What’s Price-to-Book Value and the Ideal P/BV?

The price-to-book value is a financial metric that compares a company’s market price per share to its book value per share. It is calculated by dividing the market price per share by the book value per share.

What’s the ideal price-to-book value (P/BV)?

There’s no universal or ideal price-to-book value, but a P/BV less than 1 typically suggests that the market values the company lower than its accounting value, which could indicate an undervalued stock. Conversely, a P/BV greater than 1 suggests the market values the company higher than its accounting value.

Based on that argument, I’ve checked which among the 30 bluechip stocks in the Philippine Stock Exchange have a P/BV less than 1 as of market closing on August 30, 2023.

In addition to ranking them, I’m also going to show you their month-to-date Market Sentiment Index so you’ll have a data-driven idea of the confidence level of market participants

10 Undervalued Philippine Bluechip Stocks Based on P/BV Less Than 1

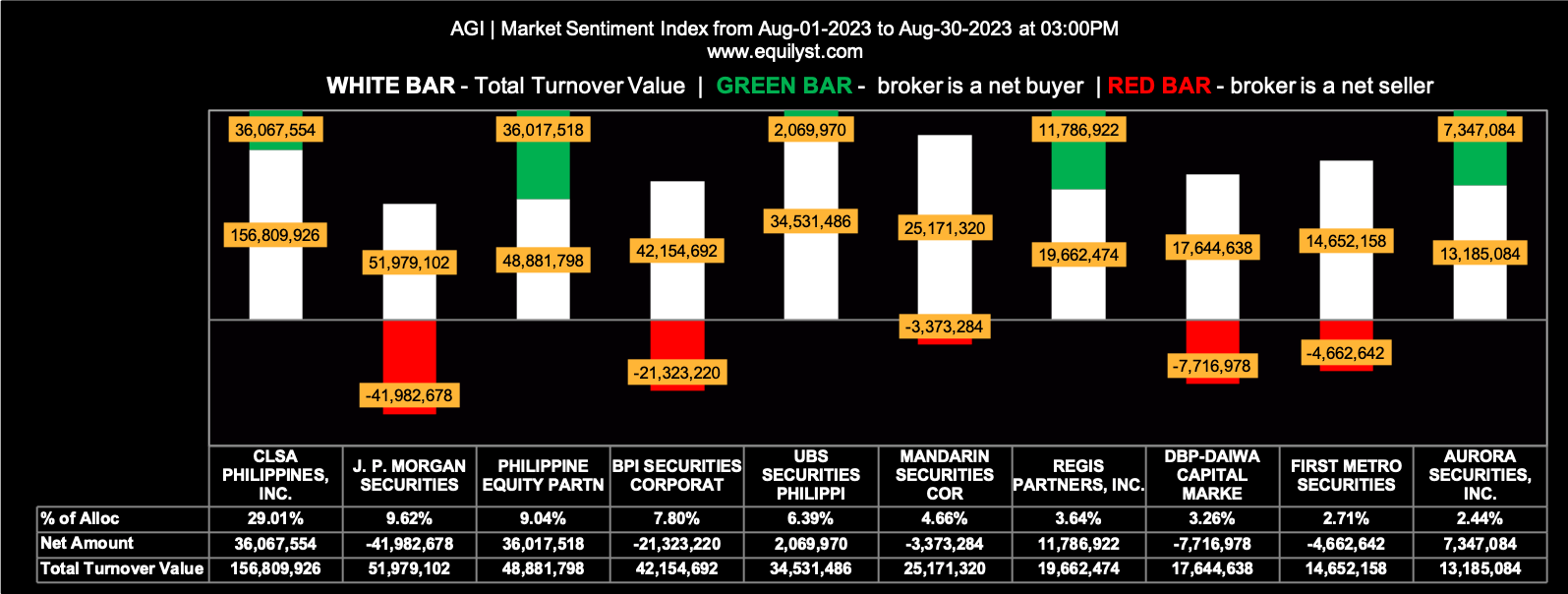

Rank: 10

Stock Code: AGI

Company Name: Alliance Global Group, Inc.

Price-to-Book Value: 0.46

Market Sentiment Index: BEARISH

23 of the 68 participating brokers, or 33.82% of all participants, registered a positive Net Amount

23 of the 68 participating brokers, or 33.82% of all participants, registered a higher Buying Average than Selling Average

68 Participating Brokers’ Buying Average: ₱12.28765

68 Participating Brokers’ Selling Average: ₱12.48985

8 out of 68 participants, or 11.76% of all participants, registered a 100% BUYING activity

12 out of 68 participants, or 17.65% of all participants, registered a 100% SELLING activity

