Bloomberry Resorts Corporation: Q2 2023 Financial Highlights

Solaire’s total Gross Gaming Revenues (GGR) reached P15.1 billion, marking a 15% rise compared to the second quarter of 2022 when it stood at P13.1 billion.

During this quarter, Solaire witnessed substantial growth in VIP rolling chip volume, mass table drop, and Electronic Gaming Machine (EGM) coin-in, hitting P172.5 billion, P13.3 billion, and P90.0 billion, respectively. These figures indicated a robust year-over-year increase of 47%, 43%, and 17%. The domestic market maintained its strength.

Consolidated net revenue saw an uptick, reaching P12.6 billion, a 26% boost compared to the previous year. Meanwhile, consolidated EBITDA surged to P5.5 billion, marking a substantial 41% increase from the same quarter in the prior year.

Consolidated net income soared to P3.4 billion, showing a significant 92% increase from the P1.8 billion reported in the corresponding quarter last year. If we exclude a one-time gain of P356.6 million from the sale of an asset at Solaire Korea, the consolidated net income would still have seen a considerable 72% year-over-year growth.

In June 2023, lenders for the P40 billion Syndicated Loan Facility, managed under wholly-owned Sureste Properties Inc., granted Bloomberry’s request to postpone covenant testing until June 30, 2026.

Bloomberry Resorts Corporation: H1 2023 Financial Highlights

The first half of 2023 witnessed a remarkable surge in consolidated GGR, reaching P31.2 billion, a staggering 41% increase from the P22.0 billion in the first half of 2022. Total GGR at Solaire amounted to P31.2 billion, marking a 41% year-over-year increase and surpassing the first half of 2019 by 110%.

Consolidated net revenue in the first half of 2023 reached P25.6 billion, a 48% increase compared to the same period in the previous year. The consolidated EBITDA also exhibited significant growth, reaching P11.2 billion, which is 66% higher than the first six months of the previous year. Notably, the consolidated EBITDA for the first half surpassed the level reported during the same period in 2019.

Consolidated net income in the first half soared to P6.4 billion, marking a substantial 160% increase from the P2.5 billion reported in the first half of 2022. Even after excluding the one-time gain of P356.6 million from the sale of an asset, consolidated net income would have still grown by an impressive 145%.

Bloomberry Resorts Corporation, the parent company of Solaire Resort Entertainment City and Jeju Sun Hotel & Casino, reported unaudited consolidated financial results for the three months and six months ending June 30, 2023.

Enrique K. Razon Jr., Bloomberry Chairman and CEO, expressed, “Our business segments continued to deliver growth during the quarter, boosting consolidated net revenues, EBITDA, and net profit in the first half to levels exceeding that of the same period in 2019. Both VIP and mass gaming volumes saw year-over-year gains, reflecting the strength of the Philippines’ domestic gaming market and gradual recovery in international visitation. We anticipate this growth trend to persist in the coming months and years.”

Bloomberry’s Gaming Performance

In the second quarter, Solaire witnessed impressive figures in VIP rolling chip volume, mass table drop, and EGM coin-in, registering year-over-year growth rates of 47%, 43%, and 17%, respectively. On a sequential basis, VIP rolling chip volume, mass table drop, and slot coin-in increased by 3%, 10%, and 7%, respectively.

Total GGR at Solaire for the second quarter reached P15.1 billion, marking a 15% increase compared to P13.1 billion in the second quarter of 2022. However, it experienced a 6% decline compared to the previous quarter. For the first half, GGR at Solaire amounted to P31.2 billion, a remarkable 41% increase from the first half of 2022.

Solaire’s VIP, mass table, and EGM GGR in the second quarter were P4.7 billion, P5.0 billion, and P5.4 billion, respectively, with year-over-year growth of 7%, 22%, and 17%. On a sequential basis, mass tables and EGM GGR recorded increases of 3% and 13%, respectively, while VIP GGR declined by 26% from the previous quarter due to a lower hold rate.

In the first six months, Total GGR reached P31.2 billion, marking a 41% year-over-year increase, reflecting the continued strength of the domestic market in the second quarter. VIP, mass table, and EGM GGR were P11.1 billion, P9.9 billion, and P10.1 billion, respectively, with year-over-year growth of 57%, 25%, and 44%. Solaire Korea’s Jeju Sun reported gross gaming revenue of P4.7 million in the second quarter, a P3.5 million increase from the previous quarter.

