Why High-Dividend Stocks Are a Smart Investment Choice

Investing in stocks with a dividend yield above 5% can be an attractive strategy for many investors, particularly those seeking steady income and long-term growth. Dividends are regular payments made by companies to their shareholders from profits, and a higher yield indicates a higher return on investment from these payments relative to the stock price.

1. Reliable Income Stream

One of the primary benefits of investing in high-dividend-yield stocks is the reliable income stream they provide. For retirees or those seeking a steady cash flow, dividends can offer a predictable source of income, often surpassing the returns of traditional savings accounts or bonds. This income can be reinvested to compound growth or used to cover living expenses, providing financial stability.

2. Lower Risk

Stocks with high dividend yields often belong to well-established companies with stable earnings. These companies, often referred to as “blue-chip” stocks, tend to be less volatile and more resilient during market downturns. Their ability to consistently pay dividends is a sign of financial health and stability, making them less risky compared to high-growth stocks that do not pay dividends.

3. Inflation Hedge

Dividend-paying stocks can serve as a hedge against inflation. As the cost of living increases, companies with strong, consistent earnings typically increase their dividend payouts over time. This helps investors maintain their purchasing power, unlike fixed-income investments whose payouts remain constant regardless of inflation.

4. Compounding Returns

Reinvesting dividends can significantly enhance total returns over time. By purchasing additional shares with dividend payments, investors can benefit from compounding, where both the original investment and the reinvested dividends generate additional earnings. This snowball effect can lead to substantial portfolio growth, particularly over long investment horizons.

5. Market Performance

Historically, stocks with higher dividend yields have outperformed the broader market, providing not only income but also capital appreciation. This dual benefit makes them a compelling choice for investors seeking a balanced approach to growth and income.

How Many Philippine Blue-Chips Have a Dividend Yield Above 5%?

As of May 24, 2024, I’ve checked which of the 30 Philippine blue-chip stocks have a dividend yield of 5% and above. Only 6 out of 30 made it to my list.

Note that a dividend yield above 5% isn’t enough for me to say that it’s logical to buy shares of a stock. The stock’s price must be higher than its 10-day simple moving average. Also, it has to have a bullish Dominant Range Index (as trading happens or as of EOD) and a bullish Market Sentiment Index (either EOD or MTD).

The Dominant Range Index and Market Sentiment Index are my proprietary indicators. You won’t find them on TradingView or any broker’s charting tool.

In this free report, I’ll show you the month-to-date (MTD) Market Sentiment Index of those 6 blue-chip stocks with a dividend yield above 5% as of May 24, 2024.

