I’d like to show you the top 5 Philippine bluechip stocks with the biggest positive Local Net Amount.

When a stock has a positive net amount, it means the participating brokers have higher buying than selling transactions. In contrary, a negative net amount means a higher selling than buying transactions.

In case you’re asking if this is the same as Net Foreign, no, it isn’t. To know more about the importance of knowing the presence of foreign investors in a stock, please read this: Impact of Foreign Investors in the Philippine Stock Market

I started writing this article around 1:30 PM of September 6, 2023.

Aside from enumerating the top 5 Philippine bluechip stocks with the highest Local Net Amount as of the time I mentioned above, I’d like to show you their prevailing dominant range and market sentiment.

Please check the timestamp on each chart of these Philippine bluechip stocks to know when each chart was generated.

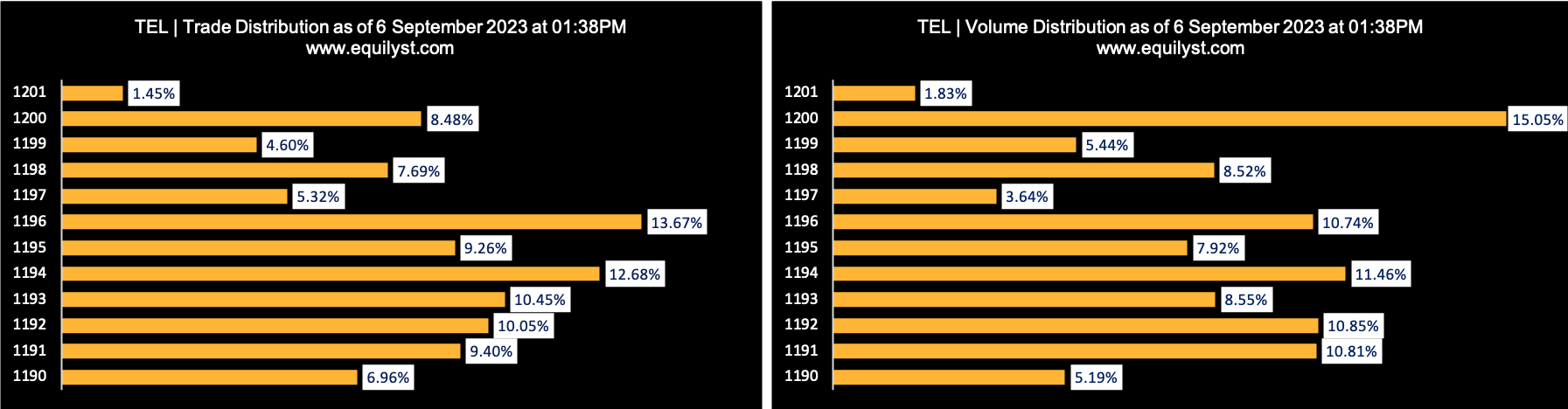

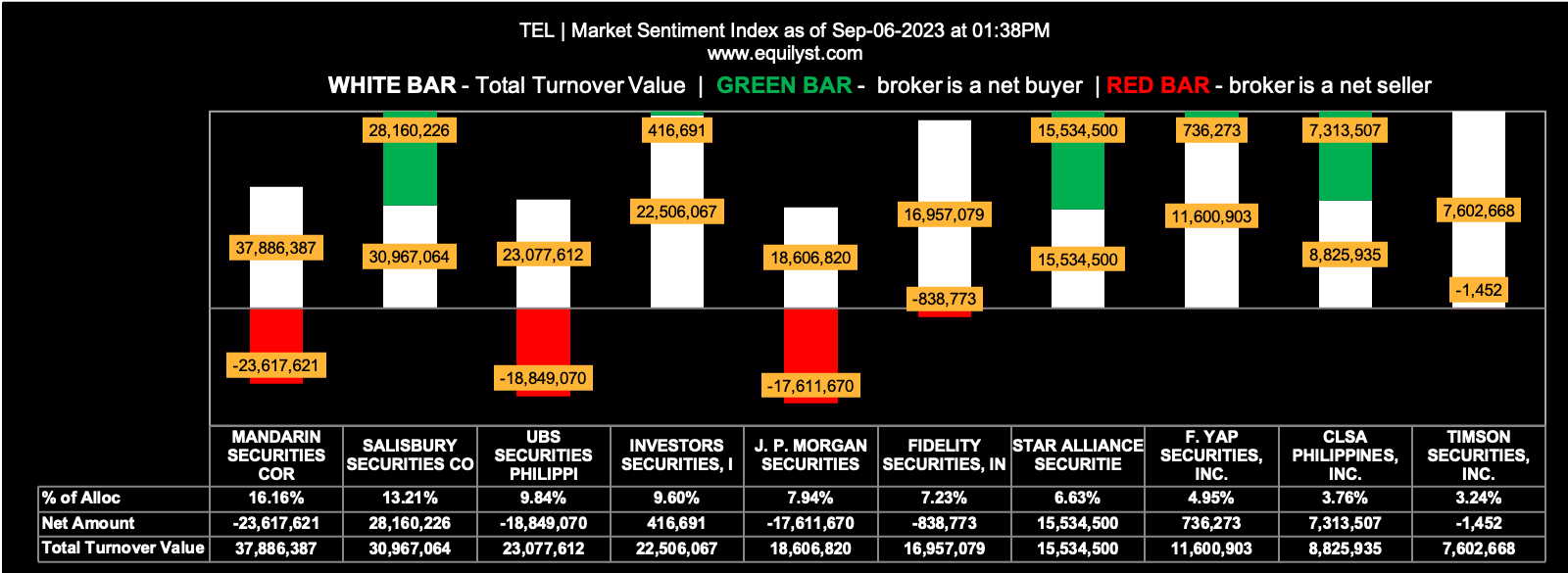

PLDT (TEL)

Local Net Amount: P17,062,580

Dominant Range Index: BULLISH

Dominant Range Index: BULLISH

Last Price: 1201.00

VWAP: 1,195.21

Dominant Range: 1,196.00 – 1,200.00

Market Sentiment Index: BULLISH

28 of the 41 participating brokers, or 68.29% of all participants, registered a positive Net Amount

29 of the 41 participating brokers, or 70.73% of all participants, registered a higher Buying Average than Selling Average

41 Participating Brokers’ Buying Average: ₱138.10299

41 Participating Brokers’ Selling Average: ₱138.18428

19 out of 41 participants, or 46.34% of all participants, registered a 100% BUYING activity

5 out of 41 participants, or 12.20% of all participants, registered a 100% SELLING activity

