DITO Telecommunity: Financial Progress Amidst Market Challenge

DITO Telecommunity Corp. has shown progress in mitigating its financial losses, reducing its net loss by P5.6 billion in 2023. The parent company, DITO CME Holdings Corp., managed to decrease its net loss by 41 percent to P8.17 billion from P13.77 billion in the previous year, moving closer to its goal of breaking even by 2025.

Revenue for DITO increased by half to P11.24 billion, compensating for a 28 percent rise in expenses to P26.21 billion. The growth in revenue is attributed to the expansion of its network coverage and customer base. The telco extended its network reach to 853 cities and municipalities, resulting in around nine million subscribers with an average revenue per user of P128 per month.

Dennis Uy’s telco primarily generated revenue from mobile data, followed by voice calls, text services, and value-added services. Despite these gains, DITO still faces significant financial obligations, particularly its mounting debt, which increased by 27 percent to P35.37 billion due to network expansion efforts.

In 2024, DITO plans to raise funds through a follow-on offer at the parent company level to support its expansion initiatives. Udenna Corp., led by Dennis Uy, will provide additional capital if necessary to ensure DITO’s financial stability.

In 2023, DITO secured a $3.9 billion loan from foreign banks and raised P5.5 billion through private placements to finance its capital expenditures and debt repayments. Despite financial challenges, DITO has achieved a milestone in internet quality, surpassing competitors Smart Communications Inc. and Globe Telecom Inc. in download speed, according to Opensignal’s April analysis.