In the second quarter, consolidated contra revenue accounts decreased by 11% year-over-year to P3.5 billion, representing 23% of consolidated GGR, compared to 26% in the previous quarter and 30% in the same quarter last year. For the first half, consolidated contra revenue accounts increased by 28% from the same period last year to P7.6 billion.

Consolidated net gaming revenue for the second quarter reached P10.6 billion, a 2% decline from the previous quarter and a 28% year-over-year increase. In the first six months, consolidated net gaming revenue reached P21.5 billion, a substantial 47% increase compared to the same period last year.

Bloomberry’s Non-Gaming Revenues

The Company reported consolidated non-gaming revenue of P2.0 billion for the quarter, marking a 16% increase from the P1.7 billion generated in the same quarter last year. However, consolidated non-gaming revenue decreased by 5% compared to the previous quarter. In the first half, consolidated non-gaming revenue reached P4.1 billion, marking a 55% increase compared to the same period last year.

At Solaire, non-gaming revenue for the second quarter reached P1.9 billion, marking an 11% increase from the same quarter last year. Hotel occupancy rose to 80.0%, compared to 76.9% in the previous quarter and 53.4% in the second quarter of 2022. In the first six months, non-gaming revenue at Solaire reached P4.0 billion, marking a 51% year-over-year increase.

At Solaire Korea, non-gaming revenue for the second quarter reached P87.9 million, marking an P86.8 million year-over-year increase.

Bloomberry’s Net Revenues

Bloomberry’s consolidated net revenue in the second quarter reached P12.6 billion, marking a 26% increase from P10.0 billion in the same period last year. However, consolidated net revenue decreased by 2% compared to the previous quarter. In the first half, consolidated net revenue reached P25.6 billion, marking a 48% year-over-year increase.

Bloomberry’s Expenses

In the second quarter, consolidated cash operating expenses reached P7.2 billion, marking a 16% increase compared to P6.2 billion in the same quarter last year. This increase was attributed to higher gaming taxes and salaries and benefits in line with improved business activity at Solaire. Consolidated cash operating expenses decreased by 1% compared to the previous quarter. In the first half, consolidated cash operating expenses reached P14.4 billion, marking a 37% increase compared to the first six months of 2022.

Bloomberry’s EBITDA, Net Income, and Earnings Per Share

The Company’s second quarter consolidated EBITDA reached P5.5 billion, marking a 41% increase from P3.9 billion in the same quarter last year. Solaire contributed P5.5 billion to consolidated EBITDA, offset by the P83.1 million LBITDA recorded at Solaire Korea. Consolidated EBITDA decreased by 5% compared to the P5.7 billion recorded in the first quarter of 2023. In the first six months, consolidated EBITDA reached P11.2 billion, marking a 66% increase from P6.7 billion in the same period last year. Consolidated EBITDA in the first half surpassed the level reported in the same period in 2019.

On a hold-normalized basis, Bloomberry’s consolidated EBITDA for the second quarter was P5.1 billion, P357.3 million lower than the reported consolidated EBITDA of P5.5 billion. Hold-normalized EBITDA in the second quarter would have increased by 53% year-over-year. Hold-normalized EBITDA in the first half reached P9.8 billion, marking a 69% year-over-year increase.

The Company reported consolidated net income of P3.4 billion for the second quarter, marking a significant 92% increase from the P1.8 billion reported in the same quarter last year. Consolidated net income was 16% higher than the P3.0 billion reported in the previous quarter. In the first six months, consolidated net income reached P6.4 billion, marking a substantial 160% increase from the P2.5 billion reported in the first half of 2022. Even after excluding the impact of a P356.6 million one-time gain on sale from the disposition of an asset at Solaire Korea, consolidated net income for the quarter would have increased by 4% sequentially and 72% year-over-year, while first half income would have increased by 145%.

Bloomberry reported Basic Earnings per Share (EPS) gain of P0.316, which compares to EPS gain of P0.166 in the second quarter of 2022. EPS in the first six months was a gain of P0.592, compared to a gain of P0.229 in the same period last year.