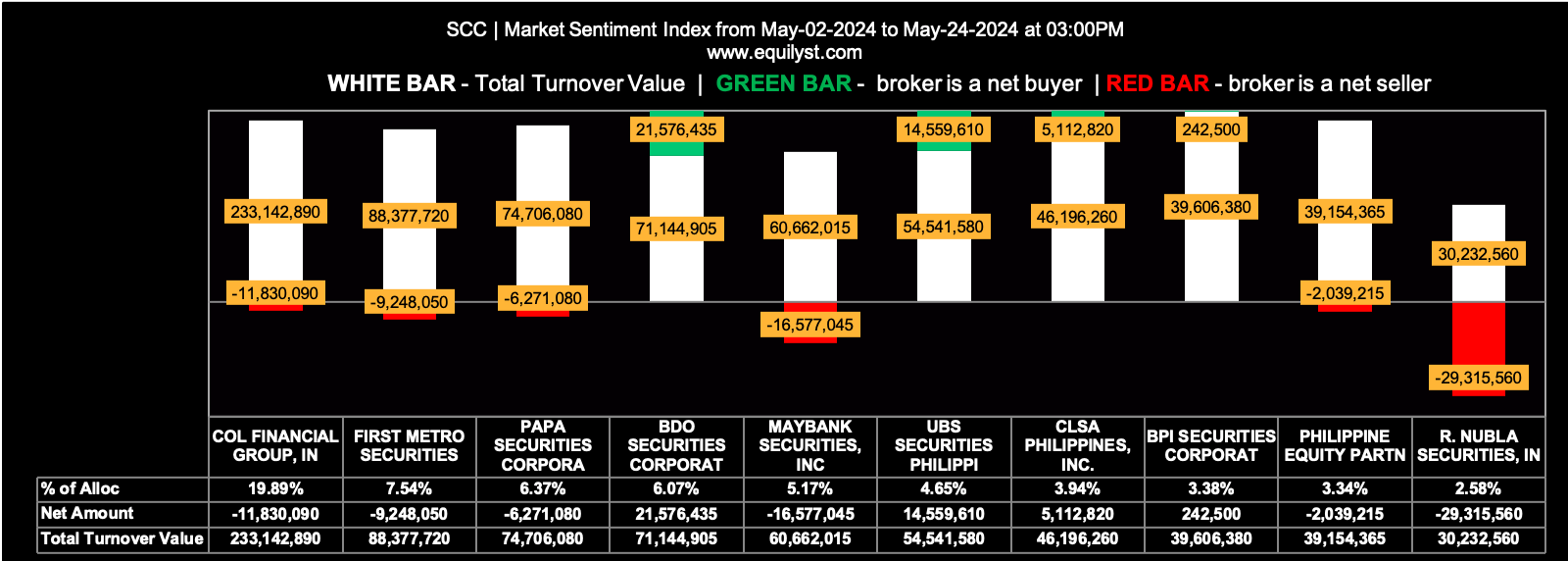

Semirara Mining and Power Corporation (SCC): 21.18% Div Yield (TTM)

Market Sentiment Index: BEARISH

42 of the 83 participating brokers, or 50.60% of all participants, registered a positive Net Amount

34 of the 83 participating brokers, or 40.96% of all participants, registered a higher Buying Average than Selling Average

83 Participating Brokers’ Buying Average: ₱32.15606

83 Participating Brokers’ Selling Average: ₱32.40902

12 out of 83 participants, or 14.46% of all participants, registered a 100% BUYING activity

7 out of 83 participants, or 8.43% of all participants, registered a 100% SELLING activity

