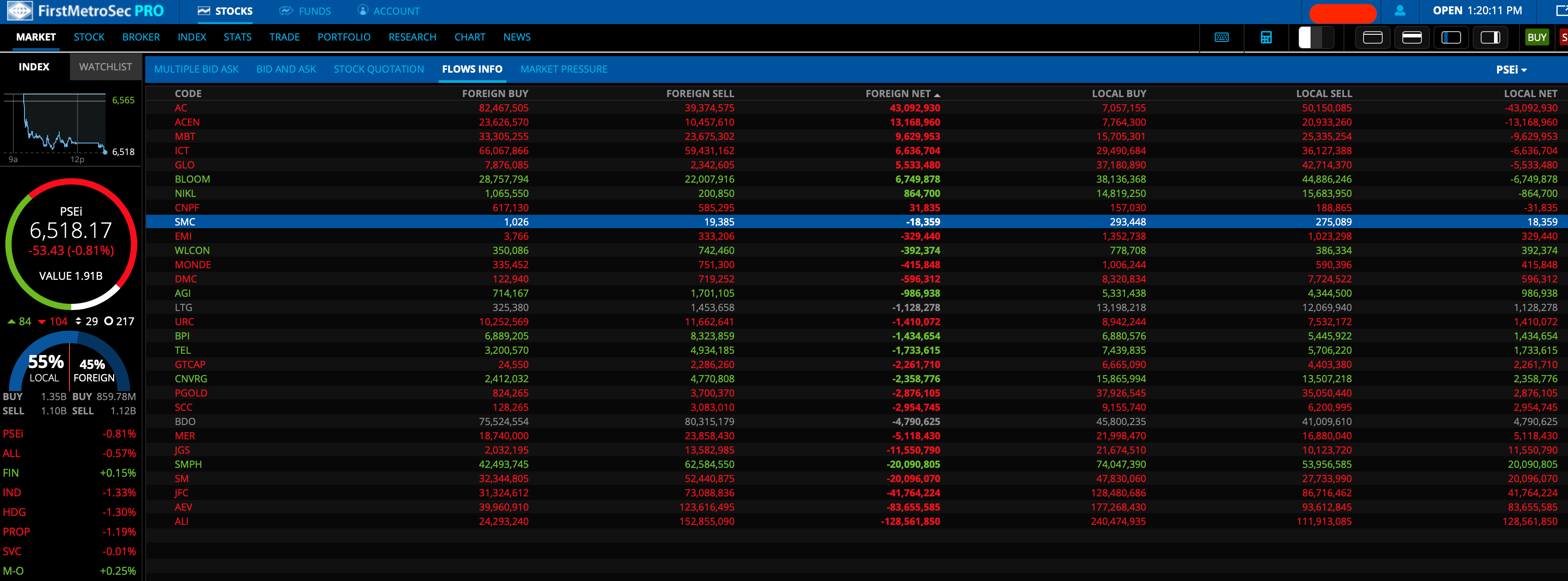

If you have AC, ACEN, and MBT in your portfolio, or if you’re planning to take a new position in any of these three stocks, I hope my analysis will help you make a data-driven and logical investment decision. These three stocks are the top bluechips with the highest Net Foreign Buying as of the time of generating this report. Check the timestamps on each photo.

What criteria did I use in choosing AC, ACEN, and MBT?

I logged into my FirstMetroSec PRO account, clicked the MARKET tab, clicked FLOWS INFO, and selected PSEi from the filter dropdown box. So, you cannot say I’m selectively featuring stocks I already have because my selection criteria don’t allow me to cherry-pick which stocks to feature.

What’s my methodology when looking for a confirmed buy signal?

I have four criteria when analyzing if the stock has a confirmed buy signal.

Firstly, the last price must be higher than its 10-day simple moving average. Not less. Not equal. Higher.

Secondly, the prevailing volume must be higher than at least 50% of the stock’s 10-day volume average.

The first and second criteria are indicators available on your broker’s platform. The last two criteria can only be produced by me.

Thirdly, the prevailing Dominant Range Index of the stock must be bullish. I can’t tell how this proprietary indicator churns out a bearish or bullish signal because it’s proprietary/

Fourthly, either the prevailing (or EOD) or month-to-date (MTD) Market Sentiment Index should be bullish. This is also my proprietary indicator.

So, a stock must get four bullish signals for it to have a confirmed buy signal for me. Once there’s a confirmed buy signal, I can either take a new position or top up my existing one.

Now that you know how I analyze, let’s go to my analysis.

