Shell Pilipinas’ Fiscal Performance for 2023

SHLPH has not issued any form of a dividend within the past 12 months. The last dividend (cash dividends) it announced had an Ex-Dividend Date of August 22, 2022.

Its price-to-earnings ratio (TTM) stands at 10.02, making it a relatively undervalued stock compared to the stocks that belong to the Industrial Sector. Its price-to-book ratio and price-to-sales ratio are at 0.55 and 0.06, respectively, making SHLPH a relatively undervalued company.

Shell Pilipinas Corp., a major player in the petroleum industry, closed 2023 with a net income of P1.2 billion, marking a decrease compared to the previous year due to the global fuel price drop and heightened interest rates.

The company’s earnings in 2023 fell short of the P4.1 billion recorded in the preceding year.

Attributing the decline in profitability to macroeconomic factors, such as increased interest rates and lower global fuel prices, Shell Pilipinas emphasized its strategic response, focusing on volume expansion and premium product retention.

Despite challenges, the company noted a substantial upswing in its marketing segment, witnessing a surge of over 60% in deliveries from 2022 to 2023.

In addition, its mobility division experienced a 4% increase in volume, maintaining a robust presence in premium product markets.

Shell Pilipinas president and CEO Lorelie Quiambao-Osial expressed pride in the organization’s resilience amid market pressures, highlighting improved marketing earnings and the introduction of innovative offerings in 2023.

