Importance of Knowing the Frequently Traded Prices of a Stock

The dominant range or frequently traded prices of a stock are either a standalone price or a range of prices with the highest volume and number of trades.

Imagine you’re on the verge of buying the stock. If the dominant prices are closer to the intraday low than the intraday high, will you rush into buying, or will you wait a bit longer because the price is likely to continue moving downward?

Now, consider you’re about to realize your gains, even though your trailing stop is still in place. If the dominant prices are closer to the intraday high than the intraday low, will you rush into selling, or will you wait a bit longer because the price is likely to continue moving upward?

Picture this: it’s been 60 minutes since the opening bell. If the current price is at the intraday high itself, but the dominant prices include the intraday low, wouldn’t that make you question the sustainability of the intraday bullishness?

I’ve only presented you with three scenarios where understanding the location of the dominant prices is useful in decision-making. There’s a lot more we can discuss in my stock investment consultancy service.

In this report, I’ll share with you the Dominant Range of all 30 Philippine Stock Exchange Index (PSEi) stocks (or bluechip stocks) as of end of trading on April 29, 2024.

Watch out for these prices as these stocks might start trading at or near these ranges today, April 30, 2024.

Ayala Corporation (AC)

Dominant Range Index: BULLISH

Last Price: 609.50

Dominant Range: 609.50 – 609.50

VWAP: 604.91

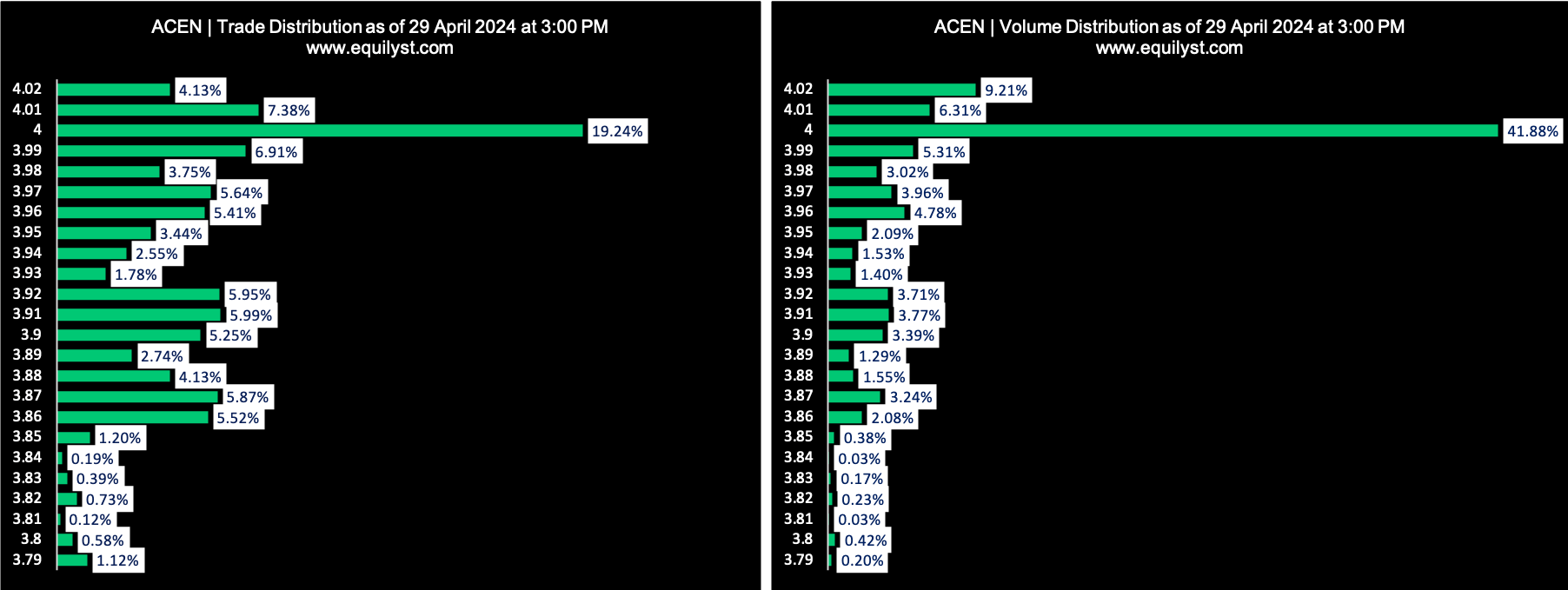

ACEN CORPORATION (ACEN)

Dominant Range Index: BULLISH

Last Price: 4.02

Dominant Range: 4.00 – 4.00

VWAP: 3.97

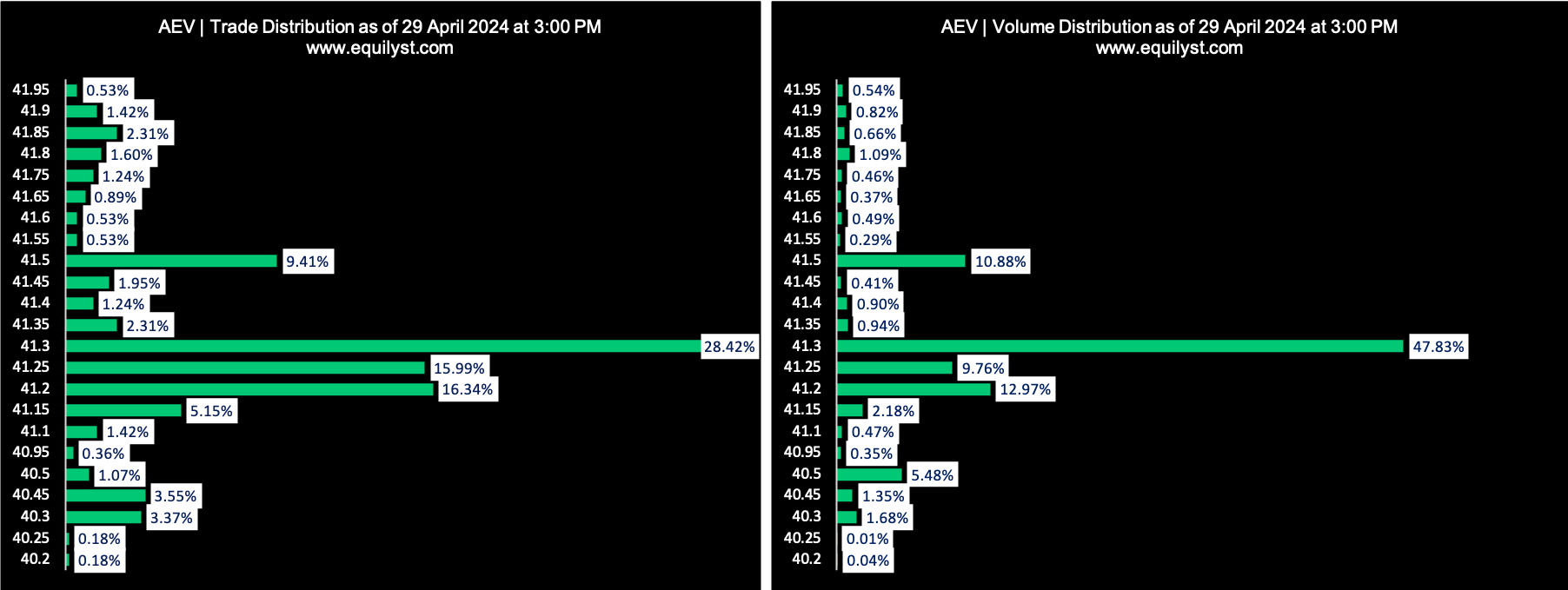

Aboitiz Equity Ventures (AEV)

Dominant Range Index: BEARISH

Last Price: 41.30

Dominant Range: 41.20 – 41.30

VWAP: 41.25

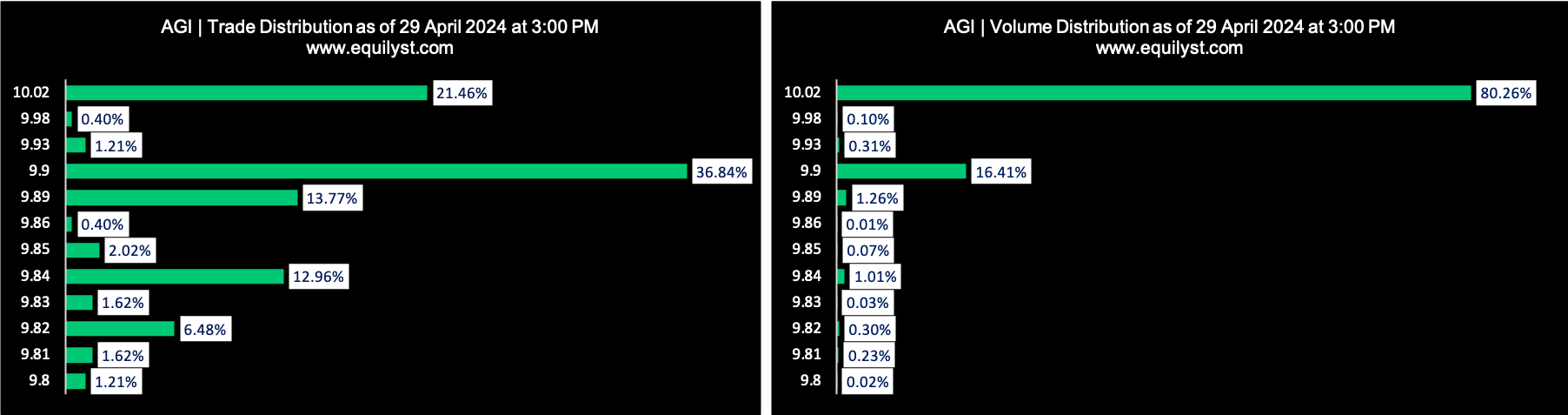

Alliance Global Group (AGI)

