Recent News Concerning ACEN Corporation

ACEN Corporation has announced its acquisition of P30 million worth of additional shares in its subsidiary, ENEX Energy Corporation.

According to a disclosure made to the Philippine Stock Exchange, the company has entered into a subscription agreement to acquire approximately 30 million non-voting Preferred Shares in ENEX at a price of P1 per share.

“The subscription proceeds will be utilized to support ENEX’s operational needs and cover transaction expenses associated with the issuance of the Preferred Shares,” stated the company.

ENEX, a publicly listed entity under ACEN, operates in the domestic and global oil and gas exploration sector, with ACEN serving as its major shareholder.

At present, ACEN holds a 5.45% stake in ENEX’s outstanding shares.

ACEN is renowned for its attributable capacity of around 4,200 megawatts (MW) spread across various locations including the Philippines, Vietnam, Indonesia, India, and Australia.

The company aims to further bolster its renewable energy portfolio, targeting a capacity of 20 gigawatts (GW) by the year 2030.

ACEN Corporation Technical Analysis

Despite increasing in share price value by 34% since April 16, 2024, ACEN remains down by 5% year-to-date. It may be bullish in the short-term period, relative to the position of its last price to the 10-day simple moving average, but it is still very much buried in the downtrend channel of the longer period, as can be seen in the chart above.

The major support is near P3.10, while resistance is at P4.64. A mid-term support lies at P3.78, however. If the price breaks below P4.07, it’ll be more likely for the price to reach P3.78. On the other hand, it’ll be more likely for the trend to go higher toward P4.64 once the price breaches P4.38.

There appears to be a strong intent to protect the price above P3.78 since ACEN managed to stay on the surface of P3.78 from March till early April this year.

Meanwhile, the size of the daily Net Foreign Buying of foreign investors has become relatively noticeable since the last trading week of April 2024. Their buying appetite in the two most recent weeks has placed ACEN in a Net Foreign Buying status year-to-date.

There are no significant volume-related issues since the majority of the daily volume of ACEN is higher than 50% of its 10-day volume average.

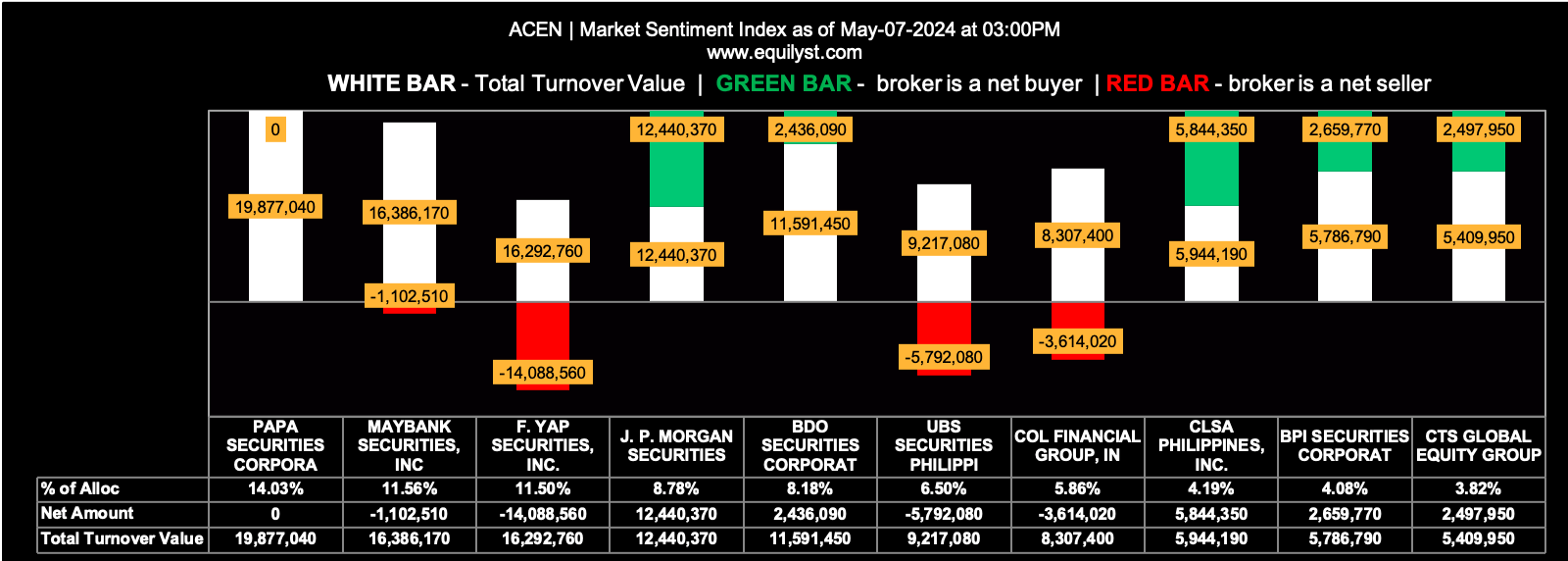

Market Sentiment Index (May 7, 2024): BEARISH

22 of the 47 participating brokers, or 46.81% of all participants, registered a positive Net Amount

