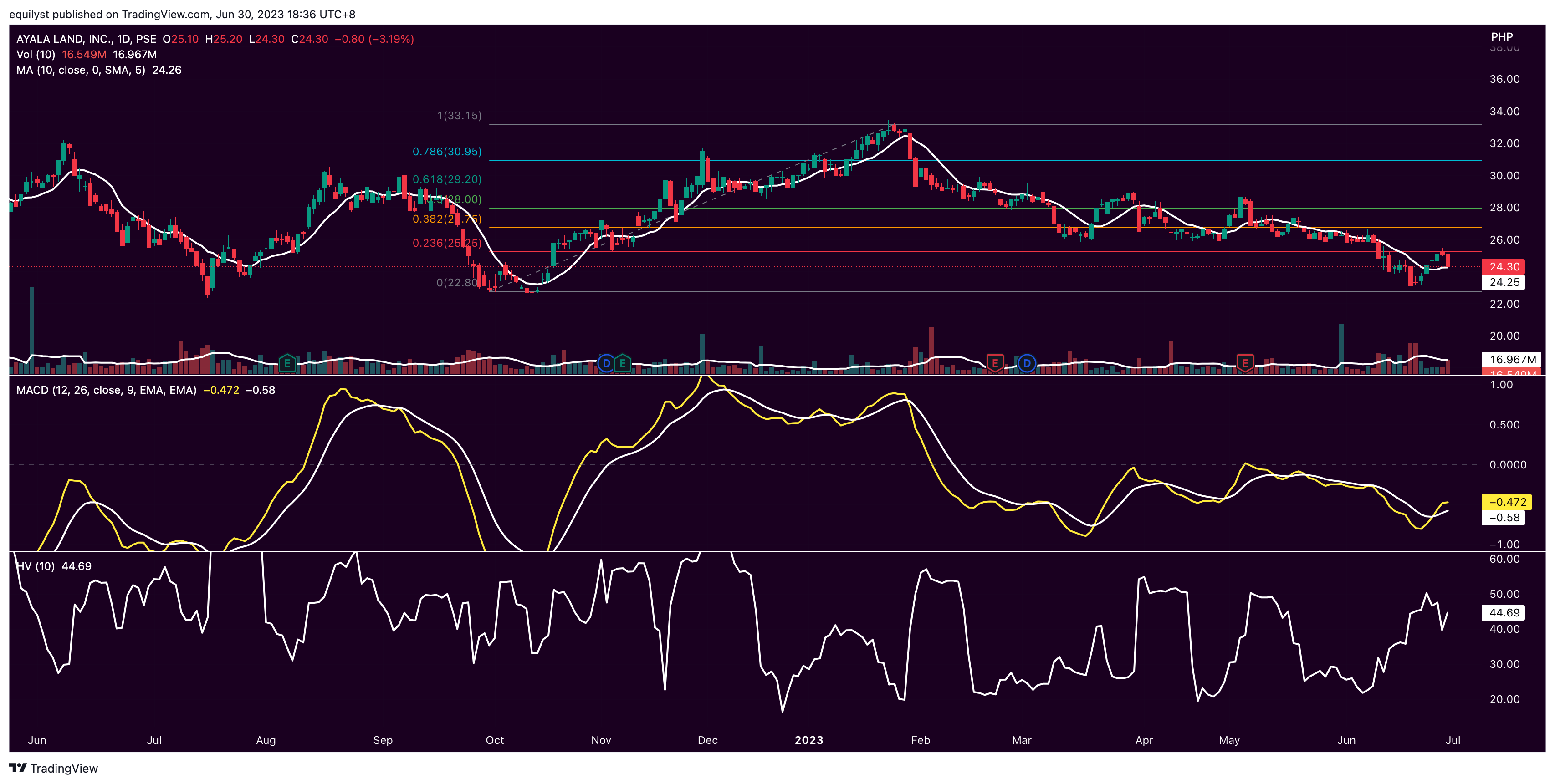

Ayala Land (PSE:ALI) closed on Friday at P24.30, down by 3.19% today, down by 21.10% year-to-date, and also down by 54.88% from its all-time high of P53.85.

Investors translated the resistance at P25.00 as a profit-taking level. This resistance level intersects with the 23.6% Fibonacci retracement. Support remains at P22.80. The secondary resistance level is at P25.75, converging with the 38.2% Fibonacci retracement.