Dominant Range Index: BULLISH

Last Price: 10.02

Dominant Range: 9.89 – 10.02

VWAP: 10.0

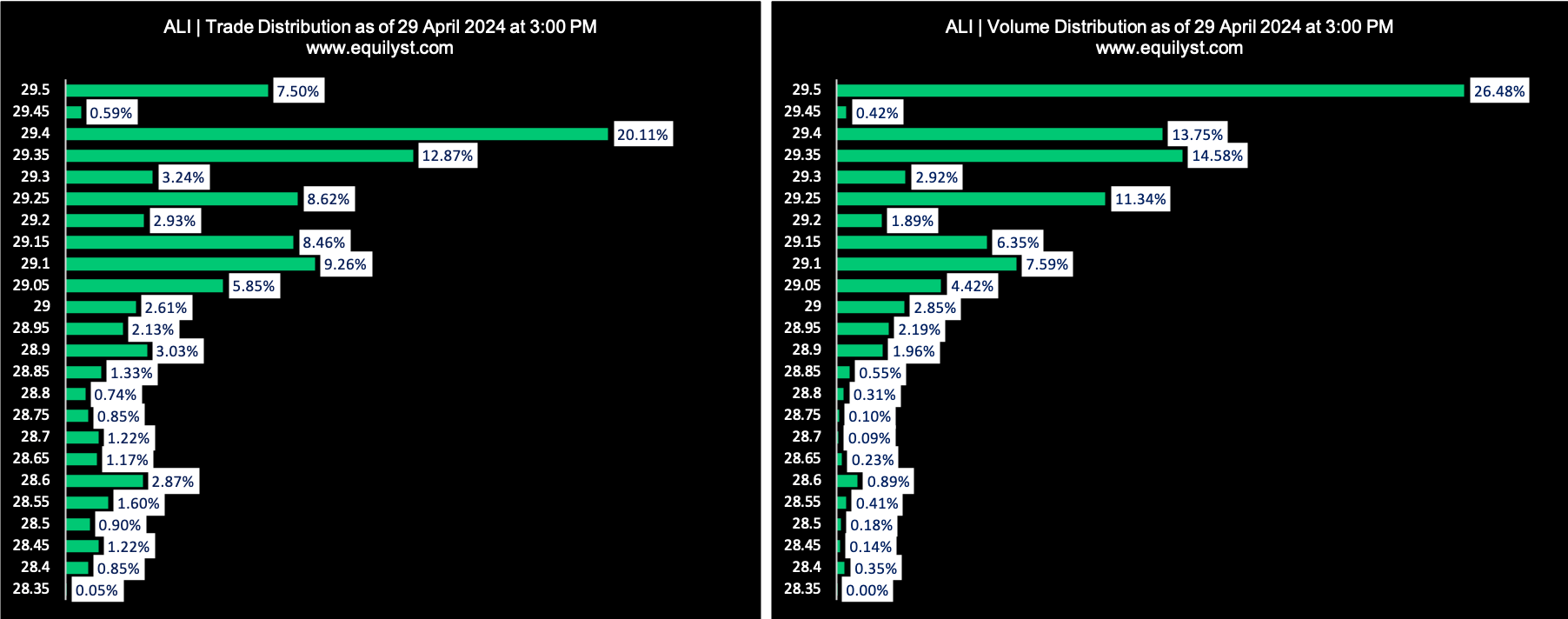

Ayala Land (ALI)

Dominant Range Index: BULLISH

Last Price: 29.50

Dominant Range: 29.10 – 29.50

VWAP: 29.29

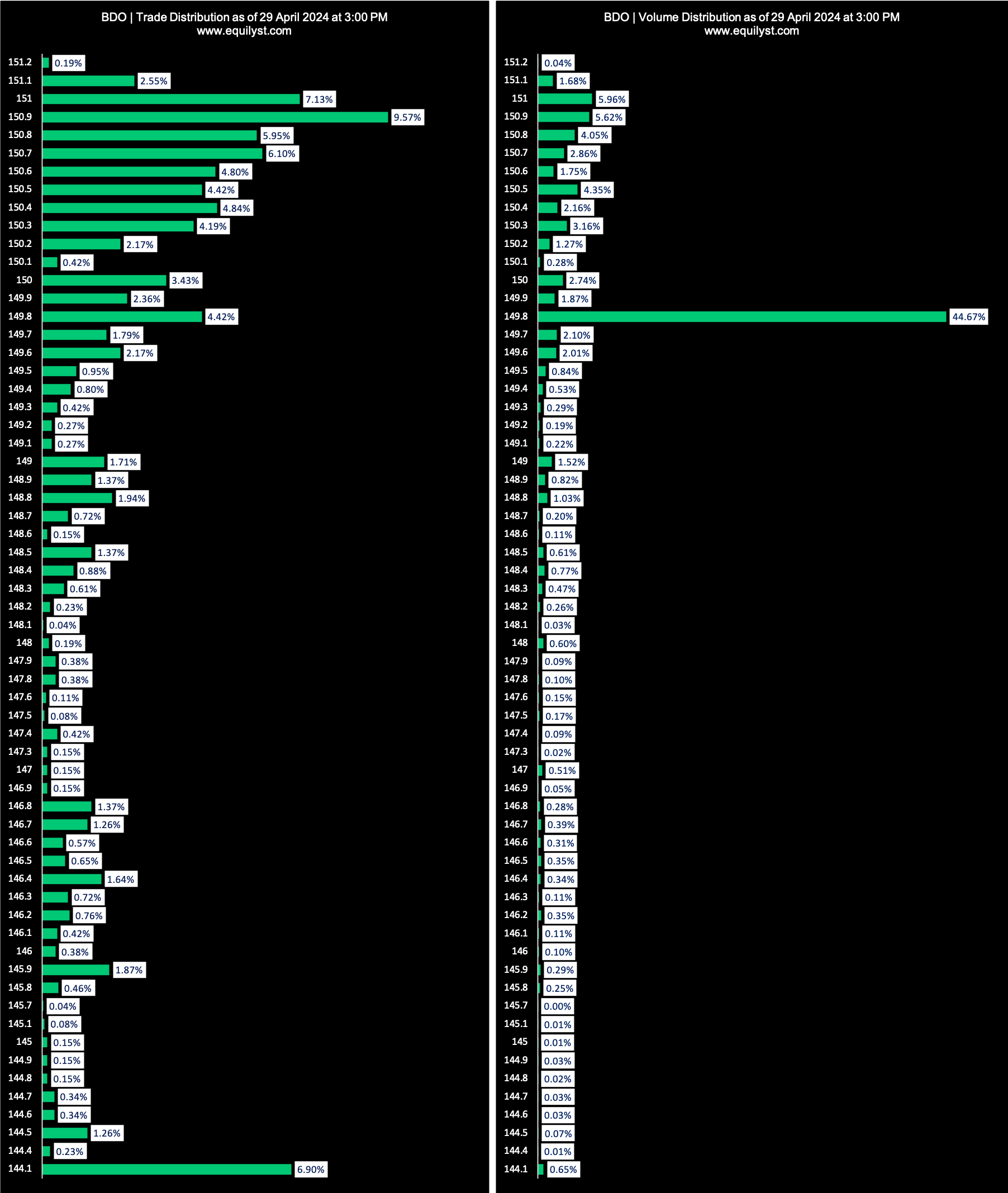

BDO Unibank (BDO)

Dominant Range Index: BEARISH

Last Price: 149.80

Dominant Range: 149.80 – 151.00

VWAP: 149.84

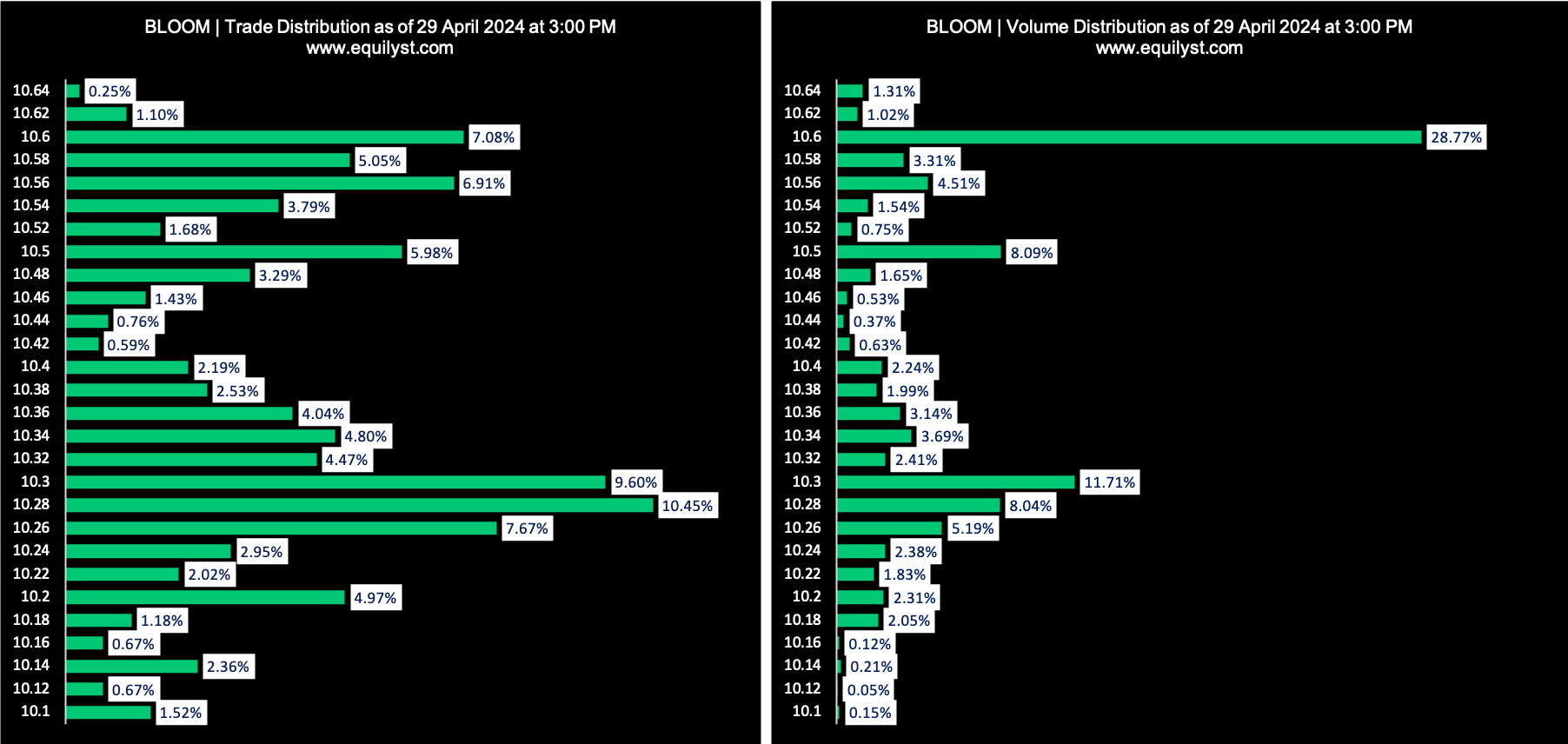

Bloomberry Resorts Corporation (BLOOM)

