Of the 9 financial stocks in the Philippine stock market, only 4 have a strong buy rating from First Metro Securities.

First Metro Securities is the stockbrokerage arm of Metrobank.

This broker rates stocks on a scale from 1 (weakest) to 5 (strongest).

Below are the 4 financial stocks with a strong buy rating above 4.00 by First Metro Securities.

I’d also like to share with you the support and resistance levels I’d recommend you to monitor if, and only if, you’re interested in trading these stocks.

Disclaimer: This is not a stock recommendation but for informational purposes only.

Related Article: 8 Bluechips with Strong Buy Rating by First Metro Securities

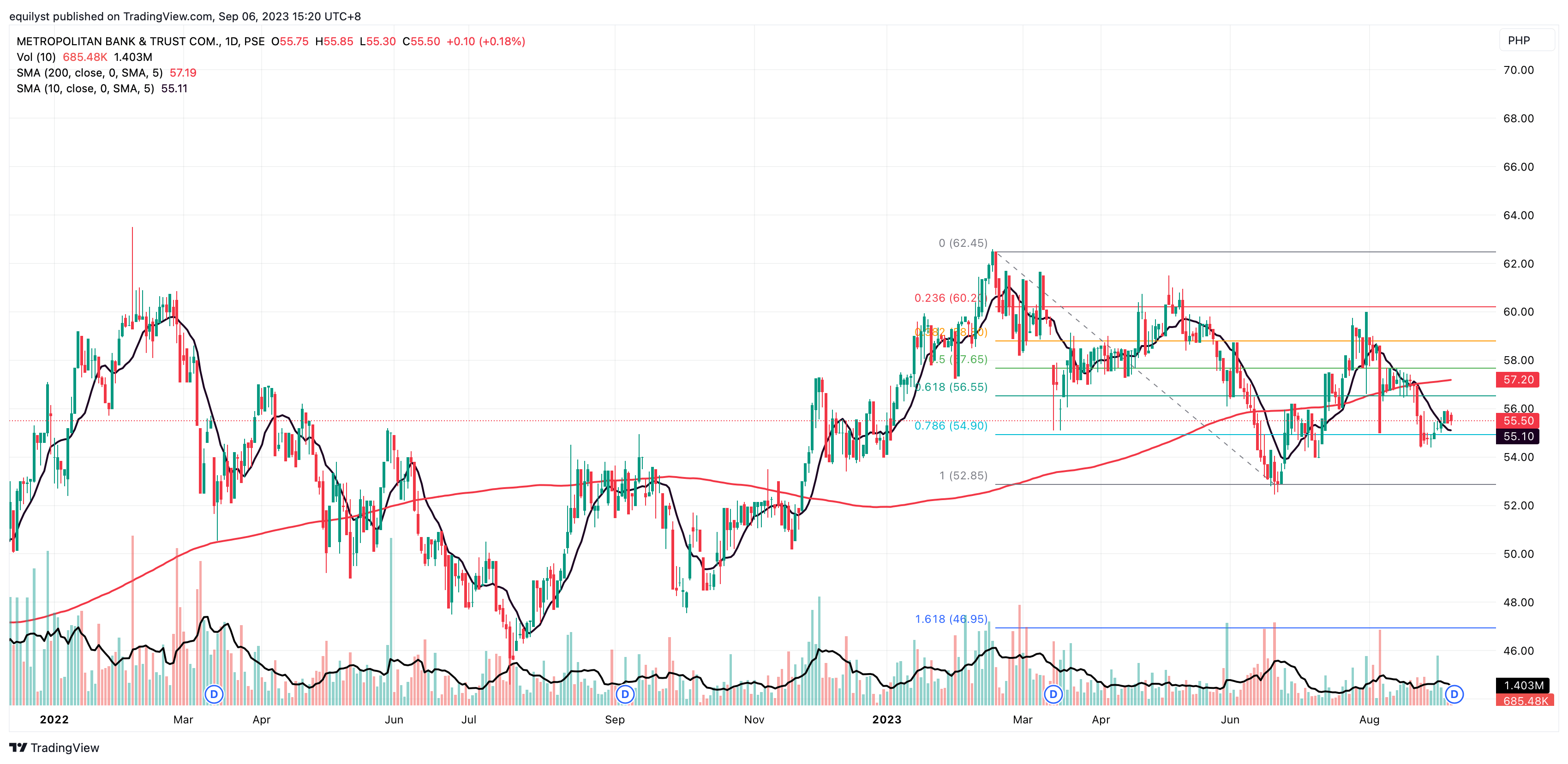

Metropolitan Bank & Trust Company (MBT)

Consensus Rating: 4.50

MBT is up 2.78% year-to-date from P54.00 on December 29, 2022, to P55.50 on September 6, 2023.