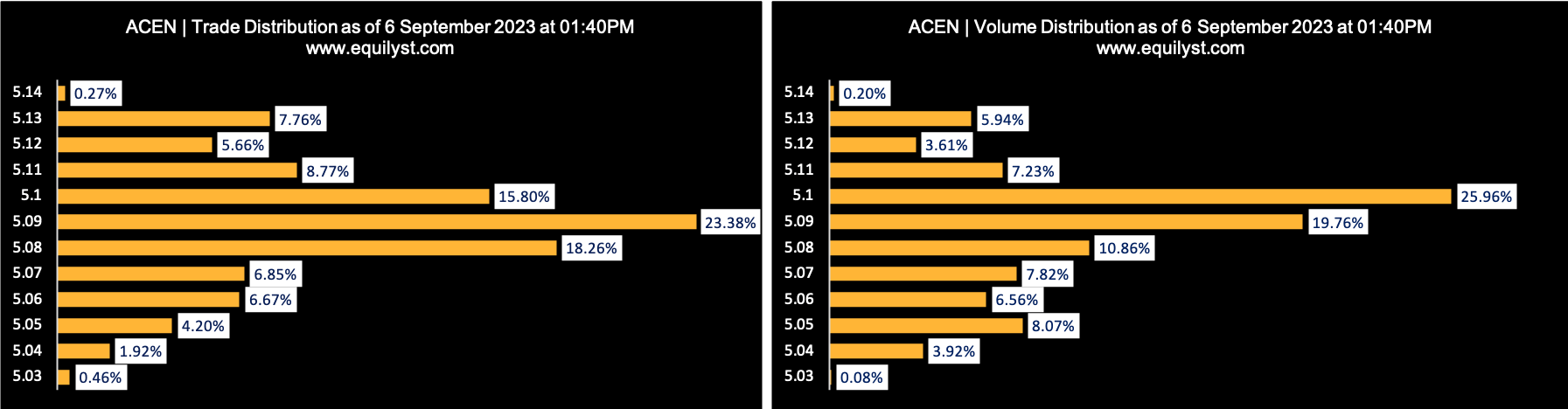

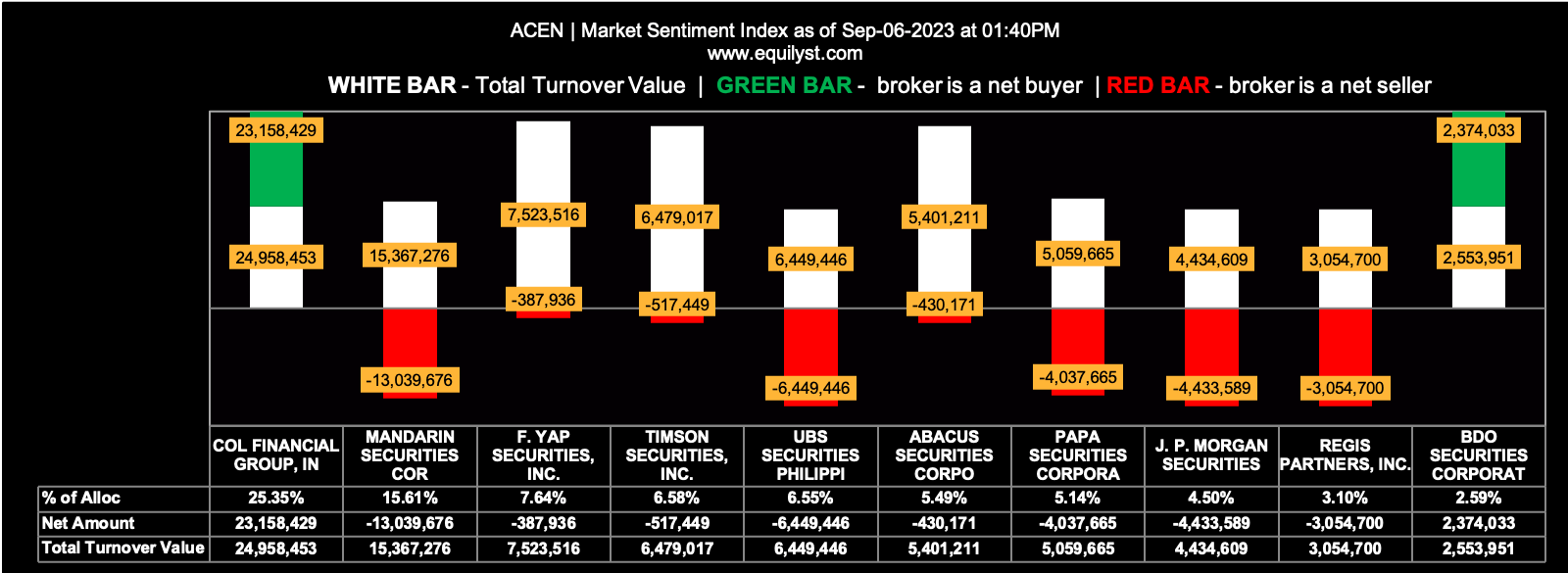

ACEN Corporation (ACEN)

Local Net Amount: P19,174,478

Dominant Range Index: BULLISH

Last Price: 5.05

VWAP: 5.09

Dominant Range: 5.09 – 5.1

Market Sentiment Index: BEARISH

21 of the 35 participating brokers, or 60.00% of all participants, registered a positive Net Amount

