Analysis of EastWest Bank’s H1 2023 Performance: 70.1% Income Growth

The combined value of the EastWest Bank Group’s consolidated assets was P434.2 billion, an increase of P12.8 billion or 3.0% when compared to P421.4 billion as of December 31, 2022. Notable shifts in the assets include:

- Cash and Other Cash Items dropped by 11.0% to P7.8 billion primarily due to the stabilization of cash in the vault, departing from the customary year-end buildup

- Due from BSP, constituting 6.5% of the total assets, declined from P36.1 billion to P28.1 billion due to reduced required reserves linked to a smaller deposit base

- Due from Other Banks decreased by P1.8 billion from P4.5 billion to P2.7 billion due to diminished nostro placements in foreign currency accounts

- Interbank Loans Receivable and Securities Purchased under Resale Agreements plummeted by 76.3%, falling from P10.0 billion to P2.4 billion

Investment securities, comprising Financial Assets at Fair Value Through Profit or Loss (FVTPL), Financial Assets at Fair Value Through Other Comprehensive Income (FVOCI), and securities at amortized cost, constituted 22.4% and 19.5% of the EastWest Bank Group’s overall assets as of June 30, 2023, and December 31, 2022, respectively, experiencing a rise of P15.2 billion or 18.5%.

This growth resulted from the combined expansion in FVTPL and securities at amortized cost portfolios, along with a reduction in the FVOCI securities portfolio. Securities at amortized cost surged by P11.7 billion, driven particularly by treasury notes and government bonds. FVTPL securities soared by P4.7 billion or 242.1%, reaching P6.7 billion. Conversely, FVOCI securities declined by P1.2 billion due to net maturities during the period.

Loans and Receivables, net of allowances and unearned interest and discounts, saw a 6.0% increase from P258.1 billion to P273.6 billion. Loans and Receivables constituted 63.0% of the consolidated assets. Consumer loans expanded across all products.

Consumer loans jumped by 10.8%, reaching P212.8 billion, driven primarily by auto loans, credit cards, and salary loans. In contrast, Corporate Banking experienced a decline of 9.4%, settling at P62.3 billion.

Investments in a joint venture escalated by P259.9 million from P929.0 million to P1.2 billion due to additional capital infusion and the recognition of EastWest’s share in the net performance of East West Ageas Life Insurance Corporation (“EWAL”), a joint venture between EW and EWAL. As of June 30, 2023, the Bank’s ownership interest in EWAL was at 50.0%.

Other assets swelled by 6.6%, a P230.7 million increase from P3.5 billion to P3.7 billion, primarily attributed to prepayments in deposit insurance and system maintenance.

As of June 30, 2023, the Group’s total consolidated liabilities amounted to P370.2 billion, marking a rise of P9.9 billion or 2.7% compared to the December 31, 2022 balances. Noteworthy shifts in liabilities include:

Deposit liabilities constituted 90.5% and 91.3% of the consolidated total liabilities as of June 30, 2023, and December 31, 2022, respectively. Among these, Demand and Savings deposits constituted 81.3% and 79.3% of the Group’s total deposits, respectively. The growth in dollar deposits stemmed from an increase in volume and foreign exchange revaluation.

Bills and acceptance payables surged by 130.7% to P15.6 billion, driven mainly by heightened repo borrowing volume.

Accrued taxes, interest, and other expenses rose by 19.8% to P688.1 million, primarily due to the accrual of bonuses and merit increases for the year.

Bonds payable comprised a 4.50% fixed-rate bonds with an issue price of 100.00% face value. If not previously redeemed, the Bonds would be repayable to the Bond Holders at 100.00% of their face value on the maturity date or February 21, 2023. It matured on February 21, 2023, with a face value of P3.70 billion and a carrying value of P3.70 billion as of December 31, 2022, and nil as of June 30, 2023.

Cashier’s and Manager’s Checks decreased by 46.9%, or P647.6 million, from P1.4 billion to P733.9 million, due to fewer outstanding issued checks.

Income tax payable amounted to P379.8 million as of June 30, 2023, reflecting accrual for the current quarter, due for remittance to BIR in the subsequent month.

Other liabilities declined by 12.3%, a P1.4 billion decrease from P11.4 billion to P9.9 billion, primarily resulting from cleared Manager’s Checks issued last quarter related to consumer loan releases by P1.0 billion.

