DITO CME Holdings Corp. Technical Analysis

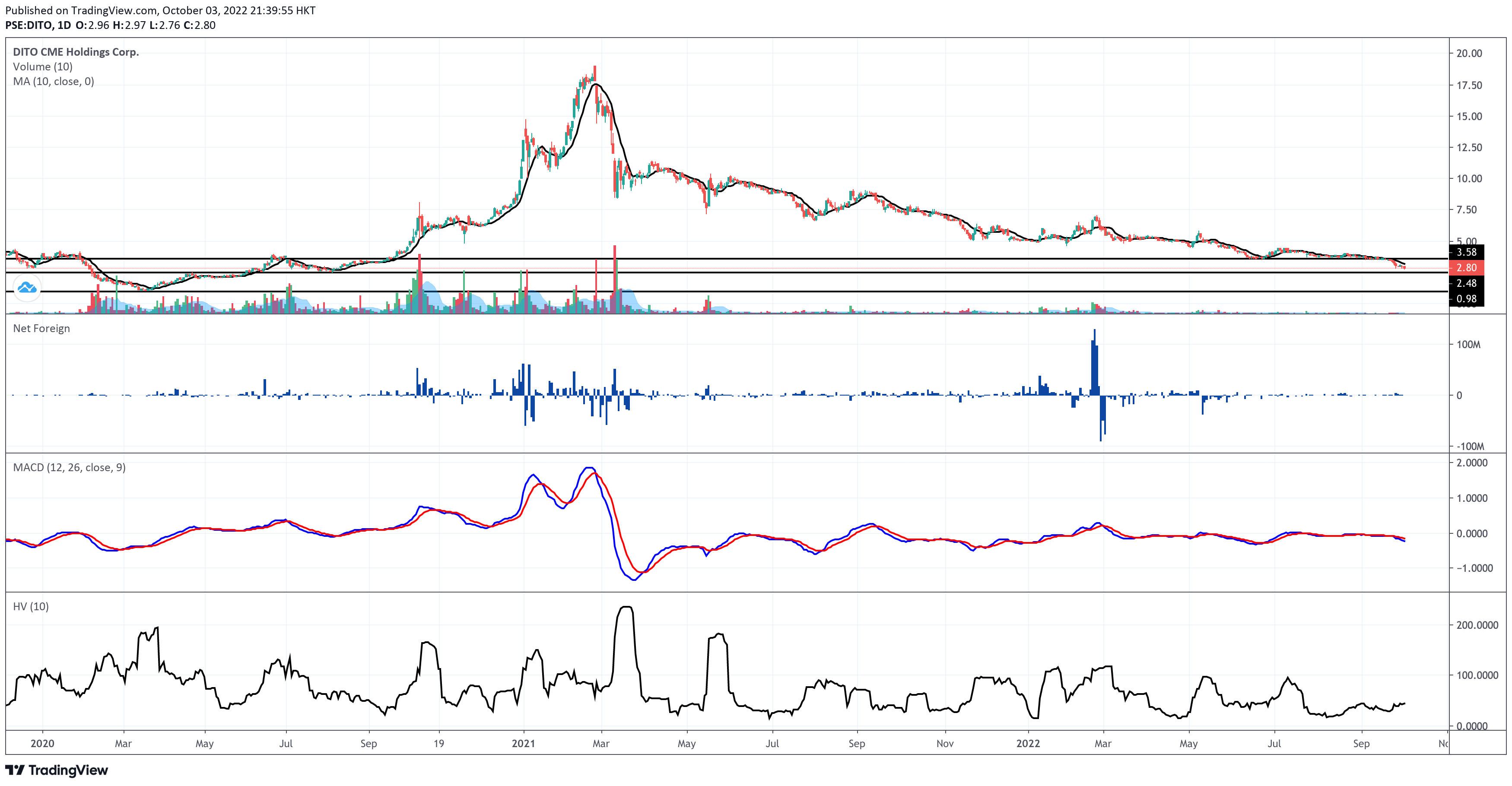

DITO has been moving in the downtrend channel for 20 months already. From its all-time high of P19.00 per share last February 22, 2021, it’s down by 85.26% at P2.80 per share as of closing on October 3, 2022.

If you bought DITO shares before February 2021 and didn’t even bother trimming your losses, someone must have successfully brainwashed you into thinking that “long-term investing is 5 to 10 years or so in the making”. Why would you hold your position for 5 or 10 more years if the stock already hit the maximum paper loss you can handle on the first week?

