Financial Performance of Empire East Land Holdings: June 2023 vs. June 2022

Across the half-year span, the combined net earnings totaled P414.2 million, marking a 15.9% uptick from the prior year’s P357.3 million net gain. Consolidated earnings, comprising real estate transactions, financial returns, fees, and sundry income, escalated by 6.1%, moving from P2.4 billion in 2022 to P2.5 billion in 2023.

Real Estate Sales for Empire East Land Holdings registered as P2.1 billion and P2.0 billion for the half-years concluding on 30 June 2023 and 2022 correspondingly. These revenues stemmed from diverse undertakings such as Kasara Urban Resort Residences, San Lorenzo Place, Pioneer Woodlands, Covent Garden, The Paddington Place, The Rochester Garden, Mango Tree Residences, The Sonoma, The Cambridge Village, and Little Baguio Terraces.

In 2023 and 2022, the Cost of Real Estate Sales reached P1.20 million and P1.22 million sequentially, equating to 57.1% and 59.8% of the Real Estate Sales for the respective half-years up to 30 June 2023 and 2022. The shift predominantly resulted from differing product compositions for each term.

Gross Profit reached P902.0 million and P819.0 million in 2023 and 2022 respectively, accounting for 42.9% and 40.2% of Real Estate Sales during the half-year stretches ending on 30 June 2023 and 2022 respectively. The margin of gross profit fluctuates with the blend of products and pricing competitiveness.

Finance Income tallied P197.3 million and P168.1 million during the half-years culminating on 30 June 2023 and 2022 in that order. These sums predominantly stemmed from short-term investments, in-house financing, and diverse advances to affiliated parties, collectively amounting to 7.8% and 7.1% of overall revenues for 2023 and 2022 respectively.

Additional revenue origins included subsidiary commissions, rental income from investment properties, and sundry sources. Commission and sundry income summed to P226.2 million in 2023 and P174.8 million in 2022, forming 9.0% and 7.3% of total revenues for 2023 and 2022 respectively.

Outgoings tied to operations witnessed an uptick, shifting from P508.8 million in 2022 to P576.2 million in 2023. Correspondingly, Finance Costs increased from P172.1 million in 2022 to P197.1 million in 2023.

A sum of P25.0 billion in capital expenditures is earmarked by Empire East Land Holdings over the forthcoming 5 years, with funding anticipated from collections, loans, and other avenues.

Due to the minimal importation of construction materials and the absence of foreign-currency-denominated loans, fluctuations in foreign exchange rates did not adversely impact the financial landscape of the group.

Empire East’s Condo Project Capitalizes on Housing Boom

Empire East Land Holdings Inc., a property developer, announced that the remaining building of its condominium project in Sta. Mesa, Manila, has nearly been completely sold due to a robust uptake in the housing market.

According to Anthony Charlemagne Yu, the President and CEO of EELHI, there has been a significant improvement in sales compared to the period before the pandemic. He explained that this surge can be attributed to pent-up demand following a crisis and a noticeable void in the middle-income market. Yu shared these insights during an informal interview with BusinessMirror subsequent to the topping off ceremony for the Covent Garden North Tower.

He pointed out that previous administrations had not adequately addressed the shortage of mid-level residences in the housing market. Instead, it has been private developers like EELHI that have stepped in to address this gap. As a result, the demand for housing in the Philippines is currently quite robust.

The Covent Garden North Tower, a 30-story structure, showcases 485 units with a variety of options including studio, one-bedroom, two-bedroom, and bi-level units complete with balconies. Yu emphasized the project’s exclusivity due to a limited number of units per floor, only 20 in total. These units cater primarily to the middle-income and affluent markets, with prices ranging from P3.9 million to P20 million each. Notably, the tower offers amenities such as a 22-meter lap pool, a kiddie pool, a function hall, and a gym – all situated on the 5th floor.

Situated along Santol Extension in Sta. Mesa, this dual-tower development prioritizes accessibility, being located in close proximity to transportation lines such as the LRT-2 and the Philippine National Railways. This strategic location ensures easy access to the University Belt and the central business districts of Ortigas and Makati.

Despite a delay in the topping-off ceremony, originally scheduled for March 2021, Yu expressed confidence that the project remains on schedule for completion. The turnover of the North Tower is expected to occur in the first or second quarter of 2024. Meanwhile, the South Tower, which constitutes the project’s initial phase, has already been sold out and is prepared for occupancy.

Yu acknowledged some challenges faced during the pandemic due to lockdown measures. However, now that operations have resumed, he noted that the skilled workforce is back on track and making steady progress.

