MTD Market Sentiment Score of the 5 Commercial and Industrial Stocks Recommended by COL Financial

Based on the COL Financial Investment Guide updated on September 1, 2023, there are seven (7) Commercial and Industrial stocks with a buy rating. Only five out of seven have a buy signal from COL Financial. To know where to find the COL Financial Investment Guide, please read How to Access the COL Financial Investment Guide.

In this article, I’ll show you the prevailing market sentiment for the five Commercial and Industrial stocks that earned COL Financial’s buy rating.

Even though I’ve indicated COL Financial’s Fair Value (COL Financial’s recommended Target Selling Price) and Buy Below Price, know that I AM NOT A FAN of using a Buy Below Price and a pre-determined Target Selling Price. Read 4 Reasons to Stop Using Buy Below and Target Selling Price to know why.

My main intention for writing this article is to show you the prevailing market sentiment of participating brokers for each the five stocks.

The market sentiment helps me estimate if the prevailing direction of the share price is likely to continue or reverse.

For example, if the stock is in a downtrend and the prevailing market sentiment is bearish, it means the downtrend is likely to continue.

If the stock is in a downtrend, but the market sentiment turns bullish, it’s a sign that investors might see a bullish reversal.

Again, and again, notice the adverbs I’m using – “likely” and “might”. We’re still talking about probabilities and not certainties.

Still, it’s better to be data-driven and be proven wrong by the market than make decisions based on gut feeling alone. The former gives you the opportunity to optimize something while the latter doesn’t.

If you want to hear me explain the significance of market sentiment and the reasons why I developed my proprietary Market Sentiment Index indicator, avail yourself of my stock market investment consultancy service.

I want you to take note of the date and time stamps on each chart of these Commercial and Industrial stocks. Know that the Market Sentiment Index rating is volatile, which means it could change in a matter of seconds, minutes, or hours relative to the buying and selling activities of the participating brokers.

In this report, I’ve used month-to-date historical brokers’ transactions from September 1, 2023 to September 5, 2023 for these Commercial and Industrial stocks given with a buy rating by COL Financial.

