Corporate Simplification: Ayala Land’s Merger Journey and Market Outlook

Ayala Land Inc., led by the Zobel family, expects to complete its consolidation with 34 subsidiary companies by the first half of 2026, aiming to streamline its corporate framework within the stock market.

Augusto Bengzon, Ayala Land’s CFO, mentioned on Thursday that the merger, involving a shares exchange with subsidiaries, required approvals from regulatory bodies such as the Securities and Exchange Commission (SEC), the Bureau of Internal Revenue (BIR), and the Philippine Stock Exchange (PSE). Bengzon estimated this process to span approximately eighteen months.

During their annual shareholders gathering, Bengzon emphasized that the merger’s primary objective was to streamline ownership structures, fostering operational efficiencies, optimized fund management, and simplified regulatory compliance.

This initiative, approved by Ayala Land’s board of directors in March, pertains to 34 subsidiaries wholly owned by Ayala Land directly or through its subsidiaries Ayala Land Estates Inc. (ALEI) and Ayala Land Hotels and Resorts Corp. (AHRC), with Ayala Land poised to emerge as the surviving entity.

Ayala Land disclosed in an earlier stock exchange disclosure its intention to issue 110.36 million shares to AHRC and 11,500 shares to ALEI. Moreover, the consolidation would lead to the issuance of 883.17 million treasury shares, representing shares repurchased by the company from existing shareholders.

Post-merger, Ayala Land’s outstanding common shares, excluding treasury shares, will rise to 15.05 billion from 14.94 billion, while preferred shares will remain at 12.44 billion.

The company awaits SEC approval prior to securing BIR clearance for the transfer of subsidiaries’ assets to Ayala Land. Subsequently, PSE’s approval is necessary for the shares’ listing on the local stock exchange.

Ayala Land’s earnings surged by 32 percent to P24.5 billion last year, buoyed by heightened demand and escalating consumer activity.

With plans to unveil P100 billion worth of projects this year, Ayala Land targets an 80 percent launch rate from its premium brands—Ayala Land Premier and Alveo Land. Anna Ma. Margarita Bautista-Dy, the company’s president and CEO, affirmed that projects under other core residential brands, Avida and Amaia, were primed for activation pending an anticipated easing of interest rates and subsequent consumer demand upsurge.

She expressed confidence, stating that the groundwork was set, permits were in place, and once market dynamics align, they could proceed with their launches.

Technical Analysis on Ayala Land (ALI)

