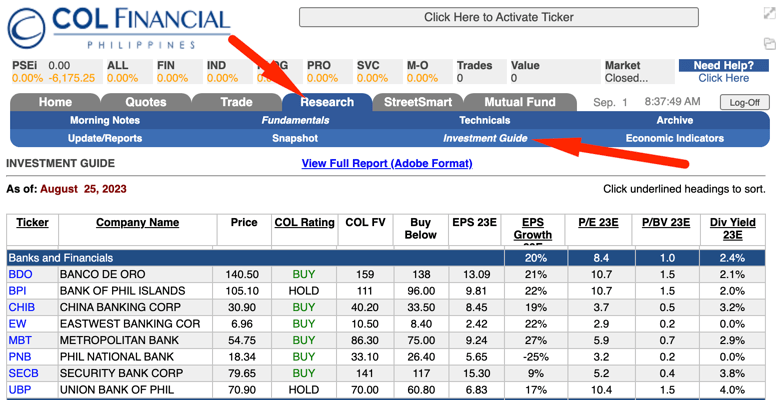

What Is COL Financial’s Investment Guide?

Before we discuss COL Financial’s 8 banking stock picks, let me explain COL Financial’s Investment Guide first. COL Financial’s investment guide is based on fundamental analysis (financial performance of the company). They check the company’s earnings-per-share ratio (EPS), price-to-earnings ratio, price-to-book value ratio, and dividend yield.

Then, they come up with their own Fair Value based on their valuation criteria. That Fair Value serves as their recommended or Target Selling Price.

They also provide a Buy Below Price. According to COL Financial, you can continue peso-cost averaging on the stock as long as its current price remains below their Buy Below Price.

COL Financial also provides a Buy, Hold, or Sell rating.

How to Find COL Financial’s Investment Guide

Here’s how to find COL Financial’s Investment Guide:

1. Log in to your COL Financial account.

2. Click RESEARCH.

3. Click INVESTMENT GUIDE.

Why I Don’t Depend on COL Financial’s Investment Guide

While COL Financial knows the financial performance of any publicly-listed company in the Philippine Stock Exchange, it doesn’t know my financial DNA.

COL Financial doesn’t know the events in my life that concern money. It doesn’t know my mood for the day. It doesn’t know the percentage of risk that I am only willing to apply to a particular stock.

There are psychological factors in decision-making that you cannot get from fundamental analysis or technical analysis.

Only I can tell myself if I should buy, hold, or sell a stock relative to those factors that are unique to my financial DNA and investment psychology.

Don’t I know the financial performance of any PSE-listed company?

I do!

The financial reports of all PSE-listed company are publicly available on PSE Edge.

Since I also have access to the same financial information COL Financial has, I am capable to make a tailored-fit investment recommendation for myself.

This is the reason why I don’t offer a stock recommendation service. If I were to offer one, it would make me feel like I was telling you to forget that only you knew all your financial circumstances in your life. It would make me feel like I was demoting you from a rational being to a monkey.

I don’t believe that stock recommendation services exist for the busy people. That’s just a convenient excuse for the lazy. Some stock market-related services are exploiting investors’ laziness by providing ready-to-eat buy-hold-sell recommendations.

For your information, outsourcing is not an alien concept to me. I’ve been running my own content outsourcing company for more than two decades now.

An investment decision is not one you should outsource because nobody understands the events in your life that concern money more than you do. What you can outsource, as far as stock investing is concerned, is the training on how you can independently make data-driven decisions like I do. That’s what my stock investment consultancy service is about.

Is COL Financial’s Investment Guide Bad for Me?

I thought about phrasing that subheading as “Is COL Financial’s Investment Guide Bad for You?” but I decided not to because I only want to answer a question on my behalf.

If it were the early 2000s, COL Financial’s Investment Guide would be very helpful for me. But I’ve been into stock investing for more than a decade, and I already know how and where to find the data and compute the numbers COL Financial provides in its Investment Guide.

For beginners, you will find COL Financial’s Investment Guide helpful, particularly the computation of the financial ratios. However, I would recommend not to make investment decisions based on anyone’s Buy Below Price or Fair Value (or Target Selling Price). Read 4 Reasons to Stop Using Buy Below and Target Selling Price to know why.

Why Only 1 Out of 8 Banking Stock Picks of COL Financial Captures My Interest?

As I’ve said, I have my own methodology for identifying which stocks are worthy to be added in my watchlist, when to identify a confirmed buy signal, and how to buy and sell logically and less emotionally.