17 of the 35 participating brokers, or 48.57% of all participants, registered a higher Buying Average than Selling Average

35 Participating Brokers’ Buying Average: ₱5.07156

35 Participating Brokers’ Selling Average: ₱5.08826

12 out of 35 participants, or 34.29% of all participants, registered a 100% BUYING activity

4 out of 35 participants, or 11.43% of all participants, registered a 100% SELLING activity

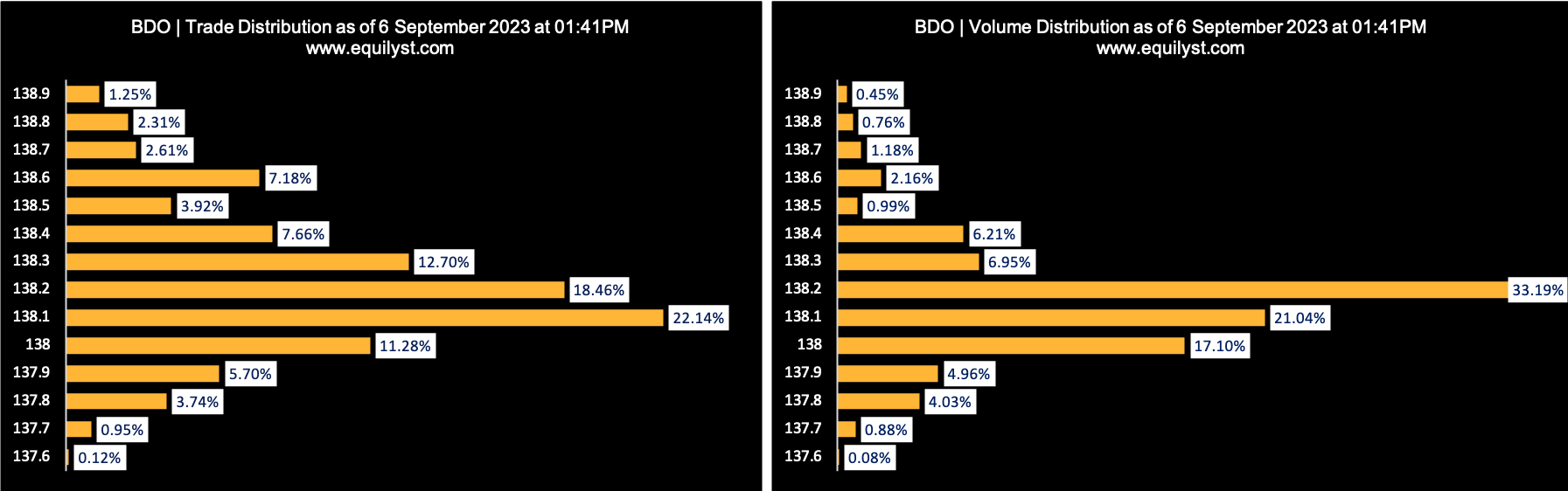

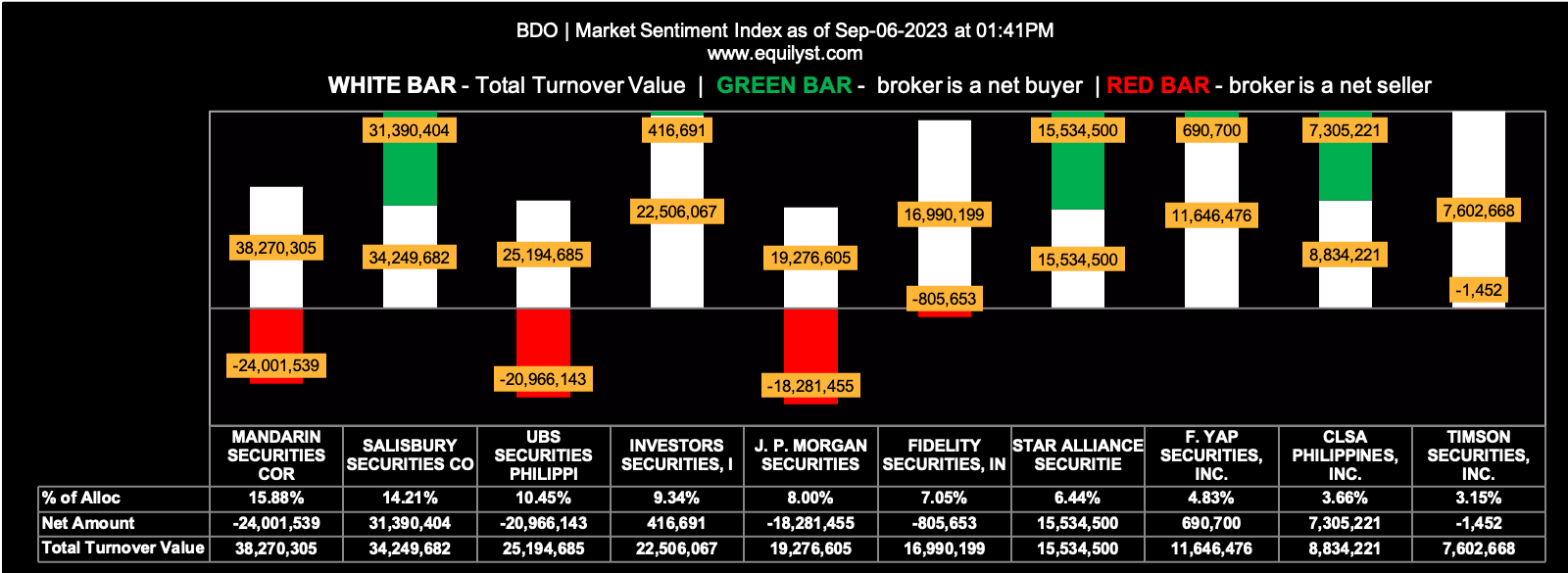

BDO Unibank (BDO)

Local Net Amount: P19,816,225

Dominant Range Index: BEARISH

Last Price: 138.1

VWAP: 138.15

Dominant Range: 138.1 – 138.2

Market Sentiment Index: BULLISH

28 of the 41 participating brokers, or 68.29% of all participants, registered a positive Net Amount

29 of the 41 participating brokers, or 70.73% of all participants, registered a higher Buying Average than Selling Average

41 Participating Brokers’ Buying Average: ₱138.10278

41 Participating Brokers’ Selling Average: ₱138.18324

19 out of 41 participants, or 46.34% of all participants, registered a 100% BUYING activity

5 out of 41 participants, or 12.20% of all participants, registered a 100% SELLING activity