Today’s negative day change was backed by a red volume bar that almost touched 100% of ALI’s 10-day volume average. That says a lot about how strong the selling sentiment was for the last trading day of the week and the second quarter of 2023, not to mention that it’s also a window dressing week.

ALI still trades above its 10-day simple moving average, but today’s towering red volume is inviting the possibility of trading below the said moving average by the next trading week.

ALI’s moving average convergence divergence (MACD) also trades above the signal line, but it has plateaued already due to today’s -3.19% day change.

No alarming price gaps were registered within the past 10 trading days. Still, the already declining risk level displayed on ALI’s 10-day historical volatility rose again due to today’s engulfing candlestick. The risk level is still low but five points away from entering the moderate risk level. If ALI registers one more engulfing candlestick on Monday, the 10-day historical volatility may increase the risk level.

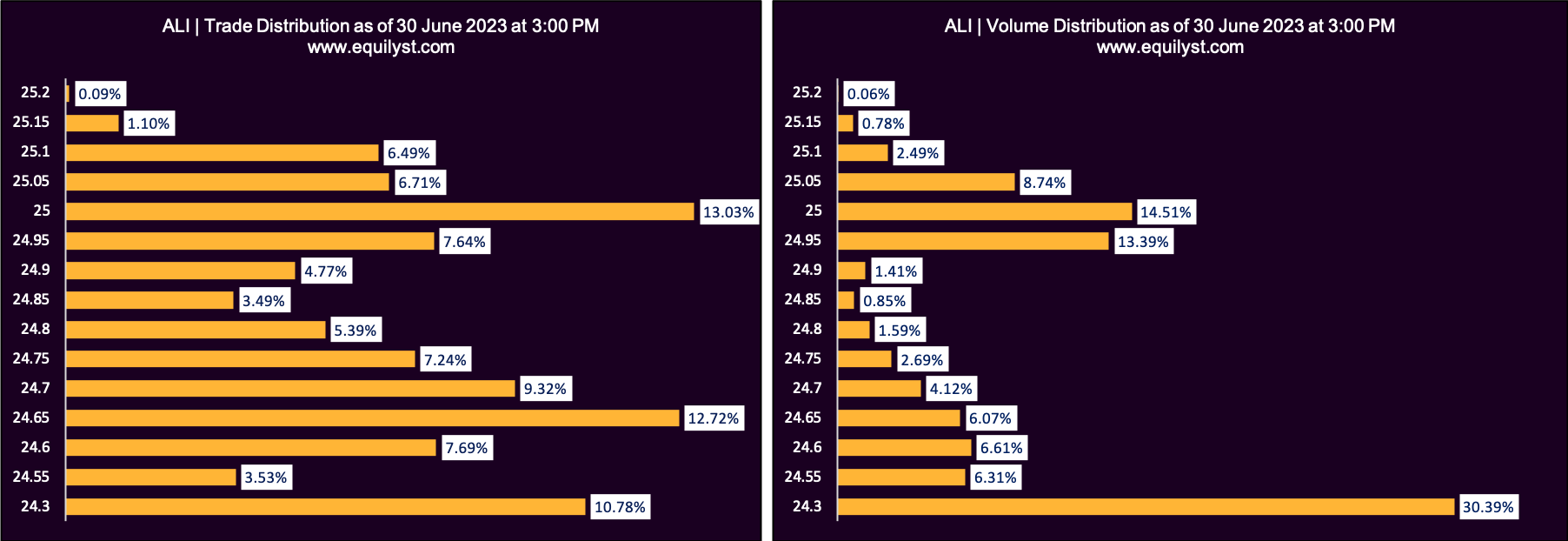

Trade-Volume Distribution Analysis

The higher volume-weighted average price (VWAP) than the last price proves the low buying morale today. The dominant range closer to the intraday low than the intraday high adds more pain to the injury.

The dominant range is the range of prices with the biggest volume and highest number of trades.