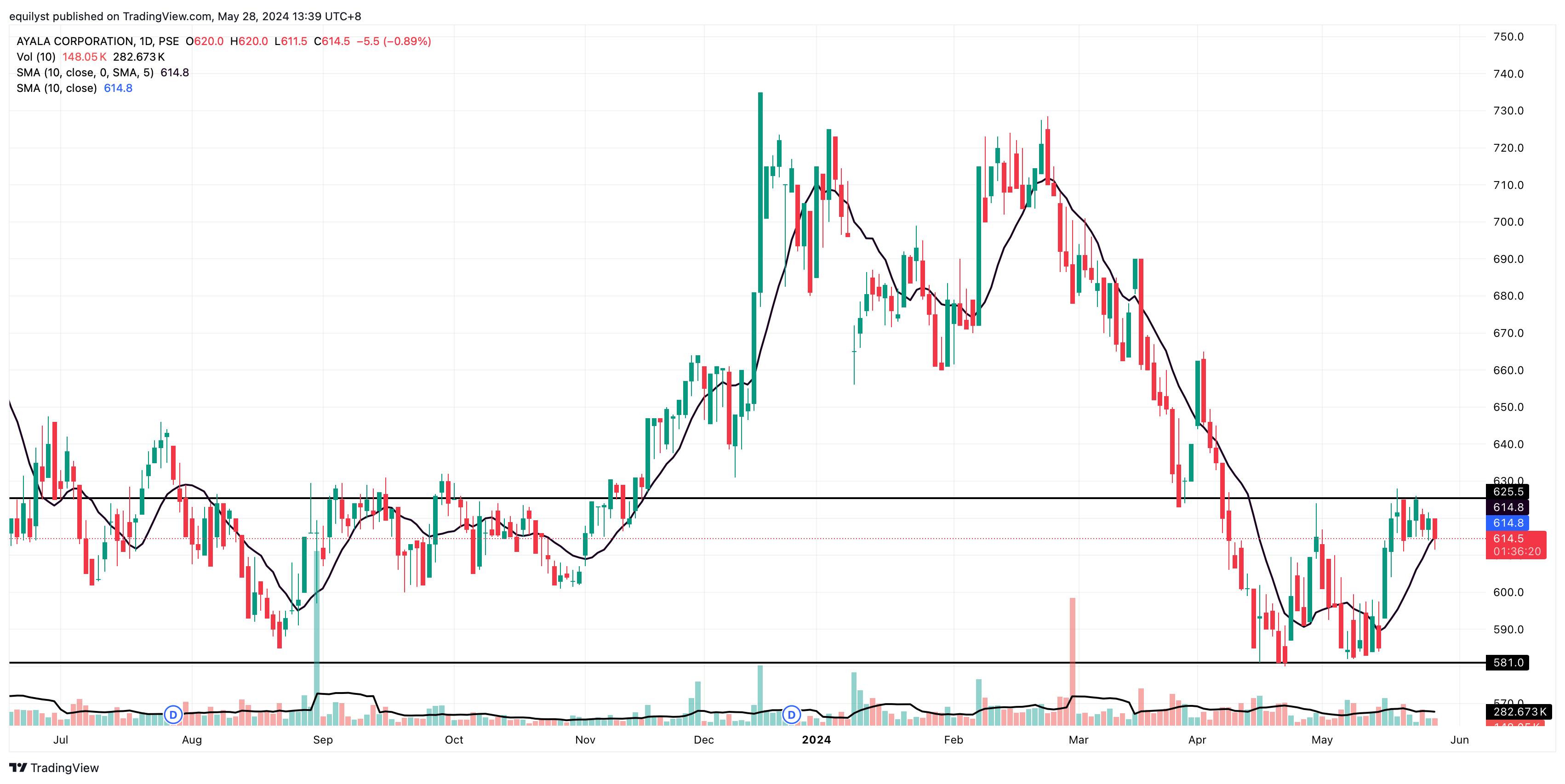

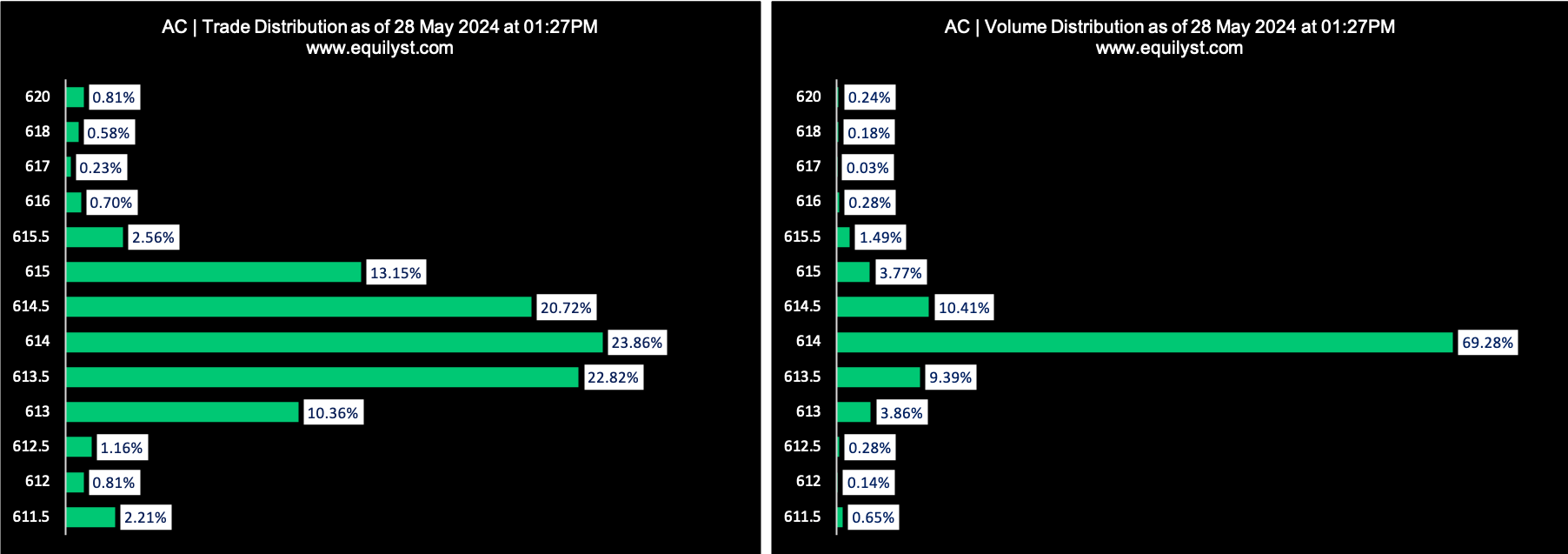

Does Ayala Corporation (AC) have a buy signal?

No, there’s no buy signal for AC as of May 28, 2024. Only 2 of 4 criteria are bullish.

