Only 6 out of 30 Philippine bluechips registered a positive net foreign amount over P10 million as of closing of trading on September 11, 2023.

In this report, I’ll show you those six stocks, together with their dominant prices.

The dominant price is a price range with the biggest volume and highest number of trades.

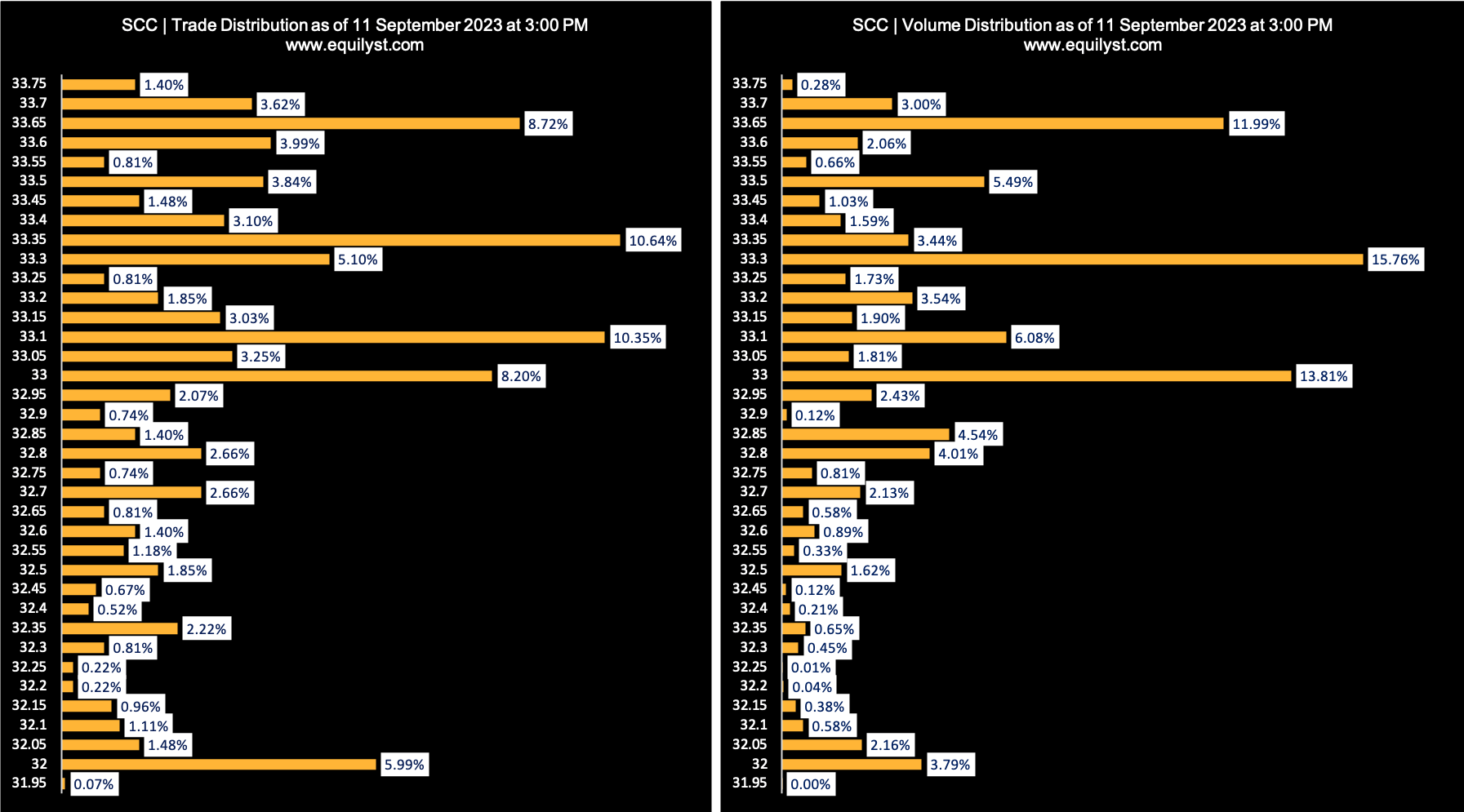

Semirara Mining and Power Corporation (SCC)