Dominant Range Index: BULLISH

Last Price: 10.60

Dominant Range: 10.60 – 10.60

VWAP: 10.44

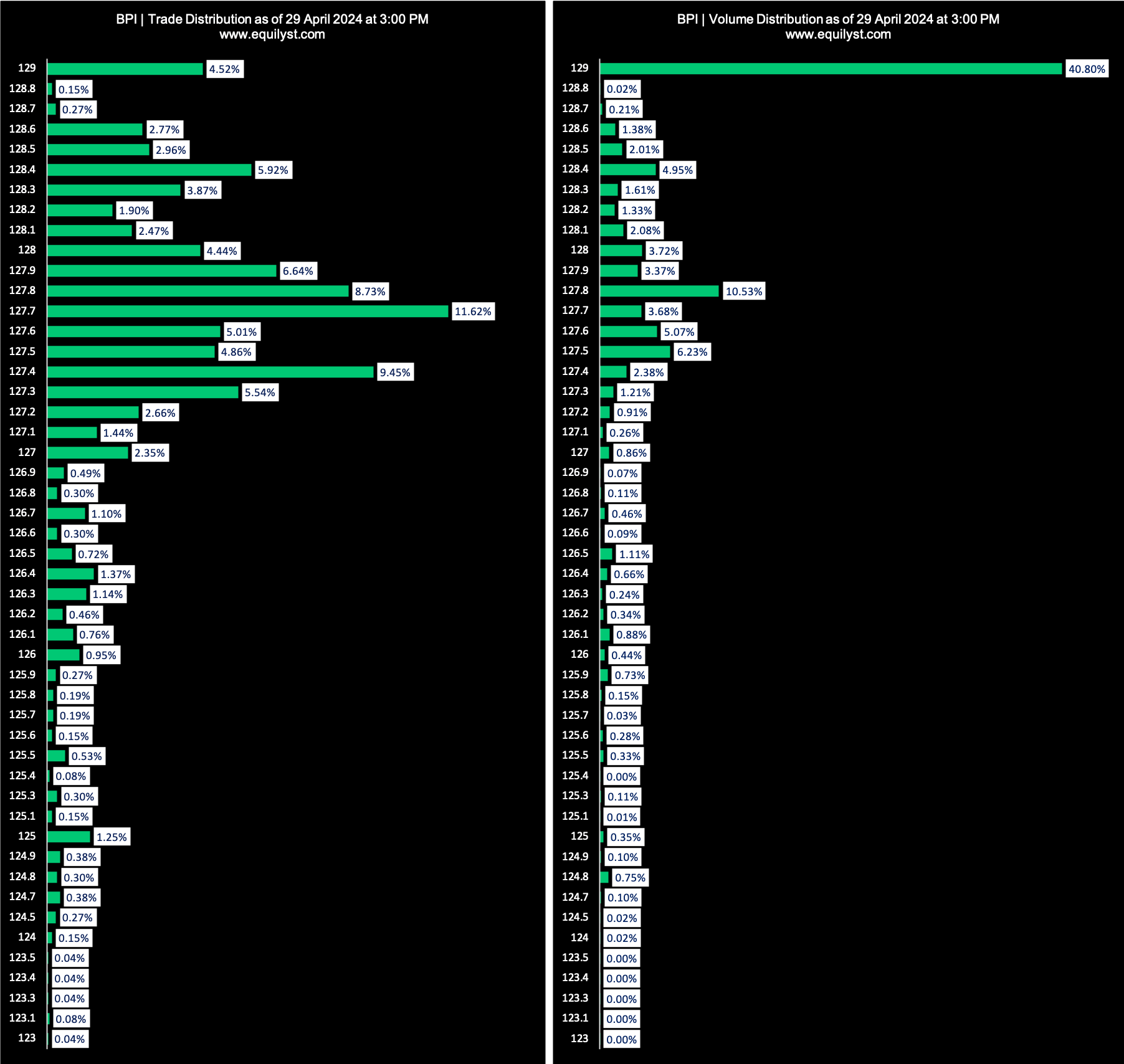

Bank of the Philippine Islands (BPI)

Dominant Range Index: BULLISH

Last Price: 129.00

Dominant Range: 127.40 – 129.00

VWAP: 128.18

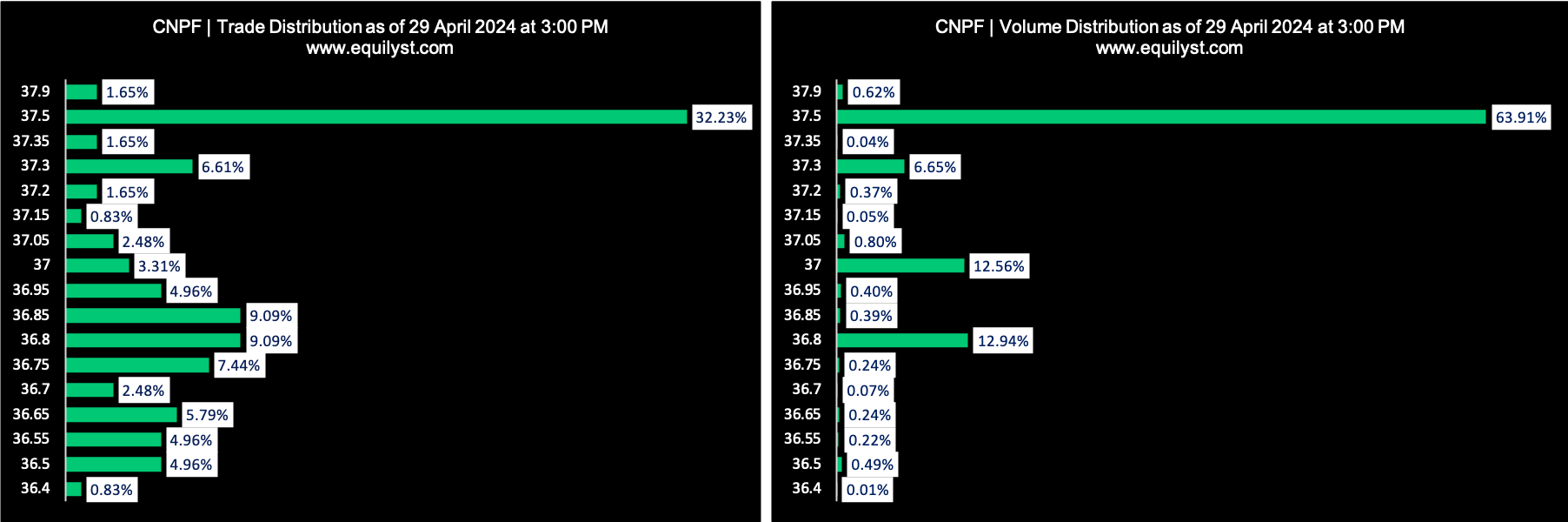

Century Pacific Food (CNPF)

Dominant Range Index: BULLISH

Last Price: 37.50

Dominant Range: 37.50 – 37.50

VWAP: 37.31

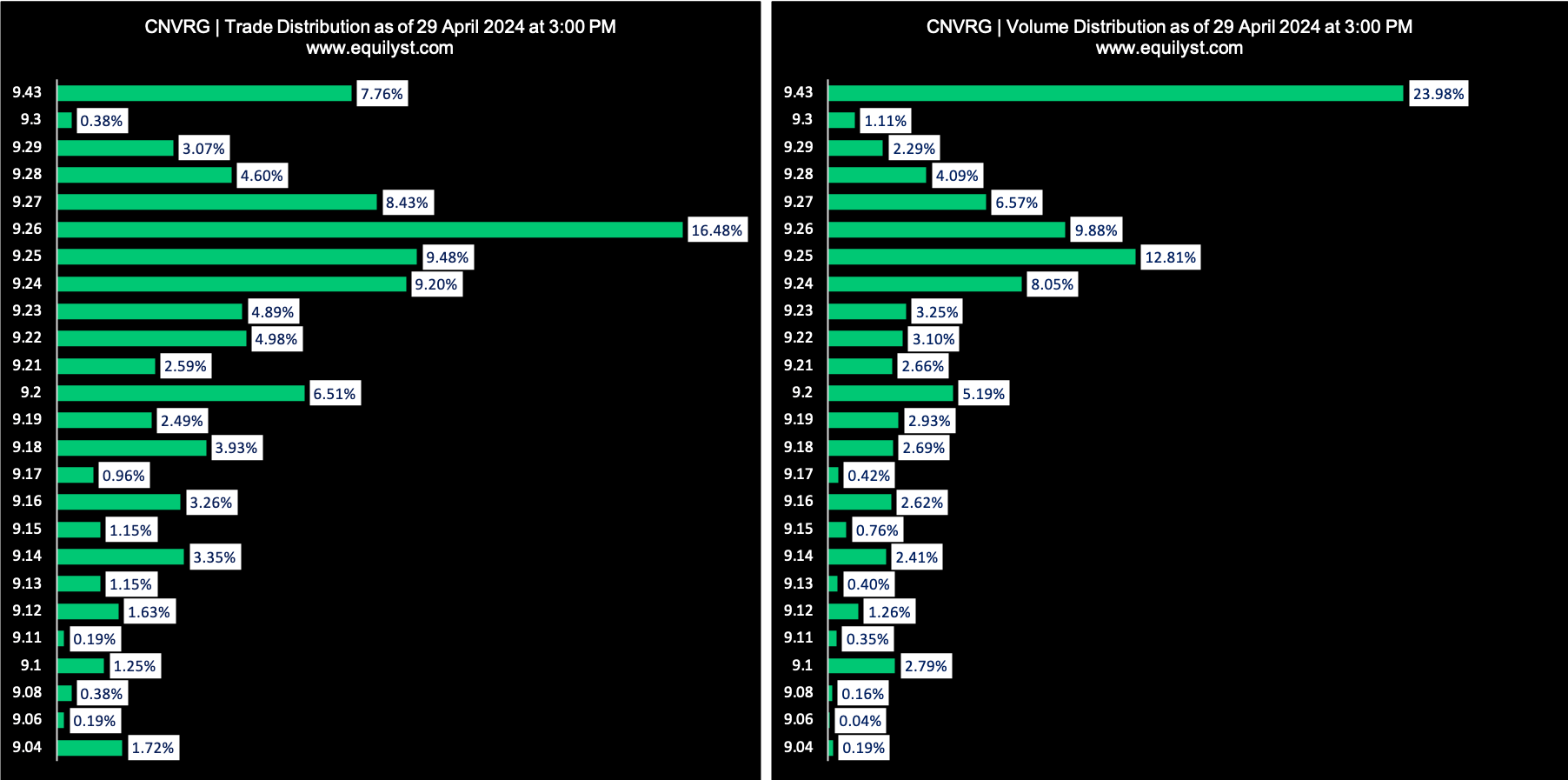

Converge Information and Communications (CNVRG)

Dominant Range Index: BULLISH

Last Price: 9.43

Dominant Range: 9.24 – 9.43

VWAP: 9.27

DMCI Holdings (DMC)

Dominant Range Index: BEARISH

Last Price: 11.10

Dominant Range: 11.06 – 11.14

VWAP: 11.10

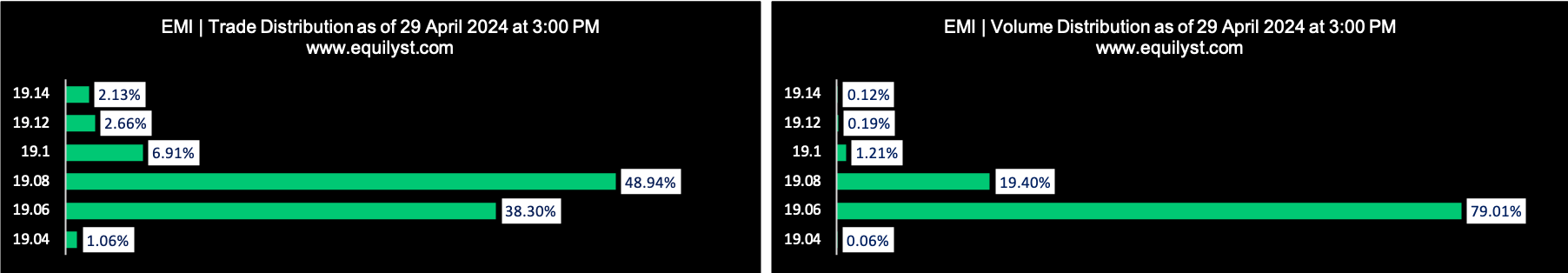

Emperador (EMI)