First Criterion: BEARISH

Second Criterion: BULLISH

Dominant Range Index: BEARISH

Last Price: 615.00

Dominant Range: 613.00 – 615.00

VWAP: 614.03

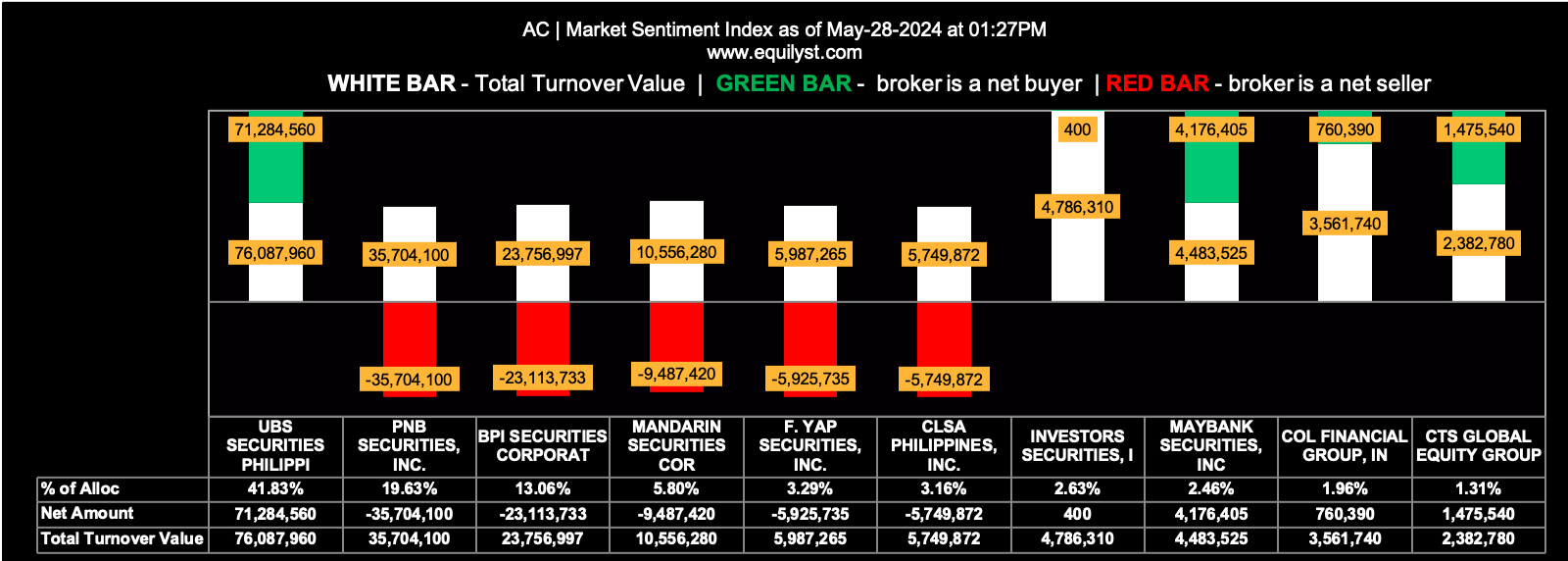

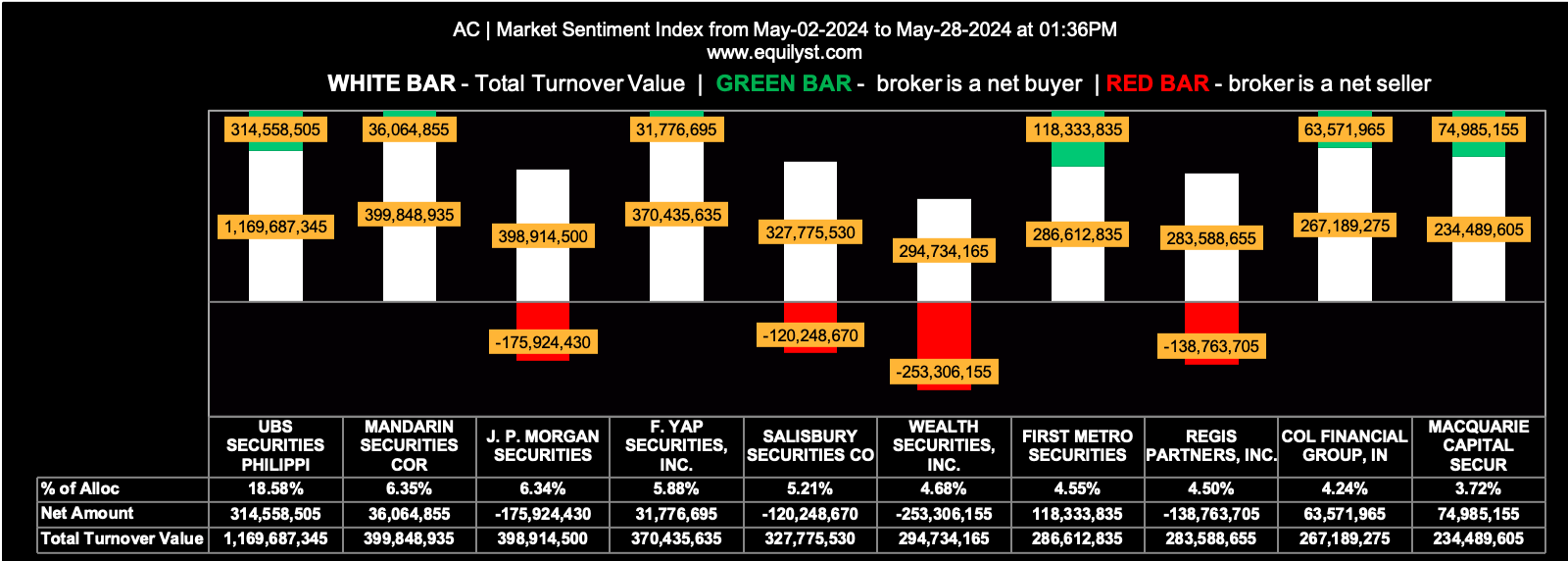

Market Sentiment Index (INTRADAY): BULLISH

16 of the 25 participating brokers, or 64.00% of all participants, registered a positive Net Amount

14 of the 25 participating brokers, or 56.00% of all participants, registered a higher Buying Average than Selling Average

25 Participating Brokers’ Buying Average: ₱614.27046

25 Participating Brokers’ Selling Average: ₱614.26105

7 out of 25 participants, or 28.00% of all participants, registered a 100% BUYING activity

