On June 17, 2023, Saturday, Bitcoin (BTC) recorded a 0.62% increase, following a 2.95% surge the previous trading day, and closed at $26,595.81.

This represented the first instance of BTC enjoying a three-day winning streak since May.

This is also the first time this June 2023 that it closed above its 10-day simple moving average for three consecutive trading days.

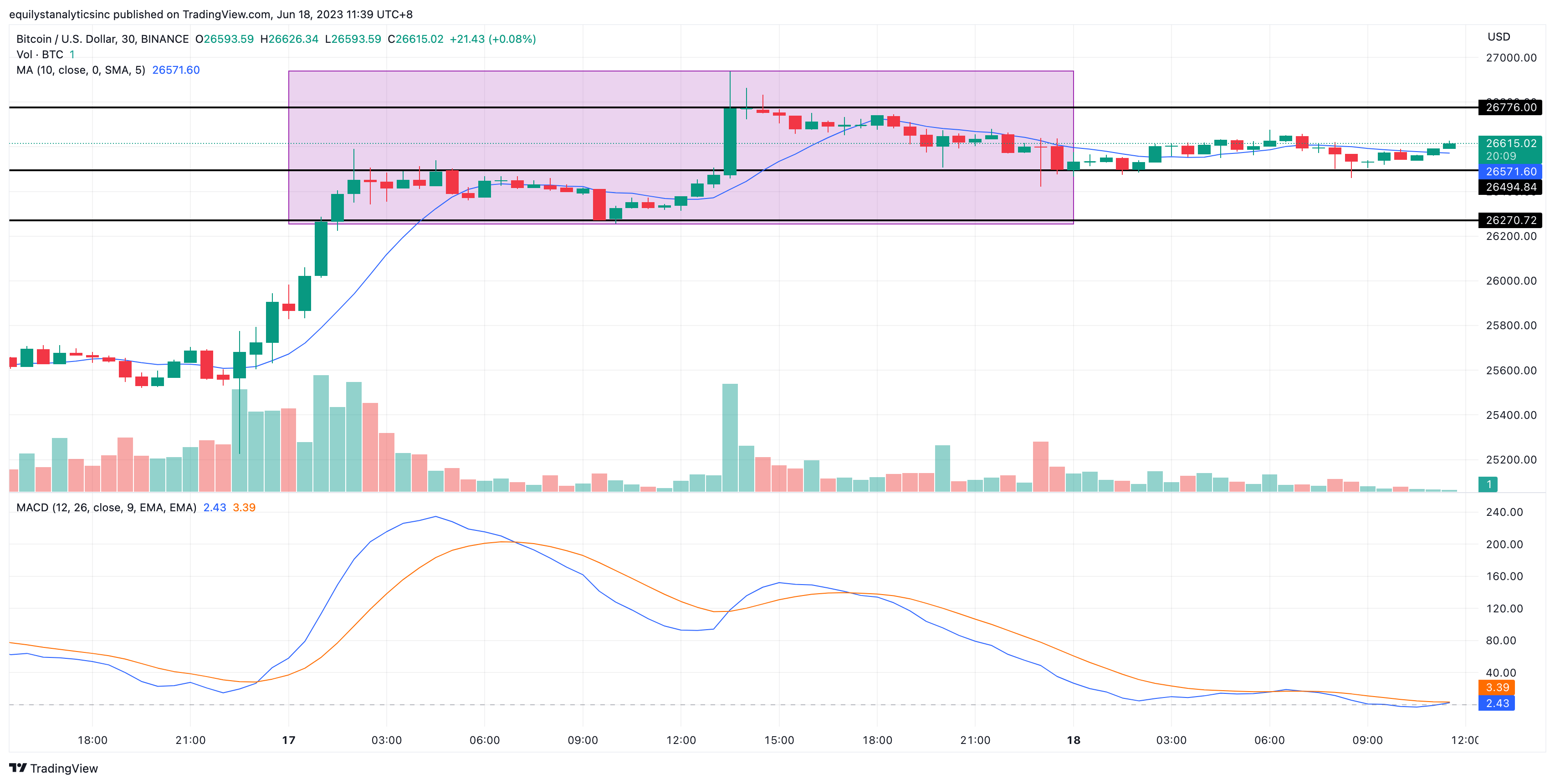

Citing the 30-minute intraday chart of BTC, this coin registered its lowest price at $26,255.80 per coin around 10AM Manila time.

On the other hand, it printed its intraday high at $26,937.56 around 1:30PM Manila time.

Based on this 30-minute intraday chart, BTC ended the day respecting the support near $26,500 and the resistance near $26,780.

The news of Binance reaching an agreement to address the SEC’s motion to freeze Binance US assets brought some relief on Saturday.

The agreement placed limitations on customer funds for Binance US employees, preventing Binance Holdings staff from accessing private keys for US wallets.

The deal received approval from the US Court, allowing Binance to repatriate all US customer funds and private keys onshore, thereby rendering the motion to freeze null and void.

Nonetheless, the charges faced by Binance US and Binance could have lasting consequences for the US digital asset space.

Moreover, the ongoing uncertainty surrounding the SEC v Ripple case presents another challenge, as optimism for a Ripple victory has waned following the release of the Hinman speech-related documents.