SHLPH Technical Analysis

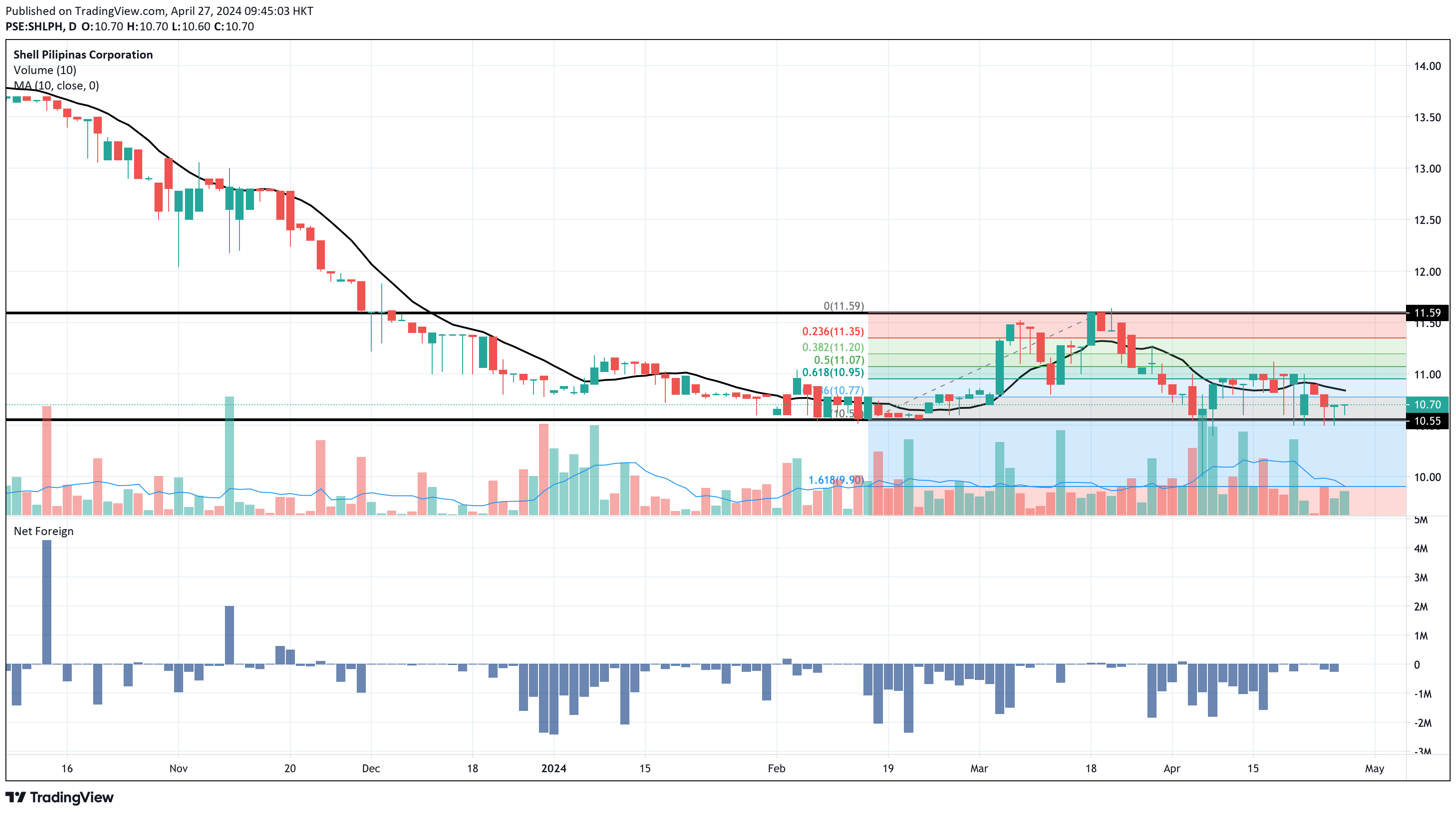

SHLPH has decreased year-to-date by 2.19%, dropping from P10.94 each on December 29, 2023, to P10.70 per share on April 26, 2024. The stock’s price has been in a downtrend channel since 2017.

The volume for the three most recent trading days is not concerning, as it exceeded 50% of the stock’s 10-day volume average. SHLPH began the week with relatively low volume, explaining the lack of sustained increase on Monday.

On a short-term basis, SHLPH remains in bearish territory, trading below its 10-day simple moving average.

The immediate support level is at P10.55, while resistance stands at P10.95, aligning with the Fibonacci’s golden ratio. SHLPH needs to surpass the minor resistance around P10.77 with preferably equal or higher volume than 100% of its 10-day volume average to maintain its price recovery.

Foreign investors provide no buying support, consistently registering net foreign selling since February 2023.