- Dominant Range Index: BEARISH

- Last Price: 24.3

- VWAP: 24.69

- Dominant Range: 24.3 – 25

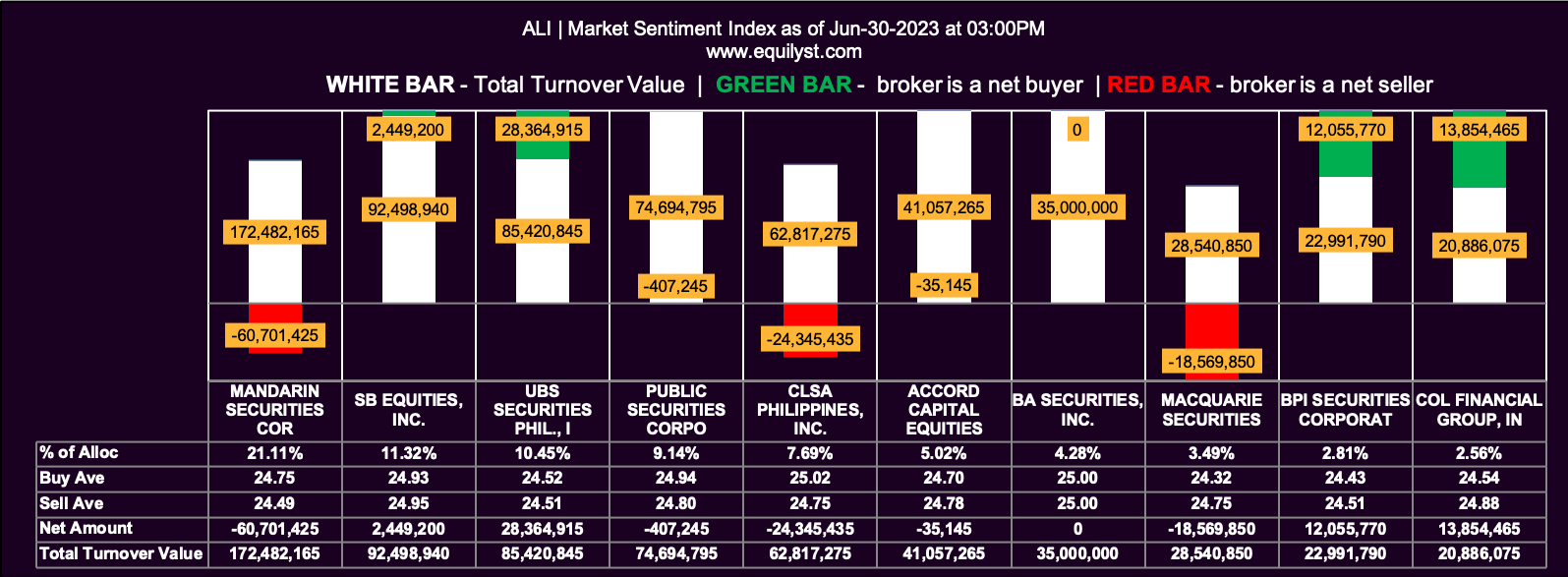

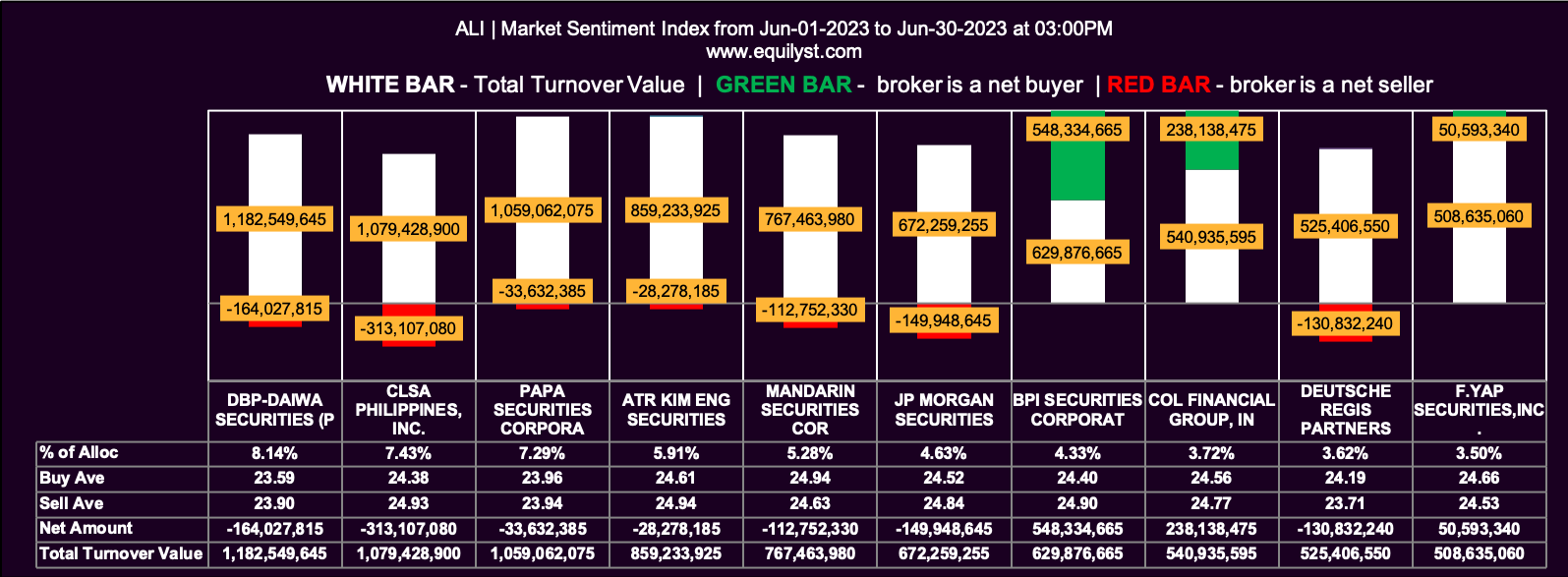

Market Sentiment Analysis

The Market Sentiment Index for end-of-day and month-to-date agrees with the bearish Dominant Range Index. Although there were more brokers with a positive net amount and a 100% buying activity, there were more brokers with a higher selling than buying average, and the selling average of all participating brokers was higher than their buying average in both periods.

- Market Sentiment Index (June 30, 2023): BEARISH

- 35 of the 57 participating brokers, or 61.40% of all participants, registered a positive Net Amount

- 26 of the 57 participating brokers, or 45.61% of all participants, registered a higher Buying Average than Selling Average

- 57 Participating Brokers’ Buying Average: ₱24.57602

- 57 Participating Brokers’ Selling Average: ₱24.80741

- 18 out of 57 participants, or 31.58% of all participants, registered a 100% BUYING activity

- 4 out of 57 participants, or 7.02% of all participants, registered a 100% SELLING activity

- Market Sentiment Index (June 1, 2023 to June 30, 2023): BEARISH

- 83 of the 112 participating brokers, or 74.11% of all participants, registered a positive Net Amount

- 47 of the 112 participating brokers, or 41.96% of all participants, registered a higher Buying Average than Selling Average

- 112 Participating Brokers’ Buying Average: ₱24.50154

- 112 Participating Brokers’ Selling Average: ₱24.70488

- 17 out of 112 participants, or 15.18% of all participants, registered a 100% BUYING activity

- 4 out of 112 participants, or 3.57% of all participants, registered a 100% SELLING activity