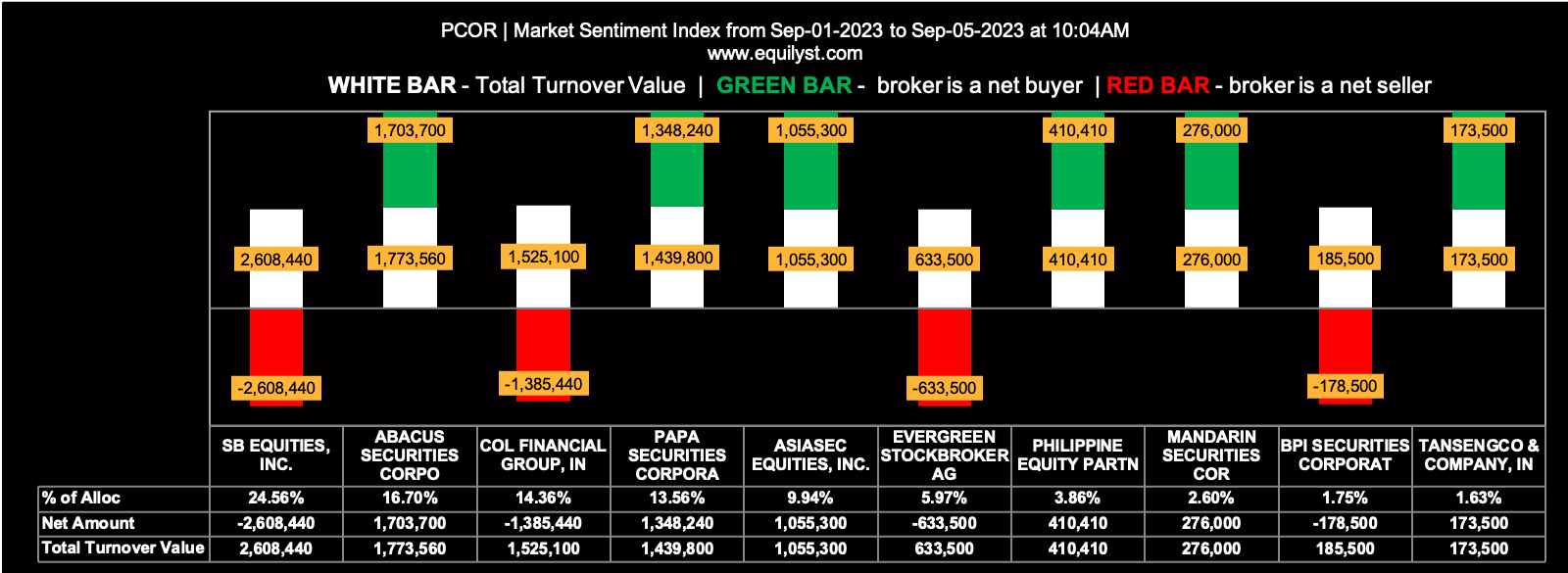

Petron Corporation

Stock Code: PCOR

COL Fair Value: P3.50

COL Buy Below Price: P2.90

Market Sentiment Index: BEARISH

9 of the 22 participating brokers, or 40.91% of all participants, registered a positive Net Amount

7 of the 22 participating brokers, or 31.82% of all participants, registered a higher Buying Average than Selling Average

22 Participating Brokers’ Buying Average: ₱3.49258

22 Participating Brokers’ Selling Average: ₱3.50371

7 out of 22 participants, or 31.82% of all participants, registered a 100% BUYING activity

10 out of 22 participants, or 45.45% of all participants, registered a 100% SELLING activity