Dominant Range Index: BEARISH

Last Price: 19.06

Dominant Range: 19.06 – 19.08

VWAP: 19.06

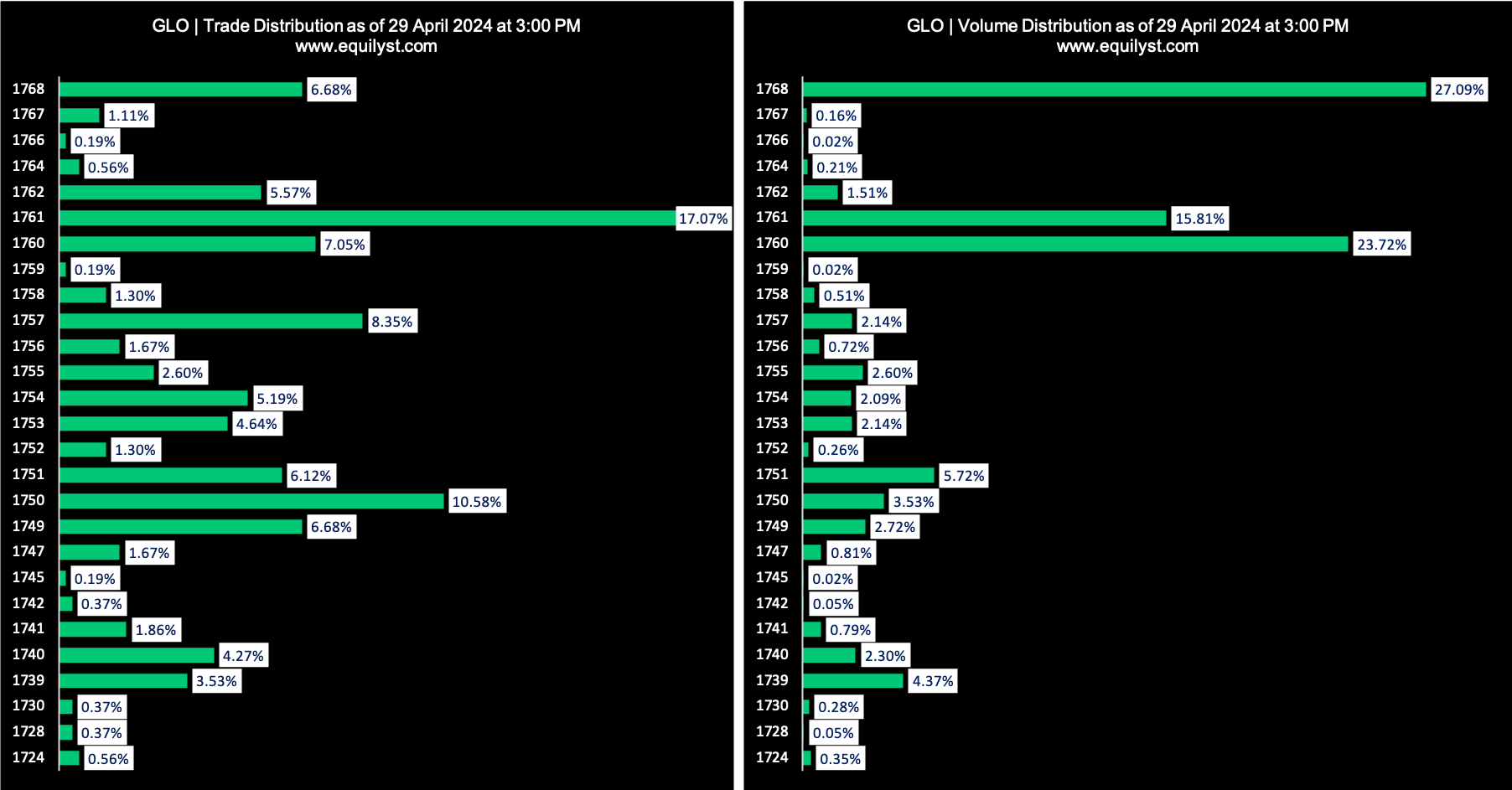

Globe Telecom (GLO)

Dominant Range Index: BULLISH

Last Price: 1,768.00

Dominant Range: 1,760.00 – 1,768.00

VWAP: 1,758.81

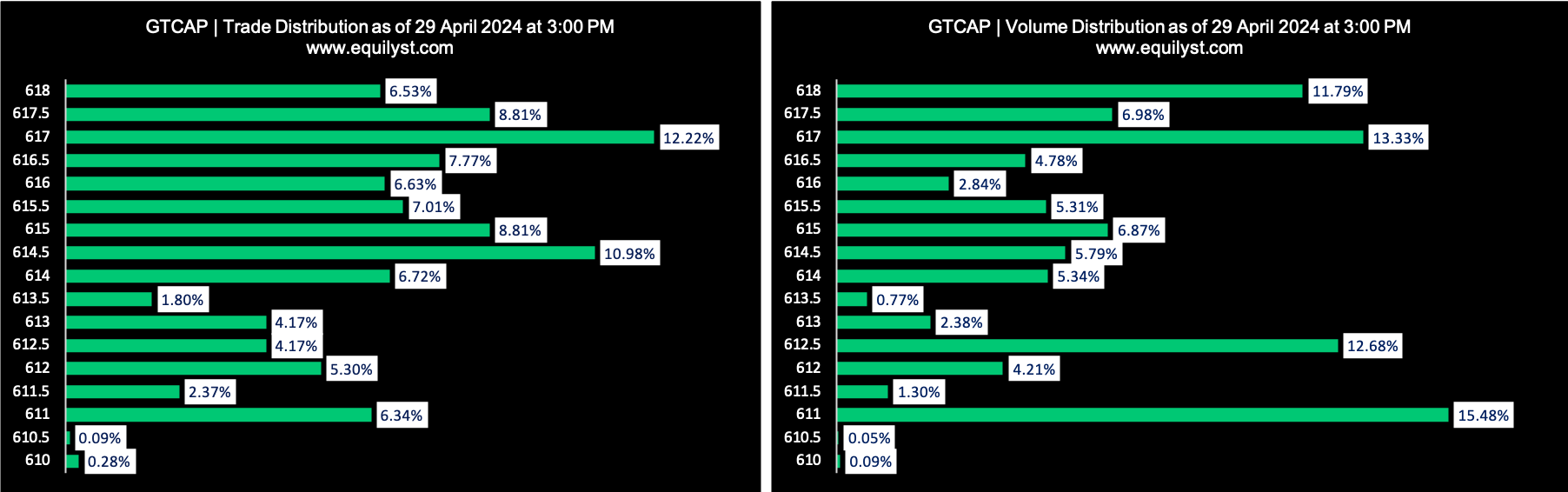

GT Capital Holdings (GTCAP)

Dominant Range Index: BEARISH

Last Price: 611.00

Dominant Range: 611.00 – 611.00

VWAP: 614.67

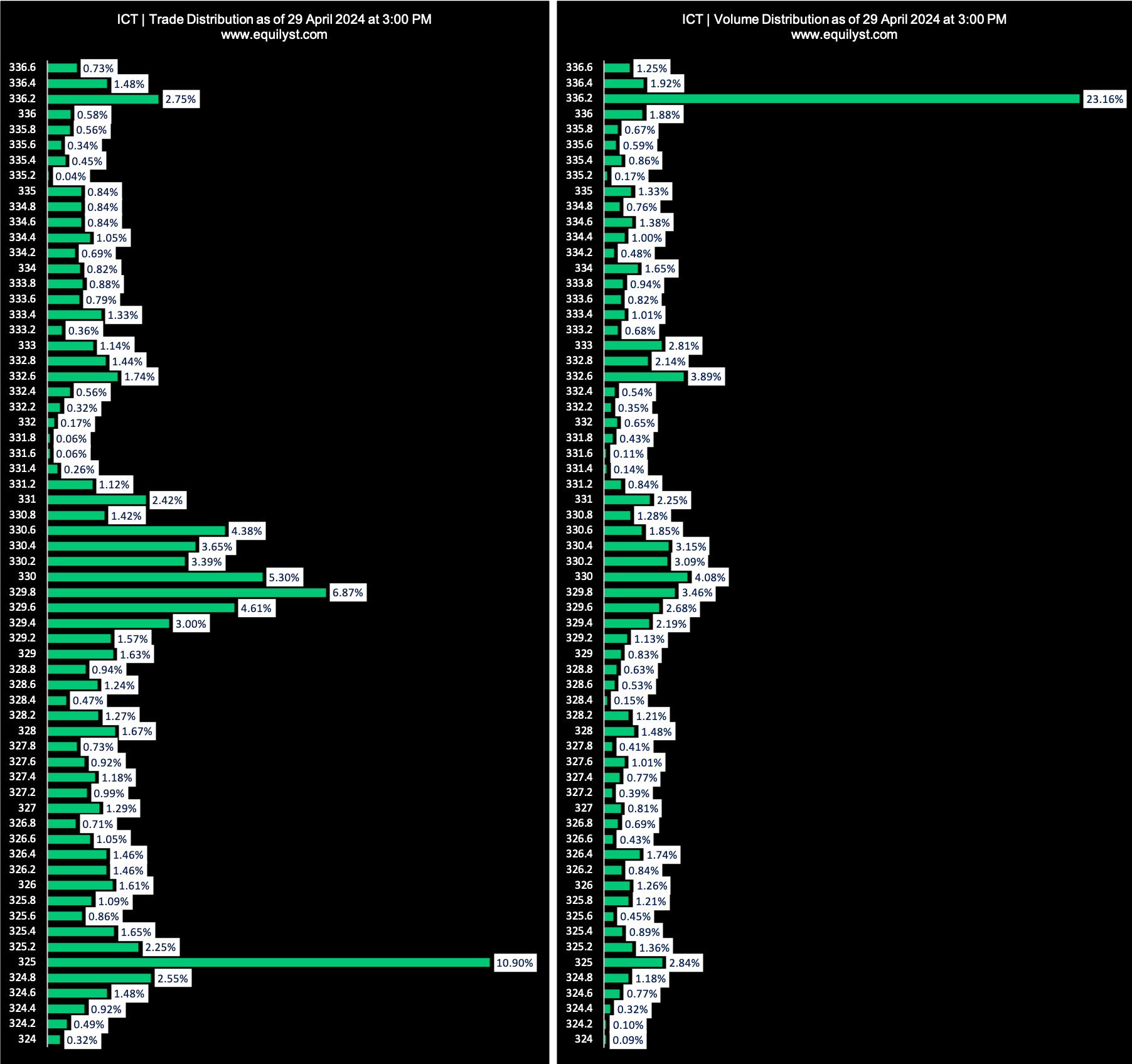

International Container Terminal (ICT)