In addition to the Covent Garden project, EELHI has successfully completed the construction of the 8th tower out of the 37 towers planned for the Empire East Highlands. This expansive project, situated within the company’s 22-hectare property in the Pasig-Cainta area, stands as one of the most significant endeavors undertaken by any developer in the country. Yu mentioned that the company is gearing up to sell its inventory, which includes units from the upcoming 9th tower. He stated that continuous launches of new buildings will be a key focus for the company, demanding a considerable portion of their time due to the sheer number of towers in the pipeline.

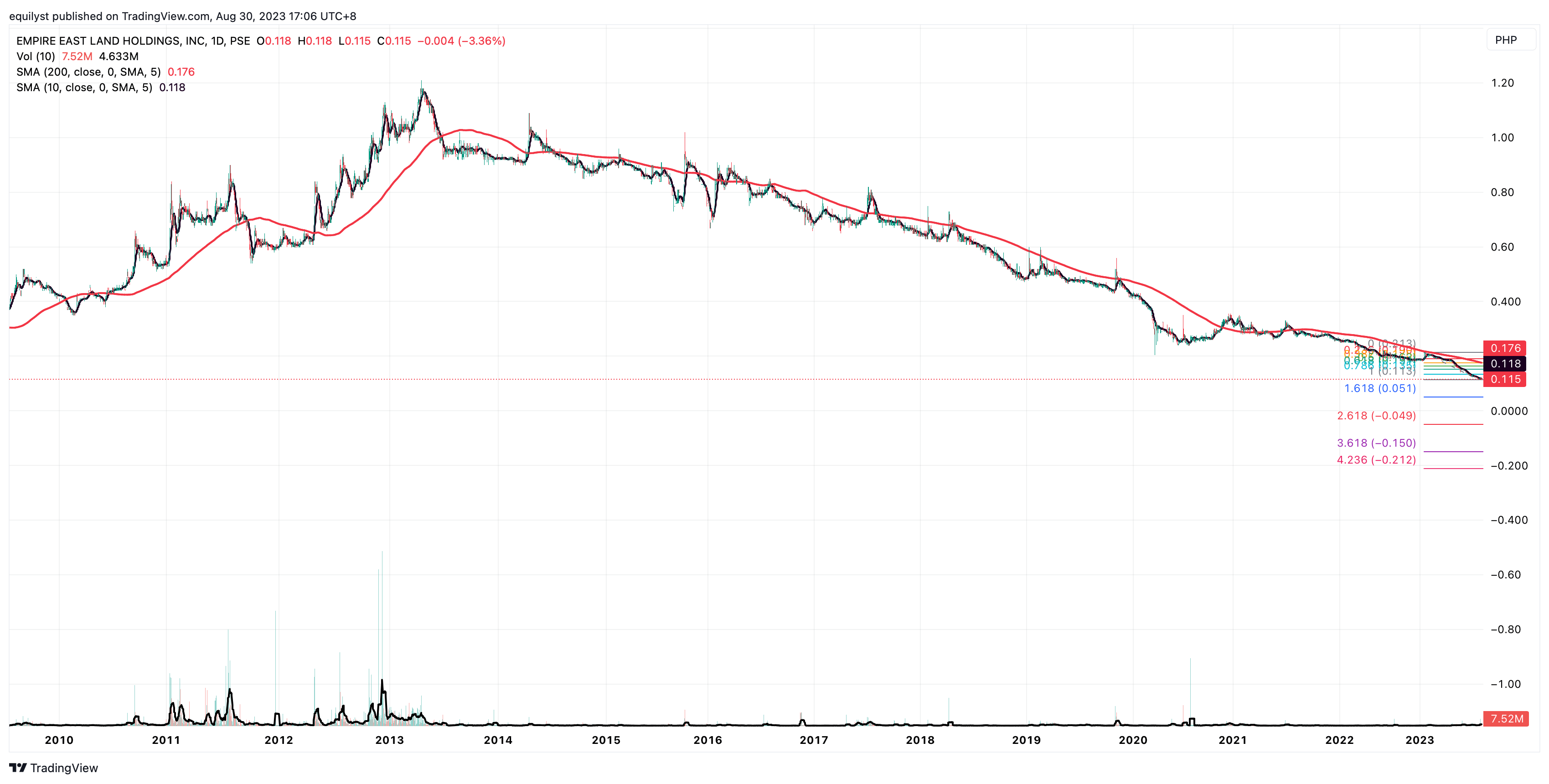

Technical Analysis: Empire East Land Holdings

Empire East Land Holdings has been in the downtrend channel for over 10 years. It closed at P0.115 on August 30, 2023, marking a decrease of 3.36%. This property stock has seen a YTD decline of 38.83%, dropping from P0.188 on December 29, 2022, to P0.115 on August 30, 2023. It has consistently followed a bearish trend, with a 9.45% decrease MTD, falling from P0.127 on July 31, 2023, to P0.115 on August 30, 2023.

