BPI Sees 4.5% YoY Rise in Q2 Net Income

Bank of the Philippine Islands (BPI) witnessed a 4.5% year-on-year surge in its net income during the second quarter, driven by heightened revenues.

In its report to the local bourse on Thursday, BPI stated that its earnings for the second quarter were at P13 billion.

This modest uptick in comparison to the prior year was due to a one-time gain observed in the same quarter of 2022, as indicated by the bank.

The bank commented that excluding the impact of the previous year’s gain from property sale, the quarterly net income would reflect a 49.3% increase from the corresponding period last year.

BPI added that total revenues for the quarter reached P33.9 billion, marking a 4.9% increase. This growth was attributed to the decline in non-interest income, which offset the rise in net interest income.

As of press time, the financial statement of the bank had not yet been made available.

BPI’s performance during the second quarter contributed to a 23% year-on-year rise in its net income for the first half of the year, totaling P25.1 billion.

This translated to a return on assets of 1.92% and a return on equity of 15.5%.

The bank noted that total revenues for the first half of the year increased by 13.8% to reach P65.6 billion. This growth was driven by a 27.4% surge in net interest income, which reached P50.1 billion. The increase was attributed to the expansion of the average asset base by 9.2% and a net interest margin widening by 56 basis points to 4.03%.

However, non-interest income experienced a 15.4% decline to P15.5 billion, primarily due to the recognition of gains from property sales in the prior year. Excluding this impact, non-interest income would have been higher by P2.2 billion or 16.3%, primarily due to increased fees from credit cards, various service charges, and securities trading.

In contrast, the bank’s operating expenses surged by 21.4% to P31.4 billion in the first semester. This increase was driven by elevated spending on salary hikes and digitalization initiatives, among other factors.

Consequently, the cost-to-income ratio stood at 47.9%.

BPI experienced a 10.5% expansion in loans during the first half of the year, reaching P1.7 trillion. This growth was propelled by expansions in the corporate (8%), credit card (42.7%), and auto (20.4%) portfolios.

Despite the rise in loans, BPI emphasized that its asset quality remained strong, with the nonperforming loan (NPL) ratio at 1.88% at the end of June.

The NPL coverage ratio was noted at 167.44%, and the bank allocated P2 billion in provisions during the period, marking a 60% decrease from the previous year’s P5 billion.

On the funding side, total deposits increased by 7.6% year-on-year to P2.1 trillion.

BPI highlighted its low-cost current and savings accounts (CASA) ratio of 70.2%.

The loan-to-deposit ratio stood at 80.2%.

The bank’s total equity reached P336.1 billion at the end of June. Its common equity Tier 1 ratio was 15.5%, and its capital adequacy ratio stood at 16.4%, both surpassing the regulatory minimum.

By the end of June, the bank’s total assets had grown by 8.9% year-on-year to reach P2.7 trillion.

Is BPI Already Oversold?