In today’s quiet Sunday session, where no significant US economic indicators are anticipated, the direction of BTC is likely to be influenced by news from the crypto market.

The SEC activities, including the SEC v Ripple case, as well as developments involving Binance and Coinbase (COIN), remain the focal points.

Additionally, discussions among lawmakers regarding the William Hinman speech-related documents and the SEC charges against Binance and Coinbase might impact market sentiment.

As of this time of writing this technical analysis on BTC, this token is up by 0.38% and trades at $26,619.65.

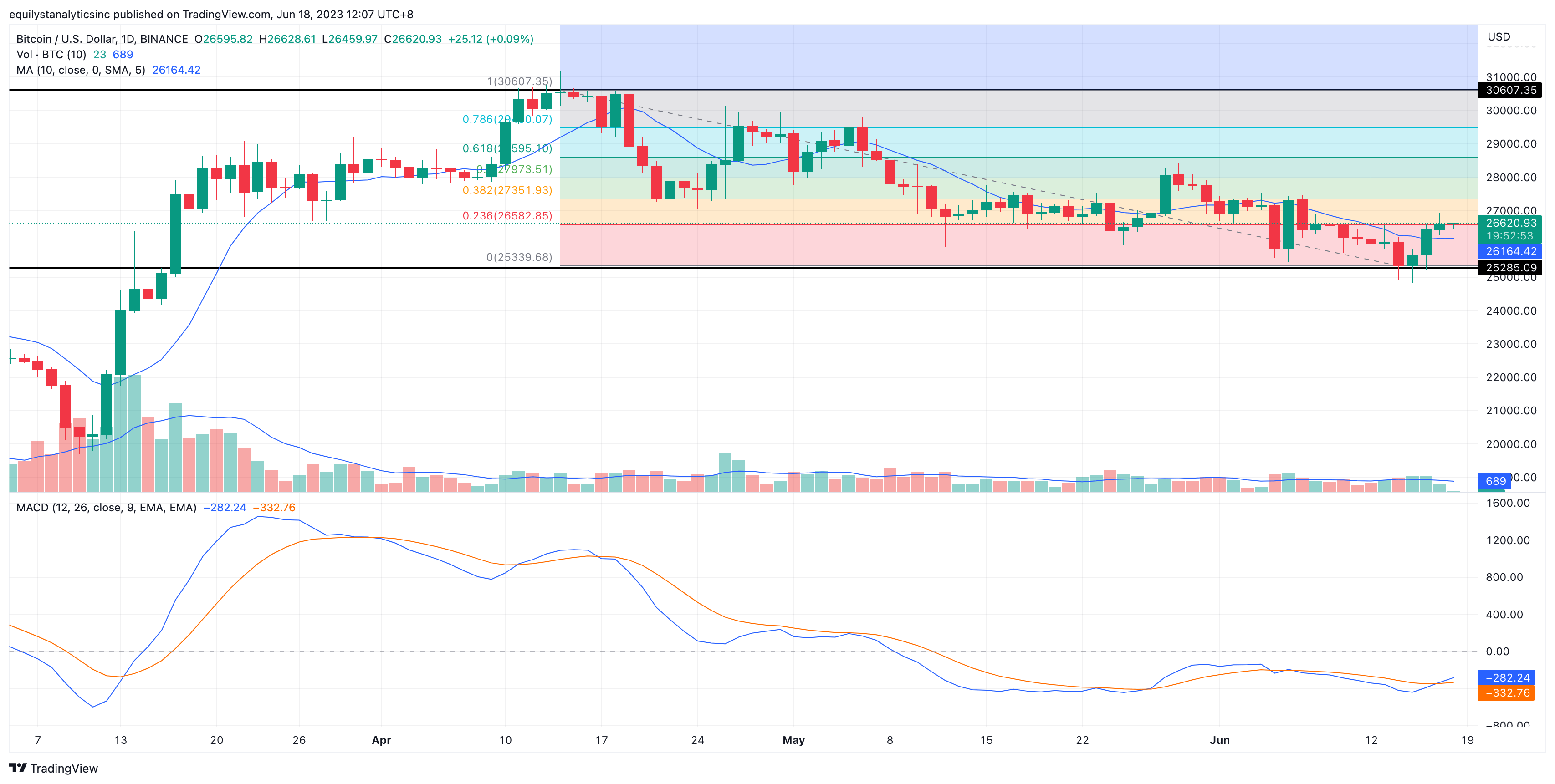

Adjusting the time interval of the chart from 30-minute to daily, the immediate support is now seen near $26,580, aligned with the 23.6% Fibonacci retracement.

If BTC sustains its position above $26,580 with a volume above 50% of its 10-day volume average, it will strengthen its potential to draw closer to and break the resistance at $27,350, confluent with the 38.2% Fibonacci retracement.

BTC’S moving average convergence divergence (MACD) already registered a golden across above the signal line yesterday, June 17, 2023.

BTC’s daily volume since June 5, 2023 is strong, as it consistently registers a daily volume above the 50% of BTC’s 10-day volume average.

Subscribe to the crypto consultancy service of Equilyst Analytics for more guidance in trading BTC and other tokens.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025