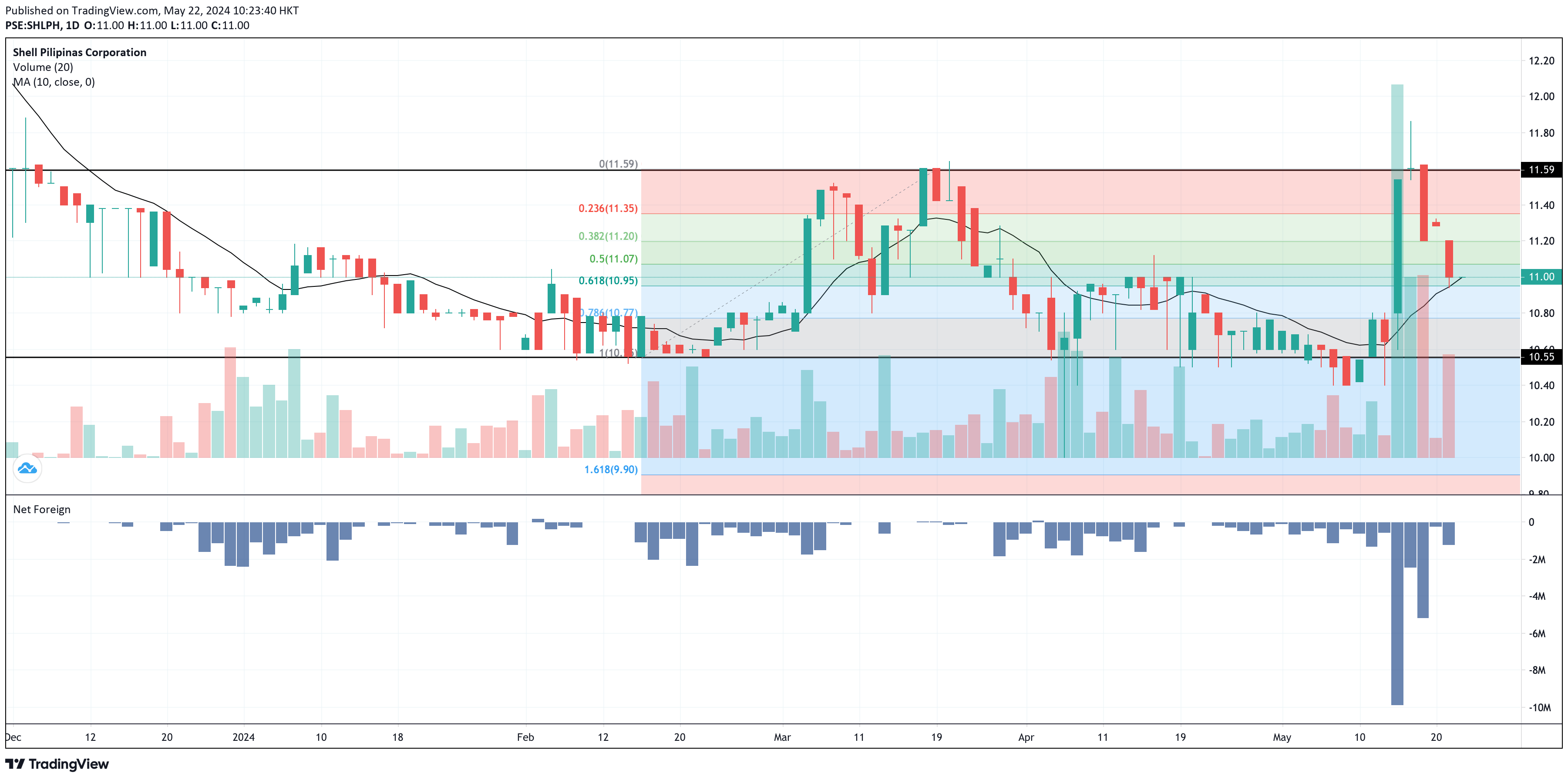

Ayala Land (ALI)

ALI might struggle to pierce the resistance near 29.40 due to the bearish Dominant Range Index at the time this report was generated. The range with the biggest volume and highest number of trades is closer to the intraday low than the intraday high.

If ALI maintains a positive day change with a volume higher than at least 50% of its 10-day volume average, then that bullish stance supersedes the previous statement.

