Abacore Capital Holdings: H1 2023 Financial Performance

Abacore Capital Holdings (ABA) reported a gross income of P364.15 million, a significant surge compared to the P15.21 million earned in the same period last year.

This increase in gross income can be attributed to several factors: a gain of P278.82 million from the sale of investment property, a gain of P75.75 million from the sale of an investment in a subsidiary, and a share of P7.9 million in net earnings from Pacific Online Systems Corporation (LOTO), which marks a notable increase from the P4.06 million reported in the first half of 2022.

Total operational expenses saw a substantial uptick of 69%, climbing from P30.64 million to P51.82 million.

This increase was primarily driven by various factors, such as a 152% rise in salaries and wages, a 406% surge in employee benefits, a 93% increase in professional and other services, a 77% jump in utilities, a 45% growth in office supplies and publications expenses, a 46% rise in repairs and maintenance costs, a 55% increase in transportation expenses, a 53% uptick in dues, and a substantial 142% increase in miscellaneous expenses.

These escalations were mainly due to salary adjustments for staff and officers, the reclassification of officer salaries, increased legal fees, higher electricity consumption, office supply purchases, vehicle repairs, allowance liquidations, membership fees for investment associations, and listing expenses on the Philippine Stock Exchange (PSE).

Additionally, expenses related to geologic investigation programs for Abacus gold also contributed to the increase.

The fees for management and directors also saw significant growth, with a 352% rise in management fees and a 158% increase in representation fees.

These increases were attributed to an increase in board and committee meetings and additional meal expenses incurred during these meetings.

Regarding financial expenses, interest expenses decreased by 12%, while bank charges increased by 105%.

The decrease in interest expenses was due to partial payments made on the principal loan to Luzon Development Bank (LDB), while the rise in bank charges was a result of fees incurred for cashing checks at branches other than the account branch.

Consequently, the net income for the first half of 2023 reached P308,426,166, marking a complete turnaround compared to the net loss of P15,514,843 reported in the same period in 2022.

Basic earnings per share for H1 2023 stood at P0.0722, a stark contrast to the negative P0.0025 reported for H1 2022, with a par value of P1.00 per share.

The net income for H1 2023 already accounts for 77% of the total net operating income (excluding revaluation increments) for the entire calendar year of 2022.

Turning to the assets accounts, significant changes were noted:

- Cash and cash equivalents increased by 49% due to the sale of investment property.

- Trade and other receivables surged by 43% due to outstanding receivables related to the purchase price of investment property and investments in the subsidiary.

- Other non-current assets saw a 7% rise due to the recognition of EVAT input tax.

Concerning liabilities accounts, notable changes included:

- A 40% decrease in the current portion of loans payable, stemming from partial payments made on LDB loans.

- An 8% decrease in advances from related parties, attributed to the repayment of advances from Abacus Global Technovisions, Inc. (AbaGT), a related company.

- A 100% decrease in income tax payable due to the settlement of income tax obligations.