Dominant Range Index: BULLISH

Last Price: 336.20

Dominant Range: 336.20 – 336.20

VWAP: 331.82

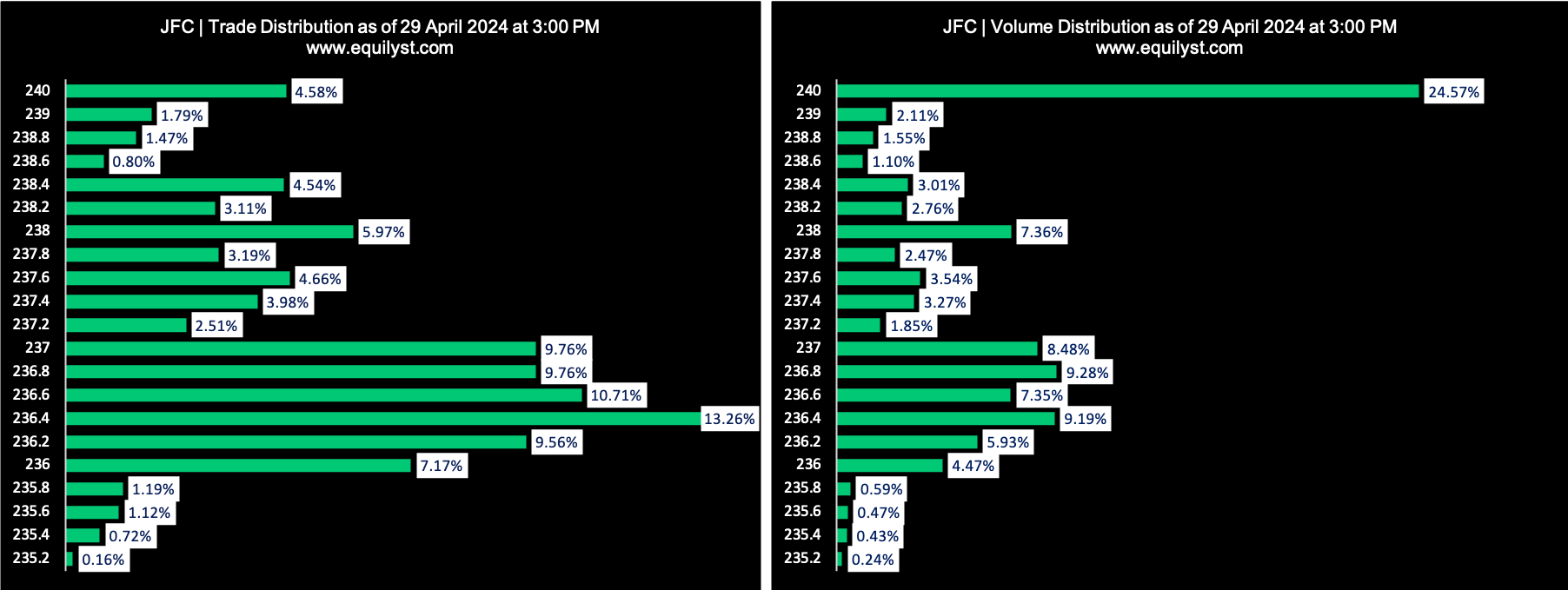

Jollibee Foods Corporation (JFC)

Dominant Range Index: BULLISH

Last Price: 240.00

Dominant Range: 240.00 – 240.00

VWAP: 237.81

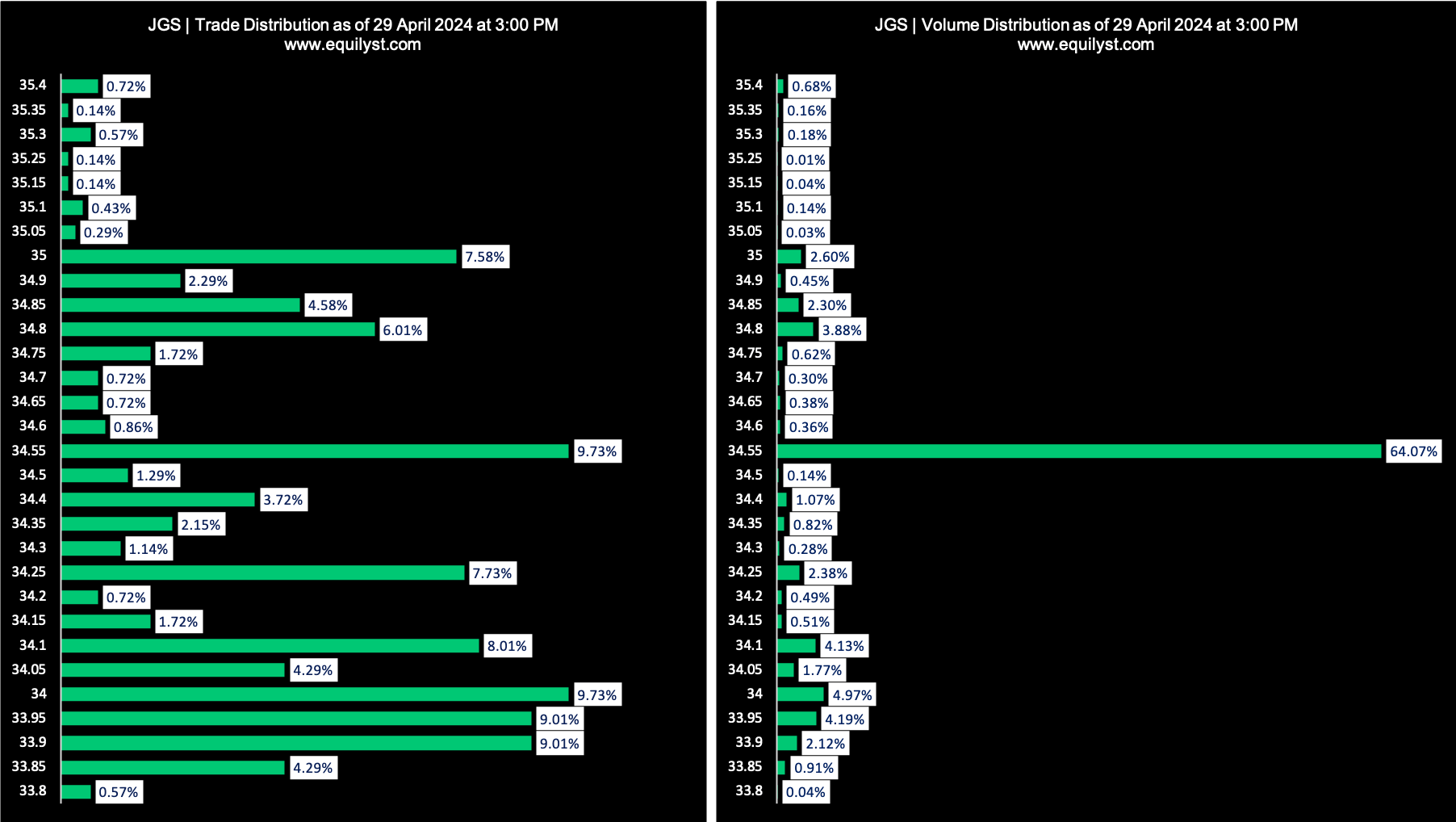

JG Summit Holdings (JGS)

Dominant Range Index: BEARISH

Last Price: 34.55

Dominant Range: 34.55 – 34.55

VWAP: 34.48

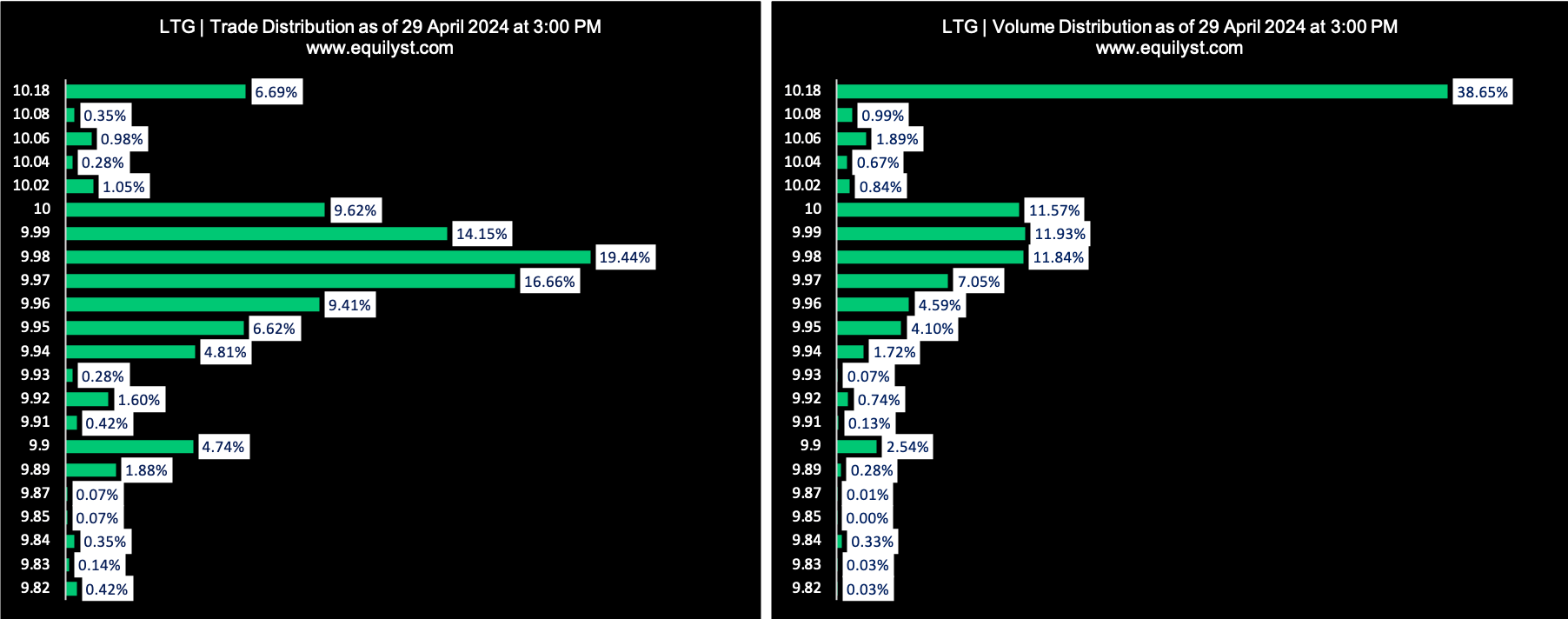

LT Group (LTG)

