Cebu Pacific Before Landing Below 10-day SMA

Around the second week of May 2023, one of my clients at Equilyst Analytics asked me when the stock would break the resistance at P44.30.

I said the stock must maintain its position above the 10-day simple moving average (SMA) with a volume above 50% of CEB’s 10-day volume average.

It would be better if the volume is higher than 100% of CEB’s 10-day volume average because investors are confident to push the dominant range closer to the intraday high than the intraday low.

If those things happen in unison, there’s a huge possibility for the investors to push the price past P44.30 and not just take profits once it touches that line.

Unfortunately, the price dropped below the 10-day SMA on May 16, 2023.

Volume bars above 100% of CEB’s 10-day volume average were printed the next two days.

That event was strongly in favor of the bearish price action.

All these things happened before the airline company’s Senate hearing last June 21, 2023.

If you have no idea about this ongoing Senate hearing on Cebu Pacific, let me give you a brief walkthrough.

Cebu Pacific in Senate Hot Seat

Cebu Pacific (PSE:CEB), a low-cost airline, apologizes to passengers who have experienced flight disruptions primarily due to fleet availability issues.

During a Senate hearing, Alexander Lao, the chief commercial officer of Cebu Pacific, recognized the difficulties faced by passengers dealing with flight delays and cancellations.

In the joint hearing of the Senate committees on tourism and public services, Lao reassured passengers of Cebu Pacific’s commitment to resolving these challenges, emphasizing their dedication to providing safe, affordable, and reliable flights.

Lao acknowledged the importance of passengers’ trust and confidence in the airline.

He outlined various factors that have affected the airline’s operations, including global supply chain issues and ground damage caused by unforeseen severe weather events.

The grounding of 120 Pratt and Whitney (PW)-powered Airbus aircraft worldwide has impacted Cebu Pacific and other carriers.

Lao explained that prematurely removing PW engines from service has extended the restoration period to 220 days, surpassing the industry standard of 90 days.

To illustrate, he drew a comparison to preventive car maintenance, where inspections occur at 3,000 kilometers instead of the expected 5,000 kilometers, and the vehicle spends a month in the shop instead of a day.

This year alone, Cebu Pacific has faced 12 unscheduled engine removals and has indefinitely grounded three Airbus A321/A320 NEOs since mid-March.

Lao also highlighted delays caused by Airbus, their aircraft manufacturer, and the global supply chain issues, resulting in 2 to 5 months of delivery delays in 2023.

Besides fleet-related matters, the budget airline mentioned other incidents impacting their operations, such as ground damage from runway debris, unexpected severe weather events, bird strikes, aircraft damage due to burst tires upon landing, and damage caused by a towing incident involving their contracted maintenance provider.

Red lightning alerts have also led to more frequent suspensions of Cebu Pacific’s operations, with 72 alerts raised between April and June alone.

To address these challenges, Cebu Pacific has implemented several measures.

These include activating a disruption management team, increasing the number of live chat agents, and improving disruption handling and communication policies and processes.

The airline acknowledges that these actions may still be insufficient for affected passengers.

Still, it assures that they are actively managing the situation and evaluating ways to provide better care during the recovery period.

Cebu Pacific: Technical Analysis

Now that you know the narrative behind this price action, let me start with my technical analysis for CEB.