I am using my proprietary Market Sentiment Index indicator to get a data-driven basis if the downtrend or uptrend is likely to reverse or continue.

You’ll find out in the statistics below why only 1 out of 8 banking stock picks COL Financial recommends captures my interest to analyze it further.

Let me make that clear just in case you have a selective vision for the words you only want to read: “captures my interest TO ANALYZE FURTHER” and not “captures my interest to buy”.

But before that, I’d like to briefly explain the significance of my Market Sentiment Index indicator.

How can you assess market sentiment? Is it through conducting surveys or observing discussions within stock market-related Facebook Groups? However, ensuring the reliability and impartiality of their comments presents a challenge!

From time to time, I conduct surveys within Facebook Groups. My intention isn’t to gauge market sentiment but rather to inquire about the stocks they’d like me to cover in upcoming articles. This approach helps me maintain objectivity when selecting stocks to feature.

To determine whether I should retain my position or take preemptive action, I examine a stock’s overall market sentiment rating. This is particularly crucial when my trailing stop is still in place.

Market sentiment aids me in projecting whether the current trajectory of a stock’s price will persist or reverse course.

As an illustration, if a stock is experiencing a downtrend and the prevalent market sentiment leans bearish, it indicates that the downtrend is likely to endure.

In cases where a stock is in a downtrend but the market sentiment shifts to bullish, it indicates that investors might anticipate a bullish reversal.

Reiterating the point, notice the use of adverbs like “likely” and “might.” Our discourse revolves around probabilities rather than certainties.

Nevertheless, a data-centric approach trumps making decisions solely based on intuition. The former provides the chance to fine-tune strategies, while the latter does not.

On my website, you can find comprehensive explanations regarding the creation of my exclusive Market Sentiment Index indicator. Feel free to utilize the SEARCH feature and input “Market Sentiment” to access my additional articles discussing this topic.

Here’s the overall Market Sentiment rating for August 2023 of the 8 banking stock picks of COL Financial:

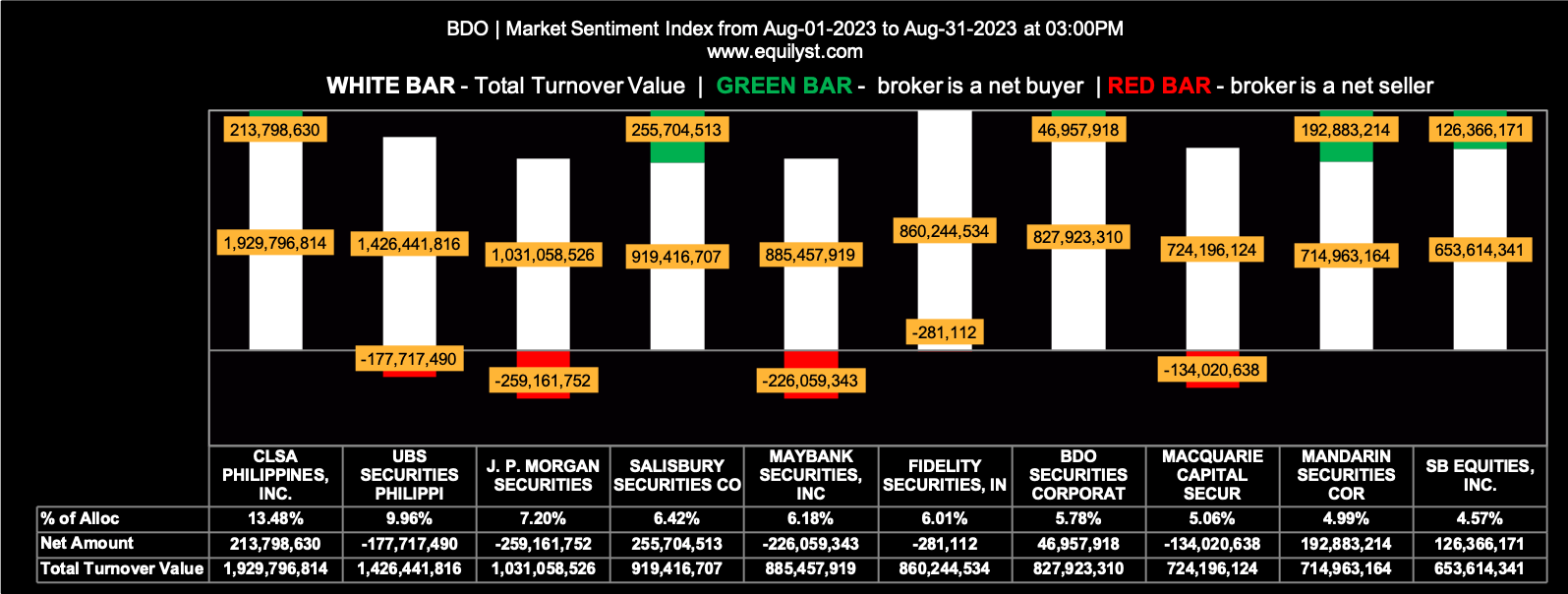

BDO Unibank, Inc. (BDO)