20 of the 47 participating brokers, or 42.55% of all participants, registered a higher Buying Average than Selling Average

47 Participating Brokers’ Buying Average: ₱4.15385

47 Participating Brokers’ Selling Average: ₱4.15456

10 out of 47 participants, or 21.28% of all participants, registered a 100% BUYING activity

17 out of 47 participants, or 36.17% of all participants, registered a 100% SELLING activity

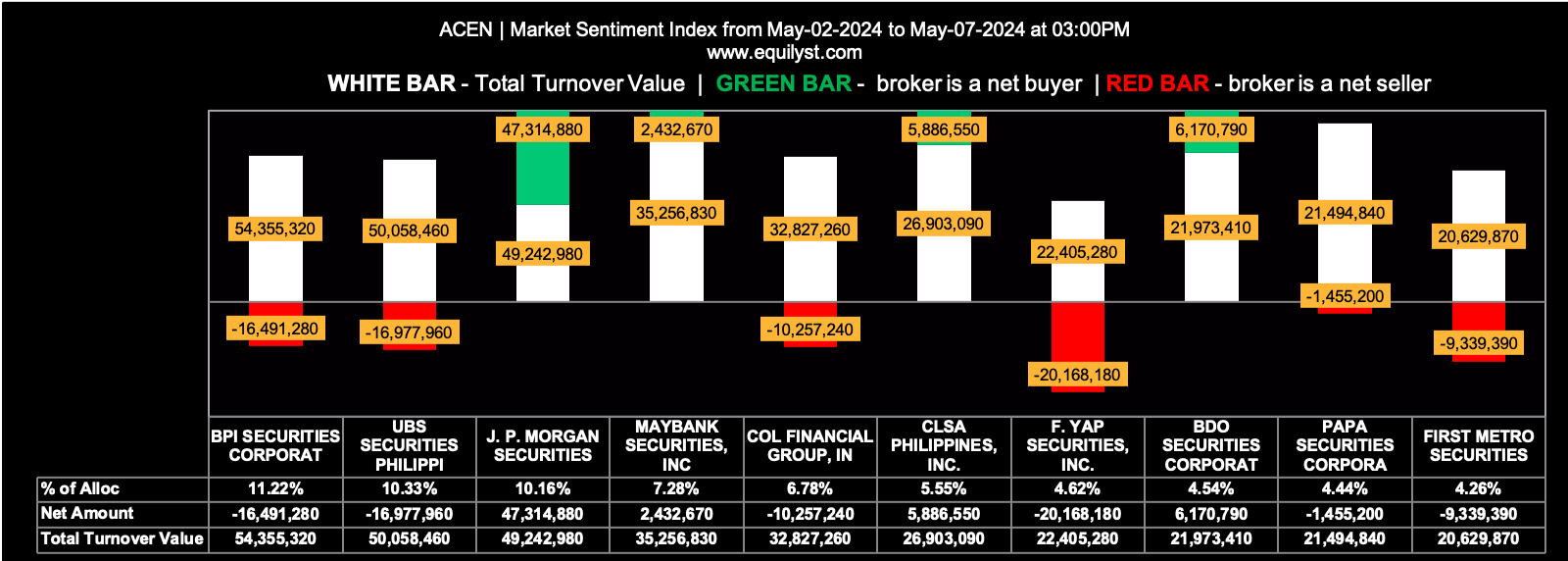

Market Sentiment Index (May 2-7, 2024): BEARISH

33 of the 74 participating brokers, or 44.59% of all participants, registered a positive Net Amount

35 of the 74 participating brokers, or 47.30% of all participants, registered a higher Buying Average than Selling Average

74 Participating Brokers’ Buying Average: ₱4.10381

74 Participating Brokers’ Selling Average: ₱4.11738

15 out of 74 participants, or 20.27% of all participants, registered a 100% BUYING activity

9 out of 74 participants, or 12.16% of all participants, registered a 100% SELLING activity

Buy or Sell ACEN?

If you already have ACEN in your portfolio, your trailing stop is intact, and you’re planning to top up, I recommend that you do it gradually or with caution. The end-of-day (EOD) and month-to-date (MTD) Market Sentiment ratings warn us that those who already have ACEN in their portfolio might be eavesdropping with each other’s sentiment, especially now that this stock has just breached the previous resistance at P4.07 fairly recently.

If you don’t have ACEN yet, it’s better to wait for the EOD Market Sentiment rating to become bullish, together with its prevailing Dominant Range Index. The Market Sentiment Index and Dominant Range Index indicators are both my proprietary indicators. You won’t find these two indicators in the charting tool of any stock brokerage firm in the Philippines or abroad. If you’re one of the subscribers to my Premium Stock Analysis service, you may email me your request not only for the latest Dominant Range Index and Market Sentiment Index of any PSE-listed stock but also for my whole analysis with recommendations.

The bottom line is that you keep an eye on your trailing stop. You need to sell once your trailing stop is hit regardless of the status of the Dominant Range Index, Market Sentiment Index, or any indicator I presented in this analysis.

What More Updates?

To receive more updates from me, here are my services:

You may also read my other reports here and watch my videos on YouTube. You may also subscribe to my newsletter.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025