Technical Analysis for ACEN Corporation (PSE:ACEN)

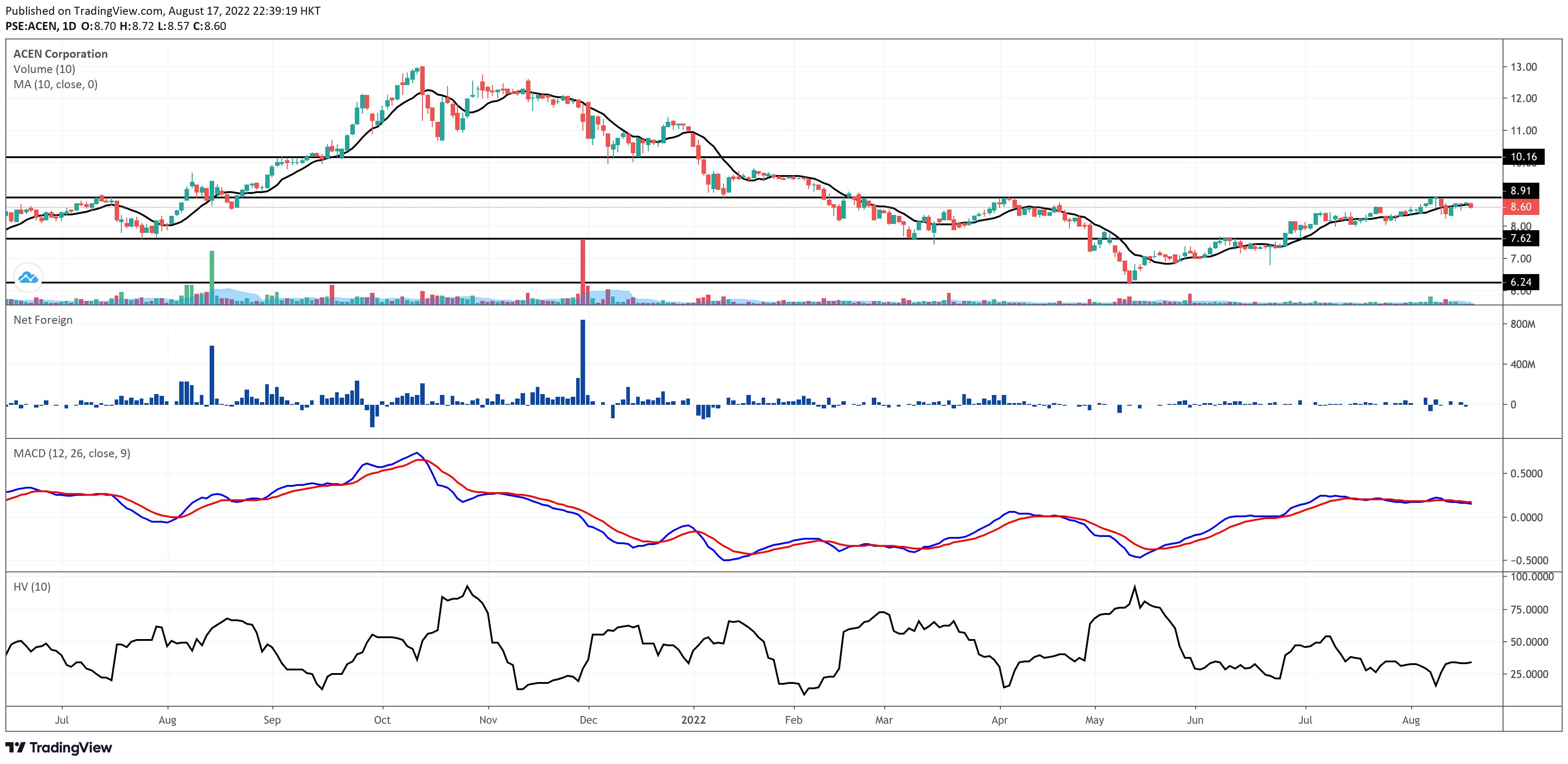

ACEN Corporation is hesitant to break the immediate resistance at P8.90 per share. This resistance level was tested during the first week of August 2022. If it had not been for the nearly P68 million Net foreign Selling last August 5, ACEN might have stayed afloat above the P8.90 level.

Holders, don’t fret much because the last price is closer to the immediate resistance at P8.90 per share than the immediate support at P7.60.

Holders, don’t fret much because the last price is closer to the immediate resistance at P8.90 per share than the immediate support at P7.60.

ACEN is struggling to sustain its ascent since there’s been no significant volume for the past three trading days. The last three trading days’ daily volumes are lower than 50% of ACEN’s 10-day volume average for each of those days. It’s difficult to expect the stock to aggressively move up if the volume is that flimsy.

Does ACEN have a buy signal for August 18, 2022 as of today’s data?

Let’s find out together.

