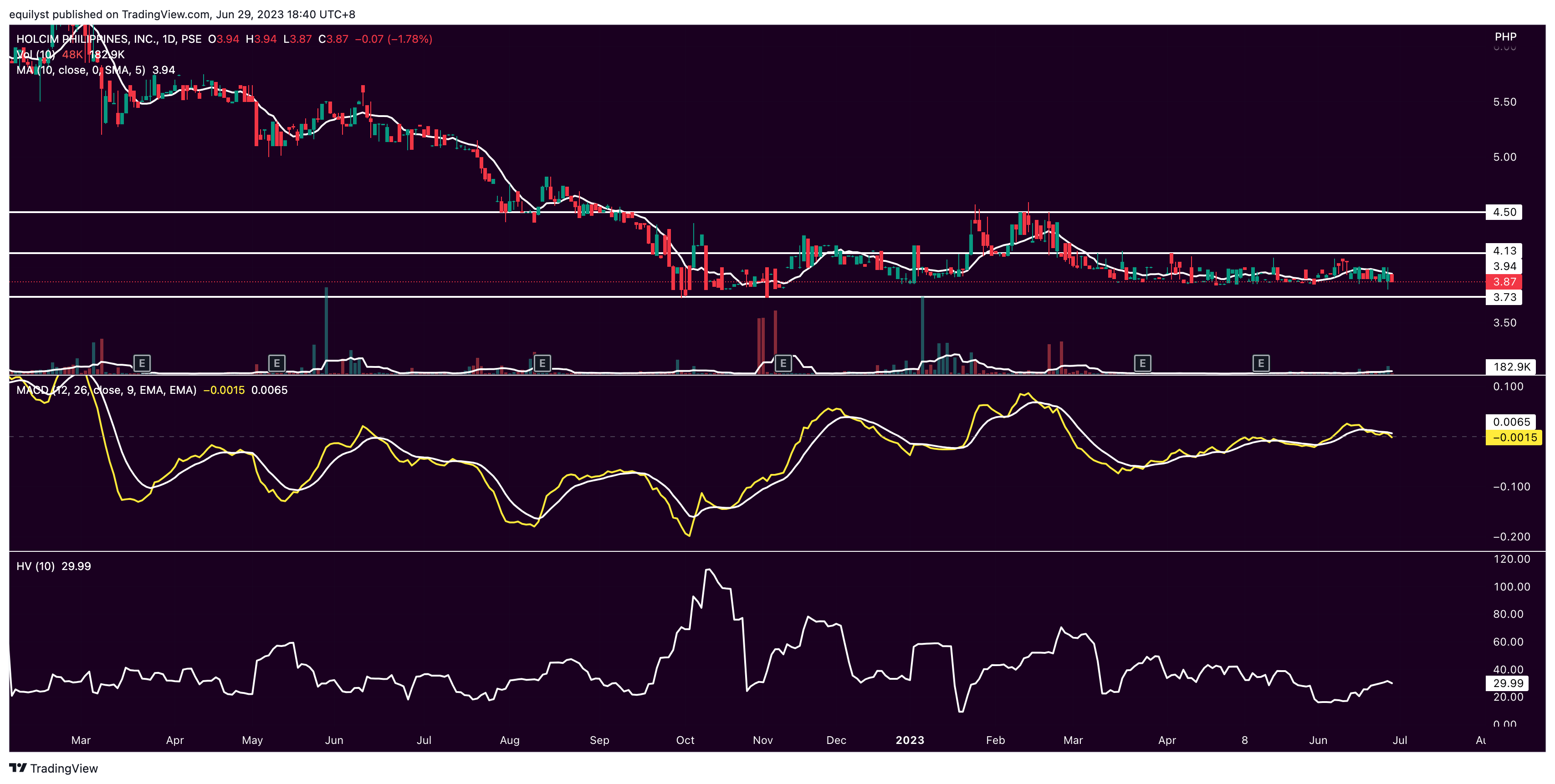

PSE:HLCM closed on Thursday, June 29, 2023, at P3.87 per share, down by 1.78% when the Philippine Stock Exchange ordered the trading suspension this morning. The last trade was transacted at exactly 10:10 AM UTC+8.

HLCM is down by 0.77% year-to-date. It is also down by 15.69% from its intra-year high of P4.59 last February 13, 2023.

HLCM pins its immediate support at P3.73 while its resistance is at P4.13.

It’s been a topsy-turvy year for HLCM as it erratically goes over and under its 10-day simple moving average (SMA) every few days. The stock has been trading in the support-resistance range for four months already.

Last Tuesday, June 27, 2023, the volume was outstanding as it exceeded 100% of its 10-day volume average. If not for the abovementioned news, we might have seen HLCM trading above its 10-day SMA again.

As a result, the formation of the bullish convergence between the moving average convergence divergence (MACD) and the signal line went in the other direction.

On a long-term timeframe, HLCM has been traversing the downtrend channel since 2017. It showed a decent recovery between 2018 and 2019 only to return to the downtrend channel again.