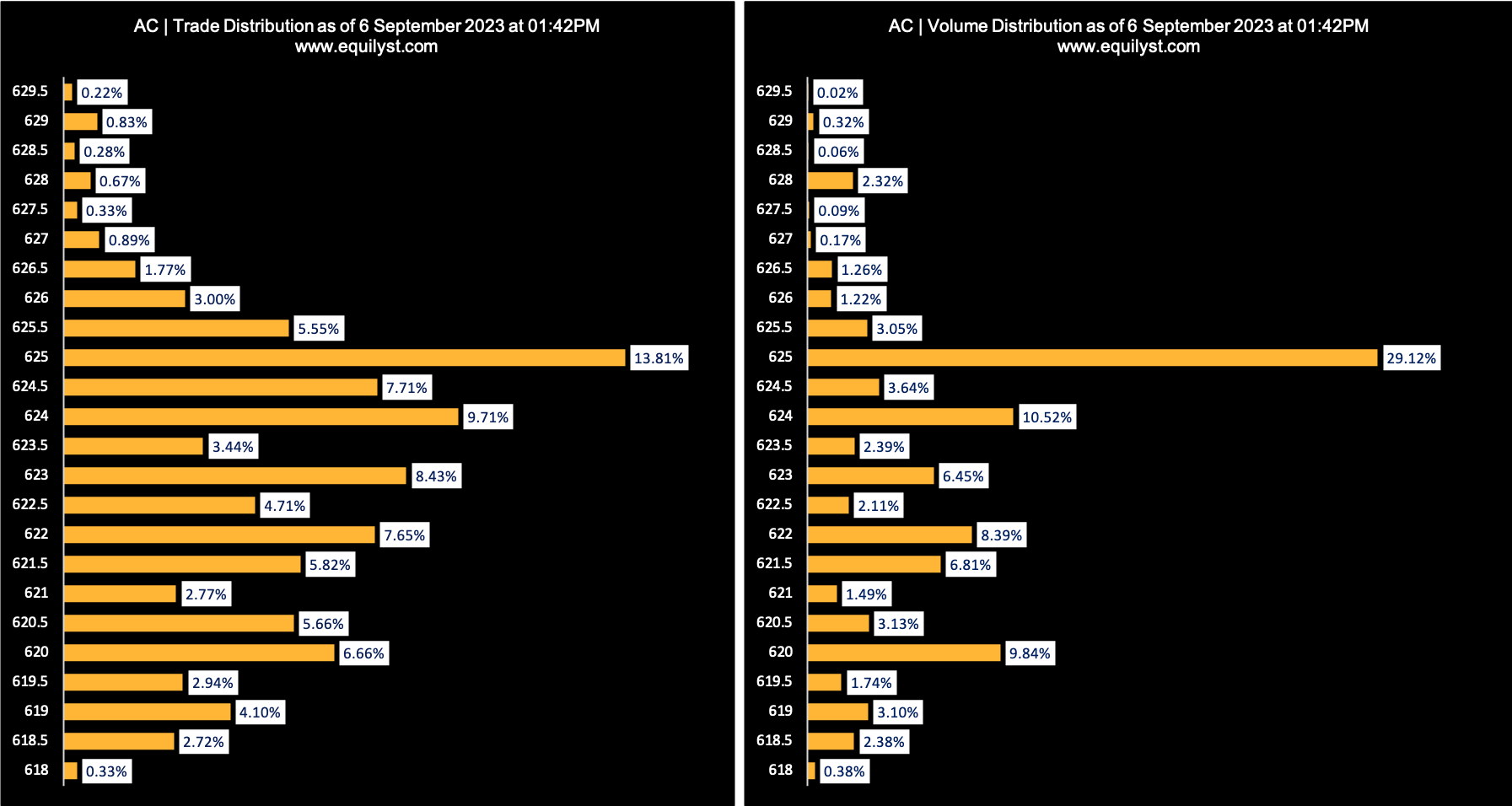

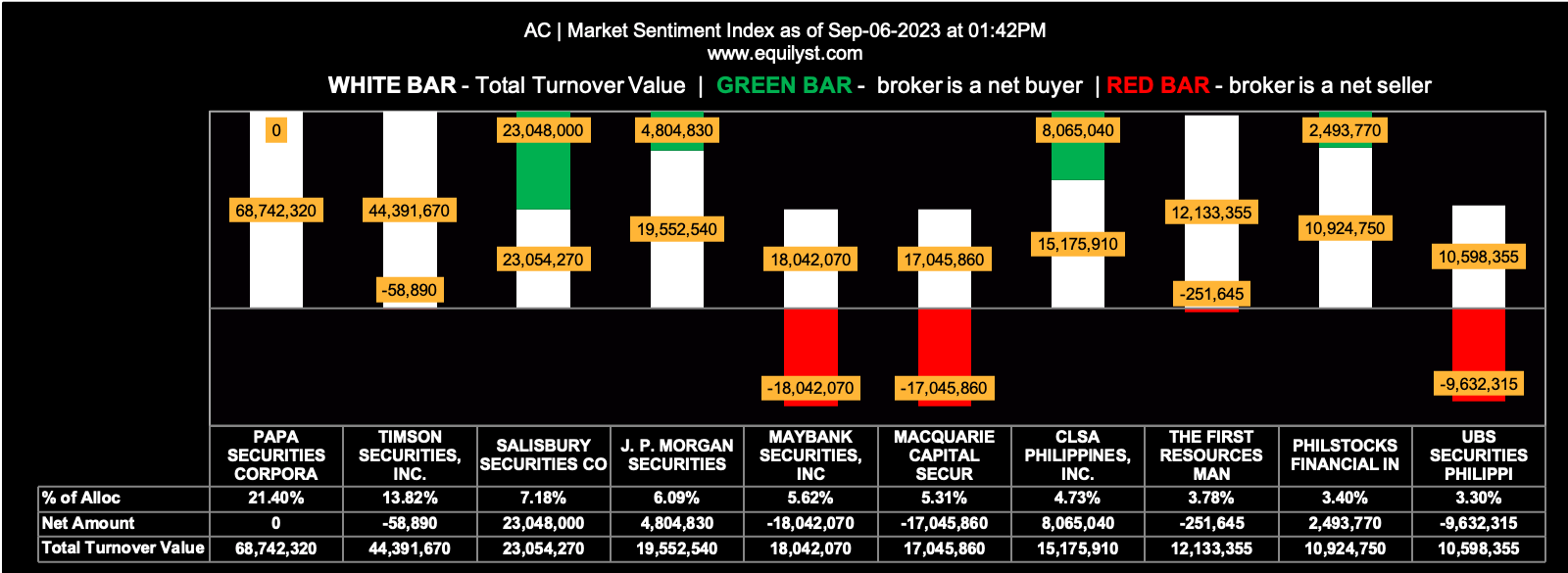

Ayala Corporation (AC)

Local Net Amount: P37,294,455

Dominant Range Index: BULLISH

Last Price: 621

VWAP: 623.15

Dominant Range: 625 – 625

Market Sentiment Index: BEARISH

16 of the 33 participating brokers, or 48.48% of all participants, registered a positive Net Amount

12 of the 33 participating brokers, or 36.36% of all participants, registered a higher Buying Average than Selling Average

