MIS Maritime Corporation’s Acquisition of 750 Million GREEN Shares

Greenergy Holdings Incorporated (PSE:GREEN) has received a copy of the Deed of Assignment of Subscription Rights July 7, 2023 between Earthright Holdings Inc. (EHI) and MIS Maritime Corporation (MIS).

In the deed, EHI has transferred all its rights, title, and interest in its 750,000,000 partially paid GREEN common shares (referred to as the “Subject Shares”) to MIS.

The Subject Shares have a par value of One Peso (Php1.00) per common share, and the transfer was made for a total consideration of Php187.5 Million. MIS will take over the responsibility of paying the remaining unpaid subscription of EHI.

The controlling shareholder of EHI, Mr. Antonio L. Tiu, will see a reduction in his total shareholdings in GREEN from 58.99% to 38.16% of the total issued and outstanding shares.

On the other hand, MIS will hold 20.83% of the total issued and outstanding shares in GREEN.

Once the Bureau of Internal Revenue issues the corresponding Certificate Authorizing Registration, the transfer of the Subject Shares will be officially recorded in GREEN’s books.

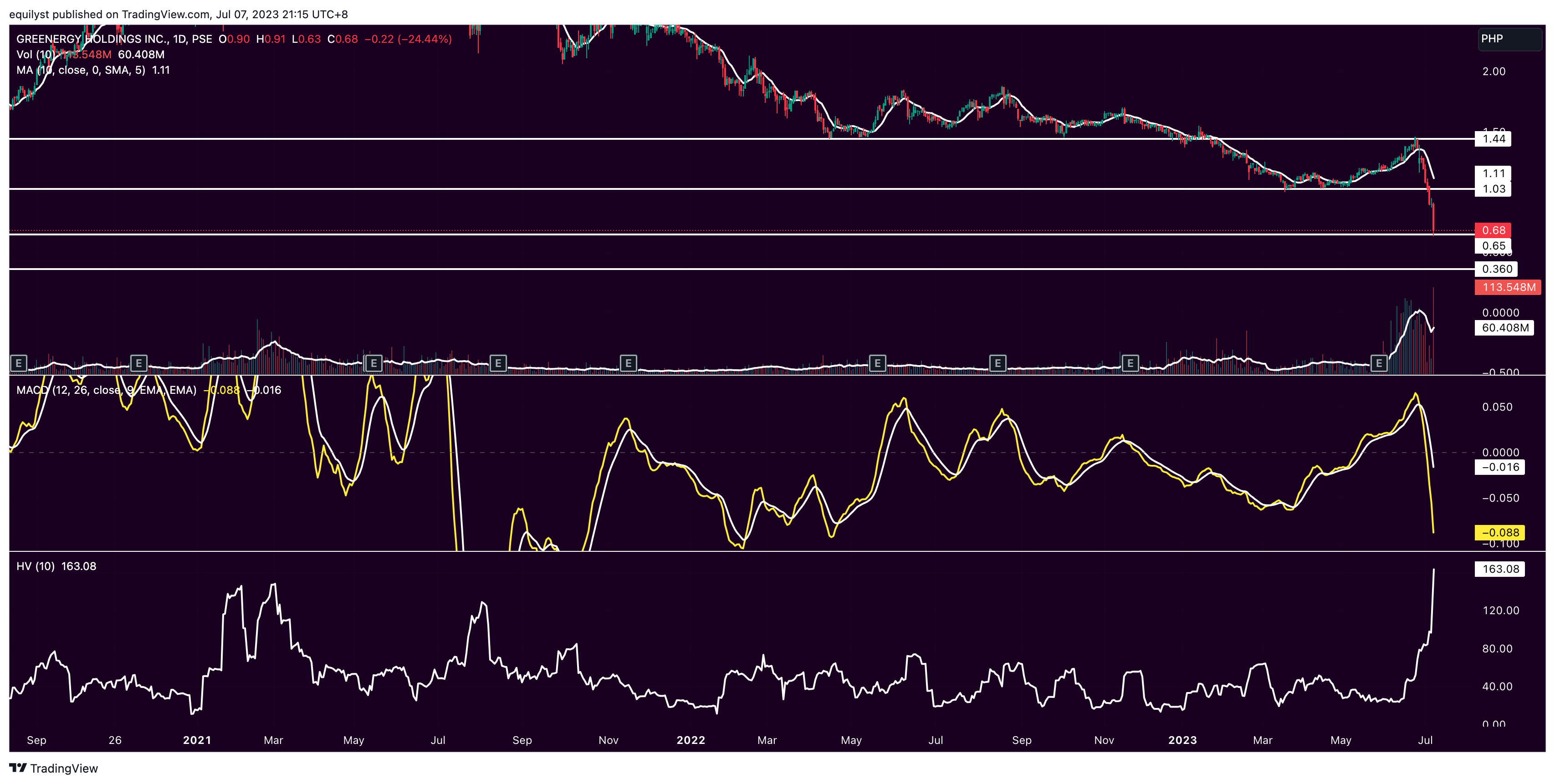

Technical Analysis

PSE:GREEN closed on Friday, July 7, 2023, at P0.68 per share, down by 24.44% today and down by 53.43% year-to-date.

Our proprietary methodology at Equilyst Analytics stopped issuing a buy signal for GREEN last June 27, 2023. That week, the price was already scratching the surface of the stock’s immediate resistance near P1.45.

Today, the support is at P0.65, while the resistance is near P1.00.

GREEN’s moving average convergence divergence (MACD) is in a bearish divergence with the signal line.

If and when GREEN breaks below the immediate support at P0.65, the next support is quite deep near P0.35.

GREEN’s risk level is already in the “extremely high” category because its 10-day historical volatility score has gone above 100% already.