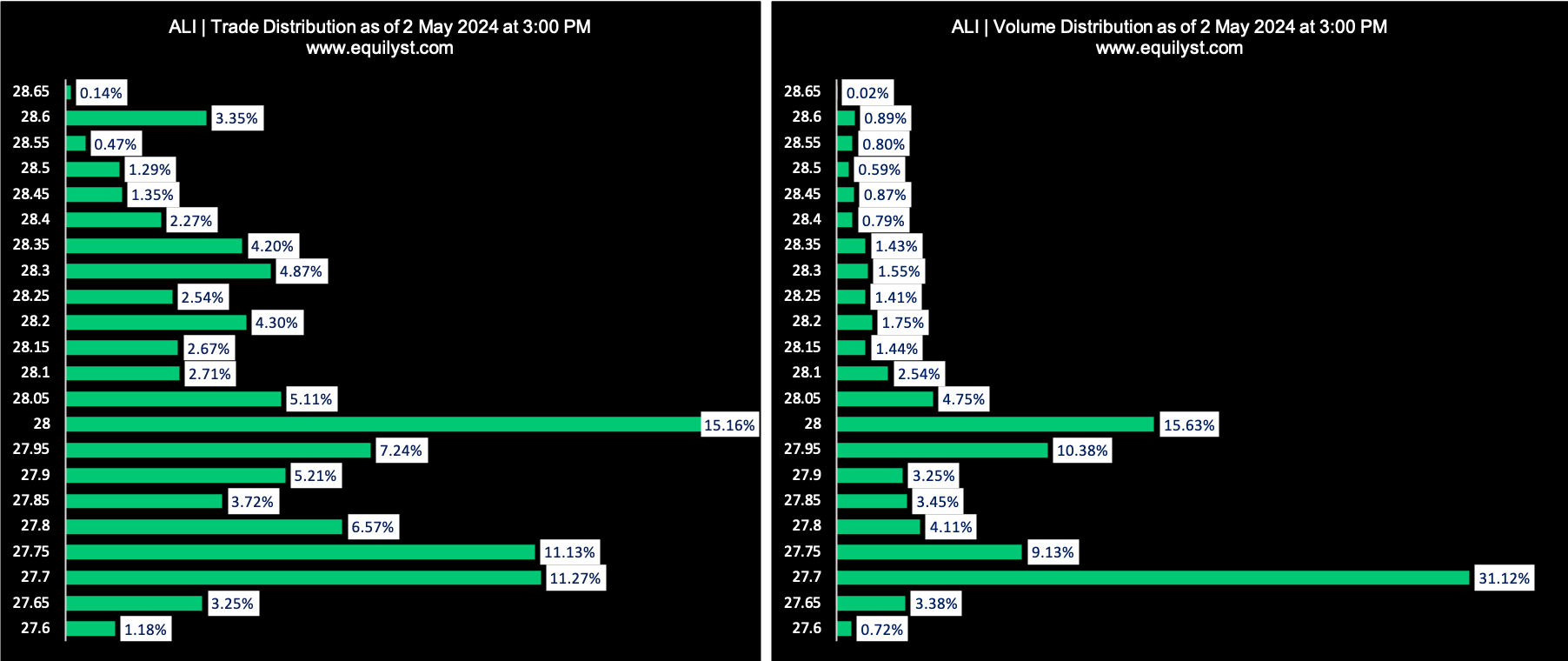

Ayala Land (ALI) has dropped by nearly 20% year-to-date as of the close on May 2, 2024. Many traders were anticipating a breakout above the resistance at P29.40, aligned with the 23.6% Fibonacci retracement, but that expectation was met with a bearish Dominant Range Index.

With the price range having the biggest volume and the highest number of trades being closer to the intraday low than the intraday high, and with the volume-weighted average price higher than the last price of P27.70, the traders’ appetite to sell is self-explanatory.

Dominant Range Index: BEARISH

Last Price: 27.70

Dominant Range: 27.70 – 28.00

VWAP: 27.89

ALI’s major support remains at P27.00, while its major resistance is pegged at P29.40. Observing the volume higher than 100% of ALI’s 10-day volume average, the appetite to sell does not seem to have subsided yet.

Another bearish angle is the stance of foreign investors on ALI. Out of the 125 trading days for ALI in 2024, only 29 days (23%) closed on a Net Foreign Buying status.

