Fusion of Fundamental and Technical Analysis

In this article, I’m going to show you which of the 10 stock recommendations by April Tan of COL Financial have a buy signal according to my methodology, which is based on data-driven sentiments and technical analysis. April Tan’s basis is fundamental analysis. I thought it would help you make a data-driven decision with this fusion of Tan’s fundamental analysis and my technical synthesis. But before we dive deep into the buy or no-buy phrases you’re looking for, I’d like to introduce what April Tan’s “COLing the Shots” is.

What Is COLing the Shots?

The monthly publication “COLing the Shots,” authored by Chief Equity Strategist April Lynn Tan, CFA, provides insights into investment opportunities influenced by global and local developments affecting the market. This report aims to offer timely and relevant information, analysis, and a model portfolio for successful investing.

April Tan’s Stock Picks

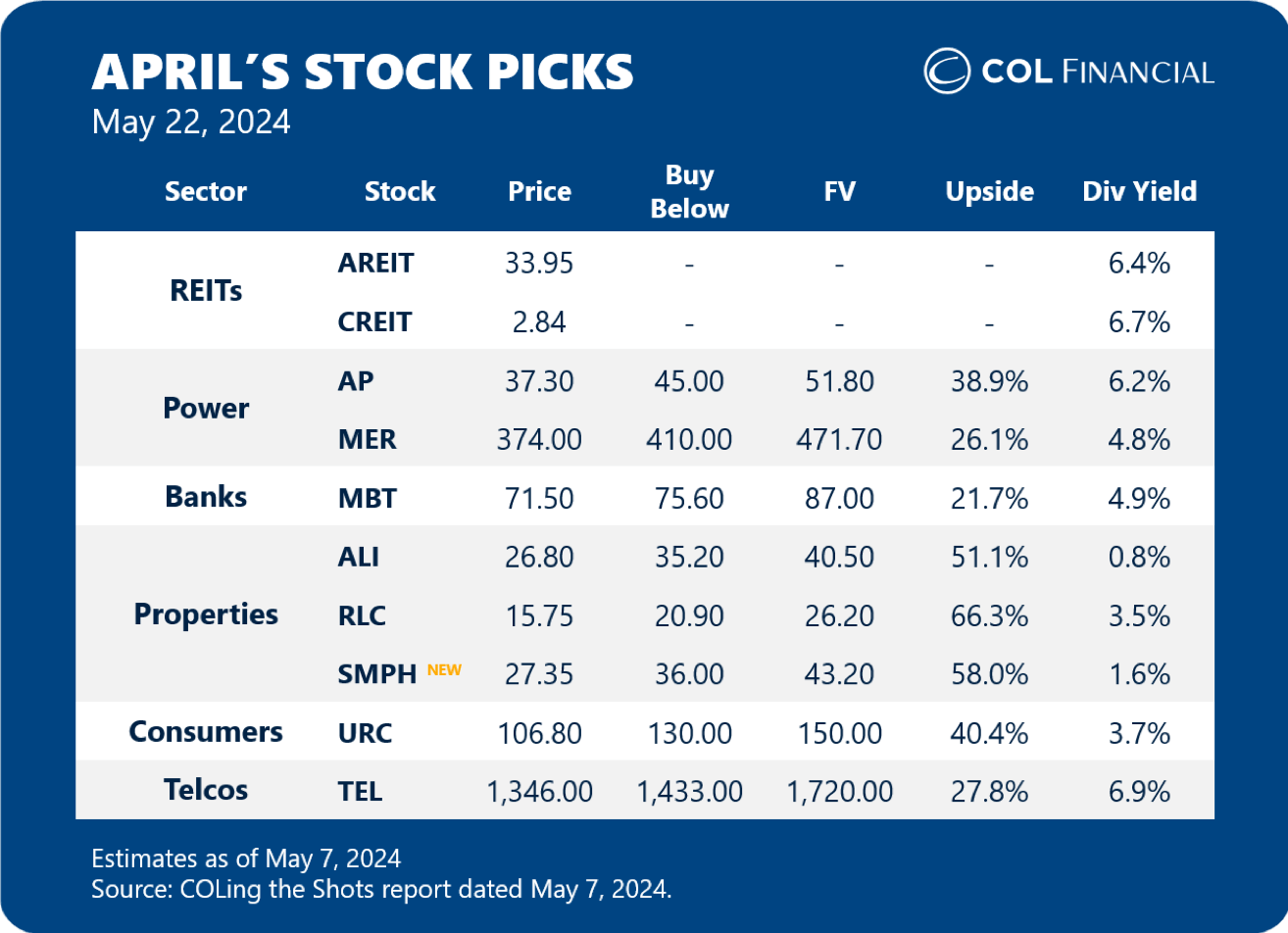

Tan noted that the Philippine Stock Exchange Index (PSEi) has experienced fluctuations in 2024, but has recently shown signs of stabilization. She believes there is a possibility of repeating the market patterns seen in 2023 due to numerous similarities between the two periods.

Despite this, Tan does not foresee significant weakness in the market, citing the strong long-term fundamentals of the Philippine market. She highlighted qualities that set the Philippines apart from other ASEAN markets, such as a robust banking system and resilient OFW remittances and BPO revenues, which historically withstand global recessions.

Additionally, Tan pointed out that the PSEi is currently trading at valuations much lower than its 10-year historical average, presenting opportunities to acquire high-quality companies at very attractive valuations. She also mentioned the prevalence of share buybacks and insider buying among some listed companies, indicating strong confidence in the market.

To capitalize on these conditions, Tan recommended focusing on stocks in more defensive sectors, such as power, telecommunications, and utilities, as high inflation and interest rates are likely to continue impacting the earnings of companies in cyclical sectors.

Tan specifically mentioned that some listed companies with defensive qualities are trading at valuations too compelling to ignore. She cited SMPH, whose mall leasing business makes it more resilient to economic downturns, as an example. Additionally, she expressed a favorable view of the big three banks (BDO, BPI, MBT) and recommended buying them on market corrections.

Below is the summary table of Tan’s Stock Picks:

Assessment of Equilyst Analytics on Tan’s Stock Picks

Now you know which stocks are fundamentally attractive according to the educated eyes of April Tan. I’ll show you which of her stock picks have a buy signal according to my Evergreen Methodology.

There are three indicators in my Evergreen Methodology that must give the stock a bullish rating for it to receive a confirmed buy signal. Firstly, the stock’s last price must be higher than its 10-day simple moving average. Secondly, the stock must get a bullish Dominant Range Index. Thirdly, the stock must secure a bullish Market Sentiment Index. My Market Sentiment Index can be either end-of-day (EOD) or month-to-date (MTD). If the EOD Market Sentiment Index is bearish, but the MTD Market Sentiment Index is bullish, the latter supersedes the former. All three indicators must give the stock a bullish signal for it to have a confirmed buy signal.

You cannot find the Dominant Range Index or Market Sentiment Index indicators on COL Financial’s platform or on TradingView because these are my proprietary indicators.