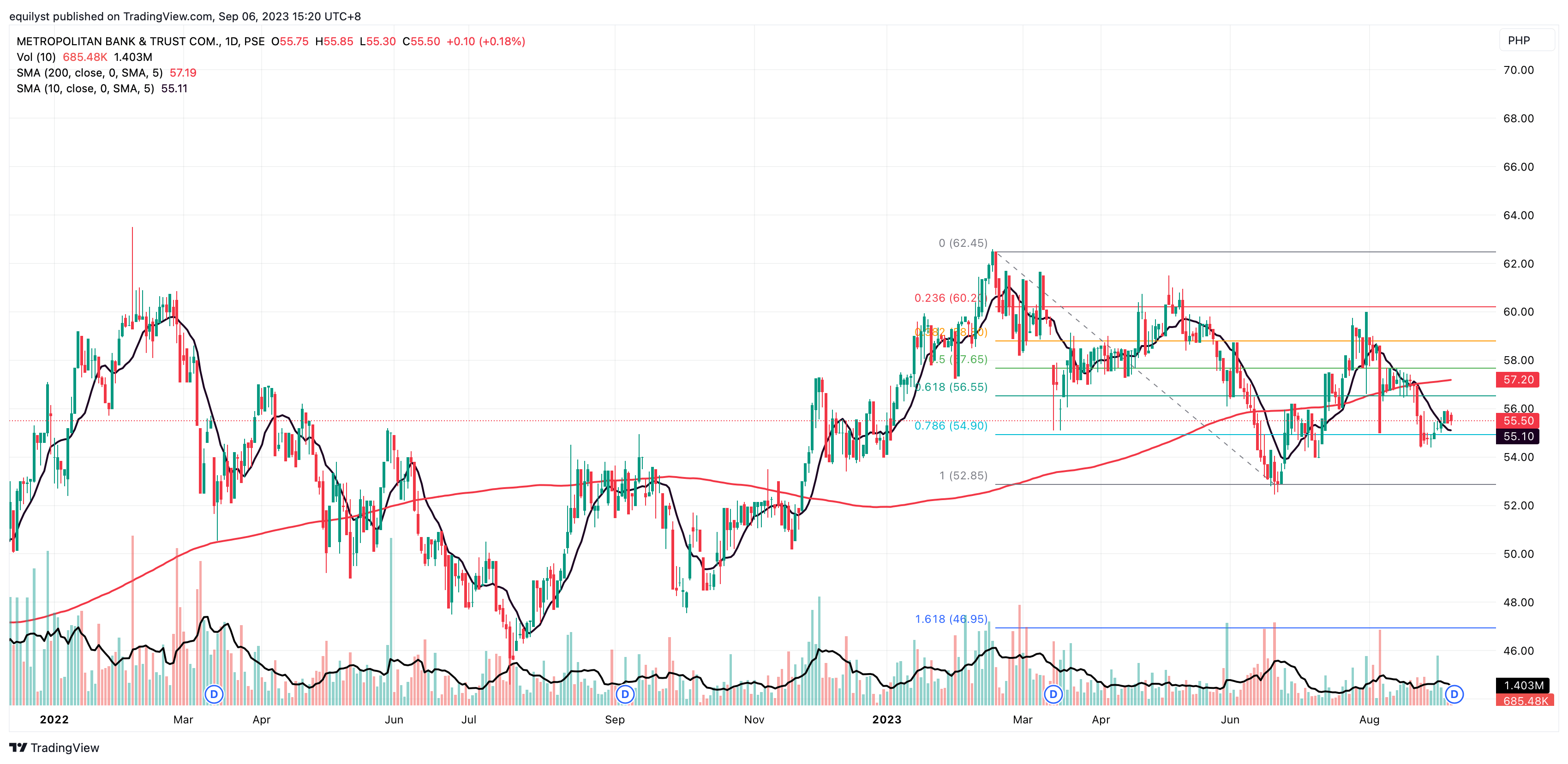

Technical Analysis: Abacore (ABA)

Abacore Capital Holdings (ABA) has experienced a 39.42% decline year-to-date, falling from P2.08 on December 29, 2022, to P1.26 on September 6, 2023. The stock saw drops of 13.65% on August 7 and 20.00% on August 8, paving the way for this significant price decline.

The stock found support near P1.00 in the last trading week of August 2023. After hitting its lowest point at P1.01 per share in August 2023, Abacore has since rebounded by 24.75% to reach P1.26 per share. Resistance is currently at P1.46, aligning with the 23.60% Fibonacci retracement level.

Abacore remains bearish in the long-term as it is still well below its 200-day simple moving average. To regain a bullish stance in the long-term relative to the position of its 200-day moving average, it needs to break through the resistance at P2.36, which aligns with the 78.60% Fibonacci retracement level.