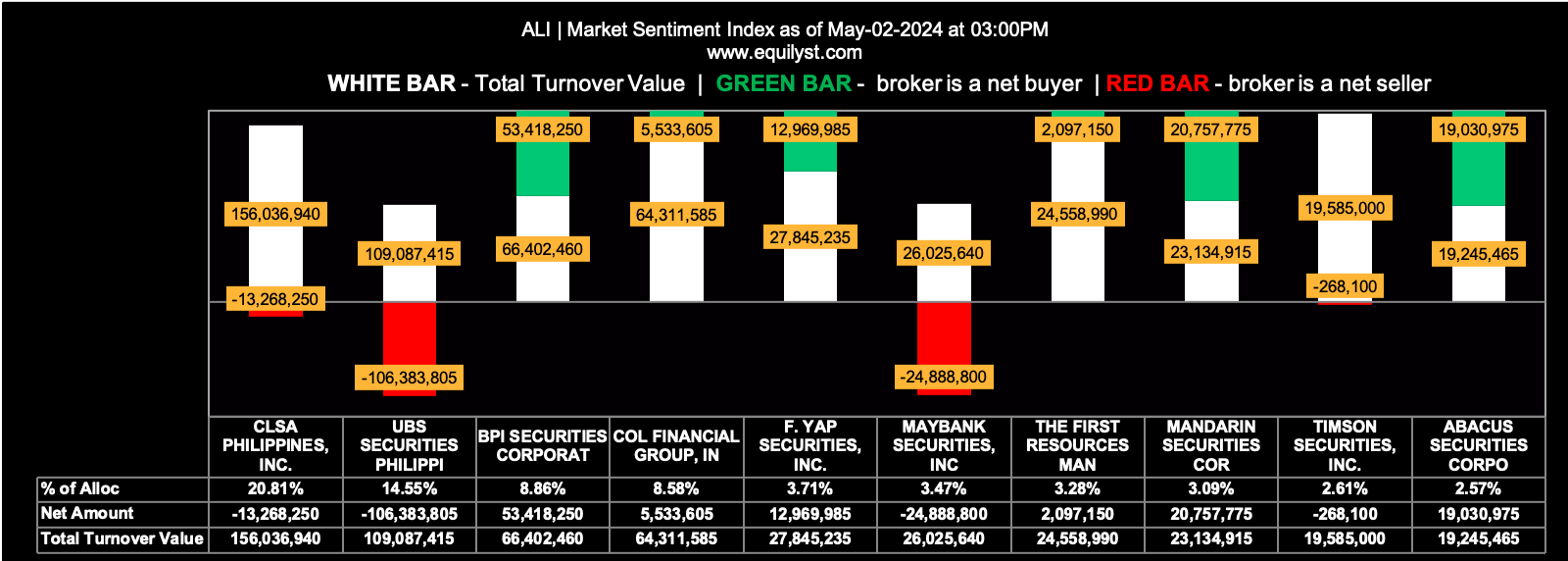

If there’s anything that consoles the despairing hearts of ALI investors, it should be the bullish Market Sentiment Index as of May 2, 2024. I suspect that the 40% of market participants who registered a 100% buying confidence on ALI are either new entrants or existing holders averaging down.

Market Sentiment Index: BULLISH

48 of the 64 participating brokers, or 75.00% of all participants, registered a positive Net Amount

38 of the 64 participating brokers, or 59.38% of all participants, registered a higher Buying Average than Selling Average

64 Participating Brokers’ Buying Average: ₱27.92719

64 Participating Brokers’ Selling Average: ₱28.01862

26 out of 64 participants, or 40.63% of all participants, registered a 100% BUYING activity

3 out of 64 participants, or 4.69% of all participants, registered a 100% SELLING activity

Buy, Hold, or Sell ALI?

If you have yet to include ALI shares in your portfolio, it’s more prudent to wait for the dominant range to be closer to the intraday high than the intraday low and for the last price to be higher than its volume-weighted average price, while maintaining a bullish Market Sentiment Index, before considering entering a new position. When these conditions align, calculate your initial trailing stop and reward-to-risk ratio first. If you’re satisfied with the ratio, then it’s logical to initiate a test-buy within or near the prevailing dominant range.

Meanwhile, if you already hold ALI shares and your trailing stop is intact, consider holding your position without adding more shares. Only consider adding more shares if both the Dominant Range Index and Market Sentiment Index are bullish. These two indices are proprietary indicators, so you won’t find them on the charting tool of any Philippine-based stockbroker. If you’re a subscriber to my Premium Stock Analysis, you may email me directly to inquire about the status of these two indices for any stock.

On the other hand, sell your shares if your trailing stop has already been triggered.

What More Updates?

To receive more updates from me, here are my services:

You may also read my other reports here and watch my videos on YouTube. You may also subscribe to my newsletter.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025