While MBT manages to stay afloat above its 10-day simple moving average, it’s likely to revisit its support at P54.90. Resistance is at P56.55.

Know that MBT still trades below its 200-day simple moving average, which means it’s still technically bearish in the long-term period.

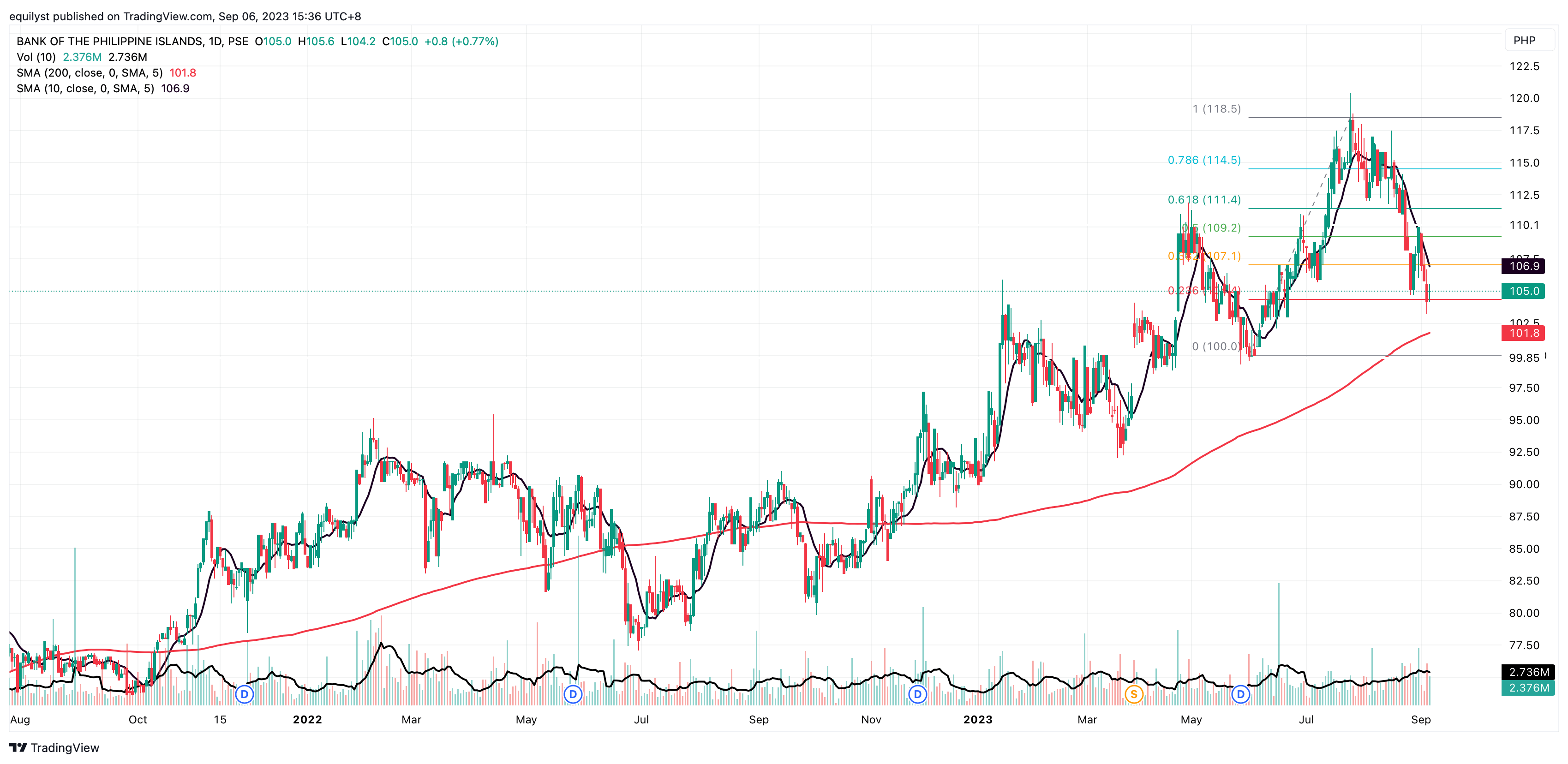

Bank of the Philippine Islands (BPI)

Consensus Rating: 4.57

BPI is up 12.18% year-to-date from P93.60 on December 29, 2022, to P105.00 on September 6, 2023.

BPI trades below its 10-day and 200-day simple moving averages, indicating its bearishness in the short-term and long-term periods.

BPI is on the brink of touching its support at P104.40. Resistance is at P107.10.