Market Sentiment Index: BEARISH

50 of the 88 participating brokers, or 56.82% of all participants, registered a positive Net Amount

28 of the 88 participating brokers, or 31.82% of all participants, registered a higher Buying Average than Selling Average

88 Participating Brokers’ Buying Average: ₱141.06727

88 Participating Brokers’ Selling Average: ₱142.01102

8 out of 88 participants, or 9.09% of all participants, registered a 100% BUYING activity

8 out of 88 participants, or 9.09% of all participants, registered a 100% SELLING activity

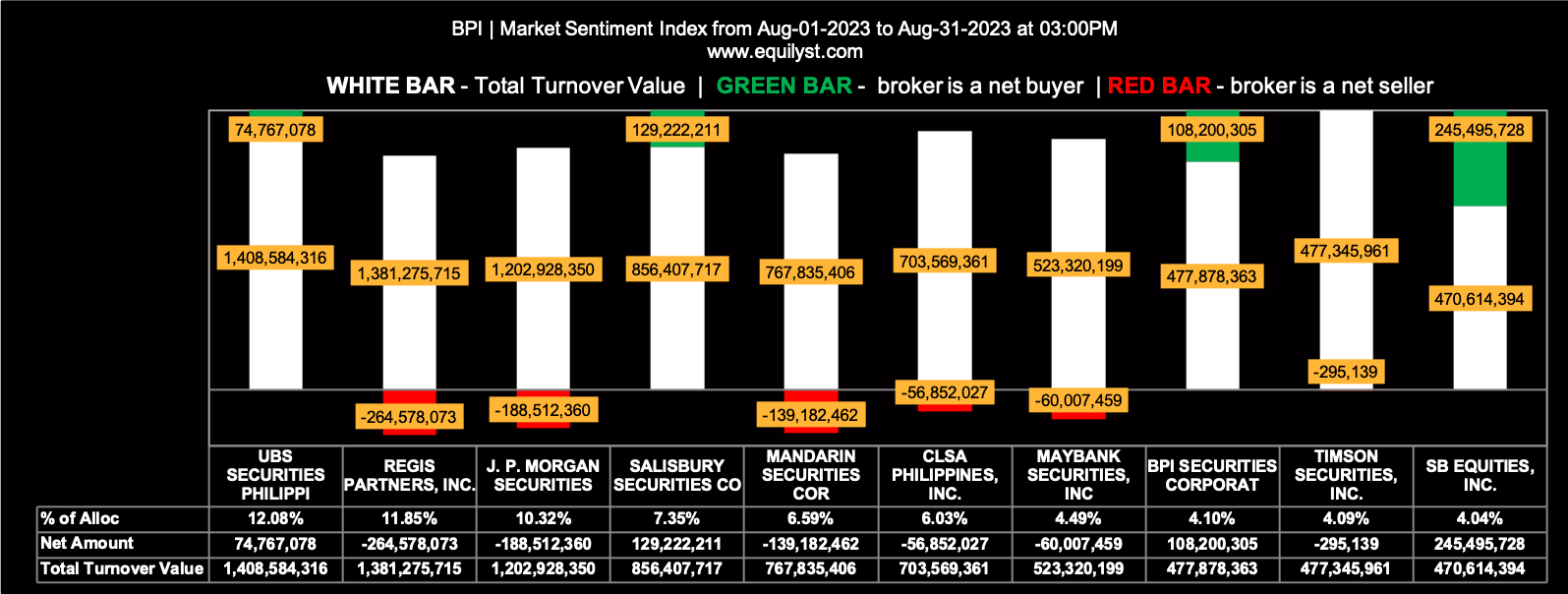

Bank of the Philippine Islands (BPI)

Market Sentiment Index: BEARISH

51 of the 87 participating brokers, or 58.62% of all participants, registered a positive Net Amount

29 of the 87 participating brokers, or 33.33% of all participants, registered a higher Buying Average than Selling Average

