Semirara’s Financials: Balancing Act Between Falling Prices and Record Sales Volumes

Semirara Mining and Power Corp. (SMPC) witnessed a 30 percent decrease in net income in 2023 compared to the previous year, dropping to P27.9 billion from P39.9 billion, primarily due to declining coal prices and power rates.

The company’s total revenues also took a hit, shrinking by 16 percent to P91.13 billion from P76.96 billion, largely attributed to lower selling prices.

Despite these challenges, SMPC managed to mitigate the impact through record-high coal shipments and electricity sales. Coal sales volume increased by seven percent to 15.8 million metric tons, with exports rising by 14 percent to 8.1 million metric tons, compensating for stagnant domestic sales.

Similarly, combined electricity sales from SMPC subsidiaries SEM-Calaca Power Corp. and Southwest Luzon Power Generation Corp. surged by 26 percent to 4,515 gigawatt hours.

SMPC President and COO Maria Cristina Gotianun emphasized the company’s focus on increasing mine and plant outputs amid volatile energy prices, acknowledging the efforts of their team in navigating the market challenges.

However, the average selling price of Semirara coal experienced a significant decline, dropping by 26 percent to P3,796 from P5,136, attributed to factors such as oversupply from Indonesia, a mild winter, and subdued global economic growth.

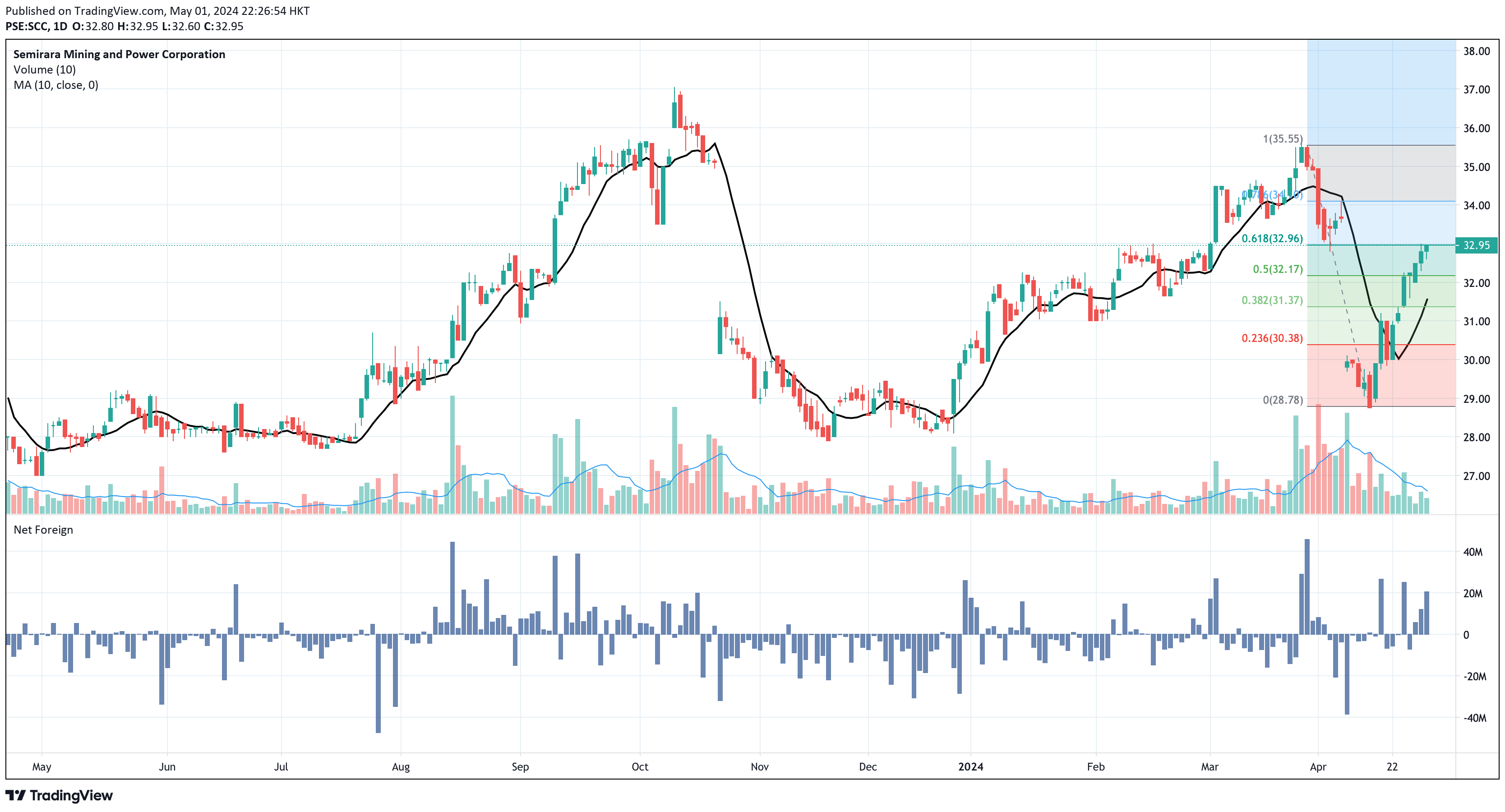

Semirara Mining and Power Corporation (SCC) Technical Analysis

Up by 8.92% year-to-date, Semirara continues to distance itself from its last price, which remains above its 10-day simple moving average. This stock is also on the verge of breaking out above the golden ratio of its Fibonacci, as can be seen on the chart above.

SCC’s immediate support is spotted near P32.15, while its immediate resistance is at P32.95. Once this resistance is broken, the next resistance will be near P34.10.

The positive Day Change on April 30, 2024, was supported by a relatively high volume since the volume exceeded 50% of its 10-day volume average.

Even though foreign investors have been net sellers year-to-date, they’ve registered three consecutive days of Net Foreign Buying.

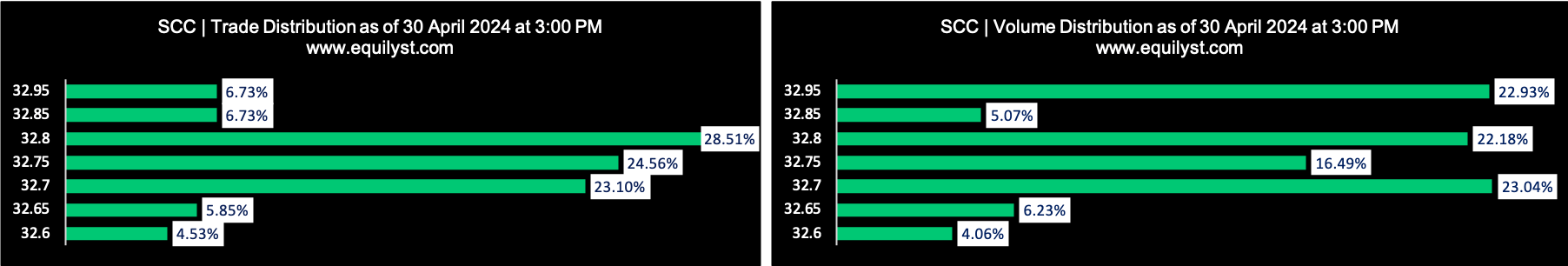

Meanwhile, Semirara has garnered a bullish rating from my proprietary Dominant Range Index, as its last price is higher than its volume-weighted average price, and the price range with the highest volume and number of trades is closer to the intraday high than the intraday low.