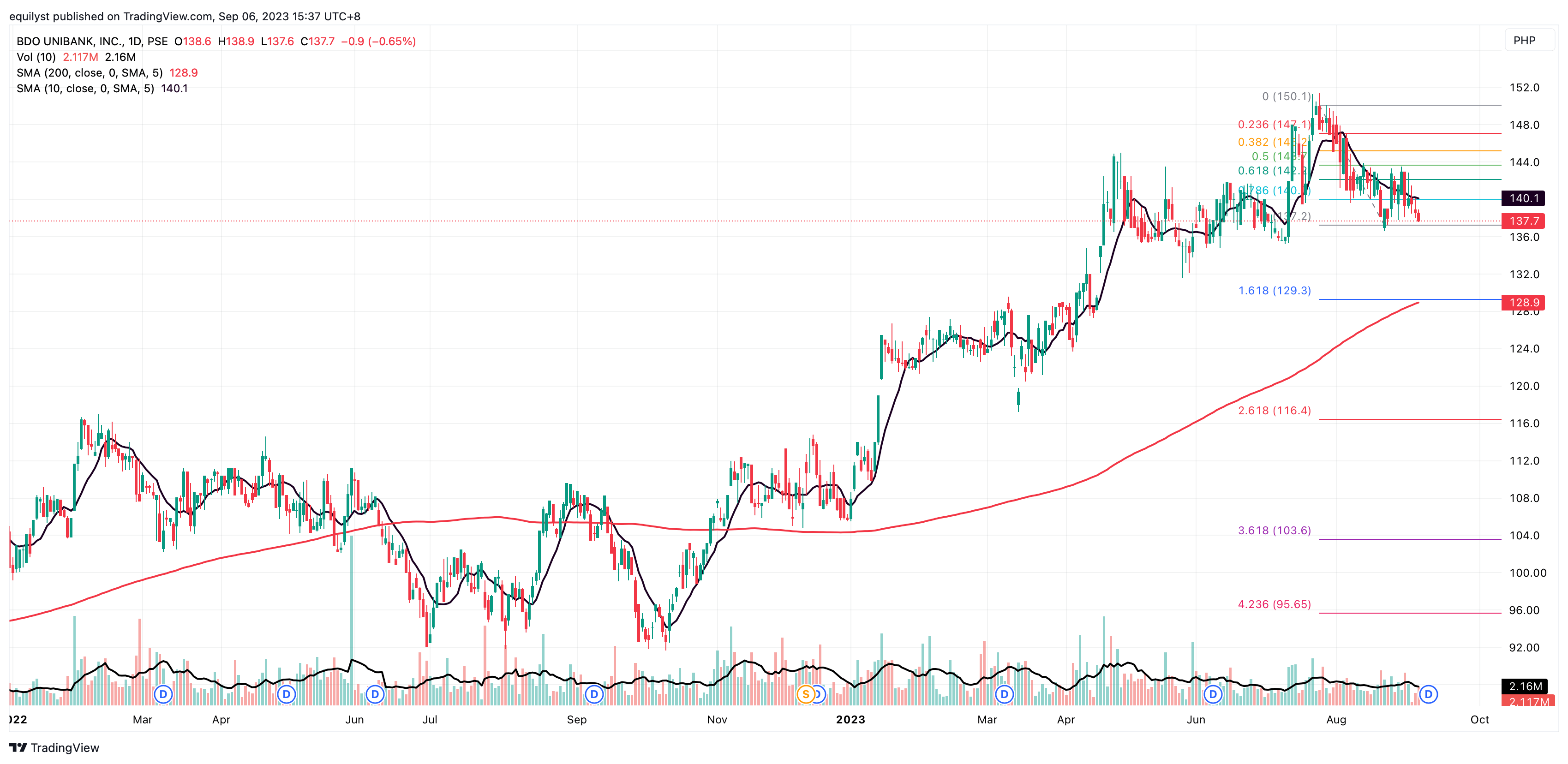

BDO Unibank (BDO)

Consensus Rating: 4.57

BDO advanced by 30.27% from P105.70 on December 22, 2022, to P137.70 on September 6, 2023.

However, it looks like BDO will reduce its positive year-to-date change as it moves to the south toward its support at P137.20. Resistance is at P140.00. If BDO breaks below its immediate support, the next support is quite deep at P129.30.

BDO remains bullish in the long-term but bearish in the short-term as it continues to move below its 10-day simple moving average.