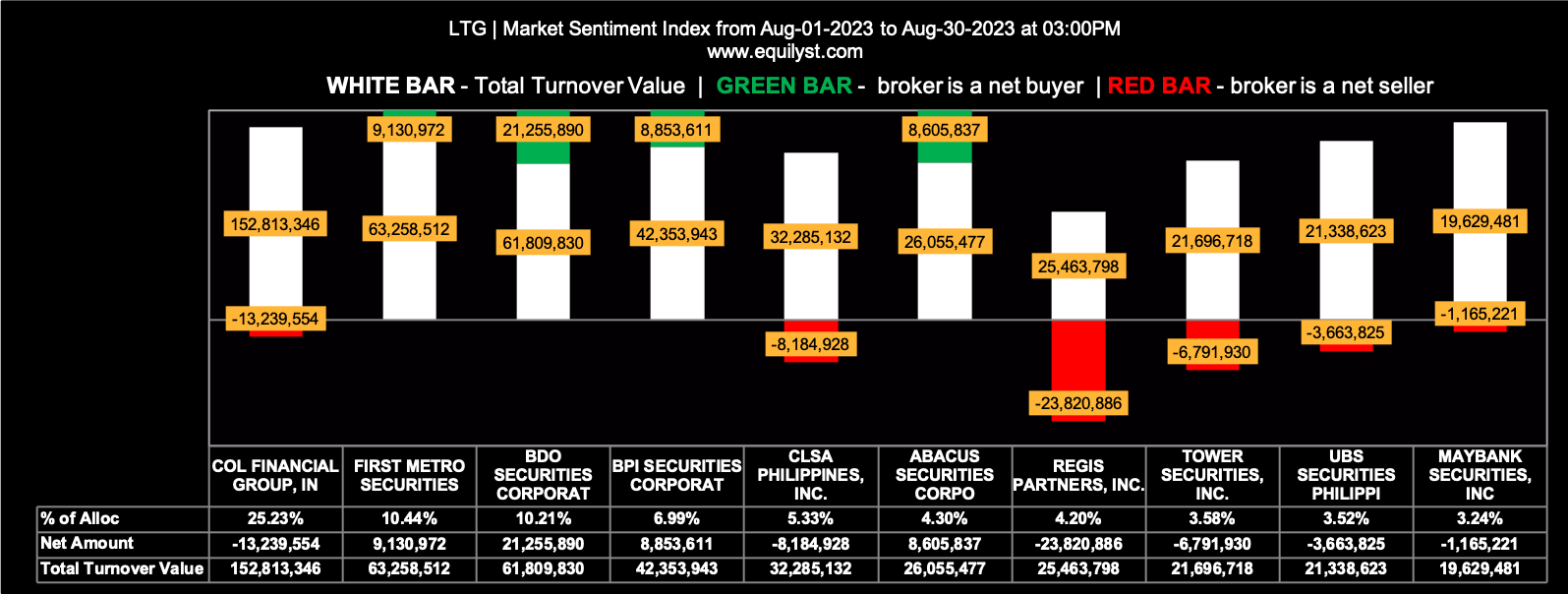

Rank: 9

Stock Code: LTG

Company Name: LT Group, Inc.

Price-to-Book Value: 0.49

Market Sentiment Index: BULLISH

51 of the 76 participating brokers, or 67.11% of all participants, registered a positive Net Amount

47 of the 76 participating brokers, or 61.84% of all participants, registered a higher Buying Average than Selling Average

76 Participating Brokers’ Buying Average: ₱9.36856

76 Participating Brokers’ Selling Average: ₱9.40510

30 out of 76 participants, or 39.47% of all participants, registered a 100% BUYING activity

6 out of 76 participants, or 7.89% of all participants, registered a 100% SELLING activity