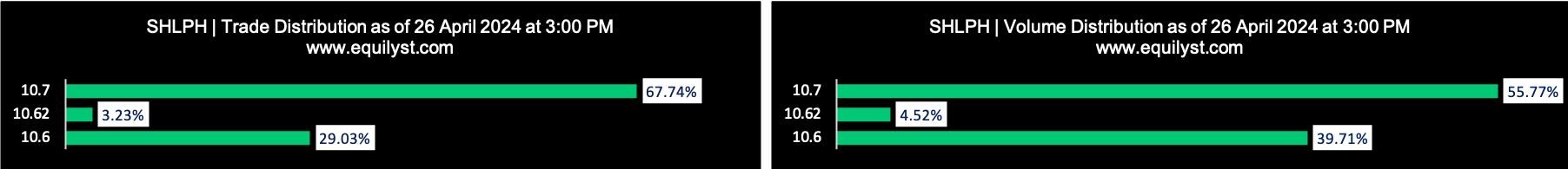

Dominant Range Index EOD: BULLISH

Last Price: 10.70

Dominant Range: 10.70 – 10.70

VWAP: 10.66

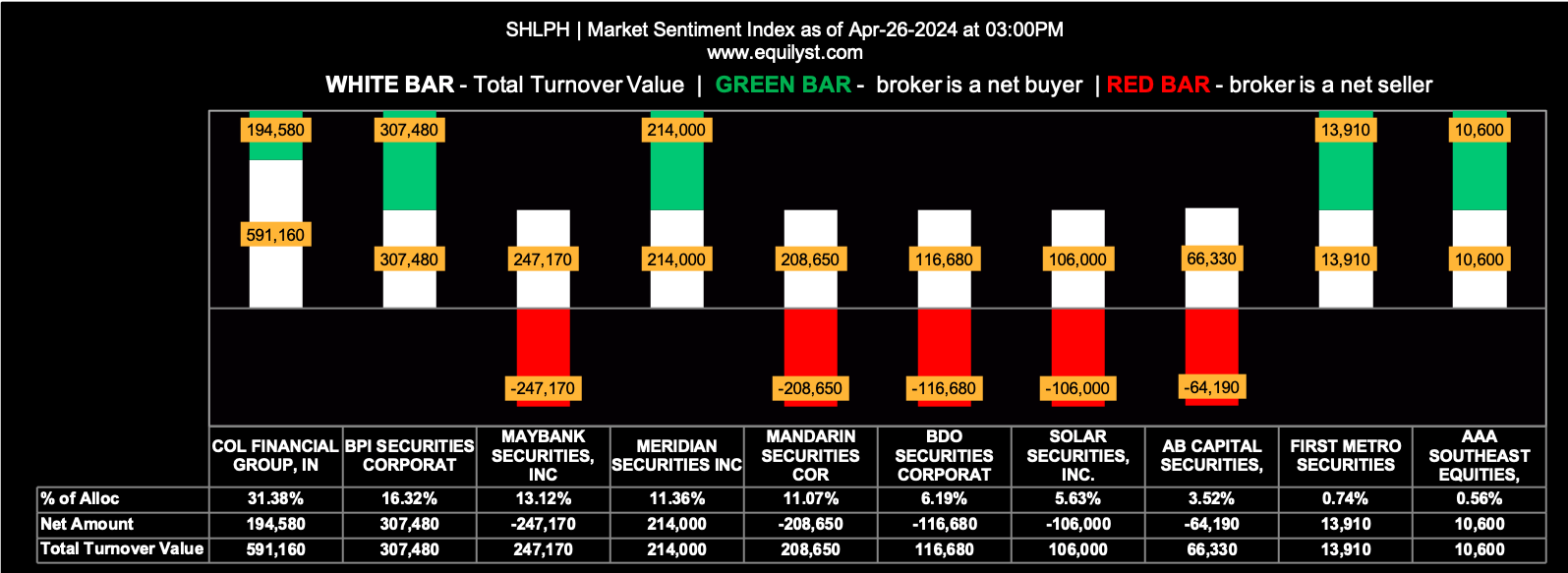

Market Sentiment Index EOD: BULLISH

6 of the 11 participating brokers, or 54.55% of all participants, registered a positive Net Amount

7 of the 11 participating brokers, or 63.64% of all participants, registered a higher Buying Average than Selling Average

11 Participating Brokers’ Buying Average: ₱10.65409

11 Participating Brokers’ Selling Average: ₱10.65157

5 out of 11 participants, or 45.45% of all participants, registered a 100% BUYING activity

4 out of 11 participants, or 36.36% of all participants, registered a 100% SELLING activity

