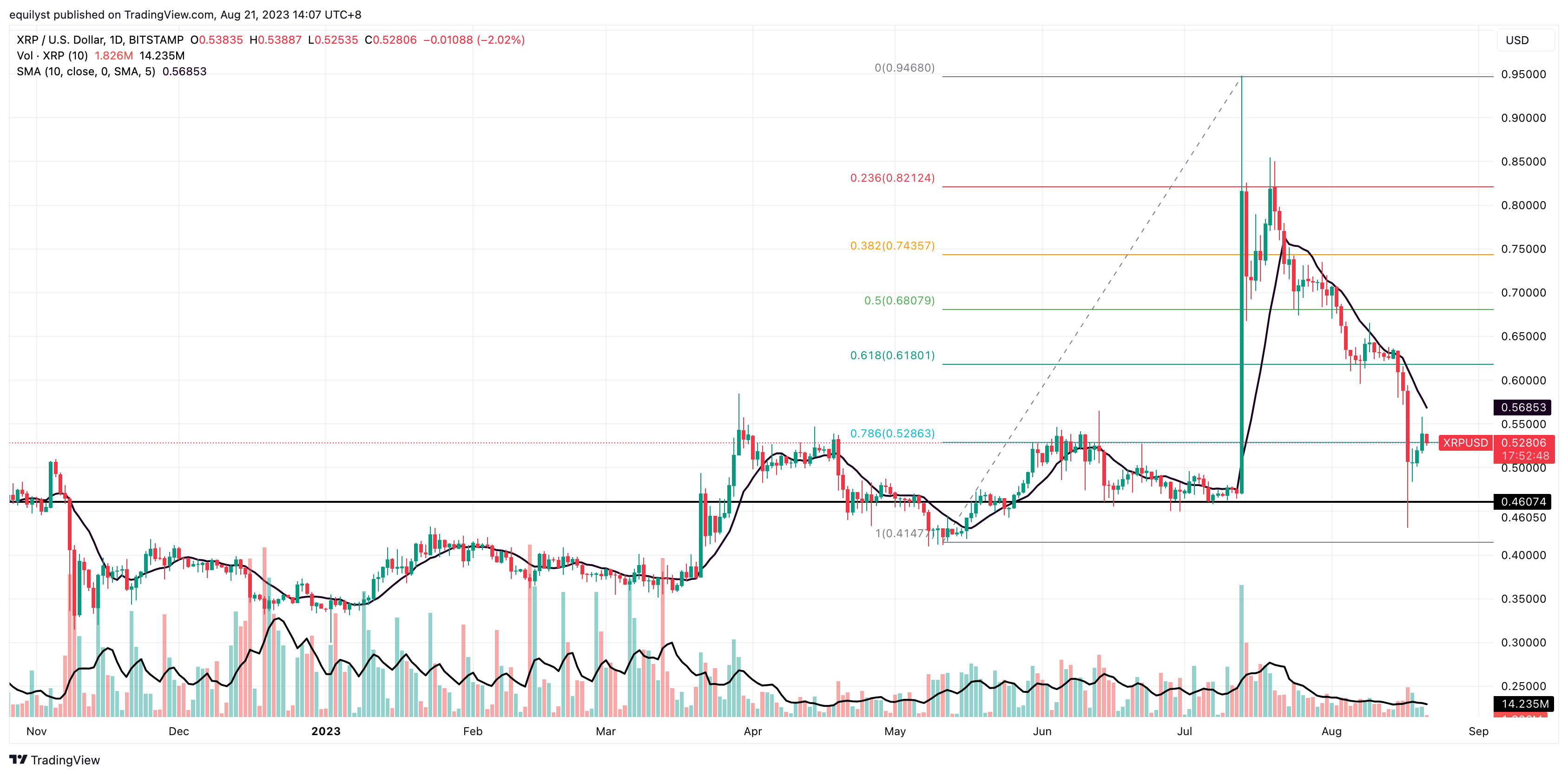

Stellar (XLM), Litecoin (LTC), and XRP (XRP) are the top three cryptocurrencies with the biggest 24-hour change as of the end of August 20, 2023. Stellar (XLM) touched its 10SMA again on August 20, but can it sustain the upward moment? Meanwhile, Litecoin (LTC) bounced at the support at $63.40, but can its upward momentum catapult it above the resistance at $75.60? Finally, can XRP regain the $18 billion outflow before the end of August 2023? Discover which of these three coins could end August 2023 better than how they started.