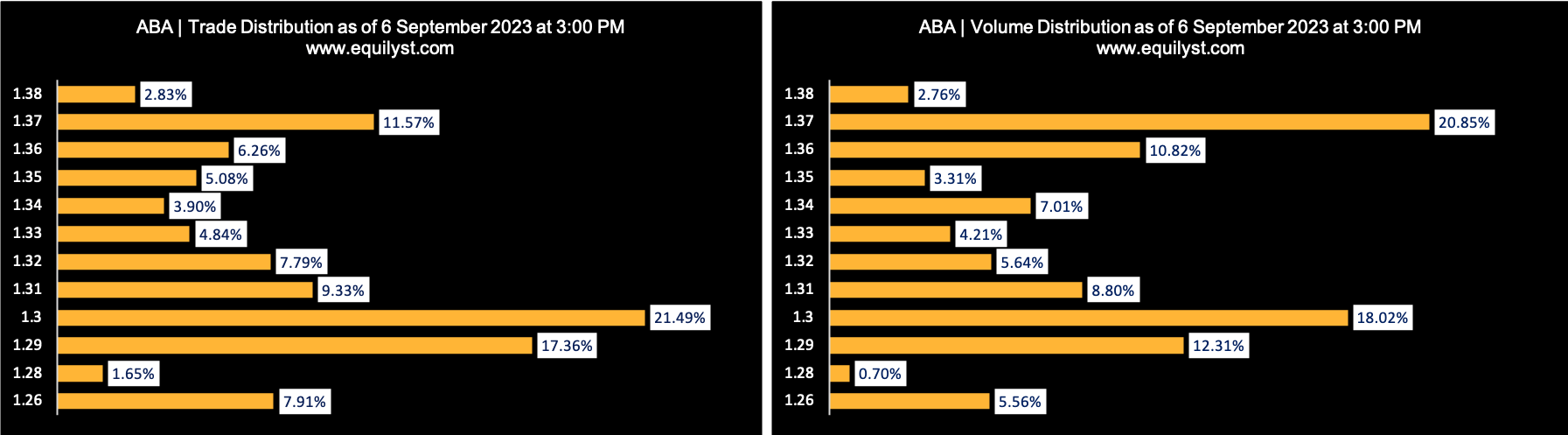

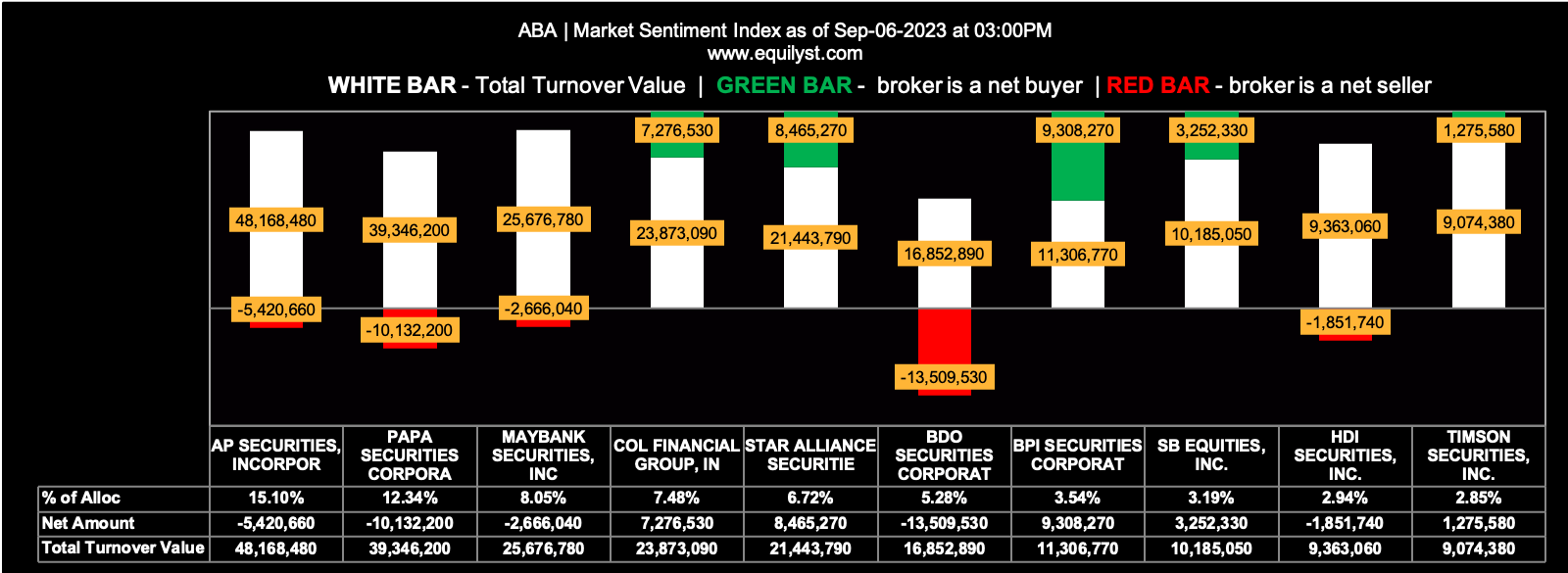

While the stock is approaching the resistance at P1.46, there is uncertainty about its ability to break above it. This is because the bearish volume on September 6, 2023, exceeded 100% of the stock’s 10-day volume average, indicating stronger selling pressure than buying interest among investors. It may continue to approach P1.46 but could bounce away from that level once it reaches it.

Abacore earned a bearish Dominant Range Index, as its price range with the highest volume and most trades (P1.29 to P1.30) is closer to its intraday low than its intraday high. This bearish rating is influenced by its volume-weighted average price of P1.33, which is higher than its closing price of P1.26.

On the other hand, Abacore has a bullish month-to-date market sentiment, supported by the following statistics:

- 37 of the 65 participating brokers, or 56.92% of all participants, registered a positive Net Amount

- 40 of the 65 participating brokers, or 61.54% of all participants, registered a higher Buying Average than Selling Average

- 65 Participating Brokers’ Buying Average: ₱1.28698

- 65 Participating Brokers’ Selling Average: ₱1.28281

- 12 out of 65 participants, or 18.46% of all participants, registered a 100% BUYING activity

- 5 out of 65 participants, or 7.69% of all participants, registered a 100% SELLING activity

This bullish MTD market sentiment is expected since Abacore’s share price has started to recover on September 1. Of the four candlesticks since September 1, only one is red. If Abacore registers two to three more consecutive red candlesticks, its month-to-date market sentiment might turn bearish.

How did I know that that’s how this indicator must be interpreted? Of course, I am the creator! Shame on me if I didn’t know how to interpret the results of my creation.