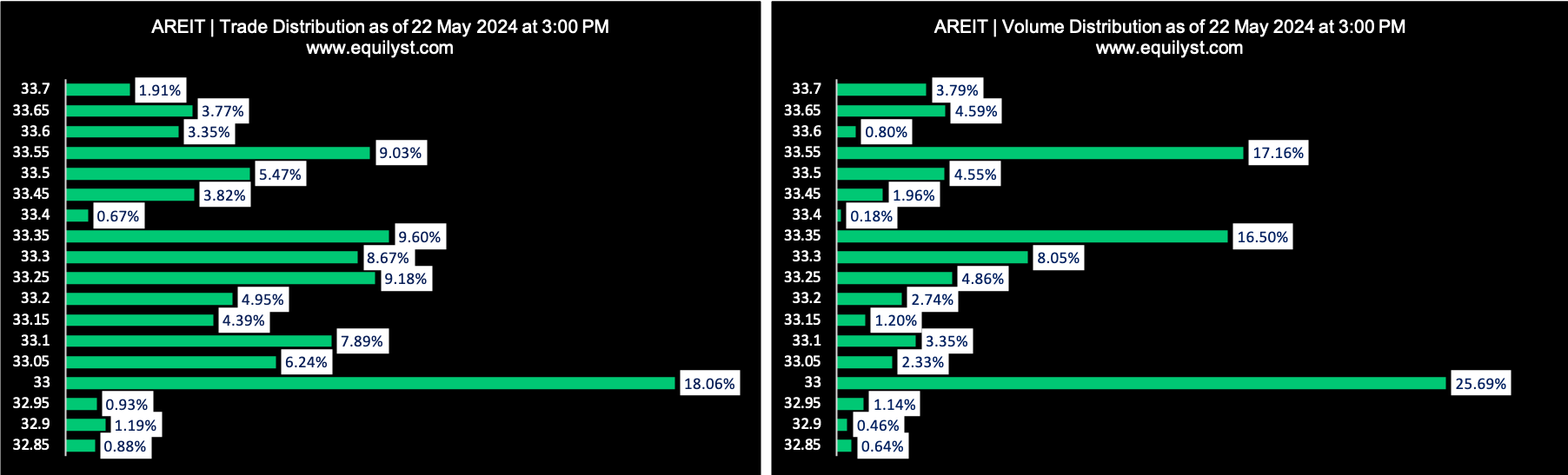

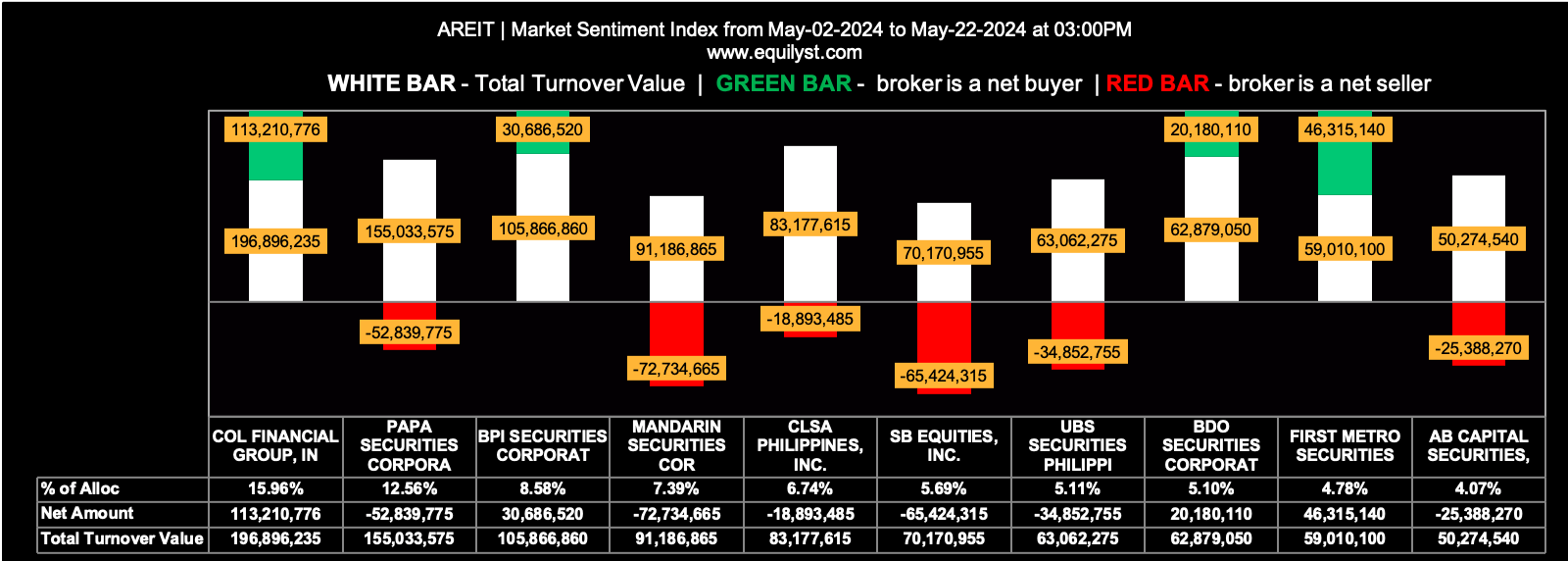

AREIT

Dominant Range Index: BEARISH

Last Price: 33.55

Dominant Range: 33 – 33.35

VWAP: 33.29

Market Sentiment Index (MTD): BULLISH

52 of the 74 participating brokers, or 70.27% of all participants, registered a positive Net Amount

41 of the 74 participating brokers, or 55.41% of all participants, registered a higher Buying Average than Selling Average

74 Participating Brokers’ Buying Average: ₱33.61494

74 Participating Brokers’ Selling Average: ₱33.72092

29 out of 74 participants, or 39.19% of all participants, registered a 100% BUYING activity

4 out of 74 participants, or 5.41% of all participants, registered a 100% SELLING activity

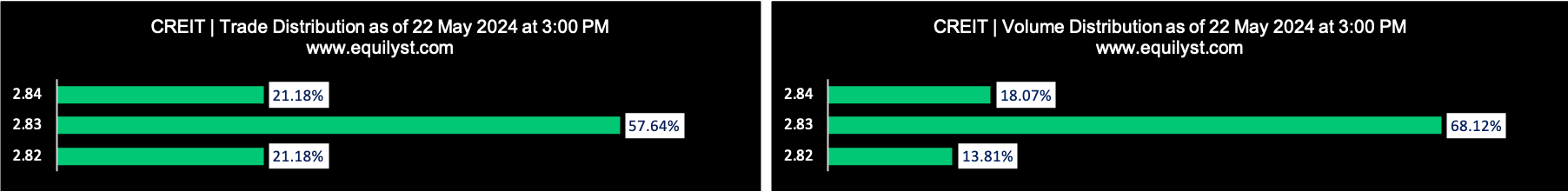

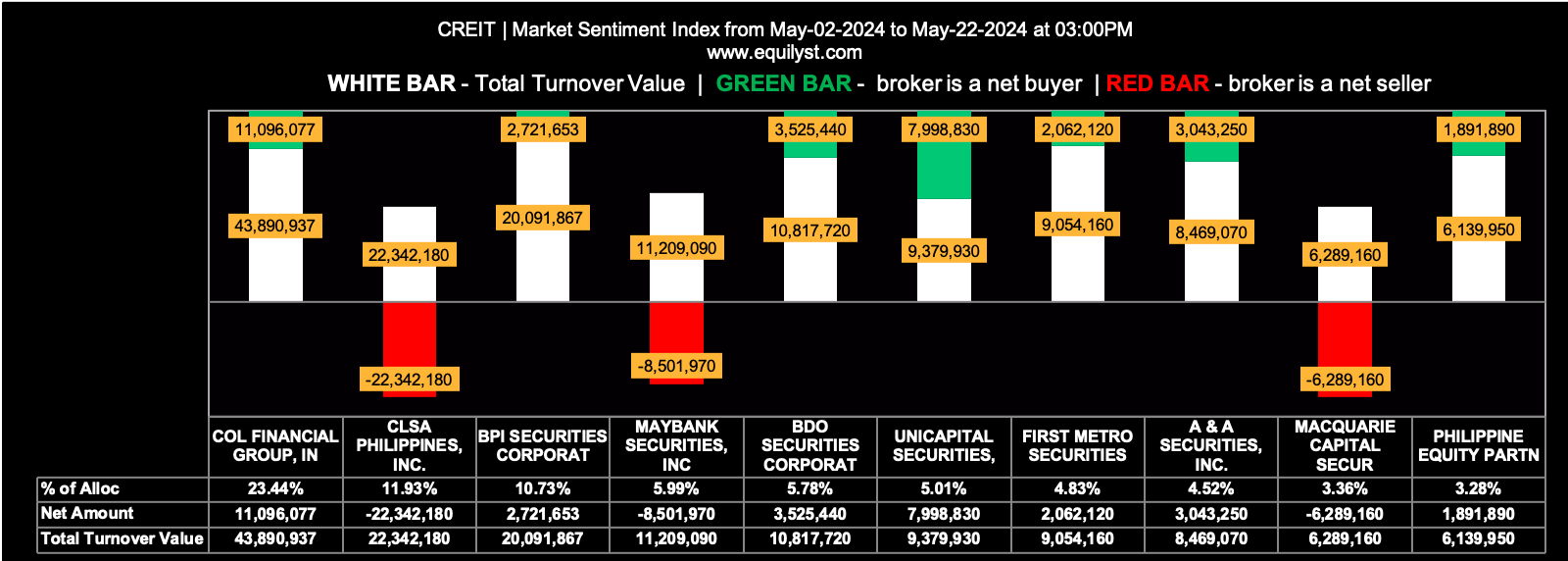

CREIT

Dominant Range Index: BEARISH

Last Price: 2.83

Dominant Range: 2.83 – 2.83

VWAP: 2.83

Market Sentiment Index (MTD): BEARISH

25 of the 51 participating brokers, or 49.02% of all participants, registered a positive Net Amount

