To begin with, I want to be crystal-clear that this is NOT a stock recommendation. I am sharing my analysis with you, for free, to give you an example of how to be a data-driven stock trader or investor.

If you need me to send you an in-depth analysis with recommendations tailored to fit your entry price, average cost, risk tolerance percentage, and other matters pertinent to buying or selling the stock, you may subscribe to the PLATINUM package of the stock and crypto market consultancy service of Equilyst Analytics. You will get 10 stock or crypto analysis credits. Visit the home page to learn more about the PLATINUM package and the sample report.

If you want to know how to analyze coins or stocks as I do, subscribe to the TITANIUM package of Equilyst Analytics. You and I will have a one-on-one online training session via Zoom. You choose if you want to learn how I analyze Philippine stocks, US stocks, or cryptocurrencies. Go to the home page to know more about the TITANIUM package.

Inside Scoop on DoubleDragon Corporation (PSE:DD)

During the previous fiscal year, DoubleDragon Corp. (PSE:DD), the investment holding firm owned by tycoon Edgar “Injap” Sia II, disclosed a consolidated net income of P12.92 billion, signifying a 14.56 percent upswing compared to the preceding year.

According to Chairman Sia, the real estate industry experiences alternating trends, with a lessees’ market prevailing during economic crises and a lessors’ market flourishing during prosperous periods.

Over time, tenant profiles have also transformed. Sia asserts that the enduring value for shareholders lies in their perpetual ownership of valuable titled land and high-quality buildings within the complex.

DoubleDragon’s growth strategy rests upon four pillars: office leasing, provincial retail leasing, industrial leasing, and hospitality.

The provincial leasing portfolio includes City Malls in central areas of provincial cities. In terms of office buildings, DoubleDragon boasts notable structures like the 42-story Jollibee Tower in Ortigas CBD, the DD Meridian Park complex in the Bay Area, The Skysuites Corporate Tower in QC, and soon, the Robinsons DoubleDragon Square Building in Bridgetowne Libis.

Furthermore, DoubleDragon plans to expand its hospitality business, represented by Hotel 101.

The company’s CentralHub chain is composed of industrial warehouse complexes.

DoubleDragon aspires to establish its subsidiary, Hotel101 Global Pte Ltd, as a leading force in the global hotel industry.

They envision operating in over 101 countries, with a vast portfolio of 500,000 standardized Hotel101 rooms by 2040.

Sia emphasizes that DoubleDragon stands out among Philippine companies due to its successful development and prototyping of a distinctive hotel business model applicable in over 100 countries worldwide.

Drawing attention to their accomplishment, Hannah Yulo-Luccini, DoubleDragon’s Chief Investment Officer, underscores the diligent accumulation of a portfolio comprising valuable titled hard assets.

This achievement has propelled DoubleDragon’s total assets beyond $2.8 billion, securing its position as one of the Philippines’ top 10 largest property companies.

Meanwhile, MerryMart Consumer Corp., Sia’s grocery chain, witnessed an extraordinary surge of 846.47 percent in net income, reaching P321.78 million in the previous year.

MerryMart exceeded its initial revenue target of P5 billion for 2022, reaching P6.72 billion.

Sia expresses the company’s next significant objective of reaching a revenue milestone of P12 billion as swiftly as possible.

Moreover, they anticipate a rapid acceleration in revenue growth as they strive to achieve their ambitious target of P120 billion by 2030.

Cracking the Stock Chart of DoubleDragon Corporation (PSE:DD)