Total equity reached P63.9 billion, an increase of P2.9 billion from the December 31, 2022, level of P61.0 billion. This increase was attributed to the net income for the six months ended June 30, 2023, totaling P3.3 billion, improvements in fair value reserves on FVOCI by P462.5 million, and cumulative translation adjustment by P53.5 million. This growth was offset by dividends paid amounting to P922.5 million.

Eastwest Bank declared and disbursed cash dividends amounting to P922.5 million, equivalent to P0.41 per share, announced on April 24, 2023, and paid on May 31, 2023, to all stockholders of record as of May 12, 2023.

Discussion of Results of Operations

For the quarter concluded June 30, 2023 (Unaudited) and quarter concluded June 30, 2022 (Unaudited)

The Group achieved a consolidated net income after taxes of P1.7 billion for the quarter ended June 30, 2023, marking a 70.1% increase of P710.3 million from the P1.0 billion reported during the corresponding period last year.

Interest income surged by P2.1 billion or 33.2%, primarily due to heightened interest income on loans and receivables by P1.9 billion, followed by interest income on FVOCI and investment securities at amortized cost by P258.7 million, offset by a decline in interest income on deposits with banks and others by P0.22 million.

Conversely, interest expense grew from interest expense on deposit liabilities by P849.8 million and interest expense on other borrowings by P143.6 million, both stemming from increased volume and a higher funding cost for the period. Nevertheless, net interest income improved by P1.1 billion or 18.8%.

Non-interest income grew by 63.0% or P611.7 million, from P971.6 million to P1.6 billion, mainly due to higher service fees and commission income, trading securities gains, and gains from the sale of foreclosed assets.

EastWest’s Service Fees and Commission Income escalated to P1.1 billion, a 69.4% rise from the P639.3 million recorded last year, attributed to increased loan-related fees and charges.

Foreign exchange gain dropped by 34.2% or P102.8 million, from P300.8 million to P198.0 million, due to diminished income on FX derivative transactions resulting from decreased volume, including revaluation gains on the Bank’s open FX position. Meanwhile, the Group registered a trading loss of (P0.5) million as of June 30, 2023, from mark-to-market losses on FVTPL.

EastWest Bank achieved a net gain on foreclosure and the sale of assets amounting to P95.4 million for the period concluded June 30, 2023, in contrast to a net loss of (P23.2) million for the period ended June 30, 2022.

Operating expenses, excluding provisions for impairment and credit losses, grew by 13.1%, from P4.2 billion to P4.8 billion, primarily driven by IT, manpower, and business-related expenses.

Compensation and Fringe Benefits totaled P1.8 billion, compensating for inflation-driven normal annual payroll increases.

Taxes and Licenses rose by P149.2 million or 32.8%, from P455.1 million to P604.3 million, due to increased gross receipts tax (GRT) and documentary stamp tax (DST) stemming from amplified volume in both loans and deposits. Meanwhile, software costs’ amortization concluded at P49.9 million, up from P42.8 million last year. Rent expense reached P82.7 million. Miscellaneous Expenses grew by P209.8 million to P1.9 billion, in comparison to P1.7 billion during the same period last year.

For the period ended June 30, 2023, the Group set aside P1.5 billion in provisions for impairment and credit losses, a P449.0 million increase compared to the previous year, due to loan portfolio expansion.

For the six months concluded June 30, 2023 (Unaudited) and June 30, 2022 (Unaudited)

The EastWest Bank Group achieved a consolidated net income after taxes of P3.3 billion for the six months ended June 30, 2023, more than doubling the P1.52 billion reported during the corresponding period last year.

Interest income grew by P3.9 billion or 32.1%, primarily attributed to increased interest income on loans and receivables by P3.3 billion, followed by interest income on FVOCI and investment securities at amortized cost by P632.1 million, offset by a decline in interest income on deposits with banks and others by P0.32 million.

Conversely, interest expense surged from interest expense on deposit liabilities by P1.7 billion and interest expense on other borrowings by P146.7 million, both due to heightened volume and a higher cost of funding for the period. Nonetheless, net interest income improved by P2.0 billion or by 18.1%.

Non-interest income grew by 109.2% or P1.7 billion, from P1.6 billion to P3.3 billion, mainly due to increased service fees and commission income, trading securities gains, and gains from the sale of foreclosed assets.

Service Fees and Commission Income escalated to P2.3 billion, marking a 70.4% rise from the P1.3 billion recorded last year, attributed to higher loan-related fees and charges.