20 of the 51 participating brokers, or 39.22% of all participants, registered a higher Buying Average than Selling Average

51 Participating Brokers’ Buying Average: ₱2.83032

51 Participating Brokers’ Selling Average: ₱2.82705

9 out of 51 participants, or 17.65% of all participants, registered a 100% BUYING activity

15 out of 51 participants, or 29.41% of all participants, registered a 100% SELLING activity

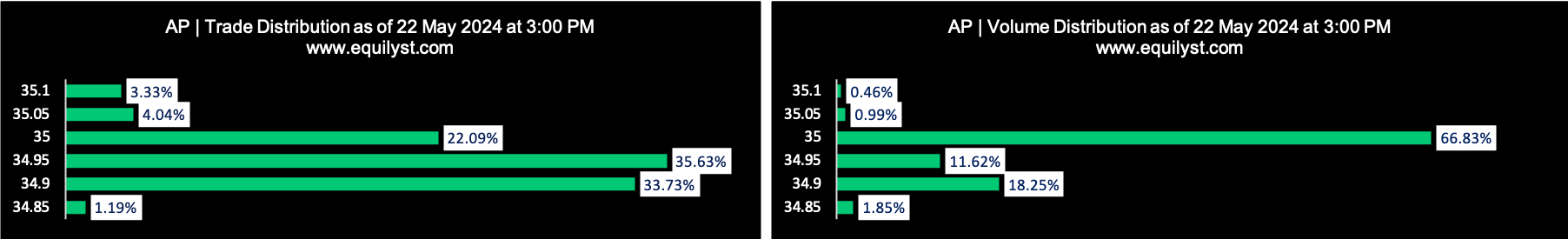

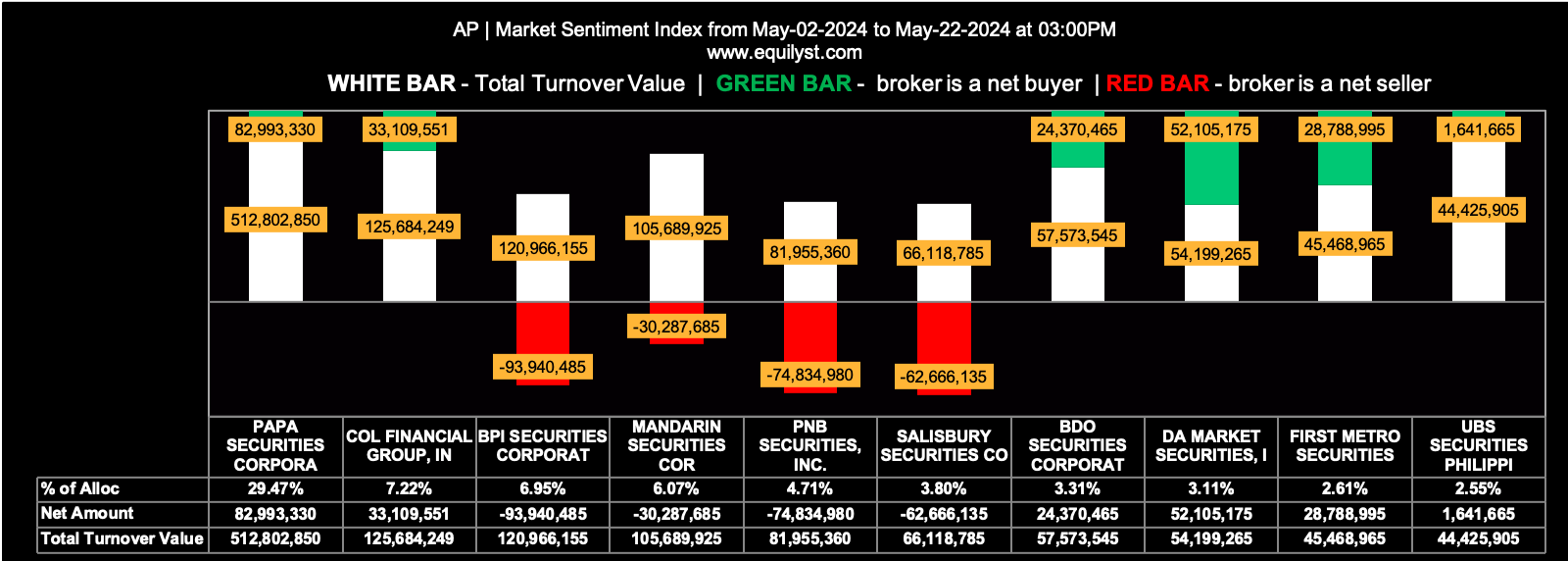

AP

Dominant Range Index: BEARISH

Last Price: 34.90

Dominant Range: 34.90 – 35.00

VWAP: 34.97

Market Sentiment Index: BULLISH

54 of the 78 participating brokers, or 69.23% of all participants, registered a positive Net Amount

42 of the 78 participating brokers, or 53.85% of all participants, registered a higher Buying Average than Selling Average

78 Participating Brokers’ Buying Average: ₱35.66302

78 Participating Brokers’ Selling Average: ₱36.09156

24 out of 78 participants, or 30.77% of all participants, registered a 100% BUYING activity

2 out of 78 participants, or 2.56% of all participants, registered a 100% SELLING activity