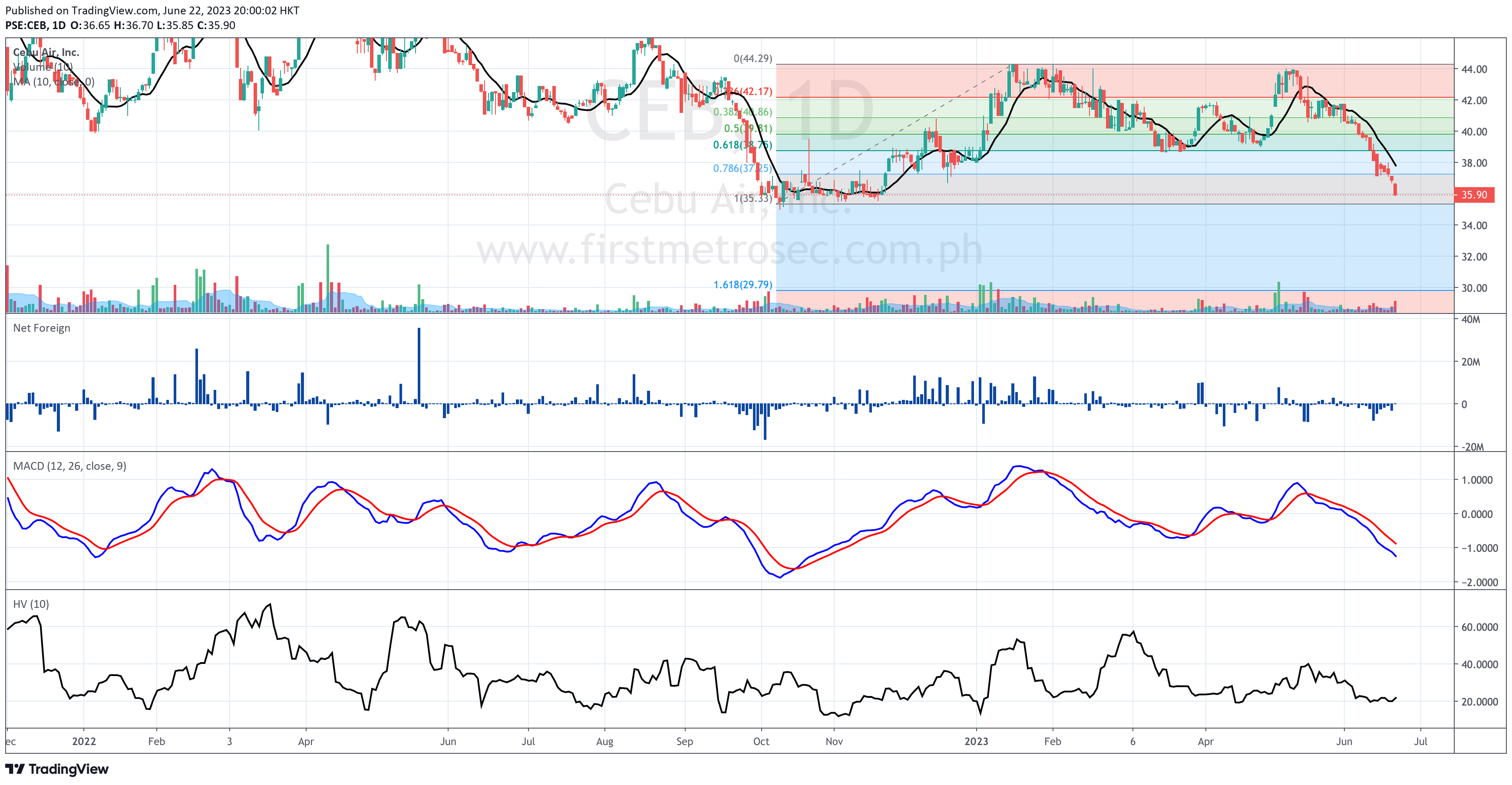

CEB still trades below its 10-day SMA.

Support is at P35.30. Resistance is at P37.25, aligned with the 78.6% Fibonacci retracement.

If the price breaks below the immediate support, the second support is quite deep at P29.80, confluent with the 61.8% Fibonacci extension.

CEB closed on June 22, 2023 at P35.90, slipped by 2.58%. The airline company is down by 6.27% year-to-date.

The net foreign selling is almost P5 million. This is the 11th consecutive Net Foreign Selling day of CEB.

The only consolation on the chart above is the low risk level derived from its 10-day historical volatility score. Thanks to the lack of engulfing candlesticks and price gaps for the past 10 trading days.