Dominant Range Index: BULLISH

Last Price: 10.18

Dominant Range: 9.97 – 10.18

VWAP: 10.06

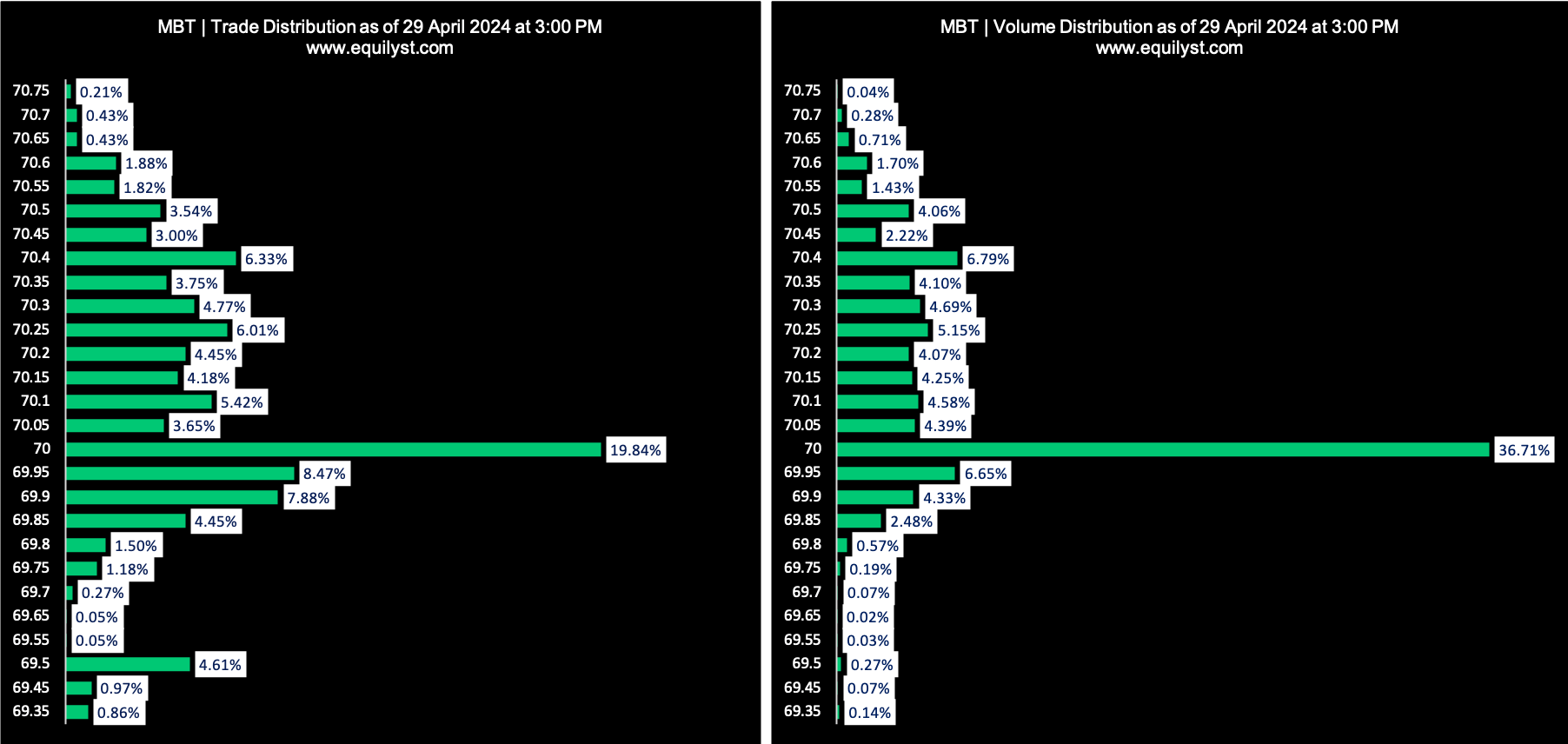

Metropolitan Bank & Trust Comp (MBT)

Dominant Range Index: BEARISH

Last Price: 70.00

Dominant Range: 70.00 – 70.00

VWAP: 70.13

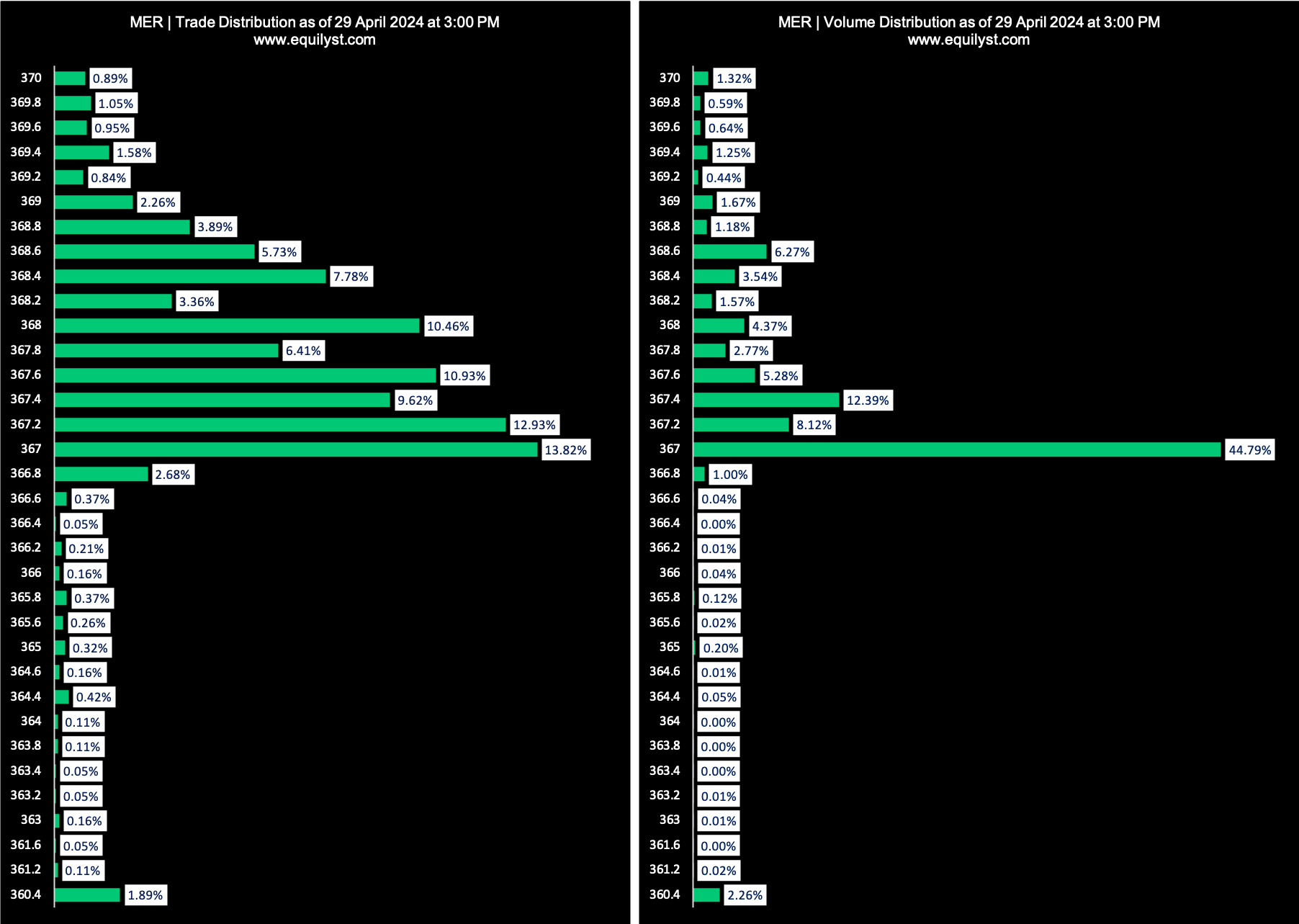

Manila Electric Company (MER)

Dominant Range Index: BULLISH

Last Price: 367.00

Dominant Range: 367.00 – 368.00

VWAP: 367.34

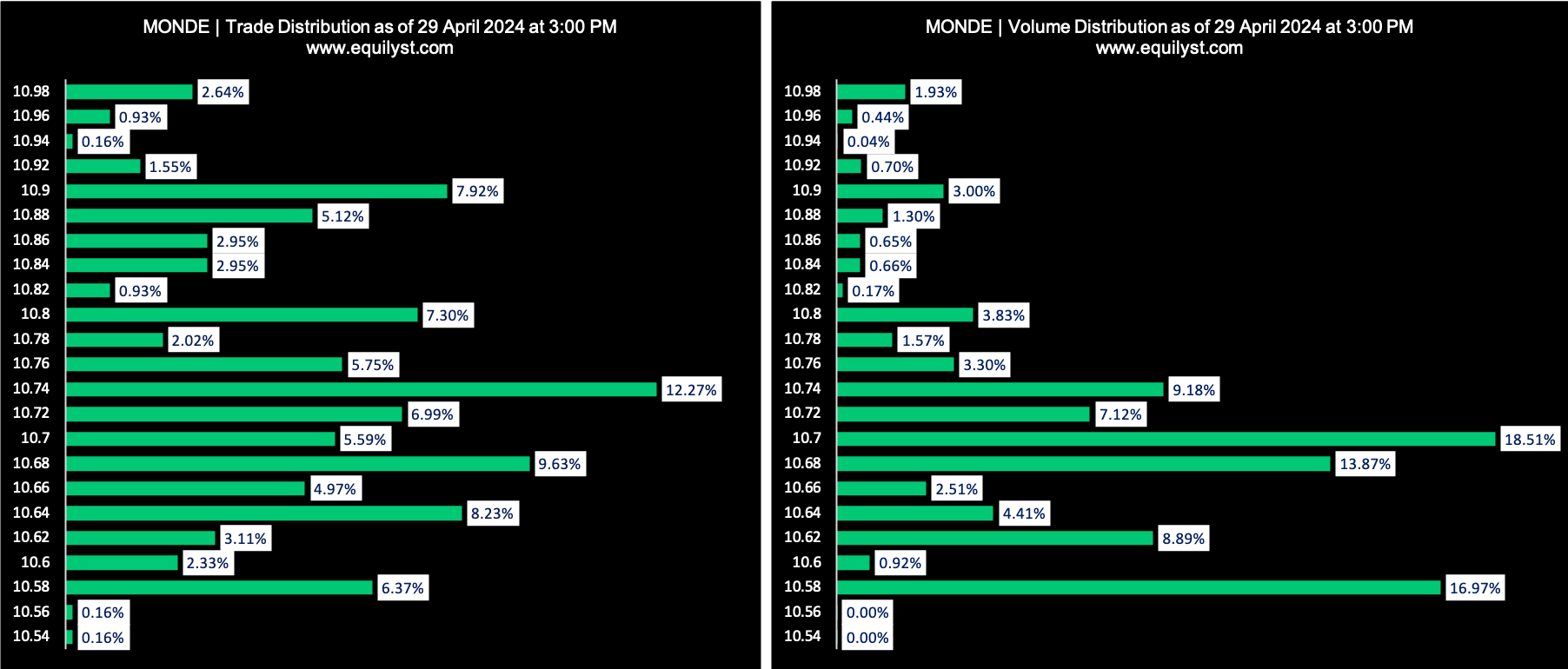

Monde Nissin Corporation (MONDE)

Dominant Range Index: BEARISH

Last Price: 10.58

Dominant Range: 10.58 – 10.74

VWAP: 10.70

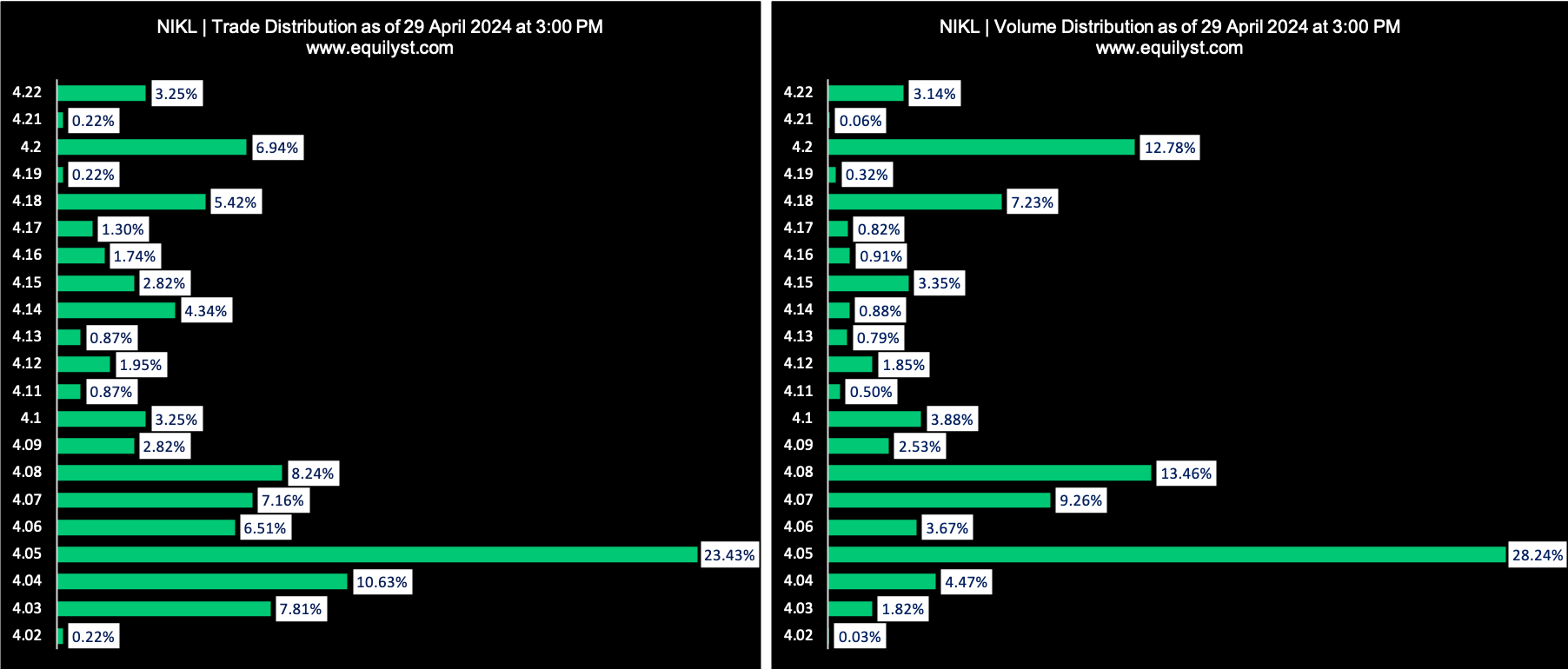

Nickel Asia Corporation (NIKL)