Foreign exchange gain was lower by 10.8%, or P35.9 million, from P333.0 million to P297.1 million. Meanwhile, the Group registered P106.4 million in trading gains as of June 30, 2023, from mark-to-market gains on FVTPL.

The Group achieved a net gain on foreclosure and the sale of assets amounting to P227.6 million for the period concluded June 30, 2023, in contrast to a net loss of (P146.3) million for the period ended June 30, 2022.

Miscellaneous income decreased by 21.7% or P90.7 million, from P417.3 million to P326.5 million, due to lower recoveries from written-off assets.

Operating expenses, excluding provisions for impairment and credit losses, grew by 15.5%, from P8.2 billion to P9.5 billion, primarily driven by IT, manpower, and business-related expenses.

Compensation and Fringe Benefits totaled P3.5 billion, compensating for inflation-driven normal annual payroll increases.

Taxes and Licenses rose by P286.0 million or 31.9%, from P896.9 million to P1.2 billion, due to heightened GRT and DST, driven by increased volume in both loans and deposits. Meanwhile, software costs’ amortization concluded at P100.0 million, up from P82.0 million last year. Rent expense reached P170.9 million. Miscellaneous Expenses grew by P718.1 million to P3.9 billion, in comparison to P3.2 billion during the same period last year.

For the period ended June 30, 2023, the Group set aside P2.9 billion in provisions for impairment and credit losses, a P794.9 million increase compared to the previous year, due to loan portfolio expansion.

Eastwest Bank also reported a share in net income from its investment in East West Ageas Life Insurance Corporation (“EWAL”), amounting to a net income of P28.8 million, in contrast to a net loss of P95.0 million.

As of June 30, 2023, EastWest Bank operated a total of 392 stores, with 213 of them located in Metro Manila. For the rest of the country, the bank maintained 100 stores in other parts of Luzon, 40 branches in Visayas, and 39 stores in Mindanao. The bank’s ATM network comprised 581 ATMs in total, composed of 475 on-site ATMs and 106 off-site ATMs. The total headcount of EastWest stood at 6,115.

The bank’s subsidiaries operated a combined total of 77 stores with 1,469 officers/staff, bringing the group’s store network total to 469 with 581 ATMs and a combined workforce of 7,584.