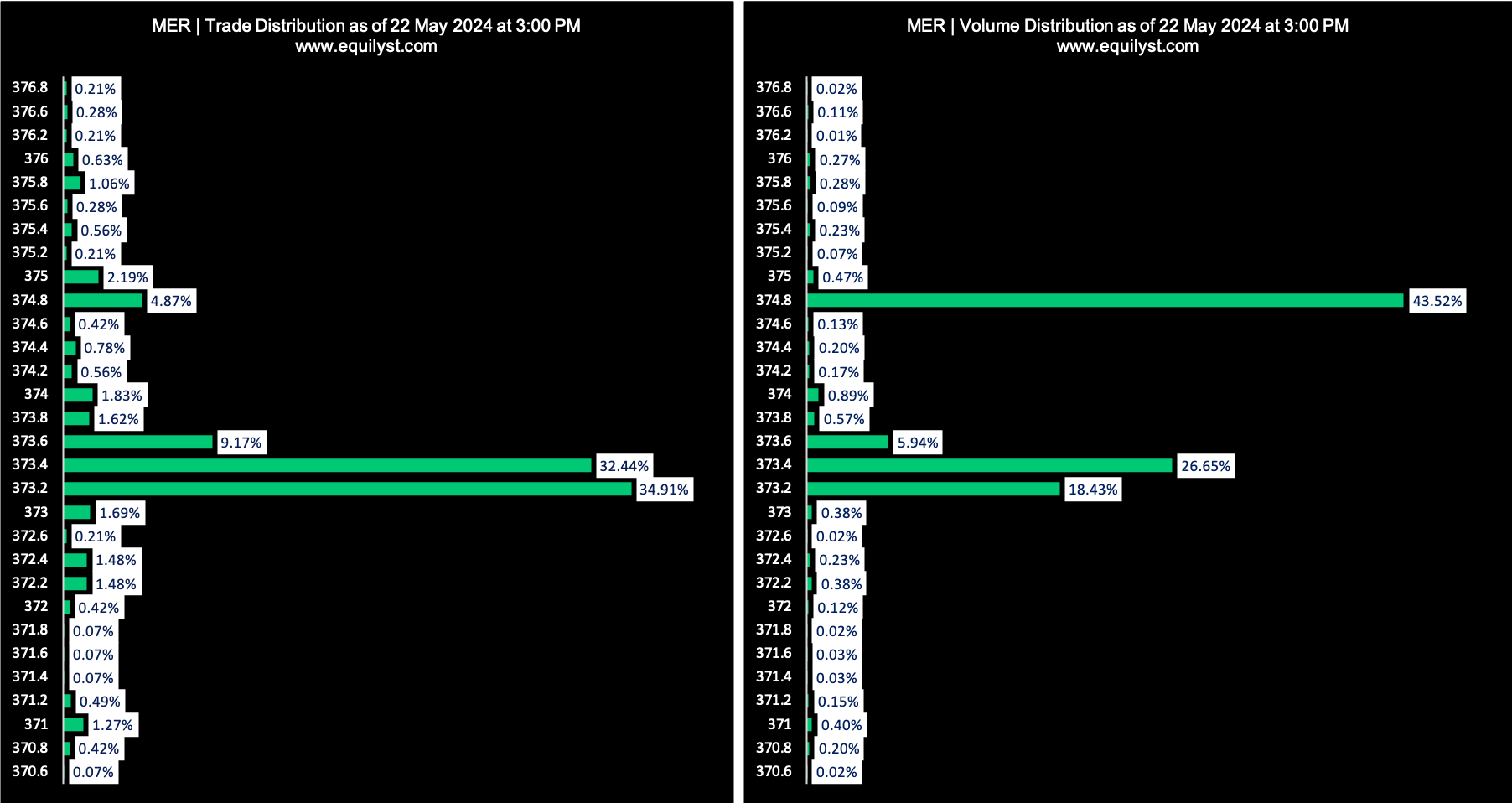

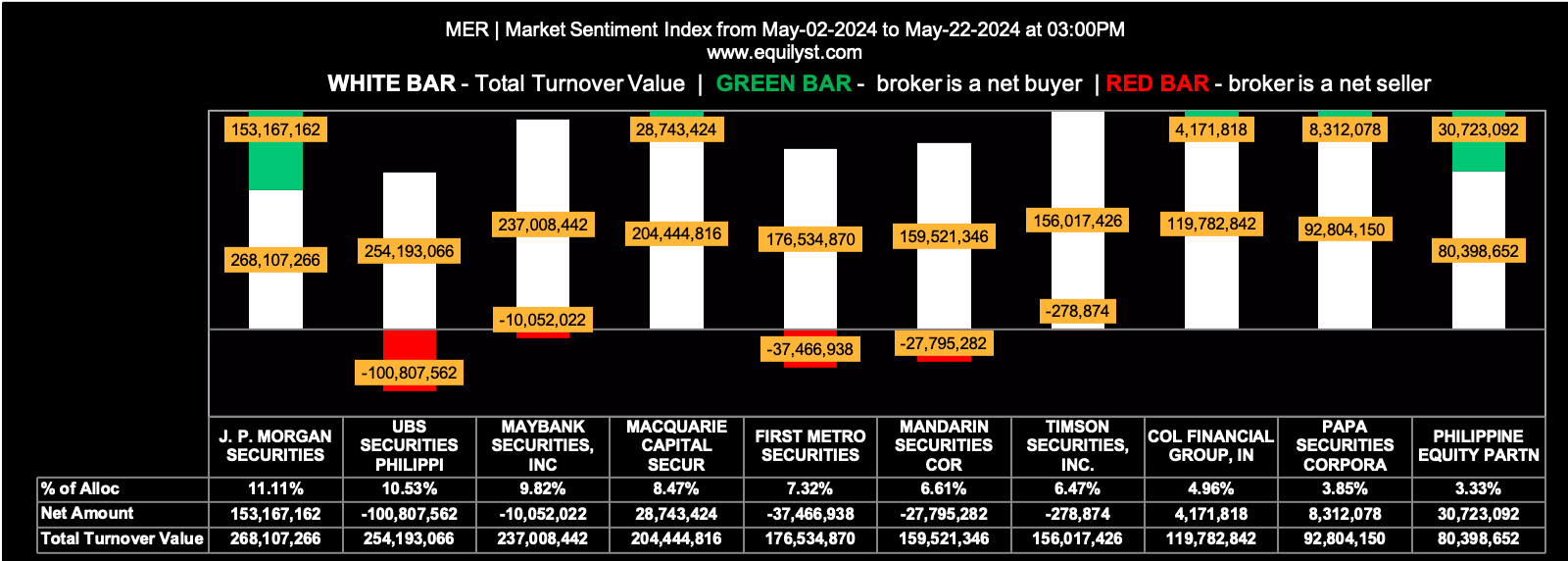

MER

Dominant Range Index: BEARISH

Last Price: 374.80

Dominant Range: 373.20 – 374.80

VWAP: 374.00

Market Sentiment Index (MTD): BEARISH

23 of the 75 participating brokers, or 30.67% of all participants, registered a positive Net Amount

18 of the 75 participating brokers, or 24.00% of all participants, registered a higher Buying Average than Selling Average

75 Participating Brokers’ Buying Average: ₱371.45550

75 Participating Brokers’ Selling Average: ₱372.39693

6 out of 75 participants, or 8.00% of all participants, registered a 100% BUYING activity

23 out of 75 participants, or 30.67% of all participants, registered a 100% SELLING activity