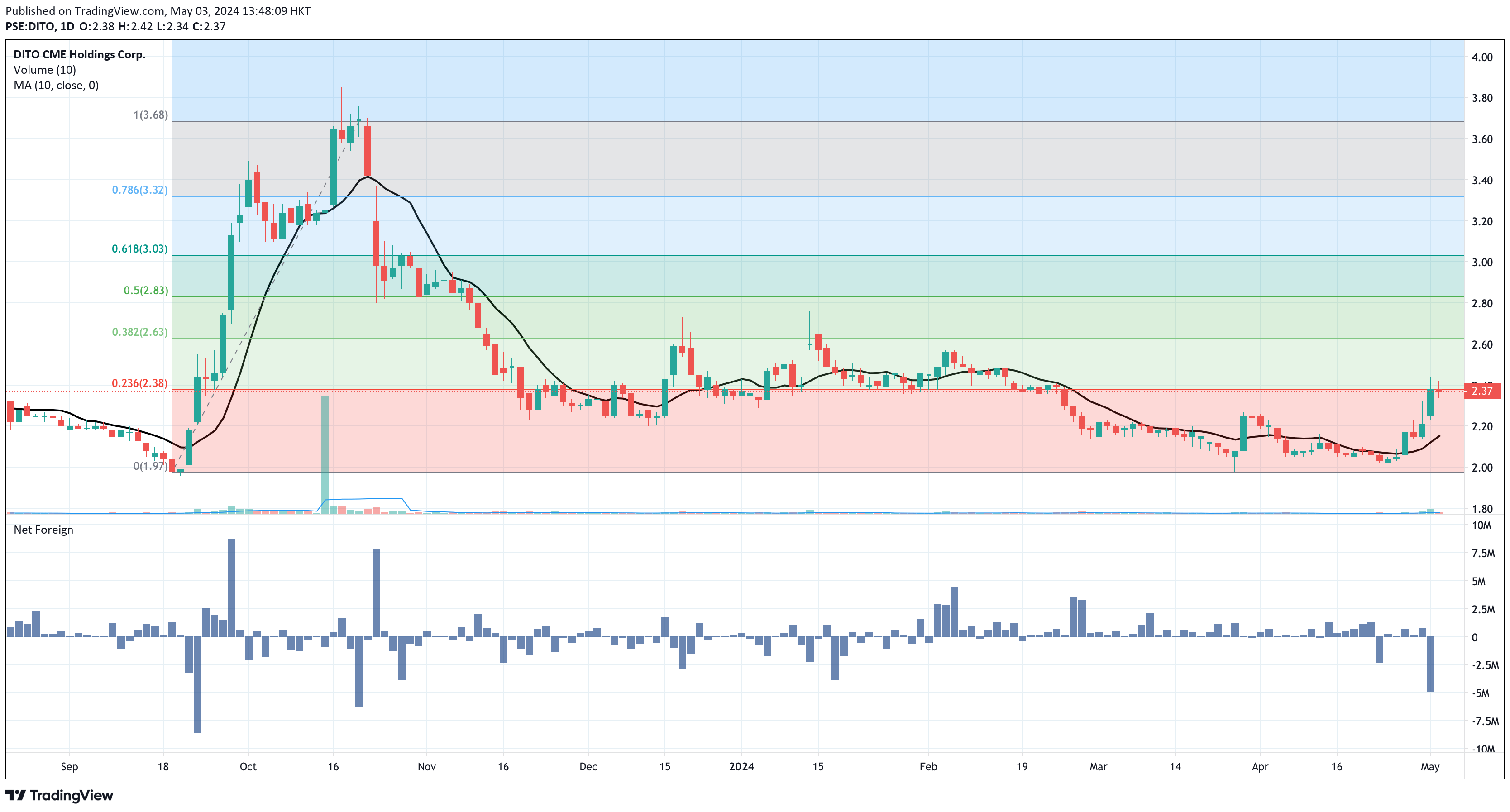

DITO CME Holdings Corp. (DITO) Technical Analysis

DITO currently trades at P2.37 per share, a tick away from its major resistance at P2.38, which aligns with the 23.6% Fibonacci retracement level. Major support still sits near P2.00 per share.

DITO’s daily volume for the past four trading days since April 26, 2024, has been higher than 100% of its 10-day volume average. It appears traders are communicating with each other as the price struggles to break the resistance at P2.38.

