Ayala Corporation: Core Income Surges 55% in H1 2023

Ayala Corporation witnessed a substantial 55% increase in its core net income, reaching P20.5 billion in the first half, driven by significant contributions from Ayala Land Inc. (ALI), Bank of the Philippine Islands (BPI), and energy company ACEN Corp.

According to a statement released on Friday, the conglomerate led by the Zobel family indicated that when including exceptional items, the net income for the period grew by 13 percent, totaling P18.4 billion.

Cezar Consing, Ayala’s President and Chief Executive Officer, noted that the robust performance of BPI, Ayala Land, and ACEN effectively balanced out the singular provisions made by AC Industrials.

Looking forward, he added, “In the coming months, we will build upon our strong first-half results and continue reallocating capital wherever it proves sensible.”

BPI experienced a 23 percent surge in its core earnings for the first half, reaching P25.1 billion compared to the previous year. This growth was attributed to an expansion in the average asset base, improved margins, and reduced provisions. Additionally, the bank achieved a 15.5-percent return on equity.

Total revenues also saw a 14 percent year-on-year increase, reaching P5.6 billion. This was propelled by a remarkable 27-percent surge in net interest income, although noninterest income dipped by 15 percent.

Meanwhile, operating expenses for the bank escalated by 21 percent year on year, amounting to P31.4 billion. This increase was due to amplified structural expenditures, investments in digitalization, and numerous marketing initiatives.

ALI’s net income experienced a 41 percent upswing, reaching P11.4 billion. Furthermore, consolidated revenues saw a significant 24 percent rise, soaring to P66 billion, supported by positive performances across all business segments.

The company also revealed a notable 39-percent upsurge in commercial leasing revenues, a 13-percent increase in property development revenues, and an 18-percent growth in residential sales reservations.

The energy subsidiary, ACEN, displayed an impressive 94-percent boost in net income, driven by a substantial 28-percent year-on-year revenue growth, which reached P20.5 billion.

Ayala mentioned that this was due to increased net generation, which allowed ACEN to acquire a net selling merchant position during a time of elevated prices on the Wholesale Electricity Spot Market.

In contrast, Ayala’s telecom unit Globe reported a 27-percent drop in net income, amounting to P14.4 billion. The reduced profit was attributed to the absence of a one-time gain recorded in the previous year from the partial sale of Globe’s data center business.

Ayala, 917Ventures, and Gogoro: Urban EV Collaboration

On August 24, 2023, a Joint Venture Agreement was signed by Ayala Corporation, 917Ventures, and Gogoro SG, outlining their collaboration to introduce Gogoro’s two-wheeled EV battery swapping technology to Metro Manila.

In addition, AC engaged in a Subscription Agreement with Gogoro PH, acquiring 42,000,000 common shares of Gogoro PH, representing a 21% ownership stake.

917Ventures, a wholly-owned subsidiary of Globe Telecom, Inc., operates as a corporate venture builder dedicated to fostering novel business concepts that enhance the quality of life for Filipinos. Possessing 98,000,000 common shares, equivalent to 49% of Gogoro PH, 917Ventures will play a substantial role.

Conversely, Gogoro SG stands as a wholly-owned subsidiary of Gogoro Inc., a publicly listed firm (NASDAQ: GGR) recognized for devising a battery-swapping refueling infrastructure tailored to urban electric two-wheeled scooters and motorcycles. Notably, Gogoro SG crafts its range of electric scooters and extends inventive vehicular solutions to collaborators in the manufacturing domain. Gogoro SG’s ownership will encompass 60,000,000 common shares, accounting for 30% of Gogoro PH.

Through the medium of Gogoro PH, the entities involved shall embark on various activities, including importing, vending, distributing, overseeing, managing, and upkeeping two-wheeled electric scooters equipped with battery swap technology under the Gogoro brand. This initiative will also encompass battery swapping stations catering to E-Scooters and the associated post-sale services sector, encompassing potential distribution of alternative E-Scooter brands compatible with the battery swapping infrastructure, within the Philippines.