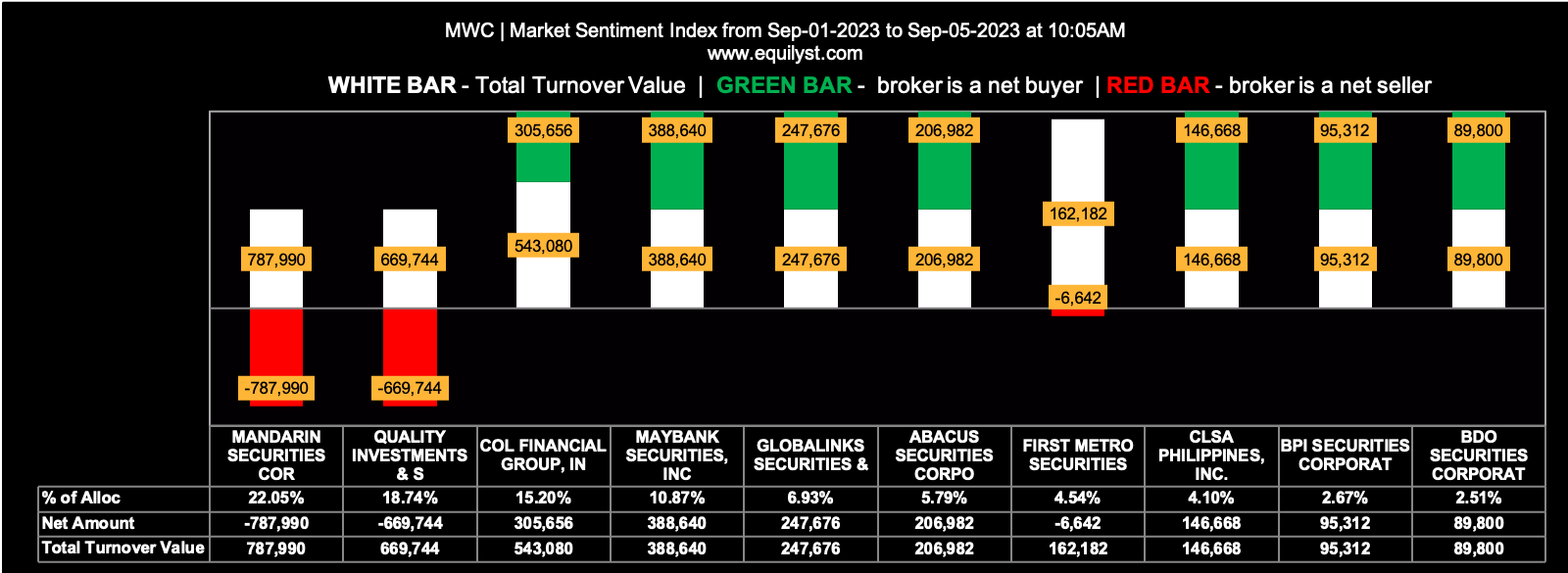

Manila Water Company

Stock Code: MWC

COL Fair Value: P25.50

COL Buy Below Price: P21.20

Market Sentiment Index: BULLISH

10 of the 19 participating brokers, or 52.63% of all participants, registered a positive Net Amount

11 of the 19 participating brokers, or 57.89% of all participants, registered a higher Buying Average than Selling Average

19 Participating Brokers’ Buying Average: ₱18.00743

19 Participating Brokers’ Selling Average: ₱17.98476

9 out of 19 participants, or 47.37% of all participants, registered a 100% BUYING activity

7 out of 19 participants, or 36.84% of all participants, registered a 100% SELLING activity

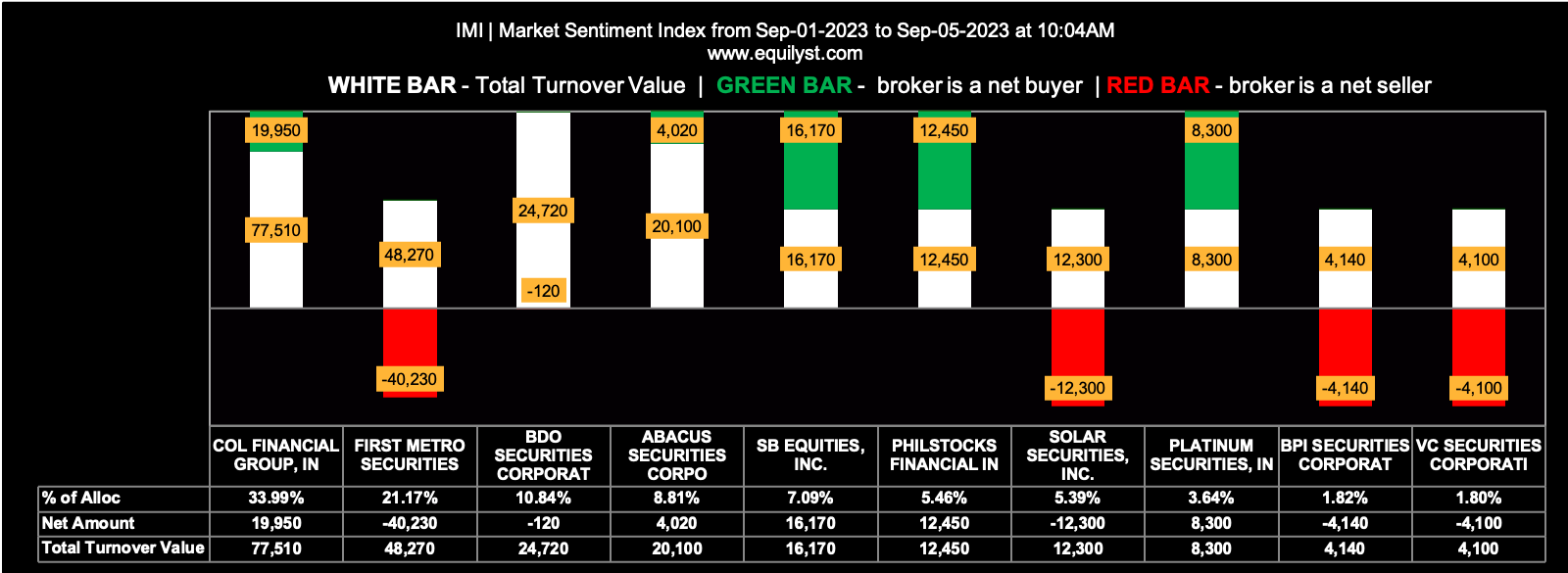

Integrated Micro-Electronics

Stock Code: IMI

COL Fair Value: P7.80

COL Buy Below Price: P6.50

Market Sentiment Index: BEARISH

5 of the 10 participating brokers, or 50.00% of all participants, registered a positive Net Amount