87 Participating Brokers’ Buying Average: ₱110.40180

87 Participating Brokers’ Selling Average: ₱112.39080

10 out of 87 participants, or 11.49% of all participants, registered a 100% BUYING activity

7 out of 87 participants, or 8.05% of all participants, registered a 100% SELLING activity

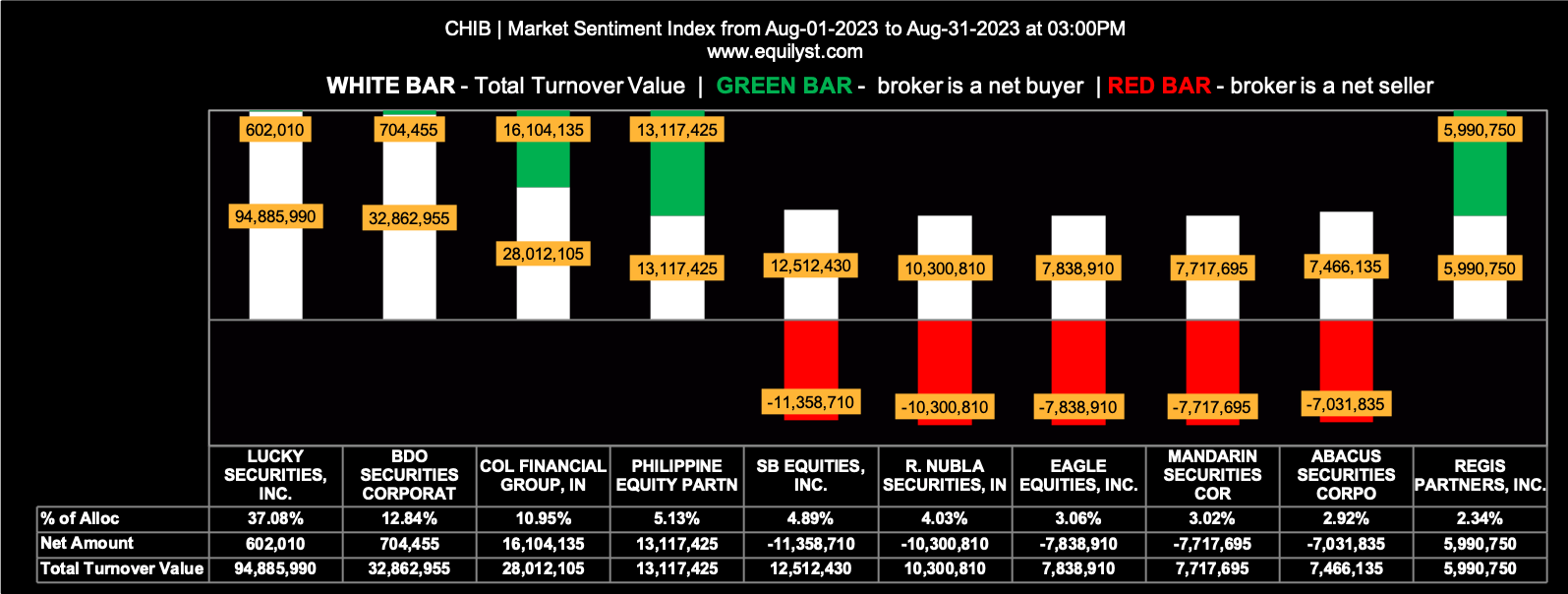

China Banking Corporation (CHIB)

Market Sentiment Index: BEARISH

18 of the 48 participating brokers, or 37.50% of all participants, registered a positive Net Amount

14 of the 48 participating brokers, or 29.17% of all participants, registered a higher Buying Average than Selling Average

48 Participating Brokers’ Buying Average: ₱31.07994

48 Participating Brokers’ Selling Average: ₱31.16334

8 out of 48 participants, or 16.67% of all participants, registered a 100% BUYING activity

22 out of 48 participants, or 45.83% of all participants, registered a 100% SELLING activity