You know my six criteria must present a bullish rating for this stock to have a confirmed buy signal, don’t you?

Let’s check each of those criteria.

Criterion 1: Is the last price moving above the 10-day simple moving average?

Negative. The last price is P8.60. The 10SMA is P8.68.

Criterion 2: Is the prevailing volume higher than 50% of ACEN’s 10-day volume average?

Negative. Today’s volume is at 5.41 million shares. The 10-day volume average of ACEN is 19.57 million shares. What’s 50% of 19.57 million? You do the Math.

Criterion 3: Is the moving average convergence divergence (MACD) moving above the signal line?

Negative. MACD is at 0.15. The signal line is at 0.17.

Criterion 4: Is the last price higher than the volume-weighted average price (VWAP)?

Negative. The last price is P8.60. VWAP is P8.62.

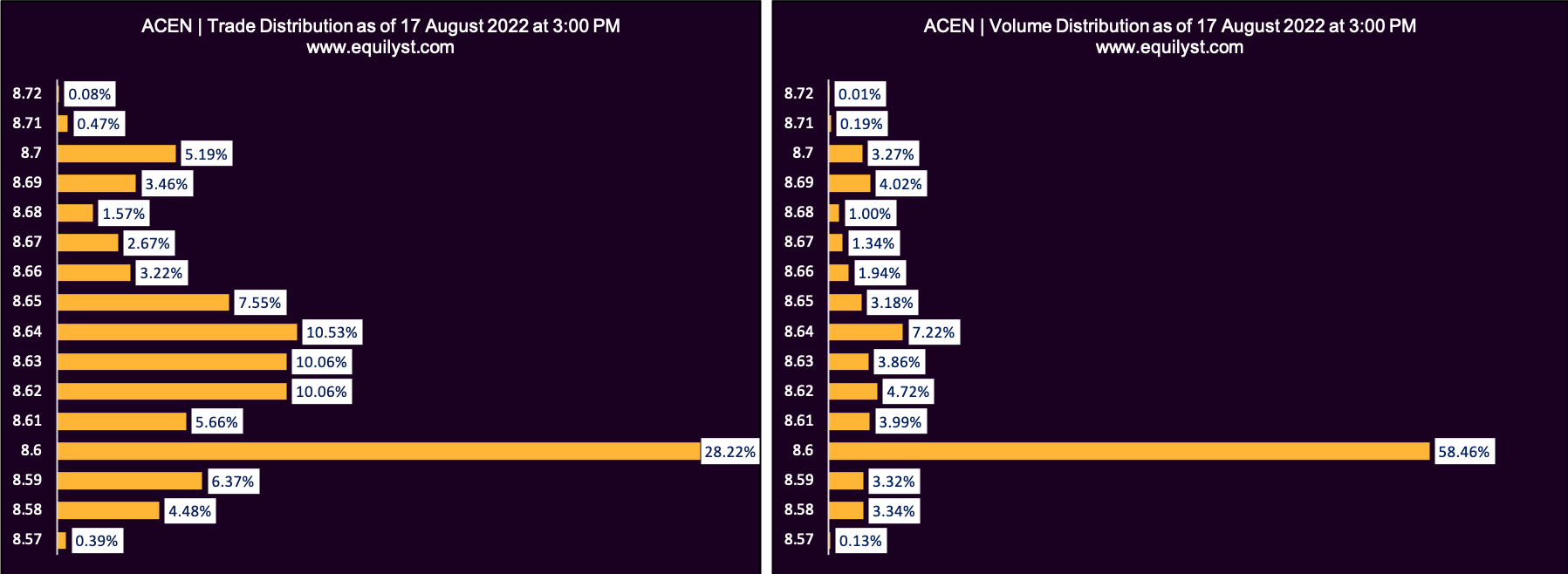

Criterion 5: Is the Dominant Range Index bullish?

Negative.

Dominant Range Index: BEARISH

Last Price: 8.6

VWAP: 8.62

Dominant Range: 8.6 – 8.6

The price range that got the biggest volume and highest number of trades is closer to the intraday low than the intraday high.