3 of the 10 participating brokers, or 30.00% of all participants, registered a higher Buying Average than Selling Average

10 Participating Brokers’ Buying Average: ₱4.07761

10 Participating Brokers’ Selling Average: ₱4.09059

3 out of 10 participants, or 30.00% of all participants, registered a 100% BUYING activity

3 out of 10 participants, or 30.00% of all participants, registered a 100% SELLING activity

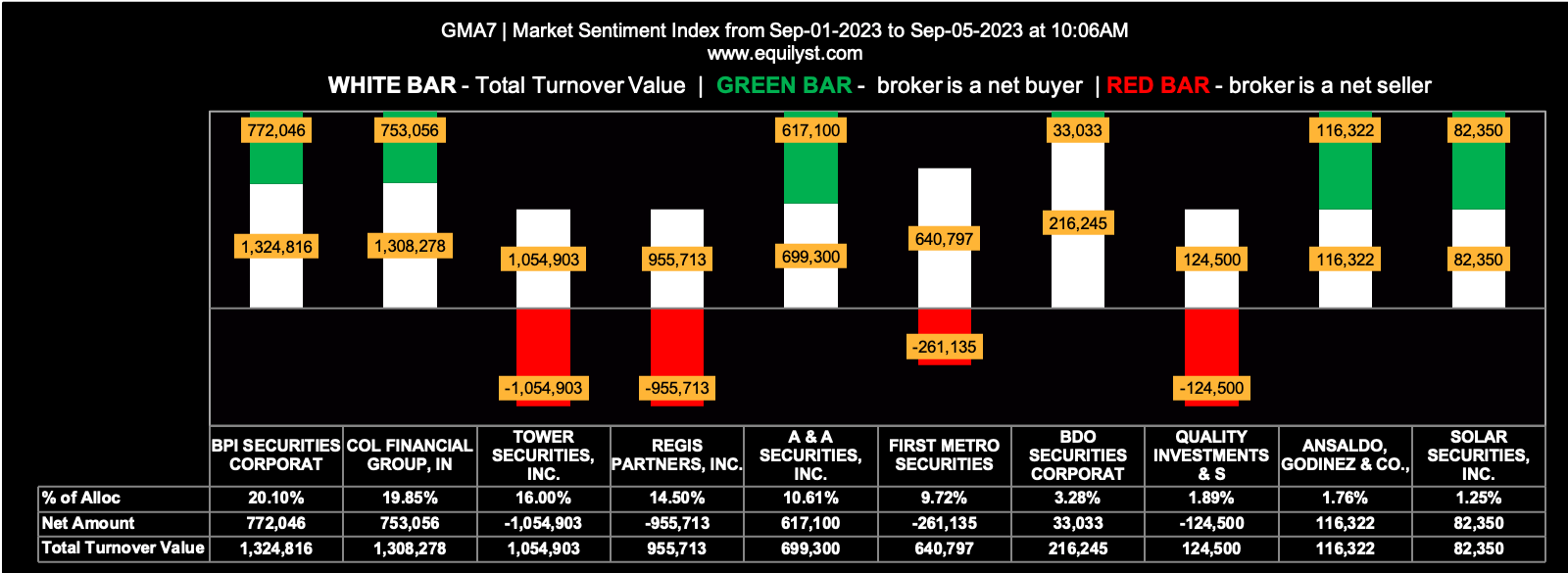

GMA Network

Stock Code: GMA7

COL Fair Value: P12.20

COL Buy Below Price: P10.60

Market Sentiment Index: BULLISH

12 of the 19 participating brokers, or 63.16% of all participants, registered a positive Net Amount

10 of the 19 participating brokers, or 52.63% of all participants, registered a higher Buying Average than Selling Average