Whether you’re into short-term trading or long-term investing, your holding period must be predicated on the risk percentage you can realistically handle and not on the number of days, weeks, years, or decades you want to hold unbearable losses.

Related Article: How Short Is Short-term Trading and How Long Is Long-term Investing?

DITO’s immediate support is spotted near P2.50, while its immediate resistance is pegged near P3.60.

Since the last price is trading below the 10-day simple moving average (SMA) and its moving average convergence divergence (MACD) is bearish, DITO will likely test the support at P2.80, which is a precursor to P1.00.

Foreign investors’ participation is far from helpful for the hopeful traders and investors of DITO. The year-to-date net foreign buying is not enough to outclass this stock’s P90 million net foreign selling registered last February 2022.

While the daily volume is almost always higher than 50% of the stock’s 10-day volume average, my data-driven forecast remains in favor of the bears.

DITO maintains its low-risk level due to its 10-day historical volatility score of nearly 44%. This isn’t a buy signal, mind you.

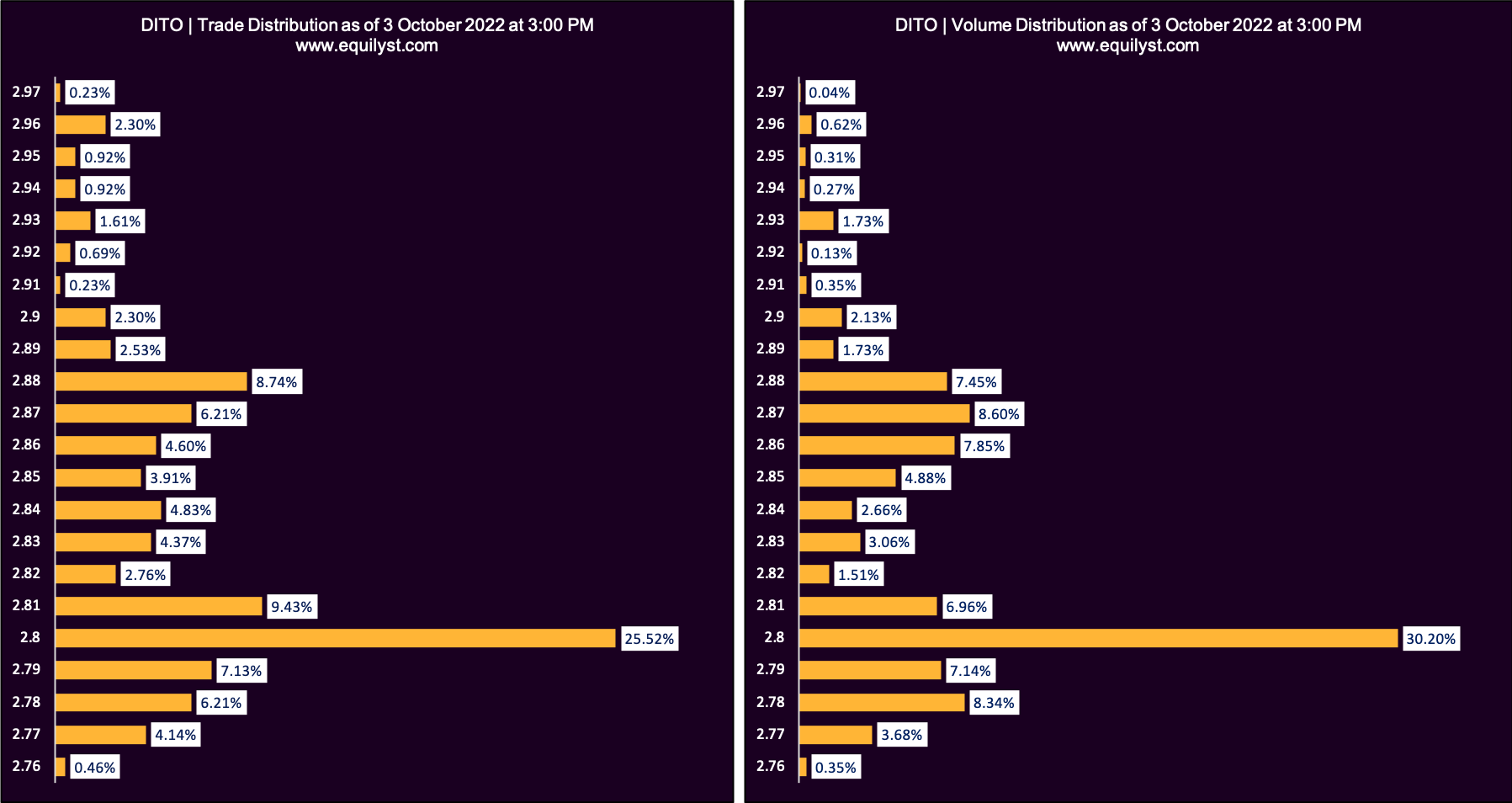

The dominant range index (DRI) of DITO adds another point for the bears.