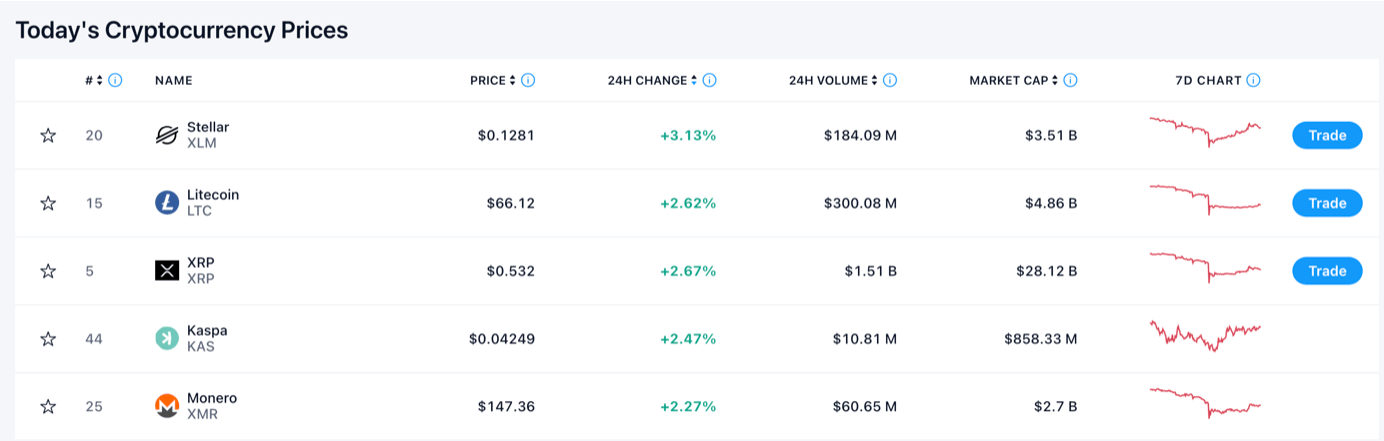

Is Stellar (XLM) Likely to End With a Lackluster August 2023?

Stellar (XLM) is not having a good month. Its price dropped 13.33% from its closing price of $0.150 on July 31 to $0.130 on August 20. Meanwhile, Stellar’s (XLM) week-to-date price change duplicates the same bearish stance as it plummeted 5.80% from $0.138 on August 12 to $0.130 on August 20.

Stellar (XLM) had been trading below its 10-day simple moving average for 20 straight trading days until it crossed a bit above its 10SMA on August 20. That golden cross was supported with a bullish volume greater than 100% of Stellar’s (XLM) 10-day volume average. Classical interpretation suggests that the price will likely go up if it’s supported with a green volume bar at least 50% higher than its 10-day volume average.

The bears of Stellar (XLM) think that the mild bullishness registered on August 20 was a dead cat bounce. Stellar (XLM) will likely enter the $0.102 and $0.122 range on or before the end of August 2023.

On the other hand, the bulls of Stellar (XLM) remain hopeful that it will break the resistance at $0.150 before the end of August 2023. Experience tells me that that forecast is probable if Stellar (XLM) registers a daily green volume of at least 50% of its 10-day average. Otherwise, Stellar (XLM) will move sideways between $0.122 and $0.150, or worse, a break below $0.122.

My overall sentiment for Stellar (XLM) is bearish.