19 Participating Brokers’ Buying Average: ₱8.25328

19 Participating Brokers’ Selling Average: ₱8.25808

7 out of 19 participants, or 36.84% of all participants, registered a 100% BUYING activity

5 out of 19 participants, or 26.32% of all participants, registered a 100% SELLING activity

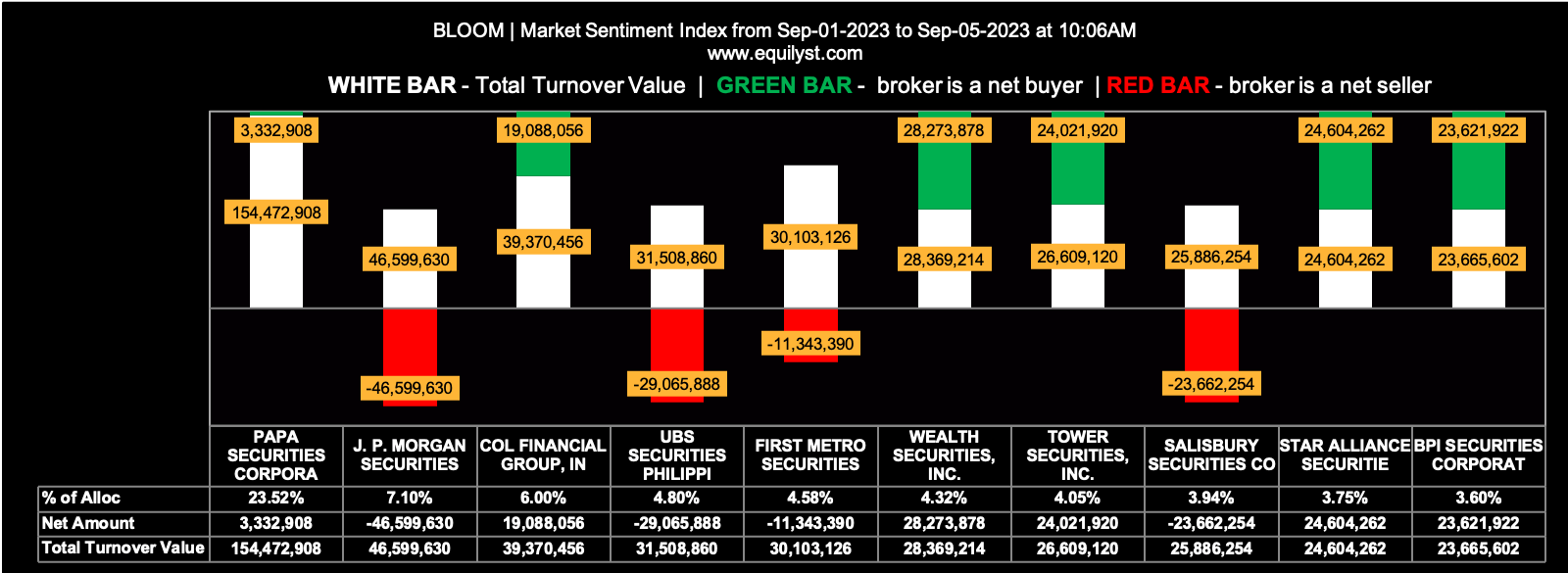

Bloomberry Resorts Corporation

Stock Code: BLOOM

COL Fair Value: P15.30

COL Buy Below Price: P13.30

Market Sentiment Index: BULLISH

38 of the 59 participating brokers, or 64.41% of all participants, registered a positive Net Amount

36 of the 59 participating brokers, or 61.02% of all participants, registered a higher Buying Average than Selling Average

59 Participating Brokers’ Buying Average: ₱10.90212

59 Participating Brokers’ Selling Average: ₱10.92085

19 out of 59 participants, or 32.20% of all participants, registered a 100% BUYING activity

6 out of 59 participants, or 10.17% of all participants, registered a 100% SELLING activity

Which of These 5 Commercial and Industrial Stocks Recommended by COL Financial Are You Monitoring?

Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025