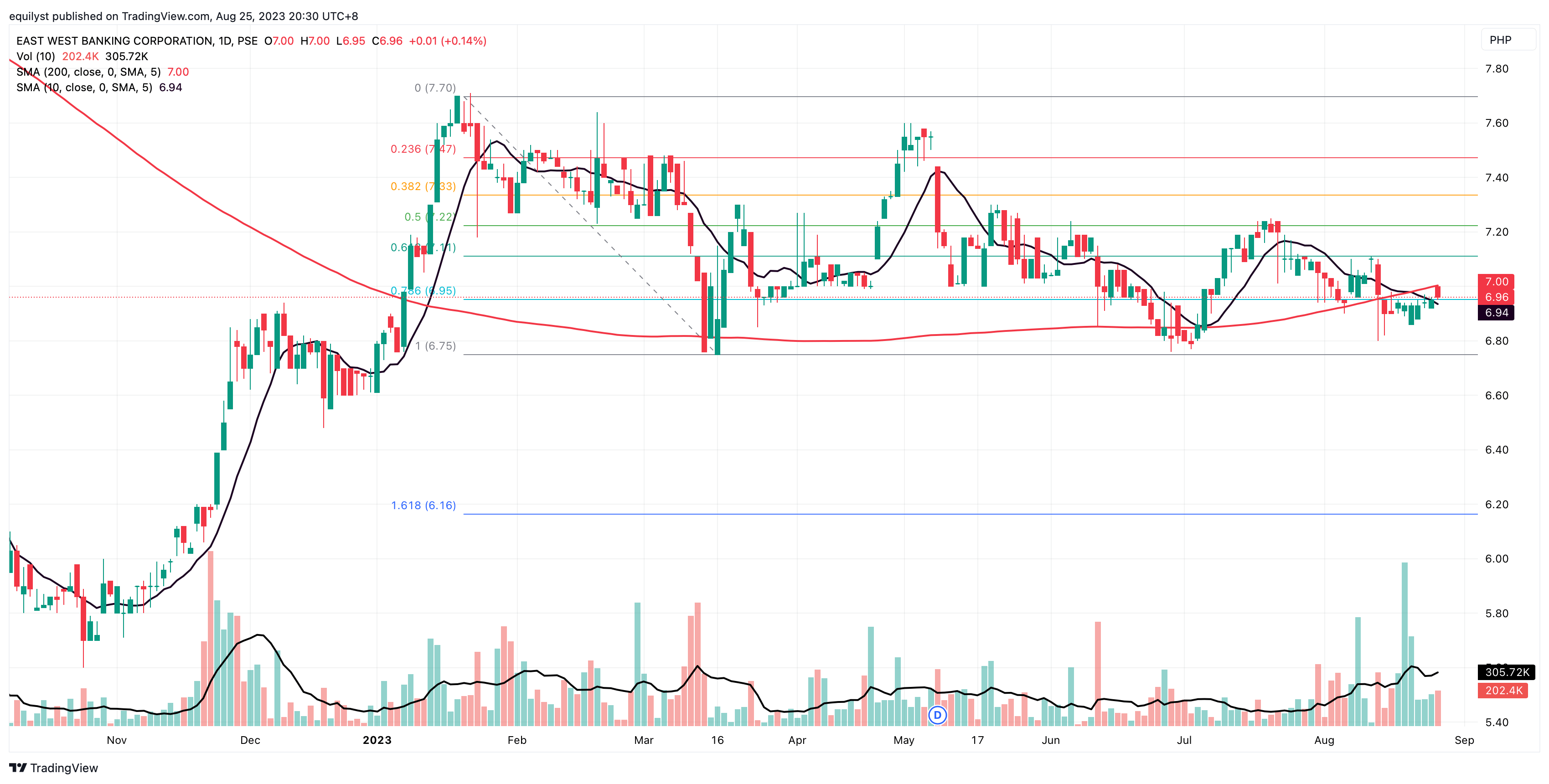

EastWest Bank Technical Analysis: Could It Get More Bearish Than This?

EastWest Bank (EW) matched its 70.1% net income growth YoY for H1 2023 with a 2.25% positive change in its share price during the same period, rising from P6.67 on December 20, 2022, to P6.82 on June 30, 2023.

Its YTD price change is more impressive at 4.35%, moving from P6.67 on December 29, 2022, to P6.96 on August 25, 2023. However, EastWest Bank’s MTD price change is a decline of 1.28%, dropping from P7.05 on July 31 to P6.96 on August 25.

EastWest Bank closed the trading week of August 22 to 25 positively, with a 0.43% increase from P6.93 on August 18 to P6.96 on August 25.

Meanwhile, EastWest Bank is on the brink of touching its support level at P6.95, aligned with the 78.6% Fibonacci retracement. The secondary support stands at P6.75, representing a 2.88% reduction from its primary support level.

The primary resistance for the banking stock is at P7.11, in alignment with its 61.8% Fibonacci retracement.

EastWest Bank concluded the last trading day of the week with a bearish volume, at 66% of its 10-day volume average. This suggests the potential for touching or even breaking below the support level within the final trading days of August.

Although EastWest Bank’s 10SMA still remains above the 200SMA, the last price has already fallen below the former.

Foreign investors continue to be involved with EastWest Bank, but their net participation isn’t significant enough to mention. Throughout 2023, there hasn’t been a month where the net foreign amount exceeded P200,000, whether positive or negative. Therefore, there’s no need to search for such instances.

Meanwhile, EastWest Bank’s volume-weighted average price (VWAP) as of the closing on August 25 aligns with its current price, indicating a bearish trend. For those anticipating a price increase, it’s ideal for the current price to exceed the VWAP.

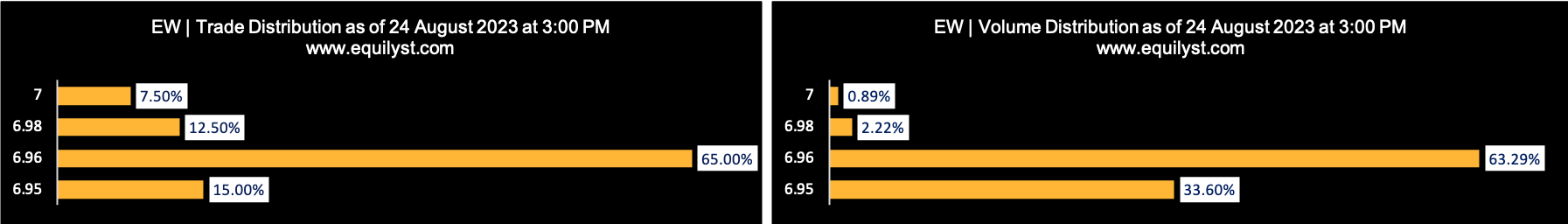

In my Dominant Range Index chart, it’s evident that the P6.95-P6.96 dominant range is closer to the intraday low than the intraday high, which favors the bears.