Net Foreign: P37,916,620

Dominant Range Index: BULLISH

Last Price: 33.65

VWAP: 33.12

Dominant Range: 33.00 – 33.35

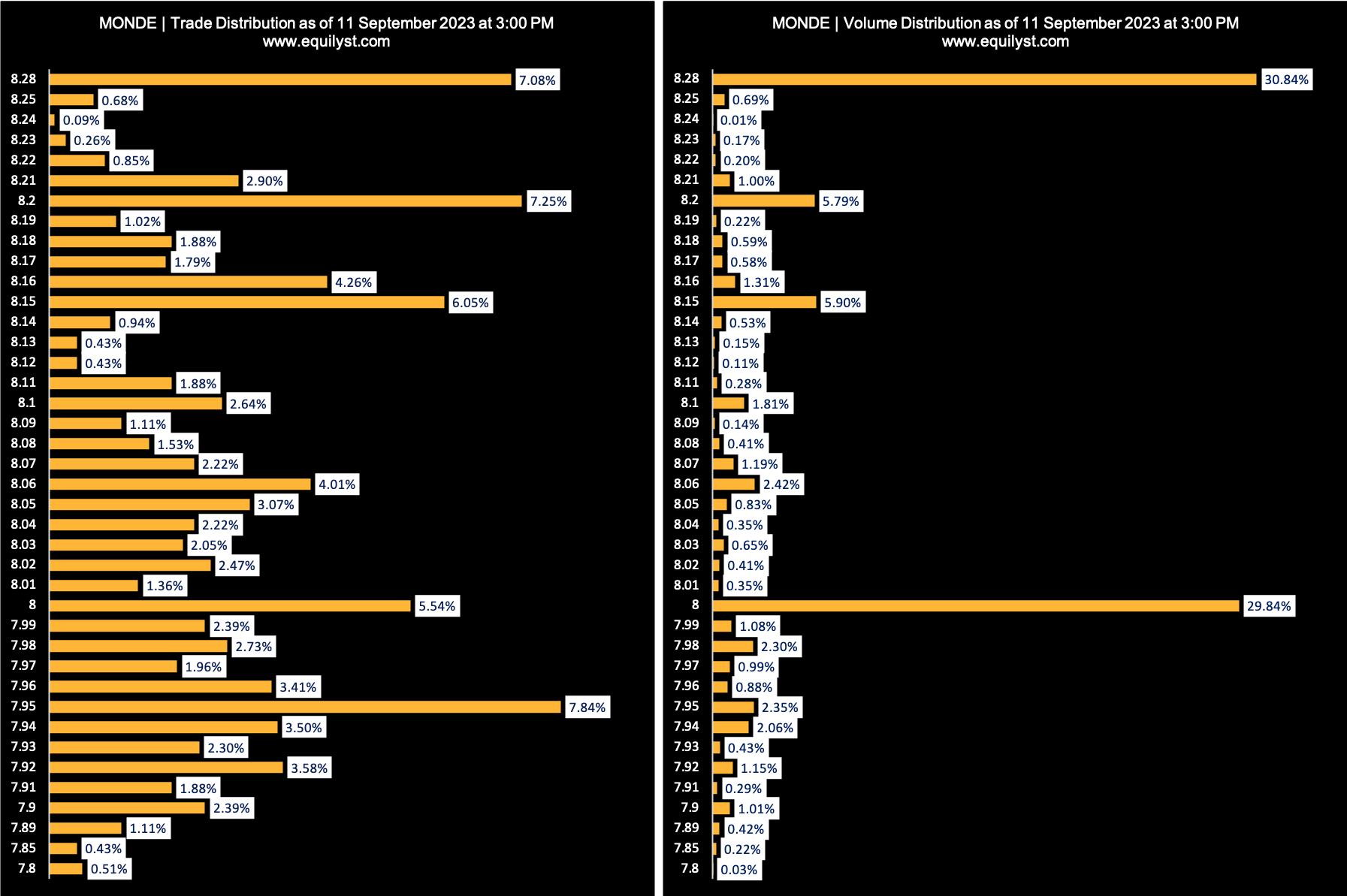

Monde Nissin Corporation (MONDE)