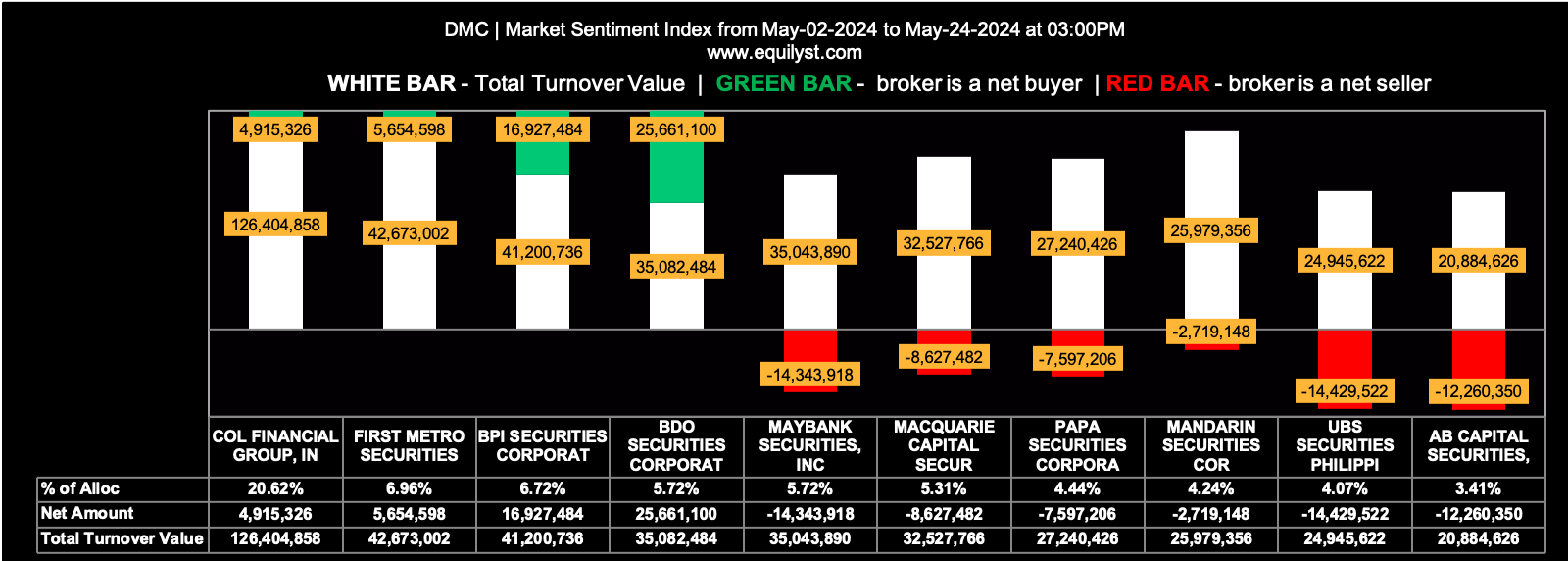

DMCI Holdings (DMC): 13.09% Div Yield (TTM)

Market Sentiment Index: BEARISH

44 of the 81 participating brokers, or 54.32% of all participants, registered a positive Net Amount

38 of the 81 participating brokers, or 46.91% of all participants, registered a higher Buying Average than Selling Average

81 Participating Brokers’ Buying Average: ₱10.85596

81 Participating Brokers’ Selling Average: ₱10.91768

20 out of 81 participants, or 24.69% of all participants, registered a 100% BUYING activity

10 out of 81 participants, or 12.35% of all participants, registered a 100% SELLING activity

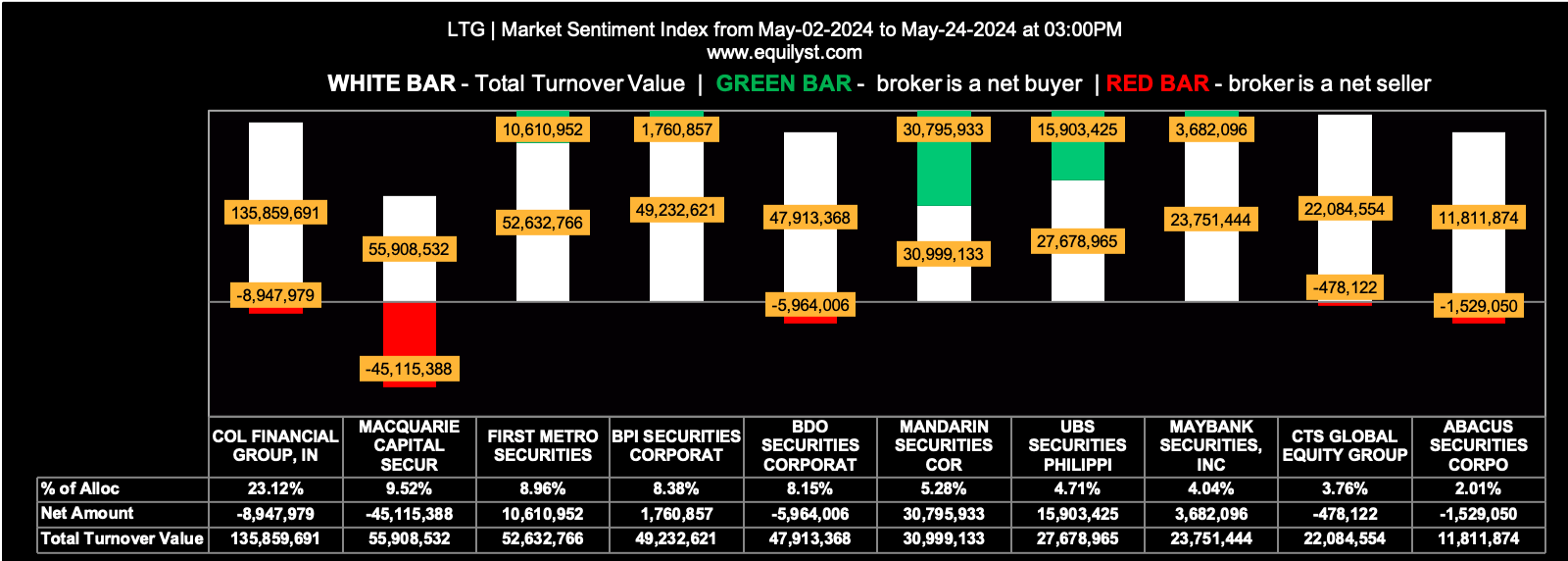

LT Group (LTG): 11.75% Div Yield (TTM)