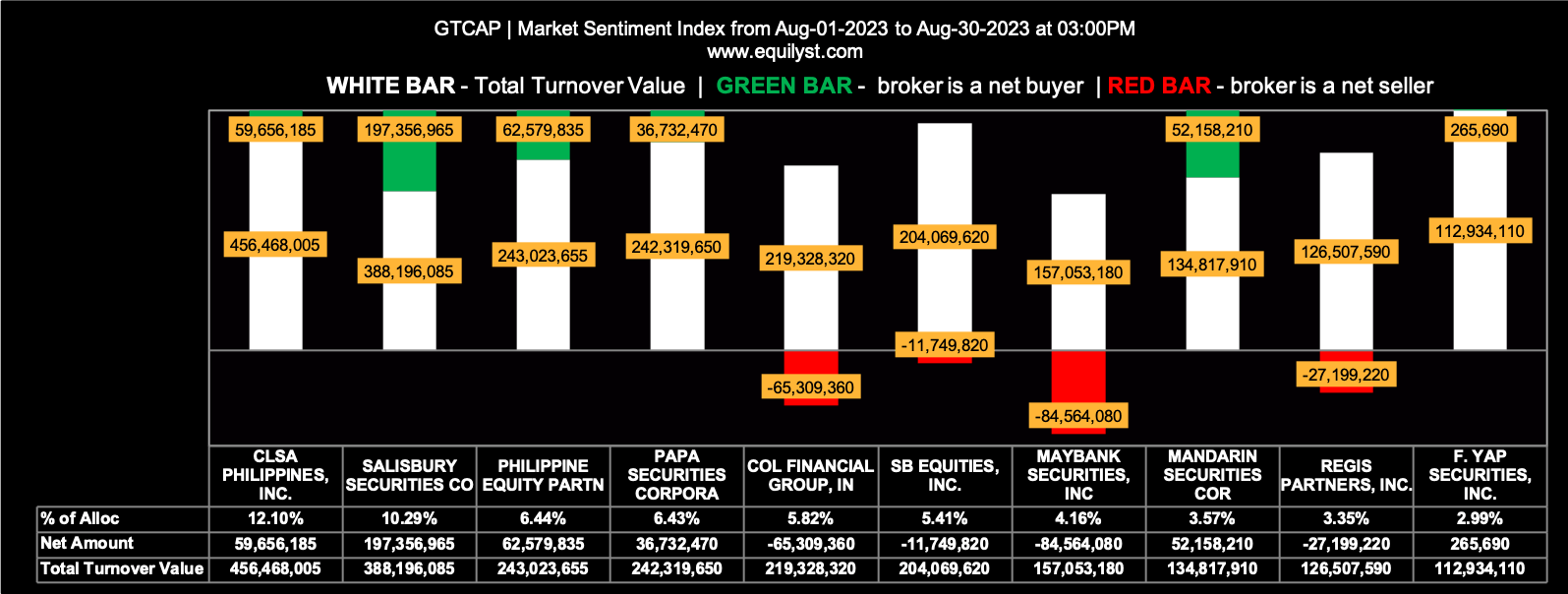

Rank: 8

Stock Code: GTCAP

Company Name: GT Capital Holdings, Inc.

Price-to-Book Value: 0.55

Market Sentiment Index: BEARISH

25 of the 91 participating brokers, or 27.47% of all participants, registered a positive Net Amount

27 of the 91 participating brokers, or 29.67% of all participants, registered a higher Buying Average than Selling Average

91 Participating Brokers’ Buying Average: ₱537.30564

91 Participating Brokers’ Selling Average: ₱543.98375

5 out of 91 participants, or 5.49% of all participants, registered a 100% BUYING activity

32 out of 91 participants, or 35.16% of all participants, registered a 100% SELLING activity

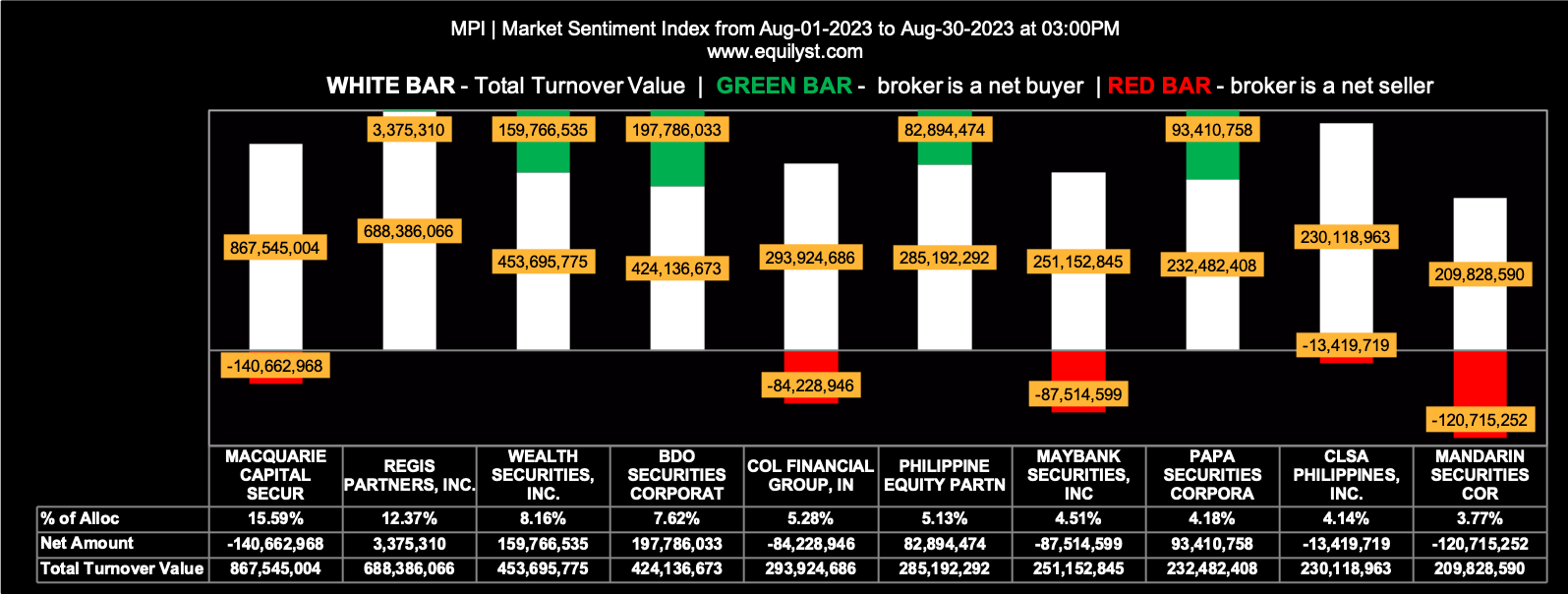

Rank: 7

Stock Code: MPI

Company Name: Metro Pacific Investments Corporation

Price-to-Book Value: 0.71

Market Sentiment Index: BEARISH

45 of the 97 participating brokers, or 46.39% of all participants, registered a positive Net Amount