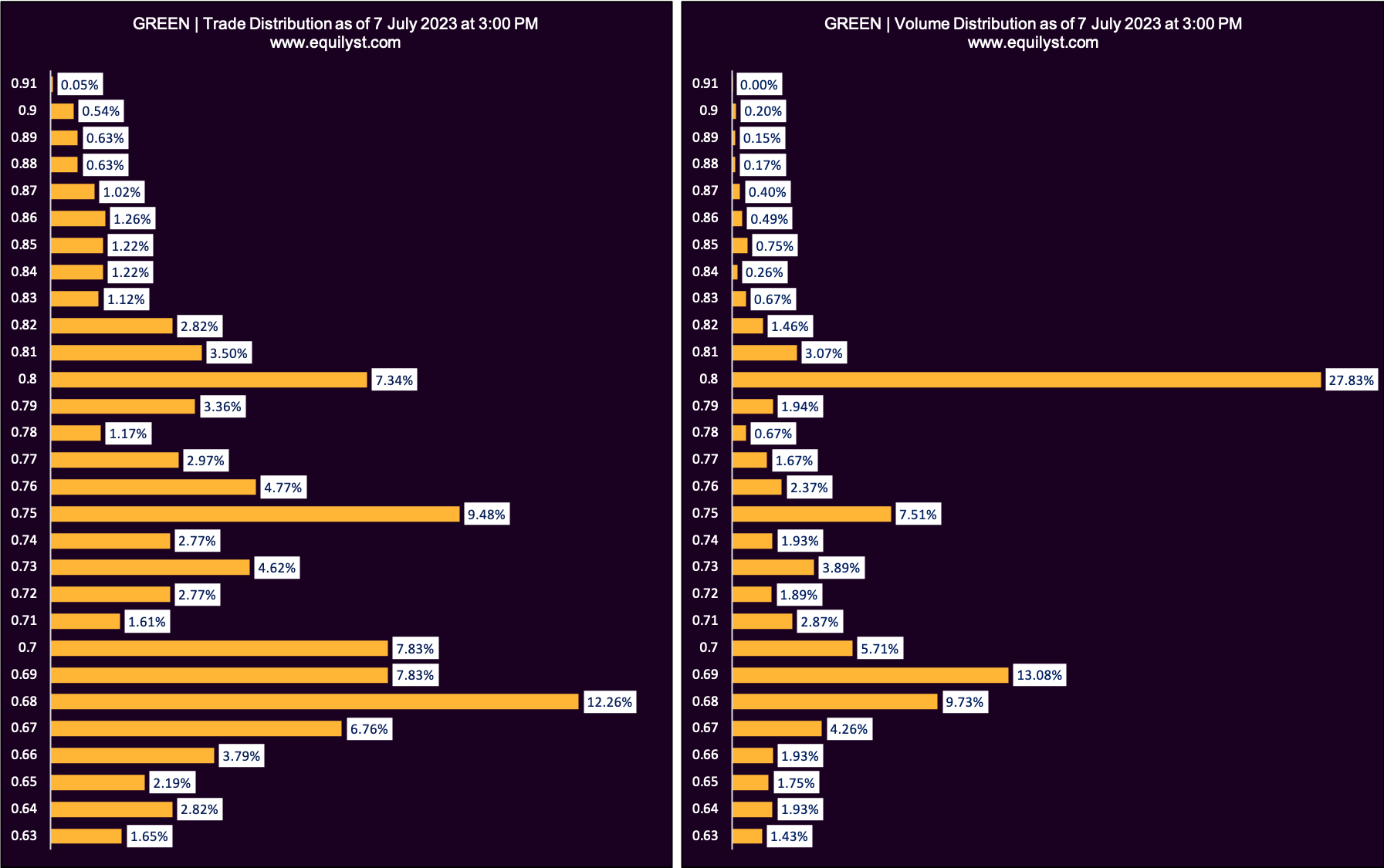

Trade-Volume Distribution Analysis

Dominant Range Index: BEARISH

Last Price: 0.68

VWAP: 0.74

Dominant Range: 0.68 – 0.8

The single biggest transaction today happened at exactly 10:32:47 AM Manila time. It was a cross-trade of Regina Capital totaling 25 million shares traded at P0.80 apiece.

Around 10:57:45 AM, COL Financial traded 1 million shares worth P0.75 apiece to China Bank Securities.

Before the resumption of trading after recess, I published a report entitled Most Traded Prices of the 10 Top-Traded PSE Stocks You Need to Watch This Afternoon.

In that report, I mentioned that the Dominant Range Index of GREEN was already bearish. That means the price points with the biggest volume and highest number of trades were already closer to the intraday low than the intraday high.

So, around 1:13:27 PM, another 1 million shares at P0.71 apiece were traded by COL Financial to China Bank Securities again.

Then, at 2:17:35PM, another cross-trade happened. AP Securities cross-traded 8.11 million shares at P0.69 apiece.

Seeing the volume-weighted average price (VWAP) being higher than the prevailing price was already a data-driven hint that the downtrend was likely to continue even before trading resumed.