Bloomberry’s Balance Sheet and Other Items

As of June 30, 2023, Bloomberry had a consolidated cash and cash equivalents balance of P44.9 billion. Total outstanding long-term debt was P98.1 billion, representing the balance of the current and non-current portions of the amended P73.5 billion and P40.0 billion Syndicated Loan facilities. Total equity attributable to equity holders of the parent company was P39.9 billion.

As of June 30, 2023, the Company had drawn P18.2 billion from the P40.0 billion Syndicated Loan Facility, marking an increase of P8.7 billion as the company drew from the facility in the second quarter to partially finance the construction of Solaire Resort North.

In June 2023, Bloomberry’s lenders agreed to waive debt covenant testing for the P40 billion Syndicated Loan Facility under wholly-owned subsidiary Sureste Properties, Inc. until June 30, 2026. This waiver provides Bloomberry with added flexibility, allowing greater focus on completing Solaire Resort North and ramping up its operations when it opens next year.

As of June 30, 2023, Bloomberry had P1.9 billion in net receivables, marking an 8% decrease from the beginning of the year. The Company made no provisions for bad debt in the second quarter.

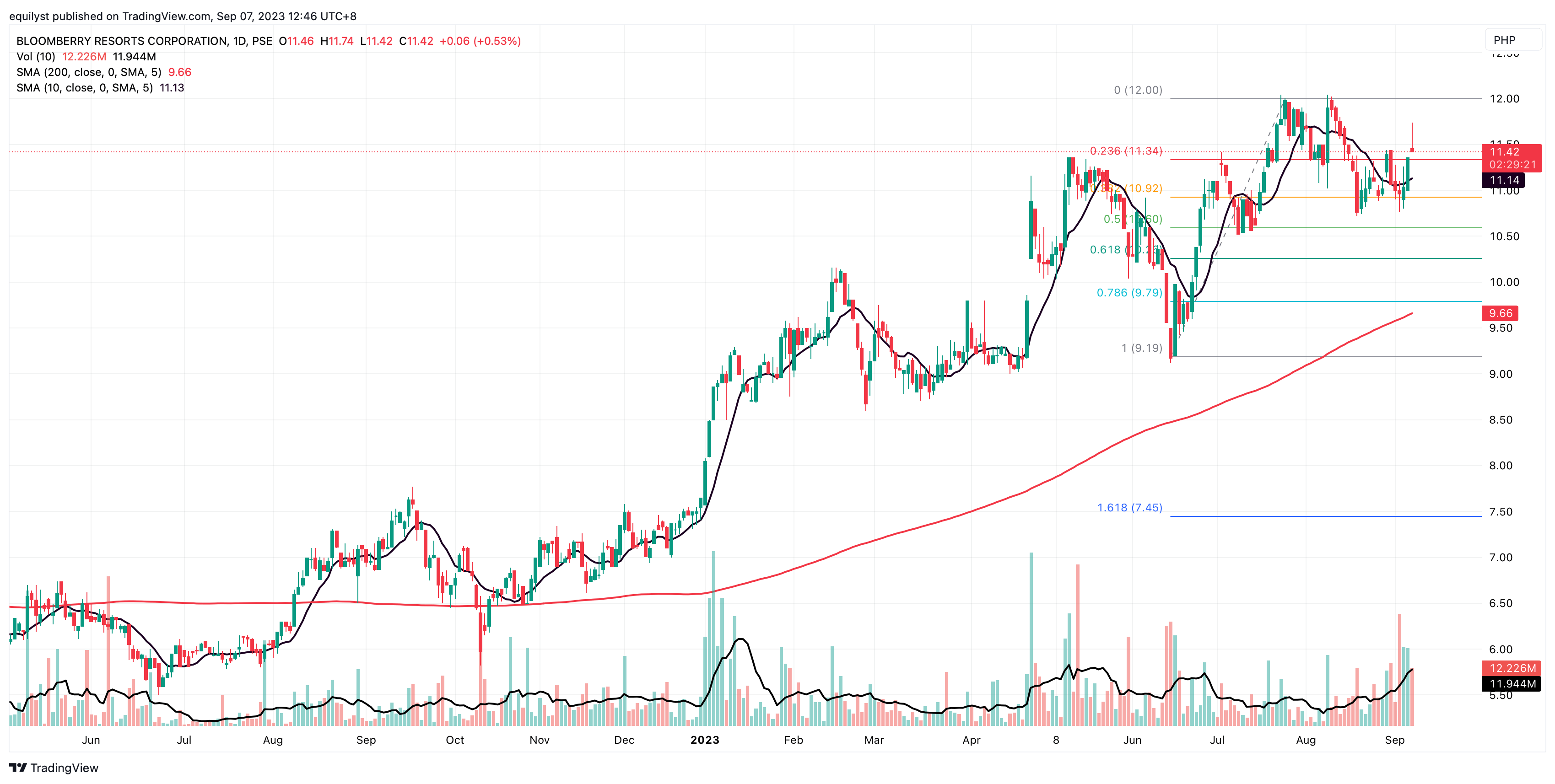

Technical Analysis: Bloomberry Resorts Corporation

Bloomberry has experienced a remarkable year-to-date increase of 49.28%, soaring from P7.65 on December 29, 2022, to P11.42 as of the first half of trading on September 7, 2023. Although the stock has not yet fully recovered to its pre-pandemic levels, it has shown significant resilience compared to its industry peers.

As of September 7, Bloomberry remains above both its 10-day and 200-day simple moving averages. It recently surpassed the P11.34 mark, now serving as immediate support, with the latest resistance level established at P12.00.

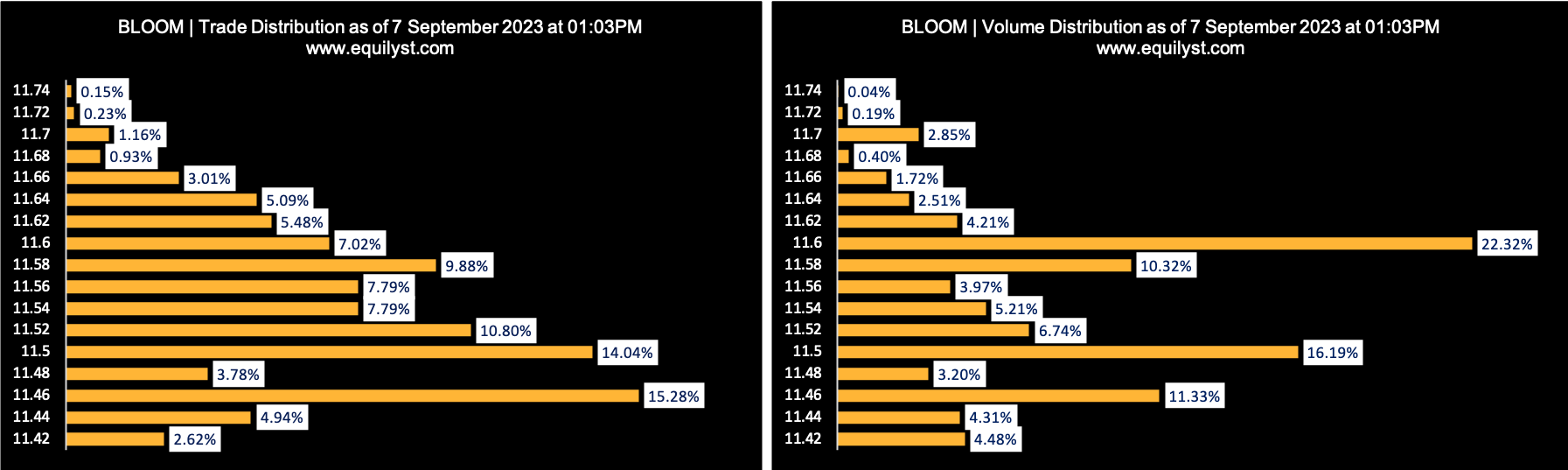

However, there is a possibility of Bloomberry retracting below P11.34, given that its volume-weighted average price of P11.54 exceeds the current price of P11.42. This possibility is further supported by the prevailing range of P11.46 to P11.60, which is closer to the intraday low than the intraday high.

As of the first half of trading on September 7, 2023, Bloomberry holds a bearish Dominant Range Index rating, although this may change in the second half of trading. Whether the dominant range moves closer to the intraday high or low remains uncertain.

