Cemex Announces Intent to Divest from Philippines Operations

Cemex’s subsidiary, Cemex Asia B.V., has agreed to sell its Philippines operations and assets to DACON Corporation, DMCI Holdings, Inc., and Semirara Mining & Power Corporation. This sale, once finalized, will further Cemex’s portfolio rebalancing strategy. The assets include:

- 100% equity interest in Cemex Asian South East Corporation, which owns approximately 89% of Cemex Holdings Philippines, Inc. (CHP), listed on the Philippine Stock Exchange, Inc. This sale involves deducting net debt and the 10.14% minority interest in CHP from an enterprise value of US$660 million. CHP owns Cemex’s main operating subsidiaries in the Philippines: APO Cement Corporation and Solid Cement Corporation.

- 40% indirect equity interest in APO Land & Quarry Corporation (ALQC) and Island Quarry and Aggregates Corporation (IQAC), with a purchase price of 40% of an aggregate enterprise value of US$140 million to be paid to Cemex.

Cemex aims to finalize the transaction by year-end 2024, pending regulatory approvals. Until then, Cemex’s Philippines operations will continue as usual. The proceeds from the divestment will fund the company’s investment growth strategy, debt reduction, and other corporate purposes.

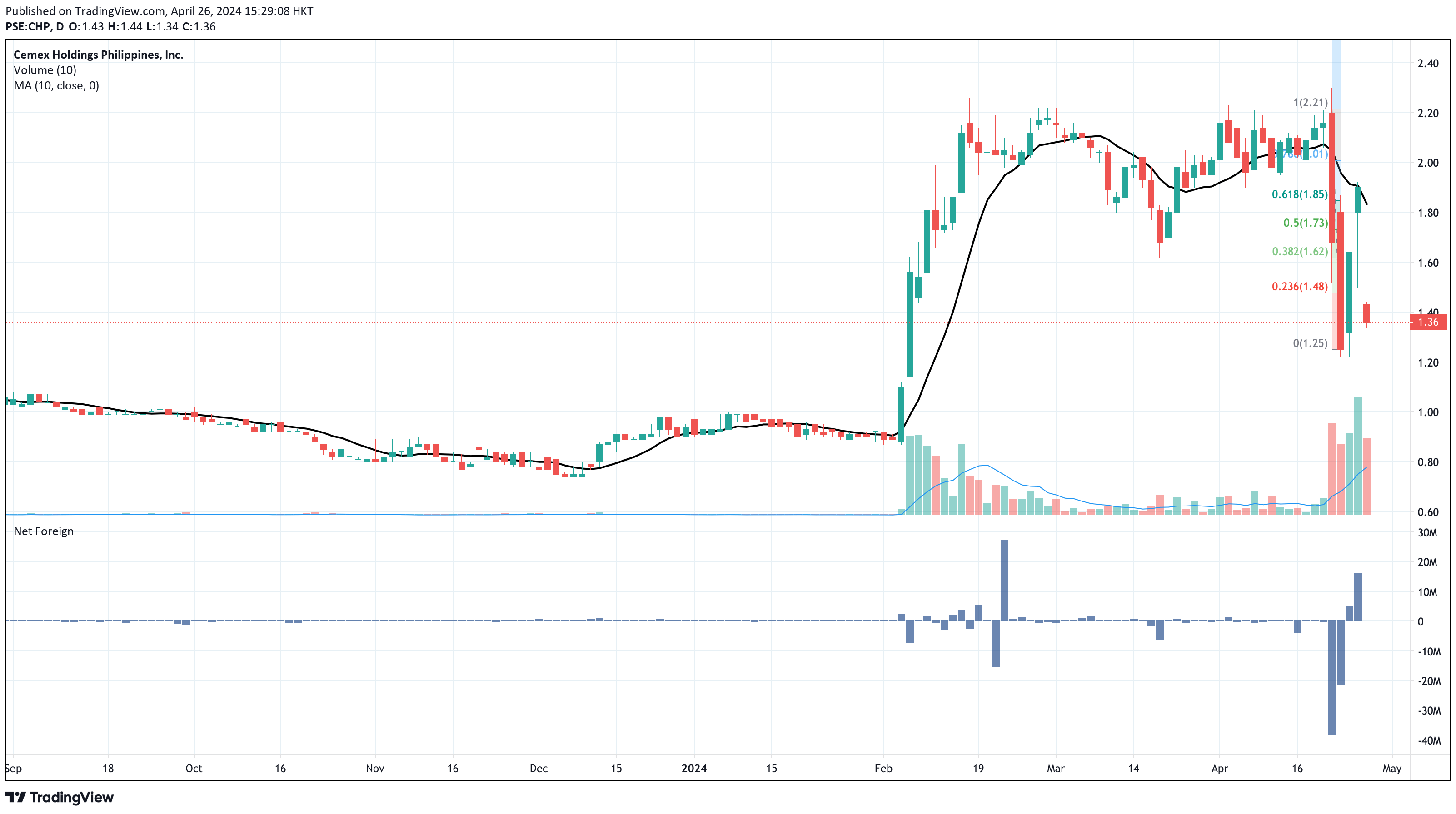

Cemex Holdings Philippines (CHP) Technical Analysis

CHP struggles to regain its position above the 23.6% Fibonacci retracement on April 26, 2024, as the stock continues to experience lackluster buying momentum.

There are no volume-related concerns as CHP managed to register a volume higher than 100% of its 10-day volume average on April 26, 2024.

CHP’s support level is at P1.25, while its resistance is confluent with the 23.6% Fibonacci retracement at P1.48. If and when P1.48 is broken, the next resistance will be at P1.62, aligned with the 38.2% Fibonacci retracement.

Today’s price is still attributed to the transactions of local traders. Foreign investors have registered a net foreign selling amount of P4.50 million as of the time of writing this report.

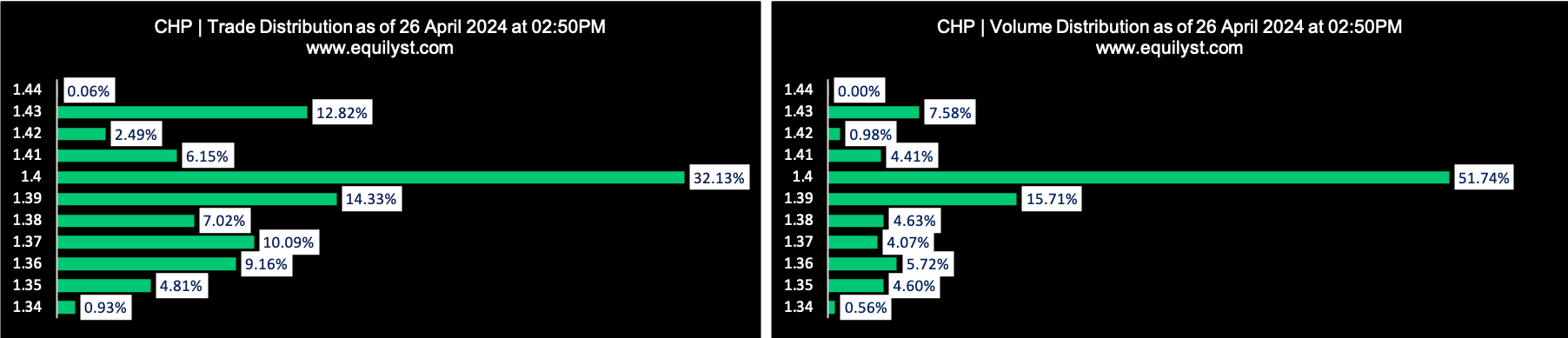

Even though CHP’s dominant range of P1.39 to P1.40 is closer to the intraday high than its intraday low, my proprietary Dominant Range Index gives this stock a bearish rating because its last price is lower than its volume-weighted average price of P1.39.