Dominant Range Index: BEARISH

Last Price: 2.8

VWAP: 2.83

Dominant Range: 2.8 – 2.8

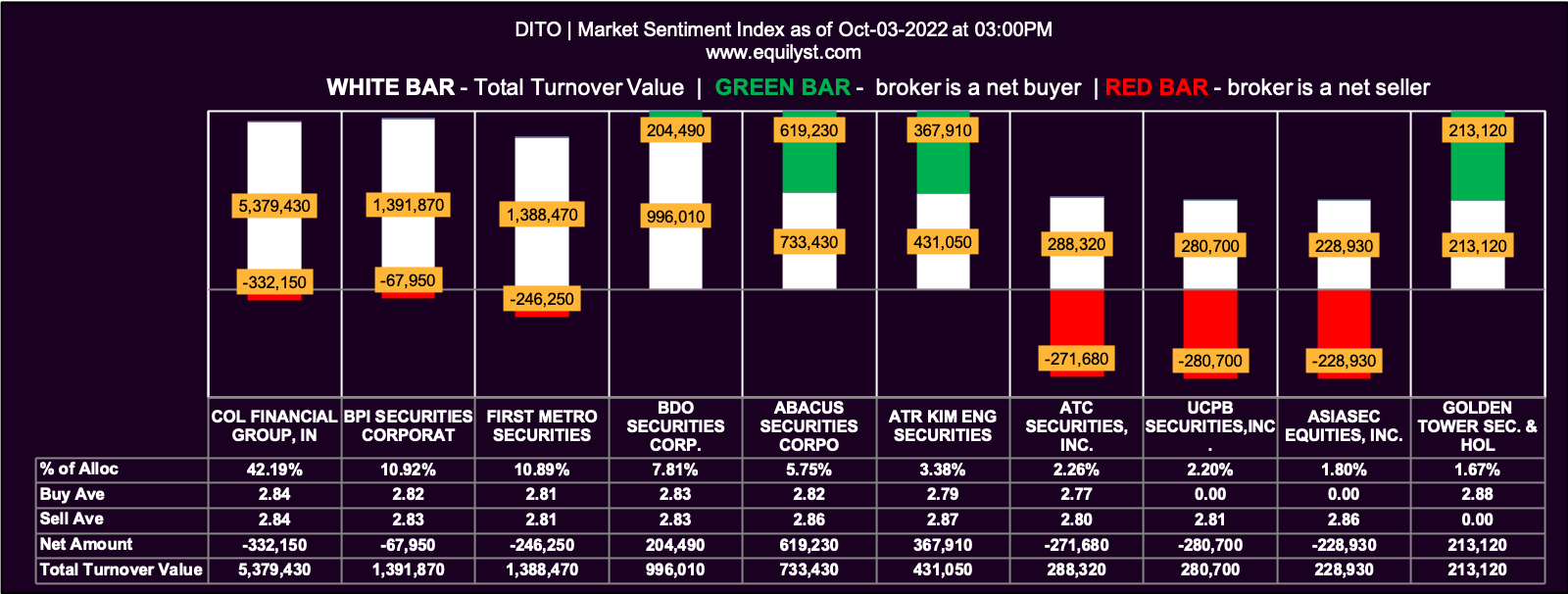

The stats below explain why the market sentiment index (MSI) of DITO is also bearish.

Market Sentiment Index (October 3, 2022): BEARISH

13 of the 27 participating brokers, or 48.15% of all participants, registered a positive Net Amount

11 of the 27 participating brokers, or 40.74% of all participants, registered a higher Buying Average than Selling Average

27 Participating Brokers’ Buying Average: ₱2.82125

27 Participating Brokers’ Selling Average: ₱2.82658

6 out of 27 participants, or 22.22% of all participants, registered a 100% BUYING activity

9 out of 27 participants, or 33.33% of all participants, registered a 100% SELLING activity