Market Sentiment Index: BEARISH

33 of the 73 participating brokers, or 45.21% of all participants, registered a positive Net Amount

34 of the 73 participating brokers, or 46.58% of all participants, registered a higher Buying Average than Selling Average

73 Participating Brokers’ Buying Average: ₱10.09184

73 Participating Brokers’ Selling Average: ₱10.10776

11 out of 73 participants, or 15.07% of all participants, registered a 100% BUYING activity

15 out of 73 participants, or 20.55% of all participants, registered a 100% SELLING activity

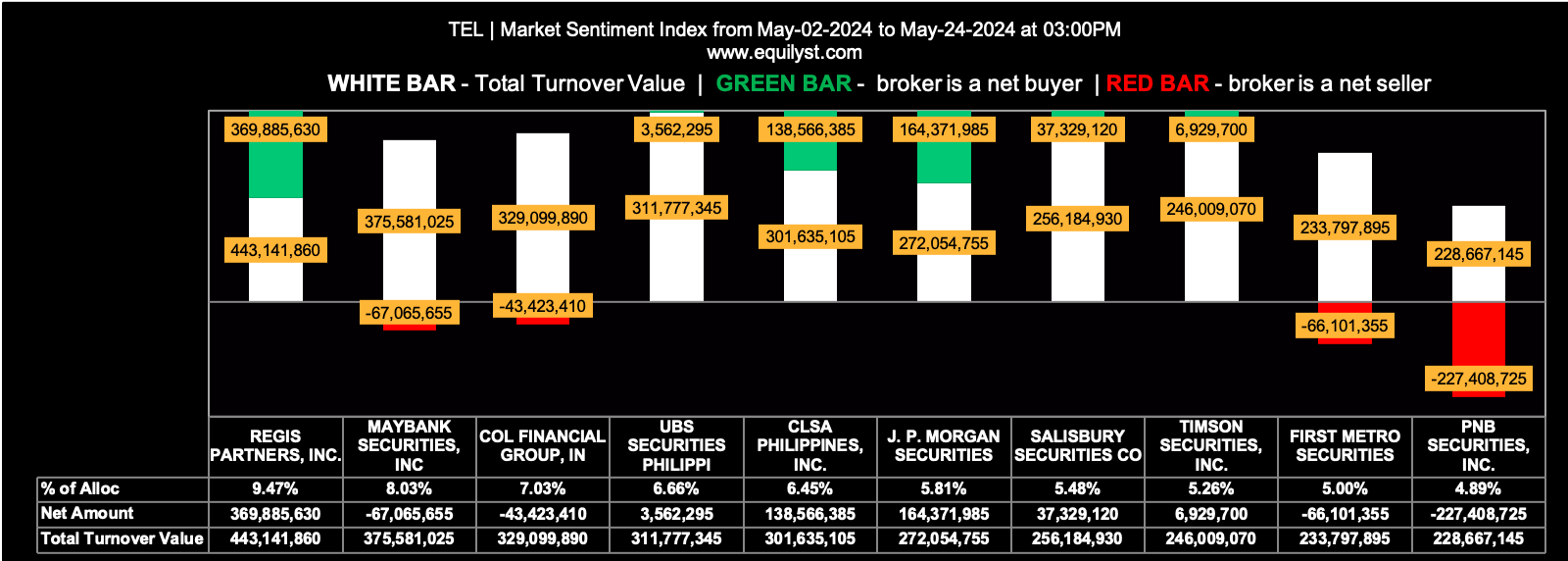

PLDT (TEL): 6.69% Div Yield (TTM)

Market Sentiment Index: BEARISH

27 of the 96 participating brokers, or 28.13% of all participants, registered a positive Net Amount

30 of the 96 participating brokers, or 31.25% of all participants, registered a higher Buying Average than Selling Average