4 out of 25 participants, or 16.00% of all participants, registered a 100% SELLING activity

Market Sentiment Index (MTD): BEARISH

58 of the 95 participating brokers, or 61.05% of all participants, registered a positive Net Amount

30 of the 95 participating brokers, or 31.58% of all participants, registered a higher Buying Average than Selling Average

95 Participating Brokers’ Buying Average: ₱596.68973

95 Participating Brokers’ Selling Average: ₱607.41996

15 out of 95 participants, or 15.79% of all participants, registered a 100% BUYING activity

7 out of 95 participants, or 7.37% of all participants, registered a 100% SELLING activity

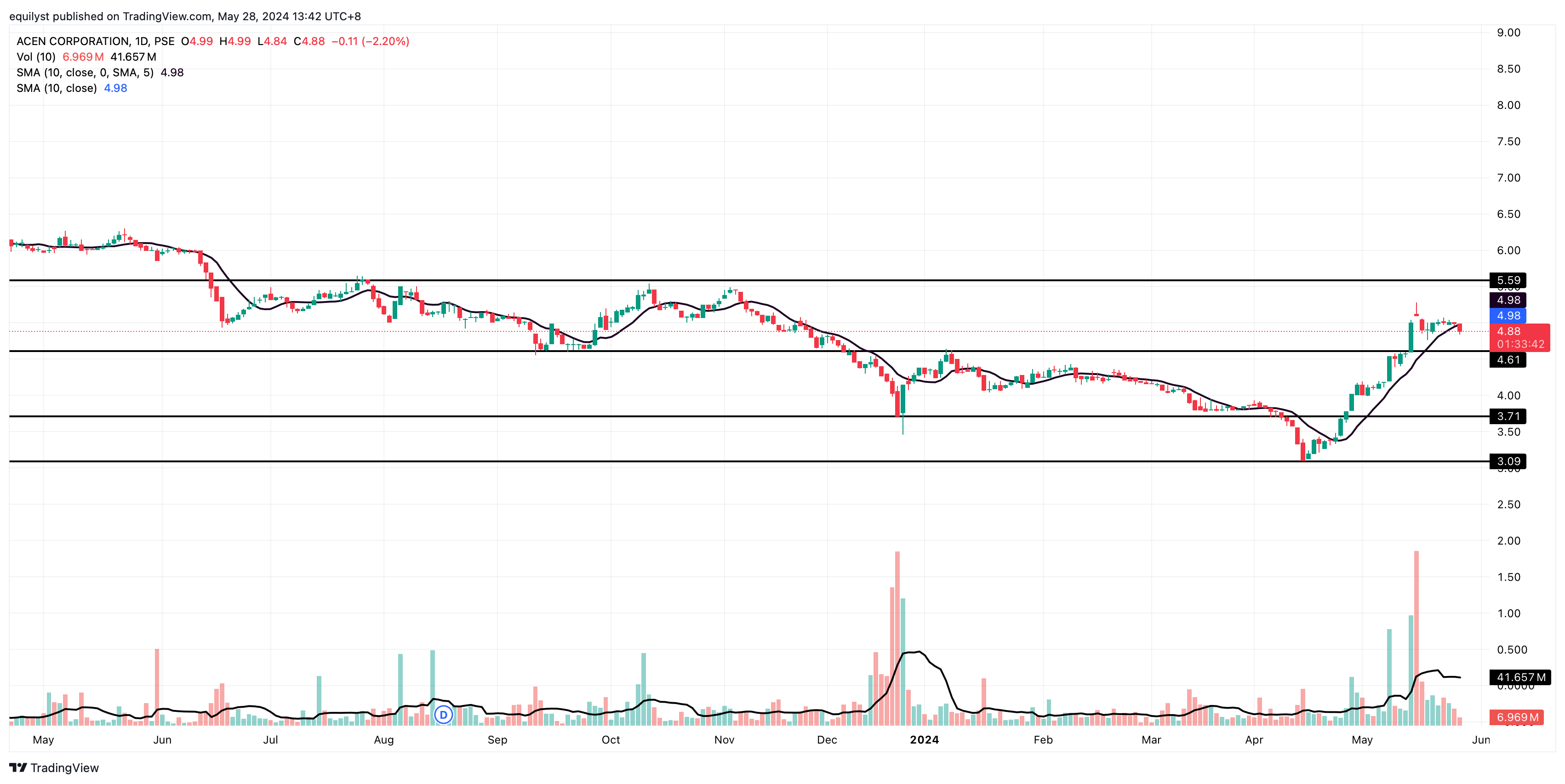

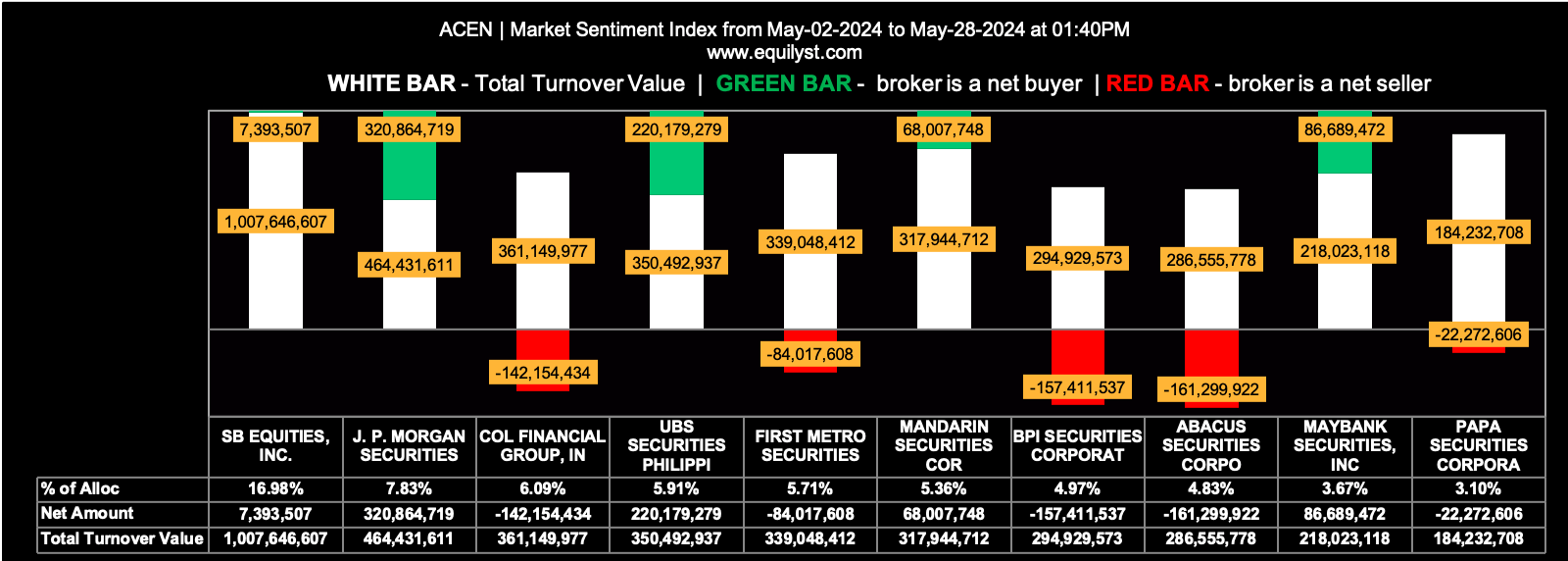

Does ACEN CORPORATION (ACEN) have a buy signal?