What’s the Verdict?

ALI has no buy signal based on the end-of-day and month-to-date data synthesis.

Have a trailing stop, for Pete’s sake! It’ll help you preserve your capital, protect gains, and prevent unbearable losses. You can use my trailing stop calculator in the CALCULATORS section of this website.

Respect your trailing stop if you have ALI in your stock portfolio. Do top up yet because the price could still go lower based on technical analysis.

Do not enter a new position if you don’t have it yet. ALI is a good candidate for your watchlist but has yet to be in your portfolio. Add it to your watchlist if you still have an available slot. Maintain the number of stocks in your watchlist at a manageable level. Monitor up to five stocks in your watchlist. That’s the number of stocks you can realistically monitor.

If you are our PLATINUM client, use one of your remaining analysis request credits as trading happens by the next trading day so we can analyze the stock in real-time. This way, we can update you with recommendations tailored-fit to your risk tolerance percentage.

Do You Need Help Trading or Investing on Stocks Mentioned in this Report?

Fix and rebalance your stock portfolio for optimal returns through our Stock Portfolio Rehabilitation Program.

Be a TITANIUM client to learn how to preserve capital, protect gains, and prevent unbearable losses when trading and investing in the Philippine stock market.

Be a PLATINUM client to request our in-depth technical analysis with recommendations tailored-it to your entry price, average cost, buy case, and risk tolerance.

Be a GOLD client to have a teleconsultation with us over the phone as trading happens.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025