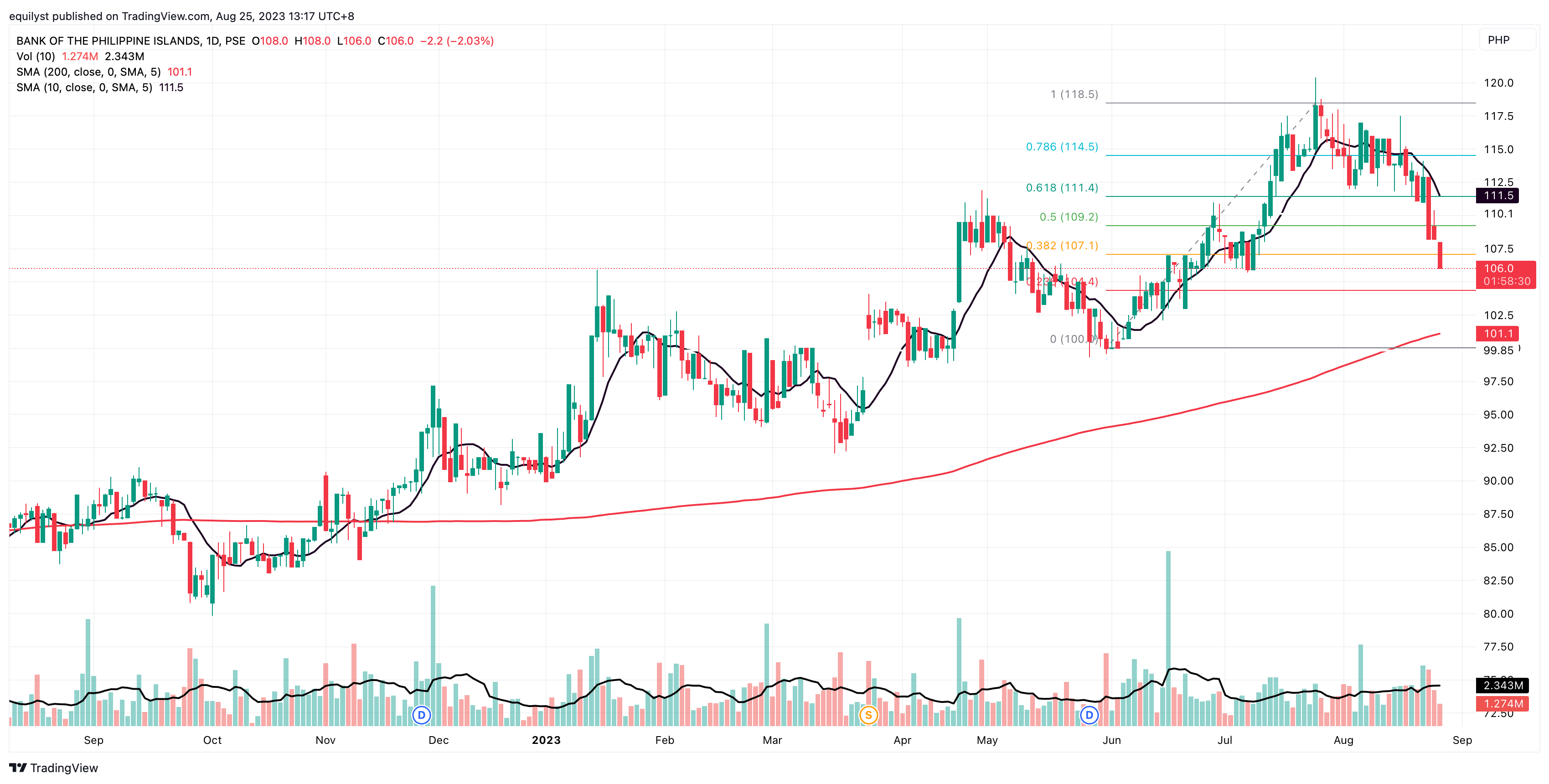

BPI’s rise by 6.67% in H1 2023, from P102 on Dec 29, 2022 to P108.80 on June 20, 2023, contrasts with its recent decline. In August, the share price saw a 7.34% drop MTD, from P114.50 on July 31 to P106.10 on Aug 25. The WTD price shift is bearish too, down 4.50% from P111.10 on Aug 18 to P106.10 on Aug 25.

Despite this, BPI’s YTD price performance remains positive at 4.02%, moving from P102.00 on Dec 29, 2022 to P106.10 on Aug 25, 2023.

The bank’s YTD Net Foreign Selling state is due to monthly outflows of P114 million in January and P98 million in May. It could end August with an NFB status given the P161 million NFB in the first week.

Investors hoped for support at P107.10 (aligned with 382% Fibonacci retracement), but bearish momentum took over.

P107.10 acts as immediate resistance, while P104.40 serves as current support.

BPI’s short-term outlook is bearish, trading below its 10SMA. Yet, its long-term trend remains bullish as it hovers around the 200SMA.

The ongoing decline on Aug 25 was anticipated, following a high red candlestick on Aug 23 that exceeded 100% of the 10-day volume average. An almost similar occurrence was noted on Aug 24.