96 Participating Brokers’ Buying Average: ₱1410.79317

96 Participating Brokers’ Selling Average: ₱1414.24979

9 out of 96 participants, or 9.38% of all participants, registered a 100% BUYING activity

26 out of 96 participants, or 27.08% of all participants, registered a 100% SELLING activity

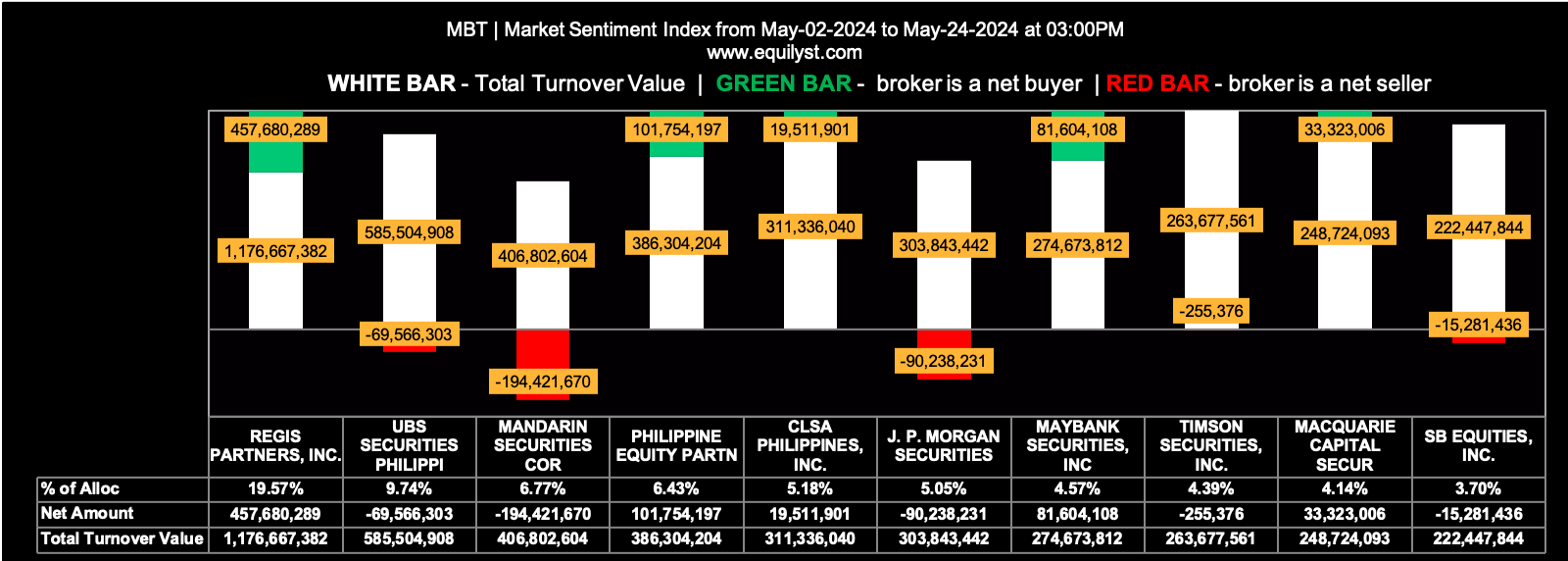

Metropolitan Bank & Trust Company (MBT): 6.23% Div Yield (TTM)

Market Sentiment Index: BEARISH

35 of the 96 participating brokers, or 36.46% of all participants, registered a positive Net Amount

18 of the 96 participating brokers, or 18.75% of all participants, registered a higher Buying Average than Selling Average

96 Participating Brokers’ Buying Average: ₱69.54674

96 Participating Brokers’ Selling Average: ₱70.74547

5 out of 96 participants, or 5.21% of all participants, registered a 100% BUYING activity

20 out of 96 participants, or 20.83% of all participants, registered a 100% SELLING activity