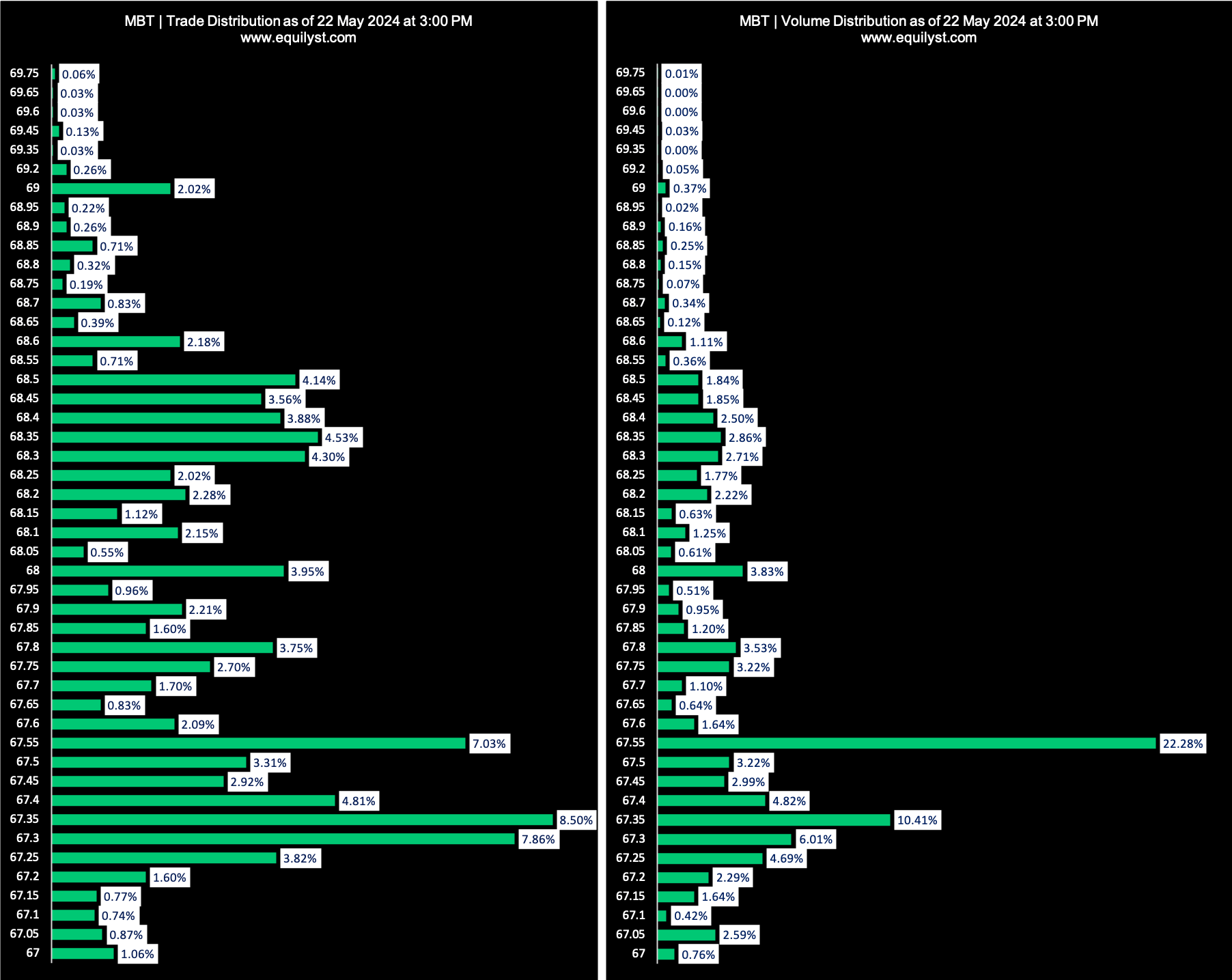

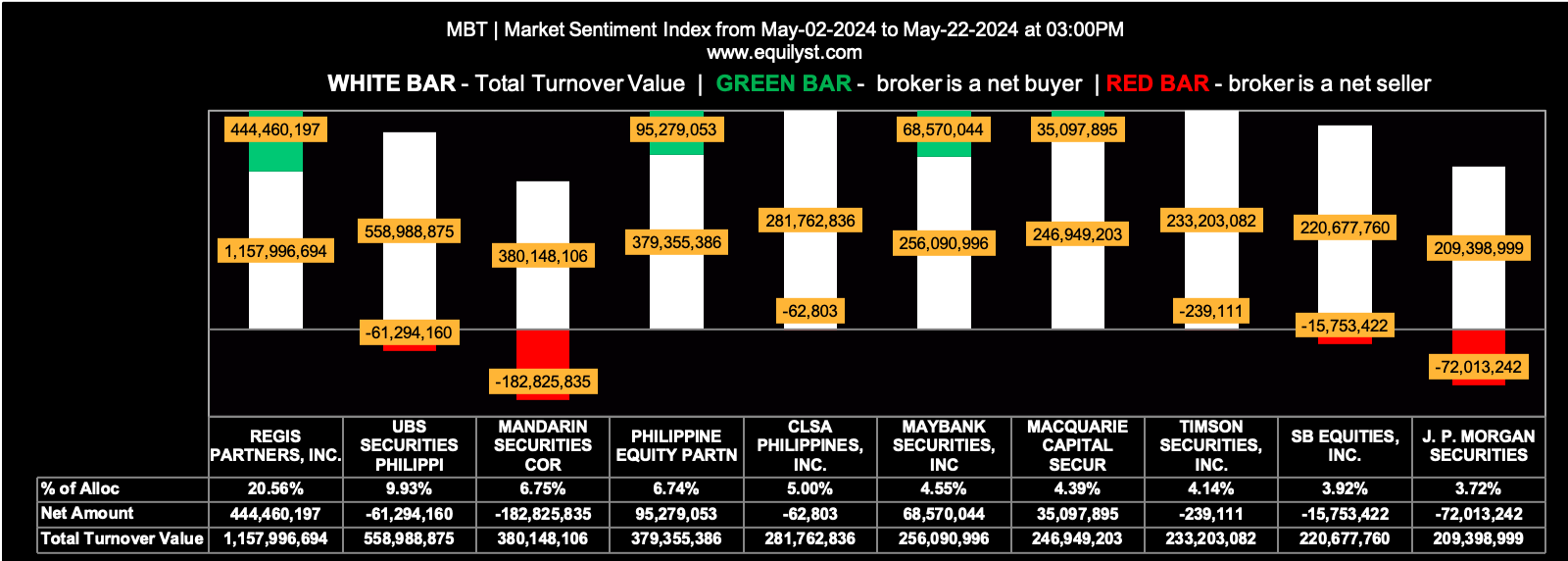

MBT

Dominant Range Index: BEARISH

Last Price: 67.55

Dominant Range: 67.35 – 67.55

VWAP: 67.67

Market Sentiment Index (MTD): BEARISH

37 of the 96 participating brokers, or 38.54% of all participants, registered a positive Net Amount

14 of the 96 participating brokers, or 14.58% of all participants, registered a higher Buying Average than Selling Average

96 Participating Brokers’ Buying Average: ₱69.28054

96 Participating Brokers’ Selling Average: ₱70.58996

6 out of 96 participants, or 6.25% of all participants, registered a 100% BUYING activity

20 out of 96 participants, or 20.83% of all participants, registered a 100% SELLING activity

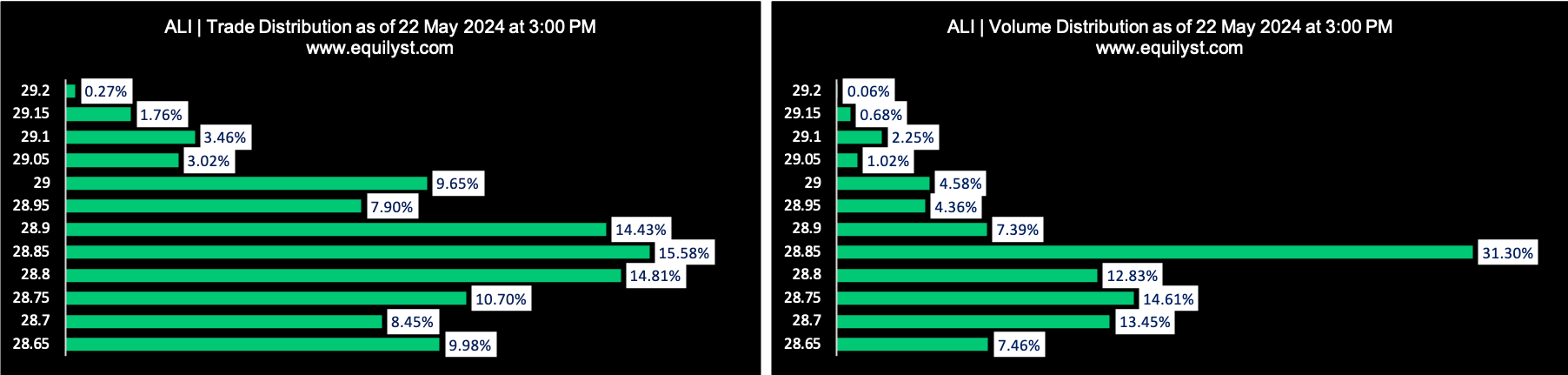

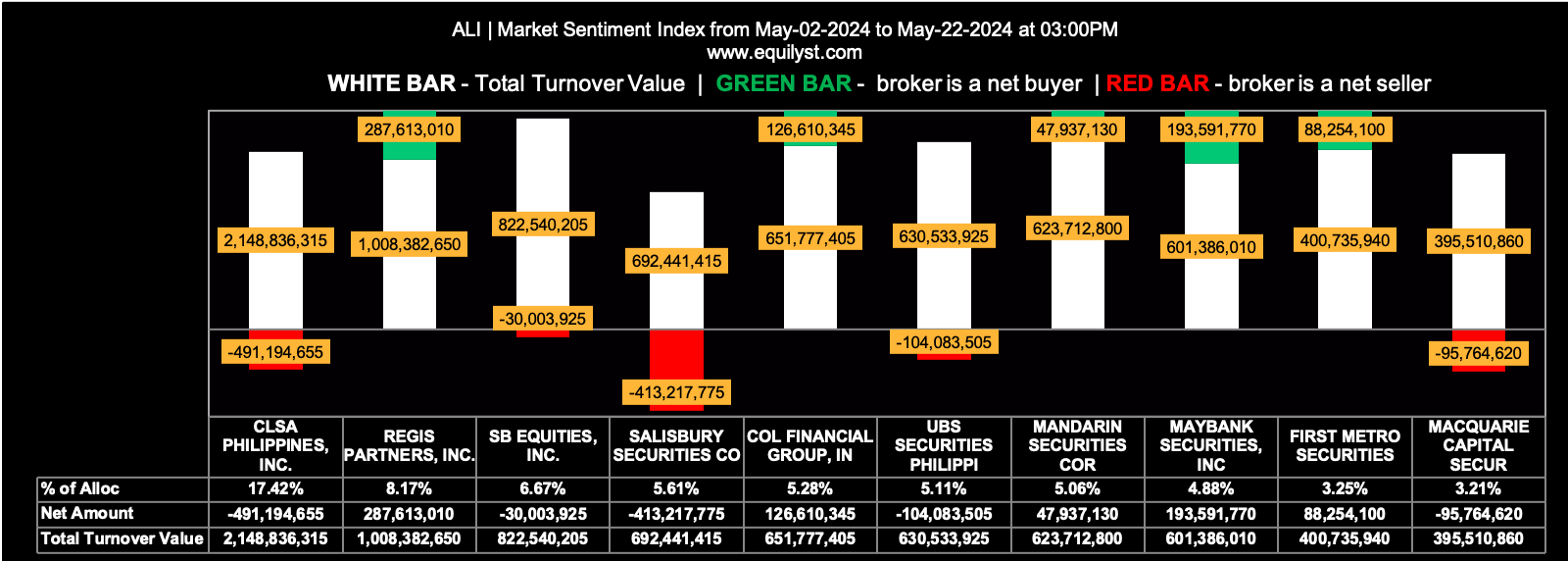

ALI

Dominant Range Index: BEARISH

Last Price: 28.85

Dominant Range: 28.85 – 28.85

VWAP: 28.82

Market Sentiment Index (MTD): BEARISH

65 of the 108 participating brokers, or 60.19% of all participants, registered a positive Net Amount