40 of the 97 participating brokers, or 41.24% of all participants, registered a higher Buying Average than Selling Average

97 Participating Brokers’ Buying Average: ₱4.98084

97 Participating Brokers’ Selling Average: ₱4.99671

17 out of 97 participants, or 17.53% of all participants, registered a 100% BUYING activity

21 out of 97 participants, or 21.65% of all participants, registered a 100% SELLING activity

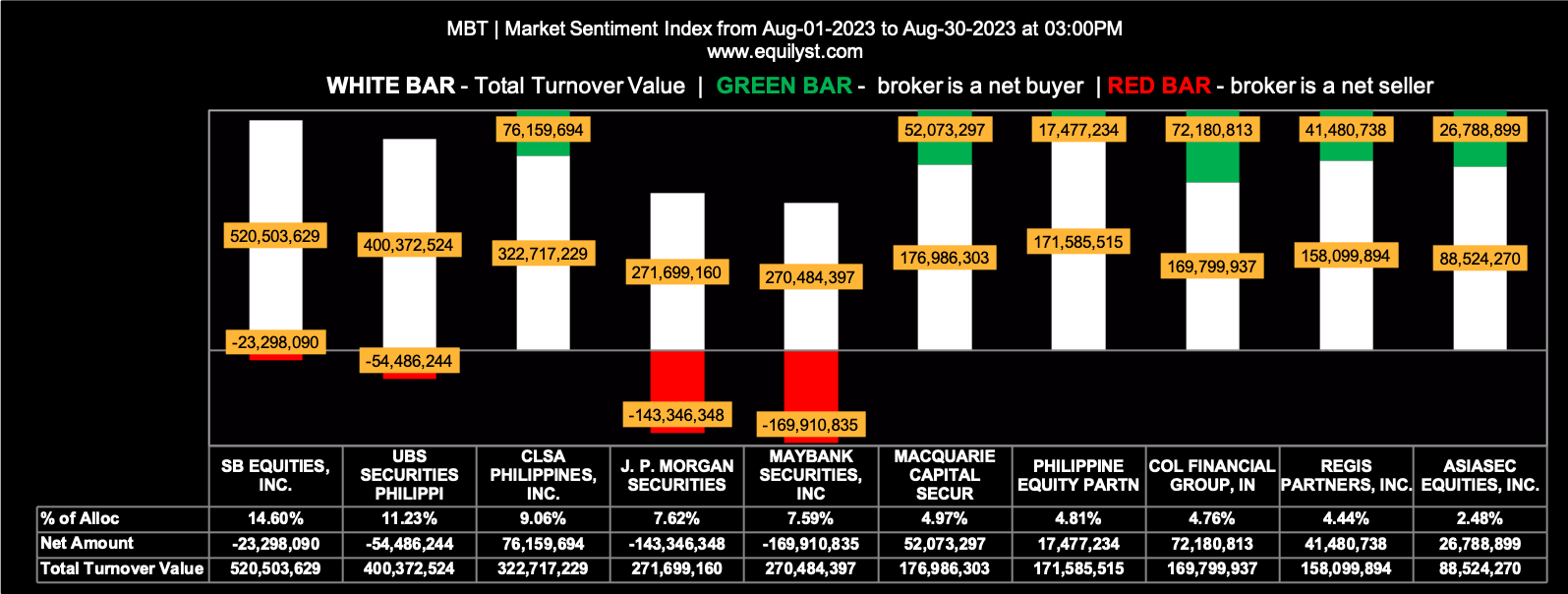

Rank: 6

Stock Code: MBT

Company Name: Metropolitan Bank & Trust Company

Price-to-Book Value: 0.75

Market Sentiment Index: BEARISH

64 of the 89 participating brokers, or 71.91% of all participants, registered a positive Net Amount

27 of the 89 participating brokers, or 30.34% of all participants, registered a higher Buying Average than Selling Average

89 Participating Brokers’ Buying Average: ₱55.79913

89 Participating Brokers’ Selling Average: ₱56.78444

12 out of 89 participants, or 13.48% of all participants, registered a 100% BUYING activity

6 out of 89 participants, or 6.74% of all participants, registered a 100% SELLING activity