Dominant Range Index: BEARISH

Last Price: 28.85

Dominant Range: 28.80 – 28.90

VWAP: 28.94

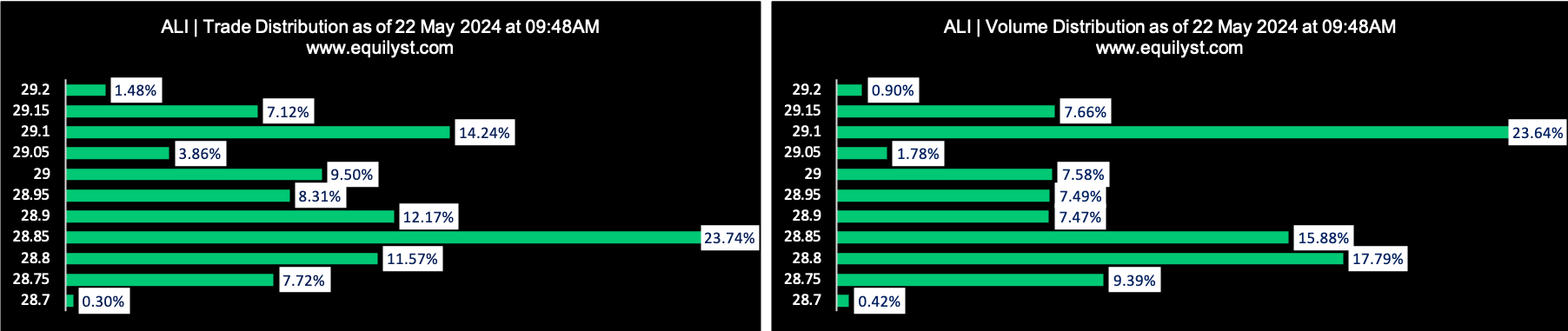

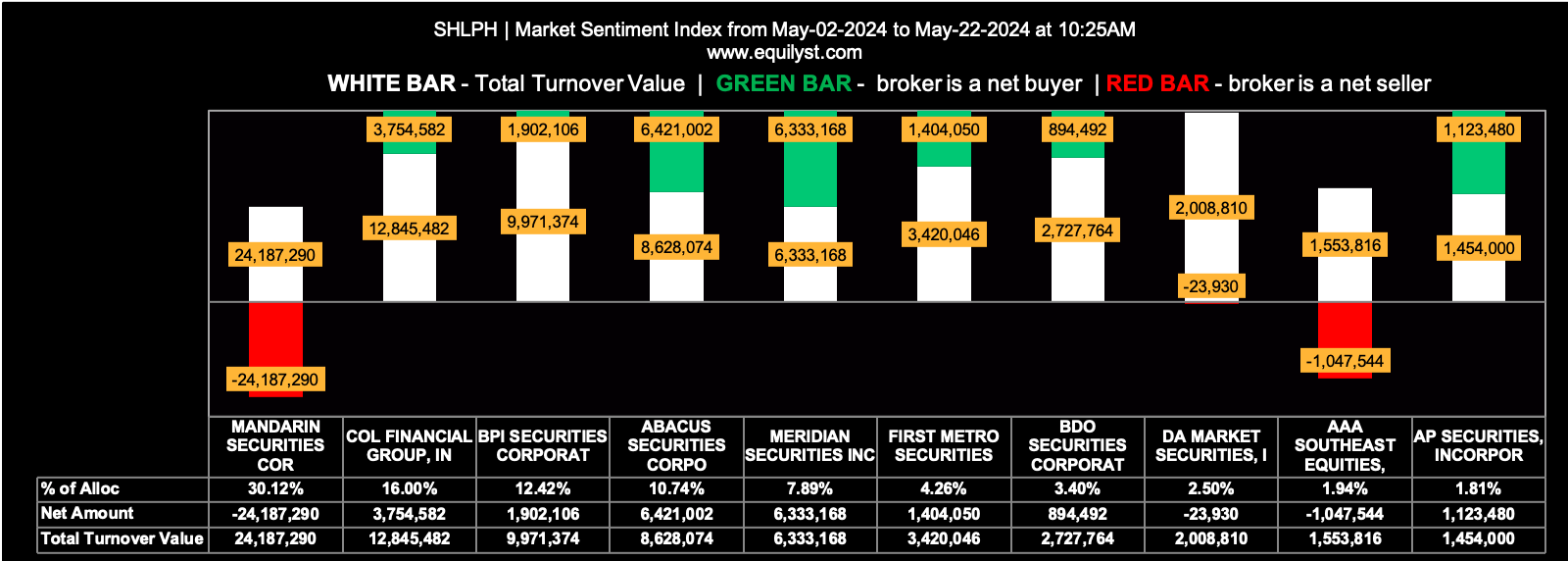

Shell Pilipinas Corporation (SHLPH)

SHLPH is on the brink of testing support at 10.95. Based on the month-to-date buying average of all participants who have traded SHLPH from May 2, 2024, to today, investors are trying to protect SHLPH at 11 per share. If and when the price breaks below 11 per share, SHLPH might drop to 10.80, which aligns with the 78.6% Fibonacci retracement.

Should SHLPH holders pre-empt potential losses by selling shares now?

It all depends on the status of your trailing stop.

If your trailing stop is intact, hold your position. You still have a data-driven reason—the bullish month-to-date Market Sentiment Index—to hold.

However, it’s a different and unfortunate situation if your trailing stop has already been hit or if you don’t know what a trailing stop is. If your trailing stop represents the percentage of risk you can reasonably handle, why would you still hold your position if your trailing stop is no longer intact? Why did you calculate it in the first place if you would just ignore it in the end?

Even though the month-to-date Market Sentiment Index is bullish, note that there is a tug-of-war between the number of market participants with a positive Net Amount and those with a higher Buying than Selling Average. They are tied at 23 brokers each.

Market Sentiment Index: BULLISH

23 of the 43 participating brokers, or 53.49% of all participants, registered a positive Net Amount

23 of the 43 participating brokers, or 53.49% of all participants, registered a higher Buying Average than Selling Average

43 Participating Brokers’ Buying Average: ₱11.00963

43 Participating Brokers’ Selling Average: ₱11.08774

13 out of 43 participants, or 30.23% of all participants, registered a 100% BUYING activity

8 out of 43 participants, or 18.60% of all participants, registered a 100% SELLING activity

Would you like to learn the methodology of Equilyst Analytics? We can work with you whether you’re a newbie or an experienced investor wanting to learn more. Visit our website and click SERVICES to learn more.

Feel free to share this post if you think it will add value to others.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025