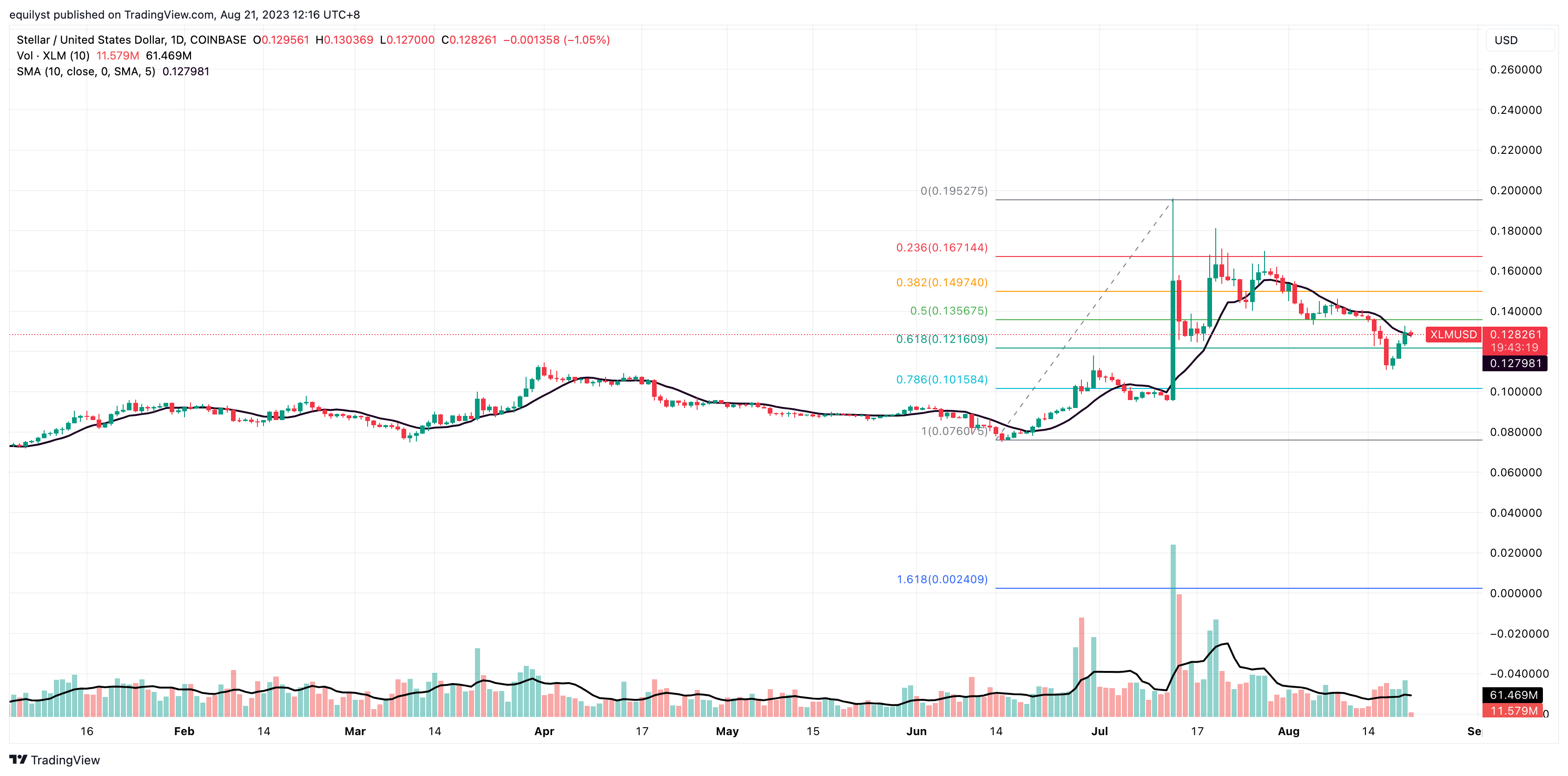

Litecoin (LTC): Likely to Cross Its 10-day SMA Before the End of August?

Litecoin (LTC) has a much worse price performance than Stellar (XLM) this August 2023. This “lite version of Bitcoin” has dropped by 29.28% month-to-date from July 31’s price of $92.28 to $65.26 on August 20. Meanwhile, Stellar’s (XLM) week-to-date price change is down, as well, by 21.77% from $83.42 on August 12 to $65.26 on August 20.

Bearish traders are waiting for Stellar (XLM) to drop below the immediate support at $63.60, but it’s been three consecutive trading days that Stellar (XLM) registers a positive day change. A drop below the immediate support level will pave the way to retesting deeper support at $50.20.

On the other hand, Stellar (XLM) respected the support at $63.40 as it did in December 2022, hinting $63.40 is relatively strong support. Add to that the two green volume bars that are almost equal to 100% of Stellar’s (XLM) 10-day volume average, and it becomes more likely for Stellar (XLM) to regain its position above its 10-day simple moving average at $72.51. Resistance is at $75.60.

Even though Stellar (XLM) needs to break a higher resistance at $82.90 to officially move out of the downtrend channel that started in July 2023, my overall sentiment for Stellar (XLM) is bullish.