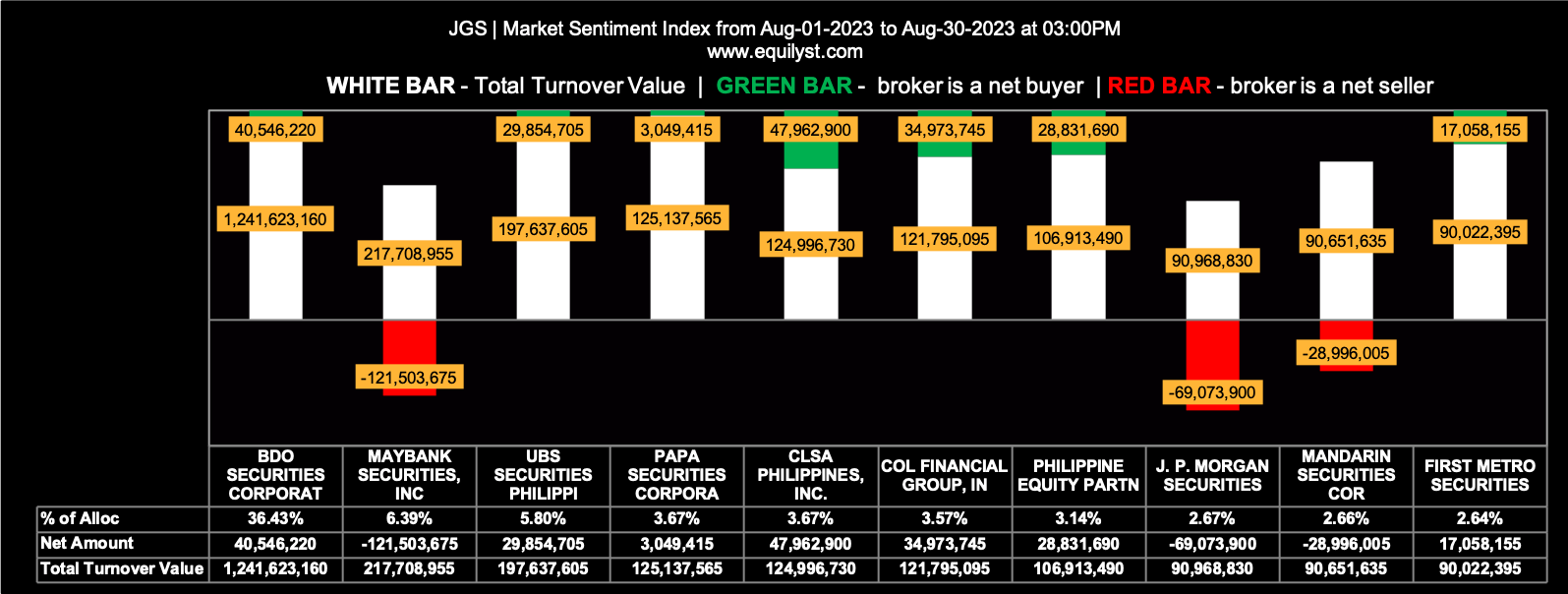

Rank: 5

Stock Code: JGS

Company Name: JG Summit Holdings, Inc.

Price-to-Book Value: 0.89

Market Sentiment Index: BULLISH

62 of the 84 participating brokers, or 73.81% of all participants, registered a positive Net Amount

49 of the 84 participating brokers, or 58.33% of all participants, registered a higher Buying Average than Selling Average

84 Participating Brokers’ Buying Average: ₱39.02677

84 Participating Brokers’ Selling Average: ₱39.10922

18 out of 84 participants, or 21.43% of all participants, registered a 100% BUYING activity

2 out of 84 participants, or 2.38% of all participants, registered a 100% SELLING activity