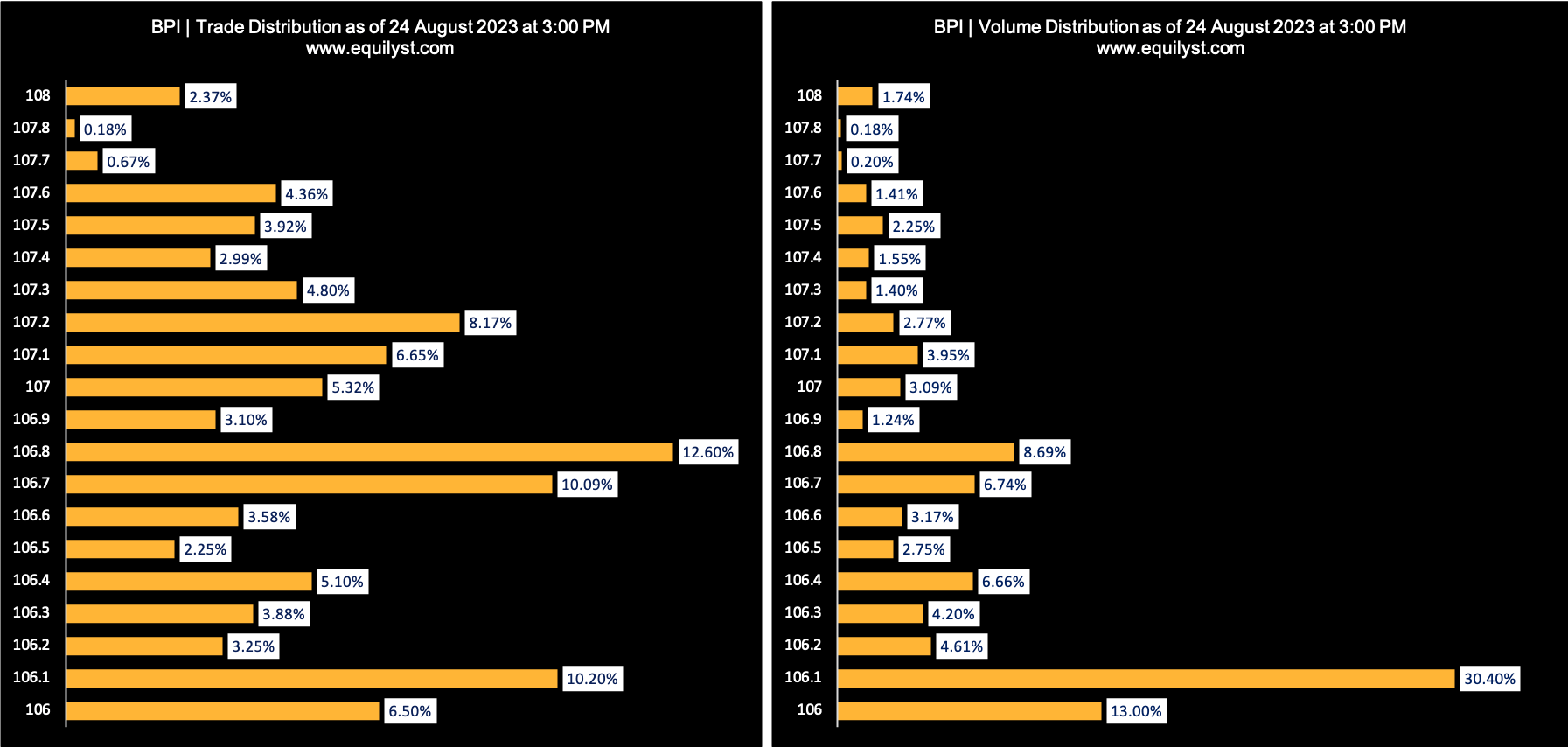

With BPI’s volume-weighted average price at P106.48, surpassing the current P106.10, hopes for a bullish reversal are challenged. Notably, the price range with substantial volume and trades (P106.00 to P106.80) leans towards the intraday low. The Dominant Range Index for the first half of trading on Aug 25 is bearish.