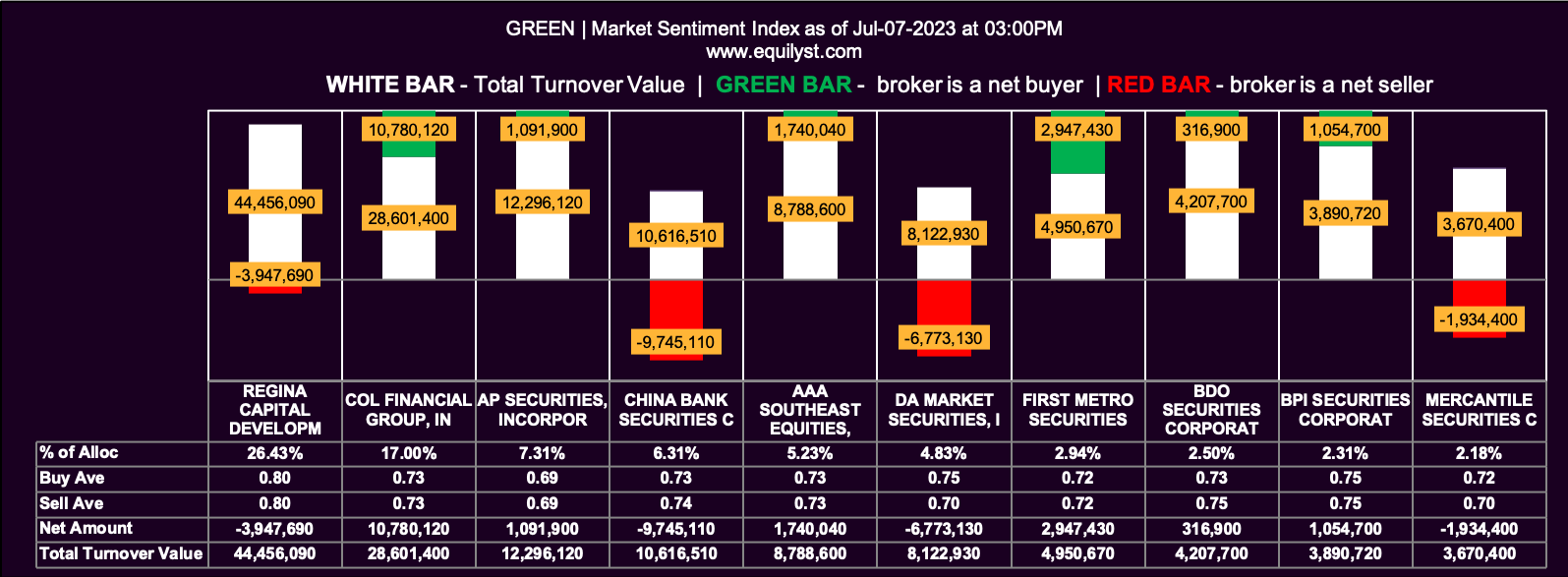

Market Sentiment Analysis

Market Sentiment Index: BULLISH

41 of the 54 participating brokers, or 75.93% of all participants, registered a positive Net Amount

41 of the 54 participating brokers, or 75.93% of all participants, registered a higher Buying Average than Selling Average

54 Participating Brokers’ Buying Average: ₱0.73041

54 Participating Brokers’ Selling Average: ₱0.71697

16 out of 54 participants, or 29.63% of all participants, registered a 100% BUYING activity

2 out of 54 participants, or 3.70% of all participants, registered a 100% SELLING activity

While there were many individual brokers with a higher buying average than selling average today, the total turnover value of Regina Capital, COL Financial, AP Securities, and China Bank Securities engulfed the turnover of the other participating brokers. The rest are just noisy loose change, so to say.

Those who decided to take a leap of faith today and bought near the immediate support at P0.65 must be position traders. Due to today’s bullish Market Sentiment Index, the price may rebound at or near P0.65 by the next trading day.

Despite this data-driven forecast, the market doesn’t care about anyone’s analysis. If the market wants GREEN to dig a hole all the way to the Earth’s core, you can only do so much but be loyal to your trailing stop. Otherwise, you just add up to the population of Filipino traders who vent out on stock market-related Facebook Groups. Not good.

To Sum It Up

Did today’s dip hit your trailing stop?

No? Good for you! You can afford to stay on the sidelines and watch if the price rebounds near support next week. Don’t top up yet because, as I said, GREEN might want to check if hell is really located near the Earth’s core, if you know what I mean.

Yes? Execute your trailing stop. You fool nobody but yourself if you ignore your trailing stop. You’re better off saving your money in the bank, earning 0.25% interest per annum, than trading or investing in the stock market without an exit strategy.

Do You Need Help Trading or Investing in the Philippine Stock Market?

Fix and rebalance your stock portfolio for optimal returns through our Stock Portfolio Rehabilitation Program.

Be a TITANIUM client to learn how to preserve capital, protect gains, and prevent unbearable losses when trading and investing in the Philippine stock market.

Be a PLATINUM client to request our in-depth technical analysis with recommendations tailored-it to your entry price, average cost, buy case, and risk tolerance.

Be a GOLD client to have a teleconsultation with us over the phone as trading happens.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025