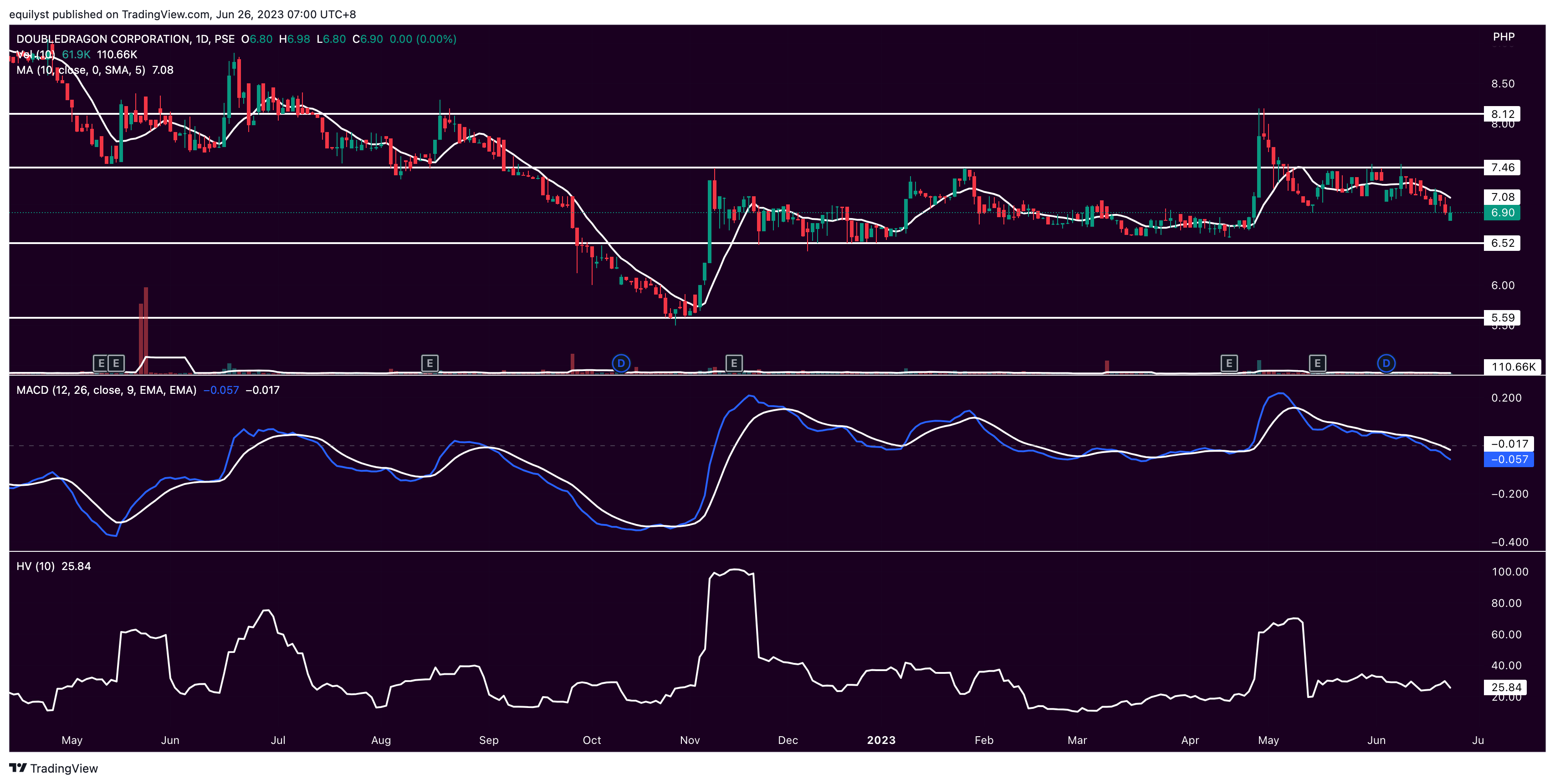

DoubleDragon Corporation (PSE:DD) closed on Friday, June 23, 2023, at P6.90 per share, unchanged from its previous closing price but up by 2.69% year-to-date.

Despite the year-to-date growth in its share price, PSE:DD has been trading below its 10-day simple moving average (SMA) for 10 consecutive trading days.

The volume last Friday was higher than 50% of PSE:DD’s 10-day volume average, but it needs to register volume higher than 100% of its 10-day volume average to increase the gap between the current price and its immediate support.

The immediate support is spotted near P6.50, while the immediate resistance is at P7.45.

It’s all the more that PSE:DD must print bullish-er volume because its moving average convergence divergence (MACD) has yet to show a sign of a bullish reversal.

MACD’s nose is still pointing in the southeast direction.

We might see the MACD line bend toward the northeast once the price breaks above the 10-day SMA.