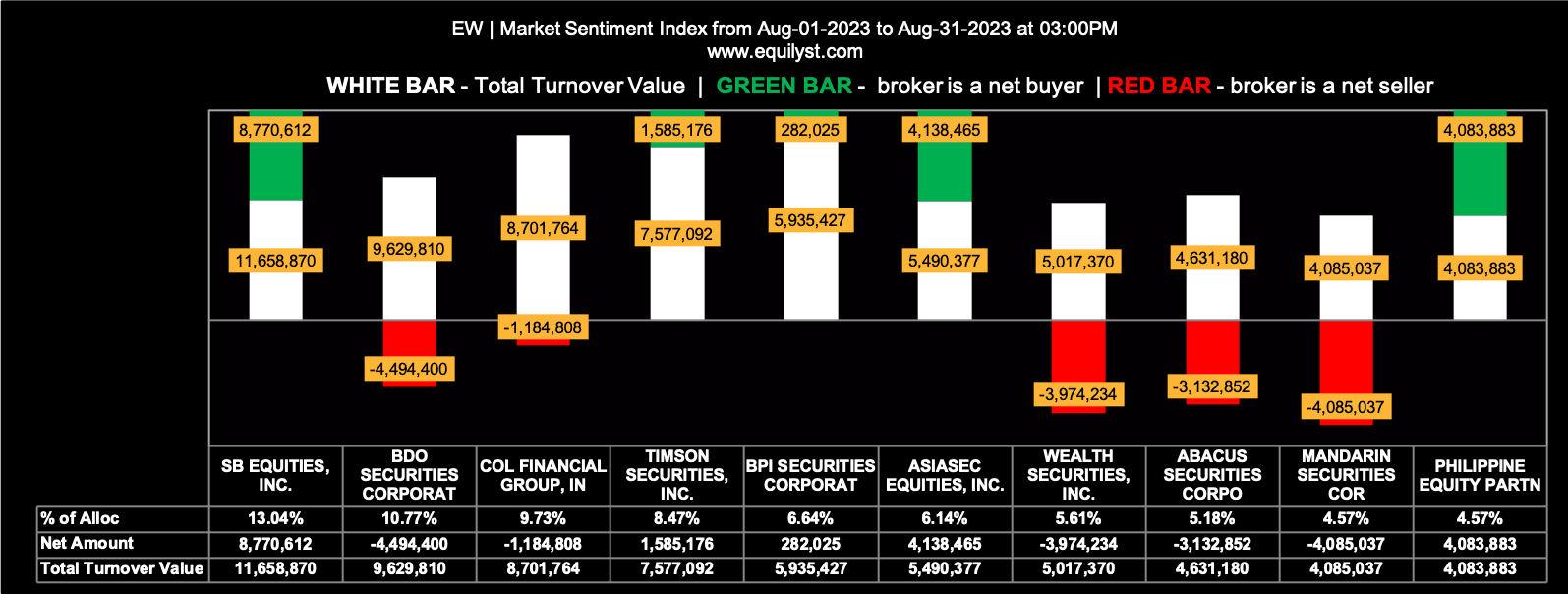

East West Banking Corporation (EW)

Market Sentiment Index: BEARISH

20 of the 47 participating brokers, or 42.55% of all participants, registered a positive Net Amount

17 of the 47 participating brokers, or 36.17% of all participants, registered a higher Buying Average than Selling Average

47 Participating Brokers’ Buying Average: ₱7.00785

47 Participating Brokers’ Selling Average: ₱7.06856

10 out of 47 participants, or 21.28% of all participants, registered a 100% BUYING activity

16 out of 47 participants, or 34.04% of all participants, registered a 100% SELLING activity

