Ayala Corporation (AC) Technical Analysis

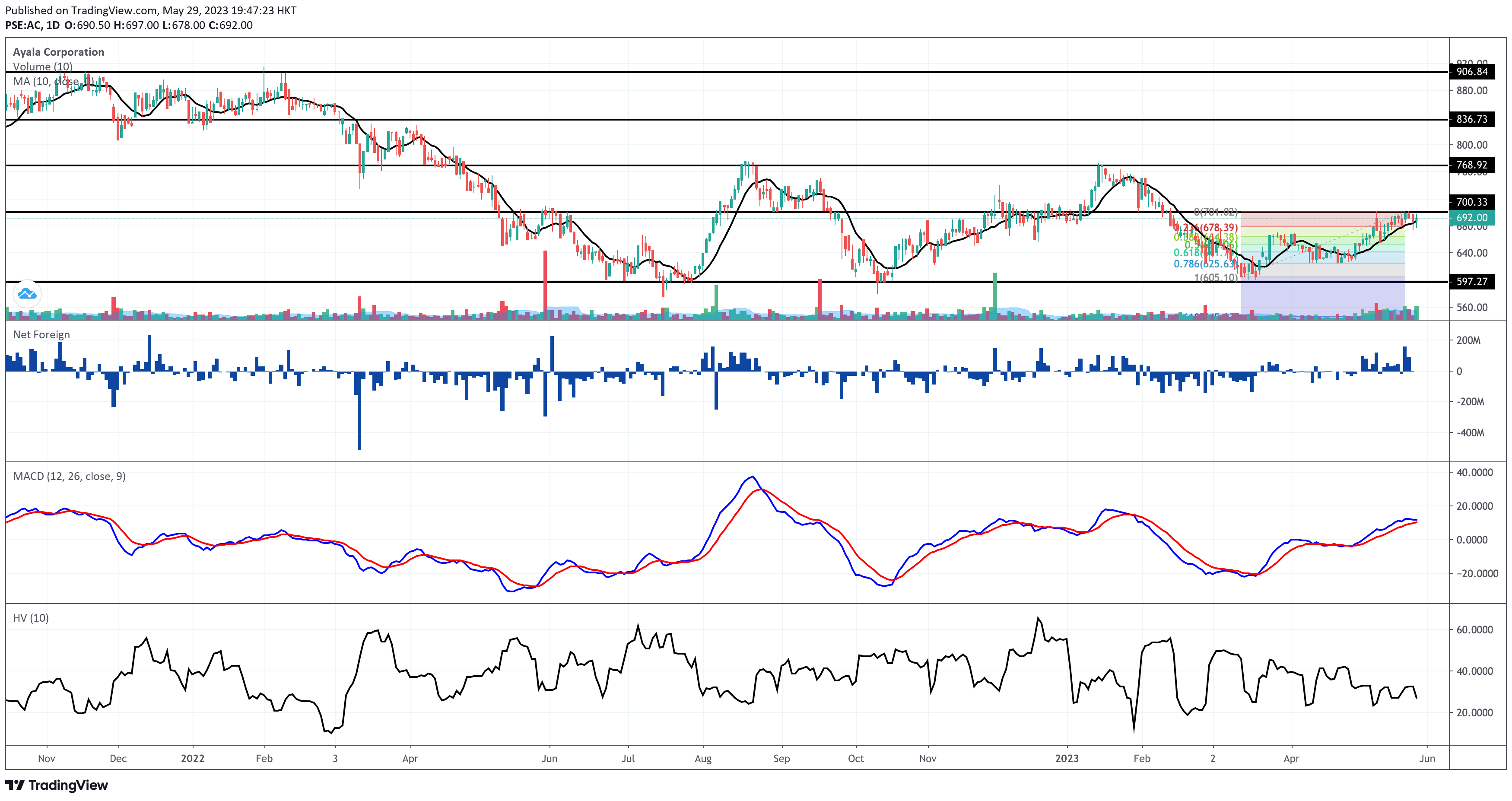

Ayala Corporation (PSE:AC) closed above its 10-day simple moving average (SMA) on May 29, 2023 at P692.00 per share, up by 0.87%.

Investors keep their hopes up to see a breakout above the immediate resistance at P700 per share. Support is near P641 per share, confluent with the 61.8% retracement of the Up Fibonacci.

I don’t see any pressing concerns on the daily of Ayala Corporation. Thanks to it being an index stock!

It’s been almost four months since it’s traded below P700-apiece, possibly influenced by the selling spree of foreign investors from February up to the third week of March 2023. The foreign investors’ daily net foreign buying stance since the second week of May 2023 is unnoticeable. Ayala Corporation registered a net foreign buying worth P44 million today.