Net Foreign: P20,161,880

Dominant Range Index: BULLISH

Last Price: 8.28

VWAP: 8.12

Dominant Range: 8.15 – 8.28

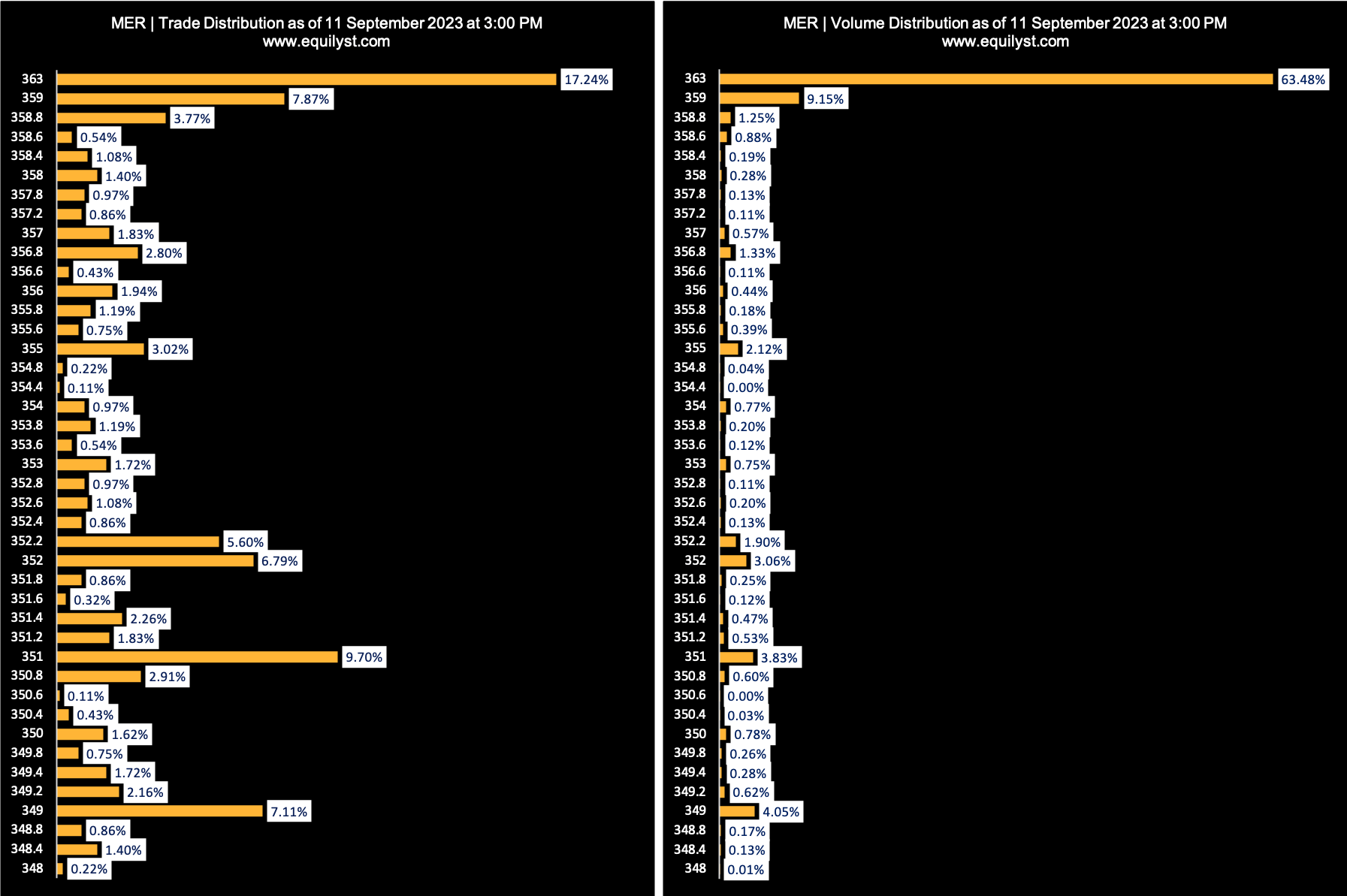

Manila Electric Company (MER)