33 Participating Brokers’ Buying Average: ₱622.64613

33 Participating Brokers’ Selling Average: ₱623.39718

5 out of 33 participants, or 15.15% of all participants, registered a 100% BUYING activity

7 out of 33 participants, or 21.21% of all participants, registered a 100% SELLING activity

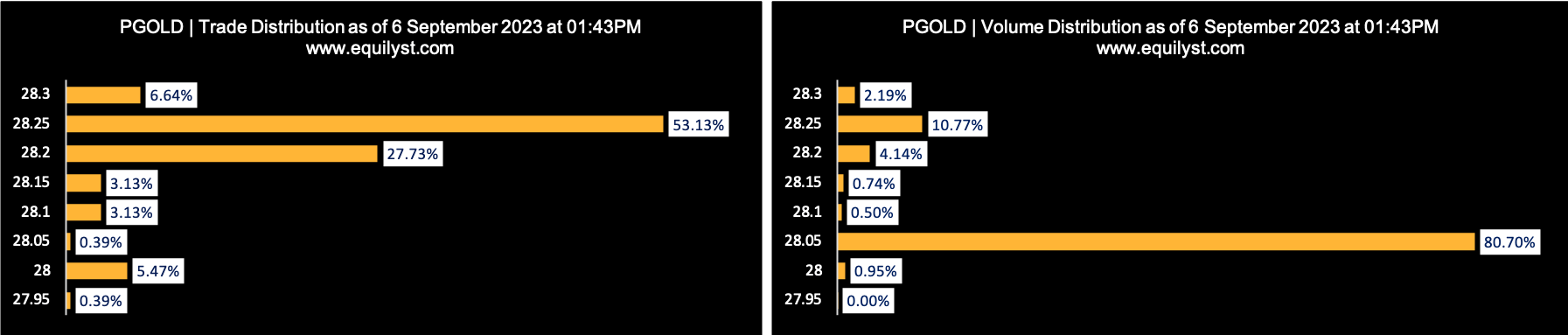

Puregold Price Club (PGOLD)