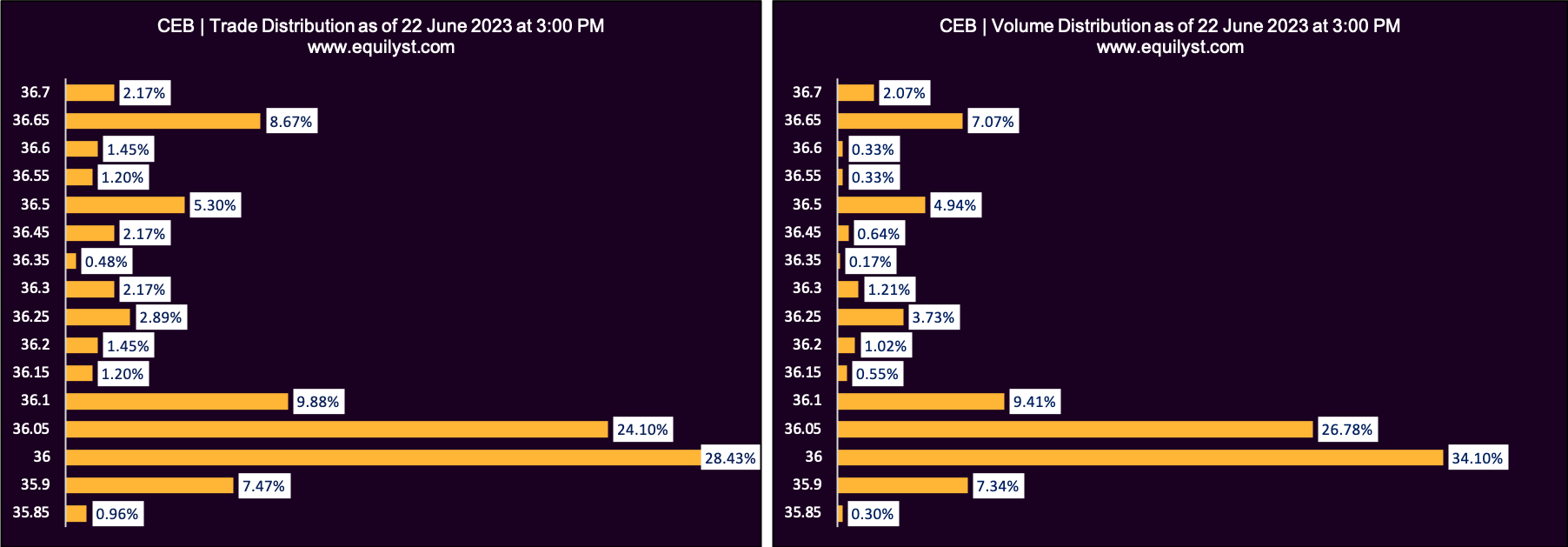

Trade-Volume Distribution Analysis

Dominant Range Index: BEARISH

Last Price: 35.9

VWAP: 36.12

Dominant Range: 36 – 36

The price range with the biggest volume and highest number of trades is closer to the intraday low than the intraday high.

That means investors’ concentration was on cutting their losses.

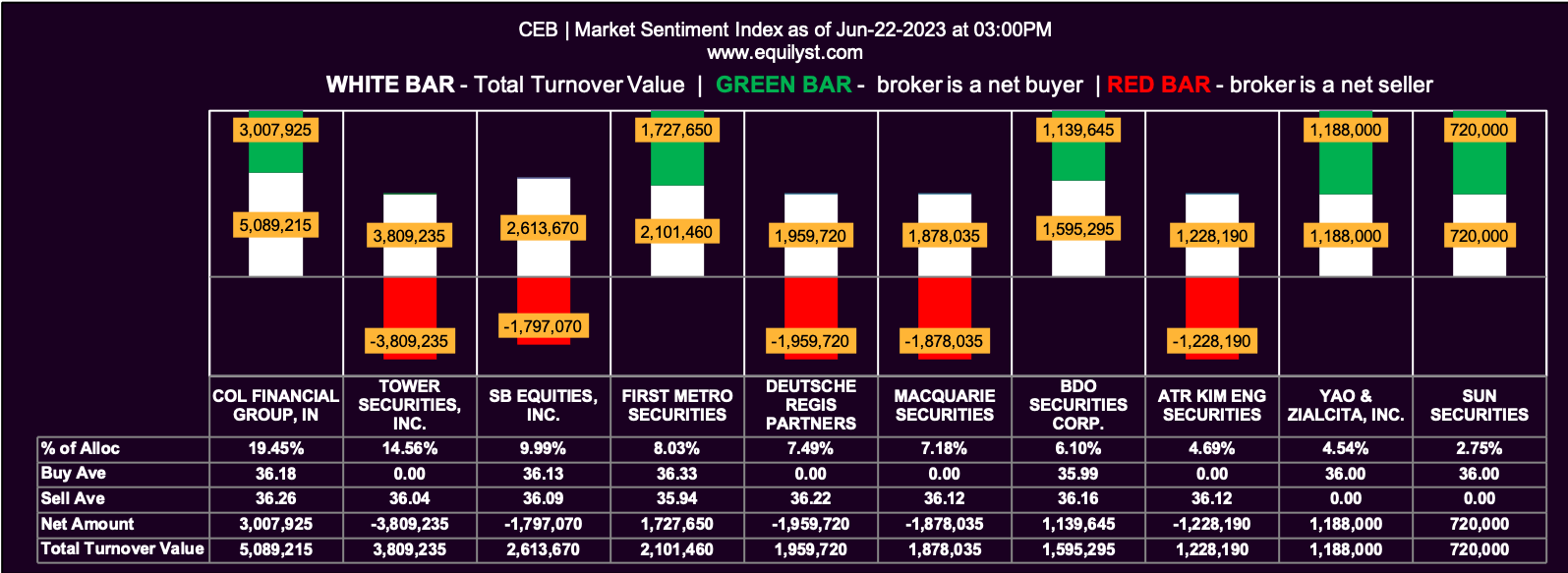

Market Sentiment Analysis

Market Sentiment Index (EOD – June 22, 2023): BULLISH

22 of the 29 participating brokers, or 75.86% of all participants, registered a positive Net Amount

21 of the 29 participating brokers, or 72.41% of all participants, registered a higher Buying Average than Selling Average

29 Participating Brokers’ Buying Average: ₱36.09643

29 Participating Brokers’ Selling Average: ₱36.13460

18 out of 29 participants, or 62.07% of all participants, registered a 100% BUYING activity