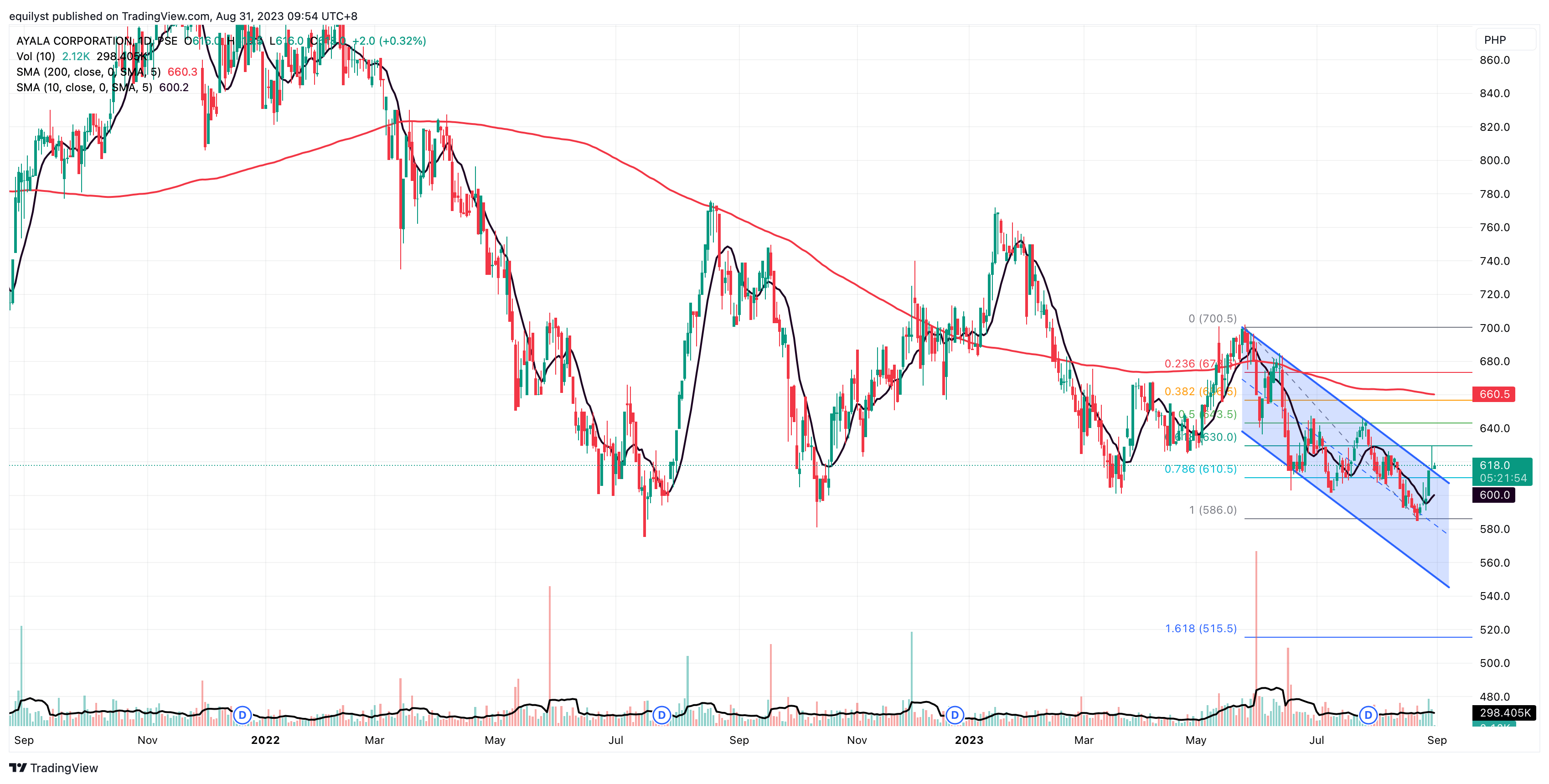

Technical Analysis on Ayala Corporation

Ayala Corporation is still struggling, down 11.37% YTD from P695.00 on December 29, 2022, to P616.00 on August 30, 2023. On a shorter scale, it has managed to enter positive territory, rising 0.16% MTD from P615.00 on July 31, 2023, to a closing price of P616.00 on August 30, 2023.

This holding firm broke its previous resistance, which now serves as its immediate support, at P610.50 on August 29, 2023. This support level aligns with the 78.60% Fibonacci retracement. Ayala Corporation attempted to break the resistance at P630.00 on August 30, 2023, but was unsuccessful.

The stock is now on the upper boundary of its downward parallel channel, indicating an attempt to break out of the downtrend channel. Ayala Corporation is currently trading above its 10-day simple moving average. However, it remains bearish in the long-term, as the 200-day simple moving average still looms above the last price. To regain a bullish stance in the long-term, this stock needs to break above P660.00, preferably surpassing P673.50.

Ayala Corporation has displayed five consecutive green candlesticks, with the last four accompanied by bullish volume exceeding 100% of its 10-day volume average. If this price-volume pattern persists, Ayala Corporation could break the resistance at P630.00.