Price Forecast for Abacore (ABA)

I have a neutral to bearish overall sentiment for Abacore.

It’s likely for its share price to draw closer to the resistance at P1.46, and temp-check the market if it still wants to move up after reaching that level. It’s premature to say with confidence that Abacore will bounce away from P1.46 or break it with a strong momentum without looking back.

If Abacore touches P1.46 or once it’s just a few ticks away from it, it’s best to re-check the prevailing Dominant Range Index and Market Sentiment Index.

Suppose I don’t have Abacore yet. Will I buy it on September 7? Not yet. I don’t see a confirmed buy signal yet as far as all the data I’ve checked and my methodology are concerned.

If I already have Abacore, is it wise to top up? Not yet – as far as my methodology is concerned.

To each their own because each of us has our own risk appetite. Even if I were to teach you my proprietary methodology, the two of us wouldn’t necessarily arrive at the same final decision because we don’t share the same financial circumstances in life, investment horizon, and risk tolerance. That’s what I’m proud of regarding my proprietary investment methodology. It doesn’t impose my personal preferences on my clients.

So, if Abacore is in your portfolio and you need my update after September 6, you may avail yourself of my stock investment consultancy service so I can give you an ad-hoc update on this stock over the telephone.

Are you looking to hire a crypto or stock investment consultant? Complete this form to avail yourself of my crypto and stock market consulting service.

Are you looking to hire a content writer for your crypto and stock investment website? Here’s the form you need to fill out.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025