No, there’s no buy signal for ACEN as of May 28, 2024. All 4 criteria are bearish.

First Criterion: BEARISH

Second Criterion: BEARISH

Dominant Range Index: BEARISH

Last Price: 4.89

Dominant Range: 4.93 – 4.97

VWAP: 4.93

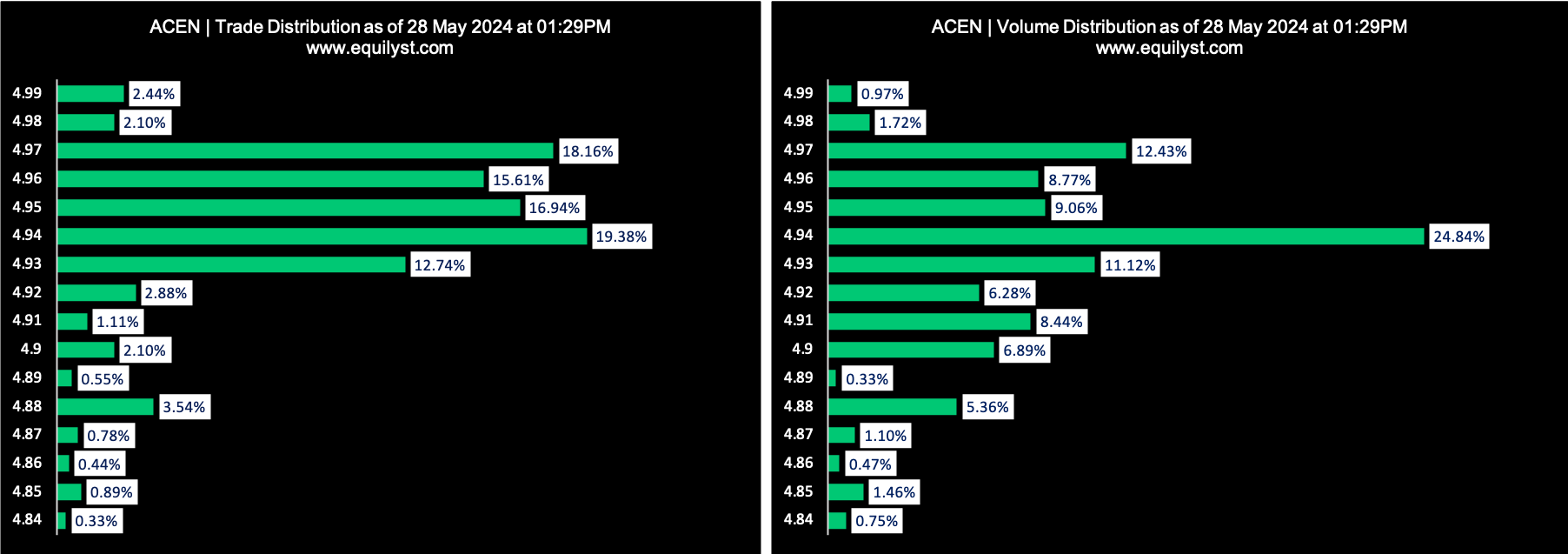

Market Sentiment Index (INTRADAY): BEARISH

16 of the 33 participating brokers, or 48.48% of all participants, registered a positive Net Amount

14 of the 33 participating brokers, or 42.42% of all participants, registered a higher Buying Average than Selling Average

33 Participating Brokers’ Buying Average: ₱4.92685

33 Participating Brokers’ Selling Average: ₱4.93502

6 out of 33 participants, or 18.18% of all participants, registered a 100% BUYING activity

12 out of 33 participants, or 36.36% of all participants, registered a 100% SELLING activity