For over two years, its short-term moving average (10SMA) has remained consistently below its longer-term moving average (200SMA).

Despite multiple attempts, I couldn’t identify any further historical support levels on Empire East Land Holdings’ chart, regardless of the timeframe (monthly, weekly, or daily) I used.

If the stock breaks below P0.113, it is likely to approach the psychological support at the 61.80% Fibonacci extension of P0.053. On the upside, resistance is observed at P0.135, aligning with the 78.60% Fibonacci retracement.

Over the last three trading days, the daily volume has favored the bears, exceeding 50% of the stock’s 10-day volume average, while the daily change remains negative.

Foreign investors’ participation on this stock is very insignificant. Don’t bother checking.

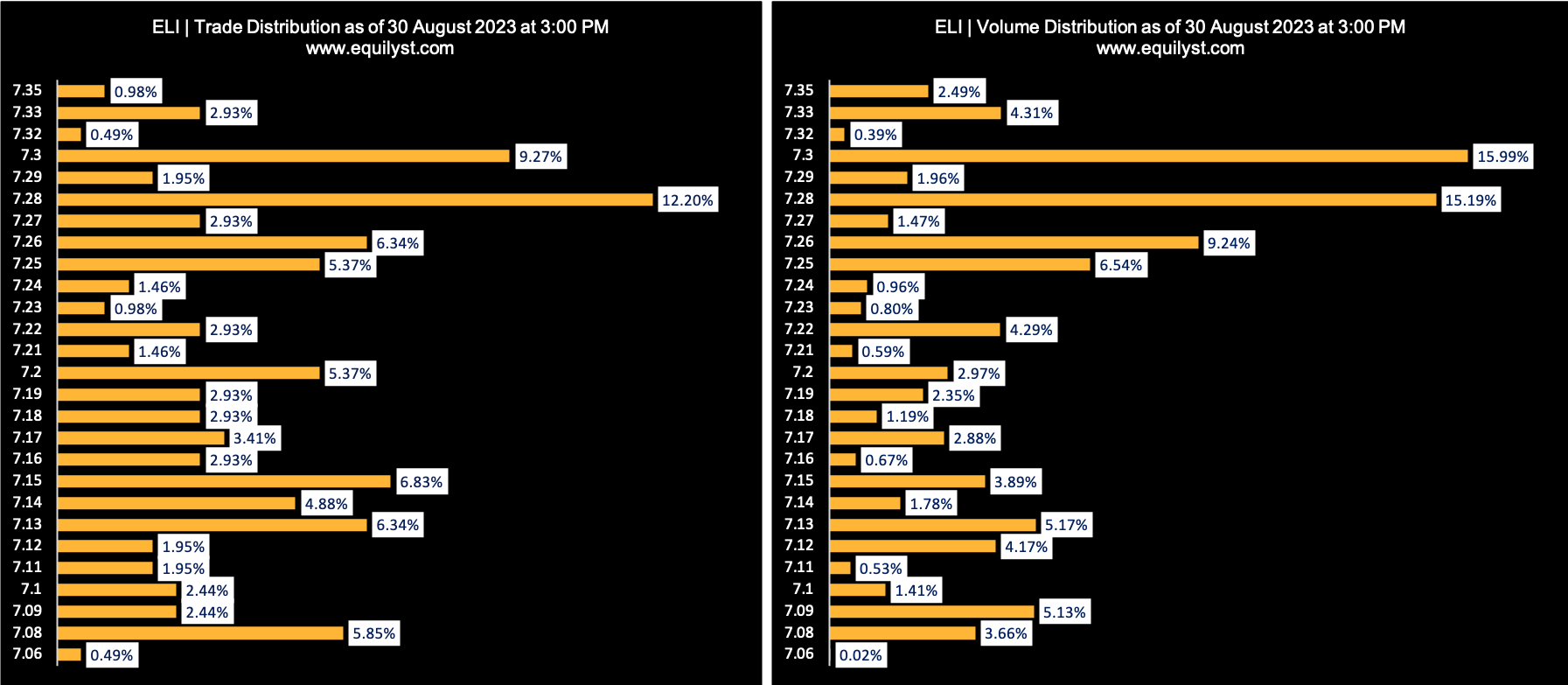

Surprisingly, on August 30, 2023, Empire East Land Holdings managed to close above its volume-weighted average price of P7.23. Its dominant range between P7.28 and P7.30 is closer to the intraday high than the intraday low. As a result, Empire East Land Holdings concluded the day with a bullish Dominant Range Index, indicating that the bulls are still hopeful that the stock won’t drop below P0.113.

