What Influenced Today’s Price Action for ACEN Corporation (PSE:ACEN)?

ACEN Corporation (PSE:ACEN) witnessed a significant increase in earnings during the first half of 2023, partly attributed to its wind assets and renewables output.

The disclosure sent to the Philippine Stock Exchange on Thursday revealed an impressive 94% year-on-year rise in ACEN’s consolidated net income, reaching P4.2 billion in the initial six months.

The company successfully navigated through previous challenges and experienced a 28% year-on-year growth in consolidated revenues, amounting to P20.5 billion during the first half of 2023.

Despite price increases in the spot market, ACEN effectively transitioned into a net-selling merchant position.

During the first six months, the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) advanced by 20% to P9.4 billion.

ACEN’s domestic operations, part of Ayala Corp.’s listed energy platform, contributed P4.1 billion to EBITDA, while its international segment saw a rise to P5.5 billion.

This increase can be attributed, in part, to the ongoing commission of the 521-megawatt direct current (MwDC) New England Solar farm in Australia and carbon credit sales in Vietnam.

The first half witnessed a remarkable 21% surge in total renewables output, reaching an impressive 2,052 Gigawatt hours.

Notably, generation from their Philippine operations also experienced substantial growth, increasing by 30% to 568 Gwh in the same period.

Eric Francia, ACEN’s president, and CEO expressed optimism about their growth trajectory, emphasizing their substantial progress in ramping up projects, which has effectively met the increasing demand for energy supply in the Philippines and the broader region.

On Thursday, PSE:ACEN closed at P5.30 per share, marking a 5.79% increase after respecting the support at P5.00.

Although ACEN is still far from breaking the resistance at P5.70, which is confluent with the 78.6% Fibonacci retracement, the day’s engulfing green candlestick is an encouraging sign for ACEN holders.

The trading volume today was quite high, nearly exceeding 100% of its 10-day volume average.

For the moving average convergence divergence (MACD) to register a golden cross above its signal line, the stock may need to break above the range of P5.40 to P5.45.

Despite the price’s engulfing candlestick, today’s risk level remains within the low-risk territory.

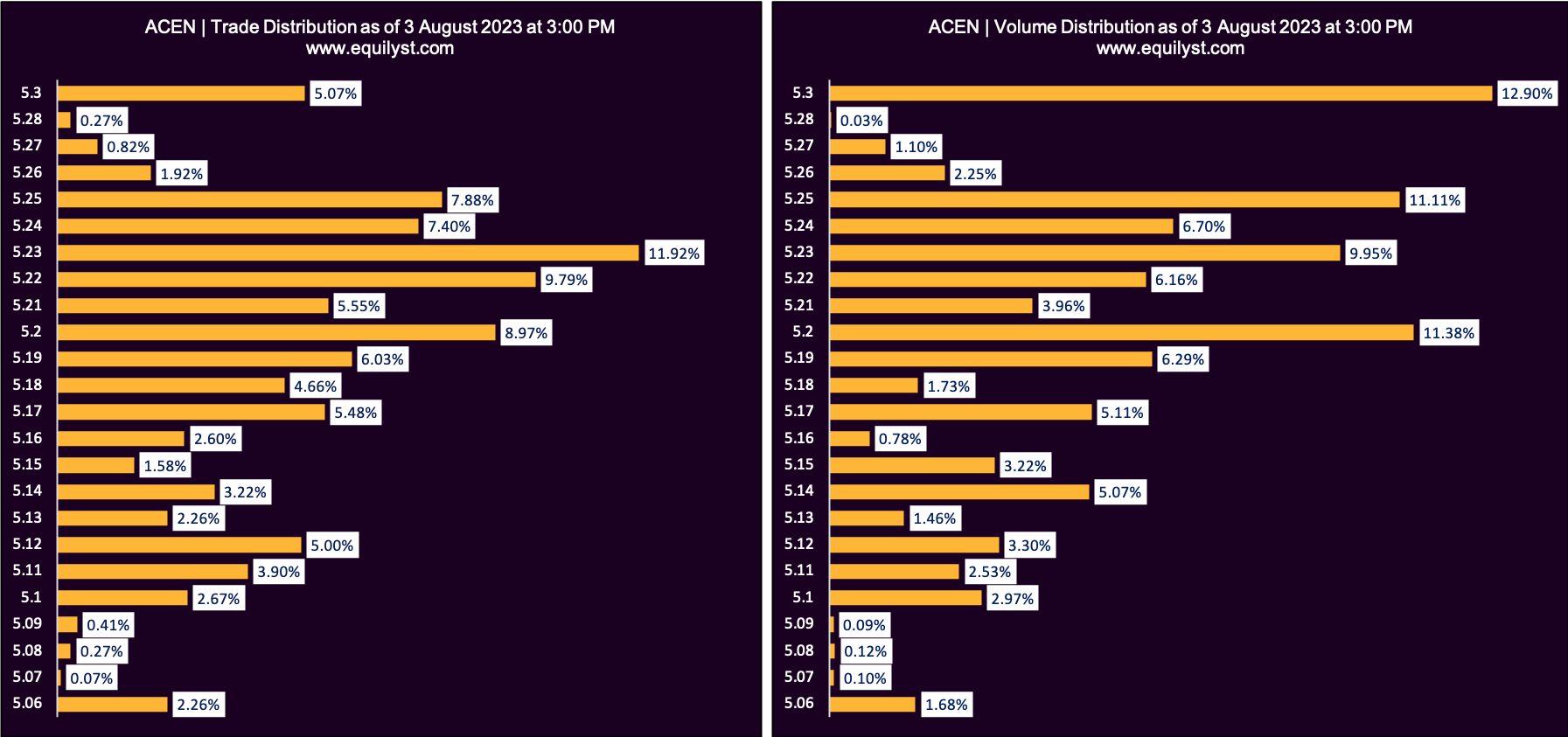

On the Dominant Range Index, PSE:ACEN exhibited a bullish trend since more than 50% of the transacted prices with the largest volume and highest number of trades were closer to the intraday high than the intraday low.