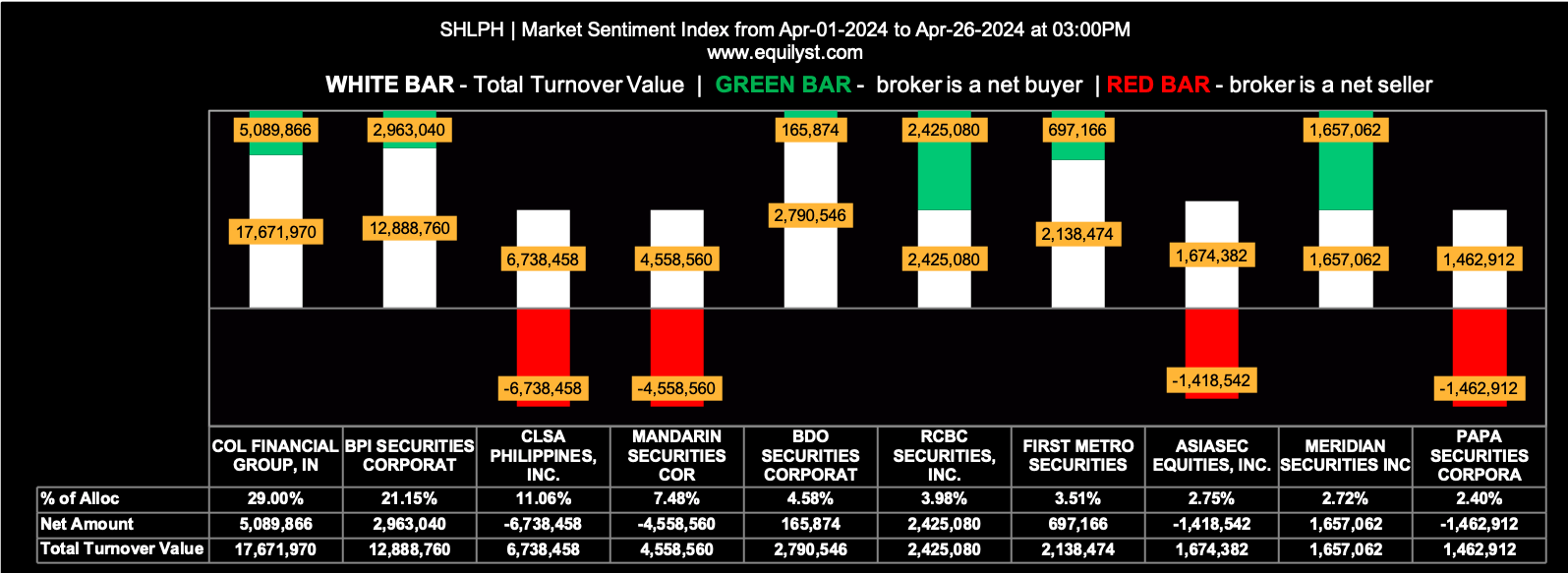

Market Sentiment Index MTD: BEARISH

20 of the 39 participating brokers, or 51.28% of all participants, registered a positive Net Amount

17 of the 39 participating brokers, or 43.59% of all participants, registered a higher Buying Average than Selling Average

39 Participating Brokers’ Buying Average: ₱10.71148

39 Participating Brokers’ Selling Average: ₱10.73243

9 out of 39 participants, or 23.08% of all participants, registered a 100% BUYING activity

14 out of 39 participants, or 35.90% of all participants, registered a 100% SELLING activity

Buy or Sell SHLPH?

Despite the bullish ratings from my proprietary Dominant Range Index EOD and Market Sentiment Index EOD, other indicators within my Evergreen Strategy suggest a bearish outlook for SHLPH. It’s advisable to decide with caution, as there’s a possibility of erratic movements in its share price.

For those who already hold SHLPH in their portfolio with an intact trailing stop, it’s not recommended to average down. For one, its Market Sentiment Index MTD (April 1 to 26) is bearish. However, there’s no need to panic if both the Dominant Range Index EOD and Market Sentiment Index EOD remain bullish. If the trailing stop is triggered, selling within the prevailing dominant range is advised.

Clients can request the latest dominant range of SHLPH via email for real-time monitoring of the market. I closely track trading activities as they occur.

For potential buyers, reconsidering SHLPH is advisable once it surpasses the resistance at P10.95.

To receive more updates from me, here are my services:

You may also read my other reports here and watch my videos on YouTube.

- MA, BDO, ALI, URC, PX: Is Their Dominant Range Pointing to a Breakout? - March 14, 2025

- Tracking Market Sentiment: MTD Ratings for 30 Bluechip Stocks (March 2025) - March 13, 2025

- PSEi Stalls Below 6,260 as Market Awaits Political Shift - March 12, 2025