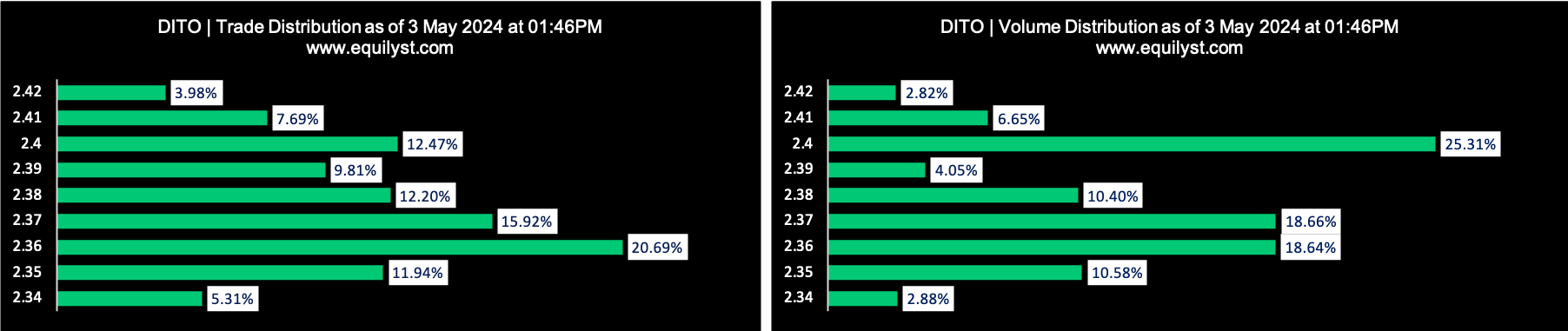

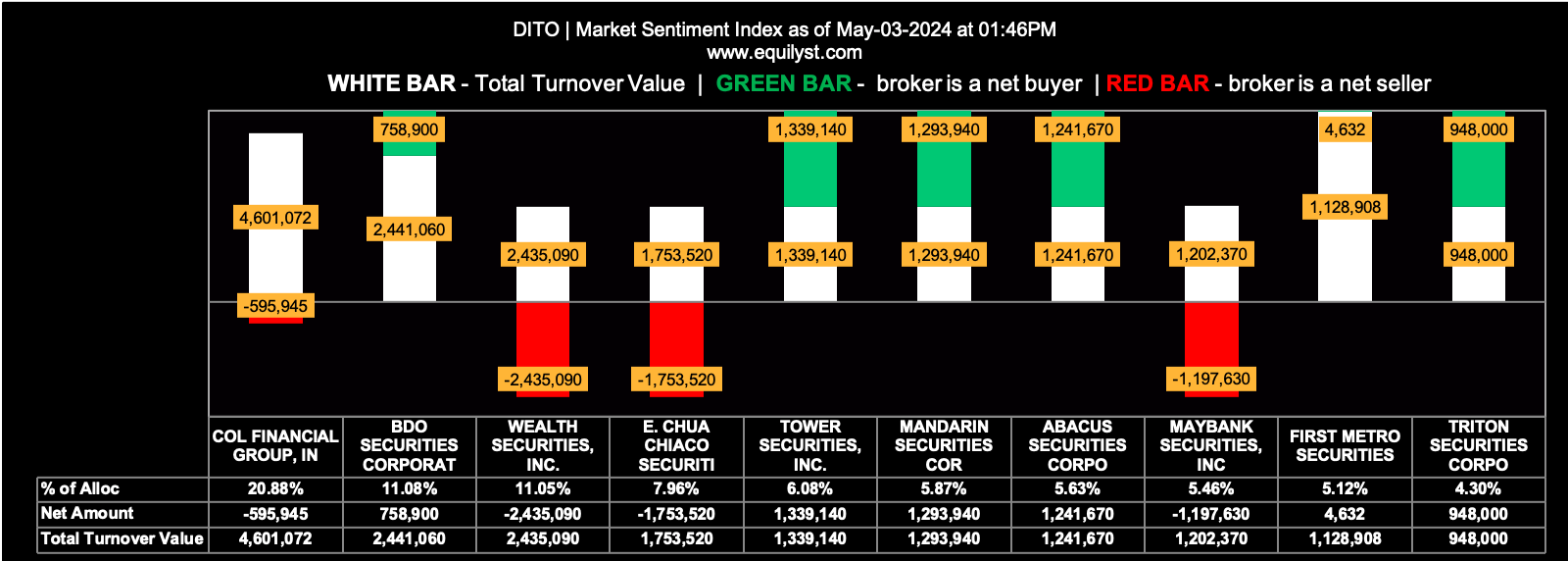

The prevailing volume-weighted average price (VWAP) of P2.38, which is higher than the current price of P2.37, suggests that overall sentiment favors the bears. DITO’s prevailing Market Sentiment Index seconds this notion.

Dominant Range Index: BEARISH

Last Price: 2.37

Dominant Range: 2.35 – 2.40

VWAP: 2.38

Market Sentiment Index: BEARISH

12 of the 27 participating brokers, or 44.44% of all participants, registered a positive Net Amount

12 of the 27 participating brokers, or 44.44% of all participants, registered a higher Buying Average than Selling Average

27 Participating Brokers’ Buying Average: ₱2.37925

27 Participating Brokers’ Selling Average: ₱2.38444

8 out of 27 participants, or 29.63% of all participants, registered a 100% BUYING activity

7 out of 27 participants, or 25.93% of all participants, registered a 100% SELLING activity

The participation of foreign investors in DITO is relatively insignificant, so we won’t dwell on that aspect.

Price Multiples Analysis for DITO

DITO’s present price-to-earnings ratio stands at -16.74, indicating that the company is experiencing losses. Similarly, its price-to-book ratio of -2.03 echoes this sentiment. Conversely, its price-to-sales ratio of 4.49 suggests that the stock is overvalued, despite its bearish price action.

Buy, Hold, or Sell DITO?

My proprietary methodology provides no logical sign to buy DITO yet. The price multiples support the don’t-buy stance of my technical analysis.

On the other hand, if you already have DITO in your portfolio and your trailing stop is still intact, you may consider preempting your trailing stop since both Dominant Range Index and Market Sentiment Index are bearish. Additionally, it’s a common notion that resistance levels are profit-taking levels, especially for short-term traders. It’s likely for the price of DITO to bounce away from P2.38.

If you’re a subscriber of my Premium Analysis service, you may email me your request for my latest analysis of DITO.

What More Updates?

To receive more updates from me, here are my services:

You may also read my other reports here and watch my videos on YouTube. You may also subscribe to my newsletter.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025