32 of the 108 participating brokers, or 29.63% of all participants, registered a higher Buying Average than Selling Average

108 Participating Brokers’ Buying Average: ₱27.56253

108 Participating Brokers’ Selling Average: ₱28.27763

12 out of 108 participants, or 11.11% of all participants, registered a 100% BUYING activity

2 out of 108 participants, or 1.85% of all participants, registered a 100% SELLING activity

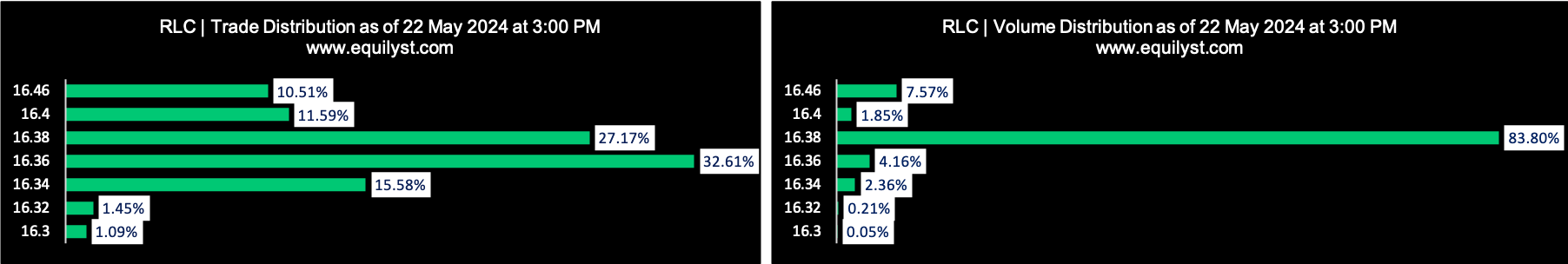

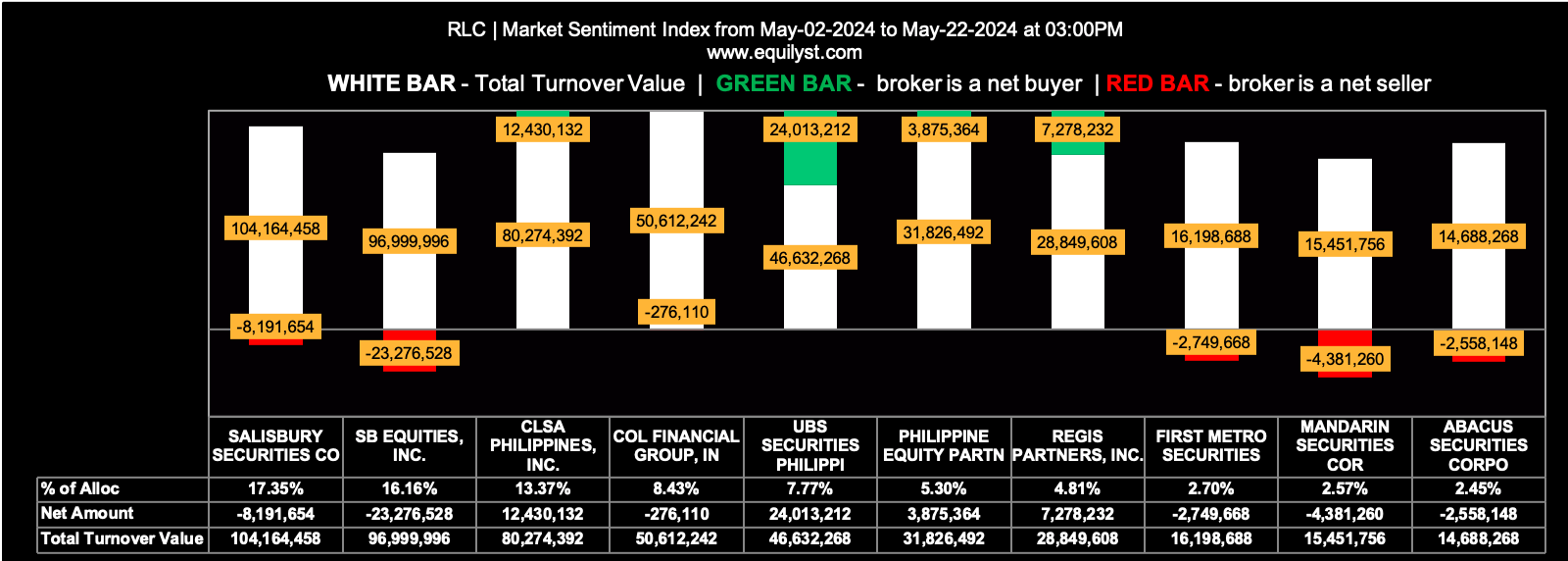

RLC

Dominant Range Index: BULLISH

Last Price: 16.46

Dominant Range: 16.36 – 16.38

VWAP: 16.38

Market Sentiment Index (MTD): BEARISH

18 of the 51 participating brokers, or 35.29% of all participants, registered a positive Net Amount

16 of the 51 participating brokers, or 31.37% of all participants, registered a higher Buying Average than Selling Average

51 Participating Brokers’ Buying Average: ₱15.76686

51 Participating Brokers’ Selling Average: ₱16.05800

7 out of 51 participants, or 13.73% of all participants, registered a 100% BUYING activity

6 out of 51 participants, or 11.76% of all participants, registered a 100% SELLING activity