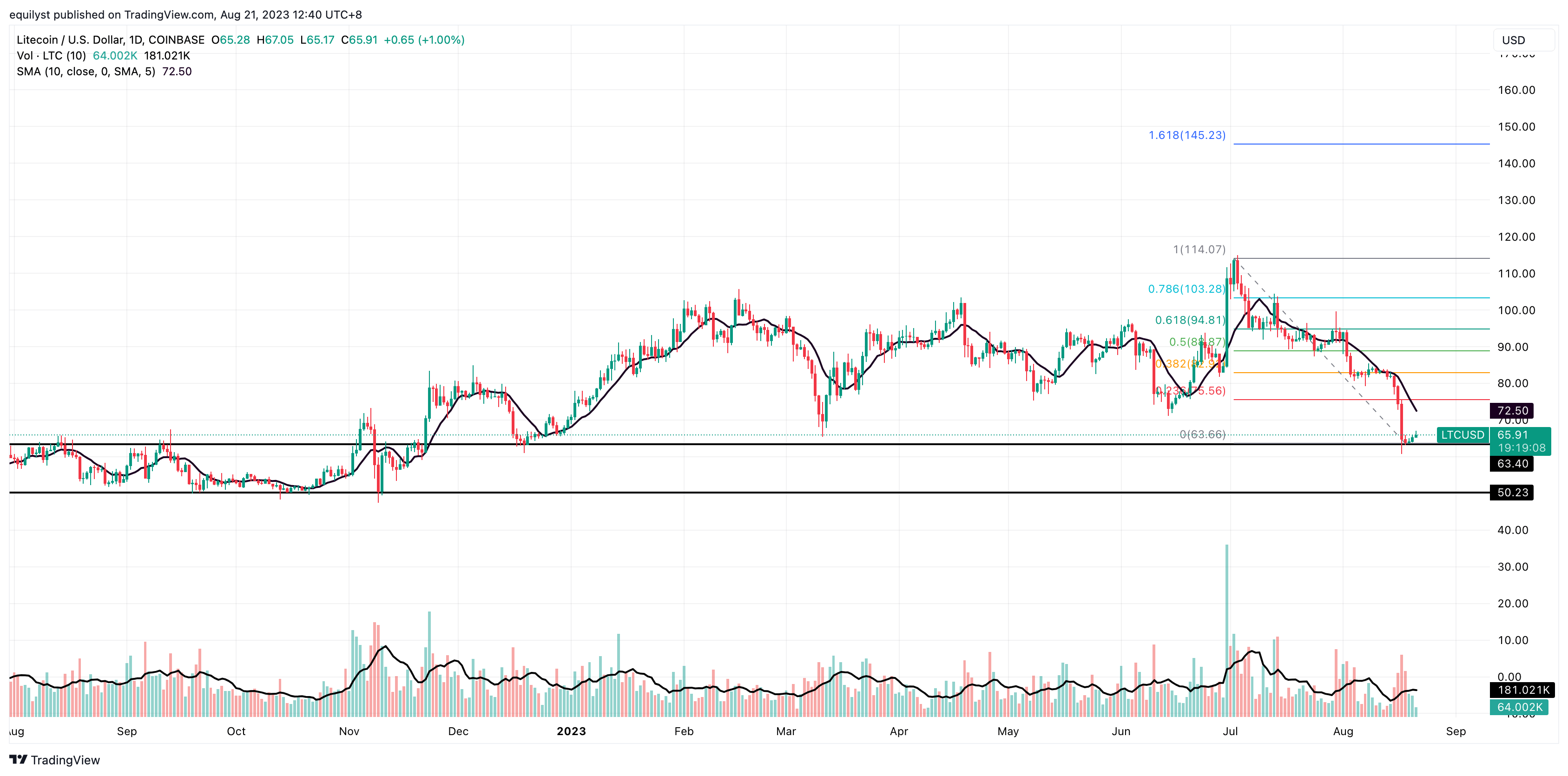

XRP: Can August Close Above $0.618 – Right Where It Started?

XRP’s (XRP) performance this August 2023 is not as bad as Litecoin’s (LTC), but it’s not better than Stellar’s (XLM). XRP erased 57.50%, or $18.23 billion, from the $42.89 billion inflow registered on July 14, after the SEC case ruling. XRP is allegedly accused of engaging with unregistered securities selling XRP tokens.

XRP is down 22.67% month-to-date from $0.697 on July 31 to $0.539 on August 20. Recovery is far from sight as it remains negative at 14.04%, from $0.627 on August 12 to $0.539 on August 20.

Pessimism is still felt among traders as some speculate a drop below $0.529, the prevailing support of XRP aligned with the 78.6% Fibonacci retracement. The engulfing red candlestick of XRP on August 17, a decline of 13.87%, is quite tough to break. The immediate resistance is at $0.618, which coincidentally aligns with the golden ratio of the Fibonacci (61.8% retracement). If XRP drops below its immediate support, the next support level will be $0.460, a precursor to $0.415.

Meanwhile, the bulls of XRP still try to race toward the north, hoping to increase their distance from the support at $0.529. There’s a chance for that hope to be translated into reality if XRP continues its 3-day streak of showcasing bullish volume bars above 50% of XRP’s 10-day volume average. Bullish XRP traders expect this token to touch its 10-day SMA at $0.569 before the end of the month.

My overall sentiment for XRP is neutral, with a bearish bias.

For further guidance, complete this form to avail of my cryptocurrency consulting service.

Fill out this form if you want to hire me to write for your website in the Blockchain or Web3 space.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025