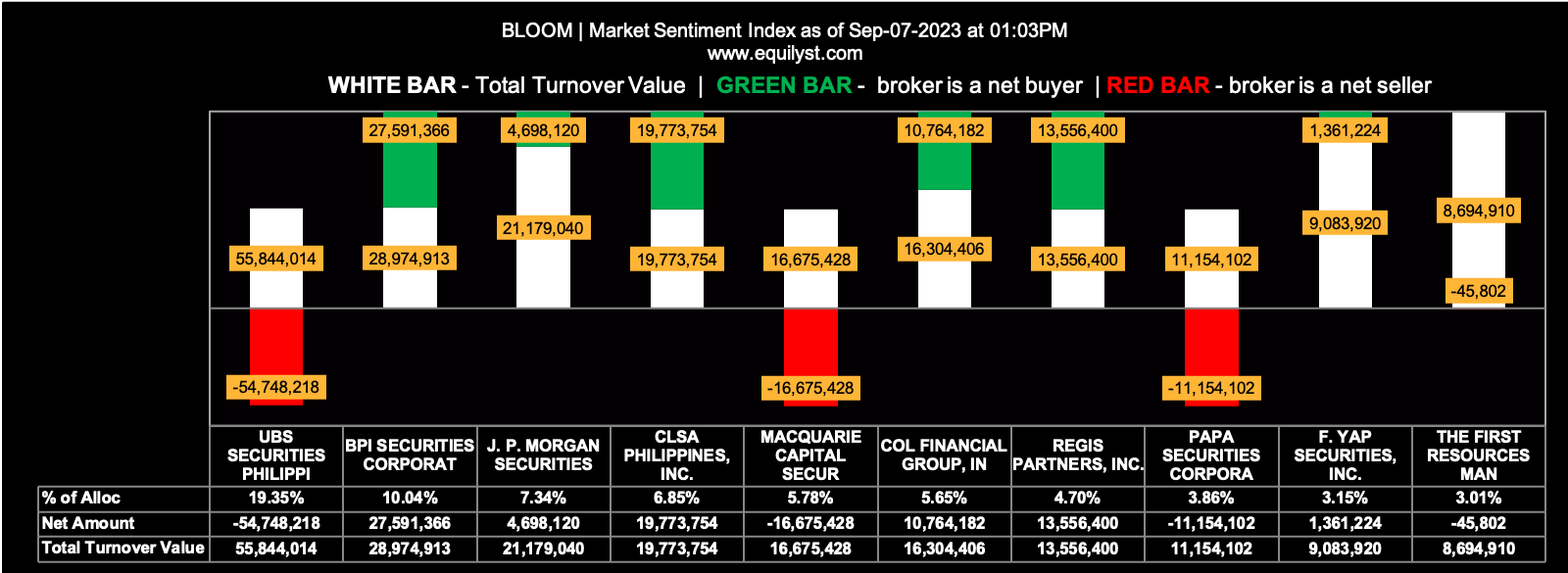

The bearish Market Sentiment Index rating for the first half of trading on September 7, 2023, aligns with the bearish Dominant Range Index. The following statistics contribute to this bearish market sentiment:

25 of the 49 participating brokers, or 51.02% of all participants, registered a positive Net Amount

23 of the 49 participating brokers, or 46.94% of all participants, registered a higher Buying Average than Selling Average

49 Participating Brokers’ Buying Average: ₱11.53849

49 Participating Brokers’ Selling Average: ₱11.55378

12 out of 49 participants, or 24.49% of all participants, registered a 100% BUYING activity

8 out of 49 participants, or 16.33% of all participants, registered a 100% SELLING activity

Share Price Forecast for Bloomberry

Considering the events of the first half of trading on September 7, 2023, Bloomberry may retest the support level at P11.34 in the second half of trading until September 8, 2023.

If Bloomberry is not currently in my portfolio, I will add it to my watchlist if I have an available slot. Bloomberry exhibits healthy volatility.

In the scenario where Bloomberry is already in my portfolio, and my trailing stop is still intact, I will maintain my position as long as the trailing stop remains active. I will consider adding to my position only when all six indicators from my proprietary methodology signal bullish trends. Please note that I haven’t disclosed all the indicators that comprise my methodology here. If you’re interested in learning my complete methodology, I offer stock investment consultancy services.

What Are Your Personal Plans for Bloomberry?

I’ve shared with you a portion of my analysis. You should be able to arrive to a data-driven investment decision for yourself relative to your investment horizon, risk tolerance, and financial circumstances now. What do you plan to do now? Let me know in the comments.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025