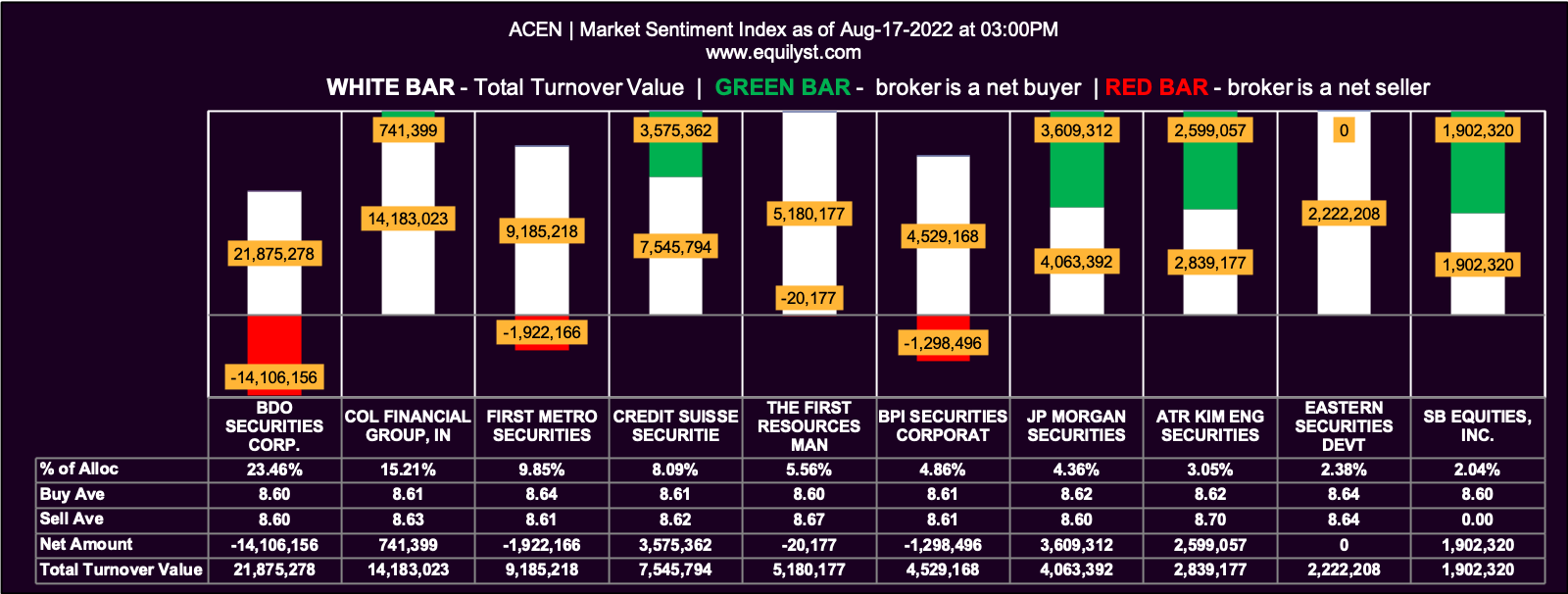

Criterion 6: Is the Market Sentiment Index bullish?

Criterion 6: Is the Market Sentiment Index bullish?

Yes.

Market Sentiment Index: BULLISH

24 of the 44 participating brokers, or 54.55% of all participants, registered a positive Net Amount

23 of the 44 participating brokers, or 52.27% of all participants, registered a higher Buying Average than Selling Average

44 Participating Brokers’ Buying Average: ₱8.61749

44 Participating Brokers’ Selling Average: ₱8.63211

14 out of 44 participants, or 31.82% of all participants, registered a 100% BUYING activity

9 out of 44 participants, or 20.45% of all participants, registered a 100% SELLING activity

Conclusion

Conclusion

ACEN does not have a confirmed buy signal for August 18, 2022.

Suppose you don’t have ACEN in your portfolio yet. If that’s the case, I recommend that you wait for a pullback or a breakout. The more it pulls back closer to the support, the better. Once it breaks out above the resistance, check if all six criteria are bullish. If they are, compute your initial trailing stop and reward-to-risk ratio using the trading calculators on my website. You can buy within the prevailing dominant range if you’re satisfied with the ratio. You must request that from me through the Private Clients Forum (for members only).

Suppose you already have ACEN in your portfolio, and your average price is P8.42. Let’s also say you’ve applied a 35% risk in calculating your initial trailing stop. If you haven’t topped up yet since the first time you bought shares of ACEN, I presume your entry price was near or between P8.58 and P8.60. It’s a different calculation if you have already topped up several times.

For the sake of argument, let’s assume your entry price was P8.58. A 35% tolerable risk puts your initial trailing stop near P5.58, which puts your mind within the circumference of sanity as long as ACEN’s price doesn’t go lower than P5.58.

However, this doesn’t mean you should wait blindly for the price to touch the nose of P5.58. Suppose the stock’s Dominant Range Index or Market Sentiment Index has been bearish for two to three consecutive days. In that case, you may want to reduce the percentage of risk of your trailing stop or pre-empt your trailing stop by either selling all shares in one go or tranches if you hold a relatively sizable amount of shares.

If you have to liquidate your shares before the end of this trading week, for whatever reason, you can go ahead since the downtrend is likely to continue insofar as today’s assessment is concerned. Understand that insights change when data change. So, have an open mind for the volatility of insights as well.

As a consolation, it’s good to see that ACEN is a low-risk stock since its 10-day historical volatility (HV) is only at nearly 34%. The low-risk level is from 1 to 50% 10-day HV.

Do you need my help?

Subscribe to my stock market consultancy service. I’ll teach you my methodology and give advice on how to manage your portfolio.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025