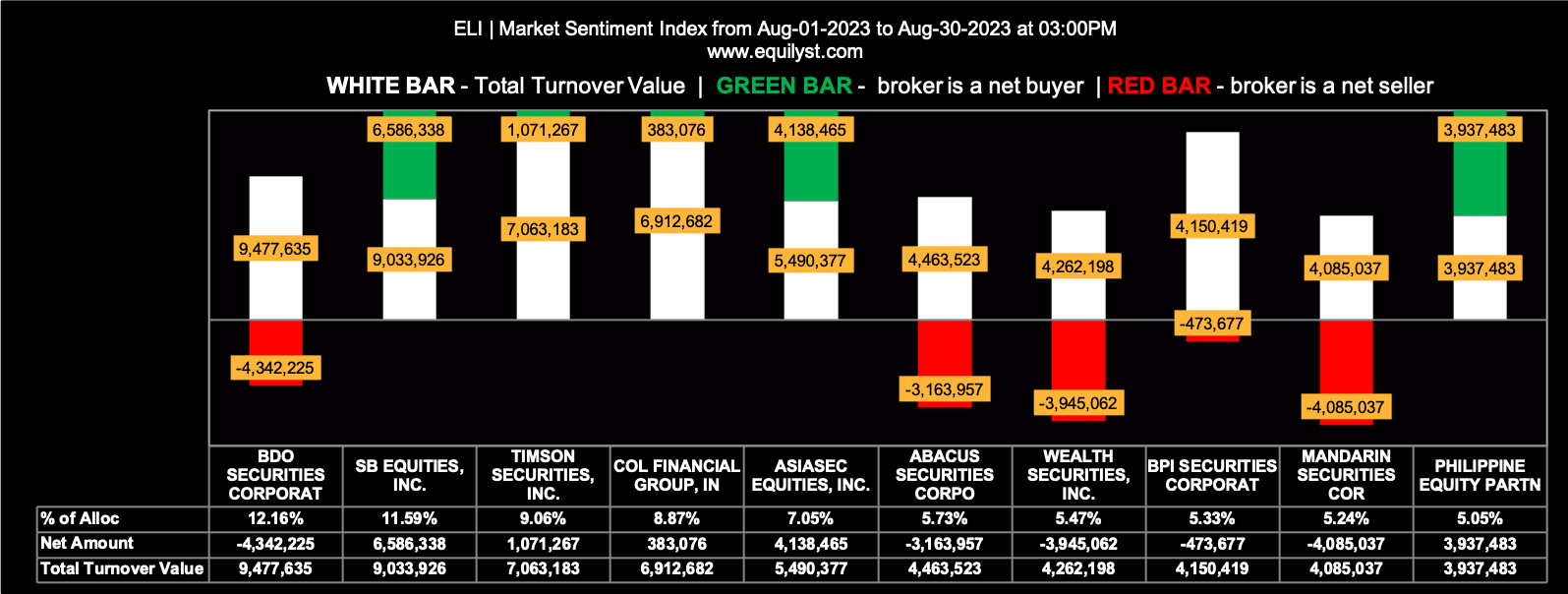

During the period from August 1, 2023, to August 30, 2023, out of the 47 brokers trading Empire East Land Holdings, 19 (40.43%) registered a positive Net Amount. Moreover, 21 out of 47 brokers (44.68%) recorded a higher buying average compared to the selling average. These numbers are in favor of the bulls.

However, the 47 brokers reported a selling average of P7.028, which is higher than their buying average of P6.982. Additionally, 34.04% of participating brokers displayed a 100% selling activity, while the same percentage logged a 100% buying activity. These statistics support the bearish sentiment.

The overall market sentiment for Empire East Land Holdings in August MTD is bearish.

Price Forecast for Empire East Land Holdings: August 31 – September 8

Since the bearish signals outnumber the bullish ones by a significant degree, Empire East Land Holdings is more likely to break below P0.113 within the first week of September 2023.

I do not see any signal to enter on a new position on this stock because the downtrend is still likely to continue. I do not see selling exhaustions yet.

It’s not logical to average down in a stock that’s likely to continue moving southward, most especially if your trailing stop is already hit (which is likely the case in a stock that’s been in a downtrend for more than 10 years).

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025