Local Net Amount: P47,576,655

Dominant Range Index: BULLISH

Last Price: 28.3

VWAP: 28.08

Dominant Range: 28.05 – 28.25

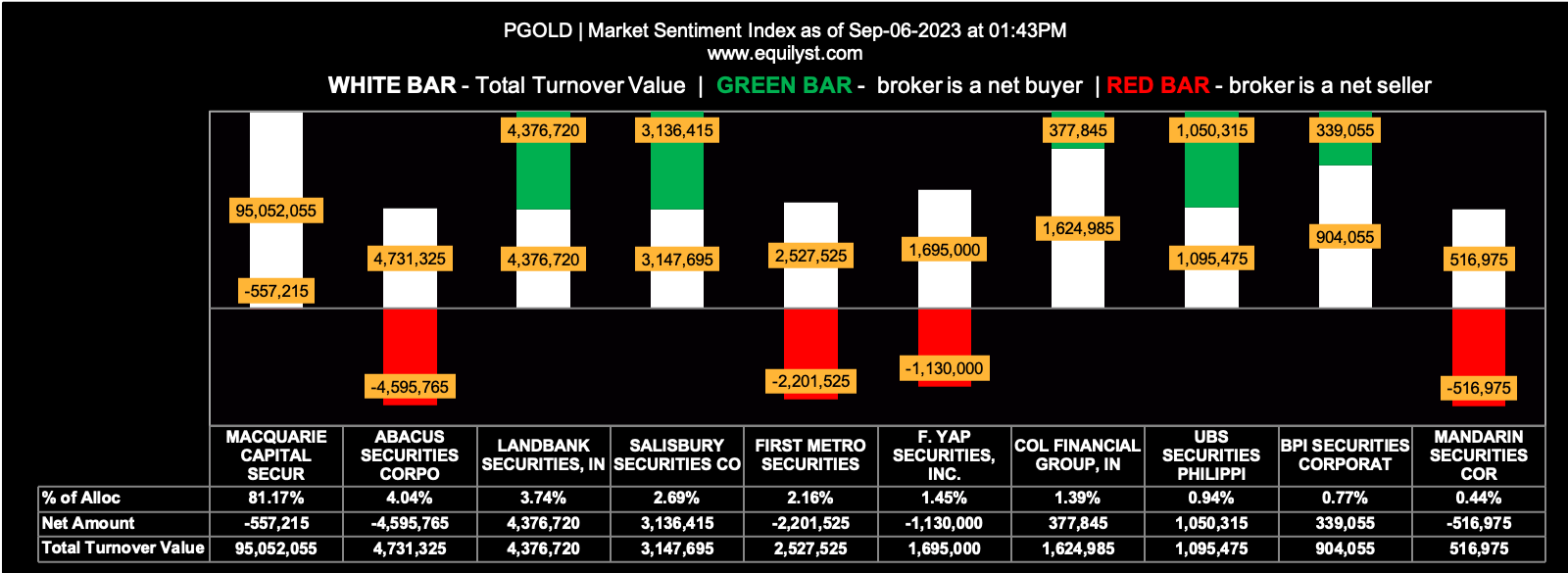

Market Sentiment Index: BEARISH

9 of the 18 participating brokers, or 50.00% of all participants, registered a positive Net Amount

9 of the 18 participating brokers, or 50.00% of all participants, registered a higher Buying Average than Selling Average

18 Participating Brokers’ Buying Average: ₱28.20328

18 Participating Brokers’ Selling Average: ₱28.21571

4 out of 18 participants, or 22.22% of all participants, registered a 100% BUYING activity

3 out of 18 participants, or 16.67% of all participants, registered a 100% SELLING activity

Which of These 5 Philippine Bluechip Stocks Do You Monitor?

After knowing this information I’ve shared with you, one bluechip stocks are in your watchlist? Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025

Puregold and Ayala corp.

God bless you on your investments, Mr. Jimenez. I hope this article has helped you in one way or another.