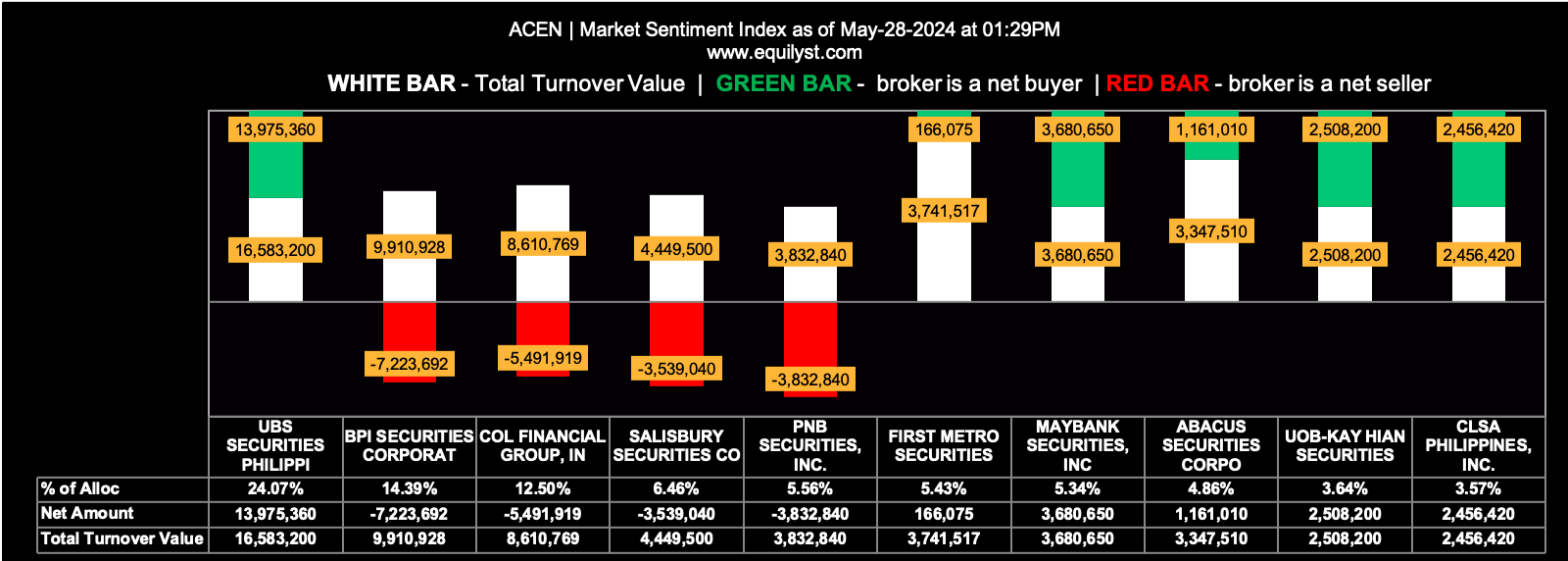

Market Sentiment Index (MTD): BEARISH

40 of the 102 participating brokers, or 39.22% of all participants, registered a positive Net Amount

54 of the 102 participating brokers, or 52.94% of all participants, registered a higher Buying Average than Selling Average

102 Participating Brokers’ Buying Average: ₱4.73811

102 Participating Brokers’ Selling Average: ₱4.73813

4 out of 102 participants, or 3.92% of all participants, registered a 100% BUYING activity

8 out of 102 participants, or 7.84% of all participants, registered a 100% SELLING activity