Dominant Range Index: BEARISH

Last Price: 1.36

Dominant Range: 1.39 – 1.40

VWAP: 1.39

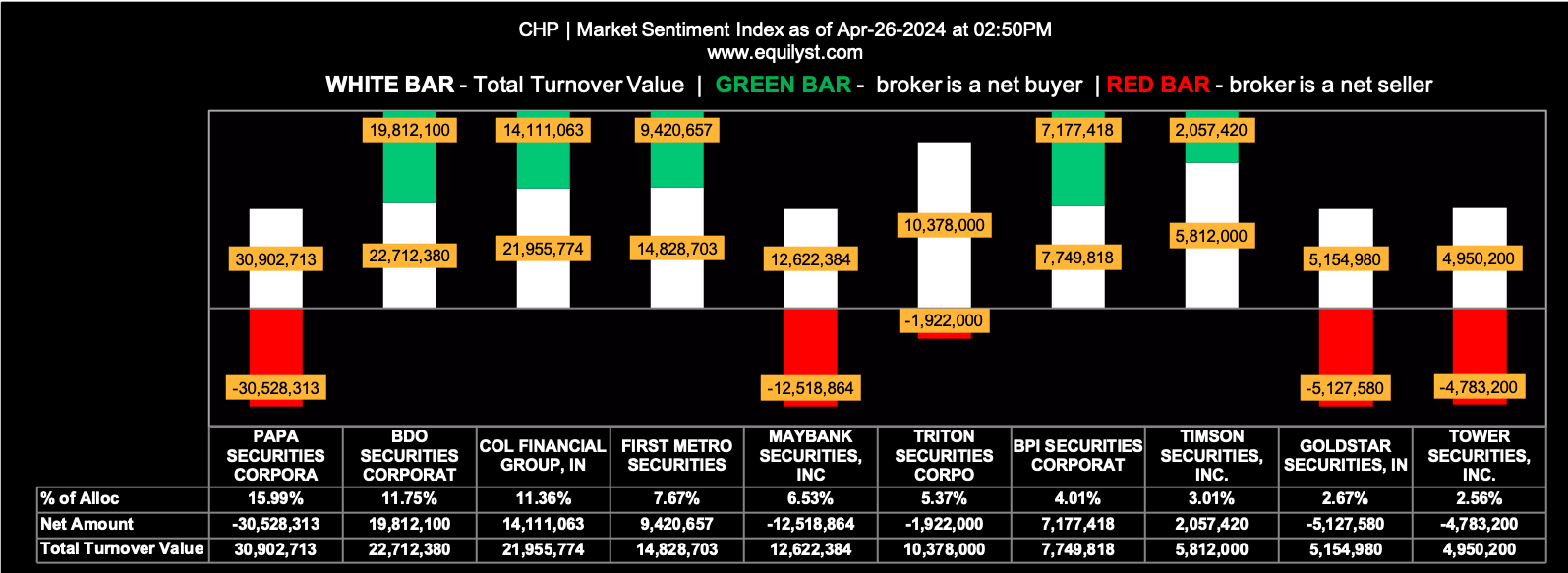

Meanwhile, my Market Sentiment Index gives CHP a contrarian bullish rating. The numbers below speak for themselves.

Before you jump to the conclusion that it’s time to buy CHP just because more than one-third of today’s market participants have registered a 100% buying appetite, consider the possibility that these confident buyers might be new entrants.

So, if you’ve held CHP for a while now, you’re in a different scenario than the new entrants. Don’t top up just for the sake of it. Top up only if there’s a slim chance of seeing the stock continuing to dig deeper.

Market Sentiment Index: BULLISH

49 of the 67 participating brokers, or 73.13% of all participants, registered a positive Net Amount

48 of the 67 participating brokers, or 71.64% of all participants, registered a higher Buying Average than Selling Average

67 Participating Brokers’ Buying Average: ₱1.39118

67 Participating Brokers’ Selling Average: ₱1.38767

26 out of 67 participants, or 38.81% of all participants, registered a 100% BUYING activity

4 out of 67 participants, or 5.97% of all participants, registered a 100% SELLING activity

Buy or Sell CHP?

My answer is based on my proprietary methodology in stock trading and investing. If you don’t have CHP in your portfolio yet, it is prudent to add CHP to your watchlist, but refrain from adding it to your portfolio at this time. The downtrend is still more likely to continue. Traders’ sentiment remains volatile overall. For example, my proprietary Dominant Range Index and Market Sentiment Index hold opposing views. As a risk-averse trader and investor, I’d rather wait for CHP’s price to touch P1.80, an area that’s close to its 10-day simple moving average. Then, I’ll re-assess the prevailing Dominant Range Index and Market Sentiment Index once it hits that price.

On the other hand, if you already have CHP in your portfolio, check if your trailing stop has been hit. If it has, consider selling (either all at once or in tranches, depending on the size of your equity in CHP). If your trailing stop is still intact, there’s no need to panic, and refrain from adding more at this time.

To receive more updates from me, here are my services:

You may also read my other reports here and watch my videos on YouTube.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025