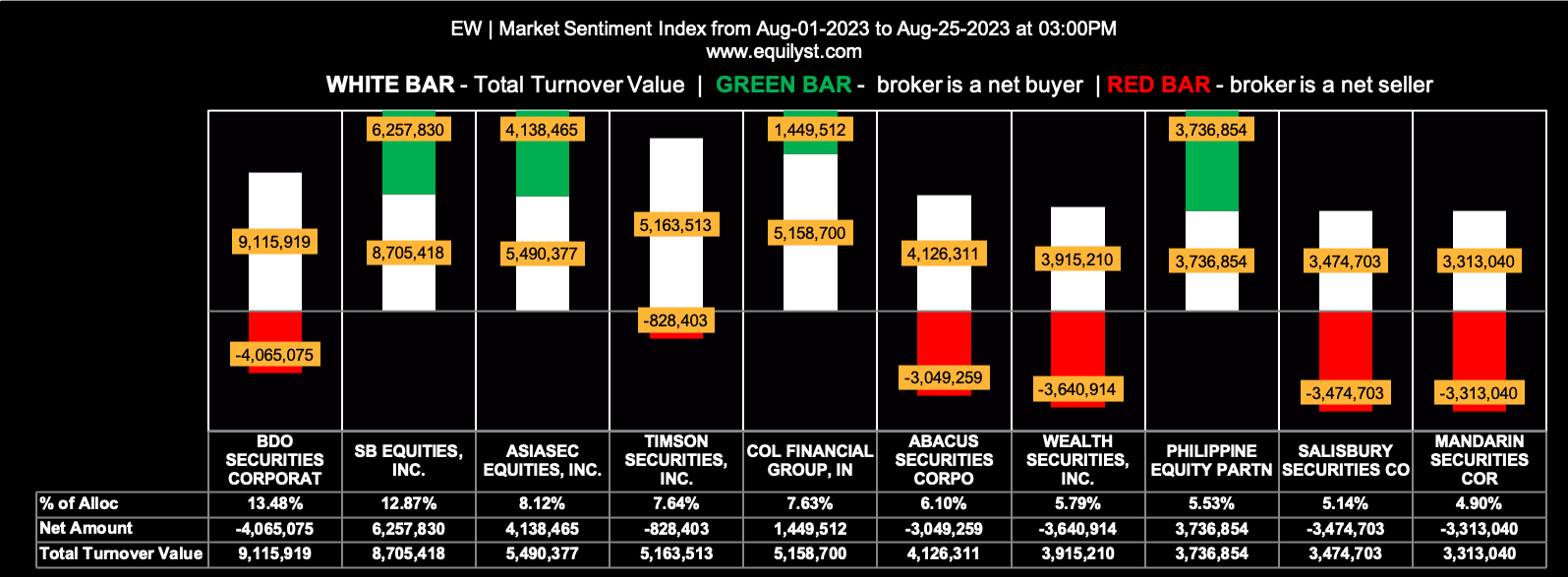

The MTD (Aug 1 to 25) Market Sentiment Index is bullish for EastWest Bank. However, as the author of this proprietary indicator, I’m aware that this rating is on the verge of shifting to a bearish state. Caution is advised!

23 of the 46 participating brokers, or 50.00% of all participants, registered a positive Net Amount

27 of the 46 participating brokers, or 58.70% of all participants, registered a higher Buying Average than Selling Average

46 Participating Brokers’ Buying Average: ₱6.96063

46 Participating Brokers’ Selling Average: ₱6.95500

17 out of 46 participants, or 36.96% of all participants, registered a 100% BUYING activity

15 out of 46 participants, or 32.61% of all participants, registered a 100% SELLING activity

Overall Sentiment and Price Forecast for EastWent Bank

My overall assessment of EastWest Bank is neutral, with a bearish bias. I am not fully bearish on this stock yet, as there is still a chance for it to hold support at P6.95.

Is there historical evidence of support at P6.95 in the past?

Take another look at the price chart above and observe what transpired from the last week of March to June.

However, if the price drops below P6.95 next week, it would be prudent to monitor whether EastWest Bank will reach down to P6.75.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025