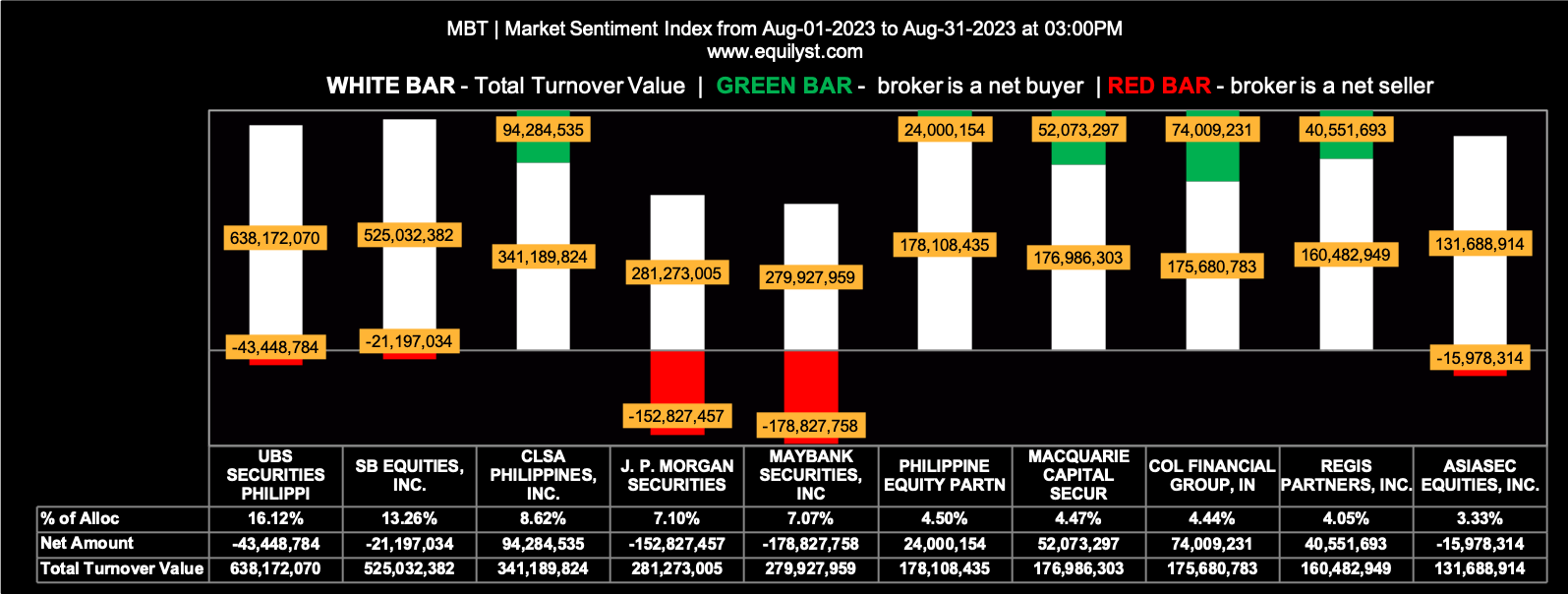

Metropolitan Bank & Trust Company (MBT)

Market Sentiment Index: BEARISH

62 of the 89 participating brokers, or 69.66% of all participants, registered a positive Net Amount

26 of the 89 participating brokers, or 29.21% of all participants, registered a higher Buying Average than Selling Average

89 Participating Brokers’ Buying Average: ₱55.75999

89 Participating Brokers’ Selling Average: ₱56.71094

12 out of 89 participants, or 13.48% of all participants, registered a 100% BUYING activity

6 out of 89 participants, or 6.74% of all participants, registered a 100% SELLING activity