Dominant Range Index: BULLISH

Last Price: 32.95

Dominant Range: 32.70 – 32.95

VWAP: 32.79

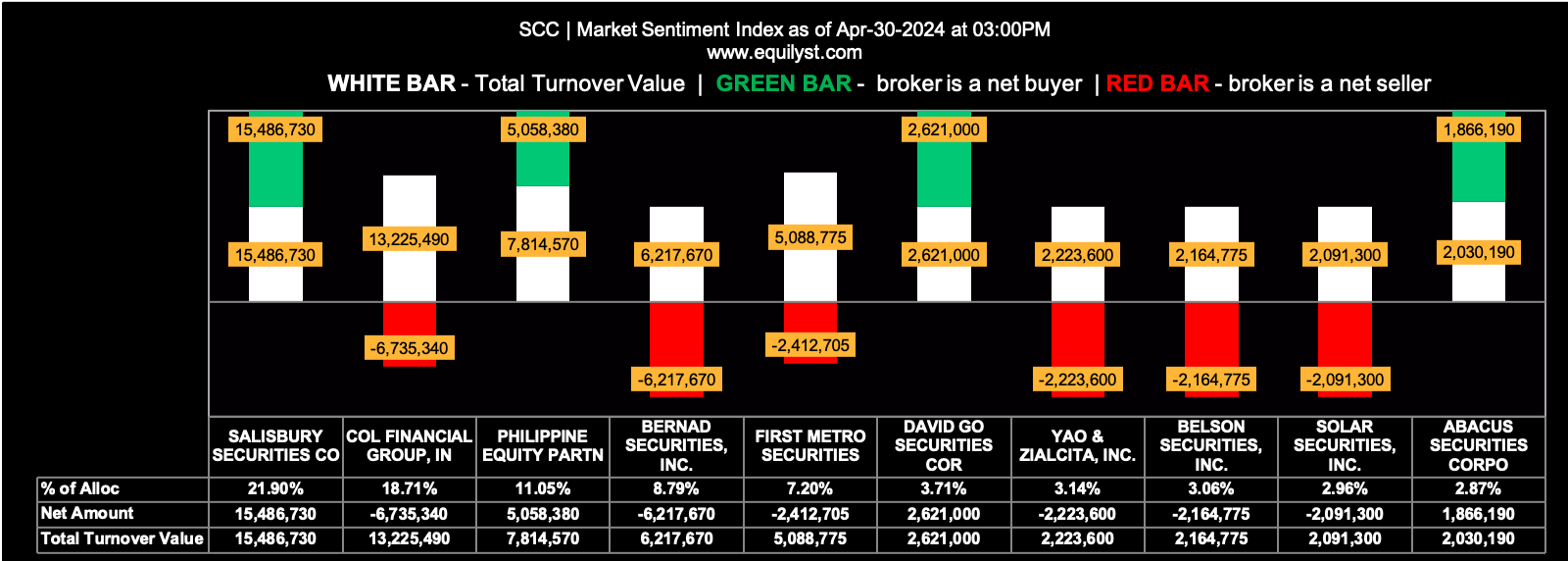

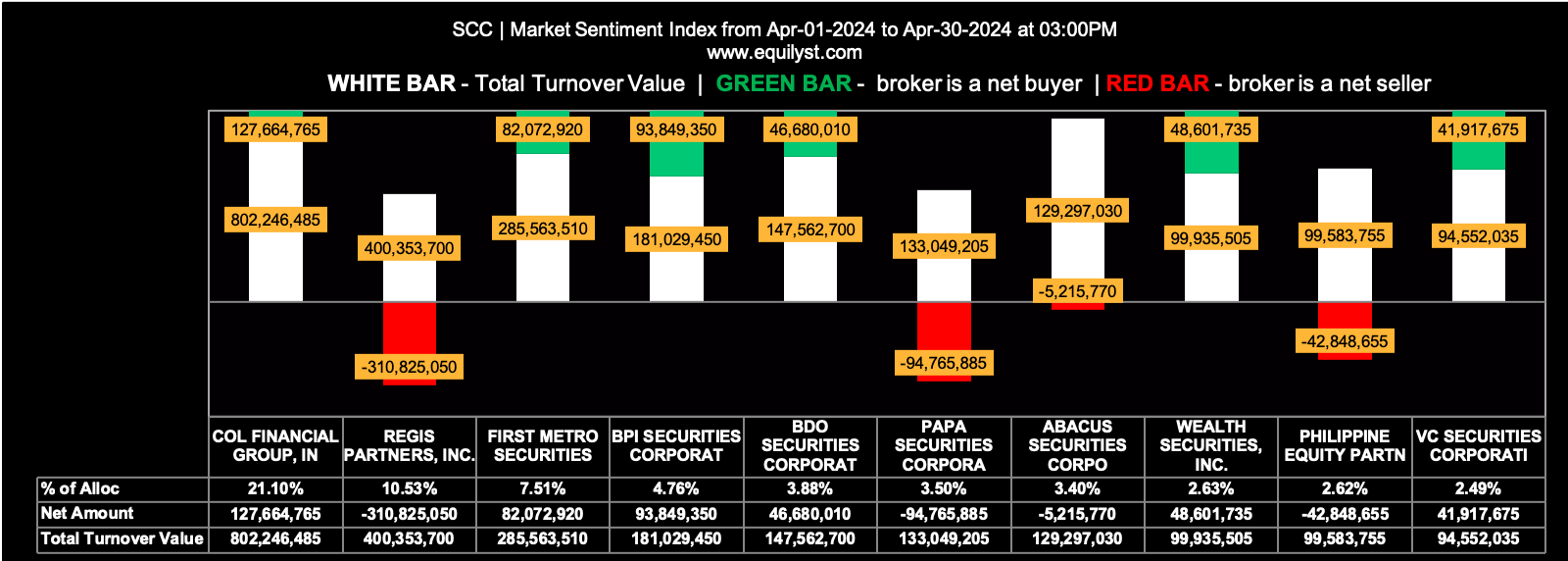

On the other hand, my proprietary Market Sentiment Index gave a contrarian (bearish) rating as of the end of trading on April 30, 2024. However, over a longer time period, Semirara still maintains its bullish Market Sentiment Index rating for the month-to-date.

Market Sentiment Index (EOD): BEARISH

12 of the 32 participating brokers, or 37.50% of all participants, registered a positive Net Amount

11 of the 32 participating brokers, or 34.38% of all participants, registered a higher Buying Average than Selling Average

32 Participating Brokers’ Buying Average: ₱32.76548

32 Participating Brokers’ Selling Average: ₱32.78989

10 out of 32 participants, or 31.25% of all participants, registered a 100% BUYING activity

12 out of 32 participants, or 37.50% of all participants, registered a 100% SELLING activity

Market Sentiment Index (MTD): BULLISH

60 of the 97 participating brokers, or 61.86% of all participants, registered a positive Net Amount

57 of the 97 participating brokers, or 58.76% of all participants, registered a higher Buying Average than Selling Average

97 Participating Brokers’ Buying Average: ₱31.92842

97 Participating Brokers’ Selling Average: ₱31.65297

11 out of 97 participants, or 11.34% of all participants, registered a 100% BUYING activity

3 out of 97 participants, or 3.09% of all participants, registered a 100% SELLING activity

Buy or Sell Semirara?

Consider buying Semirara at its opening price upon the resumption of trading on May 2, 2024, or within its most recent dominant range of 32.70 – 32.95. The reward-to-risk ratio, relative to the position of its next resistance level, is quite attractive since it’s about to breach its immediate resistance.

If you already own Semirara, you may also consider adding to your position.

If you’re contemplating selling your shares, it might be wise to allow your profit/loss to grow more positively as the uptrend is likely to continue. Ensure you adjust your trailing stop upward to protect your gains. Always keep an eye on your trailing stop because it’s possible for the share price to reverse direction despite bullish data analysis.

What More Updates?

To receive more updates from me, here are my services:

You may also read my other reports here and watch my videos on YouTube.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025