Net Foreign: P17,182,134

Dominant Range Index: BULLISH

Last Price: 363.00

VWAP: 359.81

Dominant Range: 359.00 – 363.00

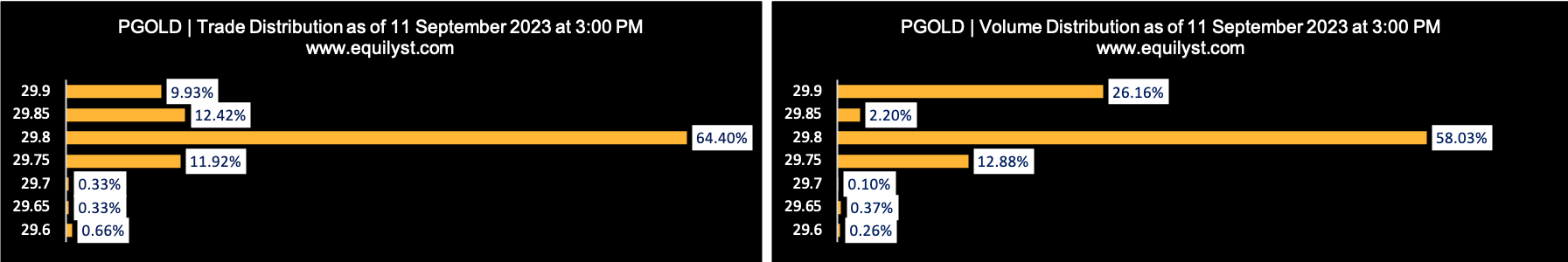

Puregold Price Club (PGOLD)