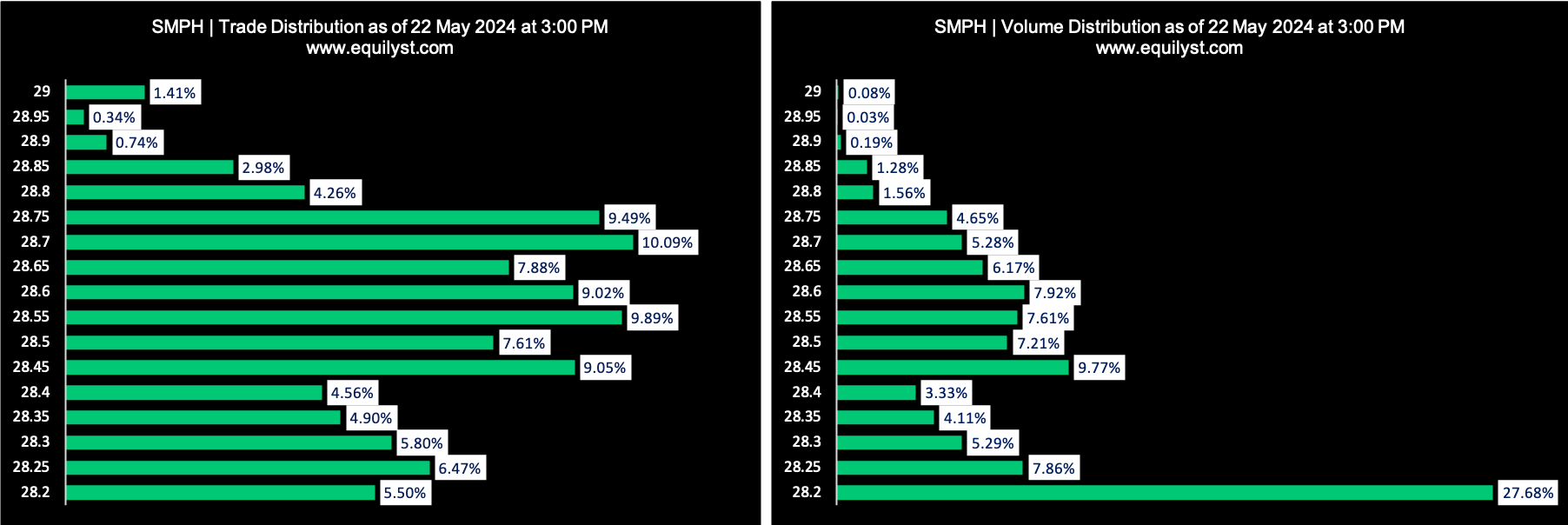

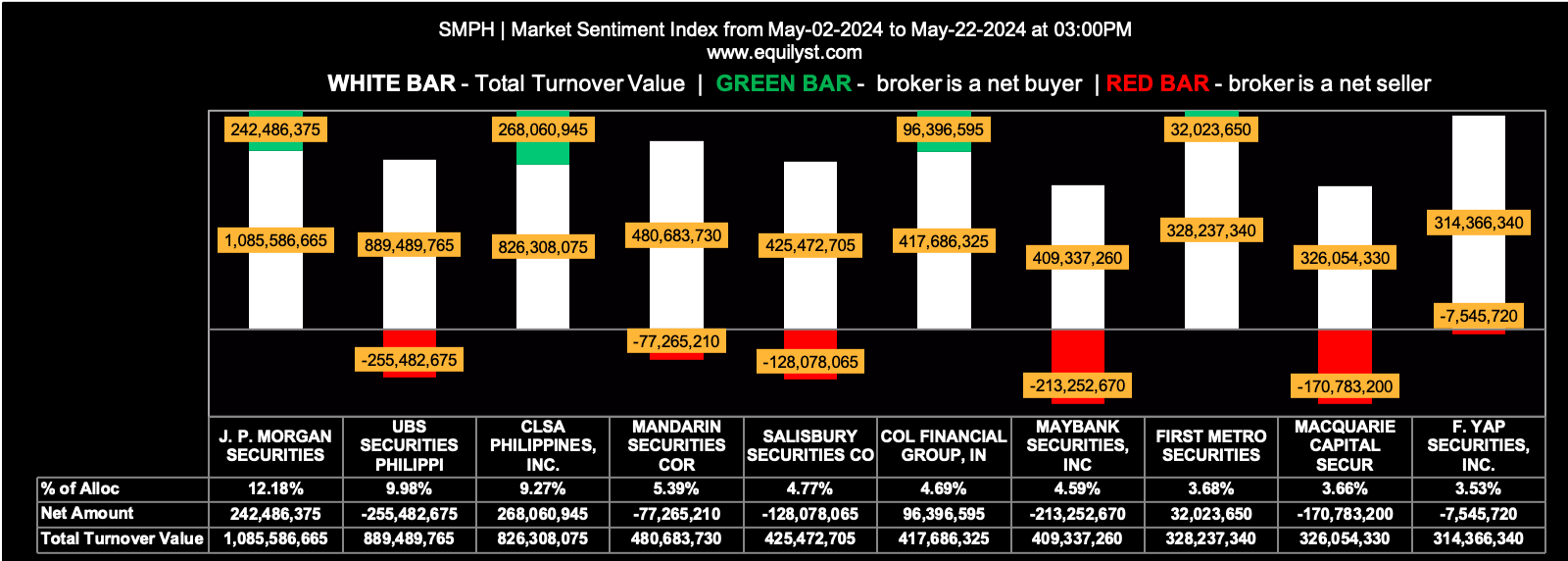

SMPH

Dominant Range Index: BEARISH

Last Price: 28.20

Dominant Range: 28.20 – 28.75

VWAP: 28.43

Market Sentiment Index (MTD): BEARISH

63 of the 94 participating brokers, or 67.02% of all participants, registered a positive Net Amount

25 of the 94 participating brokers, or 26.60% of all participants, registered a higher Buying Average than Selling Average

94 Participating Brokers’ Buying Average: ₱27.47161

94 Participating Brokers’ Selling Average: ₱28.14941

13 out of 94 participants, or 13.83% of all participants, registered a 100% BUYING activity

2 out of 94 participants, or 2.13% of all participants, registered a 100% SELLING activity

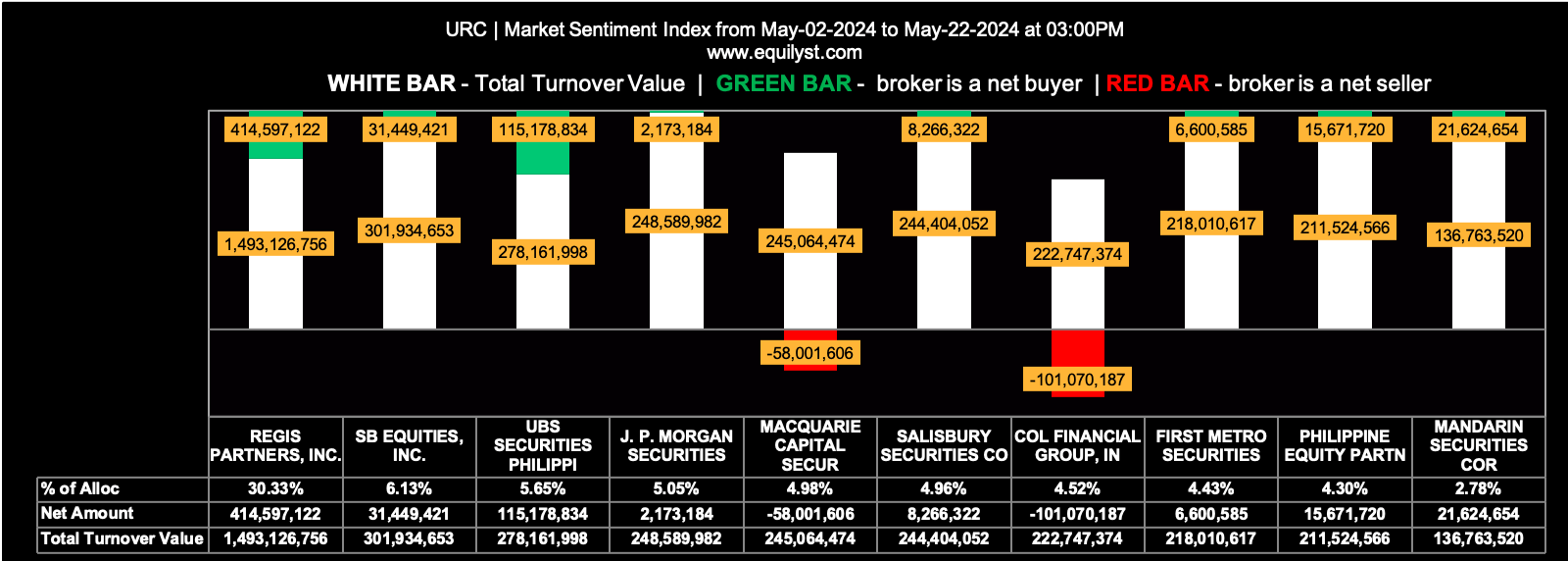

URC

Dominant Range Index: BEARISH

Last Price: 104.40

Dominant Range: 104.40 – 106.00

VWAP: 105.14

Market Sentiment Index (MTD): BEARISH

18 of the 80 participating brokers, or 22.50% of all participants, registered a positive Net Amount

20 of the 80 participating brokers, or 25.00% of all participants, registered a higher Buying Average than Selling Average

80 Participating Brokers’ Buying Average: ₱106.53730

80 Participating Brokers’ Selling Average: ₱108.17406

4 out of 80 participants, or 5.00% of all participants, registered a 100% BUYING activity

18 out of 80 participants, or 22.50% of all participants, registered a 100% SELLING activity