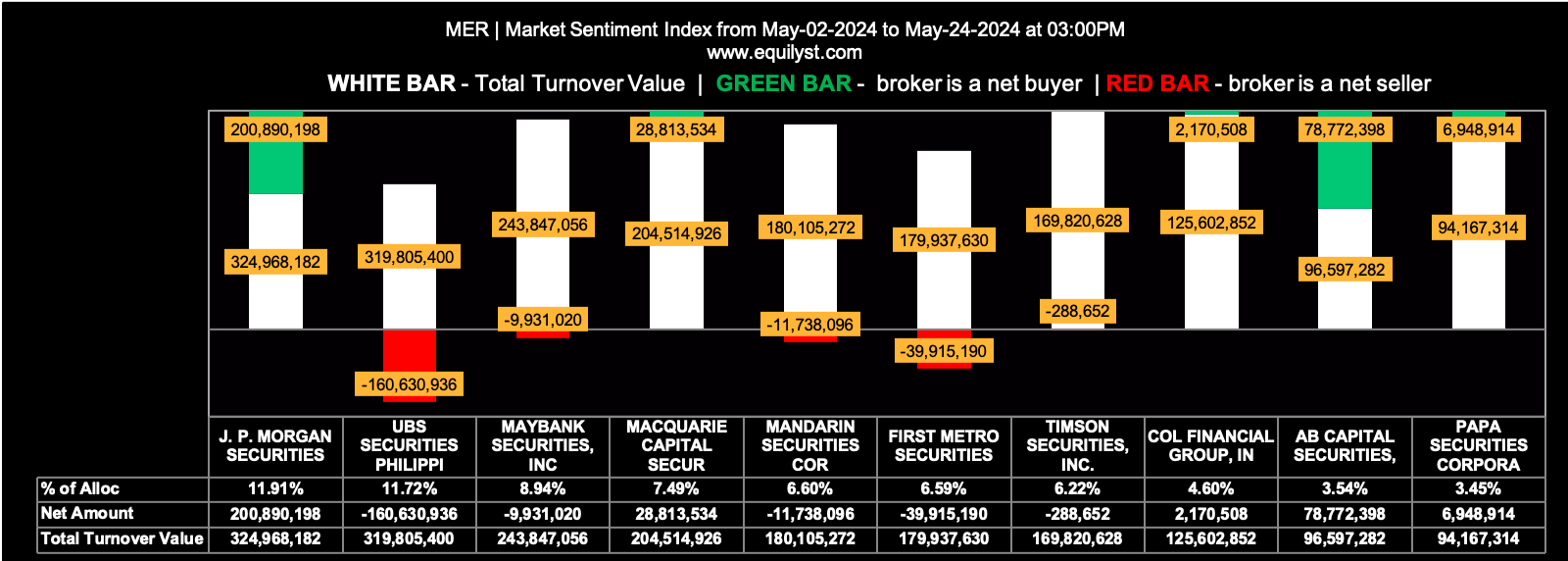

Manila Electric Company (MER): 5.35% Div Yield (TTM)

Market Sentiment Index: BEARISH

24 of the 77 participating brokers, or 31.17% of all participants, registered a positive Net Amount

22 of the 77 participating brokers, or 28.57% of all participants, registered a higher Buying Average than Selling Average

77 Participating Brokers’ Buying Average: ₱371.01351

77 Participating Brokers’ Selling Average: ₱372.01893

6 out of 77 participants, or 7.79% of all participants, registered a 100% BUYING activity

24 out of 77 participants, or 31.17% of all participants, registered a 100% SELLING activity

Verdict

Unfortunately, all 6 blue-chips received a bearish MTD Market Sentiment Index score. This means that while they are the most generous dividend-issuing companies from the list of 30 blue-chips, my methodology doesn’t find it logical to buy the stocks yet as their individual share prices are still likely to continue going down. My methodology is hinting that we should watch out for data-driven signs of reversal for now.

Invest Smarter with Equilyst Analytics: Expert Services for All Traders

At Equilyst Analytics, I offer expert consulting, advanced stock screening (list of stocks with a buy signal according to my Evergreen Methodology), and premium stock analysis tailored for both beginners and experienced traders and investors. Enhance your investing strategy with my comprehensive services designed to help you make informed decisions and maximize returns. Click the SERVICES menu on my website and elevate your trading success!

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025