Net Foreign: P15,109,110

Dominant Range Index: BULLISH

Last Price: 29.90

VWAP: 29.82

Dominant Range: 29.75 – 29.80

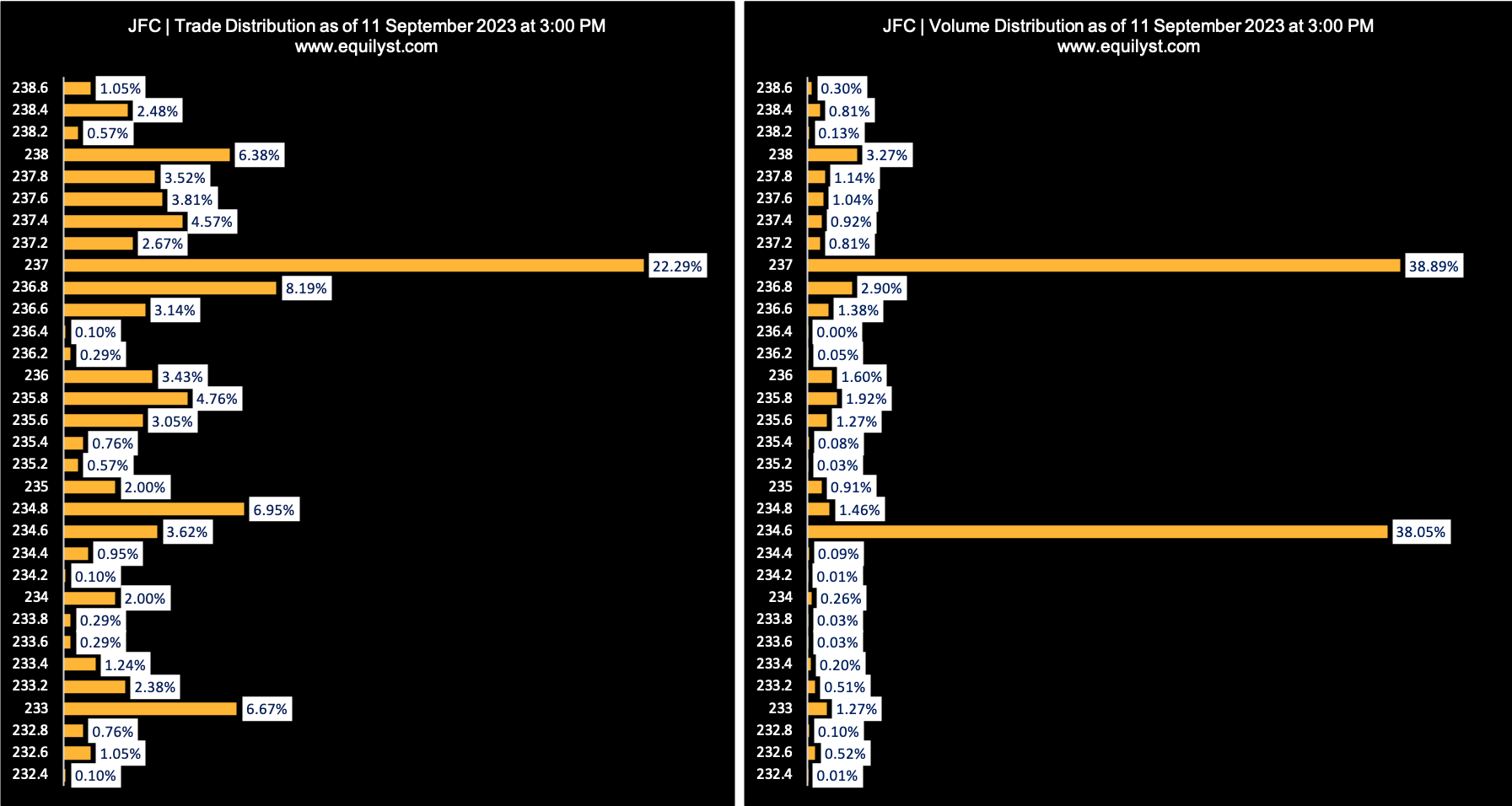

Jollibee Foods Corporation (JFC)

Net Foreign: P13,866,176

Dominant Range Index: BULLISH

Last Price: 237.00

VWAP: 235.92

Dominant Range: 234.80 – 237.00

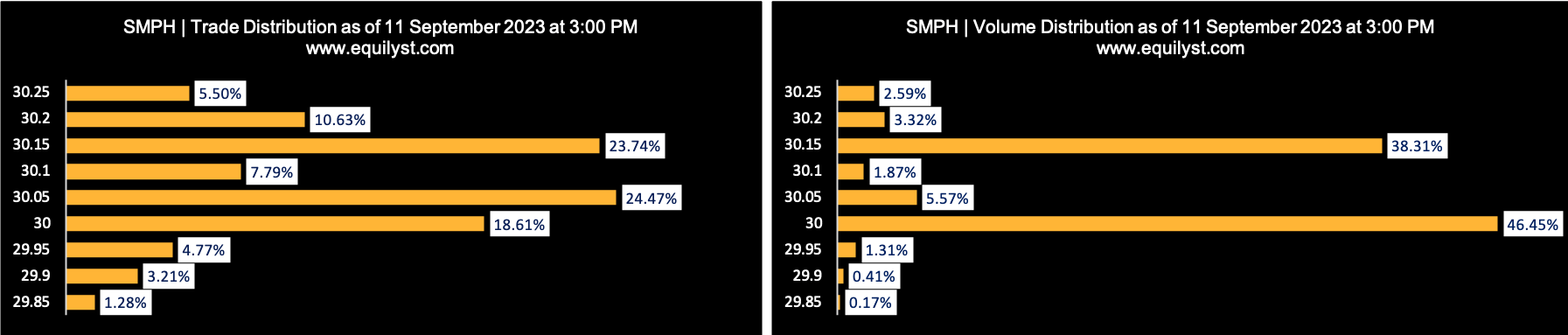

SM Prime Holdings (SMPH)

Net Foreign: P10,266,560

Dominant Range Index: BEARISH

Last Price: 30.15

VWAP: 30.07

Dominant Range: 30.00 – 30.15

Which of These 6 Bluechips Do You Already Have?

What’s your decision now that you’ve known this information? Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025