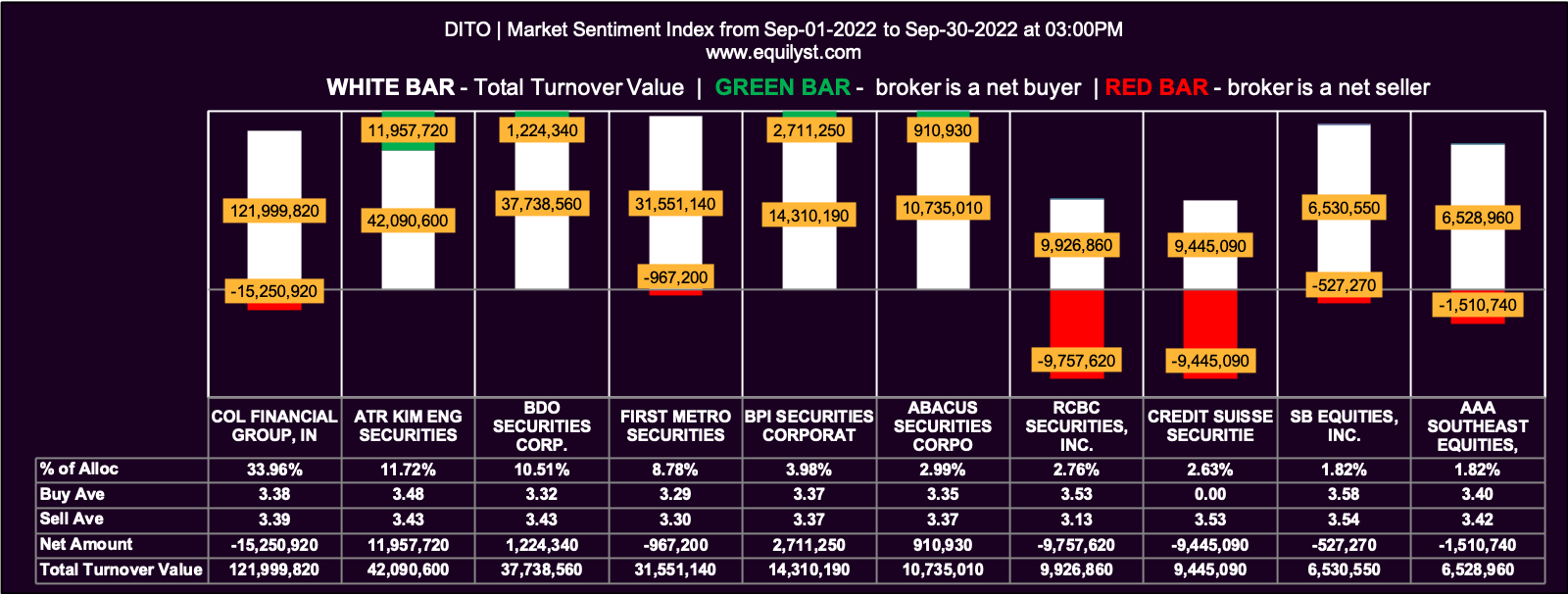

Even the market sentiment index for the entire September 2022 was bearish.

Market Sentiment Index (September 1-30, 2022): BEARISH

48 of the 77 participating brokers, or 62.34% of all participants, registered a positive Net Amount

37 of the 77 participating brokers, or 48.05% of all participants, registered a higher Buying Average than Selling Average

77 Participating Brokers’ Buying Average: ₱3.34356

77 Participating Brokers’ Selling Average: ₱3.39007

17 out of 77 participants, or 22.08% of all participants, registered a 100% BUYING activity

11 out of 77 participants, or 14.29% of all participants, registered a 100% SELLING activity

Verdict

All indicators are acting in unison in favor of the bears.

If your average cost on DITO is negative, I suggest you ask yourself for the realistically bearable risk percentage you can handle. Then, compute your supposed initial trailing stop. If the current price is already past your supposed initial trailing stop, you need to decide if you’ll sell all shares at once or in tranches. The bottomline is you need to sell because this means you’re losing more than what you can only bear.

If you don’t have DITO, you should stay on the sidelines. Be on a wait-and-see mode. Learn how to identify buy signals. Once there’s a confirmed buy signal, compute your reward-to-risk ratio and initial trailing stop. Then, you can do a test-buy within the dominant range. Then, you can top up every time there’s a buy signal and if your buying power allows it. Do an upward adjustment on your trailing stop every time the current price goes up. Sell once your trailing stop is hit or reduce the risk percentage of your trailing stop when either the dominant range index or market sentiment index is bearish. I can teach you all that and more when you subscribe to my stock market consultancy service.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025