On the other hand, I see the formation of a bearish convergence between the MACD and the signal lines. Is this a prelude to what will happen, especially when the price draws closer to its immediate resistance? Monitor closely!

Ayala Corporation doesn’t exhibit erratic movements. So, I am not expecting it to show me a 10-day historical volatility score that will put it above the low-risk erraticity level. That remains true as of today’s closing.

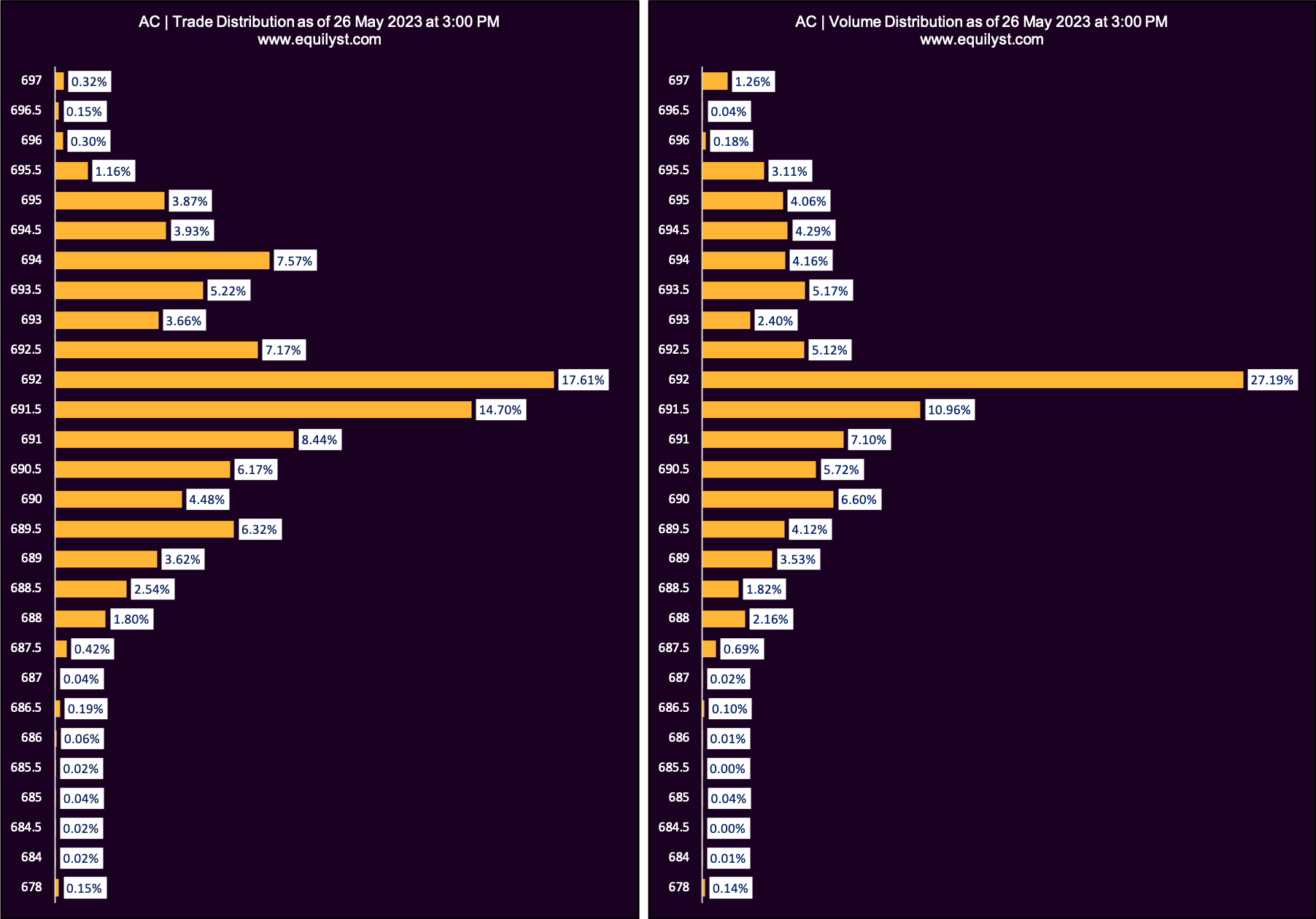

Trade and Volume Analysis

Dominant Range Index: BULLISH

Last Price: 692

VWAP: 691.86

Dominant Range: 692 – 692

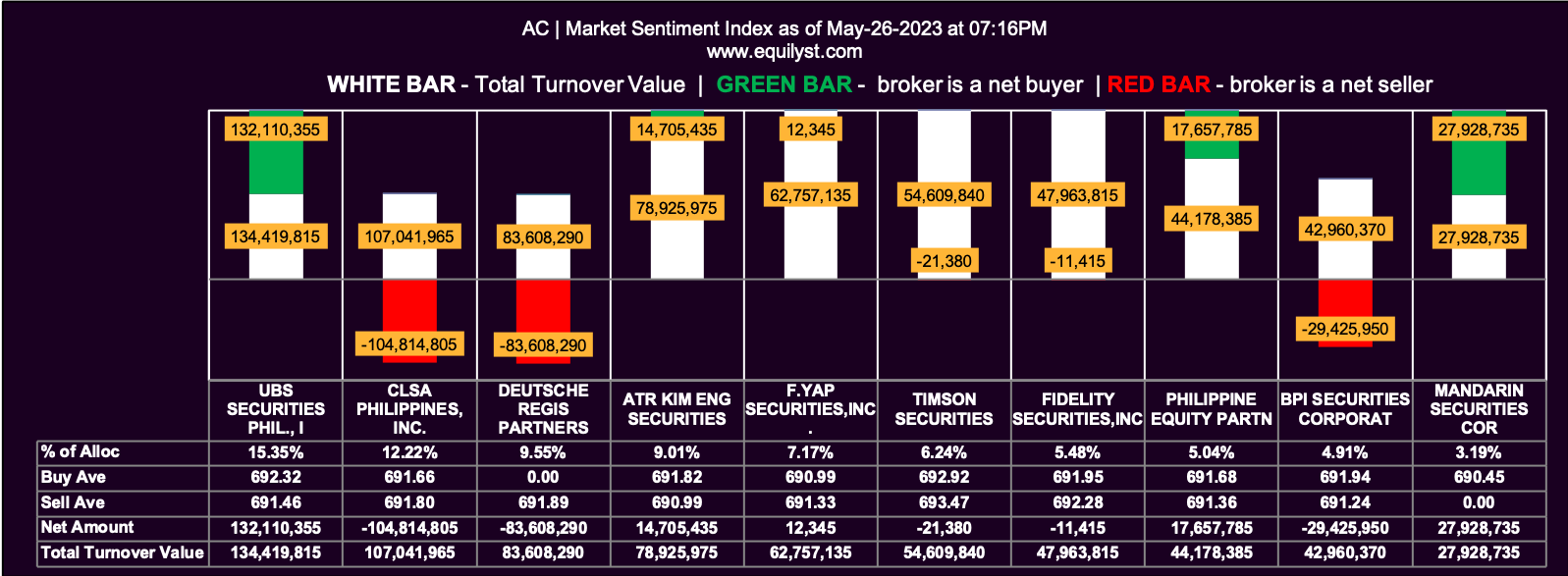

Market Sentiment Analysis

Market Sentiment Index: BEARISH

14 of the 37 participating brokers, or 37.84% of all participants, registered a positive Net Amount

13 of the 37 participating brokers, or 35.14% of all participants, registered a higher Buying Average than Selling Average

37 Participating Brokers’ Buying Average: ₱691.60425

37 Participating Brokers’ Selling Average: ₱691.94999

7 out of 37 participants, or 18.92% of all participants, registered a 100% BUYING activity

11 out of 37 participants, or 29.73% of all participants, registered a 100% SELLING activity

What to Do Next?

While five of my Evergreen Strategy indicators raised a bullish signal, Ayala Corporation’s Market Sentiment Index acted as a contrarian today.

That is a fair warning for what historically and usually happens every time the price inches closer to its immediate resistance area.

I am not saying that the majority will surely sell near P700.00, but you know what I’m talking about if you’ve been trading actively for more than a decade. Those who understand are in eavesdropping mode with the other investors of Ayala Corporation. That’s what the bearish Market Sentiment Index means.

If Ayala Corporation gets another bearish Market Sentiment Index for the next one to two trading days, you may want to consider reducing the percentage of risk applied to your trailing stop. Sell if your recomputed trailing stop is below the current price of Ayala Corporation; otherwise, hold your position and sell once your trailing stop is hit.

Do not top up yet. I don’t find it smart and logical to buy the dips since there’s a data-driven warning for me to believe and think that the upward momentum is not that crazy strong to break the glass above P700.00 as of today’s closing.

But, still, sentiments change when things change. You have to be a dynamic decision-maker. Always refer to the prevailing data. Don’t force the market to respect yesterday’s data synthesis.

Would you like to learn my strategy? Please take a look at my services here.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025