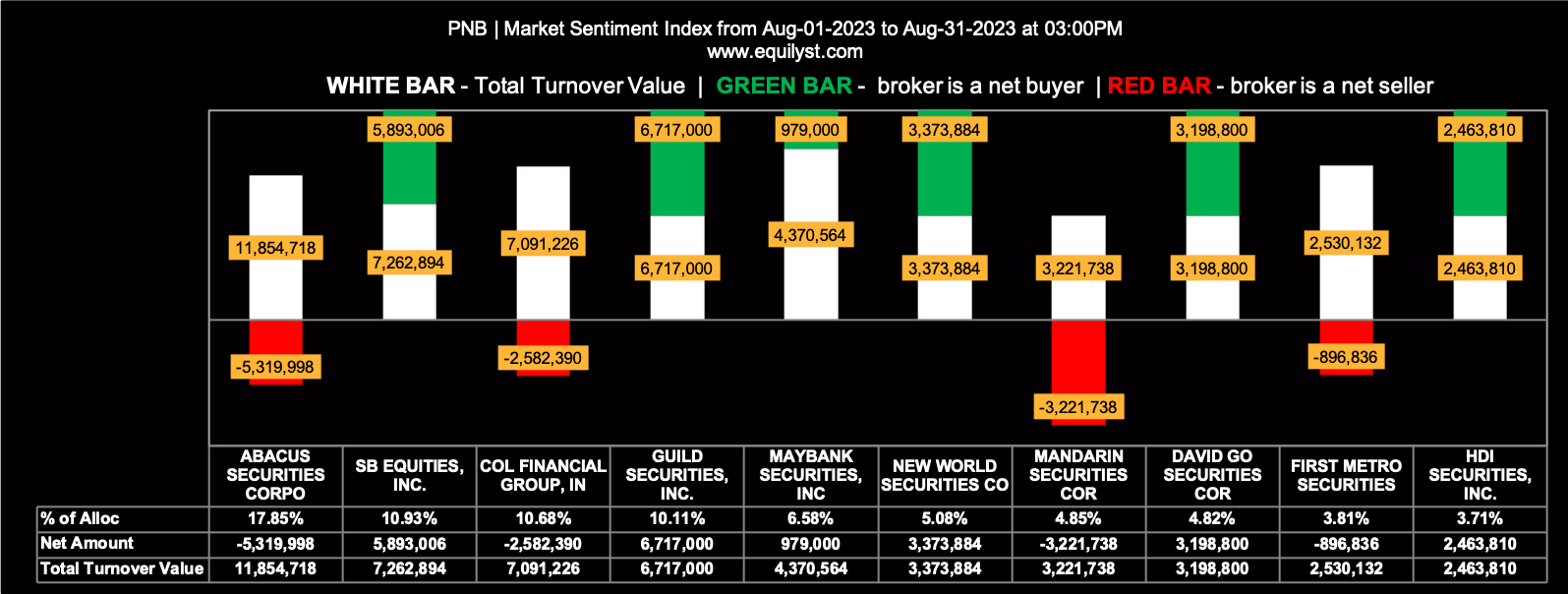

Philippine National Bank (PNB)

Market Sentiment Index: BEARISH

13 of the 43 participating brokers, or 30.23% of all participants, registered a positive Net Amount

17 of the 43 participating brokers, or 39.53% of all participants, registered a higher Buying Average than Selling Average

43 Participating Brokers’ Buying Average: ₱18.30901

43 Participating Brokers’ Selling Average: ₱18.31308

11 out of 43 participants, or 25.58% of all participants, registered a 100% BUYING activity

18 out of 43 participants, or 41.86% of all participants, registered a 100% SELLING activity

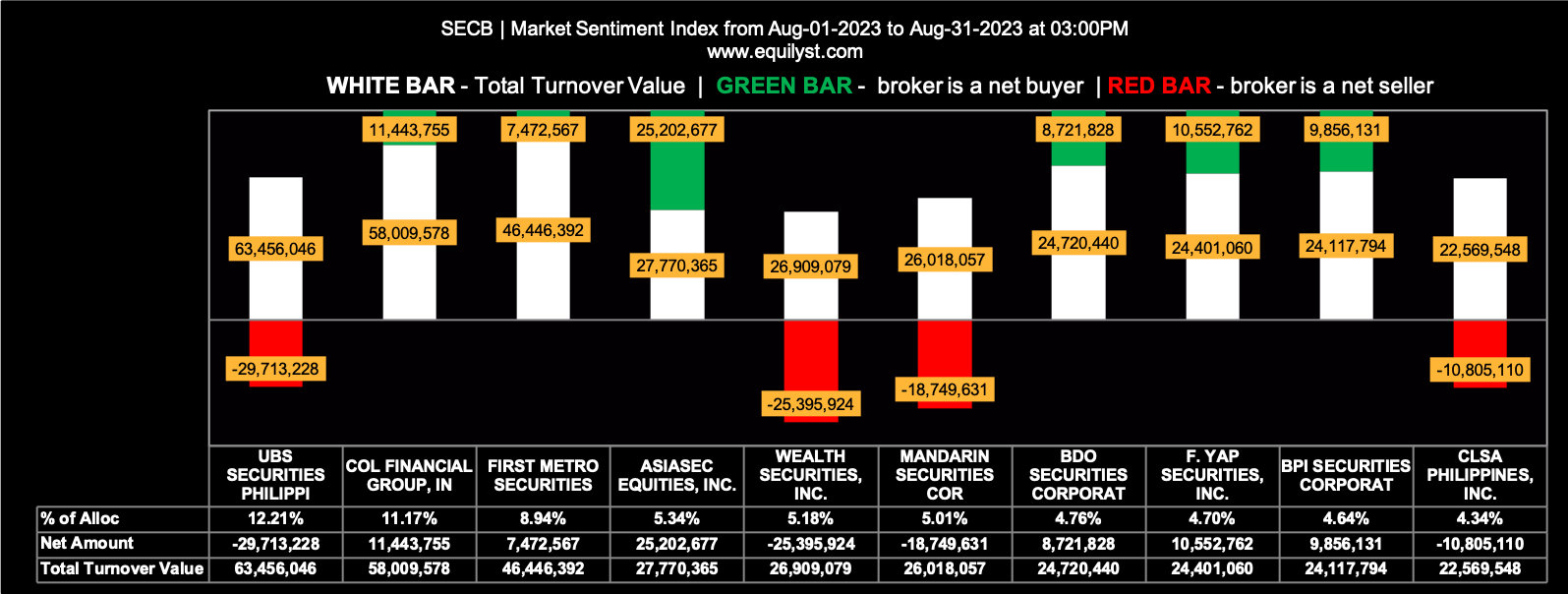

Security Bank Corporation (SECB)