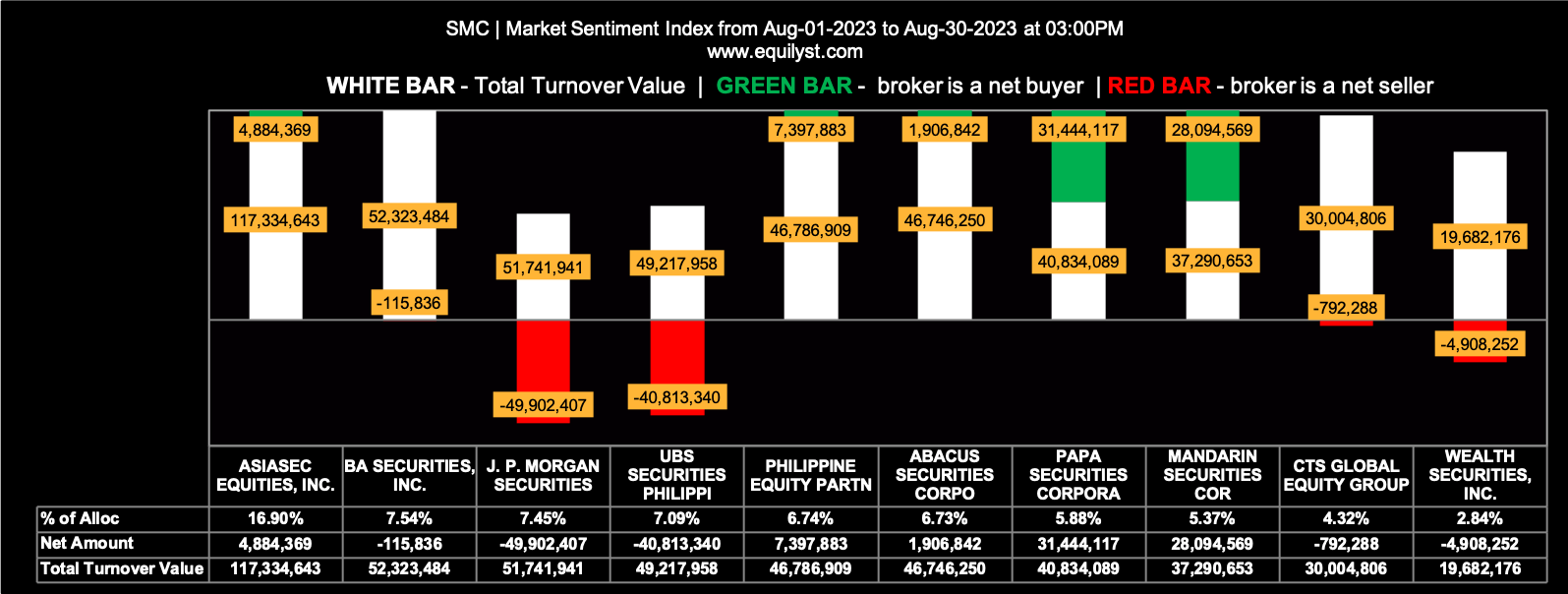

Rank: 4

Stock Code: SMC

Company Name: San Miguel Corporation

Price-to-Book Value: 0.90

Market Sentiment Index: BEARISH

29 of the 72 participating brokers, or 40.28% of all participants, registered a positive Net Amount

19 of the 72 participating brokers, or 26.39% of all participants, registered a higher Buying Average than Selling Average

72 Participating Brokers’ Buying Average: ₱102.86200

72 Participating Brokers’ Selling Average: ₱104.28155

5 out of 72 participants, or 6.94% of all participants, registered a 100% BUYING activity

20 out of 72 participants, or 27.78% of all participants, registered a 100% SELLING activity

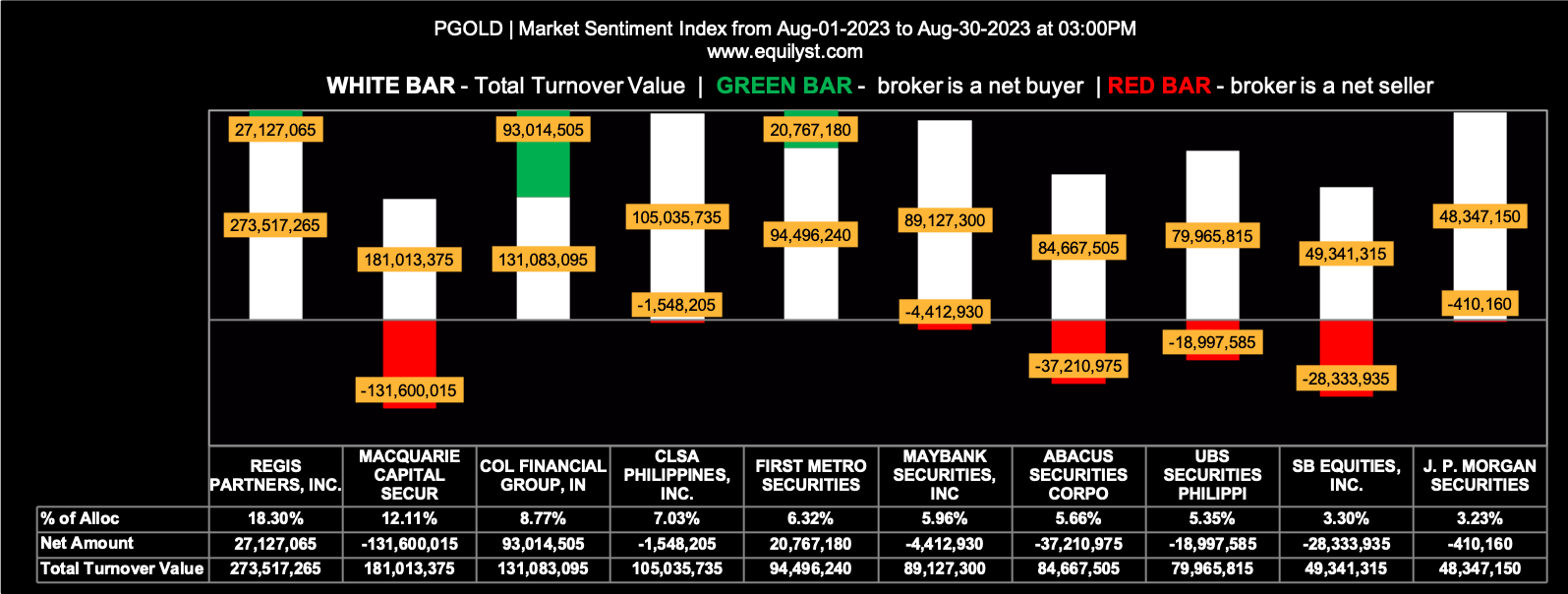

Rank: 3

Stock Code: PGOLD

Company Name: Puregold Price Club, Inc.