Dominant Range Index: BEARISH

Last Price: 4.05

Dominant Range: 4.03 – 4.08

VWAP: 4.10

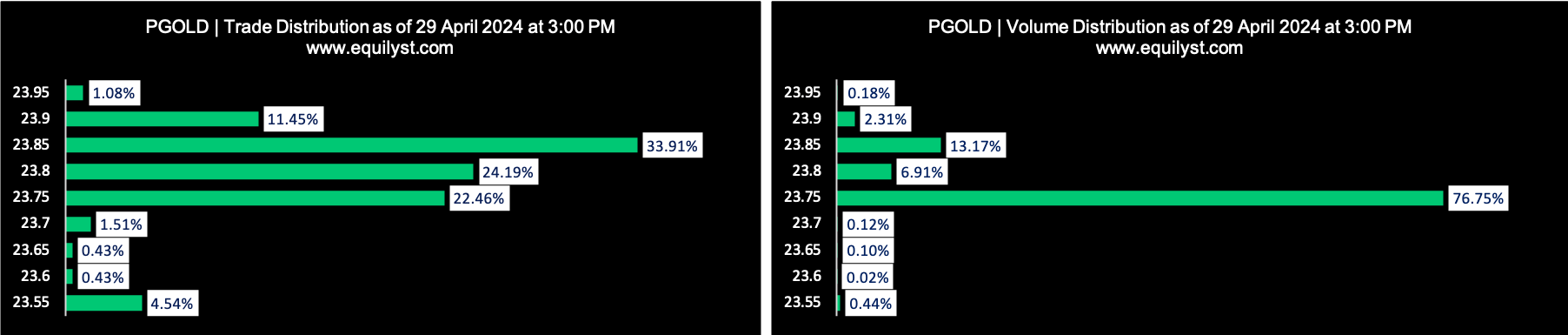

Puregold Price Club (PGOLD)

Dominant Range Index: BEARISH

Last Price: 23.75

Dominant Range: 23.75 – 23.90

VWAP: 23.77

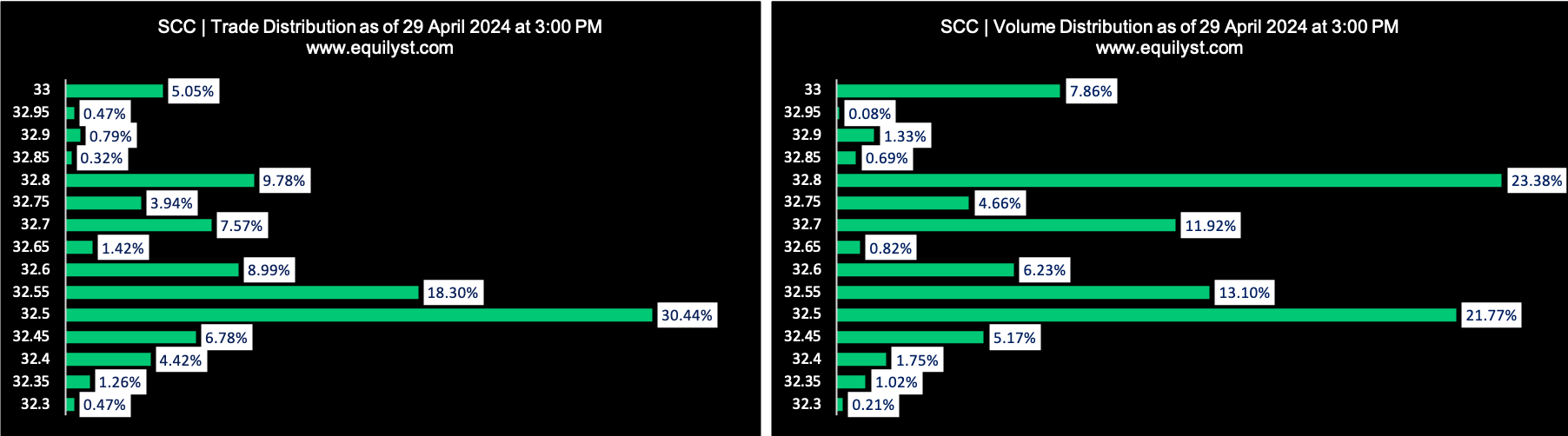

Semirara Mining and Power Corp (SCC)

Dominant Range Index: BEARISH

Last Price: 32.80

Dominant Range: 32.50 – 32.80

VWAP: 32.66

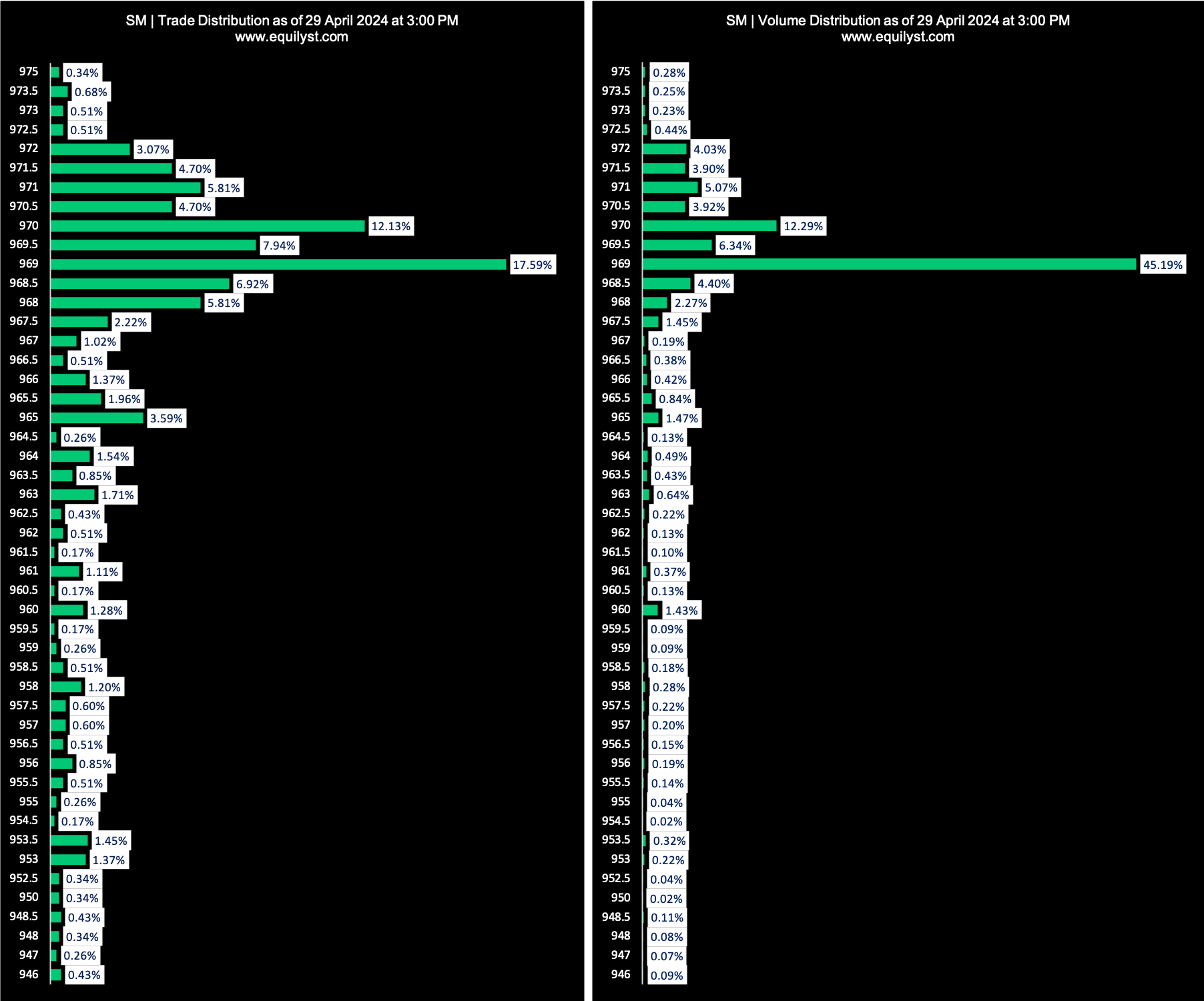

SM Investments Corporation (SM)

Dominant Range Index: BULLISH

Last Price: 969.00

Dominant Range: 969.00 – 970.00

VWAP: 968.75

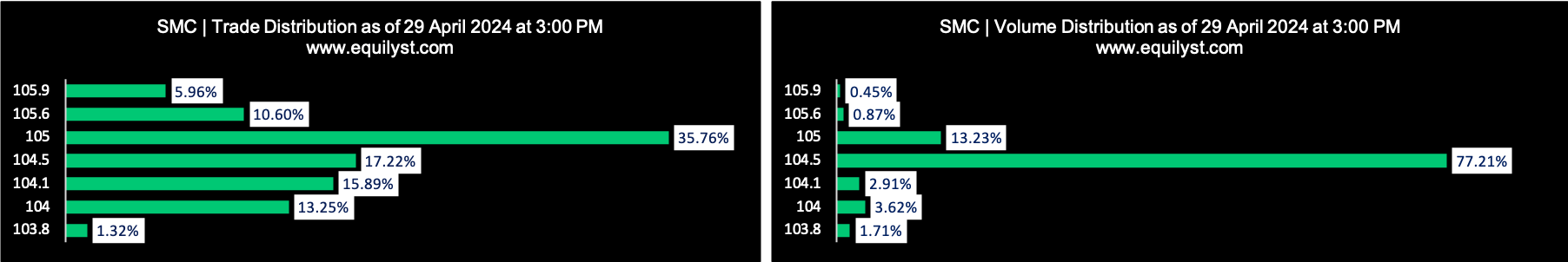

San Miguel Corporation (SMC)