Market Sentiment Index: BULLISH

53 of the 78 participating brokers, or 67.95% of all participants, registered a positive Net Amount

43 of the 78 participating brokers, or 55.13% of all participants, registered a higher Buying Average than Selling Average

78 Participating Brokers’ Buying Average: ₱80.95988

78 Participating Brokers’ Selling Average: ₱81.43464

25 out of 78 participants, or 32.05% of all participants, registered a 100% BUYING activity

7 out of 78 participants, or 8.97% of all participants, registered a 100% SELLING activity

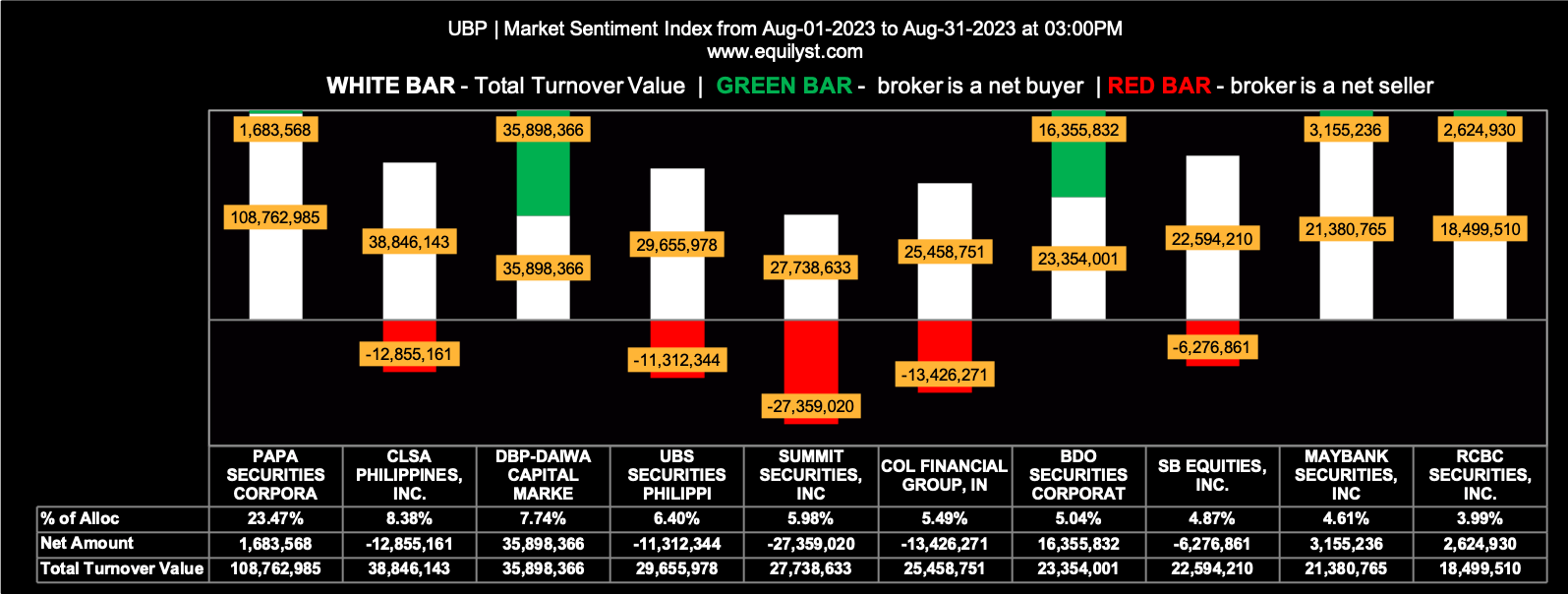

Union Bank of the Philippines (UBP)

Market Sentiment Index: BEARISH

39 of the 62 participating brokers, or 62.90% of all participants, registered a positive Net Amount

29 of the 62 participating brokers, or 46.77% of all participants, registered a higher Buying Average than Selling Average

62 Participating Brokers’ Buying Average: ₱71.44156

62 Participating Brokers’ Selling Average: ₱72.18701

18 out of 62 participants, or 29.03% of all participants, registered a 100% BUYING activity

6 out of 62 participants, or 9.68% of all participants, registered a 100% SELLING activity

What Are Your Thoughts About the 8 Banking Stock Picks of COL Financial?

Did you find this article helpful? How has it helped you? In what way? Let me know in the comments below.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025