Price-to-Book Value: 0.91

Market Sentiment Index: BULLISH

56 of the 78 participating brokers, or 71.79% of all participants, registered a positive Net Amount

47 of the 78 participating brokers, or 60.26% of all participants, registered a higher Buying Average than Selling Average

78 Participating Brokers’ Buying Average: ₱27.89903

78 Participating Brokers’ Selling Average: ₱27.98021

30 out of 78 participants, or 38.46% of all participants, registered a 100% BUYING activity

3 out of 78 participants, or 3.85% of all participants, registered a 100% SELLING activity

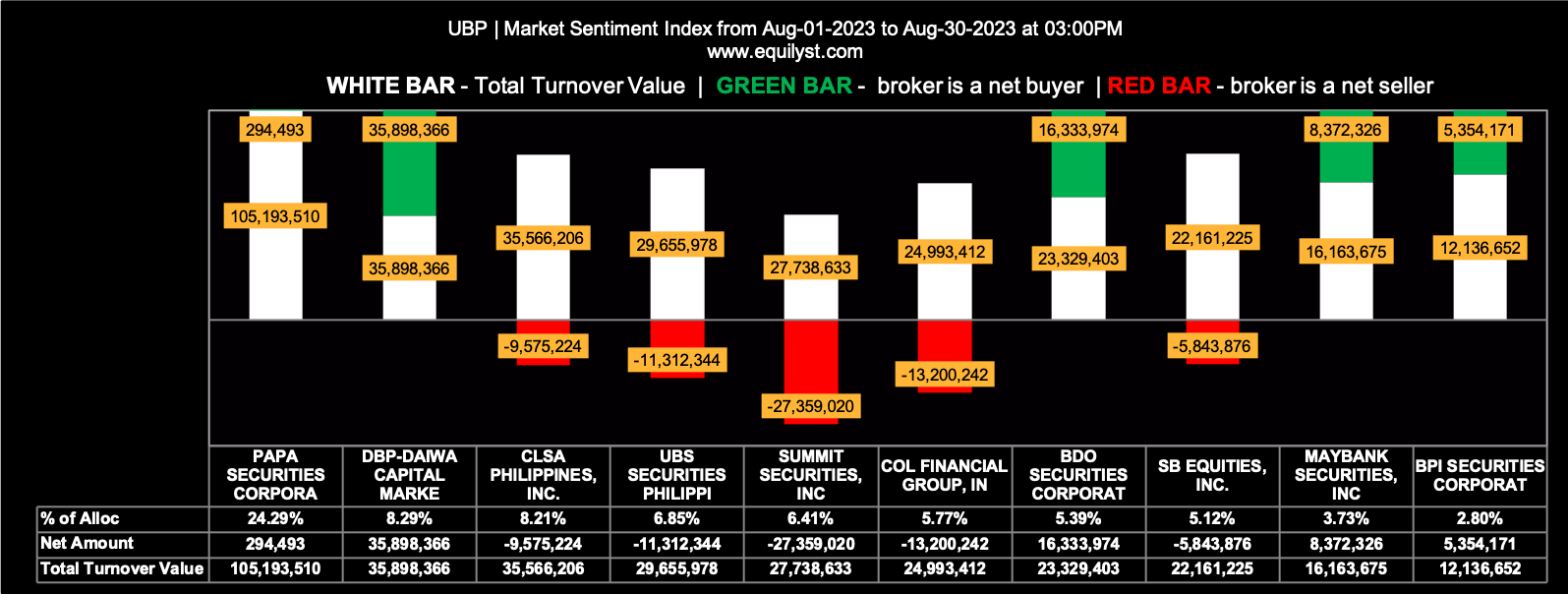

Rank: 2

Stock Code: UBP

Company Name: Union Bank of the Philippines

Price-to-Book Value: 0.94

Market Sentiment Index: BEARISH

37 of the 62 participating brokers, or 59.68% of all participants, registered a positive Net Amount

29 of the 62 participating brokers, or 46.77% of all participants, registered a higher Buying Average than Selling Average

62 Participating Brokers’ Buying Average: ₱71.66267

62 Participating Brokers’ Selling Average: ₱72.29145

18 out of 62 participants, or 29.03% of all participants, registered a 100% BUYING activity

8 out of 62 participants, or 12.90% of all participants, registered a 100% SELLING activity