Dominant Range Index: BEARISH

Last Price: 104.50

Dominant Range: 104.00 – 105.00

VWAP: 104.54

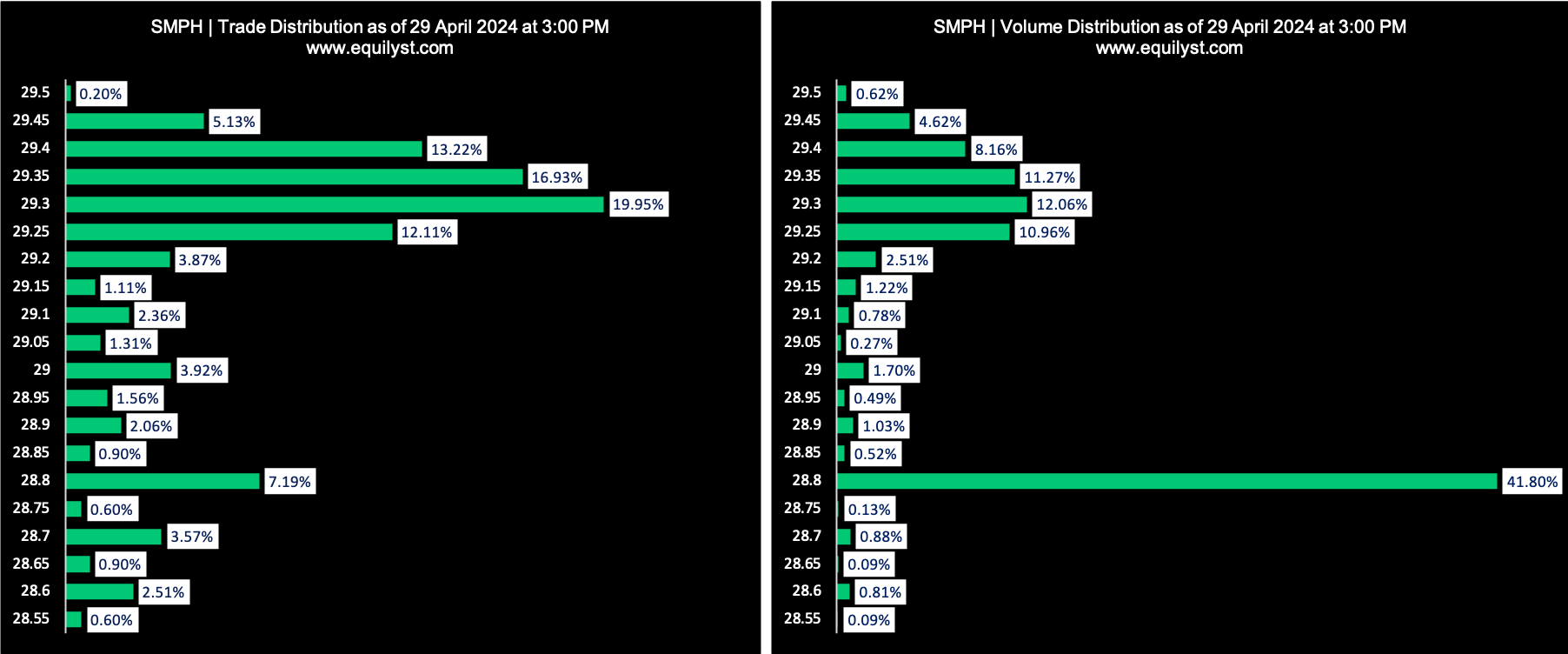

SM Prime Holdings (SMPH)

Dominant Range Index: BEARISH

Last Price: 28.80

Dominant Range: 28.80 – 28.80

VWAP: 29.07

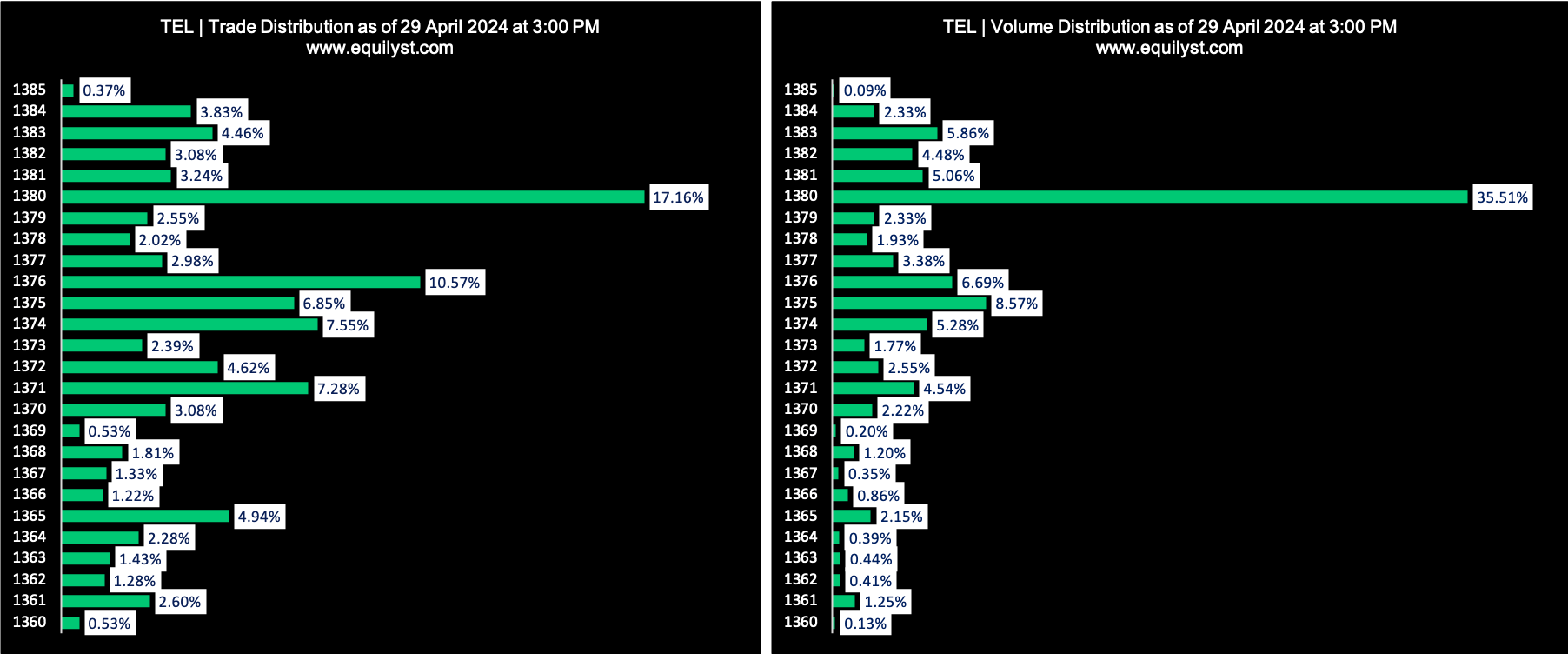

PLDT (TEL)

Dominant Range Index: BULLISH

Last Price: 1,380.00

Dominant Range: 1,380.00 – 1,380.00

VWAP: 1,377.15

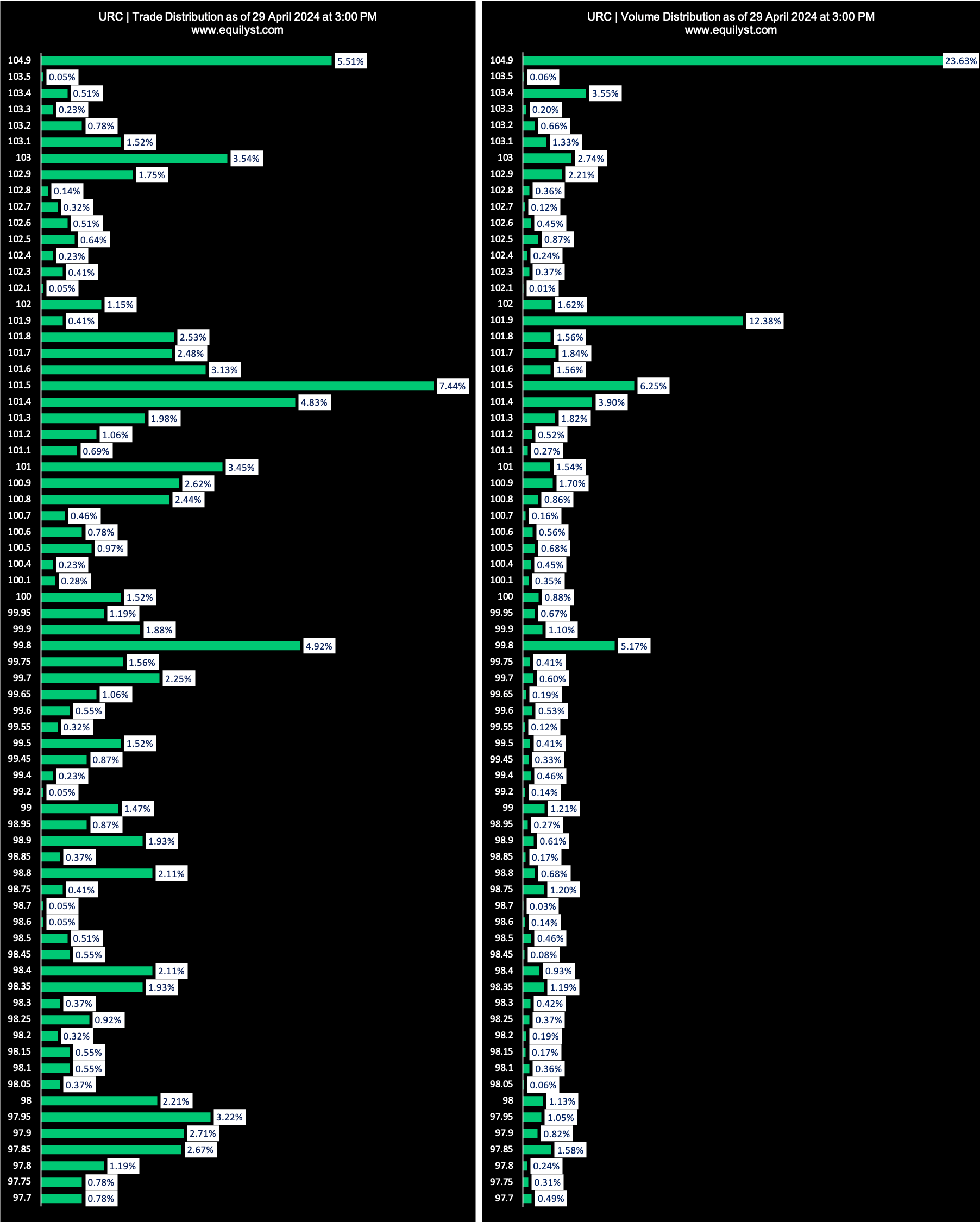

Universal Robina Corporation (URC)

Dominant Range Index: BULLISH

Last Price: 104.90

Dominant Range: 104.90 – 104.90

VWAP: 101.87

Wilcon Depot (WLCON)

Dominant Range Index: BULLISH

Last Price: 16.00

Dominant Range: 15.92 – 16.00

VWAP: 15.89

What More Updates?

To receive more updates from me, here are my services:

You may also read my other reports here and watch my videos on YouTube.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025