The Dominant Range Index for ACEN is between P5.23 and P5.3.

Dominant Range Index: BULLISH

Last Price: 5.3

VWAP: 5.21

Dominant Range: 5.23 – 5.3

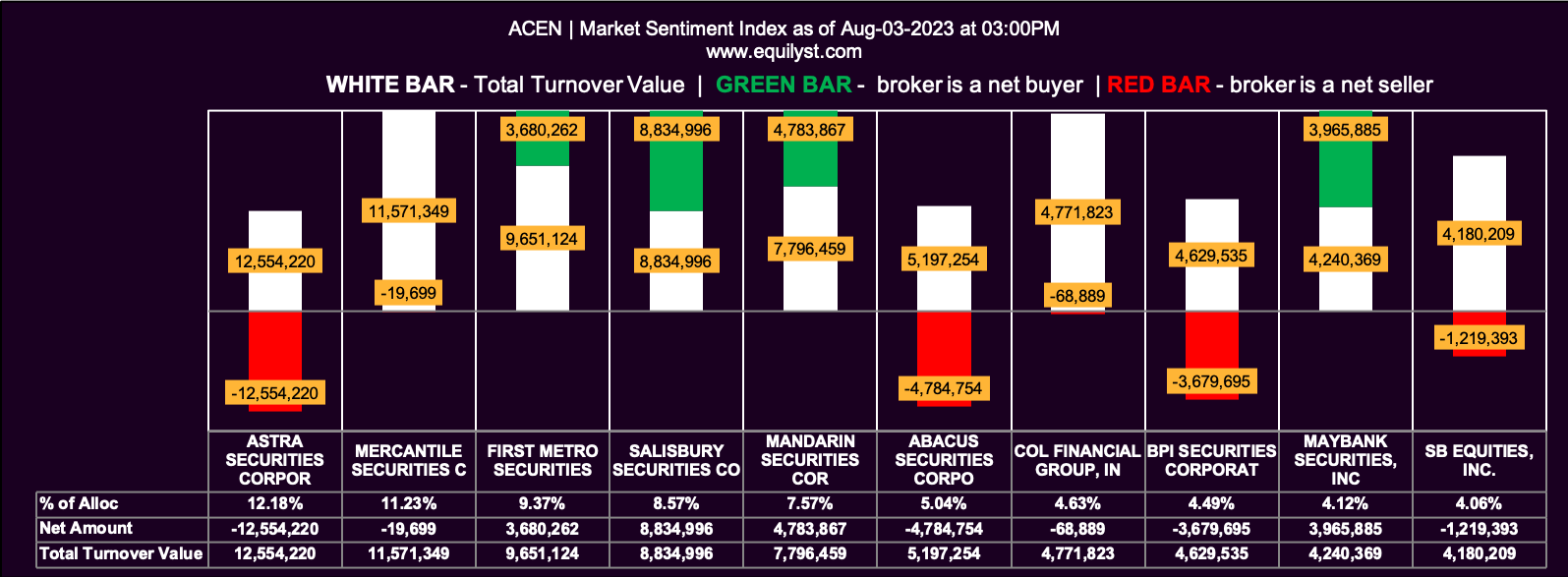

On the other hand, today’s Market Sentiment Index leans toward the bearish side of the MACD.

Over 60% of today’s trade participants registered a higher selling than buying average. The cumulative selling average of all 52 trading participants was higher than their cumulative buying average, and more trade participants engaged in 100% selling activity compared to those with 100% buying activities.

Market Sentiment Index: BEARISH

26 of the 52 participating brokers, or 50.00% of all participants, registered a positive Net Amount

20 of the 52 participating brokers, or 38.46% of all participants, registered a higher Buying Average than Selling Average

52 Participating Brokers’ Buying Average: ₱5.19256

52 Participating Brokers’ Selling Average: ₱5.21181

10 out of 52 participants, or 19.23% of all participants, registered a 100% BUYING activity

15 out of 52 participants, or 28.85% of all participants, registered a 100% SELLING activity

Bringing It Altogether

My overall sentiment is neutral with a bearish bias for PSE:ACEN. I would prefer to see the price break above the 10-day simple moving average, the MACD cross above the signal line, and the Market Sentiment Index reflecting a bullish sentiment, while maintaining the positive rating of the other indicators mentioned, before considering a new position or adding to an existing share.

If today’s green day change is sustained, traders might cash-in between P6.30 and P6.70, which are between 61.8% and 50% of the Fibonacci, respectively.

If you choose not to follow my personal strategy and buy now just because you feel like doing it, make sure you calculate your reward-to-risk ratio first in relation to the immediate resistance and your initial trailing stop. You are free to use my reward-to-risk ratio and trailing stop calculators.

If your excitement doesn’t yield the results you expected, ensure you’re prompt in executing your trailing stop; otherwise, you might be better off flipping a coin for your next trade than reading my data-driven analysis.

My approach to the stock market is not driven by immediate financial needs but rather as a passive multiplier of wealth. Therefore, I would not be overly concerned if I did not buy now and PSE:ACEN’s price continued to rise.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025