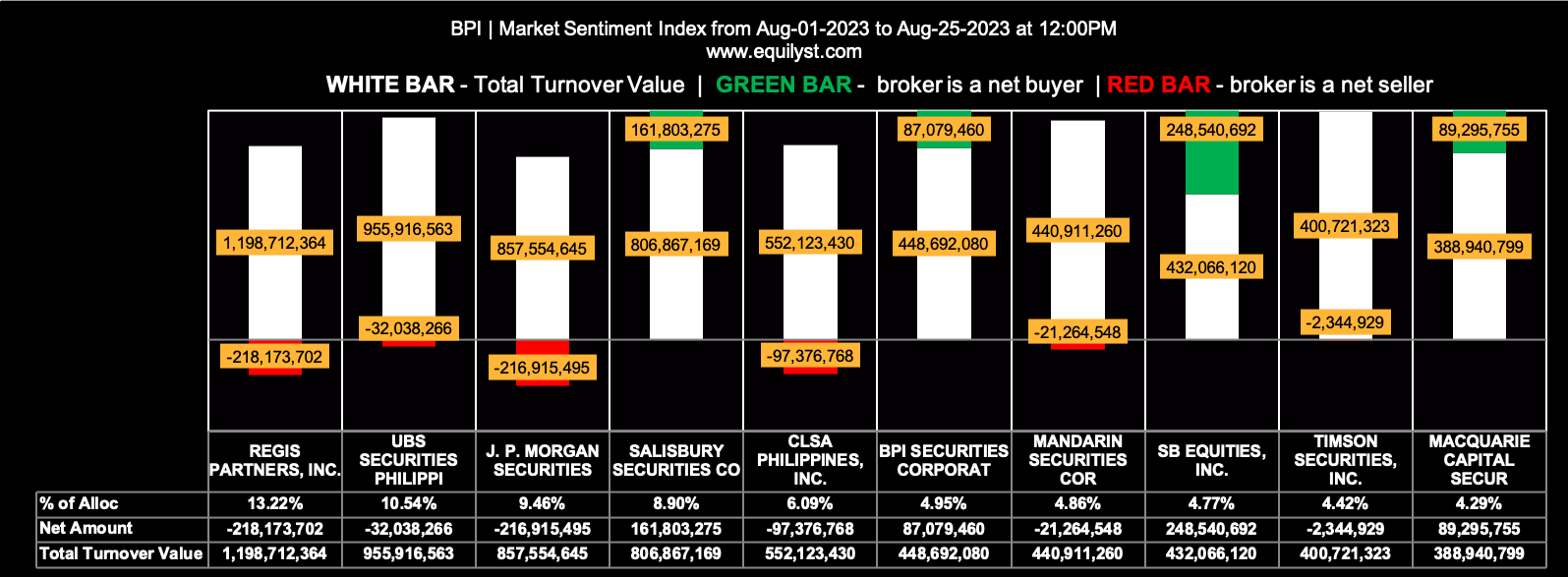

Most data points favor the bears, including the MTD Market Sentiment Index. Stats below summarize broker activity:

47 of the 81 participating brokers, or 58.02% of all participants, registered a positive Net Amount

24 of the 81 participating brokers, or 29.63% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱110.82800

81 Participating Brokers’ Selling Average: ₱112.80118

7 out of 81 participants, or 8.64% of all participants, registered a 100% BUYING activity

9 out of 81 participants, or 11.11% of all participants, registered a 100% SELLING activity

BPI Price Forecast: Recovery Above P107 or Retreat at P100?

If BPI continues to register a negative day change with a volume lower than 50% of its 10-day volume average, this could be a sign of selling exhaustion.

However, if its downtrend continues accompanied by a red volume bar above 50% of its 10-day volume average, you can rest assured that BPI’s downtrend is far from over.

Considering all the data points I’ve presented, it seems the bears have the upper hand.

If you don’t currently have a position on BPI, it’s advisable to continue observing its price and volume profile.

For those who already hold BPI, it might be a good strategy to average down when signs of selling exhaustion are spotted, provided your trailing stop remains intact.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025