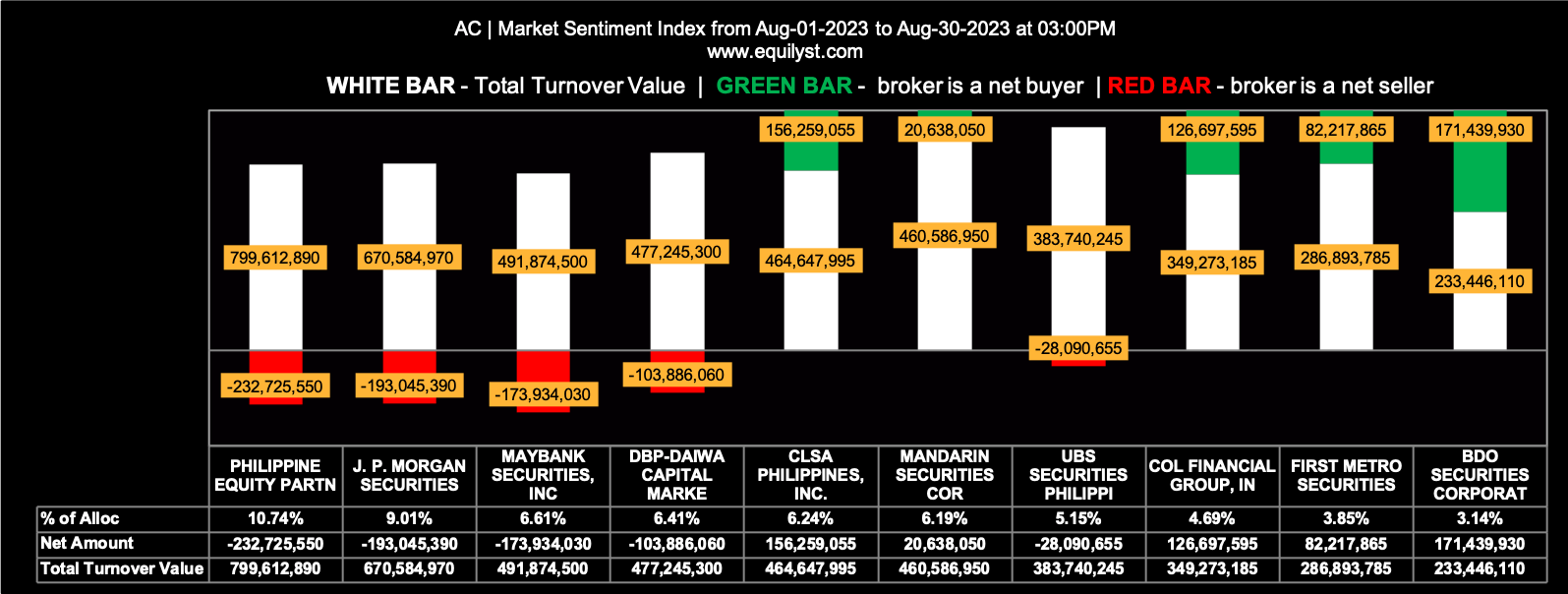

Rank: 1

Stock Code: AC

Company Name: Ayala Corporation

Price-to-Book Value: 0.97

Market Sentiment Index: BEARISH

65 of the 93 participating brokers, or 69.89% of all participants, registered a positive Net Amount

39 of the 93 participating brokers, or 41.94% of all participants, registered a higher Buying Average than Selling Average

93 Participating Brokers’ Buying Average: ₱604.11471

93 Participating Brokers’ Selling Average: ₱609.13370

16 out of 93 participants, or 17.20% of all participants, registered a 100% BUYING activity

2 out of 93 participants, or 2.15% of all participants, registered a 100% SELLING activity

Buy the Stock If Its Price-to-Book Value Is Less Than 1?

Avoid making buy or sell decisions based on a single metric or indicator. Check the price trend and market sentiment as well.

For instance, consider a company that is undervalued because its price-to-book value is less than 1. However, if it’s entrenched in a downtrend and its market sentiment is bearish, will it actually generate profit in that particular scenario?

Wouldn’t it make more sense to wait for signs of selling exhaustion before considering the purchase of the stock?

After all, as the price continues to dive, the company becomes even more undervalued relative to its P/BV.

Buy the Stock If Its P/BV Is Less Than 1 and Its Market Sentiment Index Is Bullish?

It can be a ‘yes’ or ‘no,’ depending on your strategy.

Regarding my strategy, I still need to check the other five indicators that constitute my Evergreen Strategy.

If those five indicators also show a bullish trend, I will consider topping up within or near the prevailing dominant range.

For a new position, there are two additional steps I need to take before buying within or near the dominant range. I must calculate my initial trailing stop and my reward-to-risk ratio.

If I am content with my reward-to-risk ratio in relation to my risk tolerance percentage, that’s when I will execute a pilot buy within or near the dominant range.

If you’re interested in one-on-one training with me, please explore my stock investment consultancy service.

Conversely, if you’re impressed by my writing and would like to hire me to write content for your stockbrokerage company or finance-related website, please fill out this form.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025