PSE:DD remains a newbie-friendly stock risk level-wise since its 10-day historical volatility score is below 50%. This happens due to the absence of significant engulfing candlesticks and price gaps within the past 10 trading days.

Trade-Volume Distribution Analysis

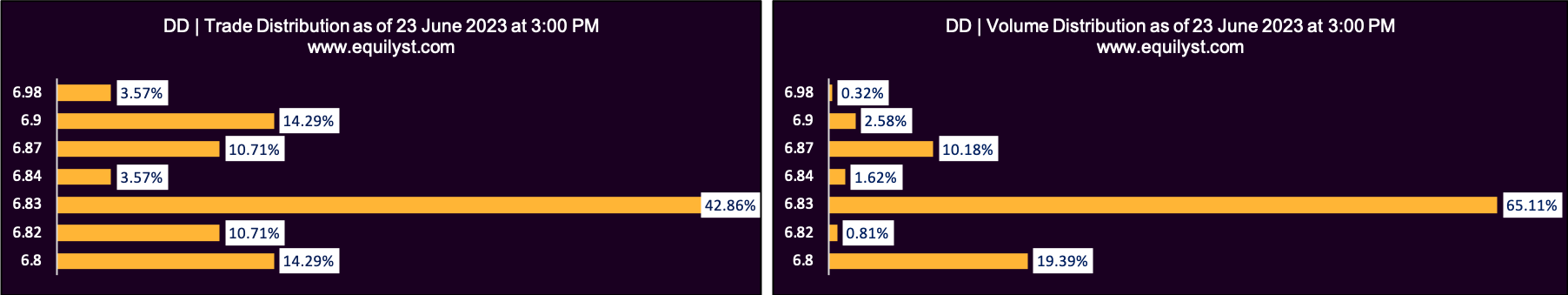

Dominant Range Index: BEARISH

Last Price: 6.9

VWAP: 6.83

Dominant Range: 6.83 – 6.83

Even though the last price of P6.90 is higher than PSE:DD’s volume-weighted average price (VWAP) of P6.83, the price with the biggest volume and highest number of trades is closer to the intraday high than the intraday low.

That’s a clear tell-tale sign about the weak appetite to push the price to a higher level.

Monitor the price at P6.83 on Monday. If the price opens below P6.83, that’s another point for the bears.

If you’re a PLATINUM client of Equilyst Analytics, you may use one of your analysis credits to request PSE:DD’s trade-volume distribution chart and Dominant Range Index rating via email (as trading happens). We will promptly respond since we monitor requests closely as trading happens.