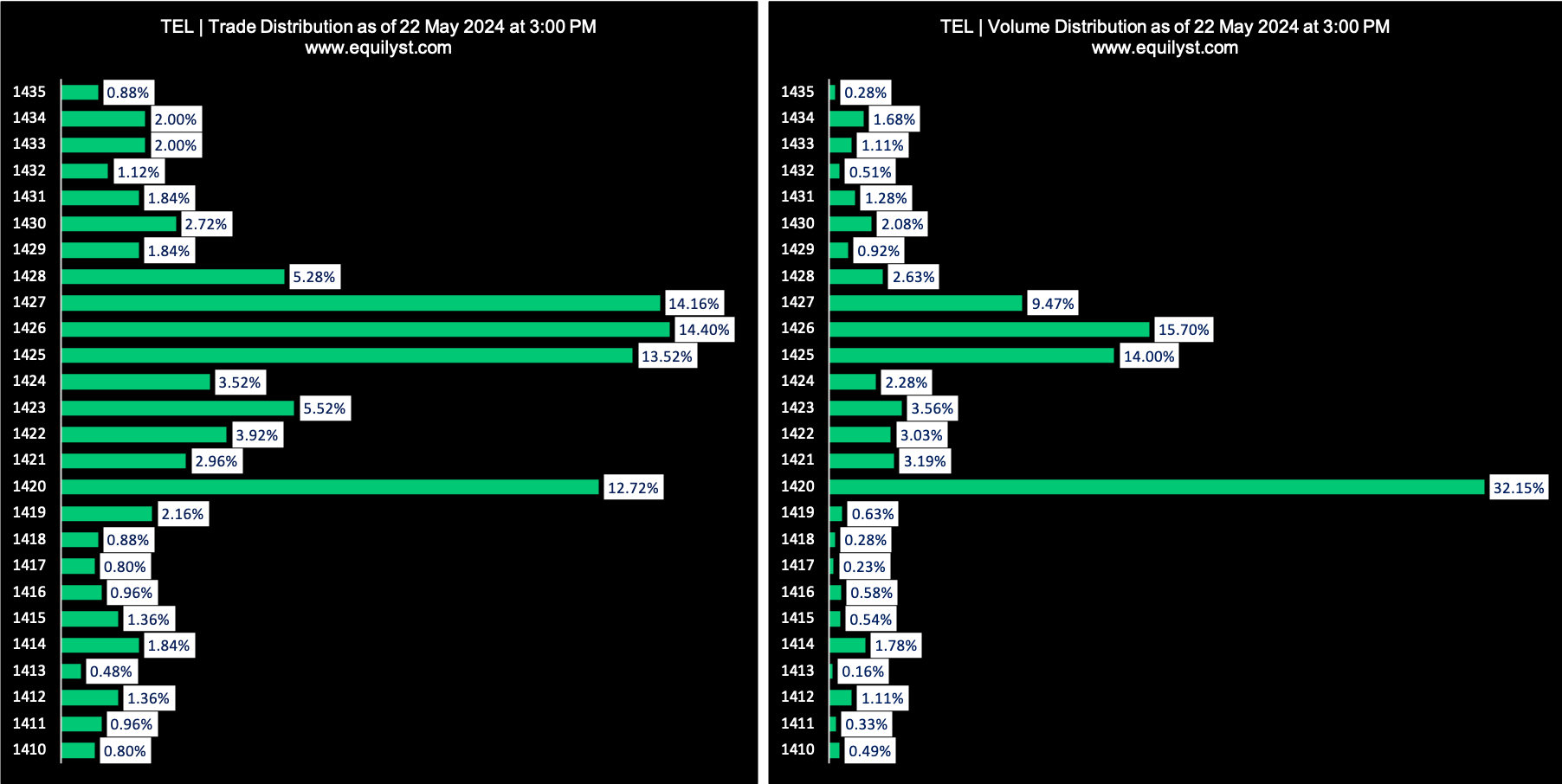

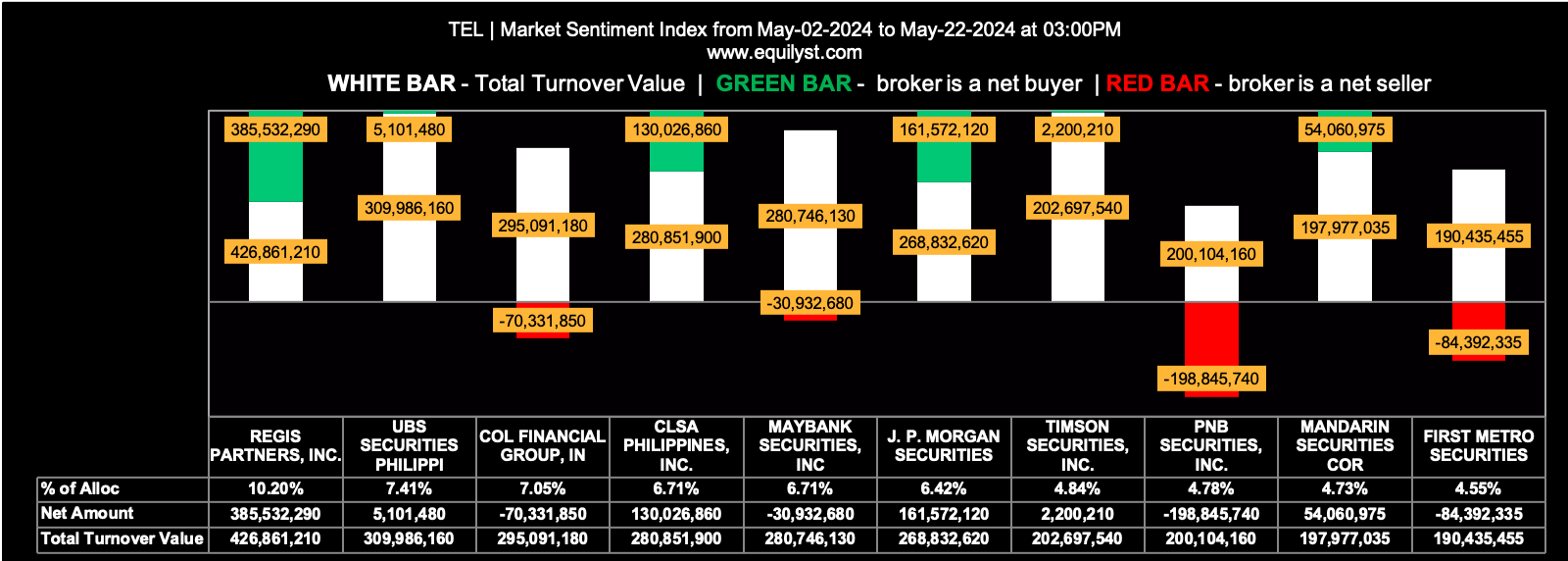

TEL

Dominant Range Index: BULLISH

Last Price: 1420

Dominant Range: 1420 – 1426

VWAP: 1,423.37

Market Sentiment Index (MTD): BEARISH

27 of the 96 participating brokers, or 28.13% of all participants, registered a positive Net Amount

31 of the 96 participating brokers, or 32.29% of all participants, registered a higher Buying Average than Selling Average

96 Participating Brokers’ Buying Average: ₱1412.88469

96 Participating Brokers’ Selling Average: ₱1414.74961

9 out of 96 participants, or 9.38% of all participants, registered a 100% BUYING activity

29 out of 96 participants, or 30.21% of all participants, registered a 100% SELLING activity

How Many of Tan’s Stock Picks Got a Buy Signal from Equilyst Analytics?

Nothing. Not one.

It only means that now is not yet the time to enter on a new position or average down on Tan’s stock picks as far as technical analysis is concerned.

- 8 out of 10 stock picks have a dominant range that’s closer to the intraday low than the intraday high

- 8 out of 10 stock picks have a month-to-date market sentiment that favors selling than buying

As a trader in the agriculture sector, I don’t buy farm inputs or commodities if there’s a consensus sentiment among my fellow traders that certain commodities are likely to drop in price.

Are those commodities spoiled? No, they’re in good condition. But being in good condition doesn’t mean I’ll rush into buying them without considering the consensus sentiment among my fellow traders. The same logic applies to stock trading and investing.

Would You Like More?

You may subscribe to my teleconsulting service, stock screener subscription, and premium analysis subscription.

You may also read my other reports here and watch my videos on YouTube.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025