5 out of 29 participants, or 17.24% of all participants, registered a 100% SELLING activity

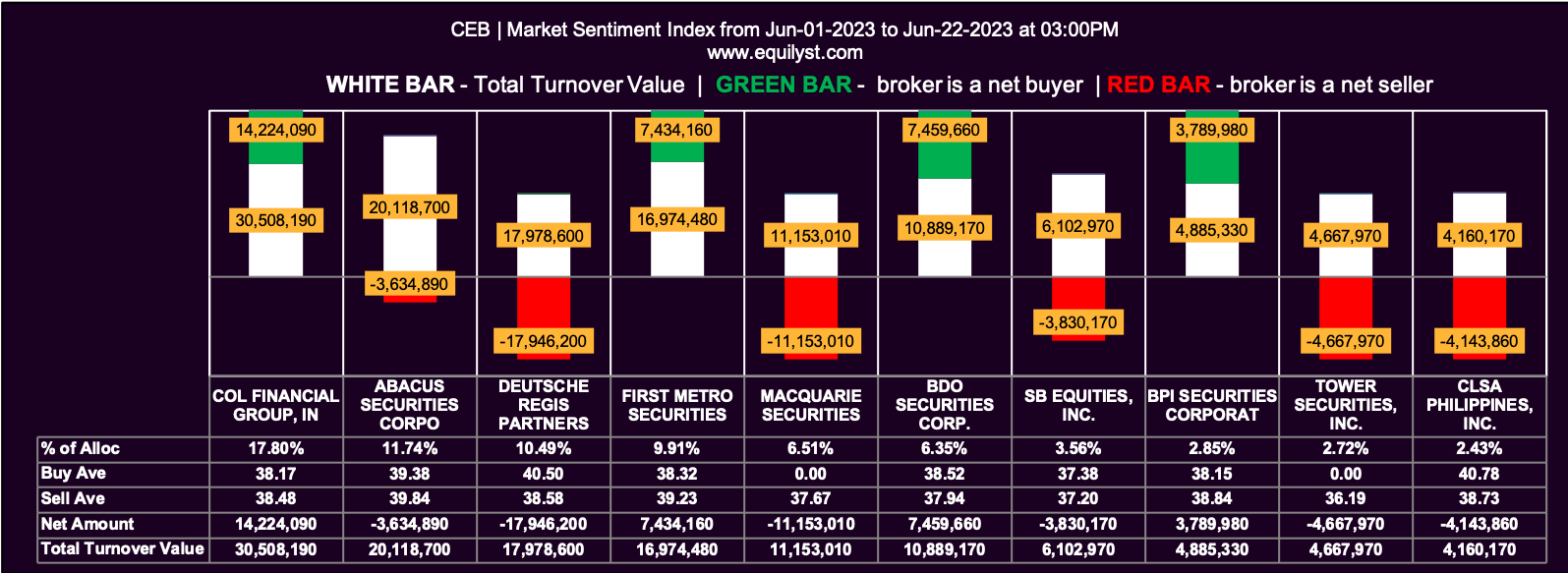

Market Sentiment Index (MTD – June 1, 2023 to June 22, 2023): BULLISH

47 of the 63 participating brokers, or 74.60% of all participants, registered a positive Net Amount

43 of the 63 participating brokers, or 68.25% of all participants, registered a higher Buying Average than Selling Average

63 Participating Brokers’ Buying Average: ₱38.37890

63 Participating Brokers’ Selling Average: ₱38.56133

31 out of 63 participants, or 49.21% of all participants, registered a 100% BUYING activity

4 out of 63 participants, or 6.35% of all participants, registered a 100% SELLING activity

What did you notice in the percentage of participating brokers that registered 100% buying activity in the two timeframes?

There are more brokers with 100% buying than selling activity.

In situations like this, the only ones who can confidently buy the dips are the position traders who expecting (and hoping) a rebound near the support at P35.90.

Possibly, hopeful position traders are behind these two bullish Market Sentiment Index ratings.

Can Cebu Pacific Still Take Off?

Based on these data, CEB is likelier to stay in the hangar.

If you’re interested in trading CEB, I hope that the ongoing Senate hearing won’t be translated as a bird strike that can bring CEB’s two engines down.

Until then, it’s prudent to err on the side of caution by not entering a new position on CEB just yet.

The potential reward isn’t as good as the potential risk so far.

If you already have a position on CEB, hold your position as long as your trailing stop is intact.

Pre-empt your trailing stop or reduce the percentage of risk applied on your trailing stop if the Dominant Range Index and/or the Market Sentiment Index becomes bearish for two or more consecutive trading days.

Consider subscribing to the stock market consultancy service of Equilyst Analytics if you need assistance in rehabilitating your stock portfolio. There are three packages you can choose from. Click here to know more about your options.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025