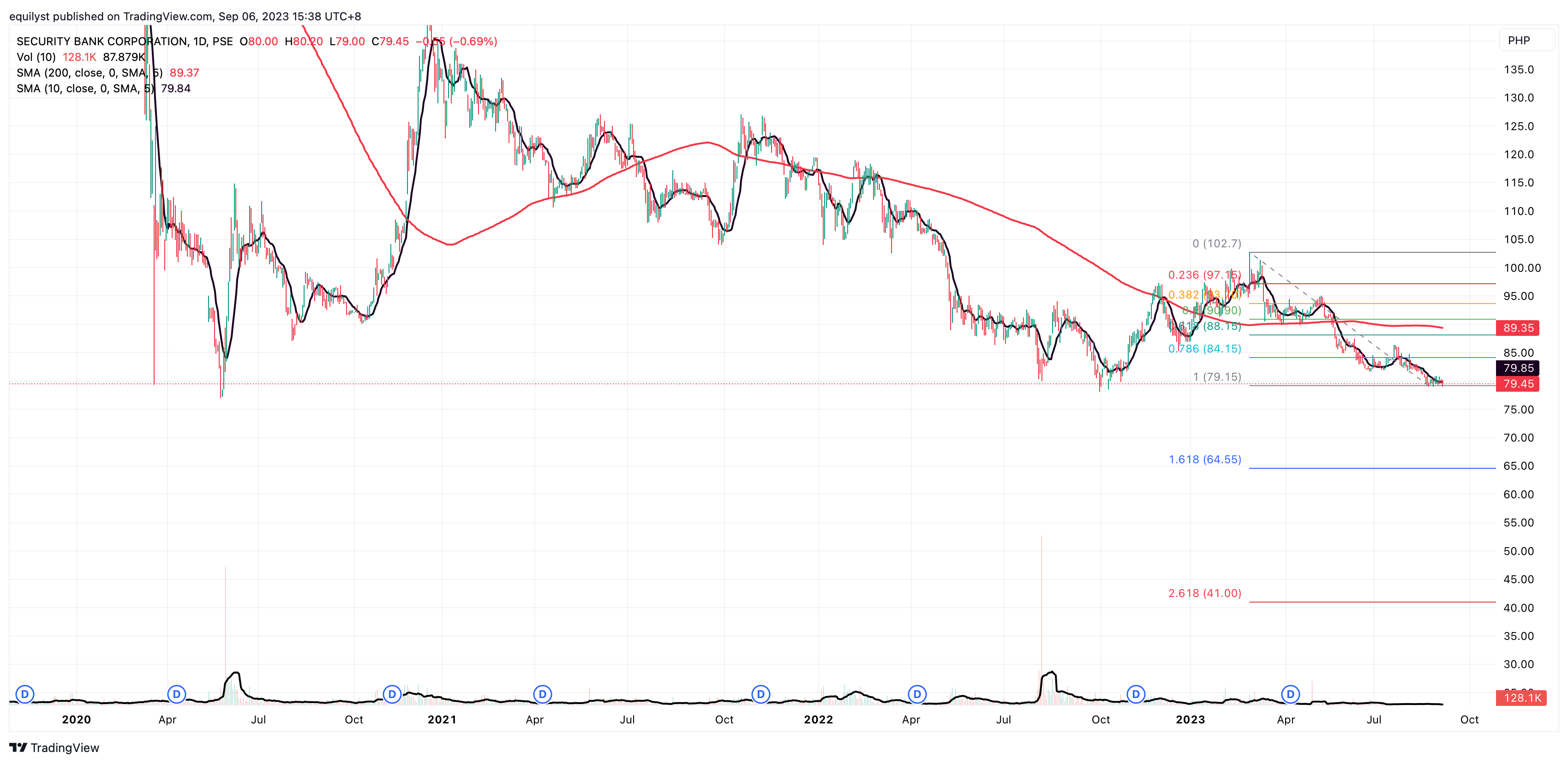

Security Bank (SECB)

Consensus Rating: 4.71

SECB plummets 8.68% from P87.00 on December 22, 2022, to P79.45 on September 6, 2023.

SECB needs to maintain its position above its support at P79.00 to not worsen its bearish price action; otherwise, it’ll retest the support at P64.55. The immediate resistance is at P84.15.

SECB is bearish in the short-term and long-term scales.

How to Trade These Financial Stocks?

The information I’ve shared with you is just a portion of all the data I need to identify confirmed buy signals based on my proprietary stock investing methodology.

I still need to check if the remaining five indicators are bullish for these financial stocks.

If a stock receives a perfect bullish rating for all six indicators, then I can consider one of two actions:

- If I already have a position in the stock and my buying power allows it, I may top up within or near the dominant range.

- If I don’t currently own shares of that stock, I will calculate the reward-to-risk ratio. If I am satisfied with the reward-to-risk ratio, that’s when I will initiate a test-buy within or near the prevailing dominant range.

If you want me to teach you my methodology through a one-on-one mentoring session, avail yourself of my stock investment consultancy service.

Through my stock investment consultancy service, I can teach you how to analyze not only these financial stocks but all stocks listed in the Philippine Stock Exchange.

Don’t Know How to Plot Support and Resistance Levels Yet?

You can use my formula-based Support and Resistance Levels Calculator if you don’t know how to identify these levels yet using horizontal lines or Fibonacci.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025