Trade-Volume Distribution Analysis

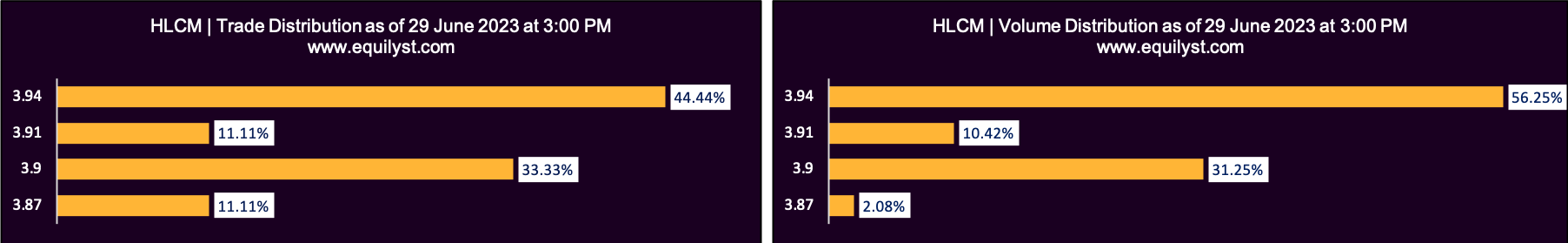

Although my Dominant Range Index issued a bullish rating for HLCM, I won’t rely on this once since trading for HLCM was halted 40 minutes past the opening bell. It would have been a different picture if the trading had not been halted.

Dominant Range Index: BULLISH

Last Price: 3.87

VWAP: 3.92

Dominant Range: 3.94 – 3.94

Market Sentiment Analysis

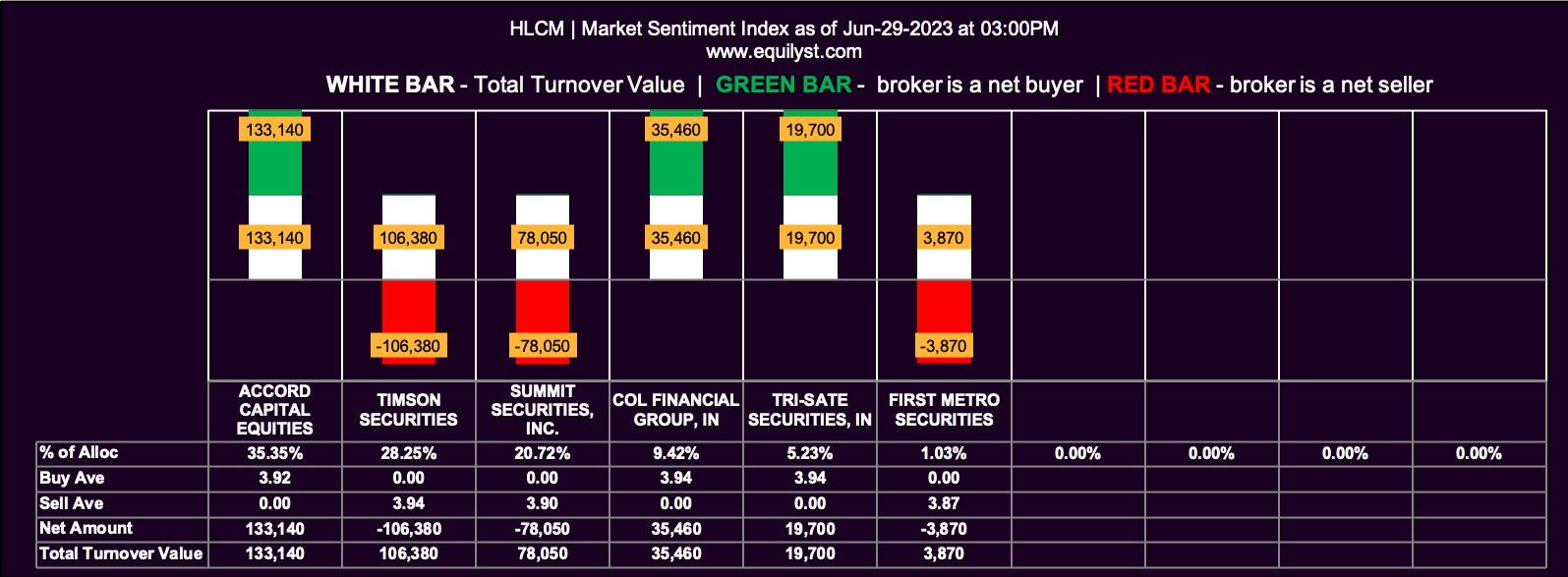

I disregard the bullish Market Sentiment Index rating for HLCM for its first 40 minutes today. This isn’t the true market sentiment due to the halted trading.