Market Sentiment Analysis

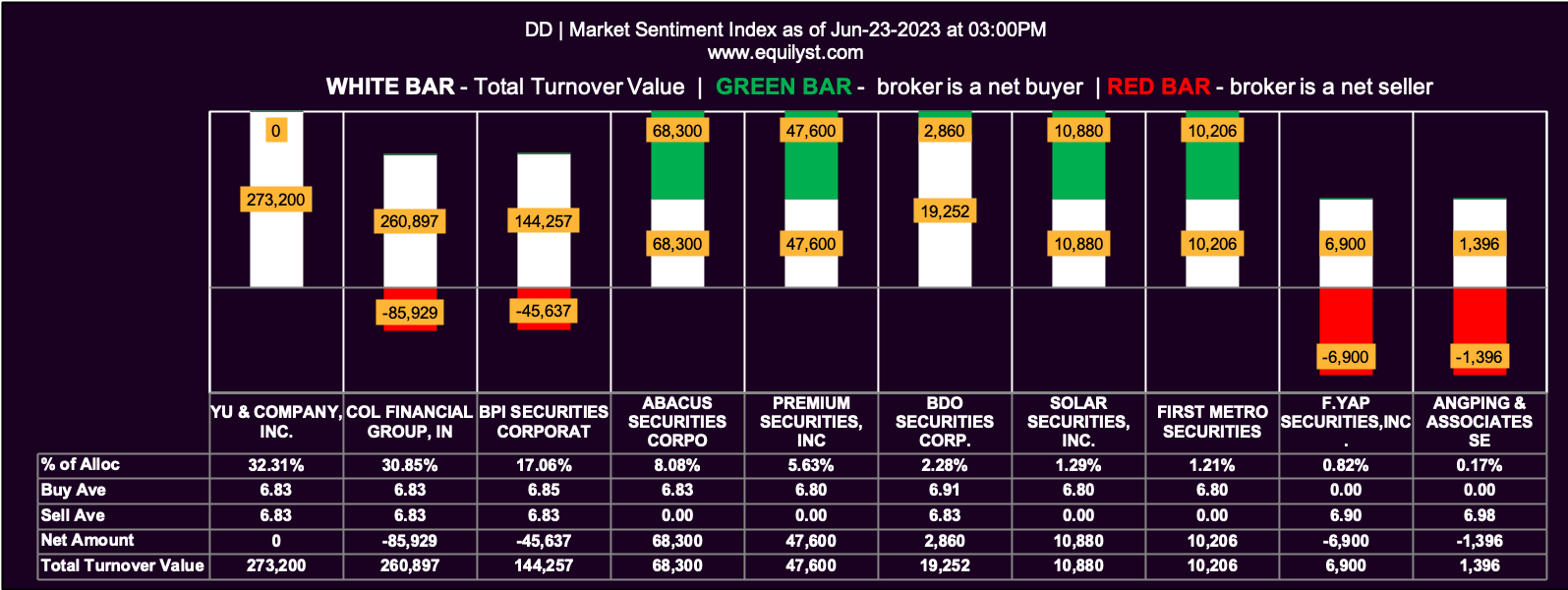

Market Sentiment Index: BULLISH

6 of the 12 participating brokers, or 50.00% of all participants, registered a positive Net Amount

8 of the 12 participating brokers, or 66.67% of all participants, registered a higher Buying Average than Selling Average

12 Participating Brokers’ Buying Average: ₱6.83970

12 Participating Brokers’ Selling Average: ₱6.85971

5 out of 12 participants, or 41.67% of all participants, registered a 100% BUYING activity

3 out of 12 participants, or 25.00% of all participants, registered a 100% SELLING activity

This bullish Market Sentiment Index rating for PSE:DD isn’t enough to outpower all the bearish signals I’ve spotted.

Besides, there were only 12 trading participants last Friday for this stock.

Did you see the total turnover value of the top 1 stock on the Market Sentiment Index’s chart?

PSE:DD needs to exhibit significant volume to strengthen its upward momentum.

Otherwise, we will continue to see this stock trade between P6.50 and P7.50, as it has almost been doing since November 2022.

While it’s true that it entered the P7.50-P8.10 territory during the last trading days and first few trading days of April and May, PSE:DD fell back to the P6.50-P7.50 range after six trading days.

If you’re a PLATINUM client, email your analysis request to us so we can tell you the month-to-date Market Sentiment Index rating for PSE:DD.

We’ll also give you our personalized recommendation relative to your entry price, average cost, and risk tolerance percentage.

Does PSE:DD Have a Signal for Monday’s Trading?

PSE:DD fails to secure a confirmed buy signal according to my Evergreen Strategy, a proprietary methodology when trading and investing in the Philippine stock market.

If you already have PSE:DD in your portfolio with an intact trailing stop, you can take the bullish Market Sentiment Index last Friday as a data-driven reason to hold your position.

However, I do not recommend topping up because the price might retest the support at P6.50 if the stock displays a lackluster volume.

Having less than 20 trading participants is okay if the overall turnover value is significant to break 100% of the stock’s 10-day volume average.

If you don’t have PSE:DD in your portfolio, I recommend entering a new position later.

Once my Evergreen Strategy confirms a buy signal, you must first calculate your initial trailing stop and reward-to-risk ratio.

If you’re satisfied with the ratio, that’s when you buy within or near the prevailing dominant price or range.

The key to understanding my Evergreen Strategy is attending my Masterclass on the Evergreen Strategy When Trading and Investing in the Philippine Stock Market.

Please register for our Titanium package for one-on-one online Zoom training with me.

Visit our home page to learn how to become a TITANIUM, PLATINUM, or GOLD client of Equilyst Analytics. You may also send us a message through our CONTACT page.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025