The Philippine Stock Exchange Index (PSEi) staged a modest recovery from 2 PM onward, paring its intraday losses to -0.18% and closing at 6,195.26.

The market remains weighed down by uncertainty following the recent political turmoil, particularly the arrest of former Philippine President Rodrigo Duterte by the International Criminal Court on March 11, 2025. This development has exacerbated investor concerns, keeping the index in a volatile range. Foreign investors continued to be net sellers for the third consecutive session, reflecting sustained risk aversion amid political uncertainties.

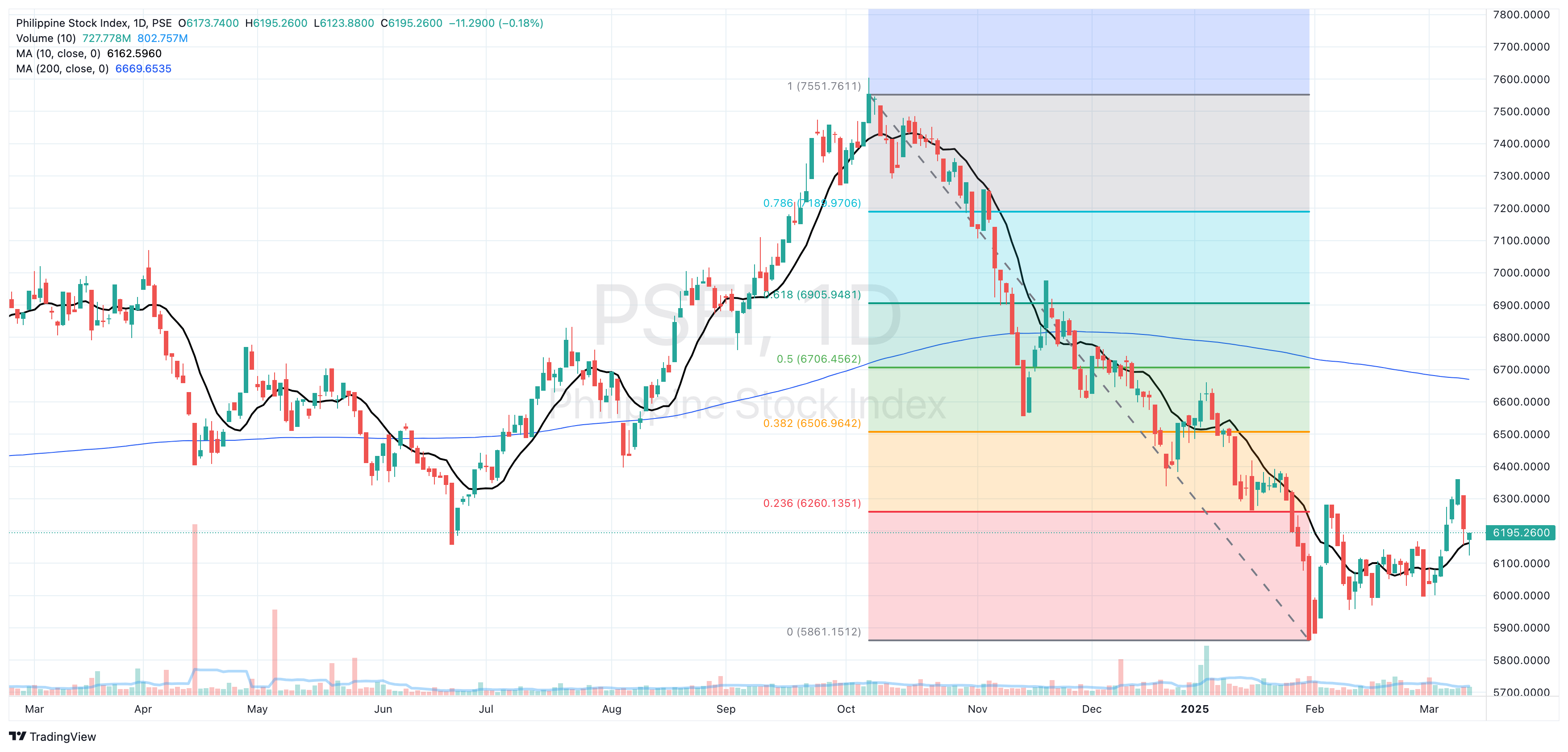

From a technical standpoint, the PSEi must decisively break through three key resistance levels—6,260, 6,506, and 6,706—to regain a sustainable bullish momentum in the longer term. On the downside, immediate support rests at 6,150, with a stronger base at 6,000. A break below these levels could accelerate selling pressure.

While daily trading volume remains above 50% of its 10-day average, there is a lack of strong bullish catalysts to support the index above 6,260. Although the PSEi briefly surpassed this level on March 7, political uncertainties have once again dampened sentiment. Sector-wise, the services and mining industries led the declines, while properties stocks displayed resilience as investors adopted a defensive stance.

Global risk sentiment remains fragile, with Wall Street closing lower on March 11 as investors braced for the upcoming U.S. inflation data release, which could influence investor flows in emerging markets like the Philippines. Given the current environment, seasoned investors and traders are likely to remain on the sidelines, closely monitoring political developments before making decisive moves. For those still holding positions, maintaining current exposure without additional accumulation remains a prudent strategy—provided that trailing stops are intact.

Unless a strong fundamental catalyst emerges, the PSEi may continue to trade sideways, with political developments dictating sentiment in the short term. For now, staying in cash appears to be the more strategic position as the market awaits further clarity on the evolving political landscape.

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025

- Key Prices for PH Bluechip Stocks 30% Above 52-Week Low - June 4, 2024