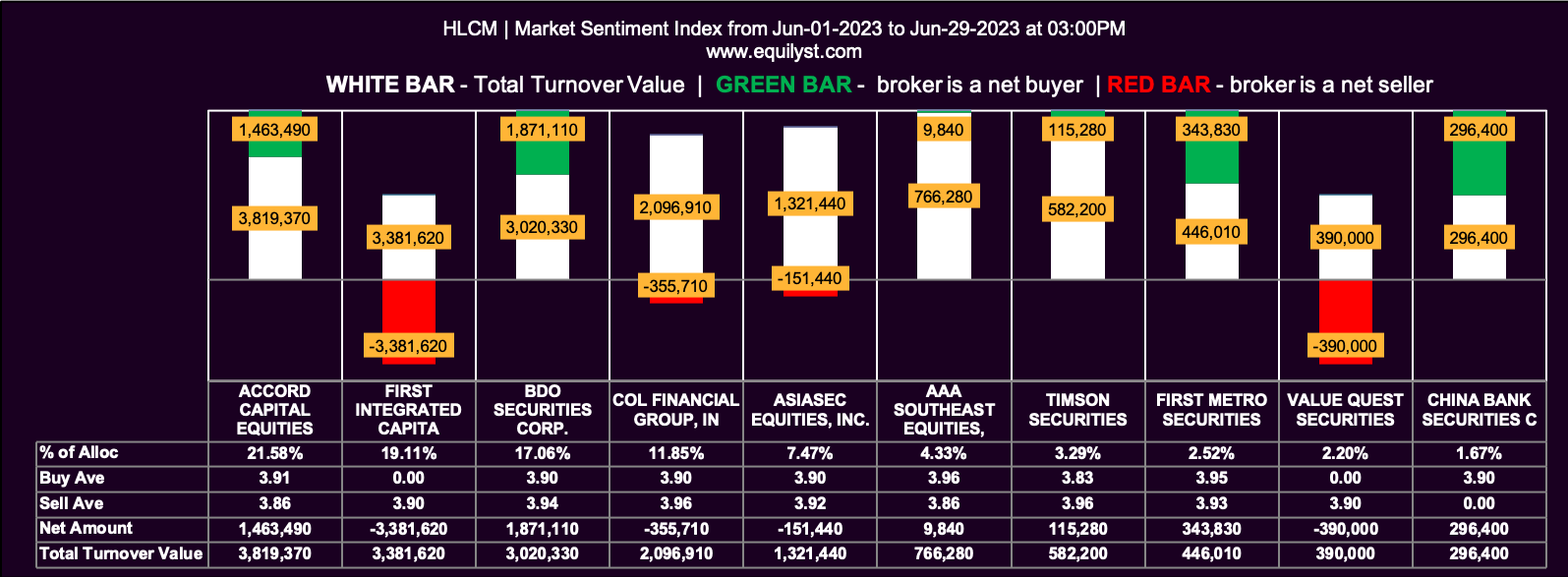

Instead, let’s focus on the month-to-date Market Sentiment Index. Over 40% of the brokers who traded HLCM from June 1, 2023 to June 29, 2023 registered a 100% selling activity.

Market Sentiment Index (June 29, 2023): BULLISH

3 of the 6 participating brokers, or 50.00% of all participants, registered a positive Net Amount

3 of the 6 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

6 Participating Brokers’ Buying Average: ₱3.93197

6 Participating Brokers’ Selling Average: ₱3.90417

3 out of 6 participants, or 50.00% of all participants, registered a 100% BUYING activity

3 out of 6 participants, or 50.00% of all participants, registered a 100% SELLING activity

Market Sentiment Index (June 1, 2023 to June 29, 2023): BEARISH

13 of the 29 participating brokers, or 44.83% of all participants, registered a positive Net Amount

9 of the 29 participating brokers, or 31.03% of all participants, registered a higher Buying Average than Selling Average

29 Participating Brokers’ Buying Average: ₱3.91720

29 Participating Brokers’ Selling Average: ₱3.93673

6 out of 29 participants, or 20.69% of all participants, registered a 100% BUYING activity

12 out of 29 participants, or 41.38% of all participants, registered a 100% SELLING activity

Does HLCM Have a Buy or Sell Signal?

If it isn’t obvious yet, then I’ll say it. HLCM has no confirmed buy signal based on my Evergreen Strategy, even when trading resumes for this stock.

Did you trade HLCM? Are you still trading it? I hope you remained loyal to your trailing stop.

The reward-to-risk ratio isn’t attractive in the range between P3.73 and P3.94. The profit margin is just a little over 5%, excluding taxes and fees.

The range I would be interested in trading would be P3.73 to P4.50. That’s a potential profit of 14% after taxes and fees. I don’t see a data-driven reason to trade the stock within that range since the stock’s bias is on the downside.

My stock screener captured the buy signal for HLCM last November 2022. My trailing stop was triggered in February 2023. It was a decent net profit above 10%.

Do you still have HLCM in your portfolio? Then, where is your trailing stop? Is it still intact? If it’s intact, consider reducing the percentage of risk applied in calculating your trailing stop. This stock’s Dominant Range Index and Market Sentiment Index call for that adjustment. Do not top up yet. The hole could get bigger and deeper from here.

Do you have questions about my analysis? Comment below.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025