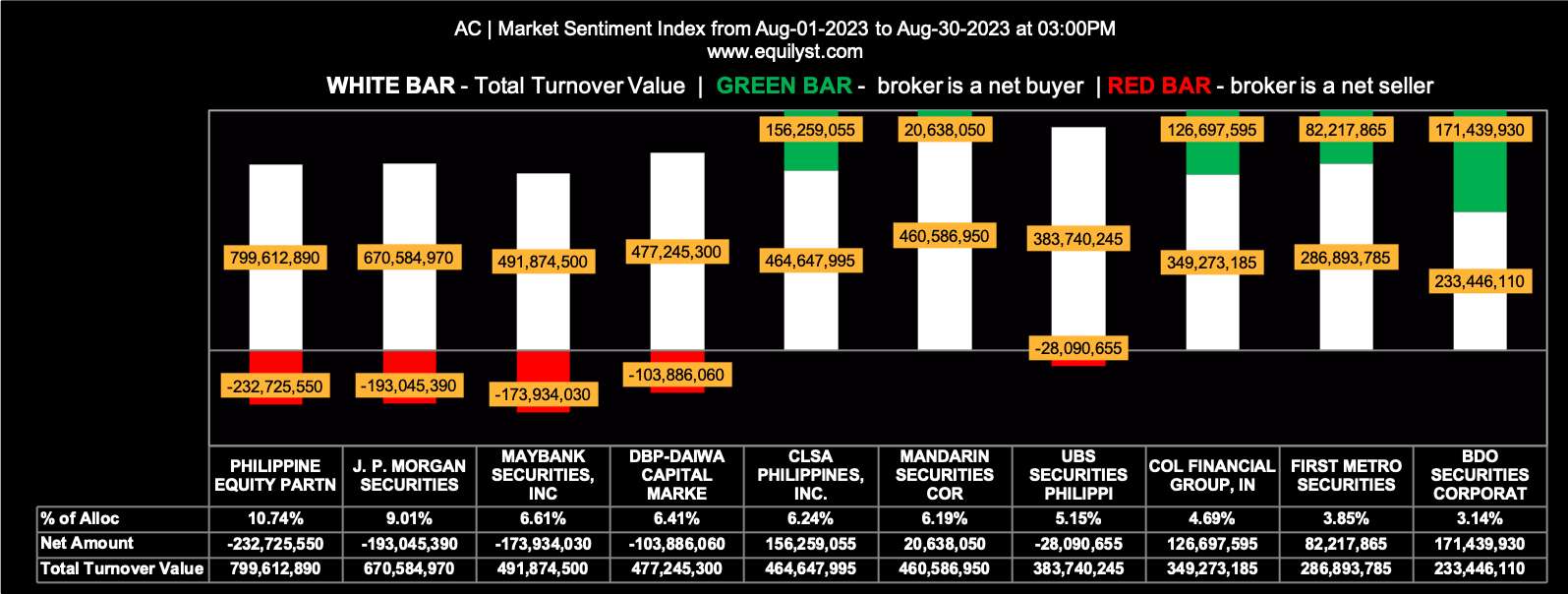

Meanwhile, the bearish month-to-date market sentiment for Ayala Corporation reflects its overall bearish position. From August 1 to 30, 93 brokers have traded this stock. Of these, 70% registered a positive Net Amount, while 42% recorded a higher buying average than selling average.

Over the past 30 calendar days, these 93 brokers posted a selling average of P609.13 and a buying average of P604.11. Despite the strength of the five most recent green candlesticks, it’s clear that the bears, who have held the upper hand for a while now, are not easily shaken.

Furthermore, even though 17% of these 93 brokers had a 100% buying activity and only 2% had a 100% selling activity, this former percentage is not significant. In short, Ayala Corporation needs to overcome not just one resistance level to reverse the prevailing bearish market sentiment.

Trend Forecast for Ayala Corporation

I have a neutral, with a bearish bias, sentiment for Ayala Corporation.

For one, the hot money has stayed away from this holding firm this 2023. Did you know that only 1 out of 8 months of 2023 is a net foreign buying month for Ayala Corporation? The foreign investors registered a measly P15 million net foreign buying amount for this stock in June 2023.

Unless and until the foreign investors migrate back to Ayala Corporation, I don’t think the local investors’ loose change can sustainably break one resistance after another.

So, stick to your trailing stop to preserve your capital, protect gains, and prevent unbearable losses. Keep on praying if you like, but don’t let your strategy have more prayers than logic.

Feel free to use my investment calculators.

Never expect me to mimic most brokers’ style of guiding investors: “Buy at this price. Sell at that price.”

I don’t do that because my ideal clients are not monkeys.

My buying and selling price points will always be volatile. They are relative to the risk percentage I applied in my trailing stop, dominant range, and market sentiment index, among other factors.

When you go through my teaching, you’ll also be able to identify your own buying and selling price points based on these factors. You will never need me to tell you where to buy or sell; you will be capable of identifying these aspects on your own.

Read “4 Reasons to Stop Using Buy Below and Target Selling Price” if you haven’t yet.

If you need my professional service, please complete this form to avail yourself of my stock investment consultancy service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025