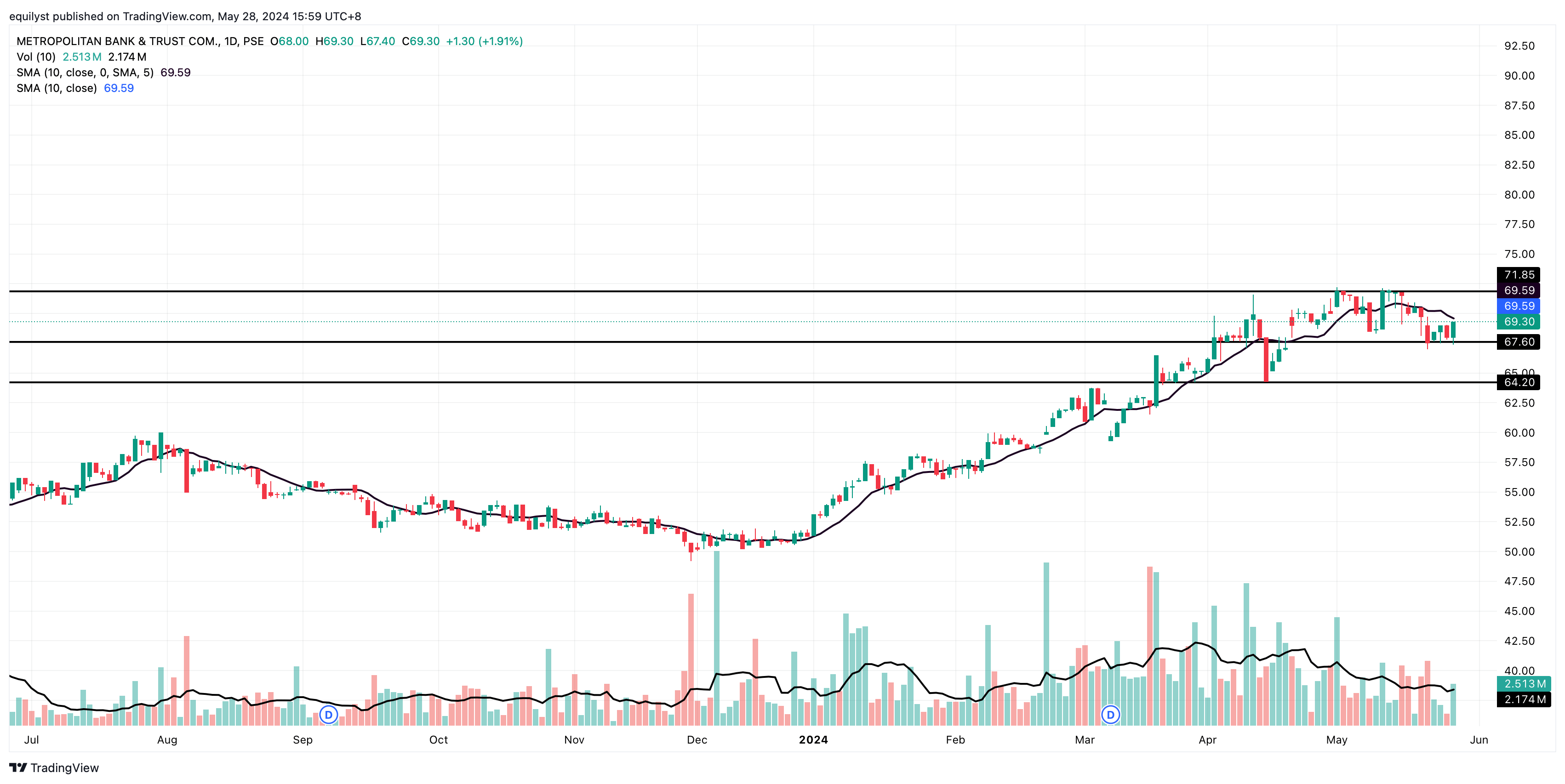

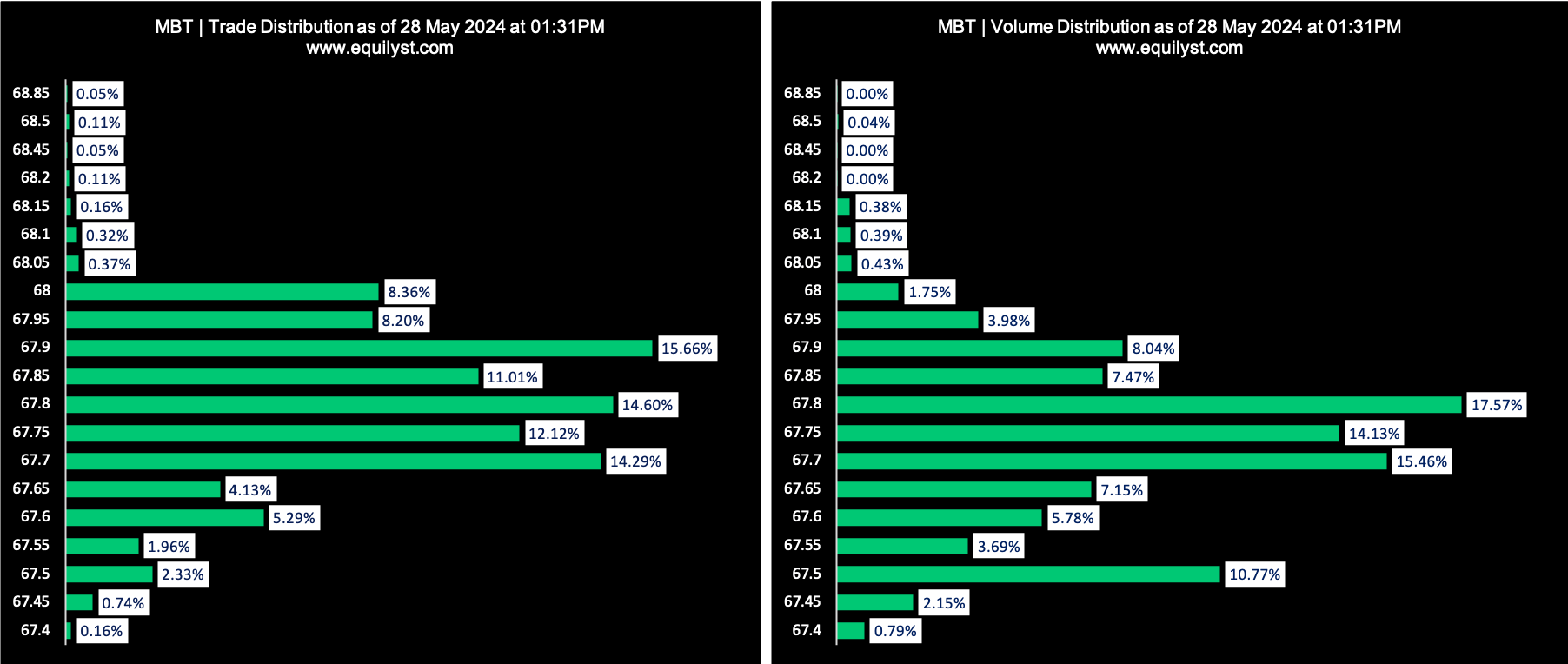

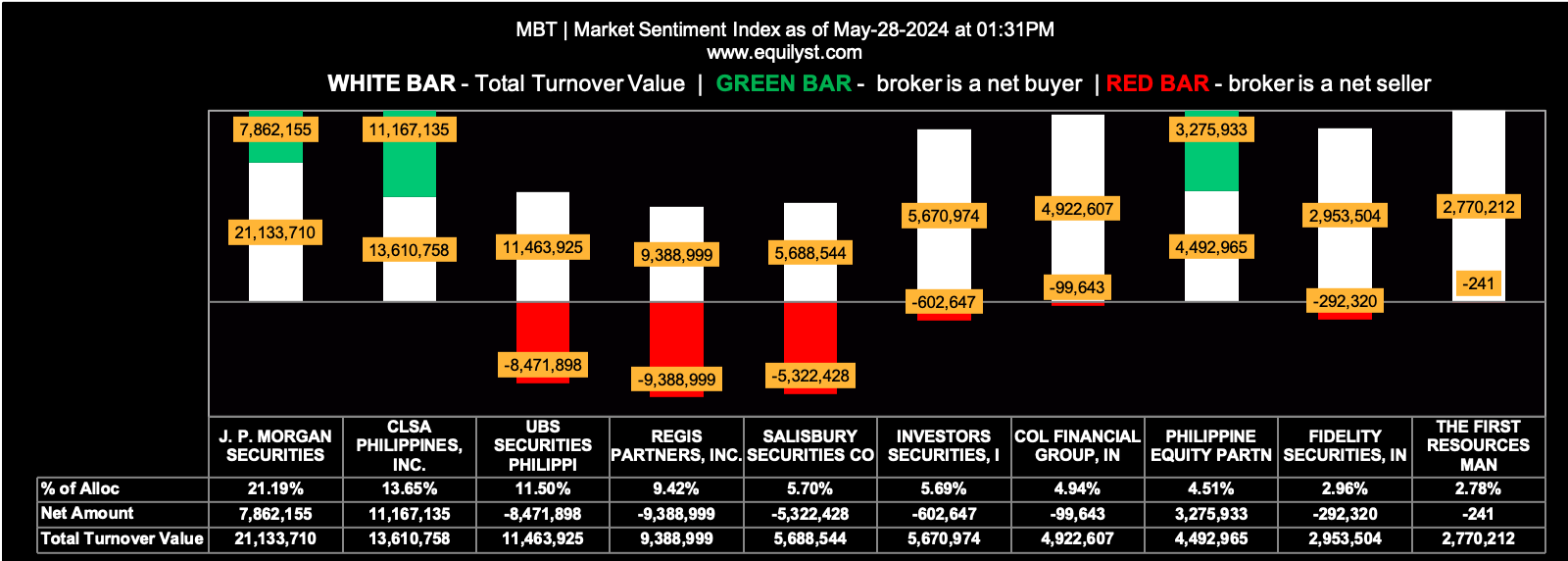

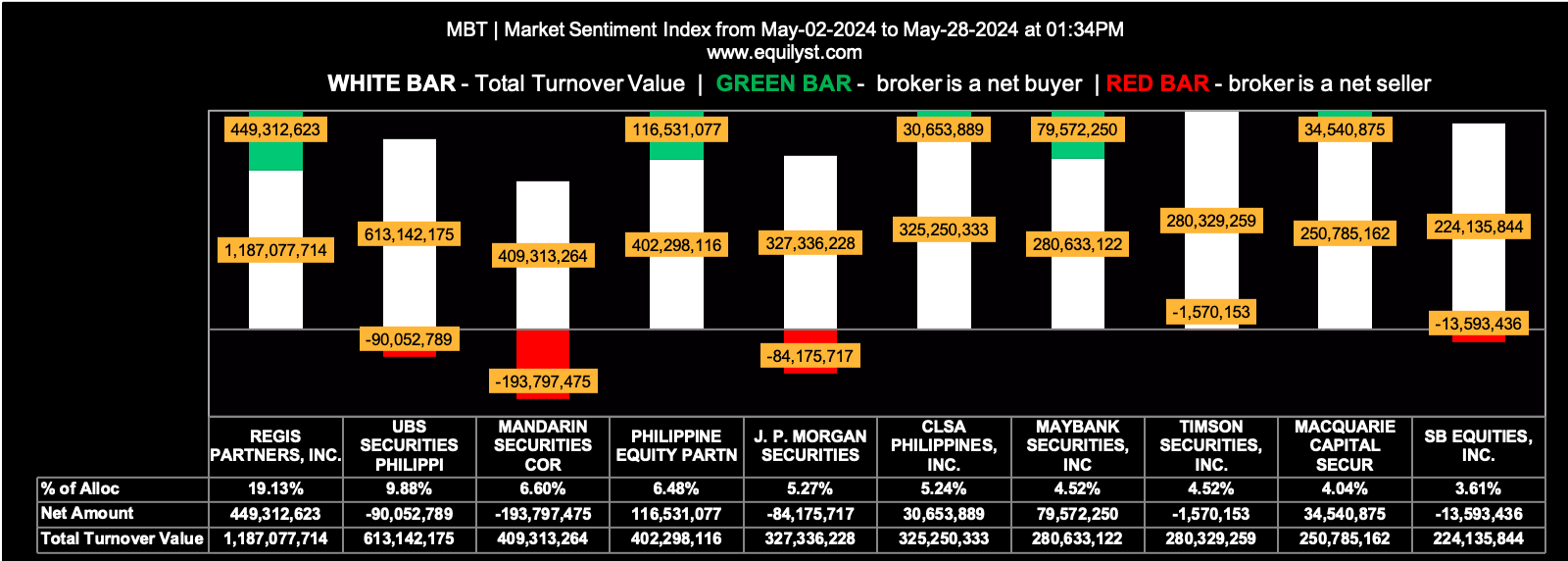

Does Metropolitan Bank & Trust Company (MBT) have a buy signal?

No, there’s no buy signal for MBT as of May 28, 2024. Only 1 out of 4 criteria is bullish.

First Criterion: BEARISH

Second Criterion: BULLISH

Dominant Range Index: BEARISH

Last Price: 67.90

Dominant Range: 67.70 – 68.00

VWAP: 67.73

Market Sentiment Index (INTRADAY): BULLISH

17 of the 31 participating brokers, or 54.84% of all participants, registered a positive Net Amount

16 of the 31 participating brokers, or 51.61% of all participants, registered a higher Buying Average than Selling Average

31 Participating Brokers’ Buying Average: ₱67.72570

31 Participating Brokers’ Selling Average: ₱67.80274

8 out of 31 participants, or 25.81% of all participants, registered a 100% BUYING activity

4 out of 31 participants, or 12.90% of all participants, registered a 100% SELLING activity

Market Sentiment Index (MTD): BEARISH

37 of the 96 participating brokers, or 38.54% of all participants, registered a positive Net Amount

20 of the 96 participating brokers, or 20.83% of all participants, registered a higher Buying Average than Selling Average

96 Participating Brokers’ Buying Average: ₱69.14117

96 Participating Brokers’ Selling Average: ₱70.35637

5 out of 96 participants, or 5.21% of all participants, registered a 100% BUYING activity

18 out of 96 participants, or 18.75% of all participants, registered a 100% SELLING activity

Does Not Having a Buy Signal Mean a Sell Signal?

Not having a buy signal can only be a sell signal if, and only if, your trailing stop has already been hit. If your trailing stop is still intact, you can ignore the lack of a buy signal unless both the Dominant Range Index and the EOD Market Sentiment Index have been bearish for three consecutive trading days.

If these two indicators have been bearish for three straight trading days, you may consider preempting your trailing stop even if it has yet to be hit.

Would You Like More?

You may subscribe to my teleconsulting service, stock screener subscription, and premium analysis subscription.

You may also read my other reports here and watch my videos on YouTube.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025